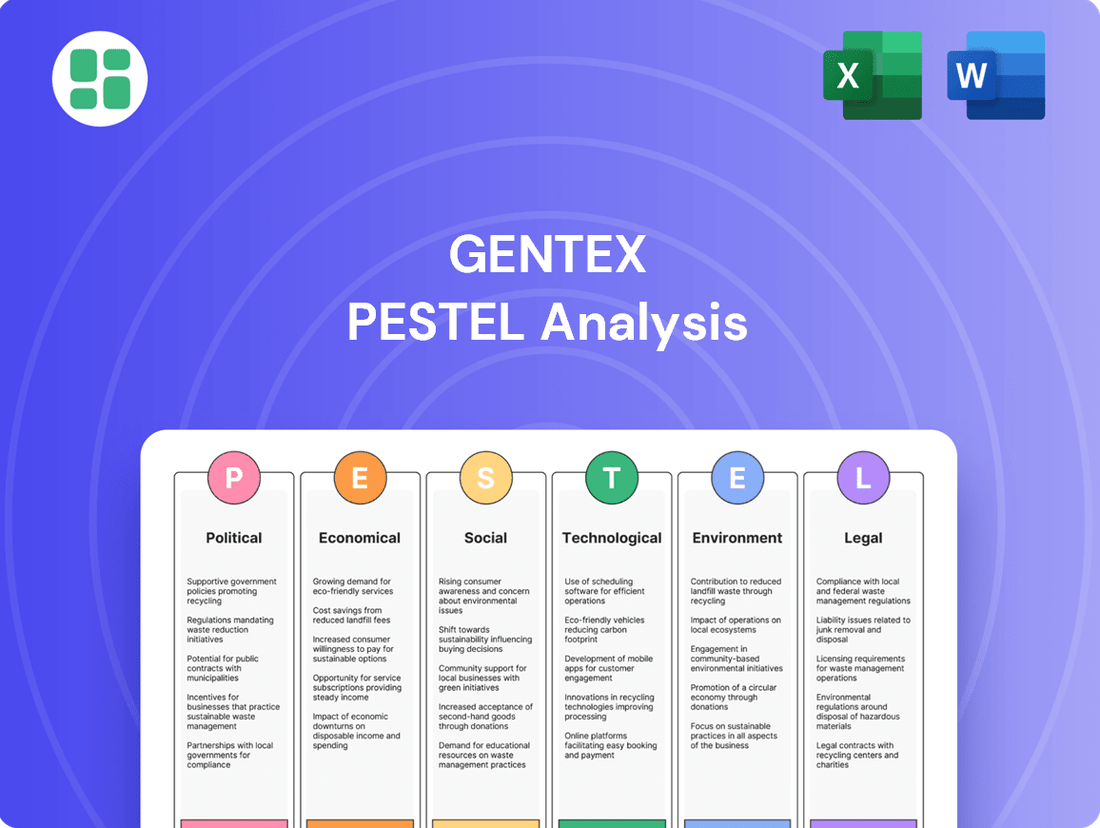

Gentex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentex Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Gentex's future. Our PESTLE analysis provides the essential intelligence to anticipate market shifts and identify strategic opportunities. Don't be left behind—download the full version for actionable insights.

Political factors

Shifting global trade policies, including new tariffs on automotive imports and components, directly impact Gentex's supply chain and pricing. The company has explicitly stated that new tariff costs led to a production halt for the China market in Q1 2025, affecting revenue projections.

Geopolitical tensions further complicate matters by influencing customer sourcing decisions and overall market demand, creating significant uncertainty for Gentex's future financial guidance.

Governments globally are intensifying vehicle safety standards, increasingly requiring advanced driver-assistance systems (ADAS). This trend directly benefits Gentex, a key supplier of auto-dimming mirrors and sophisticated vision systems, as these regulations spur demand for its offerings. For instance, the US National Highway Traffic Safety Administration (NHTSA) has been actively updating its framework, including expanding exemptions for autonomous vehicle testing and refining crash data reporting, which could accelerate the integration of new safety technologies into vehicles.

Government policies on electric vehicle (EV) adoption are a significant political factor impacting the automotive sector. For instance, in 2024, the US federal EV tax credit remained at $7,500, but the eligibility criteria for vehicles and battery components continued to evolve, influencing consumer purchasing decisions and manufacturer strategies.

The landscape is dynamic, with some nations scaling back direct EV subsidies. This has contributed to a noticeable shift, with hybrid vehicle sales showing renewed strength in 2024, particularly in markets where EV incentives have been reduced or removed. This trend necessitates flexibility in product planning for companies like Gentex.

Regulatory bodies worldwide are also setting increasingly stringent emissions targets. These targets, often phased in over the coming years, will continue to drive the long-term demand for electrified powertrains, even amidst short-term fluctuations in consumer adoption rates influenced by subsidy availability.

Domestic Manufacturing Incentives

Governments worldwide are actively encouraging domestic manufacturing, a trend that could significantly influence companies like Gentex. For instance, the United States has seen substantial investment in semiconductor manufacturing, with the CHIPS and Science Act of 2022 allocating over $52 billion to boost domestic production. This push aims to strengthen supply chains and reduce dependence on foreign sources, a strategy directly relevant to the automotive sector where component sourcing is critical.

This heightened focus on domestic production could lead automakers to prioritize local suppliers, potentially impacting Gentex's established global supply chain and distribution networks. The automotive industry, in particular, is re-evaluating its reliance on single-source suppliers. A recent report by McKinsey in late 2024 highlighted that 70% of automotive executives were actively exploring nearshoring or reshoring strategies to improve supply chain resilience.

- Government Incentives: Programs like the US CHIPS Act and similar initiatives in Europe and Asia are designed to make domestic manufacturing more competitive.

- Supply Chain Resilience: The global pandemic and geopolitical tensions have accelerated the need for diversified and localized supply chains.

- Automaker Strategies: Major automakers are increasingly demanding greater visibility and control over their component suppliers, favoring those with a strong domestic presence.

- Impact on Gentex: Gentex may need to adapt its manufacturing and sourcing strategies to align with these evolving automaker preferences and government policies.

International Relations and Market Access

The stability of international relations is a critical determinant of market access and investment opportunities for global suppliers like Gentex. Geopolitical tensions can significantly disrupt supply chains and reduce sales volumes in key markets.

For instance, trade disputes and tariffs, particularly those impacting major economies like China, have a direct influence on Gentex's operational strategies. The company's decision to pause production for the China market in response to tariff impacts underscores the vulnerability of its business to shifts in the international political landscape. This sensitivity was evident in 2024, with ongoing trade negotiations between major economic blocs creating uncertainty for automotive suppliers.

Gentex's reliance on global markets means that trade agreements and political stability are paramount. For example, changes in import/export regulations or the imposition of new tariffs can swiftly alter cost structures and market competitiveness. The company's financial reports often reflect the impact of these international dynamics on its revenue streams.

- Global Trade Tensions: Ongoing trade negotiations and potential tariff increases in 2024-2025 create a volatile environment for international business.

- Market Access Restrictions: Political instability or sanctions in certain regions can directly limit Gentex's ability to sell products and source materials.

- Supply Chain Disruptions: Geopolitical events can lead to unexpected interruptions in the flow of goods, impacting production schedules and delivery times.

- Regulatory Changes: Shifts in international trade policies and regulations necessitate continuous adaptation of business strategies to maintain market access and compliance.

Government mandates for advanced driver-assistance systems (ADAS) are a significant tailwind for Gentex, as stricter safety regulations drive demand for its vision systems. The US government's continued focus on vehicle safety, with ongoing updates to NHTSA's regulatory framework, directly supports this trend.

Shifting global trade policies and geopolitical tensions create uncertainty for Gentex's supply chain and market access, as seen with production halts in China during Q1 2025 due to tariffs. The company's financial performance is directly tied to the stability of international relations and trade agreements.

Government incentives for electric vehicles (EVs) and evolving emissions targets continue to shape the automotive market, influencing consumer preferences and manufacturer strategies. While US federal EV tax credits remained at $7,500 in 2024, evolving eligibility criteria require adaptability from suppliers like Gentex.

Governments are increasingly promoting domestic manufacturing, as exemplified by the US CHIPS Act, which could impact Gentex's global supply chain and necessitate alignment with automaker preferences for local sourcing. McKinsey data from late 2024 indicated 70% of automotive executives were exploring nearshoring strategies.

What is included in the product

This Gentex PESTLE analysis comprehensively examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a strategic overview.

Provides a clear, actionable framework that simplifies complex external factors, enabling Gentex to proactively address potential disruptions and capitalize on emerging opportunities.

Economic factors

Global light vehicle production is a critical driver for Gentex, and forecasts indicate a slowdown. Projections for 2025 suggest a decrease in production across major markets including China, North America, Europe, and the Japan/Korea region. This anticipated contraction in vehicle manufacturing directly influences the demand for automotive components like those Gentex supplies.

Despite the broader market headwinds, Gentex demonstrated resilience in its core business. Excluding the impact of the VOXX merger, the company's revenue experienced a modest uptick in the second quarter of 2025. This performance suggests Gentex's products are maintaining their appeal even as overall vehicle production numbers are expected to decline.

Persistent inflation and elevated interest rates in 2024 and projected into 2025 are directly increasing production costs for automotive suppliers like Gentex. For instance, the Producer Price Index for manufactured goods saw a notable increase in late 2023 and early 2024, impacting raw material and component expenses. This economic climate also cools consumer demand for new vehicles, as higher borrowing costs make car purchases less affordable, potentially leading to slower sales volumes for Gentex's products.

These combined pressures can squeeze profit margins for automotive component manufacturers. As vehicle affordability declines, the overall market for new cars may contract, directly affecting the volume of business available. Gentex, along with its industry peers, is actively implementing cost improvement programs and optimizing its supply chain through strategic sourcing to mitigate these adverse economic impacts and maintain profitability.

Ongoing supply chain disruptions, particularly semiconductor chip shortages, significantly impacted the automotive sector throughout 2024. These shortages directly affect Gentex's production of advanced automotive mirrors and electronics, potentially causing delays and increasing per-unit costs due to higher component prices. For instance, the automotive chip shortage saw average prices for certain microcontrollers increase by up to 15% in early 2024 compared to 2023 levels.

Rising raw material costs, including specialty metals essential for Gentex's electro-optical products, present another significant challenge. The price of lithium, a key component in many electronic systems, saw a volatility in 2024, with some reports indicating price increases of over 20% for battery-grade lithium carbonate in the first half of the year. This directly translates to higher manufacturing expenses for Gentex, squeezing profit margins if these costs cannot be fully passed on to customers.

In response, companies like Gentex are actively investing in supply chain resilience. Strategies include diversifying supplier bases, increasing inventory levels for critical components, and exploring alternative materials. By mid-2025, many automotive suppliers aim to have secured at least 6 months of critical component inventory, a notable shift from pre-disruption practices.

Currency Fluctuations

As a global supplier, Gentex's financial performance is directly influenced by currency exchange rate fluctuations. These shifts can significantly alter the value of revenues and costs generated from its international operations, impacting overall profitability. For instance, a stronger U.S. dollar could make Gentex's products more expensive for foreign buyers, potentially reducing sales volume.

Significant movements in currency values can also affect the competitiveness of Gentex's offerings in various global markets. A weakening of a competitor's home currency, for example, could give them a pricing advantage. Conversely, a strengthening of the currencies in markets where Gentex sources materials could increase its production costs.

Effective management of foreign exchange risk is therefore a critical component of maintaining Gentex's financial stability and predictable earnings. This often involves strategies like hedging to mitigate the impact of adverse currency movements.

- Impact on Revenue: For example, if the Euro weakens against the US Dollar, revenue earned in Euros translates to fewer US Dollars for Gentex.

- Impact on Costs: Conversely, if Gentex sources components in a country whose currency strengthens, its production costs in USD will rise.

- Competitiveness: A strong USD can make Gentex's products pricier in international markets, potentially impacting sales volume compared to competitors with weaker home currencies.

- Hedging Strategies: Gentex likely employs financial instruments such as forward contracts or currency options to lock in exchange rates for future transactions, thereby reducing volatility.

Consumer Spending and Vehicle Affordability

Consumer willingness to purchase new vehicles, a key driver for Gentex's automotive segment, is directly tied to disposable income, vehicle pricing, and financing costs. As of early 2025, elevated vehicle prices, coupled with interest rates that have remained higher than pre-pandemic levels, are contributing to a more cautious consumer. This caution impacts overall sales volumes for new cars, which in turn affects demand for Gentex's auto-dimming mirrors and related technologies.

Data from early 2025 indicates that the average transaction price for new vehicles in the U.S. hovers around $48,000, while average auto loan rates for a 60-month term are in the 7-8% range. These figures represent a significant hurdle for many buyers, potentially delaying purchases or pushing them towards used vehicles. Gentex's performance is therefore closely linked to the broader economic health and consumer confidence within its primary markets, particularly North America and Europe.

- Disposable Income: Fluctuations in household income directly impact a consumer's ability to afford new vehicle purchases.

- Vehicle Pricing: High MSRPs and dealer markups can deter buyers, leading to reduced demand for new vehicles.

- Financing Costs: Elevated interest rates on auto loans increase the total cost of ownership, making vehicles less affordable.

- Consumer Confidence: A strong economy and positive outlook encourage spending on big-ticket items like new cars.

Economic factors present a mixed outlook for Gentex in 2024-2025. While global light vehicle production is projected to slow, with decreases anticipated in key markets like China, North America, and Europe for 2025, Gentex has shown resilience. Persistent inflation and high interest rates are increasing production costs and dampening consumer demand for new vehicles, impacting affordability. This economic environment, coupled with ongoing supply chain disruptions, particularly semiconductor shortages, directly affects Gentex's manufacturing and component expenses.

Rising raw material costs, such as for lithium, are also a concern, potentially squeezing profit margins. Currency fluctuations add another layer of complexity, impacting the value of international revenues and costs. Consumer confidence and disposable income remain critical, as higher vehicle prices and financing costs are making new car purchases more cautious in early 2025.

| Economic Factor | Impact on Gentex | Data/Projection (2024-2025) |

|---|---|---|

| Global Light Vehicle Production | Reduced demand for automotive components | Projected decrease in major markets for 2025 |

| Inflation & Interest Rates | Increased production costs, reduced consumer demand | Persistent high rates impacting affordability; PPI increase in late 2023/early 2024 |

| Supply Chain Disruptions (Semiconductors) | Production delays, increased per-unit costs | Automotive chip prices up to 15% higher for some microcontrollers in early 2024 |

| Raw Material Costs | Higher manufacturing expenses, margin pressure | Lithium price volatility, some increases over 20% in H1 2024 |

| Currency Exchange Rates | Impact on international revenue/cost valuation, competitiveness | Stronger USD can make products pricier abroad |

| Consumer Demand/Confidence | Directly affects new vehicle sales volume | Average new vehicle price ~$48,000; auto loan rates 7-8% in early 2025 |

What You See Is What You Get

Gentex PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive Gentex PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough strategic overview for informed decision-making.

Sociological factors

Consumers are placing a much higher value on vehicle safety and the latest technology when buying a car. This trend is a significant driver for companies like Gentex.

Gentex's main offerings, like their auto-dimming mirrors and sophisticated vision systems, perfectly match what buyers are looking for in terms of safety and ease of use. For instance, in the 2024 model year, advanced driver-assistance systems (ADAS) features, which often incorporate Gentex technology, saw increased adoption across various vehicle segments, with premium features becoming more common even in mid-range vehicles.

The ongoing trend of embedding more electronic components into vehicles opens up substantial growth avenues for Gentex. As vehicles become more connected and automated, the demand for the specialized electronic systems Gentex provides is expected to continue its upward trajectory.

Societal trends are increasingly favoring flexible transportation over traditional car ownership. In 2024, ride-sharing services like Uber and Lyft saw continued robust usage, with global gross bookings projected to reach over $170 billion. This shift suggests a potential slowdown in new private vehicle sales, impacting traditional automakers and their suppliers.

However, this evolving mobility landscape presents new avenues for companies like Gentex. The growth in shared mobility fleets, estimated to increase by 15% annually through 2028, creates demand for specialized automotive electronics and safety features. Gentex's advanced camera systems and dimmable mirrors, for instance, could find significant application in these commercial fleets, offering enhanced safety and passenger experience.

Consumers and investors are increasingly prioritizing companies with strong Environmental, Social, and Governance (ESG) credentials. This trend is driving demand for transparency and accountability in corporate practices.

Gentex's commitment to sustainable manufacturing, evident in its efforts to reduce waste and energy consumption, resonates with this growing awareness. For instance, by the end of 2023, Gentex reported a 5% reduction in its overall greenhouse gas emissions compared to the previous year, showcasing tangible progress in its environmental stewardship.

Demonstrating robust ESG performance can significantly bolster Gentex's brand image and attract socially conscious investors. Companies that actively integrate ESG principles into their operations, like Gentex's focus on ethical supply chains and employee well-being, are better positioned for long-term success and stakeholder trust.

Workforce Dynamics and Labor Shortages

The automotive sector, including suppliers like Gentex, is grappling with significant labor shortages, particularly for skilled workers needed to produce and integrate advanced automotive technologies. This demand for expertise is amplified by the increasing complexity of vehicle electronics and software. For instance, in 2024, the U.S. manufacturing sector, which includes automotive suppliers, continued to experience a gap between job openings and available workers, with millions of unfilled positions reported throughout the year.

Gentex needs to prioritize robust talent acquisition, comprehensive training initiatives, and effective retention strategies. This focus on human capital is crucial for supporting its ongoing innovation in areas like advanced driver-assistance systems (ADAS) and connected car technologies. By investing in its workforce, Gentex can ensure it possesses the necessary skills to meet evolving production demands and maintain its competitive advantage in a rapidly changing market.

- Skilled Labor Demand: The automotive industry requires a workforce proficient in areas like software development, artificial intelligence, and advanced manufacturing processes.

- Talent Acquisition Challenges: Companies like Gentex face competition for talent from other high-tech industries, making recruitment more difficult.

- Training and Development Investment: Continuous investment in upskilling and reskilling existing employees is essential to adapt to new technologies.

- Retention Strategies: Implementing competitive compensation, benefits, and career development opportunities is key to retaining valuable employees.

Technological Literacy and User Experience

As vehicles become increasingly sophisticated, consumer demand for intuitive technology and effortless integration of features is growing. Gentex's ability to thrive hinges on creating products that are not only functionally advanced but also deliver a superior, user-friendly experience for everyone inside the car. This means focusing on aspects like the clarity and responsiveness of their full display mirrors and the seamless connectivity of their automotive electronics.

For instance, a 2024 J.D. Power study indicated that 75% of new vehicle buyers consider advanced technology features, such as sophisticated infotainment systems and driver-assistance technologies, to be a key factor in their purchase decision. This highlights the critical need for Gentex to ensure its innovations are easily understood and operated by the average driver, directly impacting brand perception and market adoption. Poor user experience can quickly negate the benefits of cutting-edge functionality.

Gentex's strategic focus on user experience is evident in their development of features like:

- Full Display Mirrors: Offering a wider, clearer field of vision that is easily adjustable and integrated with vehicle systems.

- Connected Car Technologies: Ensuring that features like Wi-Fi hotspots and over-the-air updates are accessible and simple to manage.

- Voice Control Integration: Developing natural language processing that accurately understands and responds to driver commands.

Societal shifts towards valuing vehicle safety and advanced technology directly benefit Gentex. The increasing adoption of driver-assistance systems, incorporating Gentex's technology, in 2024 model year vehicles underscores this trend. Furthermore, the growing demand for intuitive and user-friendly electronic integration in cars means Gentex's focus on seamless user experience is crucial for market success.

Technological factors

Gentex's core business thrives on technological leaps in electro-optical and vision systems. Their ongoing investment in research and development fuels innovation in areas such as dimmable glass, camera technology, and advanced display interfaces, directly enhancing their automatic-dimming mirrors and full display mirrors.

This technological edge is evident in Gentex's product pipeline, with new vehicle models increasingly featuring their sophisticated Full Display Mirror and HomeLink technologies. For instance, the company reported that approximately 65% of their automotive revenue in Q1 2024 was derived from dimmable mirrors, highlighting the market's adoption of their electro-optical advancements.

The automotive sector's rapid adoption of artificial intelligence (AI) and machine learning (ML) is a key technological driver, particularly for autonomous driving and advanced driver-assistance systems (ADAS). Gentex, a leader in automotive vision systems, stands to benefit as AI enhances object detection and enables more sophisticated safety features. For instance, by 2025, the global market for ADAS is projected to reach $40 billion, underscoring the growing demand for AI-powered automotive solutions.

The increasing prevalence of connected car technologies, allowing vehicles to communicate with each other, infrastructure, and cloud platforms, is driving a significant demand for deeply integrated electronic features. This evolution is fundamentally altering vehicle design and core functionalities.

Gentex, with its established expertise in automotive electronics, is well-positioned to capitalize on this trend by developing products that integrate smoothly into these connected ecosystems, thereby unlocking novel functionalities and valuable data-driven insights for consumers and manufacturers alike.

For instance, the global connected car market was valued at approximately $70 billion in 2023 and is projected to reach over $200 billion by 2030, highlighting the substantial growth and opportunity in this sector.

Smart Materials and Specialty Chemicals Development

Gentex's core strength lies in its advanced electrochromic technology, a sophisticated application of smart materials. This technology is central to their automotive dimmable mirrors and aircraft window systems. Their commitment to ongoing research and development in specialty chemicals and material science directly fuels product innovation and performance enhancements.

The company's investment in materials innovation is a significant technological factor. For instance, advancements in the chemical formulations for their electrochromic glass can lead to faster dimming speeds, improved color neutrality, and greater durability. This continuous improvement is vital for maintaining a competitive edge and expanding into new applications.

- Smart Materials Integration: Gentex leverages smart materials, particularly for its electrochromic (EC) technology, enabling dynamic light control in automotive mirrors and aircraft windows.

- R&D Focus: Ongoing research into novel chemical compounds and material properties aims to boost performance metrics like dimming speed, energy efficiency, and longevity.

- Market Differentiation: Innovations in materials science are key to Gentex's ability to offer differentiated products with enhanced features, driving market leadership.

Cybersecurity in Automotive and Connected Devices

As vehicles increasingly rely on software and connectivity, cybersecurity threats pose a significant risk. Gentex, a key supplier of electronic components and vision systems for the automotive industry, faces the critical task of securing its products against these evolving cyber threats. This focus is essential for maintaining customer trust and ensuring regulatory compliance in a rapidly digitizing automotive landscape.

The automotive sector is experiencing a surge in connected features, making robust cybersecurity measures non-negotiable. For instance, the global automotive cybersecurity market was valued at approximately $10.5 billion in 2023 and is projected to reach $25.8 billion by 2030, growing at a CAGR of 13.7%. This highlights the immense pressure on suppliers like Gentex to integrate advanced security protocols into their offerings.

Gentex's commitment to cybersecurity is demonstrated through its adherence to stringent automotive cybersecurity standards and ongoing investment in secure software development practices. This proactive approach is vital for protecting vehicles from potential breaches, ensuring the integrity of data, and safeguarding the operational functionality of their components.

- The automotive cybersecurity market is projected to grow significantly, indicating increasing demand for secure components.

- Gentex must ensure its electronic components and vision systems are resilient against sophisticated cyberattacks.

- Adherence to evolving automotive cybersecurity standards, such as ISO/SAE 21434, is crucial for market access and reputation.

- Continuous investment in secure software development lifecycles is paramount for mitigating risks and maintaining product integrity.

Gentex's technological prowess is a cornerstone of its business, particularly in advanced electro-optical systems. Their continuous investment in R&D drives innovation in areas like dimmable glass and camera technology, directly enhancing their automatic-dimming and full-display mirrors. The company's Q1 2024 results showed dimmable mirrors contributing approximately 65% of automotive revenue, underscoring market acceptance of their electro-optical advancements.

The automotive industry's embrace of AI and machine learning is a significant technological trend, especially for ADAS and autonomous driving. Gentex, a leader in automotive vision, is well-positioned to benefit as AI integration enhances safety features. The global ADAS market is expected to reach $40 billion by 2025, highlighting the demand for AI-powered automotive solutions.

Connectivity in vehicles is also a major technological driver, increasing the need for integrated electronic features. Gentex's expertise in automotive electronics allows them to develop products that fit seamlessly into these connected ecosystems, offering new functionalities and data insights. The connected car market, valued at around $70 billion in 2023, is projected to exceed $200 billion by 2030.

Cybersecurity is a critical technological challenge for Gentex, given the increasing connectivity of vehicles. As a supplier of electronic components, securing products against evolving cyber threats is paramount for trust and compliance. The automotive cybersecurity market, valued at $10.5 billion in 2023, is projected to reach $25.8 billion by 2030, emphasizing the need for robust security measures.

Legal factors

Government regulations are a major force shaping the automotive industry, and Gentex is right in the middle of it. Agencies like the National Highway Traffic Safety Administration (NHTSA) in the US and the UNECE are setting increasingly strict standards for vehicle safety and emissions. For example, mandates for Advanced Driver-Assistance Systems (ADAS) are becoming more common, directly impacting the types of features automakers need in their vehicles.

These evolving regulations create both challenges and opportunities for Gentex. Compliance with standards like those for rearview mirrors, which increasingly incorporate advanced features, is non-negotiable for market access. However, these same regulations can actually boost demand for Gentex's products. As automakers strive to meet ADAS requirements, they often look to suppliers like Gentex for integrated solutions that enhance safety, such as auto-dimming mirrors with integrated cameras and sensors.

The push for cleaner vehicles also plays a role. While Gentex's core products aren't directly emissions-related, the overall trend towards electrification and more efficient vehicles influences vehicle design and component integration. Gentex's ability to adapt its offerings to fit within these evolving vehicle architectures is crucial for its continued success. For instance, the company's dimming mirror technology is adaptable to a wide range of vehicle platforms, ensuring its relevance across different powertrain types.

Changes in international trade laws and the imposition of tariffs directly impact Gentex's global business. For instance, the ongoing trade tensions between the US and China have led to adjustments in production and affected revenue projections, especially concerning sales within the Chinese market.

Navigating these complex and evolving trade policies presents a significant legal hurdle for Gentex. The potential for reciprocal tariffs requires constant monitoring and strategic adaptation to mitigate financial risks and maintain competitive pricing for its automotive and aerospace products.

Mandatory Environmental, Social, and Governance (ESG) reporting is becoming a significant legal factor for companies like Gentex. Regions such as the European Union and California are leading the charge with stringent disclosure requirements covering environmental impact, social responsibility, and governance structures.

Gentex must navigate and comply with these evolving frameworks, including the Corporate Sustainability Reporting Directive (CSRD) in Europe and proposed SEC climate disclosure rules in the United States. Failure to comply can impact investor confidence and market access.

For instance, the EU's CSRD, which came into effect in January 2024, mandates extensive ESG reporting for a broad range of companies, aiming for greater transparency. Similarly, the SEC's proposed climate disclosure rules, expected to be finalized in 2024, will require public companies to report on climate-related risks and emissions.

Intellectual Property (IP) Protection

Intellectual property (IP) protection is paramount for Gentex, a company deeply invested in proprietary electro-optical products and advanced vision systems. Safeguarding its patents, trademarks, and trade secrets through stringent legal strategies is crucial for maintaining its competitive edge and deterring infringement. This focus on IP enforcement directly supports Gentex's continuous investment in research and development, ensuring its innovations remain protected.

In 2023, Gentex reported spending $181.6 million on research and development, underscoring the significance of its IP portfolio. The company actively manages its patents to protect its market position in areas like auto-dimming mirrors and advanced driver-assistance systems (ADAS). A strong IP framework allows Gentex to leverage its technological advancements and secure its future revenue streams.

- Patent Portfolio: Gentex holds a substantial number of patents covering its core technologies, providing a legal barrier against competitors.

- Trademark Enforcement: Protecting its brand names and logos is vital for maintaining customer trust and brand recognition in the automotive and aerospace sectors.

- Trade Secret Management: Robust internal policies are in place to safeguard proprietary manufacturing processes and unpatented technological know-how.

- Litigation and Licensing: Gentex actively engages in IP litigation when necessary to defend its rights and pursues licensing agreements to monetize its innovations.

Product Liability and Consumer Protection Laws

Gentex’s operations in automotive and aerospace sectors mean product safety is non-negotiable, exposing the company to potential product liability claims. Failure to meet rigorous safety standards and consumer protection mandates can lead to significant legal challenges and damage to its reputation.

Compliance with regulations governing product defects, warranties, and recall procedures is essential for mitigating legal exposure and preserving consumer confidence. For instance, in 2024, the automotive industry saw increased scrutiny on advanced driver-assistance systems (ADAS) and their potential for defects, a key area for Gentex.

- Product Defect Litigation: Companies like Gentex must rigorously test and validate their products to prevent defects that could lead to costly lawsuits.

- Warranty Compliance: Ensuring warranty terms are clearly communicated and honored is vital for consumer trust and legal adherence.

- Recall Preparedness: Having robust systems in place for swift and effective product recalls is a critical component of consumer protection.

- Regulatory Fines: Non-compliance with consumer protection laws can result in substantial fines, impacting financial performance.

Gentex must navigate a complex web of regulations concerning automotive safety and technology, with bodies like the NHTSA and UNECE continuously updating standards. The increasing demand for Advanced Driver-Assistance Systems (ADAS) directly influences product development and compliance requirements for components like smart mirrors. Furthermore, evolving trade policies and tariffs, particularly those affecting US-China relations, necessitate ongoing strategic adjustments to mitigate financial risks and maintain market competitiveness.

The company's robust intellectual property (IP) protection strategy is crucial, as evidenced by its substantial R&D investment of $181.6 million in 2023 to safeguard innovations in electro-optical products. Compliance with mandatory ESG reporting frameworks, such as the EU's CSRD implemented in early 2024 and anticipated SEC climate disclosure rules, is also a growing legal imperative. Finally, stringent product liability laws and consumer protection mandates require Gentex to maintain rigorous quality control to prevent defects and manage potential recall scenarios effectively.

| Legal Factor | Description | Impact on Gentex | Relevant Data/Period |

| Regulatory Compliance (Automotive Safety) | Adherence to standards set by NHTSA, UNECE for ADAS and vehicle safety features. | Drives product innovation and market access; non-compliance can lead to penalties. | Ongoing; ADAS mandates increasing. |

| Trade Policy & Tariffs | Navigating international trade laws and tariffs, especially US-China trade relations. | Affects global sales, production costs, and revenue projections. | Ongoing; US-China trade tensions impact 2024 projections. |

| Intellectual Property (IP) Protection | Safeguarding patents, trademarks, and trade secrets for proprietary technologies. | Maintains competitive edge, deters infringement, and supports R&D investment. | R&D spending: $181.6 million in 2023. |

| ESG Reporting | Compliance with mandatory environmental, social, and governance disclosure requirements. | Impacts investor confidence and market access; requires robust data collection. | EU CSRD (Jan 2024), proposed SEC climate rules (2024). |

| Product Liability & Consumer Protection | Mitigating risks from product defects, warranty claims, and recall procedures. | Requires rigorous quality control; non-compliance can result in fines and reputational damage. | Increased scrutiny on ADAS defects in 2024. |

Environmental factors

Stricter global emissions standards, such as the Euro 7 regulations proposed for 2025 and ongoing advancements in US EPA standards, are accelerating the automotive industry's pivot towards electric vehicles (EVs). This transition impacts vehicle architectures and material selection, potentially influencing demand for components like Gentex's auto-dimming mirrors and advanced electronic systems. For instance, by 2030, projections suggest over 30% of new vehicle sales globally could be electric, a significant increase from around 15% in 2023, according to industry analysis.

Environmental factors significantly impact Gentex's operations, particularly concerning resource scarcity and sustainable sourcing. The availability and cost of essential raw materials, such as specialty chemicals and sophisticated electronic components, are increasingly dictated by environmental regulations and the growing reality of resource depletion. For instance, the automotive industry, a key market for Gentex, faces increasing scrutiny over the sourcing of critical minerals like cobalt and lithium, with traceability gaps posing a significant challenge to supply chain integrity and ethical sourcing practices.

To navigate these challenges, Gentex must proactively implement robust sustainable sourcing strategies. This involves not only ensuring compliance with environmental standards but also actively exploring and adopting alternative materials that are more readily available and have a lower environmental footprint. Such initiatives are crucial for mitigating supply chain risks, reducing operational costs, and enhancing the company's overall environmental, social, and governance (ESG) profile in an increasingly eco-conscious market.

Gentex faces growing pressure to adopt sustainable manufacturing, pushing for waste reduction and circular economy models. This means actively minimizing waste during production and exploring ways to recycle components, which is crucial for environmental compliance and demonstrating corporate responsibility.

In 2024, the automotive industry, a key market for Gentex, saw increased focus on end-of-life vehicle (EOV) management. Regulations are tightening globally, with the EU's proposed Ecodesign for Sustainable Products Regulation (ESPR) aiming to make products more durable, reusable, and repairable, directly influencing how automotive suppliers like Gentex must design and manage their product lifecycles.

Embracing circular economy principles allows Gentex to not only meet these evolving environmental standards but also potentially unlock new value streams through material recovery and remanufacturing, aligning with broader Environmental, Social, and Governance (ESG) investment trends that saw significant capital allocation in 2024.

Climate Change Impacts and Supply Chain Resilience

Climate change poses significant threats to global supply chains, including those impacting Gentex. Extreme weather events like floods, hurricanes, and droughts, which are becoming more frequent and intense, can severely disrupt manufacturing, transportation, and raw material availability. For instance, the World Economic Forum's 2024 Global Risks Report highlighted extreme weather as a top concern for businesses globally, with cascading effects on production and delivery schedules.

Gentex must proactively assess and fortify its supply chain against these environmental disruptions. This involves a strategic approach to risk mitigation, focusing on adaptability and continuity. Building resilience is not just about reacting to events but about creating a robust system that can withstand and recover from shocks.

- Diversification of Production: Spreading manufacturing facilities across different geographic regions can reduce reliance on any single location vulnerable to specific climate impacts.

- Logistics Network Strengthening: Investing in more robust and flexible logistics infrastructure, including alternative transportation routes and warehousing, is crucial.

- Supplier Risk Assessment: Evaluating the climate vulnerability of key suppliers and collaborating with them to enhance their own resilience.

- Scenario Planning: Developing contingency plans for various climate-related disruption scenarios to ensure swift and effective responses.

Energy Consumption and Renewable Energy Adoption

Gentex's manufacturing processes, like many in the automotive supply chain, carry an environmental footprint primarily linked to energy consumption. In 2023, the company reported its total energy consumption was approximately 1.2 million MWh, with a significant portion coming from fossil fuels. This reliance presents both a cost and a sustainability challenge.

Recognizing this, Gentex has been actively pursuing energy efficiency initiatives and exploring renewable energy adoption. For instance, they completed an upgrade to LED lighting across their facilities in 2024, projected to reduce lighting energy use by 15%. Furthermore, Gentex is investigating the feasibility of on-site solar generation, aiming to source at least 10% of its electricity needs from renewables by 2027.

These efforts directly impact Gentex's Environmental, Social, and Governance (ESG) performance. By reducing energy intensity and increasing renewable energy usage, Gentex can lower its operational costs, mitigate risks associated with energy price volatility, and align with increasing investor and regulatory demands for sustainable business practices. This strategic focus is crucial for maintaining a competitive edge in an evolving market.

- Energy Consumption: Gentex's 2023 energy consumption was around 1.2 million MWh.

- Efficiency Measures: A 2024 LED lighting upgrade is expected to cut lighting energy use by 15%.

- Renewable Energy Goals: The company aims for 10% renewable electricity sourcing by 2027.

- ESG Impact: These initiatives enhance sustainability and potentially reduce operational costs.

Stricter environmental regulations, such as proposed Euro 7 standards and evolving US EPA rules, are driving the automotive industry towards electrification. This shift impacts vehicle design and material sourcing, potentially affecting demand for Gentex's core products. Projections indicate electric vehicles could account for over 30% of global new vehicle sales by 2030, a significant jump from roughly 15% in 2023.

Resource scarcity and sustainable sourcing are critical environmental concerns for Gentex. The availability and cost of raw materials are increasingly influenced by environmental regulations and resource depletion, with automotive supply chains facing scrutiny over critical minerals. Implementing robust sustainable sourcing strategies and exploring alternative materials are essential for mitigating supply chain risks and enhancing Gentex's ESG profile.

Climate change presents a growing threat to global supply chains, with more frequent extreme weather events disrupting manufacturing and logistics. Gentex must proactively assess and fortify its supply chain against these disruptions through diversification, logistics strengthening, supplier risk assessment, and scenario planning.

| Environmental Factor | Impact on Gentex | Key Data/Trends |

|---|---|---|

| Emissions Standards | Accelerates EV transition, influencing component demand. | EVs projected >30% global sales by 2030 (vs. ~15% in 2023). |

| Resource Scarcity | Affects raw material availability and cost. | Scrutiny on critical minerals in automotive supply chains. |

| Climate Change | Disrupts supply chains via extreme weather. | World Economic Forum 2024 Global Risks Report highlights extreme weather as a top concern. |

| Energy Consumption | Affects operational costs and sustainability. | Gentex consumed ~1.2 million MWh in 2023; 2024 LED upgrade to cut lighting energy use by 15%. |

PESTLE Analysis Data Sources

Our Gentex PESTLE Analysis is built on a robust foundation of data from official government publications, reputable industry associations, and leading market research firms. This ensures each insight into political, economic, social, technological, legal, and environmental factors is grounded in credible, current information.