Gentex Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentex Bundle

Gentex's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate its market effectively.

The complete report reveals the real forces shaping Gentex’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gentex's reliance on suppliers for highly specialized components, such as the electro-optical materials and advanced sensors crucial for its auto-dimming mirrors, significantly impacts supplier bargaining power. When the pool of suppliers for these niche inputs is limited, those suppliers gain leverage, potentially driving up costs for Gentex. For instance, in 2023, the automotive industry experienced ongoing supply chain disruptions, particularly for advanced electronics, which could have amplified the bargaining power of specialized component providers to the automotive sector.

Gentex's automatic-dimming rearview mirrors and dimmable aircraft windows rely on specialized inputs like electrochromic gels and advanced optics. The performance and functionality of these high-tech products are directly tied to the quality and reliability of these critical components. For instance, the precision of the electrochromic gel formulation is paramount to achieving the desired dimming effect.

The dependence on these specialized inputs grants suppliers considerable bargaining power. Any disruption in the supply chain or a decline in the quality of these essential materials could significantly hinder Gentex's production capabilities and compromise the performance of its flagship products. This reliance means suppliers of these niche materials hold a strong hand in negotiations.

Switching suppliers for highly specialized automotive components, like those Gentex produces, often involves substantial costs and a lengthy validation process. This can include rigorous testing of new materials, potential redesigns of existing products to accommodate different specifications, and the risk of production line interruptions. For instance, in the automotive sector, the qualification of a new supplier for critical electronic components can take 18-24 months and involve millions in development and testing costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Gentex's business, meaning they start producing dimmable mirrors or windows themselves, is a significant consideration. If suppliers possessed the capability and motivation to enter Gentex's market directly, their leverage over Gentex would increase substantially. This would allow them to capture more of the value chain.

However, for many of Gentex's specialized suppliers, this particular threat is likely constrained. The production of advanced dimmable mirrors and windows involves considerable complexity, significant investment in intellectual property, and the cultivation of long-standing relationships with automotive manufacturers. These barriers make it challenging for most suppliers to realistically undertake forward integration and compete directly with Gentex.

- Supplier Capability: Many suppliers lack the proprietary technology and manufacturing scale to directly compete with Gentex's specialized products.

- Intellectual Property: Gentex holds numerous patents, creating a high barrier to entry for suppliers seeking to replicate their technology.

- Customer Relationships: Gentex's deep integration and established trust with major automotive OEMs are difficult for suppliers to replicate quickly.

- Market Barriers: The automotive supply chain is complex, requiring extensive testing, certification, and long lead times, which deter potential new entrants.

Availability of Substitute Inputs

The availability of substitute inputs significantly shapes the bargaining power of suppliers. If Gentex faces a limited pool of suppliers for its specialized electro-optical and sensing technologies, those suppliers gain considerable leverage. For instance, in 2024, the automotive industry's increasing demand for advanced driver-assistance systems (ADAS) features, which rely on sophisticated sensors and displays, can concentrate power among a few key component providers if alternatives are scarce.

Gentex's own research and development efforts play a crucial role in mitigating this. By innovating and potentially developing in-house alternatives for critical materials or technologies, Gentex can reduce its reliance on external suppliers. This strategic move, if successful, could shift the balance of power over time, allowing Gentex more flexibility in sourcing and potentially lowering costs.

- Limited Alternatives: If Gentex has few options for its unique electro-optical and sensing technologies, supplier power is high.

- Industry Demand: In 2024, the automotive sector's growing need for ADAS components can empower key sensor and display suppliers.

- R&D Mitigation: Gentex's internal innovation in materials can reduce dependence on external suppliers.

- Supplier Leverage: A scarcity of alternative suppliers for specialized components strengthens their bargaining position.

Gentex's reliance on a limited number of suppliers for highly specialized components, such as electro-optical materials for its auto-dimming mirrors, grants these suppliers significant bargaining power. This leverage is amplified when alternative suppliers are scarce, as seen in 2024 with the automotive industry's increasing demand for advanced driver-assistance systems (ADAS) components, which often rely on sophisticated sensors and displays.

The high switching costs for Gentex, involving lengthy validation processes and potential product redesigns, further bolster supplier leverage. For instance, qualifying a new supplier for critical automotive electronic components can take up to 24 months and incur substantial development costs, making it difficult for Gentex to easily change providers.

While the threat of forward integration by suppliers exists, it is generally constrained by the complexity of Gentex's products, significant intellectual property barriers, and established customer relationships within the automotive sector, making direct competition challenging for most suppliers.

| Factor | Impact on Gentex | 2024 Context |

| Supplier Concentration | High | Increased demand for ADAS components can consolidate power among key suppliers. |

| Switching Costs | High | Lengthy qualification processes (up to 24 months) and R&D investment deter easy supplier changes. |

| Forward Integration Threat | Low to Moderate | Proprietary technology and OEM relationships limit supplier ability to compete directly. |

| Availability of Substitutes | Low | Scarcity of alternative suppliers for specialized electro-optical and sensing technologies strengthens supplier position. |

What is included in the product

Tailored exclusively for Gentex, this analysis dissects the five forces shaping its industry, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a dynamic, interactive visualization of each force.

Gain immediate clarity on strategic vulnerabilities by seeing the interplay of all five forces at a glance.

Customers Bargaining Power

Gentex's customer base is heavily concentrated among a few large automotive original equipment manufacturers (OEMs) and aircraft builders. These significant clients, such as General Motors and Ford, represent substantial purchase volumes. For example, in 2023, automotive sales constituted a significant portion of Gentex's revenue, underscoring the reliance on these key partners.

This high purchase volume grants these customers considerable bargaining power. They can leverage their substantial orders to negotiate for lower prices, more favorable payment terms, or the development of specific product features tailored to their needs. The automotive sector, in particular, is known for its aggressive procurement practices, amplifying this customer leverage.

While Gentex's advanced features like auto-dimming mirrors and camera systems significantly boost vehicle safety and driver convenience, they are ultimately components within a much larger automotive ecosystem. Automakers, even as of 2024, integrate these into vehicles that cost tens of thousands of dollars, meaning Gentex's contribution, while valuable, is a relatively small fraction of the overall vehicle price.

This positioning means that automotive manufacturers may perceive Gentex's offerings as important enhancements rather than absolutely critical, core differentiators. Consequently, their willingness to pay substantial premiums is often constrained by the need to manage costs across numerous suppliers and the overall vehicle bill of materials, thereby limiting Gentex's pricing leverage.

For automotive and aircraft manufacturers, the process of integrating a new supplier's mirror or window system is a complex undertaking. It demands substantial investment in design, engineering, and rigorous testing to ensure compatibility and performance. This intricate validation process, often spanning multiple years due to lengthy design cycles, creates significant switching costs for these customers.

These high switching costs, stemming from the deep integration and validation required, can effectively limit the bargaining power of customers once Gentex's products are incorporated into a vehicle platform. For instance, a new automotive model typically has a development cycle of 3-5 years, meaning a supplier chosen early in this phase is locked in for the life of that platform, potentially 7-10 years or more.

Threat of Backward Integration by Customers

Major automotive original equipment manufacturers (OEMs) and aircraft manufacturers possess substantial financial clout and technical expertise, enabling them to consider producing certain components internally. While producing highly specialized electro-optical technology like Gentex's smart-dimming mirrors might be impractical, the threat of backward integration for more standardized parts does exist. This potential capability acts as a constraint on Gentex's pricing power.

For instance, in 2024, the automotive industry saw continued consolidation and significant investment in R&D by major players, many of whom are exploring vertical integration strategies to control costs and supply chains. While specific figures on OEMs' internal production of automotive mirror components are not publicly detailed, the general trend of automakers seeking greater control over their supply chains, especially for critical or high-volume parts, remains a strategic consideration. This underlying capability, even if not fully realized for advanced components, influences pricing negotiations.

- Customer Bargaining Power: The threat of backward integration by large automotive OEMs and aircraft manufacturers can limit Gentex's pricing flexibility.

- Financial & Technical Capacity: Major customers possess the resources to potentially produce components in-house, especially more standardized ones.

- Strategic Considerations: Automakers' ongoing focus on supply chain control and cost management in 2024 reinforces this potential threat.

- Pricing Ceiling: The mere possibility of customers bringing production in-house creates a ceiling on the prices Gentex can command for its products.

Customer Price Sensitivity

The automotive and aviation sectors are fiercely competitive, driving Original Equipment Manufacturers (OEMs) to prioritize cost management. This intense focus on expenses directly translates to a high degree of price sensitivity among Gentex's clientele.

Consequently, Gentex faces constant pressure to innovate and refine its manufacturing processes. This ensures they can offer competitive pricing while still protecting their profit margins in these cost-conscious markets.

- OEMs' Cost Focus: The automotive industry, for instance, saw average vehicle transaction prices reach approximately $48,500 in early 2024, highlighting the significant value proposition OEMs must deliver.

- Price Sensitivity Impact: This necessitates Gentex to maintain cost efficiencies, as even minor price increases can significantly impact OEM purchasing decisions in a market where every dollar counts.

- Innovation as a Lever: Continuous product development and process optimization are crucial for Gentex to absorb cost pressures and remain an attractive supplier to price-sensitive customers.

Gentex’s customers, primarily large automotive OEMs and aircraft manufacturers, wield significant bargaining power due to their substantial order volumes and the competitive nature of their industries. This power is amplified because Gentex's products, while advanced, represent a relatively small portion of the overall vehicle cost, limiting customer willingness to pay substantial premiums.

The high switching costs associated with integrating Gentex's technology into vehicle platforms do provide some leverage for Gentex. However, the constant pressure from OEMs to manage costs, especially evident in 2024 with continued industry focus on efficiency, means Gentex must continually innovate to offer competitive pricing without sacrificing profitability.

| Customer Type | Bargaining Power Factor | Gentex's Counter-Lever | 2024 Market Context |

|---|---|---|---|

| Automotive OEMs | High purchase volume, price sensitivity | High switching costs, product innovation | Intense cost management, R&D investment |

| Aircraft Manufacturers | Concentrated customer base, large order sizes | Product specialization, long development cycles | Emphasis on safety and reliability |

Preview Before You Purchase

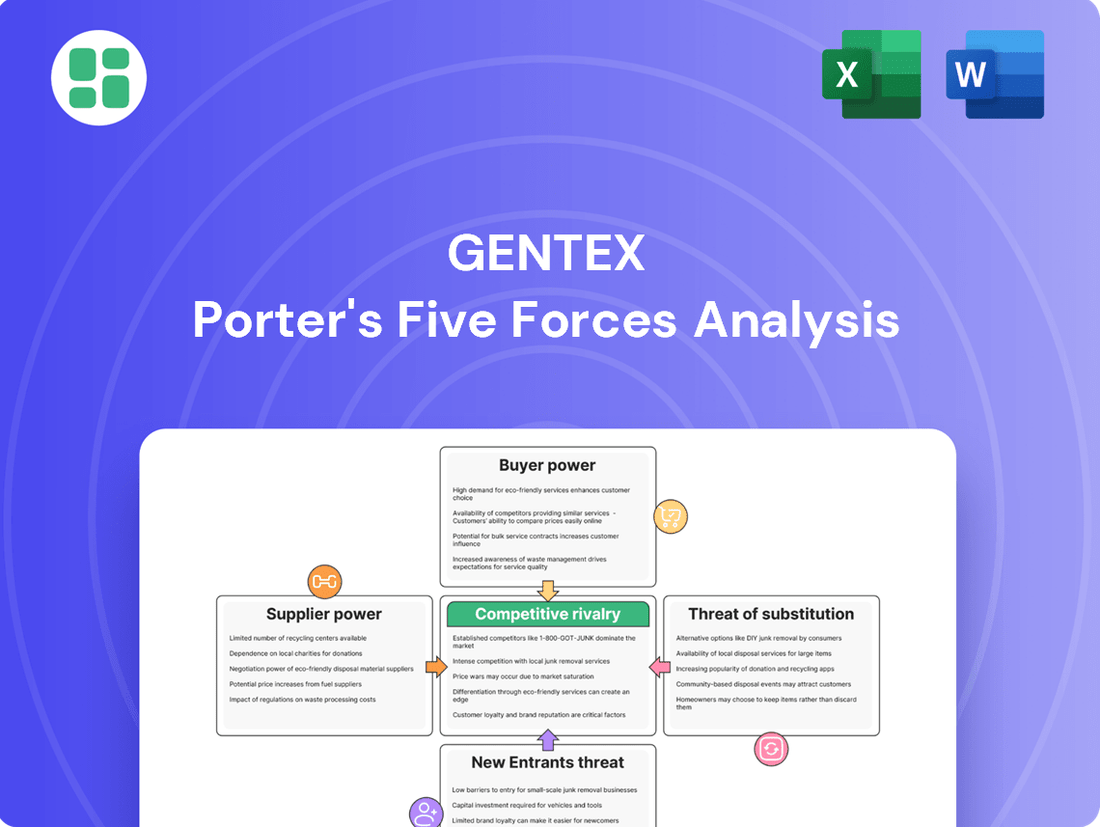

Gentex Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Gentex, detailing threats from new entrants, the bargaining power of buyers and suppliers, the intensity of competitive rivalry, and the threat of substitute products. The document you see here is precisely the same professionally formatted and ready-to-use analysis you'll receive immediately after purchase, ensuring no surprises. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, enabling you to leverage its insights without delay.

Rivalry Among Competitors

Gentex faces a competitive landscape populated by established players in both its automotive and aerospace segments. In automotive mirrors and vision systems, companies like Magna International, Murakami Corporation, and Ficosa are significant rivals, offering similar technologies and solutions. This means Gentex isn't operating in a vacuum; these firms actively compete for market share and customer contracts.

The diversity of competitors further sharpens this rivalry. Gentex contends not only with specialized automotive suppliers but also with larger, more diversified conglomerates that have automotive divisions. Similarly, in the aircraft window sector, Gentex competes with other manufacturers, some of whom may also have broader aerospace portfolios, creating a multi-faceted competitive environment.

The automotive display and vision systems market is booming, fueled by the rise of advanced driver-assistance systems (ADAS), sophisticated infotainment, and the increasing adoption of electric vehicles (EVs). Similarly, the aircraft window market is also demonstrating consistent growth. This expanding market size offers a degree of relief from intense competition, allowing companies like Gentex to focus on capturing a larger slice of the pie rather than just fighting for existing market share.

However, the landscape isn't entirely without its challenges. Gentex's Q1 2025 performance indicated a slowdown in light vehicle production within its key operating regions. This suggests that while the overall market is growing, specific segments might be experiencing headwinds, which could still intensify rivalry as companies vie for diminishing production volumes in those areas.

Gentex stands out by leveraging its unique electrochromic technology and advanced vision systems, integrating sophisticated electronic features that set its products apart. This focus on proprietary technology allows them to carve out a distinct market position.

The company's commitment to continuous innovation is evident in its development of Full Display Mirrors (FDM), dimmable sunroofs, and driver monitoring systems. These advancements are key to staying ahead and mitigating the impact of direct price wars with competitors.

In 2023, Gentex reported net sales of $1.9 billion, with their automotive segment, driven by these innovative products, accounting for the vast majority of this revenue. This demonstrates the market's appetite for their differentiated offerings.

Exit Barriers for Competitors

High fixed costs, such as those associated with specialized manufacturing equipment for automotive mirrors, can trap capital, making it difficult for competitors to exit the market. Gentex, for instance, invests heavily in its proprietary dimming glass technology, creating a significant sunk cost for any potential new entrant or exiting player.

The presence of specialized assets, like custom-built production lines for electrochromic mirrors, means these assets have limited resale value outside the automotive industry. This lack of alternative use further deters companies from leaving, as selling off such assets would likely result in substantial losses. For example, the precision required for Gentex's mirror components means their machinery isn't easily repurposed.

Long-term contracts with major automotive manufacturers, a staple in Gentex's business model, also act as a significant exit barrier. These agreements often involve substantial penalties for early termination or require ongoing commitments, making it financially prohibitive for competitors to cease operations. In 2024, many automotive suppliers, including those in Gentex's space, operate under multi-year supply agreements that lock them into production.

- High Fixed Costs: Significant investments in specialized manufacturing equipment for electrochromic mirrors.

- Specialized Assets: Production lines designed for niche automotive components have limited resale value.

- Long-Term Contracts: Commitments with automakers create financial disincentives for early market exit.

Switching Costs for End-Users (Consumers)

End-users, such as car buyers or airline passengers, don't directly select Gentex's products like auto-dimming mirrors or digital cameras. Their choices are driven by overall vehicle features, safety, and comfort, which indirectly influence Original Equipment Manufacturers (OEMs) to choose specific components. This means end-users face virtually no direct switching costs related to Gentex's particular offerings.

This lack of direct end-user switching costs places the onus on OEMs to source the most competitive and advanced components. Consequently, OEMs are more likely to switch suppliers if a competitor offers superior technology or better pricing for similar features. This dynamic creates competitive pressure on Gentex, as it must continuously innovate and maintain cost-effectiveness to retain OEM business.

For instance, while a consumer might switch brands of cars, they don't typically consider the specific mirror supplier when making that decision. This indirect influence means Gentex's competitive standing is largely determined by its ability to satisfy OEM requirements, rather than direct consumer demand or loyalty to its brand.

- Low Direct End-User Switching Costs: Consumers do not directly choose or switch Gentex components.

- Indirect Influence on OEMs: End-user demand for features indirectly pressures OEMs, impacting component selection.

- OEMs Drive Component Choice: OEMs select components based on features, cost, and supplier competition, not end-user brand preference for the component itself.

Gentex faces significant rivalry from established players like Magna International and Murakami Corporation in the automotive sector, and other manufacturers in aerospace. This competition intensifies due to the expanding market for advanced driver-assistance systems (ADAS) and aircraft windows, as seen in Gentex's 2023 net sales of $1.9 billion, with automotive driving most of that. Despite overall market growth, Q1 2025 data shows a slowdown in light vehicle production, potentially increasing pressure on market share.

Gentex differentiates itself through proprietary electrochromic technology and continuous innovation in products like Full Display Mirrors (FDM) and driver monitoring systems, which helped drive their 2023 revenue. High fixed costs and specialized assets for manufacturing electrochromic mirrors create exit barriers for competitors, as these assets have limited resale value. Furthermore, long-term contracts with major automotive manufacturers in 2024 lock in suppliers, further solidifying the competitive landscape.

End-users, such as car buyers, have virtually no direct switching costs for Gentex's components, as they don't choose specific suppliers. This shifts the competitive pressure to Original Equipment Manufacturers (OEMs), who select components based on features, cost, and supplier innovation. OEMs are therefore more likely to switch if a competitor offers better technology or pricing, making continuous innovation crucial for Gentex to retain business.

SSubstitutes Threaten

Traditional non-dimming rearview mirrors and mechanical window shades represent viable, albeit less sophisticated, substitutes for Gentex's advanced offerings. These alternatives often present a significantly lower price point, making them attractive to budget-sensitive Original Equipment Manufacturers (OEMs) and consumers.

For instance, while Gentex's automatic-dimming mirrors enhance driver comfort and safety, a basic manual mirror can fulfill the fundamental function at a fraction of the cost. In 2024, the automotive aftermarket saw continued demand for basic mirror replacements, highlighting the persistent appeal of cost-effective solutions in certain segments.

The likelihood that automakers, Gentex's primary buyers, will switch to alternative solutions hinges on several key drivers. Cost savings are always a significant consideration, but the increasing stringency of automotive safety regulations and growing consumer appetite for advanced in-car features are powerful counterbalances. As these trends solidify, the incentive for OEMs to move away from Gentex's sophisticated offerings may diminish, although cost pressures will undoubtedly persist.

Technological advancements in display technologies, such as OLED and MicroLED, are emerging as potential substitutes for traditional auto-dimming mirrors. While Gentex is actively incorporating these advanced displays into its own offerings for automotive cockpits, the development of these technologies by competitors could offer alternative solutions for glare management and rearward vision, potentially impacting Gentex's market share.

Furthermore, improvements in conventional smart glass technologies by rival companies present another avenue for substitution. These competitors might develop smart glass solutions that offer comparable or superior glare reduction and privacy features, thereby posing a threat to Gentex's established product lines and requiring continuous innovation to maintain a competitive edge.

Indirect Substitutes for Vision Enhancement

Beyond traditional automotive mirrors, advanced driver-assistance systems (ADAS) and other vision enhancement technologies pose a threat of substitution. For instance, sophisticated camera systems offering 360-degree views, thermal imaging for low-light conditions, and augmented reality head-up displays can replicate some of the safety and visibility benefits provided by Gentex’s auto-dimming mirrors and related products. These technologies can reduce reliance on traditional mirror systems.

Gentex is proactively addressing this threat by investing in and developing its own capabilities in these emerging areas. Their efforts in areas like advanced camera systems and digital mirrors demonstrate a strategy to integrate or compete with these substitutes, rather than be entirely displaced by them. For example, Gentex’s 2023 revenue reached $1.9 billion, with a significant portion attributed to its electronics segment, which includes these advanced vision technologies.

- Advanced Camera Systems: Offer comprehensive environmental awareness, potentially reducing the need for traditional side mirrors.

- Thermal Imaging: Enhances visibility in adverse conditions like fog or darkness, a function partially addressed by advanced lighting and mirror technologies.

- Augmented Reality HUDs: Project critical driving information, including navigation and safety alerts, directly into the driver's line of sight, potentially impacting the perceived value of integrated mirror displays.

- Gentex's Investment: The company's continued R&D spending, which was approximately 8% of revenue in recent years, is directed towards developing solutions that either incorporate or compete with these substitute technologies.

Regulatory and Safety Standards

Stricter government regulations for vehicle safety, such as mandates for advanced driver assistance systems (ADAS) and enhanced visibility, can significantly reduce the threat of low-tech substitutes. For instance, by mid-2024, the European Union's General Safety Regulation 2 requires new vehicle types to be equipped with advanced emergency braking and lane keeping assist systems, directly impacting the need for simpler, less technologically advanced solutions.

Gentex's innovative products, like its auto-dimming mirrors and camera systems, often align with or exceed these evolving safety standards. This positioning makes Gentex's offerings more attractive to Original Equipment Manufacturers (OEMs) who are actively seeking compliance and robust safety enhancements for their vehicles. In 2024, the automotive industry saw continued investment in ADAS technologies, with projections indicating a substantial market growth, further solidifying the advantage of suppliers like Gentex.

- Stricter Regulations: Mandates for ADAS and enhanced visibility reduce the appeal of basic, low-tech alternatives.

- Gentex Alignment: Gentex products often meet or surpass these stringent safety requirements.

- OEM Preference: Automakers favor suppliers who facilitate compliance and safety upgrades.

- Market Trend: The growing automotive safety technology market in 2024 favors advanced solutions like those offered by Gentex.

While basic mirrors and manual shades are cheaper substitutes, stricter safety regulations and consumer demand for advanced features make them less appealing to automakers. For example, the EU's General Safety Regulation 2, implemented by mid-2024, mandates advanced driver assistance systems, pushing OEMs towards sophisticated solutions like Gentex's.

Emerging technologies like advanced camera systems and augmented reality head-up displays offer alternative ways to enhance driver visibility and safety, potentially reducing reliance on traditional mirrors. Gentex is investing in these areas, with its electronics segment contributing significantly to its $1.9 billion revenue in 2023, indicating a strategic move to integrate or compete with these evolving substitutes.

The threat of substitutes is mitigated by Gentex's focus on integrating advanced features that align with or exceed evolving automotive safety standards. This proactive approach, supported by significant R&D investment, positions Gentex favorably against lower-tech alternatives and even emerging technologies by offering comprehensive solutions.

| Substitute Technology | Potential Impact on Gentex | Gentex's Response/Mitigation | 2024 Market Trend Relevance |

|---|---|---|---|

| Basic Mirrors/Manual Shades | Lower cost appeal for budget-conscious OEMs | Stricter safety regulations favor advanced features | Regulations like EU's GSR2 increase demand for ADAS |

| Advanced Camera Systems/AR HUDs | Offer alternative visibility and safety benefits | Investment in own advanced vision technologies | Growing ADAS market favors integrated solutions |

| Smart Glass Technologies | Competitors offering comparable glare reduction | Continuous innovation and product development | Ongoing competition requires differentiation |

Entrants Threaten

The automotive and aerospace sectors, particularly for sophisticated electro-optical components like those Gentex produces, demand colossal upfront investment. Consider that in 2024, the average R&D spending for a major automotive supplier can easily reach hundreds of millions of dollars annually, a substantial hurdle for newcomers.

Beyond research, establishing state-of-the-art manufacturing plants equipped with precision machinery and cleanroom environments represents another massive capital outlay. Building a new automotive-grade manufacturing facility can cost upwards of $100 million, effectively acting as a formidable barrier to entry for smaller or less capitalized firms.

Furthermore, the need for specialized, often proprietary, equipment and rigorous quality control systems adds to the already high capital requirements. Companies must also account for the costs associated with certifications and compliance, which can run into the tens of millions, making entry extremely challenging.

Gentex's substantial portfolio of patents, covering its electrochromic technology and integrated vision systems, acts as a significant deterrent for potential new entrants. In 2023, Gentex reported holding over 1,000 active patents globally, a testament to its innovation and a strong defense against imitation. This intellectual property moat makes it exceedingly difficult and costly for competitors to enter the market without infringing on existing patents, thereby raising the barrier to entry considerably.

Gentex enjoys substantial economies of scale, a direct result of its massive production volumes for auto-dimming mirrors and related products. In 2023, Gentex reported net sales of $1.9 billion, underscoring its significant market presence and the cost efficiencies derived from such output. This scale allows Gentex to command lower per-unit manufacturing costs, making it incredibly difficult for new entrants to compete on price without matching these vast operational scales and incurring massive upfront capital expenditures.

Access to Distribution Channels and Customer Relationships

New entrants face a significant hurdle in gaining access to established distribution channels and cultivating strong customer relationships within the automotive and aerospace sectors. Gentex has spent decades building trust and a robust supply chain with virtually every major automotive original equipment manufacturer (OEM) and many aircraft manufacturers. This deep integration means new competitors must navigate lengthy, intricate qualification processes that can take years, making it incredibly difficult to displace existing, trusted suppliers.

For instance, securing a contract with a major automaker often involves rigorous testing, validation, and integration into their production lines, a process that new entrants with no prior track record find exceptionally challenging. Gentex's established presence, evidenced by its consistent supply agreements with leading global car brands, acts as a formidable barrier. In 2023, Gentex reported that its automotive products were supplied to over 90% of the world's major automakers, underscoring the breadth of its established distribution network.

- Established OEM Relationships: Gentex's long-standing partnerships with nearly every major global automaker create a significant barrier to entry for new competitors.

- Lengthy Qualification Processes: New entrants must invest years and substantial resources in qualifying their products with automotive and aerospace manufacturers.

- Customer Loyalty and Trust: Years of reliable supply and product performance have fostered deep trust between Gentex and its key customers, making switching difficult.

- Distribution Channel Control: Gentex's integration into existing automotive supply chains effectively limits access for potential new entrants.

Regulatory Hurdles and Certification

The automotive and aerospace sectors, where Gentex primarily operates, demand products that adhere to rigorous safety, quality, and performance certifications. For instance, automotive components must often comply with standards like ISO 26262 for functional safety.

New companies looking to enter these markets face a significant barrier in the form of these complex regulatory hurdles and the lengthy, costly process of obtaining necessary approvals. This can deter potential competitors by requiring substantial upfront investment in compliance and testing, which established players have already absorbed.

- Regulatory Compliance Costs: New entrants must budget for extensive testing and documentation to meet automotive (e.g., FMVSS in the US) and aerospace (e.g., FAA regulations) standards.

- Certification Lead Times: Obtaining certifications can take years, a significant delay for a new business trying to establish market presence and revenue streams.

- Investment in Quality Systems: Demonstrating adherence to quality management systems like IATF 16949 for automotive suppliers requires significant operational investment.

The threat of new entrants for Gentex is relatively low due to substantial barriers. High capital requirements for advanced manufacturing and R&D, as seen in 2024 automotive R&D spending reaching hundreds of millions, deter newcomers. Furthermore, Gentex's extensive patent portfolio, with over 1,000 active patents as of 2023, creates an intellectual property moat that is costly and difficult to navigate for potential competitors.

| Barrier Type | Description | Impact on New Entrants | Gentex's Position |

|---|---|---|---|

| Capital Requirements | High cost for R&D, advanced manufacturing, and certifications. | Significant deterrent; requires massive upfront investment. | Established infrastructure and scale. |

| Intellectual Property | Extensive patent portfolio protecting core technologies. | Legal and financial risks for imitation; costly to design around. | Over 1,000 active patents (2023). |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Difficulty competing on price without matching scale. | $1.9 billion in net sales (2023). |

| Customer Relationships & Distribution | Long-standing OEM partnerships and integrated supply chains. | Lengthy qualification processes; difficult to displace incumbents. | Supplies over 90% of global automakers (2023). |

| Regulatory & Certification | Complex and costly compliance with automotive/aerospace standards. | Time-consuming and expensive to obtain necessary approvals. | Established compliance infrastructure. |

Porter's Five Forces Analysis Data Sources

Our Gentex Porter's Five Forces analysis is built upon a robust foundation of data, including Gentex's annual reports, SEC filings, and industry-specific market research from firms like IHS Markit and Frost & Sullivan.