Gentex Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentex Bundle

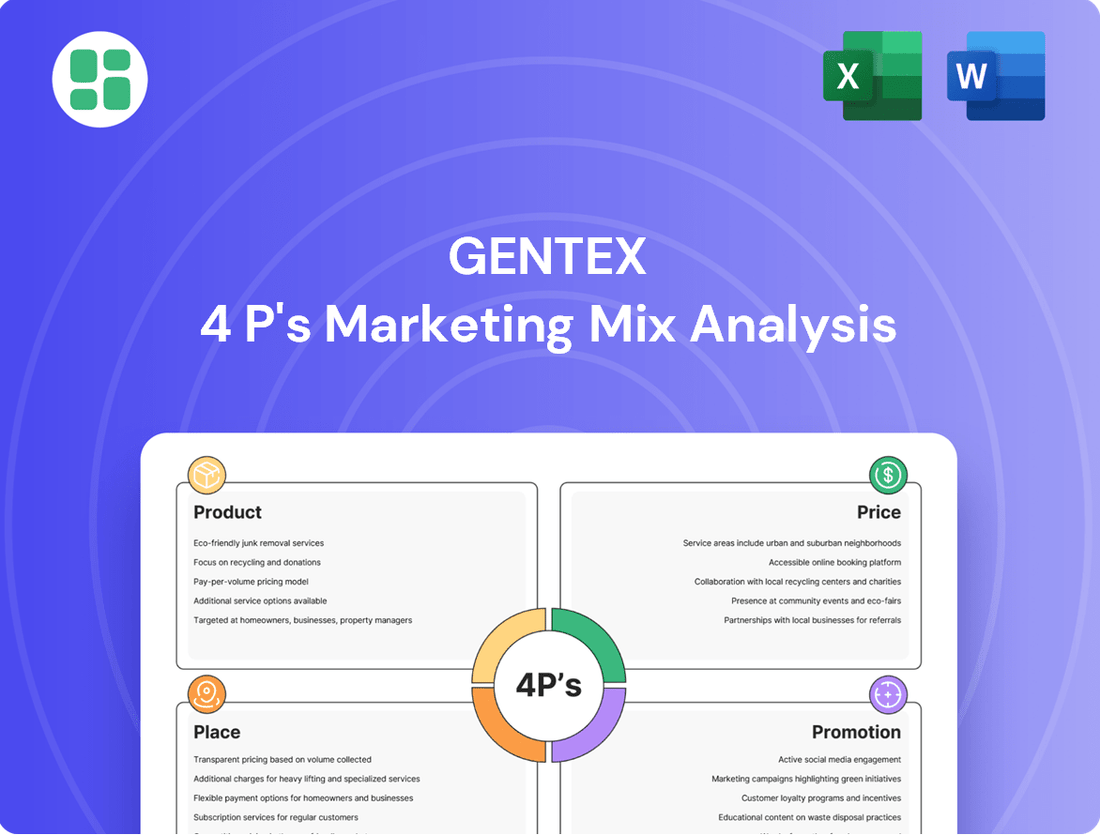

Gentex's marketing prowess is built on a carefully crafted blend of Product, Price, Place, and Promotion. Discover how their innovative product development, strategic pricing, extensive distribution networks, and impactful promotional campaigns contribute to their market leadership.

Dive deeper into the specifics of Gentex's marketing strategy with our comprehensive 4Ps analysis. This ready-to-use report provides actionable insights into each element, perfect for business professionals, students, and consultants seeking a competitive edge.

Unlock the secrets behind Gentex's success. Our full analysis breaks down their product innovation, pricing architecture, channel strategy, and communication mix, offering a blueprint for effective marketing execution.

Product

Gentex's electro-optical mirrors and electronics are central to their product strategy, offering advanced features that go beyond basic rearview functionality. Their automatic-dimming mirrors, a core offering, are supplied to virtually every major car manufacturer globally, highlighting their strong market position and product acceptance. This focus on integrated electronics, such as Full Display Mirrors and driver monitoring systems, directly addresses the growing demand for enhanced vehicle safety and connectivity.

The company's commitment to innovation is evident in their continuous development of dimmable glass technology. Showcasing advancements at CES 2025, including OLED displays and water-shedding camera lenses for FDMs, demonstrates their forward-thinking approach. Furthermore, the introduction of new dimmable sun visors broadens their product portfolio and caters to evolving consumer expectations for comfort and advanced features in vehicles.

Gentex's electronically dimmable windows (EDWs) are a key product in their aerospace offering, a segment where they hold the leading global supplier position. These windows, featured on aircraft such as the Boeing 787 Dreamliner, allow passengers to control cabin light and heat, enhancing comfort and potentially reducing cooling energy demands. For instance, by reducing solar heat gain, EDWs can contribute to significant cabin temperature regulation, lessening the load on the aircraft's environmental control systems.

The product's appeal lies in its dual functionality: providing passengers with personalized control over their environment while maintaining visibility. This feature directly addresses passenger experience, a critical factor in airline competitiveness. Gentex's continuous innovation, such as the recently unveiled switchable scattering layer (SSL) technology at AIX 2025, further refines the user experience by minimizing mirror effects and boosting privacy, demonstrating a commitment to product advancement.

Gentex's commercial fire protection products, a cornerstone of their offering built on over five decades of expertise, include sophisticated smoke and carbon monoxide alarms alongside essential signaling devices such as bells, speakers, and strobes. Their commitment to innovation is evident in their pioneering photoelectric technology, first introduced in 1974 with the world's inaugural dual-cell photoelectric smoke alarm, a technology now safeguarding numerous institutions like schools, hotels, and hospitals.

This extensive product line supports Gentex's market presence, with their commercial fire protection solutions being integral to safety infrastructure across various sectors. While the company has also recently expanded into the consumer market with its smart home safety system, PLACE, its legacy and continued development in commercial fire safety remain a significant aspect of its business, reflecting a deep understanding of critical safety needs in public and commercial spaces.

Advanced Vision Systems and Sensing Technologies

Gentex's advanced vision systems and sensing technologies represent a significant expansion beyond its foundational auto-dimming mirrors. These systems, including driver and in-cabin monitoring, leverage the company's expertise in microelectronics and glass processing. For instance, their driver monitoring systems are designed to detect driver drowsiness and distraction, crucial for improving automotive safety. In 2024, the automotive industry continued to prioritize advanced driver-assistance systems (ADAS), with a growing demand for integrated sensing solutions.

The company is also exploring cutting-edge applications like thermal imaging for enhanced nighttime visibility, a key feature for pedestrian detection. This technology is particularly valuable in improving safety in low-light conditions. Gentex's commitment to innovation is further demonstrated by concept technologies such as facial recognition for personalized experiences, potentially in sectors like aerospace, aiming to elevate user interaction and security.

- Driver Monitoring Systems: Integrated into rearview mirrors, these systems enhance automotive safety by detecting driver fatigue and inattention.

- Thermal Imaging: Advanced sensing capabilities for improved nighttime pedestrian detection, a critical safety feature for modern vehicles.

- Biometrics and Personalization: Concept technologies like facial recognition aim to create personalized user experiences, expanding applications beyond automotive.

- Core Competency Leverage: Gentex utilizes its strengths in microelectronics, glass processing, and chemical development to drive innovation in these advanced systems.

Specialty Chemicals and Electro-Optical s

Gentex's strength in specialty chemicals and electro-optical products forms the bedrock of its dimmable mirror technology. This deep technical expertise fuels innovation, allowing for the creation of advanced materials and sophisticated electronic integration. For instance, Gentex's proprietary chemical formulations are key to the electrochromic (EC) glass that darkens on demand, a core component in their automotive offerings.

This vertical integration is a significant competitive advantage. It enables Gentex to control the entire development process, from the chemical compounds used in their electrochromic mirrors to the sophisticated electronic controls. This control fosters continuous improvement and the ability to develop highly differentiated products. In 2023, Gentex reported that its automotive segment, heavily reliant on these electro-optical capabilities, generated approximately 88% of its total revenue, underscoring the importance of this product category.

The company's focus on these high-value components allows it to carve out a distinct position in its markets. Gentex's ability to offer integrated solutions, combining advanced optics with intelligent electronic features, provides superior performance and functionality compared to competitors. This specialization is reflected in their market share; by the end of 2024, it's estimated that over 90% of new vehicles produced globally feature some form of Gentex's dimming technology.

Key aspects of Gentex's specialty chemicals and electro-optical products include:

- Proprietary Electrochromic Chemistry: The core chemical formulations enabling the light-dimming function in mirrors and other glass applications.

- Advanced Optical Coatings: Specialized coatings that enhance mirror performance, durability, and integration with electronic systems.

- Integrated Electronic Controls: Sophisticated microelectronics and software that manage the electrochromic effect and other mirror functionalities.

- Vertical Integration: Control over manufacturing processes from raw chemical inputs to finished electro-optical components, ensuring quality and innovation.

Gentex's product strategy centers on leveraging its core competencies in electro-optical technology and specialty chemicals to deliver advanced features for the automotive, aerospace, and fire protection industries. Their automatic-dimming mirrors, a dominant offering, are found in a vast majority of global vehicles, with over 90% of new cars produced globally featuring some form of Gentex dimming technology by the end of 2024. This dominance is built on proprietary electrochromic chemistry and a vertically integrated manufacturing process, which in 2023 accounted for approximately 88% of Gentex's total revenue through its automotive segment.

Expanding beyond mirrors, Gentex is innovating in driver and in-cabin monitoring systems, utilizing microelectronics and glass processing expertise to enhance automotive safety. Their commitment to future technologies was highlighted at CES 2025 with advancements like OLED displays and water-shedding camera lenses for Full Display Mirrors. In aerospace, their electronically dimmable windows (EDWs) are a leading product, enhancing passenger comfort and potentially reducing energy consumption on aircraft like the Boeing 787 Dreamliner.

The company also maintains a strong position in commercial fire protection, a segment where they pioneered photoelectric smoke alarm technology in 1974. Their product portfolio includes advanced smoke and carbon monoxide alarms, as well as signaling devices, underpinning safety infrastructure in numerous institutions. Gentex's recent venture into the consumer market with its smart home safety system, PLACE, signifies a strategic diversification of its established safety solutions.

| Product Category | Key Features/Applications | Market Position/Data Point | Innovation Highlight | Revenue Contribution (2023) |

| Automotive Electro-Optical Mirrors | Automatic dimming, Full Display Mirrors, Driver Monitoring | Over 90% of new global vehicles feature Gentex dimming technology (End of 2024) | CES 2025: OLED displays, water-shedding camera lenses | Approx. 88% of total revenue |

| Aerospace Electronically Dimmable Windows (EDWs) | Cabin light and heat control | Leading global supplier, featured on Boeing 787 Dreamliner | AIX 2025: Switchable Scattering Layer (SSL) technology | N/A (Segmental data not specified) |

| Fire Protection Systems | Photoelectric smoke/CO alarms, bells, speakers, strobes | Pioneered dual-cell photoelectric smoke alarm (1974) | Smart home system PLACE (consumer market expansion) | N/A (Segmental data not specified) |

| Advanced Vision & Sensing | Driver/in-cabin monitoring, Thermal imaging | Growing demand for ADAS solutions (2024) | Concept: Facial recognition for personalization | N/A (Segmental data not specified) |

What is included in the product

This analysis provides a comprehensive examination of Gentex's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking to understand Gentex's market positioning, offering a benchmark for competitive analysis and strategic planning.

Provides a clear, actionable framework for understanding and optimizing Gentex's marketing efforts, addressing the pain point of scattered or unclear strategic direction.

Simplifies complex marketing decisions by breaking down Gentex's strategy into digestible components, relieving the pressure of overwhelming data for decision-makers.

Place

Gentex's place in the market hinges on its direct sales strategy to automotive OEMs. This B2B approach means the company works hand-in-hand with car manufacturers, embedding its innovative products like auto-dimming mirrors directly onto assembly lines. This integration is crucial for meeting the high-volume demands and precise schedules of global automakers.

The success of this direct sales model is evident in Gentex's widespread adoption. As of the first quarter of 2024, their products are featured in vehicles from over 29 different automaker brands and are available across 124 distinct vehicle models worldwide. This broad reach underscores the trust and reliance major automotive players place on Gentex's technology.

Gentex directly sells its electrochromic dimmable windows to major aircraft manufacturers, solidifying its position as the go-to supplier for this specialized technology. This strategy involves deep integration with manufacturers during the early stages of new aircraft development, ensuring their technology is a core component from the outset.

This direct engagement allows Gentex to collaborate closely on design and integration, a critical factor for success in the aerospace industry. For instance, Gentex's dimmable windows are a key feature in numerous Boeing and Airbus models, reflecting the success of this approach.

The company actively participates in industry events such as the Aircraft Interiors Expo (AIX), a crucial platform for nurturing these vital manufacturer relationships and showcasing their latest innovations. In 2024, AIX saw significant interest in advanced cabin technologies, underscoring the ongoing demand for Gentex's solutions.

Gentex's commercial fire protection products reach contractors, distributors, and developers across North America, supporting major projects in commercial and institutional settings. This established channel ensures widespread adoption in critical infrastructure.

The introduction of the PLACE smart home safety system signifies a strategic move into the direct-to-consumer retail market. This expansion makes advanced safety technology accessible through major national retailers and online channels, broadening Gentex's market reach.

Global Manufacturing and Supply Chain Network

Gentex leverages a sophisticated global manufacturing and supply chain network to meet the diverse distribution demands of its automotive, aerospace, and fire protection clients. This intricate system is vital for the timely and efficient delivery of specialized components and finished products worldwide, reflecting a commitment to operational excellence.

The company's focus on efficiency and waste reduction is evident in its advanced manufacturing processes. For instance, in 2023, Gentex reported a significant portion of its sales originating from outside the United States, underscoring the global reach and complexity of its operations. This necessitates robust supply chain management to navigate international logistics and ensure product availability.

- Global Reach: Supports worldwide distribution across automotive, aerospace, and fire protection sectors.

- Logistical Complexity: Manages the movement of highly specialized components and finished goods.

- Efficiency Focus: Aims for optimized manufacturing processes and waste minimization.

- 2023 International Sales: A substantial percentage of revenue derived from global markets, highlighting network importance.

Strategic Partnerships and Aftermarket

Gentex actively cultivates strategic partnerships and engages with the automotive aftermarket, a strategy highlighted by its participation in events like SEMA 2024. Here, the company demonstrated its advanced technologies tailored for race teams and aftermarket vehicle enhancements, underscoring its commitment to a broader automotive ecosystem.

The HomeLink system exemplifies Gentex's successful aftermarket strategy. This key connectivity product is integrated into a vast number of vehicles, reaching an impressive installed base of approximately 110 million HomeLink-equipped vehicles currently on the road. This widespread adoption signifies strong consumer demand and OEM integration.

- SEMA 2024 Presence: Showcased technologies for race teams and aftermarket upgrades, indicating a focus on performance and customization segments.

- HomeLink Adoption: Integrated into an estimated 110 million vehicles, demonstrating broad market penetration and consumer acceptance.

- Aftermarket Value Proposition: The availability of HomeLink as an integrated feature highlights Gentex's ability to provide valuable, sought-after technology to both manufacturers and end-users.

Gentex's place strategy is multi-faceted, encompassing direct B2B sales to automotive and aerospace OEMs, a growing presence in the commercial fire protection market, and a new direct-to-consumer push with its smart home system. The company also actively engages the automotive aftermarket, as seen with its HomeLink system, now in an estimated 110 million vehicles. Their global manufacturing and supply chain are critical for delivering specialized components efficiently worldwide, with a significant portion of 2023 sales originating internationally.

| Market Segment | Place Strategy | Key Data/Examples |

|---|---|---|

| Automotive OEM | Direct Sales, On-Assembly Line Integration | Products in vehicles from 29+ brands, 124+ models (Q1 2024) |

| Aerospace | Direct Sales, Early Development Integration | Key feature in Boeing and Airbus models; AIX 2024 presence |

| Fire Protection | Distribution to Contractors & Developers | North American commercial/institutional projects |

| Smart Home | Direct-to-Consumer Retail | Major national retailers and online channels |

| Automotive Aftermarket | Integrated Features, Event Participation | HomeLink in ~110 million vehicles; SEMA 2024 participation |

Full Version Awaits

Gentex 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Gentex 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You can confidently purchase knowing you're getting the exact, finished analysis.

Promotion

Gentex leverages industry trade shows like CES, AIX, and SEMA as key promotional tools. In 2024, for instance, CES saw over 4,300 exhibitors, offering Gentex a prime opportunity to display its advancements in automotive and aerospace technologies directly to key decision-makers and potential clients.

Gentex's investor relations and financial communications are crucial for its 'Promotion' element. As a public entity, they actively engage with stakeholders through press releases, earnings calls, and comprehensive annual reports, ensuring transparency on financial performance and strategic direction.

In 2024, Gentex's commitment to clear communication was evident. For instance, their Q3 2024 earnings call, held on October 25, 2024, provided detailed insights into their revenue growth, which reached $560.6 million, a 9% increase year-over-year, alongside discussions on advancements in their dimmable glass and ADAS technologies.

Gentex's technical sales force is crucial for its B2B markets, particularly in automotive and aerospace. These teams directly engage with engineering and procurement departments at major original equipment manufacturers.

This direct interaction involves in-depth product demonstrations and collaborative development, ensuring Gentex's advanced technologies are seamlessly integrated into client platforms. For instance, in 2023, Gentex's automotive segment, which heavily relies on these relationships, saw continued growth, contributing significantly to their overall revenue.

This hands-on, consultative approach is fundamental to securing the long-term supply agreements that underpin Gentex's business model, fostering deep client partnerships and driving innovation.

Public Relations and Media Outreach

Gentex actively leverages public relations and media outreach to underscore its position as a technological leader, particularly in automotive safety and dimmable glass. Press releases, often targeting niche industry publications and broader news channels, are a key tool. For instance, in early 2024, Gentex highlighted its advancements in electrochromic technology at CES, generating significant media attention.

This strategic communication effort is crucial for building and maintaining a strong brand reputation within its core markets. The company's consistent innovation, such as its development of advanced driver-assistance systems (ADAS) features integrated into mirrors, is frequently communicated through these channels. In 2023, Gentex reported a revenue of $1.93 billion, partly fueled by the market's recognition of its technological contributions.

- Technological Leadership: Showcasing advancements in areas like smart rearview mirrors and digital vision systems.

- Safety Innovations: Communicating the safety benefits of their products, such as enhanced visibility and ADAS integration.

- Market Achievements: Highlighting successful product launches and market share gains in automotive and fire protection sectors.

- Brand Awareness: Building recognition and trust among automotive OEMs, suppliers, and end-users.

Digital Presence and Content Marketing

Gentex leverages its corporate website and digital platforms to disseminate comprehensive product details, technical specifications, and company updates. This digital strategy is crucial for its business-to-business (B2B) focus, but it also extends to consumer education, particularly for features like HomeLink and the emerging 'PLACE' smart home system. Through targeted content, Gentex effectively articulates the advantages and unique selling propositions of its offerings to a broader audience.

In 2023, Gentex reported a significant portion of its revenue derived from automotive, underscoring the importance of its digital channels in reaching automotive manufacturers and their Tier 1 suppliers. The company's investment in digital presence, including content marketing, aims to reinforce its position as an innovator in advanced automotive technologies and smart home solutions. For instance, their website likely features case studies and white papers detailing the integration and benefits of their electrochromic technology, a core component of their automotive mirrors and dimmable windows.

- Digital Channels: Gentex utilizes its corporate website, industry publications, and social media platforms to showcase its technological advancements and product applications.

- Content Marketing Focus: The company employs content to explain the value proposition of its products, such as the convenience and safety features of HomeLink and the integrated capabilities of the 'PLACE' smart home system.

- B2B and Consumer Reach: While primarily serving the automotive industry, Gentex’s digital content aims to build brand awareness and educate end-consumers about the benefits of its embedded technologies.

- Information Hub: The website acts as a central repository for detailed product information, technical specifications, and company news, supporting both business partners and interested consumers.

Gentex's promotional strategy effectively communicates its technological prowess and market achievements. By participating in key industry events like CES and leveraging investor relations, they ensure visibility among critical stakeholders. Their technical sales teams foster direct relationships with OEMs, driving product integration and securing long-term partnerships, crucial for their business model.

Public relations and digital platforms further amplify Gentex's message, highlighting innovations in automotive safety and smart home technology. This multi-faceted approach builds brand awareness and reinforces their leadership position, as evidenced by their consistent revenue growth, with $1.93 billion reported in 2023.

| Promotional Activity | Key Focus Areas | 2023/2024 Data Points |

|---|---|---|

| Industry Trade Shows | Automotive & Aerospace Tech, ADAS | CES 2024: Over 4,300 exhibitors |

| Investor Relations | Financial Performance, Strategic Direction | Q3 2024 Revenue: $560.6 million (9% YoY growth) |

| Technical Sales Force | B2B Engagement, Product Integration | Automotive segment growth in 2023 |

| Public Relations & Digital | Technological Leadership, Safety Innovations | 2023 Revenue: $1.93 billion |

Price

Gentex utilizes value-based pricing for its Original Equipment Manufacturer (OEM) clients in the automotive and aerospace sectors. This approach aligns pricing with the substantial technological advancements, safety improvements, and intricate integration requirements of their electro-optical products.

The pricing structure directly reflects the tangible benefits Gentex's solutions offer, such as improved driver visibility and enhanced safety features. These advantages translate into increased value for the final vehicle or aircraft, justifying the premium pricing for these sophisticated components.

Gentex strategically prices its products in specialized automotive, aerospace, and fire protection markets, focusing on delivering significant value. For example, the global auto-dimming mirror market was estimated to be worth over $2 billion in 2023 and is projected to see continued growth, allowing Gentex to price competitively while reflecting its technological advancements and market leadership.

The company’s pricing approach balances the substantial costs associated with its continuous innovation in areas like electrochromic technology with the prevailing market demand and competitor pricing. This ensures they maintain their strong position and secure crucial long-term supply agreements.

Gentex likely employs tiered pricing for its automotive products, aligning with the varying levels of integrated electronic features. For instance, a basic auto-dimming mirror would be priced differently than a Full Display Mirror incorporating Driver Monitoring Systems (DMS) and HomeLink functionality.

This tiered approach empowers Original Equipment Manufacturers (OEMs) to select solutions that best fit specific vehicle segments and their target price points. By bundling advanced technologies, Gentex can effectively maximize content per vehicle, offering a range of options from essential driver assistance to premium integrated systems.

Impact of Tariffs and Cost Management

Gentex's pricing strategy is significantly impacted by external factors, including tariffs. For instance, tariffs on goods imported from or exported to China can directly influence the cost of components and finished products, potentially leading to price adjustments for consumers, especially on newly acquired product lines like those from VOXX. This pressure necessitates a proactive approach to cost management.

To counteract these tariff-related cost increases and maintain profitability, Gentex focuses on rigorous cost management. This involves strategic purchasing reductions, negotiating better terms with suppliers, and implementing operational efficiencies across its manufacturing and supply chain. The company's ability to absorb or pass on these costs while preserving gross margins is crucial for its competitive pricing.

- Tariff Impact: Tariffs, particularly those involving China, can directly increase the cost of goods for Gentex, potentially affecting the pricing of its products, including recent acquisitions.

- Cost Management Strategies: Gentex actively pursues purchasing reductions and operational efficiencies to mitigate the impact of rising costs and maintain healthy gross margins.

- Pricing Adjustments: The company may need to adjust its pricing to reflect increased costs stemming from tariffs, balancing market competitiveness with the need to protect profitability.

Long-Term Contracts and Volume Discounts

Gentex's pricing strategy, particularly for its automotive clients, heavily leans on long-term contracts that often include volume discounts. This approach is a cornerstone of its business-to-business model, fostering predictable revenue streams and enabling manufacturing efficiencies through economies of scale. These agreements are crucial for maintaining stability in a cyclical industry.

The company's financial health, evidenced by its consistent share repurchase programs, underscores management's confidence in its pricing power and the long-term viability of its contracts. For instance, in the first quarter of 2024, Gentex reported a strong financial performance, further solidifying the effectiveness of its volume-based discount strategy.

- Long-Term Contracts: Securing multi-year agreements with major automotive manufacturers provides revenue visibility.

- Volume Discounts: Incentivizing higher purchase volumes helps Gentex achieve greater production efficiency.

- Revenue Stability: These contracts contribute to a predictable financial outlook, mitigating short-term market fluctuations.

- Financial Confidence: Consistent share repurchases, such as those seen in early 2024, reflect a strong belief in the company's pricing strategy and future earnings potential.

Gentex's pricing strategy is deeply rooted in value-based principles, reflecting the advanced technology and safety enhancements its electro-optical products deliver to automotive and aerospace OEMs. This approach ensures pricing aligns with the tangible benefits, such as improved driver visibility and integrated safety features, which justify premium costs for sophisticated components.

The company employs a tiered pricing model for automotive products, catering to different levels of integrated electronic features. For example, a basic auto-dimming mirror would be priced differently than a Full Display Mirror with Driver Monitoring Systems and HomeLink, allowing OEMs to select solutions suited to specific vehicle segments and price points.

Long-term contracts with volume discounts are a cornerstone of Gentex's B2B model, fostering revenue predictability and manufacturing efficiencies. This strategy is supported by strong financial performance, as evidenced by consistent share repurchases, such as those seen in early 2024, reflecting management's confidence in their pricing power and contract viability.

| Pricing Strategy Component | Description | Example/Data Point |

|---|---|---|

| Value-Based Pricing | Aligns price with technological advancements and safety benefits. | Justifies premium pricing for sophisticated electro-optical components. |

| Tiered Pricing | Offers different price points based on feature integration. | Basic auto-dimming mirror vs. Full Display Mirror with DMS and HomeLink. |

| Long-Term Contracts & Volume Discounts | Incentivizes higher purchase volumes and ensures revenue stability. | Contributes to predictable revenue streams and manufacturing efficiencies; supported by early 2024 share repurchase programs. |

4P's Marketing Mix Analysis Data Sources

Our Gentex 4P's analysis leverages a comprehensive blend of official company disclosures, including SEC filings and investor presentations, alongside detailed market research and competitive intelligence. We meticulously examine product portfolios, pricing structures, distribution channels, and promotional activities to provide an accurate representation of Gentex's go-to-market strategy.