Gentex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentex Bundle

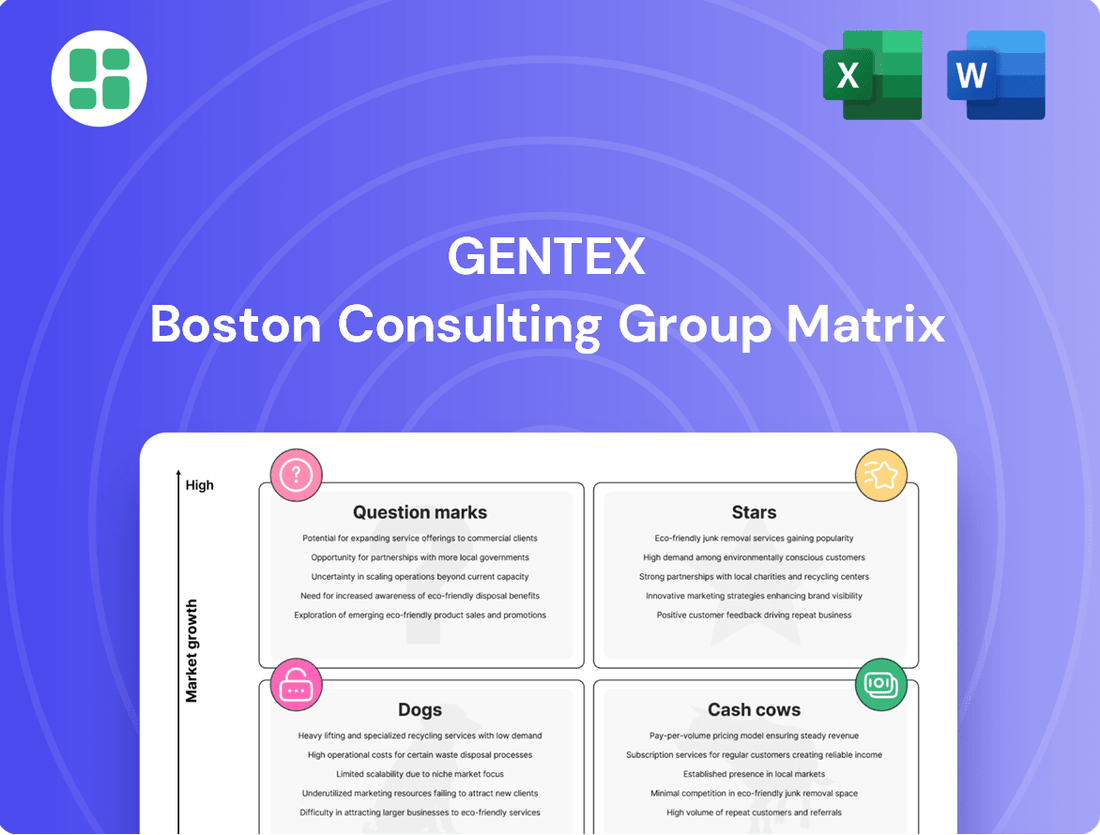

Curious about Gentex's product portfolio performance? Our BCG Matrix preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Uncover the full strategic picture and make informed decisions by purchasing the complete report.

This is just a snapshot. The full Gentex BCG Matrix provides detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing their product investments. Get the complete report to truly understand their market position.

Gain the competitive edge by understanding Gentex's strategic product positioning. The full BCG Matrix delivers in-depth analysis and tailored recommendations to guide your next moves. Invest in clarity and purchase the complete report today.

Stars

Gentex's Full Display Mirror (FDM) systems are a prime example of a star in the company's product portfolio. Unit shipments for FDMs saw a robust 21% increase in 2024, demonstrating strong market adoption. This growth is expected to continue, with projections indicating an additional 150,000 to 300,000 unit shipments in 2025.

The widespread integration of FDM technology across 29 automaker brands and 139 distinct vehicle models underscores its market penetration and appeal. This broad adoption highlights the FDM's success in a dynamic automotive interior market.

FDMs effectively build upon Gentex's foundational mirror technology, enhancing driver safety and convenience with improved rearward visibility and digital functionalities. This strategic evolution positions Gentex as a frontrunner in a high-growth segment of the automotive electronics market.

Gentex's advanced mirror-integrated ADAS features, including Driver Monitoring Systems (DMS) and Cabin Monitoring Systems (CMS), are a significant growth area. These systems monitor driver alertness and in-cabin activity, aligning with upcoming EU safety mandates and NCAP requirements. As of early 2024, 124 vehicle models incorporate Gentex's AI-driven systems, demonstrating strong market adoption driven by regulatory push and consumer demand for enhanced safety.

Gentex is a significant force in the electronically dimmable aircraft window (EDW) sector. This market is expected to see robust growth, with a projected Compound Annual Growth Rate (CAGR) of 7.1% between 2025 and 2031, indicating substantial future demand.

EDWs offer tangible benefits like enhanced passenger comfort and improved cabin aesthetics, while also contributing to aircraft energy efficiency by managing cabin light and glare. These advantages are increasingly sought after by airlines looking to upgrade their fleets.

The accelerating expansion of the EDW market, fueled by airlines prioritizing modern interiors and passenger experience, clearly places Gentex's EDWs in a strong position within a high-growth category. This strategic placement suggests the product is a Star in the BCG matrix.

HomeLink Smart Home Solutions Ecosystem

Gentex's HomeLink Smart Home Solutions Ecosystem represents a significant move into a rapidly expanding Internet of Things (IoT) market. By integrating with platforms like Apple CarPlay and Android Auto, HomeLink is evolving beyond its core garage door opener function to become a central hub for car-to-home automation.

This strategic pivot leverages Gentex's substantial installed base, with HomeLink technology already present in over 110 million vehicles. This provides a massive existing customer base for its new smart home offerings, enabling seamless control of various smart home devices from leading manufacturers.

- Market Expansion: Gentex is actively diversifying its revenue streams by entering the high-growth smart home market.

- Technological Integration: New features include compatibility with major automotive infotainment systems, enhancing user convenience.

- Leveraging Existing Assets: The 110 million HomeLink-equipped vehicles offer a significant advantage in market penetration.

- IoT Growth: The move aligns with the projected substantial growth in the connected home device market, which is expected to reach hundreds of billions of dollars globally by 2025.

Large-Area Dimmable Devices

Gentex is leveraging its electrochromic expertise for larger automotive surfaces, including dimmable sunroofs and advanced sun visors. This strategic move targets the expanding automotive interior market, which is projected to reach USD 223.76 billion by 2030, growing at a compound annual growth rate of 4.72%.

- Large-Area Dimmable Devices

- Market Growth: Automotive interior market expected to reach USD 223.76 billion by 2030, with a CAGR of 4.72%.

- Gentex's Innovation: Applying electrochromic technology to sunroofs and visors.

- Consumer Demand: Driven by consumer desire for personalized and tech-advanced vehicle cabins.

Gentex's Full Display Mirrors (FDMs) are a standout product, experiencing a 21% unit shipment increase in 2024 and projected to add another 150,000 to 300,000 shipments in 2025. This technology is now in 139 models across 29 automakers, showcasing its strong market acceptance.

The company's advanced mirror-integrated ADAS, like Driver Monitoring Systems (DMS) and Cabin Monitoring Systems (CMS), is another star. By early 2024, 124 vehicle models featured these AI-driven systems, driven by new EU safety mandates and NCAP requirements.

Gentex's electronically dimmable aircraft windows (EDWs) are poised for significant growth, with the market expected to grow at a 7.1% CAGR from 2025 to 2031. This expansion is fueled by airlines focusing on passenger comfort and cabin upgrades.

The HomeLink Smart Home Solutions Ecosystem is a strategic move into the booming IoT market. With HomeLink already in over 110 million vehicles, Gentex has a massive installed base to leverage for its car-to-home automation features.

Gentex is also applying its electrochromic technology to larger automotive surfaces like sunroofs and visors. This taps into the automotive interior market, projected to reach USD 223.76 billion by 2030, with a 4.72% CAGR.

| Product Category | 2024 Performance/Projection | Market Context | BCG Status |

| Full Display Mirrors (FDMs) | 21% unit shipment growth (2024), 150k-300k projected 2025 shipments | Integrated into 139 models (29 automakers) | Star |

| ADAS Mirror Integration (DMS/CMS) | 124 models equipped by early 2024 | Driven by EU safety mandates and NCAP | Star |

| Electronically Dimmable Aircraft Windows (EDWs) | 7.1% CAGR projected (2025-2031) | Airlines prioritizing cabin upgrades and passenger experience | Star |

| HomeLink Smart Home Ecosystem | Leverages 110M+ installed vehicles | Expands into high-growth IoT market | Star |

| Large-Area Dimmable Surfaces (Sunroofs, Visors) | Targets automotive interior market (USD 223.76B by 2030, 4.72% CAGR) | Consumer demand for advanced vehicle cabins | Star |

What is included in the product

The Gentex BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment and resource allocation.

Clear visual representation of Gentex's portfolio, easing strategic decision-making.

Cash Cows

Gentex's traditional automatic-dimming interior mirrors are a classic cash cow. In 2024, the company commanded an impressive 86% of the global market for these mirrors, a testament to its enduring leadership. This segment, while mature, benefits from near-universal adoption by automakers, ensuring a reliable and substantial cash flow stream.

Gentex's traditional automatic-dimming exterior mirrors function as a classic Cash Cow within their BCG Matrix. These mirrors hold a substantial market share, mirroring the success of their interior counterparts and significantly bolstering Gentex's revenue streams.

These exterior mirrors offer essential safety and convenience by effectively mitigating glare from vehicles behind. While the market for this mature technology exhibits moderate growth, Gentex's dominant market position and the technology's widespread acceptance translate into reliable profits and strong cash flow with minimal promotional expenditure.

The foundational HomeLink system, a familiar feature for garage door and gate operation, represents a significant cash cow for Gentex. With an impressive installed base of approximately 110 million units on the road, this mature product requires minimal ongoing investment.

This high installed base and strong brand recognition translate into stable, predictable cash flow for Gentex. It acts as a reliable revenue generator, providing the necessary capital to fuel investments in emerging, higher-growth technologies within the company's portfolio.

Core Electrochromic Technology Licensing

Gentex's core electrochromic technology, the backbone of its auto-dimming mirrors and dimmable windows, is a significant intellectual property asset. This proprietary technology is a key driver for stable revenue generation through licensing and direct product integration.

The widespread application of this established technology across various product lines creates a strong competitive advantage. In 2024, Gentex continued to see consistent, low-risk cash contributions from its electrochromic offerings, underscoring their status as cash cows.

- Proprietary Electrochromic Technology: Gentex's patented technology is a significant differentiator.

- Stable Revenue Streams: Licensing and direct application of the technology ensure consistent income.

- Competitive Moat: The established technological foundation provides a lasting advantage.

- Low-Risk Contributions: Widespread product integration leads to predictable cash flow.

Aftermarket Sales of Standard Auto-Dimming Mirrors

The aftermarket sales of standard auto-dimming mirrors represent a solid Cash Cow for Gentex within its BCG Matrix. This segment is characterized by its stability, providing a reliable revenue stream even if it's not the company's primary growth engine.

These sales are driven by the ongoing need for replacement parts and the desire for upgrades in older vehicles. The sheer volume of vehicles already on the road that are compatible with Gentex's technology underpins the consistent demand in this area.

- Stable Revenue: The aftermarket for auto-dimming mirrors provides a predictable and consistent income for Gentex.

- Replacement & Upgrade Market: Sales cater to vehicle owners needing to replace existing mirrors or enhance older models.

- Low Growth, High Cash Flow: While not a high-growth area, the mature market ensures significant cash generation due to widespread product compatibility.

Gentex's dominance in automatic-dimming mirrors, both interior and exterior, firmly establishes them as cash cows. The company's 86% market share in interior mirrors in 2024 highlights this strong position. These mature products, with near-universal adoption, generate consistent and substantial cash flow, requiring minimal investment for continued profitability.

| Product Segment | Market Share (2024) | Cash Flow Generation | Growth Potential |

|---|---|---|---|

| Interior Auto-Dimming Mirrors | 86% | High, Stable | Low |

| Exterior Auto-Dimming Mirrors | High (Dominant) | High, Stable | Low to Moderate |

| HomeLink System | High Installed Base (~110M units) | High, Predictable | Low |

| Electrochromic Technology | Broad Application | Consistent, Low-Risk | Low (for core tech) |

| Aftermarket Auto-Dimming Mirrors | Significant | Stable, Reliable | Low |

Delivered as Shown

Gentex BCG Matrix

The Gentex BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This means you get the exact same strategic analysis, with no watermarks or placeholder content, ready for immediate implementation in your business planning. The professional formatting and comprehensive insights are preserved, ensuring you have a polished and actionable tool from the moment of acquisition. You can confidently use this preview as a direct representation of the high-quality, ready-to-use BCG Matrix report that will be yours.

Dogs

Gentex's traditional commercial fire protection alarms, a business with over 50 years of history, represent a stable yet low-growth segment. In 2024, sales in this area remained largely flat, indicating a mature market where Gentex may not hold a dominant position.

This segment's limited growth potential and modest market share mean it contributes little to Gentex's overall expansion, placing it in the question mark category of the BCG matrix. The company's focus remains on higher-growth areas within its portfolio.

Legacy Non-Connected Mirror Models represent older automotive mirror technologies lacking advanced electronic features or connectivity. These were a substantial part of Gentex's past product lines.

With the automotive industry's move towards smarter, more integrated vehicles, demand for these basic mirrors is expected to decrease. For instance, the global automotive electronics market, which includes these features, was projected to reach over $370 billion in 2024, highlighting the shift away from simpler components.

While these models might still contribute some revenue, their limited growth potential and shrinking relevance in the current automotive environment suggest they are candidates for reduction or eventual discontinuation.

Within Gentex's Business Growth Matrix, Niche, Low-Volume Specialty Chemicals would likely fall into the Dogs category. These are products that don't align with Gentex's core electro-optical business and operate in markets with minimal growth. Think of highly specialized chemical formulations for industries outside of automotive or aerospace, where Gentex has a limited market presence.

These niche chemical products would represent a small fraction of Gentex's overall revenue, potentially less than 1% in 2024, given the company's strong performance in its primary segments. Their low market share and lack of strategic alignment mean they are unlikely to receive significant investment or drive future growth for the company.

Outdated Production Processes

Outdated production processes within Gentex can be categorized as internal 'dogs' in the BCG matrix. These are operational inefficiencies, not products, that drain resources without delivering proportional value. For instance, if Gentex's automotive mirror manufacturing still relies heavily on manual assembly for components that could be automated, this represents an outdated process.

Consider a scenario where a specific assembly line for a legacy automotive component uses machinery that is 20 years old. While it still functions, its speed and precision are significantly lower than modern equipment. In 2024, such a line might operate at 70% of the efficiency of a new automated system, leading to higher labor costs per unit and increased defect rates. Investing in upgrading this particular line might offer a return on investment (ROI) of only 5%, whereas investing in a new product line with advanced manufacturing could yield an ROI of 20%.

- Inefficiency Metric: Older assembly lines in 2024 might exhibit a 15% higher defect rate compared to newly implemented automated systems.

- Cost Factor: Manual labor costs associated with outdated processes could be 25% higher per unit than in modernized operations.

- ROI Comparison: Upgrading legacy machinery might show a 5% ROI, while investing in new, high-growth product manufacturing could offer a 20% ROI.

Underperforming Non-Core Investments

Underperforming non-core investments in Gentex's BCG Matrix would represent ventures into areas outside its primary automotive and fire protection businesses that have not yielded expected results. For instance, if Gentex invested in a niche technology or a small company in a tangential market that failed to capture significant market share or generate substantial revenue, it would fall into this category. These could be R&D projects that didn't lead to a viable product or acquisitions that struggled to integrate or grow.

These underperforming assets are essentially cash traps, consuming capital and management attention without contributing meaningfully to the company's overall growth or profitability. For example, a hypothetical investment in a small, unproven software solution for a non-automotive industry might have been made in 2023, but by mid-2024, it showed minimal customer adoption and negligible revenue growth, indicating it's a prime candidate for re-evaluation.

- Underperforming Non-Core Investments: Ventures into areas outside Gentex's core businesses that have not achieved significant market share or growth.

- Resource Drain: These investments tie up capital and management focus without providing a substantial return, hindering resource allocation to more promising ventures.

- Potential for Divestiture: Such assets are candidates for divestiture or discontinuation to reallocate resources to core strengths or higher-growth opportunities.

Gentex's legacy non-connected mirror models are considered Dogs due to declining demand and market relevance. The automotive industry's rapid shift towards advanced driver-assistance systems (ADAS) and integrated electronics means these basic mirrors are becoming obsolete. For instance, the market for advanced automotive sensors, which complement connected mirrors, saw significant investment and growth in 2024, overshadowing simpler mirror technologies.

Niche, low-volume specialty chemicals also fit the Dog category. These products operate in markets with minimal growth and are outside Gentex's core electro-optical expertise. In 2024, these likely represented a very small portion of Gentex's revenue, perhaps less than 1%, as the company prioritizes its higher-margin, high-growth segments.

Outdated production processes, such as using 20-year-old machinery on a legacy component line, are internal Dogs. These processes are less efficient, potentially exhibiting a 15% higher defect rate than newer systems in 2024, and incur higher labor costs per unit, making them candidates for modernization or elimination.

Underperforming non-core investments, like a hypothetical 2023 investment in an unproven software solution that showed negligible growth by mid-2024, are also Dogs. These ventures consume resources without contributing to overall profitability and are prime candidates for divestiture.

| Category | Description | 2024 Market Relevance | Strategic Implication |

| Legacy Non-Connected Mirrors | Basic automotive mirrors without advanced features. | Low; declining demand due to ADAS integration. | Potential for phasing out or reduced investment. |

| Niche Specialty Chemicals | Products outside core electro-optical business. | Minimal; operate in low-growth, non-strategic markets. | Likely to be divested or managed for minimal cost. |

| Outdated Production Processes | Inefficient manufacturing methods. | Low; higher defect rates and labor costs. | Require modernization or replacement to improve efficiency. |

| Underperforming Non-Core Investments | Ventures outside primary business areas. | Negligible; low adoption and revenue growth. | Candidates for divestiture to reallocate capital. |

Question Marks

Mirror-integrated Driver and Cabin Monitoring Systems (DMS/CMS) represent a nascent but high-growth opportunity for Gentex, driven by evolving safety mandates. European regulations, for instance, are pushing for enhanced driver alertness monitoring, creating a significant market tailwind for these technologies. Gentex's active development with multiple automakers positions them well, but their current market share in this specific segment is still developing.

Capturing leadership in this emerging DMS/CMS market requires substantial investment to solidify Gentex's position before the technology matures into a 'Star' category. The company's expertise in mirror technology provides a unique integration advantage, potentially allowing for more seamless and cost-effective deployment of these advanced sensing capabilities compared to standalone solutions. Success here could significantly bolster Gentex's future revenue streams.

Gentex is actively investing in in-vehicle biometric authentication systems, like iris scanners, aiming to enhance vehicle security and personalize the driving experience. This aligns with the automotive industry's push towards greater connectivity and tailored user interfaces.

While the automotive biometrics market is projected to grow significantly, reaching an estimated $2.5 billion by 2028 according to some industry forecasts, Gentex's biometric solutions are currently in a nascent stage within this sector. This means they hold a low market share for now, demanding considerable R&D and market development expenditure to establish a strong foothold.

PLACE Residential Smart Home Sensing Products, soft-launched at CES 2024, signifies Gentex's strategic move into the burgeoning residential smart home market. These products, including smart smoke and carbon monoxide detectors, capitalize on Gentex's established fire protection acumen, aiming to capture a share of this high-growth consumer segment.

As a nascent player, PLACE currently commands a minimal market share within the smart home sensing industry. Significant investment in marketing and distribution channels will be crucial for building brand awareness and achieving widespread consumer adoption, thereby unlocking its substantial growth potential.

Integrated Toll Module (ITM) Payment Solutions

The Integrated Toll Module (ITM) represents a potential star in Gentex's product portfolio, aiming to simplify toll payments and broaden into other vehicle-based transactions such as fueling and charging. This innovation taps into the increasing consumer desire for connected and convenient in-car experiences.

While the ITM technology holds significant promise for broad market adoption, its current market penetration is likely in its nascent stages. Gentex's specific market share within this emerging payment solution is also expected to be low, necessitating strategic investment to secure a competitive position.

- Market Potential: The global market for connected car services, which includes payment solutions, is projected to reach hundreds of billions of dollars by the late 2020s, with toll payments being a significant segment.

- Gentex's Position: As an emerging technology, Gentex's ITM likely faces limited current market share, requiring aggressive development and partnerships to gain traction.

- Strategic Imperative: Investment in ITM development and market entry is crucial for Gentex to capitalize on the growing trend of in-vehicle commerce and avoid being a late entrant.

Next-Generation Display Technologies

Gentex is pushing the envelope with next-generation display technologies, moving beyond their core auto-dimming mirrors. They are developing fully programmable active non-structured displays and advanced digital signal processing to boost nighttime visibility in their Full Display Mirrors (FDMs). This innovation aligns with the automotive industry's shift towards more interactive and immersive in-cabin experiences.

These advanced display solutions represent a significant growth opportunity for Gentex. While the market adoption is still in its early stages, these technologies are positioned to capitalize on the increasing demand for sophisticated automotive interiors. For instance, the global automotive display market was valued at approximately $10.5 billion in 2023 and is projected to grow significantly in the coming years, with advanced display technologies being a key driver.

- Innovation Focus: Gentex is investing in active non-structured displays and enhanced digital signal processing.

- Market Trend Alignment: These developments cater to the growing demand for interactive and immersive automotive cabin experiences.

- Growth Potential: These are considered high-growth areas, though market adoption and Gentex's specific market share are still evolving.

- Industry Context: The automotive display market is expanding, with advanced technologies expected to play a crucial role in this growth.

Question Marks in Gentex's portfolio represent emerging technologies with high growth potential but currently low market share. These are areas where Gentex is investing heavily to establish a competitive advantage before the market fully develops.

Mirror-integrated Driver and Cabin Monitoring Systems (DMS/CMS) and in-vehicle biometric authentication are prime examples of Question Marks. While the automotive biometrics market is projected to reach $2.5 billion by 2028, Gentex's current share in these segments is minimal, requiring significant R&D and market development.

Similarly, Gentex's PLACE Residential Smart Home Sensing Products and the Integrated Toll Module (ITM) are also classified as Question Marks. The smart home market and connected car services offer substantial growth, but Gentex is a nascent player in both, necessitating investment in brand awareness and distribution to capture market share.

Next-generation display technologies, including active non-structured displays, also fall into the Question Mark category. The global automotive display market was valued at approximately $10.5 billion in 2023, and while these advanced displays offer high growth, their market adoption and Gentex's specific share are still evolving.

| Product Area | Market Potential | Gentex's Current Share | Strategic Focus |

|---|---|---|---|

| DMS/CMS | High (driven by safety mandates) | Low (nascent segment) | Investment for market leadership |

| Biometric Authentication | High (projected $2.5B by 2028) | Low (early stage) | R&D and market development |

| Smart Home Sensing (PLACE) | High (growing consumer segment) | Minimal (nascent player) | Marketing and distribution investment |

| Integrated Toll Module (ITM) | High (part of connected car services) | Low (emerging technology) | Development and partnerships |

| Next-Gen Displays | High (part of expanding automotive display market, ~$10.5B in 2023) | Evolving (early adoption) | Capitalize on demand for advanced interiors |

BCG Matrix Data Sources

Our Gentex BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analysis, to accurately position each business unit.