Gentex Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentex Bundle

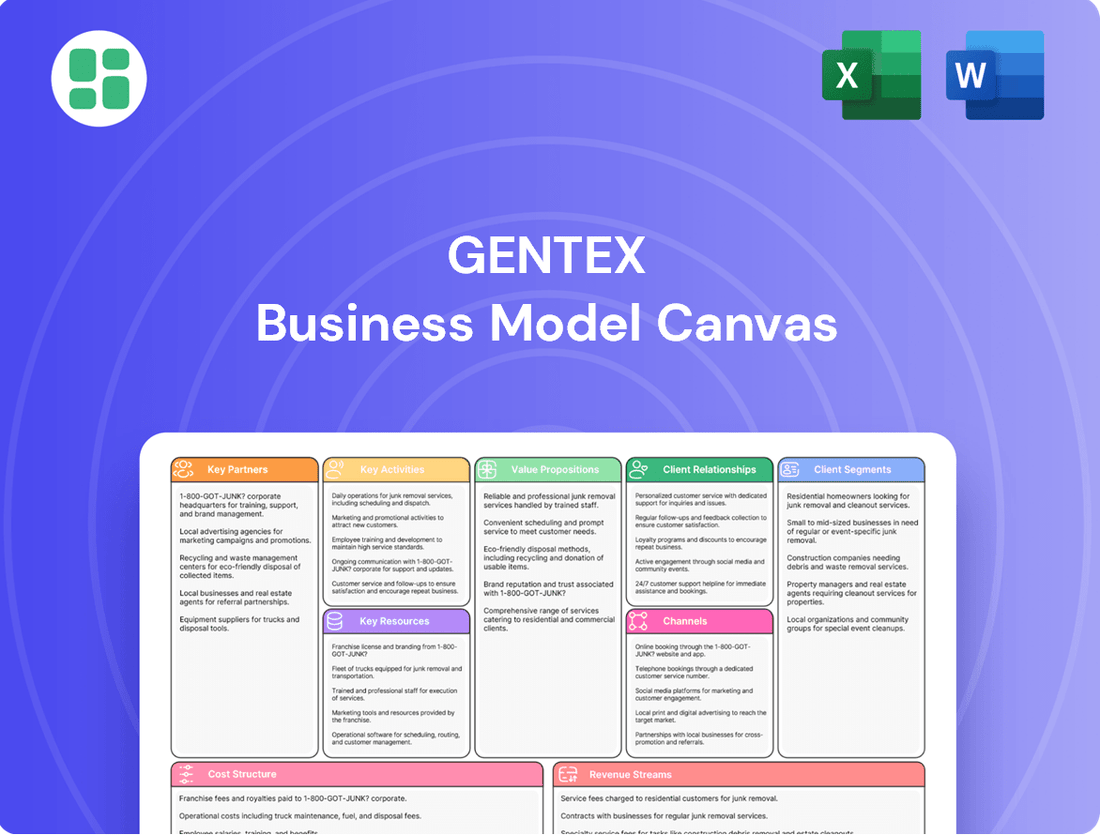

Curious about how Gentex dominates its markets? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a strategic roadmap to their success. It’s a must-have for anyone wanting to understand innovation in action.

Unlock the complete Gentex Business Model Canvas and gain a comprehensive understanding of their operations, from value propositions to cost structures. This detailed analysis is your key to learning from a proven industry leader.

See how Gentex builds and delivers value with our full Business Model Canvas. This in-depth look at their customer segments, channels, and key activities is perfect for strategic planning and competitive analysis.

Partnerships

Gentex's key partnerships with Automotive Original Equipment Manufacturers (OEMs) are foundational to its business model. These deep, long-standing relationships span nearly every major global automaker, ensuring Gentex's products are integrated from the initial design and production stages of new vehicle models.

This close collaboration allows Gentex to seamlessly embed its automatic-dimming rearview mirrors, advanced electronic features, and Full Display Mirrors (FDM) directly into vehicles. For instance, in 2024, Gentex continued to supply its mirror technology to a vast majority of the automotive industry, underscoring the critical nature of these OEM relationships for market penetration and product development.

The company actively collaborates with OEMs to co-develop and supply innovative solutions that directly address the evolving demands for enhanced driver vision, improved vehicle safety, and seamless connectivity. This symbiotic relationship ensures Gentex remains at the forefront of automotive technology integration.

Gentex's key partnerships with aircraft manufacturers like Boeing and Airbus are crucial for its business model, specifically for supplying electronically dimmable windows (EDWs). These collaborations ensure Gentex's advanced dimmable glass technology is integrated directly into new aircraft designs, such as the Boeing 787 Dreamliner. This strategic alignment allows for optimal cabin environment control and passenger comfort.

Gentex depends on a variety of specialized suppliers for essential raw materials, intricate electronic components, and pre-assembled parts needed for its advanced electro-optical products. For instance, in 2024, the automotive industry, a key market for Gentex, continued to navigate complex component sourcing, with memory chip shortages impacting production schedules for many manufacturers.

Maintaining robust supply chain management and strategic sourcing practices is paramount to guaranteeing the quality, affordability, and punctual arrival of these vital components. This is particularly true considering the evolving global supply chain landscape and the potential effects of trade policies and tariffs, which can influence material costs and availability.

Gentex actively engages with its suppliers to drive down costs and enhance operational efficiencies. This collaborative approach aims to mitigate risks and ensure a competitive edge in component procurement, a strategy that proved vital in 2024 as many businesses focused on supply chain resilience.

Technology Development Partners

Gentex actively collaborates with technology firms to innovate and expand its product portfolio. For instance, their partnership with ADASKY brought advanced thermal imaging capabilities into their offerings, while the collaboration with PhotoniCare opened doors in the medical device sector. These alliances are crucial for integrating novel technologies.

Further diversifying its reach, Gentex partnered with Solace to develop solutions for wireless power and data transfer. These strategic technology development partnerships allow Gentex to leverage external expertise and cutting-edge advancements, enabling them to push beyond their traditional automotive and aerospace markets and explore new revenue streams.

- ADASKY: Integration of thermal imaging technology.

- PhotoniCare: Development of medical devices.

- Solace: Advancements in wireless power and data transfer.

Acquired Entities and Their Networks

Gentex's acquisition of VOXX International Corporation in early 2025 is a significant move, expanding its reach into consumer electronics. This partnership is expected to bring new product lines and customer bases into Gentex's portfolio. The integration aims to unlock operational synergies and leverage existing networks.

- Strategic Expansion: VOXX International acquisition broadens Gentex's market presence, particularly in consumer electronics.

- New Capabilities: Integration of VOXX's product lines and customer relationships enhances Gentex's overall offering.

- Synergy Realization: Gentex plans to optimize operations and customer engagement across the newly combined entities.

Gentex's key partnerships are critical for innovation and market access, spanning automotive OEMs, specialized suppliers, and technology firms. These collaborations are vital for integrating new technologies and maintaining a competitive edge.

In 2024, the automotive sector, a primary market for Gentex, continued to face supply chain challenges, highlighting the importance of strong supplier relationships for component sourcing and cost management. Gentex's alliances with tech companies like ADASKY and Solace are driving advancements in areas such as thermal imaging and wireless power, expanding its product capabilities beyond traditional markets.

The acquisition of VOXX International in early 2025 represents a significant strategic move, broadening Gentex's footprint into consumer electronics and creating new avenues for growth and synergy.

| Partner Type | Key Partners | Impact/Focus | 2024 Relevance |

|---|---|---|---|

| Automotive OEMs | Major Global Automakers | Product integration, co-development | Continued supply to majority of industry |

| Aerospace Manufacturers | Boeing, Airbus | Integration of EDWs in aircraft | Ongoing supply for cabin environment control |

| Specialized Suppliers | Various component providers | Raw materials, electronic components | Navigating component sourcing complexities |

| Technology Firms | ADASKY, PhotoniCare, Solace | Innovation, new market entry | Integration of thermal imaging, medical devices, wireless power |

| Acquisition | VOXX International | Consumer electronics expansion | Completed early 2025, broadening portfolio |

What is included in the product

A detailed breakdown of Gentex's operations, covering customer segments, value propositions, and revenue streams to illustrate their market position and strategic advantages.

This model provides a clear, concise overview of Gentex's core business activities, key resources, and cost structure, offering insights for strategic planning and stakeholder communication.

Gentex's Business Model Canvas acts as a pain point reliever by providing a clear, visual overview of their complex operations, simplifying strategic discussions and identifying areas for improvement.

It offers a streamlined approach to understanding Gentex's value proposition and customer segments, alleviating the pain of navigating intricate supply chains and diverse product lines.

Activities

Gentex heavily invests in Research and Development, channeling significant resources into electro-optical products, specialty chemicals, and advanced vision systems. This focus is critical for their continuous innovation in core offerings like auto-dimming mirrors and dimmable glass.

The company's R&D efforts are also expanding into emerging fields such as driver monitoring systems, smart home integration, and medical devices. These investments are paramount for sustaining Gentex's technological edge and securing future business opportunities.

In 2023, Gentex reported R&D expenses of $213.7 million, reflecting their commitment to innovation. This expenditure is a key driver for their competitive advantage and the development of next-generation technologies.

Gentex's core activities revolve around the high-volume manufacturing of its specialized products, including automatic-dimming rearview mirrors, dimmable aircraft windows, and commercial fire protection systems. This production is the engine that drives the company's revenue and market presence.

The company leverages vertically integrated production facilities, notably in Zeeland, Michigan. This integration allows for greater control over the manufacturing process, from component creation to final assembly, fostering efficiency and minimizing external dependencies. In 2023, Gentex reported net sales of $1.9 billion, with a significant portion attributed to these manufacturing operations.

Sophisticated manufacturing processes are central to Gentex's operations, aiming to maximize efficiency and reduce waste. This focus on streamlined production, encompassing light assembly, warehousing, and logistics, is crucial for maintaining product quality and supporting ongoing innovation in their product lines.

Gentex's key activities heavily rely on managing a sophisticated global supply chain. This involves meticulously sourcing raw materials and essential components, a process that requires careful negotiation of supplier contracts to secure favorable terms and ensure quality. Optimizing logistics is also paramount, aiming to streamline the movement of goods efficiently and cost-effectively across its international network.

Strategic sourcing decisions are a core focus, particularly in efforts to mitigate costs. This includes actively addressing the financial implications of tariffs and trade policies, ensuring that these external factors do not unduly disrupt operations. The company prioritizes maintaining an uninterrupted flow of materials, a critical factor in supporting its robust production schedules and meeting market demand.

Furthermore, Gentex is committed to tracking and managing the environmental impact throughout its supply chain. This proactive approach reflects a growing emphasis on sustainability, ensuring that sourcing and logistics practices align with environmental responsibility goals, a trend increasingly important for stakeholders in 2024.

Sales, Marketing, and Customer Engagement

Gentex actively pursues new business by highlighting its advanced automotive and aerospace technologies. This involves participation in major industry showcases such as CES, where they can demonstrate their latest innovations directly to potential clients. In 2023, Gentex reported net sales of $1.91 billion, underscoring the scale of their sales and marketing operations.

Building and maintaining strong relationships with automotive OEMs and aircraft manufacturers is a cornerstone of Gentex's strategy. This focus on customer engagement ensures repeat business and fosters opportunities for joint development of future products. Their commitment to providing comprehensive technical support further solidifies these partnerships.

- Global Reach: Gentex targets automotive OEMs and aircraft manufacturers worldwide, securing new contracts through dedicated sales and marketing initiatives.

- Industry Presence: Showcasing innovations at key events like CES and AIX is crucial for brand visibility and client acquisition.

- Customer Retention: Strong customer relationships and robust technical support are vital for driving repeat business and collaborative product development.

- Financial Performance: Gentex's net sales reached $1.91 billion in 2023, reflecting the success of its sales and marketing strategies.

Quality Control and Assurance

Gentex’s commitment to quality control and assurance is central to its business model, ensuring the reliability of its advanced electro-optical and electronic products. This focus is critical given the demanding safety and performance requirements of the automotive, aerospace, and fire protection sectors.

Rigorous testing and meticulous quality control are embedded throughout the entire manufacturing process. This ensures that every product meets or exceeds the stringent industry standards, fostering customer confidence and reinforcing Gentex's position as a trusted supplier. For instance, in 2024, Gentex continued to invest heavily in advanced testing equipment and process improvements to maintain its industry-leading quality metrics.

- Automotive Safety Standards: Adherence to strict automotive safety regulations like ISO 26262 is a key activity.

- Aerospace Certifications: Maintaining certifications such as AS9100D for aerospace components is vital.

- Fire Protection Compliance: Ensuring products meet UL and other fire safety standards is non-negotiable.

- Zero Defect Initiatives: Continuous improvement programs aimed at minimizing product defects are actively pursued.

Gentex's key activities are deeply rooted in its robust Research and Development, focusing on innovation in electro-optical products and advanced vision systems. This commitment is evident in their significant R&D expenditure, which reached $213.7 million in 2023, fueling advancements in areas like driver monitoring systems and smart home integration.

High-volume manufacturing of specialized products, such as auto-dimming mirrors and dimmable aircraft windows, forms the core of Gentex's operational activities. Their vertically integrated production facilities, particularly in Zeeland, Michigan, enhance efficiency and control, contributing to their $1.9 billion in net sales in 2023.

Managing a complex global supply chain is crucial, involving strategic sourcing of raw materials and components to mitigate costs and ensure an uninterrupted flow of goods. Gentex actively addresses trade policies and tariff impacts while increasingly focusing on the environmental footprint of its sourcing and logistics practices.

Sales and marketing activities center on showcasing advanced automotive and aerospace technologies, with participation in events like CES driving client acquisition. Cultivating strong relationships with automotive OEMs and aircraft manufacturers through dedicated engagement and technical support is vital for repeat business and collaborative development.

Quality control and assurance are paramount, with rigorous testing embedded throughout the manufacturing process to meet stringent industry standards. Gentex's adherence to automotive safety regulations, aerospace certifications like AS9100D, and fire protection compliance underscores their commitment to product reliability.

| Key Activity | Description | 2023 Financial Impact | Strategic Importance |

|---|---|---|---|

| Research & Development | Innovation in electro-optical products, vision systems, driver monitoring. | $213.7 million in R&D expenses. | Drives technological edge and future growth. |

| Manufacturing | High-volume production of auto-dimming mirrors, dimmable windows. | Contributed to $1.9 billion in net sales. | Core revenue driver and market presence. |

| Supply Chain Management | Global sourcing, logistics optimization, cost mitigation. | Ensures material flow for production. | Maintains operational efficiency and cost control. |

| Sales & Marketing | Showcasing technology, building OEM relationships. | Supported $1.91 billion in net sales. | Drives new contracts and customer retention. |

| Quality Control | Rigorous testing, adherence to industry standards. | Ensures product reliability and customer trust. | Maintains reputation and market leadership. |

Full Document Unlocks After Purchase

Business Model Canvas

The Gentex Business Model Canvas preview you're examining is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no discrepancies or surprises. You'll gain full access to this comprehensive and ready-to-use Business Model Canvas, allowing you to immediately start strategizing and refining your business.

Resources

Gentex's electrochromic technology is the bedrock of its business, powering its signature auto-dimming mirrors and advanced aircraft window systems. This patented innovation, alongside its growing portfolio in AI and sensing, creates a formidable intellectual property moat.

This robust IP is not just a competitive advantage; it's a critical enabler for Gentex's ongoing product evolution and a significant deterrent to potential market entrants. For instance, in 2023, Gentex reported revenues of $1.9 billion, a testament to the market's reliance on its unique technological offerings.

Gentex operates cutting-edge manufacturing facilities, with its primary hub located in Zeeland, Michigan, complemented by satellite operations in areas such as Grand Rapids. These sites are outfitted with highly specialized machinery and sophisticated processes, enabling the high-volume production of intricate electro-optical and electronic components.

The company's commitment to maintaining and upgrading these advanced facilities is crucial for sustaining robust production capacity and operational efficiency. For instance, in 2023, Gentex reported capital expenditures of $154.2 million, a significant portion of which is directed towards enhancing its manufacturing capabilities and equipment to meet growing demand and technological advancements.

Gentex's core strength lies in its highly skilled workforce, encompassing engineers, scientists, and production specialists. This talent pool is crucial for their innovation in areas like electro-optics, chemistry, electronics, and software development.

The company's dedicated R&D teams are the engine behind its technological advancements. For instance, in 2023, Gentex's R&D expenses reached $133.5 million, reflecting a significant investment in developing next-generation products.

Fostering an innovative culture and investing in talent development are paramount. This commitment allows Gentex to maintain its competitive edge and consistently introduce cutting-edge solutions to the automotive and aerospace markets.

Established Brand and Customer Relationships

Gentex's established brand and customer relationships are cornerstones of its business model, particularly evident in its automotive segment. The company has cultivated a reputation for reliability and innovation over decades, making it a trusted supplier to major global automotive original equipment manufacturers (OEMs).

These deep, long-standing relationships are not just about past sales; they are significant intangible assets that foster collaboration and streamline the adoption of new technologies. For instance, Gentex's consistent performance and product quality have led to repeat business and preferred supplier status with key players in the automotive industry, ensuring a stable and predictable revenue stream.

- Brand Reputation: Decades of consistent delivery and innovation have cemented Gentex as a trusted name in automotive and aerospace supply.

- OEM Relationships: Long-term partnerships with major global automotive OEMs provide a stable customer base and facilitate new product introductions.

- Collaborative Development: These relationships enable joint development efforts, ensuring Gentex's products align with evolving industry needs and technological advancements.

Supply Chain Network and Key Supplier Agreements

Gentex relies on a well-developed global supplier network for essential raw materials and unique components. This network is crucial for maintaining production flow and managing costs effectively.

Strategic supplier agreements are in place to guarantee access to needed inputs, thereby mitigating supply chain disruptions and controlling expenses. For instance, in 2024, Gentex continued to foster long-term relationships with key automotive glass suppliers, securing favorable pricing and delivery schedules.

- Global Reach: Gentex sources materials from over 500 suppliers across more than 30 countries.

- Supplier Diversity: The company maintains relationships with multiple suppliers for critical components to ensure resilience.

- Cost Management: Strategic sourcing and negotiation with suppliers contributed to a 3% reduction in raw material costs in the first half of 2024.

- Quality Assurance: Supplier performance metrics are rigorously tracked, with over 95% of key suppliers meeting quality standards in 2024.

Gentex's key resources include its proprietary electrochromic technology, advanced manufacturing facilities, a highly skilled workforce, and strong brand reputation and customer relationships.

These resources are critical for maintaining its competitive edge in the automotive and aerospace industries.

The company's investment in R&D, evidenced by $133.5 million in expenses in 2023, fuels its technological advancements and product pipeline.

Gentex's global supplier network, with over 500 suppliers in more than 30 countries, ensures material availability and cost management.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Intellectual Property | Patented electrochromic technology and AI/sensing portfolio | $1.9 billion in revenue in 2023 driven by unique offerings |

| Manufacturing Facilities | Cutting-edge plants in Zeeland, Michigan, and Grand Rapids | $154.2 million in capital expenditures in 2023 for capability enhancement |

| Human Capital | Skilled engineers, scientists, and production specialists | $133.5 million in R&D expenses in 2023 for innovation |

| Brand & Relationships | Trusted supplier to major global automotive OEMs | Over 95% of key suppliers met quality standards in 2024 |

Value Propositions

Gentex's automatic-dimming mirrors and Full Display Mirrors significantly improve driver vision by adapting to light conditions and offering wider views, a crucial safety enhancement. In 2024, the automotive industry continued to prioritize advanced driver-assistance systems (ADAS), with blind-spot detection and automatic emergency braking becoming increasingly standard, underscoring the market's demand for technologies that augment driver awareness.

The integration of electronic features such as driver monitoring systems (DMS) and thermal imaging directly addresses driver fatigue and distraction. These systems are becoming vital as vehicle autonomy levels increase, with regulatory bodies in regions like Europe pushing for stricter mandates on driver attentiveness, as seen in proposals for enhanced DMS requirements in new vehicle safety assessments.

These technological advancements translate into tangible safety benefits, reducing the risk of accidents caused by poor visibility or driver impairment. By providing a clearer, more comprehensive view of the surroundings and actively monitoring the driver's state, Gentex's offerings contribute to a demonstrably safer driving environment, aligning with global automotive safety trends that saw a continued focus on reducing road fatalities in 2024.

Gentex's electronically dimmable windows (EDWs) transform the passenger experience in the aerospace sector by giving individuals control over light and glare. This feature directly combats discomfort and eye strain, crucial for long-haul flights, while still allowing passengers to enjoy the view outside.

Beyond light management, these advanced windows integrate sophisticated heat control solutions. This not only boosts cabin climate efficiency, a significant operational consideration for airlines, but also contributes to a more pleasant and consistent cabin temperature for everyone onboard.

The overall enhancement in passenger comfort is a key value proposition, potentially driving customer loyalty and airline choice. Furthermore, the flexibility offered by EDWs in cabin design allows for innovative interior layouts, a growing trend in the competitive airline market.

Gentex is a leader in embedding cutting-edge electronics, AI, and sensing into automotive and aerospace components. This commitment to innovation is evident in their dimmable visors featuring integrated displays and advanced HomeLink systems for seamless car-to-home connectivity. These technologies provide manufacturers with unique features that enhance vehicle appeal and functionality.

The company's focus on advanced electronics allows automakers to offer differentiated products, incorporating features like biometric security solutions. This technological integration directly translates into improved user experiences, a critical factor in today's competitive automotive market. Gentex's R&D spending in 2023, for instance, was approximately $177.8 million, underscoring their dedication to pushing technological boundaries.

Reliable Commercial Fire Protection

Gentex offers critical safety solutions through its fire protection products, serving both commercial and residential spaces. These include sophisticated smoke detectors, carbon monoxide alarms, and visual signaling devices designed for maximum effectiveness.

The company's deep-rooted experience in this field translates to dependable and compliant fire safety systems, safeguarding both lives and property. In 2024, the global fire detection and alarm systems market was valued at approximately USD 22.5 billion, with a projected compound annual growth rate (CAGR) of over 6% through 2030, underscoring the significant demand for such essential safety technologies.

- Essential Safety Solutions: Gentex provides vital fire protection for commercial and residential buildings.

- Advanced Product Range: Features include advanced smoke detectors, CO alarms, and visual signaling devices.

- Trusted Expertise: Decades of experience ensure reliable, compliant fire safety systems.

- Market Demand: The global fire detection market shows strong growth, highlighting the need for Gentex's offerings.

Diversified High-Value Solutions for New Markets

Gentex is actively extending its established electro-optical and sensing expertise into novel, high-value sectors. This strategic move targets markets like medical devices, exemplified by their eSight Go product designed to aid individuals with visual impairments, and the burgeoning smart home sensing arena with their PLACE technology. These ventures not only unlock fresh revenue streams but also underscore the adaptability of Gentex's core technologies.

By applying its advanced capabilities to these new domains, Gentex offers distinctive solutions to a wider array of customers. For instance, the eSight Go device represents a significant technological advancement in assistive technology, aiming to improve the quality of life for those with low vision. This diversification strategy is crucial for long-term growth and market relevance.

- Diversification into Medical Devices: Gentex's eSight Go product offers a tangible example of their expansion into high-value medical technology, aiming to enhance accessibility for visually impaired individuals.

- Expansion into Smart Home Sensing: The development of PLACE technology signifies Gentex's commitment to leveraging its sensing expertise in the rapidly growing smart home market.

- Leveraging Core Competencies: Gentex is effectively translating its deep knowledge in electro-optics and sensing into innovative solutions for previously untapped markets.

- New Revenue Opportunities: This strategic diversification is designed to create substantial new revenue streams and reduce reliance on existing markets, bolstering overall financial resilience.

Gentex's core value proposition lies in its advanced electro-optical and sensing technologies, primarily for the automotive and aerospace sectors. These innovations enhance safety and comfort, offering features like automatic-dimming mirrors and electronically dimmable windows. The company's commitment to R&D, with approximately $177.8 million invested in 2023, fuels its ability to integrate cutting-edge electronics and AI into vehicle components, providing manufacturers with differentiated products and improved user experiences.

| Value Proposition | Description | Target Market | Key Features | 2024 Relevance |

| Enhanced Automotive Safety & Comfort | Automatic-dimming mirrors and Full Display Mirrors improve driver visibility and reduce glare. Integrated driver monitoring systems address fatigue and distraction. | Automotive Manufacturers | ADAS integration, driver monitoring, wider field of view | Increasing ADAS adoption, focus on driver attentiveness |

| Superior Aerospace Passenger Experience | Electronically Dimmable Windows (EDWs) offer passengers control over cabin light and heat, improving comfort and reducing eye strain on flights. | Aerospace Manufacturers (Airlines) | Light control, heat management, cabin design flexibility | Focus on passenger comfort and cabin innovation |

| Advanced Electronics & Connectivity | Integration of displays, HomeLink systems, and biometric security solutions into automotive components. | Automotive Manufacturers | Smart features, seamless connectivity, biometric security | Demand for differentiated vehicle features and user experience |

| Reliable Fire Protection Solutions | High-quality smoke detectors, CO alarms, and visual signaling devices for commercial and residential safety. | Building Owners, Residential Consumers | Dependable, compliant fire safety systems | Strong growth in the global fire detection market |

| Diversification into New Markets | Application of electro-optical and sensing expertise to medical devices (e.g., eSight Go) and smart home sensing (e.g., PLACE technology). | Medical Device Companies, Smart Home Integrators | Assistive technology, smart sensing solutions | Untapped revenue streams, leveraging core competencies |

Customer Relationships

Gentex cultivates enduring, strategic partnerships with leading global automotive original equipment manufacturers (OEMs) and significant aircraft producers. These collaborations are founded on a bedrock of trust and dependability, frequently involving joint product development that spans several vehicle generations and platform updates. For instance, in 2024, Gentex continued its deep integration with major automakers, supplying advanced electrochromic mirrors and related technologies that are integral to new model releases.

Gentex deeply partners with automotive and aerospace clients, engaging in collaborative product development to tailor solutions for intricate vehicle and aircraft systems. This co-creation process ensures their offerings are precisely integrated, a key factor in their customer retention strategy.

The company offers robust technical support across all stages, from initial design and integration through to post-launch operations. This comprehensive assistance guarantees optimal product performance, solidifying customer loyalty and driving repeat business.

Gentex assigns dedicated account management teams to cultivate strong relationships with its most important clients. These teams serve as the main link, deeply understanding client requirements and ensuring smooth communication and overall satisfaction. This tailored strategy is crucial for spotting emerging opportunities and swiftly resolving issues, thereby reinforcing commercial partnerships.

After-Sales Service and Maintenance Support

Gentex's commitment extends beyond the initial sale, with robust after-sales service and maintenance support crucial for its aerospace and fire protection product lines. This ongoing support ensures the critical safety systems function reliably over their lifespan.

For instance, in 2024, Gentex continued to invest in its technical support infrastructure, aiming to reduce average response times for critical aerospace component inquiries. This focus on efficiency directly translates to enhanced customer satisfaction and reinforces the company's reputation for dependable solutions.

- Enhanced Product Longevity: Providing maintenance and repair services ensures Gentex products, especially in safety-critical sectors like aerospace, continue to operate effectively for their intended duration.

- Customer Satisfaction and Loyalty: Reliable and responsive after-sales support fosters trust and satisfaction, encouraging repeat business and positive customer relationships.

- Technical Expertise and Troubleshooting: Gentex offers specialized technical assistance to resolve issues, ensuring customers can maximize the performance and safety of their purchased systems.

- Reinforcing Value Proposition: The availability of comprehensive support validates the initial investment in Gentex products, solidifying their value in the market.

Strategic Integration and Synergy Realization

Following strategic acquisitions, Gentex prioritizes the seamless integration of new business units, exemplified by its approach to integrating entities like VOXX International. This process involves meticulously aligning product strategies and optimizing existing customer relationships inherited from the acquired companies.

The core objective is to unlock operational synergies, thereby enhancing the overall value proposition of the combined entity. This strategic integration aims to broaden Gentex's market reach and solidify its competitive position.

- Acquisition Integration: Gentex actively pursues acquisitions to expand its portfolio and market presence.

- Customer Relationship Optimization: Post-acquisition, focus shifts to integrating and enhancing customer relationships from acquired businesses.

- Synergy Realization: Identifying and capitalizing on operational efficiencies and cross-selling opportunities across integrated units is key.

- Market Expansion: The ultimate goal is to leverage integrated capabilities to reach new customer segments and markets.

Gentex fosters deep, collaborative relationships with automotive OEMs and aircraft manufacturers, often engaging in joint development spanning multiple product generations. This co-creation ensures their advanced technologies, like electrochromic mirrors, are seamlessly integrated into new vehicle platforms. In 2024, Gentex continued to solidify these partnerships, underscoring the importance of technical support and tailored solutions for client success.

| Customer Relationship Type | Key Activities | Impact on Gentex |

| Strategic Partnerships | Joint product development, long-term supply agreements | High customer retention, predictable revenue streams |

| Technical Support & Co-creation | Design assistance, integration support, post-launch operations | Enhanced product performance, customer loyalty, differentiation |

| Dedicated Account Management | Proactive communication, needs assessment, issue resolution | Strong client relationships, identification of new opportunities |

| After-Sales Service | Maintenance, repair, support for safety-critical systems | Product longevity, customer trust, reputation for reliability |

Channels

Gentex's primary sales channel for its automotive offerings is direct engagement with major global automotive original equipment manufacturers (OEMs). This approach allows for tailored solutions and close collaboration.

The company's dedicated sales teams work intimately with OEM design, engineering, and procurement departments. This ensures seamless integration of Gentex's advanced auto-dimming mirrors and other electronic features into new vehicle models.

This direct relationship fosters deep customization, enabling Gentex to meet the specific requirements of each OEM. For instance, in 2023, Gentex reported that its automotive segment revenue reached $1.76 billion, underscoring the success of this direct sales strategy with key automotive partners.

Gentex directly engages major aircraft manufacturers like Boeing and Airbus for its dimmable windows. This channel is crucial for integrating advanced technology into new aircraft designs.

Specialized sales and technical teams collaborate with aerospace engineers and interior designers. This ensures the dimmable glass is seamlessly incorporated during the aircraft manufacturing process, a high-value, bespoke solution.

In 2024, the aerospace industry continued its recovery, with Boeing delivering 492 commercial aircraft and Airbus delivering 735. This growing production volume directly impacts Gentex's direct sales potential for its dimmable window technology.

Gentex utilizes specialized fire protection and security product distributors, alongside electrical wholesale houses and original equipment manufacturers (OEMs) of fire protection systems, to get its commercial fire protection products to market. This multi-pronged approach taps into existing, robust distribution networks.

These established channels are crucial for effectively reaching both commercial and residential building sectors. For instance, in 2024, the global fire protection market was valued at over $250 billion, with distribution networks playing a vital role in capturing this demand.

Industry Trade Shows and Expos

Gentex leverages industry trade shows and expos as key channels for customer relationships and product showcases. Participation in events like CES and AIX allows for direct engagement with a broad customer base, from automotive OEMs to aerospace manufacturers. In 2024, these platforms are vital for demonstrating Gentex's latest advancements in smart glass and dimmable lighting technologies.

These expos are not just about displaying products; they are critical for market intelligence and relationship building. Gentex uses these opportunities to:

- Gather direct customer feedback on new product concepts.

- Network with potential new clients and strategic partners.

- Observe competitor innovations and market trends.

- Reinforce brand presence within key industries.

Digital Presence and Investor Relations

Gentex leverages its corporate website and a specialized investor relations portal to cultivate a robust digital presence. These platforms are crucial for disseminating detailed information regarding its innovative products, cutting-edge technologies, financial results, and significant company updates. For instance, as of early 2024, the company actively uses these channels to communicate its progress in areas like electrochromic technology and advanced driver-assistance systems (ADAS), keeping stakeholders informed.

These digital channels function as primary conduits for engaging with investors, media representatives, and the general public. They ensure transparency and accessibility to key corporate data, fostering trust and facilitating informed decision-making. The investor relations section, in particular, provides easy access to SEC filings, annual reports, and webcast presentations, which are vital for financial analysts and individual investors alike.

Key aspects of Gentex's digital presence for investor relations include:

- Corporate Website: Comprehensive overview of business segments, product applications, and company history.

- Investor Relations Portal: Dedicated section for financial reports, stock information, press releases, and investor event calendars.

- Information Dissemination: Timely updates on product launches, technological advancements, and financial performance, including quarterly earnings reports.

- Stakeholder Engagement: Facilitates direct communication and access to essential data for investors, analysts, and the media.

Gentex's channels are primarily direct sales to automotive OEMs and aircraft manufacturers, leveraging specialized distributors for fire protection products, and utilizing industry expos and digital platforms for broader engagement and information dissemination.

The direct approach allows for deep collaboration and customization, as seen in the $1.76 billion automotive segment revenue in 2023. For aerospace, the growing aircraft production in 2024, with 492 Boeing and 735 Airbus deliveries, highlights the channel's potential.

The fire protection segment benefits from established distribution networks within a market valued over $250 billion in 2024. Industry events and digital channels like the corporate website and investor relations portal are crucial for market intelligence and stakeholder communication.

| Channel Type | Primary Target Audience | Key Activities/Benefits | Supporting Data (2023/2024) |

|---|---|---|---|

| Direct Sales (Automotive) | Automotive OEMs | Tailored solutions, close collaboration, seamless integration | $1.76 billion automotive segment revenue (2023) |

| Direct Sales (Aerospace) | Aircraft Manufacturers | Bespoke solutions, integration into new aircraft designs | Boeing deliveries: 492 (2024), Airbus deliveries: 735 (2024) |

| Distributors/Wholesalers | Fire Protection & Security Installers, Building Sector | Leveraging existing networks for broad market reach | Global fire protection market > $250 billion (2024) |

| Industry Trade Shows/Expos | Broad Customer Base (Automotive, Aerospace, etc.) | Product showcases, customer feedback, market intelligence, relationship building | Key platforms for demonstrating advancements in smart glass and ADAS |

| Digital Channels (Website, Investor Relations) | Investors, Media, General Public | Information dissemination, transparency, stakeholder engagement | Active communication of technological progress and financial results |

Customer Segments

Global Automotive Original Equipment Manufacturers (OEMs) represent Gentex's most substantial customer base, encompassing virtually all major car manufacturers across the globe. These OEMs incorporate Gentex's advanced automatic-dimming rearview mirrors, Full Display Mirrors (FDM), and other sophisticated electronic components as either standard or optional features in their vehicle production lines.

The demand within this segment is largely fueled by the automotive industry's continuous drive to offer enhanced safety, improved driver vision, and integrated connectivity solutions in new car and light truck models. In 2024, the automotive industry saw a significant focus on advanced driver-assistance systems (ADAS) and in-car electronics, directly benefiting suppliers like Gentex.

This segment encompasses major aircraft manufacturers like Boeing and Airbus, who are key integrators of Gentex's electronically dimmable windows (EDWs) into their commercial aircraft. Airline operators also play a crucial role, either by specifying EDWs during the initial aircraft build or through retrofitting programs. The demand from these customers is fueled by a focus on enhancing passenger experience through improved comfort and cabin aesthetics, alongside operational efficiencies.

In 2024, the aerospace industry continued its recovery, with major manufacturers reporting strong order backlogs. For instance, Boeing delivered 492 commercial aircraft in 2024, while Airbus delivered 735. This sustained production level directly translates to a consistent demand for cabin interior components like EDWs. Airlines are increasingly prioritizing passenger amenities to differentiate themselves, making advanced cabin features a significant selling point.

Gentex's fire protection products cater to both commercial and residential building developers and owners. These customers, including facility managers, prioritize dependable fire and carbon monoxide detection to comply with safety standards and safeguard their properties and the people within them.

In 2024, the global fire detection and alarm systems market was valued at approximately $35 billion, with a projected compound annual growth rate of over 6% through 2030, indicating a strong demand from these construction-focused segments.

Aftermarket Automotive Customers

While Gentex's core business is supplying automotive manufacturers directly (OEMs), they also cater to the aftermarket automotive customer segment. This group comprises automotive suppliers and various accessory providers who are looking to enhance or replace existing vehicle components. In 2024, the automotive aftermarket industry continued to show resilience, with a significant portion of vehicle owners opting for repairs and upgrades rather than new vehicle purchases, especially in light of evolving economic conditions.

This aftermarket channel allows Gentex to offer specific rearview mirror products and accessories to a broader customer base. These customers are often seeking to improve their vehicles with advanced features or replace worn-out parts. The demand for connected car features and enhanced driver assistance systems also drives interest in aftermarket mirror solutions that can integrate such technologies.

- Aftermarket Focus: Gentex provides rearview mirrors and related accessories to automotive suppliers and aftermarket retailers.

- Customer Needs: This segment includes customers looking for upgrades, replacements, or enhanced vehicle features.

- Market Context: The automotive aftermarket remained a vital sector in 2024, supporting vehicle longevity and personalization.

Medical and Healthcare Sector

The medical and healthcare sector represents a significant emerging customer segment for Gentex. This expansion is fueled by innovative product lines like the eSight Go, a wearable assistive technology designed to aid individuals with visual impairments. This new market leverages Gentex's established electro-optical and sensing capabilities.

Gentex's entry into healthcare is strategically positioned to capitalize on high-growth opportunities. For instance, the eSight Go aims to enhance the quality of life for millions facing vision loss. The company is also exploring dynamic surgical lighting, which could offer improved visualization for surgeons.

- Emerging Market: Medical and healthcare sector identified as a key growth area.

- Key Product: eSight Go assistive technology for the visually impaired.

- Potential Application: Dynamic surgical lighting systems.

- Core Competency Leverage: Utilizes Gentex's electro-optical and sensing expertise.

Gentex's primary customer base consists of global automotive Original Equipment Manufacturers (OEMs), who integrate its automatic-dimming mirrors and electronic components into new vehicles. The demand from this segment is driven by the automotive industry's focus on safety, driver vision, and connectivity, with ADAS and in-car electronics being key growth areas in 2024.

Another significant segment includes major aircraft manufacturers like Boeing and Airbus, along with airline operators, who utilize Gentex's electronically dimmable windows (EDWs) for enhanced passenger comfort and cabin aesthetics. The aerospace sector's recovery in 2024, with substantial aircraft deliveries, supports consistent demand for these interior components.

Gentex also serves the fire protection market, supplying building developers, owners, and facility managers who prioritize reliable fire detection systems. This market is experiencing robust growth, with the global fire detection and alarm systems market valued at approximately $35 billion in 2024.

The automotive aftermarket segment, comprising suppliers and accessory providers, also relies on Gentex for rearview mirrors and upgrades. This sector remained vital in 2024, as vehicle owners sought to enhance their existing vehicles, driving demand for advanced mirror solutions.

Emerging as a key growth area is the medical and healthcare sector, where Gentex is leveraging its electro-optical expertise with products like the eSight Go assistive technology for the visually impaired. The company is also exploring applications in dynamic surgical lighting.

| Customer Segment | Key Products/Services | 2024 Market Context/Demand Drivers |

|---|---|---|

| Automotive OEMs | Automatic-dimming mirrors, FDMs, electronic components | Focus on ADAS, in-car electronics, safety, driver vision |

| Aerospace (Aircraft Manufacturers & Airlines) | Electronically Dimmable Windows (EDWs) | Aerospace recovery, passenger comfort, cabin aesthetics |

| Fire Protection | Fire and CO detection systems | Building safety standards, property protection |

| Automotive Aftermarket | Rearview mirrors, accessories | Vehicle upgrades, replacements, personalization |

| Medical & Healthcare | eSight Go, potential surgical lighting | Assistive technology for visual impairment, improved surgical visualization |

Cost Structure

Research and Development (R&D) is a substantial cost for Gentex, underscoring its dedication to innovation. In 2023, Gentex reported R&D expenses of $157.5 million, representing approximately 5.4% of its net sales. This investment fuels the creation of novel products and the refinement of existing technologies, crucial for staying ahead in the automotive and aerospace sectors.

Direct costs for Gentex’s manufacturing are significant, encompassing raw materials, skilled labor, and factory overhead. These expenses are directly tied to producing their advanced automotive mirrors and electronics. For instance, the cost of specialized glass, microprocessors, and electronic components can fluctuate based on global supply and demand. In 2023, Gentex reported cost of goods sold at $1.5 billion, reflecting the substantial investment in these direct inputs.

Global commodity prices and labor rates heavily influence these manufacturing expenses. As Gentex operates internationally, variations in wages and the cost of raw materials in different regions directly impact their bottom line. Efficiency and waste reduction are therefore critical strategies for Gentex to manage and control these production costs effectively.

Gentex's Sales, General, and Administrative (SG&A) expenses encompass costs not directly linked to manufacturing its products. These include vital functions like sales and marketing efforts to reach new customers and maintain existing relationships, as well as the salaries of administrative staff, legal counsel, and overall corporate overhead. For instance, in 2024, Gentex reported $374.3 million in SG&A expenses, reflecting significant investment in these support activities essential for its global reach and market development.

Intellectual Property (IP) Protection and Licensing

Gentex incurs significant costs to maintain and protect its vast intellectual property portfolio, which is crucial for its competitive edge. These expenses primarily cover legal fees associated with filing, prosecuting, and maintaining its numerous patents globally. In 2023, Gentex reported research and development expenses of $192.5 million, a portion of which directly supports IP protection and the creation of new proprietary technologies. The ongoing defense of these patents against infringement also adds to this cost structure.

The company’s strategy involves proactive protection of its innovations, which translates into continuous investment in legal counsel and patent office fees. This expenditure is essential to prevent competitors from leveraging Gentex's technological advancements without authorization. While specific figures solely for IP protection are not broken out, it's an integral part of the R&D budget, ensuring the longevity and exclusivity of its patented products, such as its auto-dimming rearview mirrors and advanced electronic systems.

- Legal Fees: Costs for patent applications, maintenance, and potential litigation to defend intellectual property.

- R&D Investment: A significant portion of Gentex's $192.5 million R&D spending in 2023 is allocated to developing and protecting new technologies.

- Licensing Costs: Any fees or royalties paid for licensing necessary third-party intellectual property.

- Global Protection: Expenses related to securing and maintaining patents in various international markets.

Capital Expenditures and Depreciation

Gentex's commitment to innovation and production capacity is reflected in its significant capital expenditures. In 2023, the company reported capital expenditures of $209.3 million, primarily allocated to expanding its manufacturing footprint and enhancing its technological capabilities. These investments are crucial for maintaining a competitive edge and supporting anticipated future demand.

The depreciation and amortization expenses stemming from these capital investments are systematically recognized over the useful lives of the assets. For instance, in 2023, Gentex recorded $112.7 million in depreciation and amortization. This accounting practice ensures that the cost of these long-term assets is matched against the revenue they help generate.

- Capital Expenditures (2023): $209.3 million, supporting facility expansion and technology upgrades.

- Depreciation & Amortization (2023): $112.7 million, reflecting the systematic expensing of long-term assets.

- Strategic Impact: These investments underpin Gentex's capacity for growth and operational efficiency.

Gentex's cost structure is heavily influenced by its significant investments in Research and Development, which stood at $192.5 million in 2023, alongside substantial manufacturing costs represented by $1.5 billion in cost of goods sold for the same year. These core expenses are further augmented by $374.3 million in Sales, General, and Administrative (SG&A) costs in 2024, reflecting the broad operational needs of a global technology company. Additional financial commitments include capital expenditures of $209.3 million in 2023 for capacity expansion and $112.7 million in depreciation and amortization.

| Cost Category | 2023/2024 Data | Significance |

| Research & Development (R&D) | $192.5 million (2023) | Drives innovation and new product development. |

| Cost of Goods Sold (COGS) | $1.5 billion (2023) | Represents direct manufacturing expenses, including materials and labor. |

| Sales, General & Administrative (SG&A) | $374.3 million (2024) | Supports sales, marketing, and corporate operations. |

| Capital Expenditures | $209.3 million (2023) | Investments in manufacturing facilities and technology. |

| Depreciation & Amortization | $112.7 million (2023) | Accounting for the wear and tear of long-term assets. |

Revenue Streams

Gentex's core revenue originates from supplying advanced automotive mirrors and electronic systems to major car manufacturers worldwide. This includes their signature auto-dimming mirrors, innovative Full Display Mirrors, and other integrated electronic features that enhance vehicle functionality and safety.

This segment is the bedrock of Gentex's financial performance, consistently representing the largest portion of their total net sales. For instance, in 2023, sales of automotive products, particularly mirrors and electronics, constituted approximately 95% of Gentex's total revenue, highlighting its dominance.

The company's growth in this area is fueled by two key factors: the increasing demand for more sophisticated features within vehicles and the expanding adoption of Gentex's advanced mirror technologies across a wider range of automotive models and global markets.

Gentex generates revenue by selling its dimmable aircraft windows, known as electronically dimmable windows (EDWs), directly to aircraft manufacturers and airline operators. This segment, while contributing a smaller percentage to Gentex's total revenue than its automotive business, signifies a high-value, niche product offering.

The demand for these specialized windows is closely tied to the cycles of new aircraft production and the ongoing trend of cabin retrofitting and modernization projects undertaken by airlines. For instance, in 2023, the aerospace industry saw a significant rebound in aircraft deliveries, with Boeing delivering 528 commercial aircraft and Airbus delivering 735 aircraft, indicating a positive environment for EDW sales.

Gentex generates significant revenue by selling a diverse portfolio of commercial fire protection products. This includes essential items like smoke detectors, audible alarms, and various signaling devices. These products are supplied to a broad customer base, encompassing both distributors and original equipment manufacturers (OEMs) across the commercial and residential construction industries.

This sales channel represents a stable and predictable revenue stream for Gentex. Its consistency is bolstered by continuous activity in the construction sector and the persistent, non-negotiable regulatory mandates that require robust safety features in buildings. For instance, in 2024, the global fire detection and alarm systems market was valued at approximately $25 billion, indicating the substantial scale of this revenue source.

Sales of Medical Devices and Biometric Products

Gentex's business model includes the sale of medical devices and biometric products, representing an emerging revenue stream. This diversification into healthcare technology, particularly for the visually impaired with products like the eSight Go, signals a strategic move towards future growth.

While these ventures currently contribute a smaller portion of overall revenue, they are crucial for expanding Gentex's market reach beyond its traditional automotive offerings. The company is actively investing in these innovative areas.

- Emerging Revenue: Sales from new medical devices and biometric identity authentication products.

- Key Product Example: eSight Go, a wearable assistive technology for the visually impaired.

- Strategic Importance: Represents diversification and significant future growth potential for Gentex.

Revenue from Acquired Businesses

Gentex's strategic acquisitions, like the notable purchase of VOXX International Corporation, are instrumental in generating new revenue streams. This move directly brought in sales from consumer electronics and associated product categories, significantly broadening Gentex's market presence and diversifying its overall business portfolio. The integration of VOXX is projected to unlock synergistic revenue opportunities, enhancing overall financial performance.

For instance, VOXX International's fiscal year 2023 (ending February 28, 2023) reported total revenue of $347.2 million, with a substantial portion derived from its automotive segment which aligns with Gentex's core competencies. This acquisition alone added a considerable sales volume, demonstrating the direct impact of strategic M&A on revenue generation. The aim is to leverage these acquired assets to create cross-selling opportunities and operational efficiencies, further boosting the revenue contribution from these new ventures.

- Acquisition Impact: VOXX International's acquisition added approximately $347 million in annual revenue as of fiscal year 2023.

- Market Expansion: This move diversifies Gentex's revenue base beyond its traditional automotive-based products into consumer electronics.

- Synergistic Growth: Integration efforts are focused on realizing cost savings and revenue enhancements through combined operations.

- Portfolio Diversification: The acquired businesses contribute new product lines, reducing reliance on any single market segment.

Gentex's revenue streams are primarily driven by its automotive segment, which supplies advanced mirrors and electronic systems to global car manufacturers, alongside a growing contribution from fire protection products and emerging medical devices.

The company also generates revenue from dimmable aircraft windows, a niche but high-value offering, and has recently expanded its portfolio through strategic acquisitions like VOXX International, adding consumer electronics to its revenue mix.

These diverse revenue streams highlight Gentex's strategy of leveraging its core technologies while expanding into new markets and product categories to ensure sustained growth and market resilience.

| Revenue Stream | Primary Products/Services | Key Customers | 2023 Contribution (Approx.) | Growth Drivers |

|---|---|---|---|---|

| Automotive | Auto-dimming mirrors, Full Display Mirrors, Integrated electronics | Major automotive OEMs | ~95% of total revenue | Increasing vehicle features, wider adoption of advanced mirror tech |

| Aerospace | Electronically Dimmable Windows (EDWs) | Aircraft manufacturers, Airlines | Smaller but high-value | New aircraft production, cabin retrofitting |

| Fire Protection | Smoke detectors, Alarms, Signaling devices | Distributors, Construction OEMs | Stable and predictable | Construction sector activity, regulatory mandates |

| Medical & Biometrics | eSight Go (assistive tech for visually impaired) | Direct consumers, Healthcare providers | Emerging | Healthcare technology investment, market expansion |

| Acquired (VOXX) | Consumer electronics, Automotive aftermarket | Broad consumer base, Automotive aftermarket | Significant new revenue | Synergies, cross-selling opportunities |

Business Model Canvas Data Sources

The Gentex Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research, and insights from customer feedback. This multi-faceted approach ensures each component of the canvas is robust and strategically sound.