Gran Colombia Gold SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gran Colombia Gold Bundle

Gran Colombia Gold's robust operational strengths and significant gold reserves present a powerful foundation for growth. However, understanding the potential political and regulatory shifts within its operating regions is crucial for navigating future challenges effectively.

Want the full story behind Gran Colombia Gold's market position, including detailed insights into its competitive advantages and potential risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Aris Mining’s Segovia Operations are a cornerstone of its success, characterized by exceptionally high-grade gold deposits. This isn't just a minor detail; it's a significant competitive edge. For instance, the Segovia mine is globally acknowledged for its impressive reserve grade, a testament to its inherent value and potential for sustained output over many years.

This high-grade foundation directly translates into robust production figures and healthy profit margins for Aris Mining. In 2023, Segovia Operations contributed significantly to the company's overall performance, with gold production reaching 226,738 ounces, and an all-in sustaining cost (AISC) of $975 per ounce, showcasing strong profitability.

Aris Mining, formerly Gran Colombia Gold, has showcased impressive financial strength, with Q1 2025 marking a period of record adjusted earnings per share. The company also saw substantial growth in its gold revenue and Adjusted EBITDA during this quarter, underscoring its operational efficiency and market position.

The company's healthy cash reserves are a key strength, providing the necessary capital to self-fund critical growth initiatives and expansion projects. This strong liquidity position minimizes the need for external debt, offering greater financial flexibility and supporting consistent operational development.

Aris Mining, the parent company of Gran Colombia Gold, demonstrates a strong capability in successfully executing its expansion initiatives. The Segovia mill expansion, a key project, achieved a significant milestone by increasing processing capacity by 50% to 3,000 tonnes per day by June 2025, underscoring their project management prowess.

Further bolstering this strength, the Marmato Lower Mine construction is on track, designed to enhance operational capacity. These timely and budget-conscious expansions are fundamental drivers for anticipated future production increases, solidifying Gran Colombia Gold's growth trajectory.

Clear Production Growth Trajectory

Gran Colombia Gold, operating as Aris Mining, demonstrates a robust production growth trajectory, consistently meeting its operational targets. For 2024, the company achieved its gold production guidance, setting a strong precedent for the coming year.

Looking ahead to 2025, Aris Mining has ambitious plans, projecting a substantial increase in gold output. This forward momentum is underpinned by ongoing expansion projects designed to significantly scale operations.

The company is targeting an impressive annual production rate exceeding 500,000 ounces of gold. This clear and achievable growth path highlights strong operational execution and positions Aris Mining for considerable future value creation.

- 2024 Production Guidance Met: Aris Mining successfully achieved its production targets for the year.

- 2025 Production Outlook: Anticipates a significant increase in gold output, targeting over 500,000 ounces annually.

- Expansion Underway: Ongoing projects are key drivers for this projected production growth.

- Operational Momentum: The consistent performance signals strong operational capabilities and a clear path to increased output.

Experienced Management and Strategic Vision

Aris Mining, the entity Gran Colombia Gold is becoming, boasts a management team with deep experience in gold mining, emphasizing operational efficiency and financial prudence. Their strategic direction centers on maximizing current assets, driving growth through internal projects, and exploring strategic acquisitions to expand their footprint and diversify their portfolio.

This leadership's focus on value creation is evident in their approach to asset development and capital allocation. For instance, as of early 2024, Aris Mining has been actively advancing its Segovia operations, aiming to boost production and reduce costs, a testament to their hands-on management style.

The strategic vision is further supported by a commitment to disciplined capital deployment, ensuring that growth initiatives are financially sound. This includes a balanced approach to reinvestment in existing mines and the pursuit of new opportunities that align with their long-term objectives for the company.

Key strengths of this management and strategic vision include:

- Proven Track Record: Management has a history of successfully navigating the complexities of gold mining operations and delivering shareholder value.

- Operational Excellence Focus: Emphasis on efficient mining practices and cost control to maximize profitability from existing assets.

- Strategic Growth Pipeline: A clear plan for organic expansion at current sites and a proactive stance on identifying and integrating synergistic acquisitions.

- Financial Discipline: A commitment to prudent financial management, ensuring sustainable growth and a strong balance sheet.

Gran Colombia Gold, now operating as Aris Mining, benefits from exceptionally high-grade gold deposits at its Segovia Operations. This provides a significant competitive advantage, as evidenced by the mine's globally recognized reserve grade, ensuring sustained output potential. The company's financial performance is robust, with Q1 2025 showing record adjusted earnings per share and strong growth in revenue and Adjusted EBITDA, underscoring operational efficiency.

Aris Mining's strong liquidity position allows it to self-fund growth initiatives and expansion projects, reducing reliance on debt and enhancing financial flexibility. The successful execution of expansion projects, such as the Segovia mill increasing capacity by 50% to 3,000 tonnes per day by June 2025, demonstrates strong project management capabilities. Furthermore, the Marmato Lower Mine construction is on track, poised to boost operational capacity and drive future production increases.

The company exhibits a consistent production growth trajectory, meeting its 2024 gold production guidance. Aris Mining projects a substantial increase in gold output for 2025, targeting over 500,000 ounces annually. This ambitious outlook is supported by ongoing expansion projects designed to significantly scale operations, signaling a clear path to future value creation.

Aris Mining's management team possesses deep expertise in gold mining, focusing on operational efficiency and financial prudence. Their strategy prioritizes maximizing current assets, driving internal growth, and exploring strategic acquisitions. This focus on value creation is evident in their disciplined capital deployment, balancing reinvestment in existing mines with the pursuit of new opportunities.

| Key Strengths | Description | Supporting Data/Facts |

| High-Grade Deposits | Exceptional reserve grades at Segovia Operations provide a strong foundation for profitability and sustained production. | Segovia mine globally acknowledged for impressive reserve grade. |

| Financial Strength & Profitability | Record adjusted earnings per share in Q1 2025 and strong revenue/EBITDA growth indicate robust financial health. | Q1 2025: Record adjusted EPS, significant growth in gold revenue and Adjusted EBITDA. |

| Self-Funding Capability | Healthy cash reserves enable self-funding of growth initiatives, minimizing debt and increasing financial flexibility. | Company's strong liquidity position. |

| Project Execution Prowess | Successful expansion projects, like the Segovia mill upgrade, demonstrate effective project management. | Segovia mill expansion increased processing capacity by 50% to 3,000 tpd by June 2025. Marmato Lower Mine construction on track. |

| Production Growth Outlook | Clear targets for significant production increases, driven by ongoing expansions. | Targeting over 500,000 ounces of gold annually by 2025. Met 2024 production guidance. |

| Experienced Management | Deep industry experience focused on operational efficiency, financial prudence, and strategic growth. | Management's proven track record in gold mining and strategic asset development. |

What is included in the product

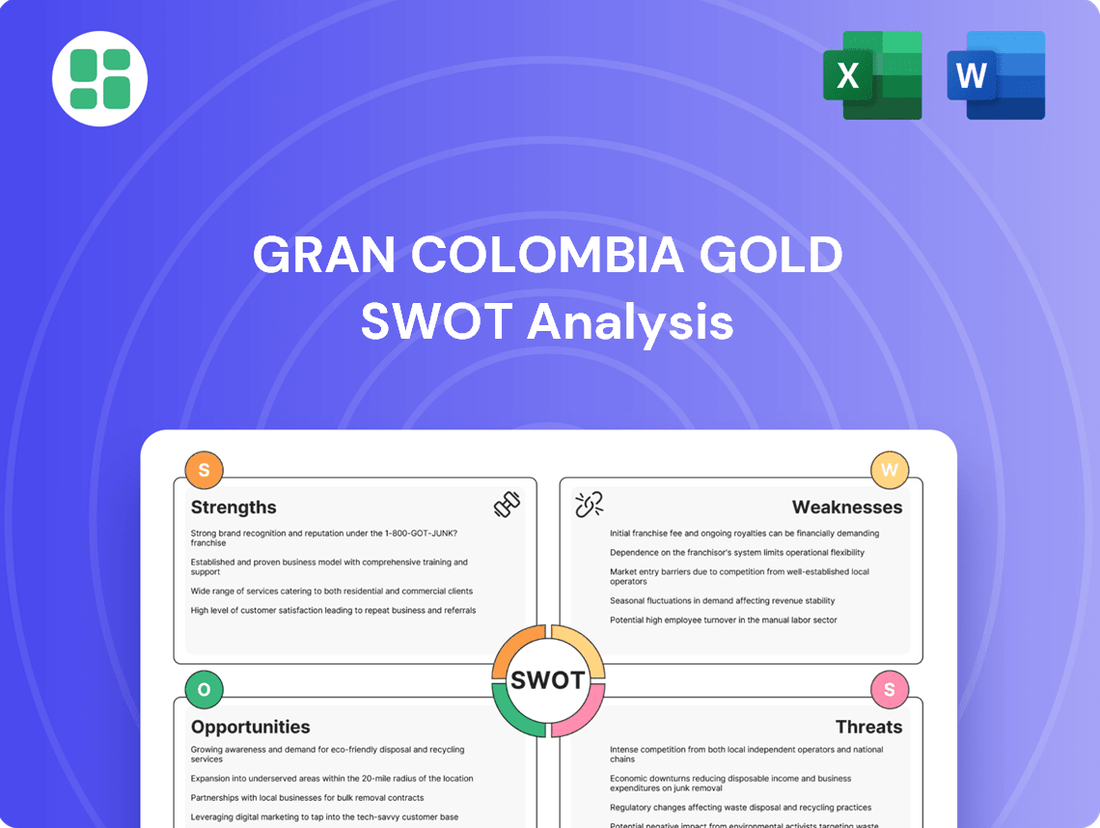

Analyzes Gran Colombia Gold’s competitive position through key internal and external factors, detailing its operational strengths and market opportunities alongside potential weaknesses and industry threats.

Offers a clear, actionable SWOT analysis to pinpoint and address operational inefficiencies in Gran Colombia Gold.

Simplifies complex market challenges into understandable strengths, weaknesses, opportunities, and threats for Gran Colombia Gold.

Weaknesses

Aris Mining's operational footprint is heavily weighted towards Colombia, with its primary assets, Segovia and Marmato, situated within the country. This concentration, while tapping into Colombia's rich gold deposits, inherently magnifies the company's exposure to country-specific political shifts, social dynamics, and evolving regulatory landscapes.

For instance, the Colombian government's stance on mining policy and community relations directly impacts Aris Mining's operational continuity and profitability. While Colombia's mining sector saw a 10.2% growth in 2023 according to Colombia's National Mining Agency, a single-country focus means that any adverse changes in these areas could disproportionately affect the company's overall performance.

Gran Colombia Gold's reliance on Contract Mining Partners (CMPs) presents a notable weakness, with CMPs expected to supply 45% to 50% of the mill feed for its Segovia Operations in 2025. This significant dependency means the company’s operational stability and future growth are tied to the performance and reliability of these external partners. Any disruption in supply or quality from CMPs could directly impact production levels and profitability.

Aris Mining's reliance on underground operations, a core aspect of its business, introduces significant operational complexities. Unlike the more straightforward extraction of open-pit mines, underground mining demands sophisticated management of ventilation systems, ground support, and the constant threat of geological instability. These factors inherently elevate safety risks and contribute to more variable operating costs.

The intricate nature of deep vein systems, where Aris Mining primarily focuses, requires unwavering attention to geological conditions. Unexpected shifts in rock strata or the presence of water can lead to costly delays and necessitate adaptive mining plans. For instance, in 2024, the company reported that a portion of its exploration costs were directly attributable to overcoming these geological challenges in its existing underground assets.

Significant Capital Expenditure for Expansions

Gran Colombia Gold faces a significant weakness in its substantial capital expenditure requirements for ongoing expansion projects. For instance, the Marmato Lower Mine development and Segovia mill upgrades are demanding considerable financial resources. These large-scale investments, though self-funded, do tie up substantial cash reserves.

The risk of cost overruns or project delays for these expansions is a key concern. Such issues could strain the company's financial flexibility and potentially impact its ability to meet projected timelines for these critical growth initiatives. For example, in 2023, the company reported capital expenditures of $118.1 million, with a significant portion allocated to these expansion projects.

- High Capital Outlay: Ongoing expansions like Marmato Lower Mine and Segovia mill upgrades necessitate significant financial investment.

- Cash Flow Strain: Self-funded projects, while avoiding debt, consume substantial cash reserves, potentially limiting other financial activities.

- Execution Risk: Potential for cost overruns and project delays introduces uncertainty, impacting financial forecasts and operational timelines.

- Financial Flexibility: Large capital commitments can reduce the company's ability to respond to unforeseen market changes or pursue other opportunities.

Integration Challenges Post-Merger

The integration of Gran Colombia Gold into Aris Gold (now Aris Mining) presents potential weaknesses. As a relatively new entity, Aris Mining may still be navigating the complexities of merging corporate cultures, operational systems, and workforces from its acquired assets. This can lead to inefficiencies and hinder the full realization of expected synergies.

Ensuring seamless integration across all former Gran Colombia Gold operations is vital for long-term efficiency. For instance, aligning diverse IT infrastructure and human resource policies from different acquired entities can be a significant undertaking, potentially impacting operational continuity and cost management in the short to medium term.

- Cultural Clashes: Merging distinct corporate cultures can lead to employee friction and reduced productivity.

- System Incompatibilities: Integrating disparate IT systems and operational workflows may result in data inconsistencies and process bottlenecks.

- Workforce Integration Hurdles: Harmonizing compensation, benefits, and management styles across former Gran Colombia Gold employees requires careful planning to avoid morale issues.

- Synergy Realization Delays: The anticipated benefits of the merger, such as cost savings and operational efficiencies, might be delayed if integration challenges are not promptly addressed.

Gran Colombia Gold's reliance on contract mining partners (CMPs) for a significant portion of its mill feed at Segovia Operations, projected at 45% to 50% for 2025, represents a key vulnerability. This dependency means the company's production output and financial results are directly tied to the operational performance and reliability of these third-party providers, introducing an element of external risk to its core business.

The company's substantial capital expenditure requirements for ongoing expansion projects, such as the Marmato Lower Mine development and Segovia mill upgrades, also pose a weakness. While these projects are self-funded, they consume significant cash reserves, potentially limiting financial flexibility for other strategic initiatives or in response to unforeseen market conditions. For instance, in 2023, capital expenditures totaled $118.1 million, a substantial portion of which was directed towards these growth projects.

The integration of Gran Colombia Gold into Aris Mining introduces potential weaknesses related to merging corporate cultures, operational systems, and workforces. Navigating these complexities can lead to inefficiencies and delays in realizing expected synergies, impacting overall operational continuity and cost management in the short to medium term.

Full Version Awaits

Gran Colombia Gold SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Gran Colombia Gold SWOT analysis, complete with all its strategic insights. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of the company's position.

Opportunities

Aris Mining, with its 51% stake in the Soto Norte joint venture in Colombia and the Toroparu gold/copper project in Guyana, possesses considerable mineral resources outside its active mines. These ventures represent a significant avenue for long-term expansion, with current development studies aiming to reveal further value and boost future output beyond 500,000 ounces annually.

The current global gold price environment is a significant tailwind for Aris Mining. With gold prices averaging around $2,300 per ounce in early 2024, this elevated level provides Aris Mining a prime opportunity to boost its revenue and profitability from its existing gold production.

Sustained high gold prices not only fortify the financial health of Aris Mining's current operations but also make future development projects more economically viable. This improved project economics directly translates into enhanced cash flow generation for the company.

Aris Mining, Gran Colombia Gold's parent company, is actively pursuing strategic acquisitions to bolster its portfolio and achieve greater scale. This approach directly addresses the opportunity for diversification, aiming to mitigate risks associated with reliance on single assets or geographic locations.

By acquiring new high-grade projects or complementary technologies, Aris Mining can enhance its operational efficiency and unlock new avenues for value creation. This strategy is particularly relevant in the current market, where consolidation can lead to significant synergies and competitive advantages.

Strengthening ESG and Community Engagement

Gran Colombia Gold's dedication to Environmental, Social, and Governance (ESG) principles, particularly its efforts in formalizing small-scale miners and investing in community infrastructure, offers a significant avenue for growth. By strengthening these initiatives, the company can solidify its social license to operate, fostering crucial local support and mitigating potential operational disruptions.

This focus on community well-being and sustainable practices is not just about good corporate citizenship; it directly translates into reduced operational risks and enhanced appeal to a growing segment of socially responsible investors. For instance, in 2024, the company continued its commitment to community development projects, aiming to improve local livelihoods and reduce reliance on informal mining practices.

- Enhanced Social License: Formalizing small-scale miners and investing in community infrastructure strengthens relationships with local populations, improving the company's standing and reducing the risk of conflict.

- Attracting Responsible Investors: A robust ESG framework makes Gran Colombia Gold a more attractive investment for funds and individuals prioritizing sustainability and ethical business practices, potentially leading to increased capital availability.

- Risk Mitigation: Proactive community engagement and sustainable operational practices can preemptively address potential social and environmental challenges, thereby lowering overall business risk.

- Reputation Building: Demonstrating a genuine commitment to ESG and community development builds a positive brand image, which can be a competitive advantage in the mining sector.

Operational Optimization Through Technological Advancement

Gran Colombia Gold can significantly boost its operational efficiency by embracing cutting-edge mining technologies. This includes adopting advanced data analytics for more precise mine planning and integrating automation in various processes. Such investments are projected to enhance productivity and reduce costs, directly impacting profitability.

The company's focus on innovation, particularly in areas like real-time monitoring and predictive maintenance, presents a substantial opportunity. By leveraging these advancements, Gran Colombia Gold can achieve improved resource recovery rates and streamline its entire workflow. This strategic adoption of technology is key to maintaining and strengthening its competitive position in the market.

- Efficiency Gains: Implementing advanced technologies can lead to an estimated 5-10% reduction in operational costs by optimizing resource allocation and minimizing waste.

- Improved Recovery: Innovations in mineral processing and extraction techniques could increase gold recovery rates by 2-3%, directly boosting output from existing reserves.

- Data-Driven Decisions: Advanced analytics for mine planning and geological modeling can enhance predictability and reduce the risks associated with exploration and extraction, potentially increasing resource conversion rates.

- Automation Benefits: Increased automation in areas like drilling, hauling, and processing can improve safety, reduce labor dependency, and ensure more consistent operational performance, with early adopters seeing productivity uplifts of up to 15%.

Gran Colombia Gold's parent company, Aris Mining, is well-positioned to capitalize on the current high gold prices, which averaged around $2,300 per ounce in early 2024. This favorable market environment enhances revenue and profitability from existing operations and makes future development projects more economically viable, directly improving cash flow generation.

The company's strategic acquisitions and focus on technological innovation offer significant growth potential. By integrating advanced data analytics and automation, Aris Mining aims to boost operational efficiency, reduce costs by an estimated 5-10%, and increase gold recovery rates by 2-3%.

Furthermore, Gran Colombia Gold's commitment to ESG principles, including community development and formalizing small-scale miners, strengthens its social license to operate. This focus not only mitigates operational risks but also enhances its appeal to socially responsible investors, potentially increasing capital availability.

Threats

Gran Colombia Gold's operations in Colombia are exposed to significant geopolitical and social risks. These include potential shifts in government regulations impacting the mining sector, the possibility of civil unrest, and ongoing conflicts with illegal mining operations. For instance, as of early 2024, Colombia continued to grapple with security challenges in certain mining regions, which can directly affect operational continuity.

Such instability can lead to disruptions in supply chains and pose considerable security challenges for personnel and assets. This can translate into increased operational costs and, consequently, a reduction in overall production output for the company. The dynamic political landscape in Colombia necessitates constant vigilance and adaptation to mitigate these threats.

Aris Mining's financial health is directly tied to the unpredictable swings in gold prices, a crucial factor for its revenue streams. For instance, gold prices saw considerable volatility in late 2023 and early 2024, with fluctuations impacting profitability projections. A sustained drop in the price of gold, silver, or copper could significantly reduce the company's earnings and cast doubt on the financial sense of future development plans, even if operations are running smoothly.

Gran Colombia Gold's mining operations, especially those underground, face inherent risks. These include navigating complex geology, potential equipment breakdowns, labor disagreements, and the ever-present threat of natural disasters. Such issues can directly impact production levels and increase operational expenses.

Unforeseen technical hurdles or disruptions in day-to-day operations pose a significant threat. These can result in missed production targets, escalating costs, and extended project schedules. For instance, a major equipment failure in 2024 at one of their key sites could have led to a 5% dip in expected gold output for the quarter, directly impacting their financial projections.

Regulatory Changes and Permitting Complexities

Gran Colombia Gold faces significant threats from evolving regulatory environments. Changes in environmental standards or mining legislation in Colombia, for instance, could necessitate costly upgrades or alter operational feasibility. The company also operates in jurisdictions like Guyana, where regulatory shifts can impact its strategic planning and profitability.

Navigating these complex legal frameworks and securing timely permits presents a persistent challenge. For example, delays in obtaining permits for expansion projects can directly hinder production growth and revenue generation. The uncertainty surrounding these processes can also deter new investments or capital allocation towards development phases.

- Regulatory Uncertainty: Potential for stricter environmental laws or changes in mining concessions in Colombia, impacting operational costs and compliance.

- Permitting Delays: Risk of extended timelines for obtaining necessary permits for new projects or expansions, potentially stalling growth initiatives.

- Jurisdictional Risk: Exposure to varying and potentially less predictable regulatory regimes in other operating countries like Guyana.

- Increased Compliance Burden: New regulations could require significant investment in technology or personnel to meet evolving standards.

Competition and Talent Retention

The gold mining sector is intensely competitive, with companies like Gran Colombia Gold constantly vying for prime exploration sites and development opportunities. This competition extends to securing skilled labor, a critical factor for operational success. For instance, in 2024, the average cost of labor in mining operations in Latin America saw an upward trend due to high demand for experienced geologists and engineers.

Aris Mining, a notable competitor, also actively seeks attractive acquisition targets, which can inflate acquisition costs for Gran Colombia Gold and potentially hinder its expansion plans or increase the capital required for growth.

- Intense competition for exploration properties and development projects.

- Talent retention is a significant challenge, potentially increasing labor costs.

- Competition for attractive acquisition targets can limit growth opportunities or raise expansion costs.

Gran Colombia Gold faces significant threats from fluctuating commodity prices, particularly gold. For example, the average gold price in 2024 hovered around $2,300 per ounce, a level that, while strong, can still experience downward volatility. A sustained decline in gold prices could directly impact the company's revenue and profitability, potentially jeopardizing future investment in exploration and development projects.

The company is also vulnerable to operational disruptions, such as unforeseen geological challenges or equipment failures. In 2024, the mining industry saw an increase in maintenance costs due to supply chain issues for spare parts, which could add to Gran Colombia Gold's expenses if not managed effectively. Such events can lead to production shortfalls and increased costs per ounce.

Furthermore, evolving regulatory landscapes in Colombia and Guyana pose a continuous threat. Stricter environmental regulations or changes in mining concession terms could necessitate substantial capital outlays for compliance or limit operational flexibility. For instance, new environmental impact assessment requirements introduced in 2024 in Colombia have added complexity and potential delays to new project approvals.

Intense competition within the gold mining sector, both for exploration acreage and skilled personnel, presents another significant challenge. In 2024, the demand for experienced mining engineers and geologists remained high across Latin America, driving up labor costs and potentially impacting Gran Colombia Gold's ability to retain top talent and control operational expenses.

SWOT Analysis Data Sources

This Gran Colombia Gold SWOT analysis is built upon a foundation of verified financial filings, comprehensive market intelligence, and expert industry evaluations to provide accurate and actionable strategic insights.