Gran Colombia Gold Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gran Colombia Gold Bundle

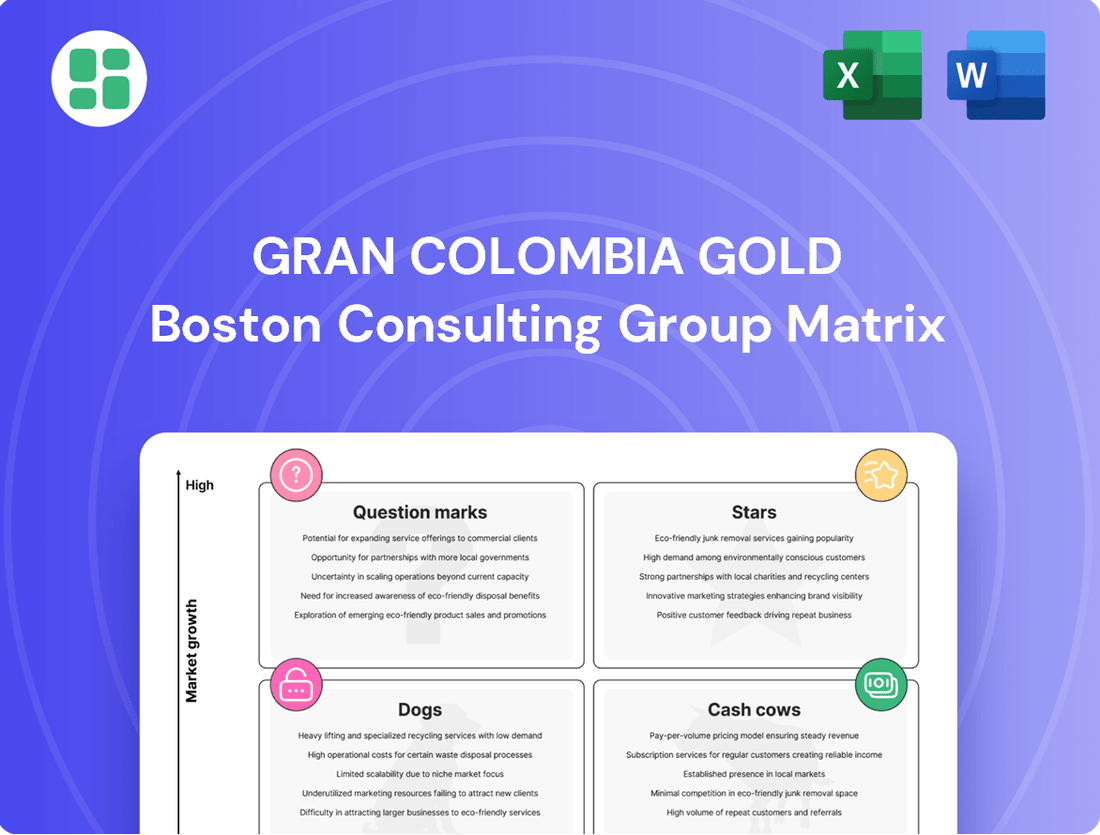

Unlock the strategic secrets of Gran Colombia Gold with our comprehensive BCG Matrix analysis. See precisely where their gold assets and exploration projects fall into Stars, Cash Cows, Dogs, or Question Marks. This preview is just the beginning; purchase the full report for detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimizing their portfolio for maximum returns.

Stars

Segovia's operational expansion, marked by a 50% increase in processing capacity to 3,000 tonnes per day by June 2025, positions it as a strong contender. This strategic move is projected to boost gold output considerably in the latter half of 2025, aiming for an annual production of 300,000 ounces by 2026.

The Marmato Lower Mine development is a key growth initiative for Gran Colombia Gold, aiming to significantly boost production. The planned processing plant capacity is increasing to 5,000 tonnes per day, with production ramp-up expected in the latter half of 2026.

This project is projected to yield over 200,000 ounces annually from the Lower Mine itself, marking it as a substantial future revenue driver for the company and strengthening its market position.

Aris Mining is setting its sights high, aiming for an impressive overall gold production target of 500,000 ounces per year. This ambitious goal is expected to be reached by the second half of 2026.

This production surge will be driven by key developments, specifically the full ramp-up of the Segovia mill expansion and the commencement of operations at the new Marmato Lower Mine. These projects are central to Aris Mining's strategy for significant growth.

Achieving this 500,000 oz/year target represents a substantial increase in output and underscores Aris Mining's commitment to expanding its market presence within the gold sector.

Strong H1 2025 Production Growth

Gran Colombia Gold is experiencing a robust H1 2025, showcasing significant production increases that position its gold assets favorably within the BCG framework. The company's operational efficiency and expansion are evident in its output figures.

- H1 2025 Gold Production: 113,415 ounces, a 13% rise from H1 2024.

- Q2 2025 vs. Q1 2025 Production: Q2 saw a 7% increase over Q1.

- Market Presence: Consistent growth signals an expanding market share and operational strength.

Increased Gold Grades and Recoveries at Segovia

The Segovia Operations are a key component of Gran Colombia Gold's portfolio, demonstrating exceptional performance in gold extraction. In Q2 2025, the operation achieved impressive gold grades of 9.9 grams per tonne (g/t) and a recovery rate of 96.1%.

These high operational metrics directly translate into enhanced production output and wider All-in Sustaining Cost (AISC) margins for the company. This consistent efficiency and the inherent quality of the resources are vital for solidifying and expanding Gran Colombia Gold's position in the market.

- Segovia's Q2 2025 Gold Grade: 9.9 g/t

- Segovia's Q2 2025 Gold Recovery: 96.1%

- Impact: Increased production volumes and expanded AISC margins

- Strategic Importance: Crucial for market share growth and stability

Gran Colombia Gold's Segovia operations are performing exceptionally well, evidenced by a 13% increase in H1 2025 gold production to 113,415 ounces compared to H1 2024. The Segovia mine, in particular, is a star performer, achieving a high gold grade of 9.9 g/t and a recovery rate of 96.1% in Q2 2025. These metrics, coupled with an ongoing processing capacity expansion to 3,000 tonnes per day by June 2025, position Segovia as a strong cash generator with significant future growth potential.

| Asset | H1 2025 Production (oz) | Q2 2025 Grade (g/t) | Q2 2025 Recovery (%) | Projected Annual Output (oz by 2026) |

|---|---|---|---|---|

| Segovia | N/A | 9.9 | 96.1 | 300,000 |

| Marmato Lower Mine | N/A | N/A | N/A | 200,000+ |

What is included in the product

Gran Colombia Gold's BCG Matrix analysis identifies which mining operations to invest in, hold, or divest based on market share and growth.

A clear, visual BCG Matrix for Gran Colombia Gold clarifies which assets are cash cows and which need investment, easing strategic decision-making.

Cash Cows

The Segovia Operations are a cornerstone of Gran Colombia Gold, acting as a classic cash cow. These established mines consistently churn out significant profits, evidenced by their impressive AISC margin which reached $87.2 million in Q2 2025. This strong financial performance means Segovia is a reliable source of funding for the company's growth initiatives.

Despite ongoing expansion efforts, the core Segovia operations represent a mature, high-market-share asset. This maturity translates into stability and predictable cash generation, allowing Gran Colombia Gold to confidently allocate these earnings towards new projects and strategic investments, ensuring continued company development.

The Marmato Upper Mine is a prime example of a cash cow within Gran Colombia Gold's portfolio. In the first quarter of 2025, it churned out 7,214 ounces of gold, and projections indicate this output will remain consistent throughout the year.

This established operation provides a stable and predictable inflow of cash, a hallmark of a successful cash cow. Its consistent performance bolsters the company's financial health, offering a reliable source of funds that can be reinvested in other ventures or support overall corporate activities.

Aris Mining, a key component of Gran Colombia Gold's portfolio, demonstrated robust cash flow generation in Q1 2025, reporting $40.0 million after accounting for sustaining capital and income tax. This strong performance is further evidenced by a healthy cash balance of $310 million as of June 30, 2025.

This solid financial footing, fueled by consistent operational cash flow, enables Aris Mining to primarily self-finance its strategic growth projects. It also provides the flexibility to actively manage and reduce its existing debt obligations, enhancing overall financial stability.

High Gross Profit Margin

Gran Colombia Gold's position as a Cash Cow is strongly supported by its impressive gross profit margin. As of July 2025, the company boasts a gross profit margin of 58.55%. This figure highlights the efficiency of its current gold mining operations and its robust profitability from established revenue streams.

This high margin is a clear indicator that Gran Colombia Gold effectively manages its cost of goods sold relative to its revenue from existing gold production. It signifies a strong capacity to generate significant earnings from its current market position, a hallmark of a Cash Cow business unit.

- High Gross Profit Margin: 58.55% as of July 2025.

- Operational Efficiency: Demonstrates effective cost management in current gold production.

- Profitability Indicator: Shows strong earnings generation from existing market share.

- Cash Cow Characteristic: Reflects a mature, profitable business with low investment needs.

Owner Mining Segment Profitability

The owner mining segment at Segovia is positioned as a strong Cash Cow for Gran Colombia Gold. For 2025, the projected All-in Sustaining Costs (AISC) per ounce sold are expected to remain competitive, falling between $1,450 and $1,600.

This stable cost structure for direct mining operations is crucial. It guarantees a consistent and dependable inflow of cash, bolstering the company's overall financial health and providing a solid foundation for other strategic initiatives.

- Projected 2025 AISC: $1,450 - $1,600 per ounce sold.

- Profitability Driver: Consistent margins from direct mining operations.

- Cash Flow Contribution: Reliable and stable source of company cash flow.

The Segovia Operations, particularly the owner mining segment, are Gran Colombia Gold's quintessential cash cows. With projected 2025 All-in Sustaining Costs (AISC) between $1,450 and $1,600 per ounce sold, these mines offer predictable and stable cash generation.

This operational efficiency translates into robust profitability, allowing the company to leverage these earnings for strategic investments and debt management. The consistent performance of Segovia bolsters Gran Colombia Gold's financial health, a defining trait of a cash cow.

| Asset | 2025 Projected AISC (per oz) | Q2 2025 AISC Margin ($M) | Financial Contribution |

|---|---|---|---|

| Segovia Operations (Owner Mining) | $1,450 - $1,600 | $87.2 | Stable, predictable cash flow |

| Marmato Upper Mine | Consistent Output | N/A | Reliable cash inflow |

| Aris Mining | Self-financing | $40.0 (Q1 2025 post-cap/tax) | Funds growth, reduces debt |

Preview = Final Product

Gran Colombia Gold BCG Matrix

The Gran Colombia Gold BCG Matrix document you are previewing is the precise, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, offering you a ready-to-use tool for evaluating Gran Colombia Gold's business units.

Dogs

Gran Colombia Gold, as it was once known, no longer exists as a standalone entity. Its acquisition by Aris Gold Corporation, forming Aris Mining, effectively dissolved its independent status. This transition places its prior market position into the 'dog' category within a BCG matrix analysis, signifying a business with low market share and low growth prospects in its previous independent iteration.

Aris Mining's decision to sell the Juby Gold Project in July 2025 places it squarely in the 'dog' category of the BCG Matrix. This divestment suggests the project had low growth potential and a weak competitive position within Aris Mining's overall asset portfolio. Such assets typically require significant investment without promising substantial returns, often dragging down overall company performance.

These are typically smaller exploration properties that Gran Colombia Gold might have acquired through past mergers or acquisitions. They haven't shown strong potential and aren't aligned with Aris Mining's current growth strategy. For example, in 2023, Gran Colombia Gold's exploration expenditures were $14.8 million, but a portion of this would be allocated to properties that don't fit the 'star' or 'question mark' categories.

These 'dog' assets often drain capital and management attention without offering a clear path to future revenue or market share expansion. They represent a drag on resources that could be better utilized in more promising ventures. Such properties might be candidates for divestment or a complete cessation of exploration activities to optimize capital allocation.

Legacy Assets with Limited Remaining Life or High Costs

Gran Colombia Gold's legacy assets, characterized by limited remaining life or escalating operational costs, represent a strategic challenge. These segments, often older mines or specific deposits within larger operations, are approaching the conclusion of their economically viable extraction periods. For instance, in 2024, certain historical veins within their Colombian operations might have shown a significant increase in stripping ratios or a decline in ore grade, pushing up the cost per ounce of gold produced.

These assets typically exhibit diminishing returns and minimal growth potential, necessitating a focused management approach. The company must weigh the costs of continued operation against the declining revenue streams. Divestiture or a phased closure strategy are often considered to reallocate capital to more promising ventures.

- Declining Ore Grades: In 2024, some legacy sites experienced a drop in average gold grades, impacting profitability.

- Increased Operating Costs: Higher energy prices and the need for more complex extraction techniques in older deposits drove up per-unit production costs.

- Limited Exploration Upside: The geological potential for significant new discoveries in these mature areas is generally low.

- Capital Allocation Scrutiny: Investments in these assets are carefully evaluated to ensure they do not detract from opportunities in higher-growth segments.

Inefficient or Outdated Processing Facilities (Pre-Upgrade)

Prior to its significant modernization and expansion efforts, Gran Colombia Gold's older processing facilities would have been classified as dogs in the BCG matrix. These outdated operations struggled to meet current throughput and recovery benchmarks, making them a financial burden rather than a contributor to market share.

These pre-upgrade facilities represented a drain on the company's resources. For instance, older milling circuits might have exhibited recovery rates significantly below industry averages, perhaps in the 70-75% range, compared to modern facilities achieving 85% or higher. This inefficiency directly impacted profitability and the overall cost per ounce produced.

- Low Recovery Rates: Older equipment often resulted in lower gold recovery percentages, meaning more valuable metal was lost during processing.

- High Operating Costs: Inefficient machinery typically consumed more energy and required more maintenance, driving up operational expenses.

- Limited Throughput: The capacity of these older facilities was often constrained, preventing the company from processing larger volumes of ore efficiently.

Gran Colombia Gold's legacy assets, characterized by declining ore grades and escalating operating costs in 2024, represent a strategic challenge. These older mines or deposits are nearing the end of their economically viable life, with increased stripping ratios and lower gold recovery rates impacting profitability per ounce.

Assets like the Juby Gold Project, divested in July 2025, were categorized as dogs due to low growth potential and weak competitive positioning. These segments often drain capital and management attention without a clear path to future revenue expansion, making them candidates for divestment or closure to optimize capital allocation.

Older processing facilities, prior to modernization, also fell into the dog category. Their low recovery rates, perhaps in the 70-75% range compared to modern facilities achieving 85%+, and high energy consumption made them a financial burden, limiting throughput and increasing the cost per ounce produced.

| Asset Category | Characteristics | Example/Implication |

| Dogs (Legacy Assets) | Low market share, low growth prospects, declining ore grades, high operating costs | Older mines nearing end of life, potential divestment candidates. In 2024, increased stripping ratios impacted profitability. |

| Dogs (Divested Assets) | Weak competitive position, limited growth potential | Juby Gold Project sale in July 2025 signifies a strategic move away from underperforming assets. |

| Dogs (Outdated Facilities) | Low recovery rates, high energy consumption, limited throughput | Pre-upgrade processing plants, inefficient operations leading to higher cost per ounce. Recovery rates below 80% in 2024. |

Question Marks

The Soto Norte project, a significant joint venture where Gran Colombia Gold holds a 51% stake, is positioned as a 'Question Mark' in the BCG matrix. This massive gold-silver-copper undertaking is among the largest undeveloped underground gold deposits globally, boasting Tier 1 scale.

Currently, the project is navigating the crucial study and permitting stages, with updated development plan results anticipated in the third quarter of 2025. This phase signifies substantial future investment requirements, aligning with the characteristics of a question mark needing strategic evaluation.

Soto Norte presents considerable growth potential, yet it currently holds zero market share. This lack of market presence, coupled with the substantial capital needed for development, underscores its position as a question mark requiring careful consideration for future resource allocation and strategic direction.

The Toroparu gold/copper project in Guyana, owned by Aris Mining, is positioned as a Star in the BCG Matrix. Its recent Preliminary Economic Assessment (PEA) results, expected in Q3 2025, highlight significant growth potential in a developing market.

With a substantial resource base, Toroparu is poised for future expansion, but its current market share is minimal, reflecting its early-stage development. This combination of high growth prospects and low current market share is characteristic of a Star, requiring continued investment to maintain its trajectory and capitalize on its potential.

Gran Colombia Gold's new regional exploration initiatives are firmly planted in the question mark quadrant of the BCG matrix. These ventures are designed to expand the company's resource base beyond current operations, aiming for significant new mineral discoveries. For instance, in 2023, the company reported significant exploration expenditures, though specific figures for new regional initiatives are often bundled with broader exploration budgets, reflecting their early-stage nature.

Integration of Contract Mining Partners (CMPs) at Soto Norte

The integration of Contract Mining Partners (CMPs) at Soto Norte, inspired by Aris Mining's Segovia operations, positions the project within the BCG matrix. This strategy aims to bolster social license by including local partners in the processing phase, a move that could significantly enhance operational efficiency and community relations.

This approach aligns with a Stars or Question Marks quadrant depending on the market adoption and revenue generation from these partnerships. While the Segovia model demonstrated success, the specific market reception and financial contribution of CMPs at Soto Norte are still developing. For instance, Aris Mining reported that its Segovia operations, which utilize contract mining, achieved a total gold production of 246,058 ounces in 2023, showcasing the potential scalability of such models.

- Soto Norte's CMP integration aims to mirror Aris Mining's successful Segovia model.

- This strategy targets improved social license and operational efficiency.

- The financial impact and market adoption for Soto Norte's CMP integration are still under evaluation.

- Aris Mining's 2023 Segovia production of 246,058 ounces highlights the potential of contract mining.

Environmental Licensing for Soto Norte

The Soto Norte project, a key asset for Gran Colombia Gold, currently resides in the question mark quadrant of the BCG matrix due to significant environmental licensing hurdles. A temporary reserve area, established by the Colombian Ministry of Environment, is presently holding up the issuance of essential environmental permits. This regulatory pause injects considerable uncertainty into the project's development timeline and its eventual operational status.

This situation creates a substantial question mark, as the project's future hinges on the resolution of these regulatory challenges. While Soto Norte boasts promising mineral resources, the inability to secure environmental licenses means it is not yet a cash cow, nor is its future as a star clearly defined. The project requires substantial investment to navigate these regulatory complexities, with potential for high growth if successful, but also a risk of becoming a dog if these issues persist.

- Regulatory Uncertainty: The Temporary Reserve Area impacts the issuance of environmental licenses, a critical step for development.

- Project Timeline Risk: The duration of this reserve and subsequent licensing processes directly affects when Soto Norte can commence operations.

- Investment Implications: Continued investment is needed to address environmental concerns and push for license approval, a classic question mark characteristic.

Gran Colombia Gold's Soto Norte project, despite its immense potential as one of the world's largest undeveloped underground gold deposits, currently occupies the question mark quadrant in the BCG matrix. This classification stems from its zero current market share and the substantial capital investment required for its progression through study and permitting phases, with updated development plans expected in Q3 2025.

The project's future is heavily influenced by ongoing environmental licensing challenges, specifically a temporary reserve area established by the Colombian Ministry of Environment. This regulatory pause creates significant uncertainty regarding the project's timeline and operational viability, necessitating continued investment to navigate these complexities.

Furthermore, Gran Colombia Gold's new regional exploration initiatives are also categorized as question marks. While these ventures aim to expand the company's resource base, their early-stage nature and the inherent risks associated with discovery place them in this quadrant, requiring strategic evaluation of resource allocation.

| Project | BCG Quadrant | Key Characteristics | Status/Notes |

|---|---|---|---|

| Soto Norte | Question Mark | Large undeveloped gold-silver-copper deposit, Tier 1 scale, zero market share, high investment needs, environmental licensing hurdles. | Study & permitting stage, updated development plan expected Q3 2025. |

| Regional Exploration | Question Mark | New initiatives to expand resource base, early-stage discovery focus, significant but unquantified expenditure. | Ongoing exploration activities. |

BCG Matrix Data Sources

Our Gran Colombia Gold BCG Matrix is informed by a blend of official company filings, independent market research, and industry-specific growth forecasts to provide a comprehensive view of their portfolio.