Gran Colombia Gold PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gran Colombia Gold Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Gran Colombia Gold's future. Our comprehensive PESTLE analysis provides the essential intelligence you need to anticipate challenges and capitalize on opportunities in the dynamic mining sector. Download the full version now to gain a strategic advantage.

Political factors

The Colombian government's evolving approach to mining, particularly its focus on a 'Mining for Life' strategy emphasizing energy transition and reindustrialization, directly shapes the operating environment for companies like Gran Colombia Gold. Discussions around new mining legislation and potential exploration limitations, alongside the proposed establishment of a state mining entity, introduce a layer of policy uncertainty that can affect investment decisions and long-term strategic planning.

Colombia's government is making significant strides in formalizing its artisanal and small-scale mining (ASM) sector, aiming to bring informal operations into the legal framework. This push, exemplified by legislation like the 'Ecominerales' law, seeks to improve environmental standards and revenue collection. For instance, by the end of 2024, the goal is to have over 500 mining titles formalized through these new initiatives.

Companies like Aris Mining are actively participating in these formalization efforts, recognizing the strategic advantage of integrating artisanal miners into legal supply chains. This approach not only strengthens their social license to operate by fostering better community relations but also creates opportunities for more secure and traceable mineral sourcing. In 2024, Aris Mining reported successfully integrating approximately 1,500 artisanal miners into its formalization programs in the Antioquia region.

Security challenges in Colombia, including the presence of illegal mining and armed groups, directly impact Gran Colombia Gold's operations. These issues can disrupt supply chains, damage infrastructure, and pose significant risks to employee safety. In 2023, the Colombian government continued efforts to combat illegal mining, though the extent of its success in fully securing mining regions remains a key concern for investors.

Regulatory Environment for Foreign Investment

Colombia's regulatory landscape for foreign investment, while generally robust, presents specific challenges within the mining sector. Proposed regulations, such as the establishment of food production protection zones and specialized mining districts, are generating investor apprehension and uncertainty regarding future development prospects. This regulatory flux could potentially disincentivize new foreign direct investment in mining operations.

The evolving nature of these regulations is a key political factor for companies like Gran Colombia Gold. For instance, discussions around potential changes to mining concession terms or environmental permitting processes can directly impact operational costs and project timelines. Investors closely monitor these developments, as shifts in policy can significantly alter the risk-return profile of mining ventures in the country.

- Potential for new mining regulations: Concerns exist regarding proposed measures that could restrict mining activities in certain areas.

- Investor uncertainty: The introduction of specialized mining districts and food production protection zones creates ambiguity for foreign investors.

- Impact on development: These regulatory shifts may disincentivize new mining development and expansion projects.

Local and Regional Government Relations

Gran Colombia Gold's operations are significantly influenced by its relationships with local and regional governments, particularly in Colombia. These authorities play a critical role in the permitting process, land access, and the overall social license to operate. For instance, in 2023, the company continued to navigate complex local governance structures to advance its projects, underscoring the importance of consistent and effective dialogue.

Changes in political leadership or policy interpretations at the regional level can introduce uncertainty. Such shifts might affect environmental regulations, royalty structures, or community benefit agreements, potentially impacting project development timelines and operational costs. Maintaining strong, transparent communication channels with these stakeholders is therefore paramount for mitigating risks and ensuring smooth operations.

Key areas of engagement often include:

- Permitting and Licensing: Securing and maintaining necessary permits from regional bodies.

- Land Use Agreements: Negotiating and adhering to agreements regarding land access and usage.

- Community Relations: Collaborating with local authorities on community development initiatives and addressing social impacts.

- Regulatory Compliance: Ensuring adherence to regional environmental and operational standards.

The Colombian government's focus on formalizing artisanal mining, with a target of over 500 formalized titles by the end of 2024, presents opportunities for companies like Gran Colombia Gold to integrate ethical sourcing. However, ongoing security challenges, including illegal mining activities, continue to pose operational risks and impact supply chain stability. Regulatory uncertainty, stemming from proposed changes to mining concessions and environmental permitting, adds complexity to investment decisions and project planning for 2024 and beyond.

| Political Factor | Description | Impact on Gran Colombia Gold | 2024/2025 Data Point |

| Mining Policy Evolution | Government's 'Mining for Life' strategy, focus on energy transition. | Shapes operating environment, potential for new legislation. | Discussions ongoing regarding new mining laws and state mining entity proposals. |

| Artisanal Mining Formalization | Efforts to legalize informal mining operations. | Opportunities for ethical sourcing, improved community relations. | Target of over 500 formalized mining titles by end of 2024. |

| Security and Illegal Mining | Presence of illegal mining and armed groups. | Disruptions, infrastructure damage, safety risks. | Continued government efforts to combat illegal mining in 2023, with ongoing concerns. |

| Foreign Investment Regulations | Specific challenges in the mining sector, proposed protection zones. | Investor apprehension, uncertainty impacting FDI. | Investor apprehension noted regarding specialized mining districts and food production protection zones. |

What is included in the product

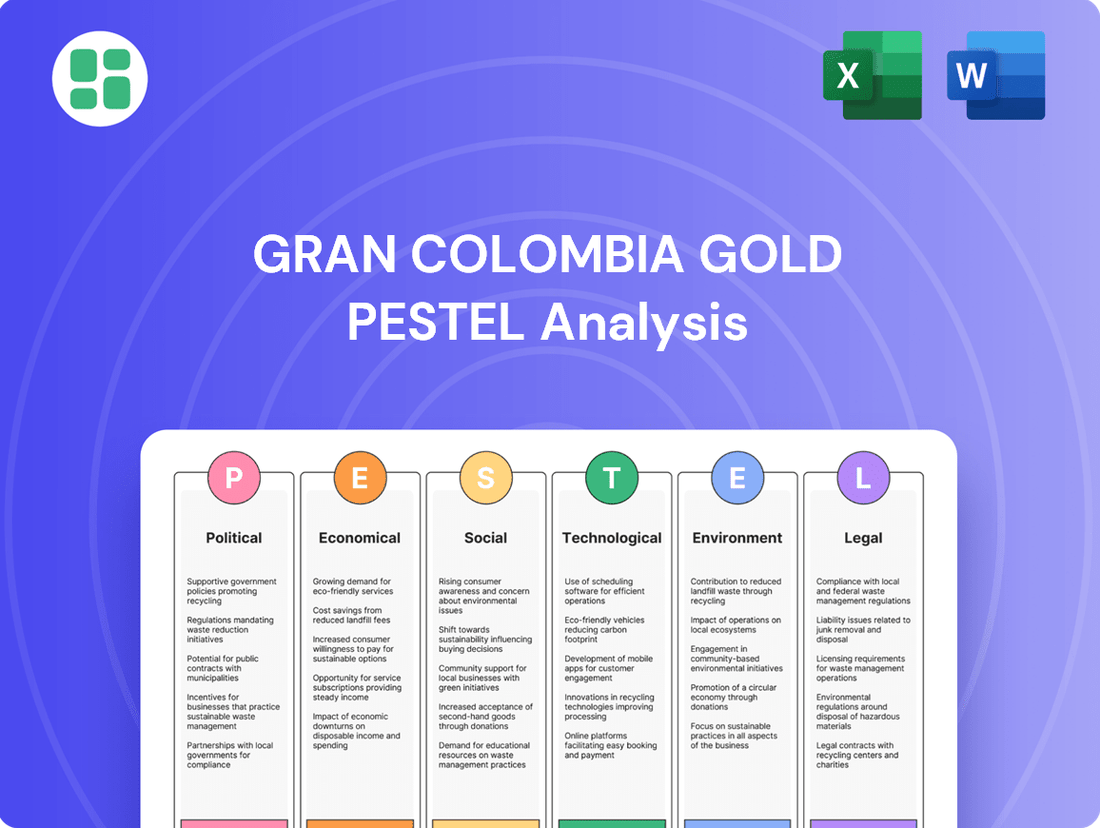

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Gran Colombia Gold, providing a comprehensive overview of its operating landscape.

It offers actionable insights for strategic decision-making by detailing how these external factors present both challenges and opportunities for the company's growth and stability.

A Gran Colombia Gold PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by offering easily digestible insights for strategic decision-making during meetings and presentations.

This analysis, segmented by PESTEL categories, visually simplifies complex external influences, allowing for quick interpretation and relieving the pain of information overload for stakeholders.

Economic factors

Fluctuations in global gold and silver prices are a critical economic factor for Aris Mining, directly influencing its revenue and profitability due to its focus on precious metals. For instance, gold prices have shown resilience, with forecasts suggesting they will remain elevated through 2025 and into 2026. This upward trend is underpinned by ongoing geopolitical tensions and general economic uncertainty, which historically drive demand for safe-haven assets like gold. Furthermore, robust purchasing by central banks globally continues to provide a solid floor for gold prices.

Inflationary pressures in Colombia and globally significantly impact Gran Colombia Gold's operational costs. Rising prices for labor, energy, and essential supplies directly increase the expenses associated with mining, affecting the company's overall cost structure and profitability. For instance, in early 2024, Colombia's inflation rate hovered around 4.5%, a notable increase from previous years, directly translating to higher input costs for the company.

Managing these escalating operational expenses is paramount for Gran Colombia Gold to maintain healthy profit margins. The company must implement strategies to mitigate the impact of inflation on its cost of goods sold and administrative expenses. This includes optimizing supply chains, negotiating favorable contracts for energy and materials, and improving operational efficiency to offset rising input prices.

Foreign exchange rates significantly influence Gran Colombia Gold's financial health. The exchange rate between the Colombian Peso (COP) and the US Dollar (USD) directly affects the company's profitability, especially since a substantial portion of its revenue is denominated in USD while many operating costs are in COP. For instance, if the COP weakens against the USD, the company's USD-denominated revenues translate into more COP when repatriated, potentially boosting local profitability. Conversely, a stronger COP would make USD revenues worth less in local terms.

As of mid-2024, the USD to COP exchange rate has shown volatility. For example, in early 2024, the rate hovered around 3,900-4,000 COP per USD. A sustained trend of a weaker peso, such as the rate moving towards 4,200 COP per USD, would generally benefit Gran Colombia Gold by reducing the local currency cost of its operations when viewed from a US dollar perspective. This currency dynamic is a critical factor in managing cost structures and ensuring competitive pricing in the global gold market.

Investment Climate and Capital Availability

The investment climate in Colombia, while generally improving, can still present challenges due to fluctuating economic stability and occasional regulatory unpredictability. This directly impacts how easily companies like Gran Colombia Gold can access the capital needed for growth and new ventures. For instance, in 2024, foreign direct investment (FDI) into Colombia saw a notable increase, reaching approximately $12.1 billion USD by the end of the third quarter, signaling growing investor confidence, though specific sector regulations remain a point of attention.

Despite potential policy uncertainties, Aris Mining, a significant player in the Colombian gold sector, has showcased a robust financial standing. They are actively funding substantial expansion projects, demonstrating that well-positioned companies can still secure necessary capital. This is partly supported by their strong operational performance, with Aris Mining reporting a production increase in their Colombian operations during the first half of 2024, contributing to their ability to finance expansion.

- Investment Climate: Colombia's investment climate is shaped by economic stability and regulatory predictability, influencing capital availability for projects.

- Capital Access: Companies require a stable environment to attract the necessary funding for expansion and new initiatives.

- Aris Mining's Position: Aris Mining, operating in Colombia, has maintained a strong financial position, enabling them to fund significant expansion projects.

- FDI Trends: Foreign direct investment into Colombia showed an upward trend in early 2024, indicating improving investor sentiment despite some policy considerations.

Contribution to National and Local Economy

The mining sector is a cornerstone of Colombia's economic landscape, significantly impacting its Gross Domestic Product (GDP), export earnings, and overall employment figures, especially within regions heavily reliant on mining activities. For instance, in 2023, Colombia's mining sector contributed approximately 3.8% to its GDP, showcasing its vital role in the national economy.

Aris Mining's operational footprint directly bolsters both local and federal tax revenues. Beyond tax contributions, the company is a crucial source of direct and indirect employment, actively fostering economic development and improving livelihoods within the communities where it operates. In 2024, Aris Mining reported employing over 2,500 individuals directly, with an estimated multiplier effect supporting thousands more jobs indirectly.

- GDP Contribution: Mining sector accounted for roughly 3.8% of Colombia's GDP in 2023.

- Employment: Aris Mining directly employed over 2,500 people in 2024, with significant indirect job creation.

- Tax Revenue: Operations contribute substantially to government coffers at national and local levels.

- Regional Development: Aris Mining's presence stimulates economic activity and improves living standards in its operating areas.

Global economic growth directly influences demand for commodities like gold, affecting Gran Colombia Gold's sales volume and pricing power. Projections for 2025 indicate a moderate global growth rate, which typically supports steady, rather than booming, demand for precious metals. Furthermore, interest rate policies in major economies can shift investment away from gold towards higher-yielding assets, potentially impacting gold prices.

The company's financial performance is also tied to commodity price volatility, with gold prices expected to remain robust through 2025. For instance, gold averaged around $2,300 per ounce in early 2024, a figure analysts anticipate will see continued strength. This stability is a positive economic factor for Gran Colombia Gold, providing a predictable revenue stream.

Colombia's economic health, including its GDP growth and inflation rates, directly impacts Gran Colombia Gold's operational costs and market conditions. With inflation in Colombia moderating to around 4.0% by late 2024, this offers some relief on input costs compared to earlier in the year, though vigilance on cost management remains crucial.

| Economic Factor | Impact on Gran Colombia Gold | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Global Economic Growth | Influences demand and pricing for gold. | Moderate global growth projected for 2025. |

| Commodity Prices (Gold) | Directly affects revenue and profitability. | Gold prices showing resilience, expected to remain elevated through 2025 (avg. ~$2,300/oz in early 2024). |

| Inflation Rates (Colombia) | Impacts operational costs (labor, energy, supplies). | Inflation in Colombia around 4.0% by late 2024, showing some moderation. |

| Interest Rate Policies | Can shift investment away from gold. | Central banks globally maintaining cautious interest rate stances. |

Preview Before You Purchase

Gran Colombia Gold PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Gran Colombia Gold PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the intricate market landscape and strategic considerations for Gran Colombia Gold.

Sociological factors

Aris Mining's social license to operate hinges on robust community engagement, a cornerstone for its operations in Colombia. This involves ongoing dialogue and building trust with local populations and various stakeholders to ensure continued acceptance and support.

Maintaining this informal agreement is crucial for preventing operational disruptions and securing the company's long-term viability. In 2024, Aris Mining reported investing over $3 million in community development projects, demonstrating a tangible commitment to its social license.

Aris Mining, a key player in Gran Colombia Gold's operational landscape, demonstrates a strong commitment to community engagement by investing in local infrastructure and social programs. This goes beyond simply providing jobs and paying taxes, aiming to foster genuine positive relationships and address the specific needs of the communities where they operate. In 2024, Aris Mining allocated over $5 million towards community development initiatives, including education, healthcare, and infrastructure improvements, significantly impacting over 15,000 residents.

The company actively seeks partnerships to ensure its operations are not only safe and legal but also environmentally responsible, with a clear focus on benefiting local populations. These collaborations are crucial for sustainable development, ensuring that mining activities contribute positively to the long-term well-being of the region. For example, a recent partnership with local authorities in the Marmato region in 2025 resulted in the construction of a new potable water system, directly benefiting 3,000 households.

Effective management of labor relations, including fair wages, working conditions, and safety standards, is crucial for Gran Colombia Gold's operational stability. In 2024, the mining sector globally continued to grapple with demands for improved worker welfare, impacting production costs and continuity.

Aris Mining's Segovia operations, a key partner for Gran Colombia Gold, formalize a substantial portion of their workforce through contract mining partners. This approach provides essential social security and benefits to employees, a practice increasingly scrutinized by stakeholders and regulators in 2024, aiming to ensure ethical labor practices across the supply chain.

Public Perception of Mining

Public perception of mining in Colombia remains a significant factor influencing operational success. Historically, the industry has been associated with environmental damage and social conflict, leading to skepticism among local communities and a cautious approach from regulators. This sentiment can translate into stricter permitting processes and increased community engagement requirements.

Companies like Aris Mining are actively working to reshape this narrative by emphasizing their commitment to sustainable practices and positive community impact. For instance, Aris Mining reported investing over $5 million in community development projects in 2023, focusing on education, health, and infrastructure, aiming to build trust and demonstrate tangible benefits beyond resource extraction.

The ongoing efforts to improve environmental stewardship and social responsibility are crucial for securing and maintaining a social license to operate. Public opinion, as reflected in media coverage and community feedback, directly impacts the perceived legitimacy of mining operations. A positive shift in perception can lead to smoother project approvals and stronger local partnerships.

Key aspects influencing public perception include:

- Environmental Impact: Concerns about water usage, land reclamation, and biodiversity protection are paramount.

- Social Responsibility: The perceived fairness of benefit sharing with local communities and adherence to labor standards are critical.

- Economic Contribution: Transparency in job creation, tax contributions, and local procurement practices can foster goodwill.

- Regulatory Compliance: Adherence to environmental and safety regulations is fundamental to building public trust.

Health and Safety Standards

Maintaining robust health and safety standards is a paramount social and operational imperative for mining firms like Gran Colombia Gold. This commitment extends to all employees and contractors, reflecting a deep responsibility for worker well-being.

Aris Mining, a company with operations in similar jurisdictions, showcased a significant improvement in worker safety during 2024. They reported a notable reduction in Lost Time Injuries, underscoring the effectiveness of proactive safety measures.

- Employee Safety: Prioritizing the physical and mental health of the workforce is a core social responsibility.

- Contractor Management: Extending safety protocols to all third-party personnel working on-site is crucial.

- Injury Reduction: Companies are increasingly focused on minimizing workplace accidents, as evidenced by Aris Mining's 2024 performance.

- Regulatory Compliance: Adherence to stringent health and safety regulations is non-negotiable in the mining sector.

Sociological factors significantly shape Gran Colombia Gold's operational environment, particularly through community relations and public perception. Aris Mining, a key operational entity, demonstrated this by investing over $5 million in community development projects in 2024, focusing on education, health, and infrastructure to foster positive local relationships.

The company’s commitment to social license involves ongoing dialogue and trust-building with local populations, which is vital for preventing disruptions and ensuring long-term viability. For instance, in 2025, a partnership in the Marmato region resulted in a new potable water system, directly benefiting 3,000 households.

Labor relations, including fair wages and safe working conditions, are also critical, with Aris Mining formalizing a substantial portion of its workforce through contract mining partners, ensuring social security and benefits in 2024.

Public perception of mining, historically marked by concerns over environmental damage and social conflict, is being actively managed through transparent economic contributions and adherence to regulations, aiming to build goodwill and legitimacy.

Technological factors

Technological advancements are significantly enhancing gold exploration. Innovations like remote sensing, AI-driven geological mapping, and drone technology are boosting precision and efficiency, thereby lowering costs and improving discovery rates for companies like Gran Colombia Gold.

These sophisticated tools enable deeper exploration and more accurate identification of gold deposits. For instance, AI can analyze vast geological datasets much faster than traditional methods, potentially uncovering previously overlooked resource potential.

The mining industry saw significant investment in exploration technology in 2024, with a focus on digital transformation. Companies are leveraging these tools to reduce the time and expense associated with initial resource delineation, making the process more data-driven and less reliant on costly, on-the-ground surveys.

The mining industry, including companies like Gran Colombia Gold, is increasingly leveraging automated and robotic equipment to boost efficiency and safety. These advancements, such as autonomous drills and trucks, significantly reduce the need for manual labor in hazardous underground and open-pit environments. This technological shift directly translates to lower operational costs and a marked decrease in workplace accidents.

In 2024, the global mining automation market was valued at an estimated $4.5 billion, with projections to reach $7.8 billion by 2029, indicating a robust compound annual growth rate of 11.5%. This trend highlights the significant investment and adoption of these technologies across the sector, promising increased productivity and a safer future for mining operations worldwide.

Innovations in gold processing, like better cyanide management and bioleaching, are making it possible to extract more gold from lower-grade ores. These advancements also provide more eco-friendly options. For instance, Aris Mining's Segovia mill expansion to 3,000 tonnes per day significantly boosts its processing capacity and efficiency, directly impacting potential output.

Data Analytics and Real-time Monitoring

Gran Colombia Gold's operations are significantly enhanced by the integration of data analytics, the Internet of Things (IoT), and Artificial Intelligence (AI). These technologies allow for the real-time monitoring of mining processes, from extraction to environmental compliance. For instance, sensors on heavy machinery can transmit operational data, enabling predictive maintenance to prevent costly breakdowns. This proactive approach helps minimize downtime, a critical factor in maintaining production schedules and profitability in the gold mining sector.

The application of these advanced technologies directly impacts efficiency and decision-making. By analyzing vast datasets, Gran Colombia Gold can pinpoint operational inefficiencies, optimize resource allocation, and better manage the environmental footprint of its activities. This data-driven approach supports more informed strategic choices, leading to improved extraction yields and reduced waste. For example, AI algorithms can forecast ore grades with greater accuracy, guiding more efficient mining plans.

The benefits extend to improved resource management and environmental stewardship. Real-time data on water usage, energy consumption, and emissions allows for immediate adjustments to mitigate negative impacts. This granular oversight is crucial for meeting increasingly stringent environmental regulations and for fostering sustainable mining practices. The ability to track and analyze these factors continuously provides a competitive edge in an industry where environmental performance is under constant scrutiny.

Key technological advancements supporting these capabilities include:

- Real-time operational dashboards: Providing instant insights into production metrics and equipment status.

- Predictive maintenance algorithms: Forecasting equipment failures based on sensor data, reducing unscheduled downtime.

- AI-driven geological modeling: Enhancing the accuracy of ore body identification and extraction planning.

- IoT sensors for environmental monitoring: Tracking emissions, water quality, and land disturbance in real-time.

Safety Innovations

Technological advancements are revolutionizing safety in mining operations, directly benefiting companies like Gran Colombia Gold. Innovations such as smart sensors embedded in personal protective equipment (PPE) provide real-time monitoring of environmental hazards and worker vital signs, offering immediate alerts for potential dangers. For example, advanced gas detection sensors can identify toxic levels of methane or carbon monoxide instantly. This proactive approach significantly reduces the risk of accidents and enhances overall worker well-being.

Virtual reality (VR) is also playing a crucial role in safety training. By simulating hazardous scenarios, such as tunnel collapses or equipment malfunctions, VR allows workers to practice emergency responses in a controlled, risk-free environment. This hands-on, immersive training is far more effective than traditional methods in preparing staff for critical situations. Gran Colombia Gold can leverage these technologies to foster a stronger safety culture.

- Smart Sensors in PPE: Real-time monitoring of gas levels, temperature, and worker biometrics.

- Virtual Reality Training: Immersive simulations for hazard response and operational procedures.

- Automated Monitoring Systems: Early detection of geological instability or equipment failures.

- Advanced Ventilation Technology: Improved air quality management in underground mines.

Technological advancements are critical for Gran Colombia Gold, enhancing everything from exploration to safety. The company is increasingly adopting AI for geological mapping and predictive maintenance, aiming for greater efficiency. In 2024, the global mining automation market was valued at approximately $4.5 billion, showing a strong trend towards digital transformation and operational optimization.

Legal factors

Colombia's mining sector is governed by a specific mining code and an evolving regulatory landscape. Proposals for a new Mining Law are underway, aiming to update regulations and enhance social and environmental accountability. These potential shifts could significantly affect licensing processes, operational mandates, and compliance obligations for mining entities such as Aris Mining.

Obtaining and maintaining environmental licenses and permits in Colombia for mining operations like Gran Colombia Gold is a rigorous undertaking. This process involves detailed environmental and social impact assessments, which can be lengthy. For instance, in 2023, the average time for obtaining a major environmental permit in Colombia was reported to be around 18-24 months, though this can vary significantly by project complexity and location.

Recent regulatory shifts, including government decrees and proposed environmental legislation in 2024, are introducing new requirements and potentially increasing the complexity of these permitting processes. These changes could lead to further delays in project timelines and necessitate additional compliance measures for companies operating in the mining sector.

The legal framework governing land tenure and property rights significantly impacts mining operations like Gran Colombia Gold. In 2024, the company's operations in Colombia, for instance, are subject to national mining laws that define exploration and exploitation rights, as well as regional regulations concerning land use and environmental protection. Securing clear title and respecting community land claims are paramount for avoiding operational disruptions and ensuring long-term investment viability.

Labor Laws and Social Security Obligations

Mining operations in Colombia, including those of Gran Colombia Gold, must strictly adhere to national labor laws. This includes compliance with maximum legal working hours, which are typically set at 48 hours per week, and mandatory social security contributions for all employees. Failure to comply can result in significant penalties and operational disruptions.

Aris Mining, a significant player in the Colombian gold sector, has been actively engaged in formalizing artisanal miners. This initiative is crucial for ensuring that these workers are brought under the purview of formal labor laws and social security systems. By formalizing, Aris Mining not only ensures legal compliance but also provides essential benefits such as health insurance and pension contributions to its workforce, fostering a more stable and equitable employment environment.

- Colombian Labor Law Compliance: Companies must adhere to regulations on working hours, minimum wage, and employee benefits.

- Social Security Contributions: Employers are mandated to contribute to the national social security system, covering health, pensions, and unemployment.

- Formalization of Artisanal Miners: Initiatives like those by Aris Mining aim to integrate informal workers into the formal economy, ensuring legal protections and benefits.

- Impact on Operational Costs: Meeting labor and social security obligations represents a significant cost component for mining companies operating in Colombia.

Anti-Corruption and Transparency Regulations

Gran Colombia Gold must navigate a complex web of anti-corruption and transparency regulations in Colombia. Adherence to laws like Law 1778 of 2016, which targets bribery of foreign officials, is paramount. The company's commitment to ethical operations directly impacts its reputation and ability to secure financing, especially as global investors increasingly scrutinize ESG (Environmental, Social, and Governance) compliance.

The Colombian government and international bodies are actively working to enhance transparency in the mining sector. This includes measures designed to prevent illicit activities and ensure fair business practices. For instance, initiatives promoting beneficial ownership transparency are gaining traction, requiring companies to disclose who ultimately owns and controls them.

- Regulatory Framework: Compliance with Colombian anti-corruption laws, including Law 1778 of 2016.

- International Scrutiny: Increasing investor focus on ESG factors and anti-bribery compliance.

- Transparency Initiatives: Support for measures to disclose beneficial ownership in the mining sector.

- Risk Mitigation: Robust internal controls are essential to prevent and detect corrupt practices.

The legal landscape for mining in Colombia, impacting companies like Gran Colombia Gold, is subject to ongoing evolution. Proposals for a new Mining Law in 2024 aim to modernize regulations, with a particular focus on enhancing social and environmental accountability, potentially altering licensing and compliance requirements.

Securing environmental permits remains a complex process, with average timelines for major permits in Colombia hovering around 18-24 months in 2023, a figure that can extend based on project specifics. Recent decrees and proposed legislation in 2024 signal a trend towards increased regulatory stringency.

Land tenure and property rights are critical legal considerations for mining operations. In 2024, Gran Colombia Gold's activities are governed by national mining laws and regional land use regulations, underscoring the importance of clear title and respect for community land claims to prevent operational disruptions.

Compliance with Colombian labor laws, including adherence to the 48-hour work week and mandatory social security contributions, is a significant operational cost. Initiatives like Aris Mining's formalization of artisanal miners in 2023-2024 highlight efforts to integrate workers into formal systems, ensuring legal protections and benefits, which adds to labor expenses.

Anti-corruption and transparency regulations, such as Law 1778 of 2016, are crucial for companies like Gran Colombia Gold. Investor focus on ESG compliance in 2024 means robust internal controls and transparency in beneficial ownership are essential for maintaining reputation and access to capital.

| Legal Factor | 2023-2024 Context | Implication for Gran Colombia Gold |

|---|---|---|

| Mining Law Evolution | Proposals for new Mining Law focusing on social/environmental accountability. | Potential changes in licensing, operational mandates, and compliance costs. |

| Environmental Permitting | Average 18-24 month permit times in 2023; increasing regulatory stringency. | Extended project timelines, higher compliance burdens, increased operational risk. |

| Land Tenure & Property Rights | National mining laws and regional land use regulations in effect. | Necessity for clear titles and community engagement to avoid disruptions. |

| Labor Law & Social Security | 48-hour work week, mandatory social security contributions. Formalization of artisanal miners. | Significant labor cost component; benefits from formalization initiatives. |

| Anti-Corruption & Transparency | Law 1778 of 2016; increasing ESG scrutiny; beneficial ownership transparency. | Need for robust internal controls; reputational risk mitigation; investor confidence. |

Environmental factors

Gran Colombia Gold's mining operations, especially for gold and silver, are water-intensive, making effective water management and conservation paramount. In 2023, the company reported significant water usage across its Colombian sites, emphasizing the need for sustainable practices to mitigate environmental impact and ensure operational continuity.

Stringent regulations govern water use, discharge, and quality in the mining sector. Gran Colombia Gold invests in advanced water treatment and recycling technologies to comply with these environmental standards, aiming to reduce its freshwater footprint and minimize the impact of its operations on local water bodies.

Gran Colombia Gold faces significant environmental scrutiny regarding its tailings management and waste disposal. Effective strategies are crucial to prevent pollution and ensure the long-term stability of these facilities, a challenge underscored by the increasing regulatory focus on mining waste globally.

In 2024, the mining industry continued to invest heavily in advanced tailings management systems, with companies like Gran Colombia Gold exploring solutions such as filtered dry stack tailings and paste backfill to reduce water usage and improve stability. These innovations are driven by a need to mitigate risks associated with traditional tailings dams, which have historically posed environmental hazards.

Gran Colombia Gold's operations in Colombia are directly influenced by the nation's commitment to biodiversity and ecosystem protection. Mining, by its nature, can disrupt local habitats and impact sensitive ecosystems, necessitating robust mitigation and offset strategies from the company. For instance, in 2023, Colombia continued to expand its protected areas, with over 37 million hectares designated for conservation, a significant portion of which could overlap with or be adjacent to mining concessions.

Colombian environmental policies are increasingly stringent, reflecting a global trend towards safeguarding natural resources. The potential declaration of temporary environmental reserves, a mechanism available to the government, could impose further restrictions or require enhanced environmental management plans for mining companies like Gran Colombia Gold. This regulatory landscape underscores the importance of proactive environmental stewardship and adherence to evolving conservation mandates.

Climate Change and Carbon Footprint

Mining companies like Gran Colombia Gold face growing pressure to mitigate climate change, which includes lowering their carbon footprint. This means actively pursuing strategies to reduce greenhouse gas emissions and integrating renewable energy sources into their operations. For instance, by 2024, many mining firms are setting ambitious targets for emission reductions, often aligning with global initiatives.

Colombia's own environmental agenda significantly shapes the mining sector. The nation's commitment to reducing emissions and achieving carbon neutrality by 2050 directly impacts operational strategies and investment decisions for companies like Gran Colombia Gold. This national policy framework encourages the adoption of cleaner technologies and sustainable practices.

- Emission Reduction Targets: Many global mining companies aim to cut Scope 1 and 2 emissions by 30-50% by 2030, with renewable energy sourcing playing a key role.

- Colombia's NDC: As part of its Nationally Determined Contribution (NDC), Colombia aims for a 51% reduction in greenhouse gas emissions by 2030 compared to 2018 levels.

- Renewable Energy Adoption: Gran Colombia Gold, like its peers, is exploring solar and wind power to reduce reliance on fossil fuels for its energy-intensive operations.

Land Reclamation and Mine Closure

Effective land reclamation and mine closure are critical for Gran Colombia Gold, often legally mandated to ensure a positive environmental legacy. In 2024, mining companies globally are facing heightened scrutiny from regulatory bodies regarding these plans. This includes the requirement to develop comprehensive closure strategies and establish adequate financial provisions to cover the associated costs.

Gran Colombia Gold, like its peers, must adhere to stringent regulations concerning post-mining land rehabilitation. These regulations typically mandate the creation of detailed mine closure plans years in advance of operations ceasing. Furthermore, financial assurance mechanisms, such as escrow accounts or bonds, are often required to guarantee that funds are available for reclamation activities, even if the company faces financial difficulties.

The increasing focus on Environmental, Social, and Governance (ESG) factors means that robust land reclamation and mine closure strategies are not just a compliance issue but also a significant reputational one. Companies that demonstrate proactive and effective closure planning can enhance stakeholder trust and potentially reduce long-term liabilities. For instance, by 2025, it's anticipated that regulatory frameworks will further emphasize the integration of biodiversity restoration and community engagement into closure plans.

- Legal Mandates: Companies must develop comprehensive mine closure plans, often requiring submission and approval by regulatory authorities well before the cessation of mining activities.

- Financial Assurance: Establishing dedicated funds or financial instruments (e.g., bonds, surety bonds) to cover the estimated costs of reclamation and closure is a common regulatory requirement.

- Increased Scrutiny: Regulatory bodies are enhancing oversight of mine closure planning and execution, with a growing emphasis on long-term environmental stewardship and post-mining land use.

- ESG Integration: Effective land reclamation and mine closure are increasingly viewed as key components of a company's ESG performance, impacting investor relations and social license to operate.

Gran Colombia Gold's operations are significantly impacted by Colombia's commitment to biodiversity and ecosystem protection, with over 37 million hectares designated for conservation as of 2023. This focus necessitates robust mitigation strategies to address potential habitat disruption. Furthermore, evolving environmental policies, including the potential for temporary environmental reserves, require mining companies to maintain proactive environmental stewardship and adapt to stricter conservation mandates.

PESTLE Analysis Data Sources

Our Gran Colombia Gold PESTLE Analysis is informed by a robust blend of official government publications from Colombia and Venezuela, reports from international financial institutions like the World Bank, and industry-specific data from mining associations and market research firms.