Gran Colombia Gold Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gran Colombia Gold Bundle

Unlock the strategic blueprint behind Gran Colombia Gold's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they effectively manage key resources, cultivate vital partnerships, and deliver compelling value propositions in the competitive mining sector. Discover the core drivers of their operational efficiency and market positioning.

Dive deeper into Gran Colombia Gold’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Gran Colombia Gold, now operating as Aris Mining, leverages strategic service providers, including specialized contractors for drilling, engineering, and mine construction. These crucial partnerships grant access to advanced expertise and necessary equipment, bypassing the need for substantial internal capital expenditure. For instance, in 2023, Aris Mining's Segovia Operations reported significant progress, partly enabled by contracted services for its underground development and expansion projects.

Gran Colombia Gold's engagement with Colombian government and regulatory bodies is paramount for its operational foundation. These collaborations are essential for obtaining and retaining crucial mining concessions, environmental permits, and various operating licenses, ensuring the company adheres to all national and local legal frameworks.

In 2024, maintaining these relationships is vital for Gran Colombia Gold's continued compliance and operational stability. For instance, securing permits for expansion projects or new exploration areas directly hinges on positive interactions with entities like the National Mining Agency (ANM) and the Ministry of Environment and Sustainable Development.

Gran Colombia Gold's key partnerships with financial institutions, including banks and investment firms, are absolutely crucial for its business operations. These relationships are the backbone for securing the significant capital needed for exploration, mine development, and ongoing operational costs. For instance, in 2023, the company reported total debt of approximately $375 million, highlighting its reliance on external financing.

These financial partnerships go beyond just capital infusion; they are vital for effective cash flow management. Furthermore, working with these institutions allows Gran Colombia Gold to implement strategies for hedging against the inherent volatility of commodity prices, a critical factor in the gold mining industry. Access to diverse financing options, such as credit facilities and equity offerings, ensures the company can sustain and grow its ambitious mining projects.

Local Communities and Indigenous Groups

Gran Colombia Gold actively engages with local communities and Indigenous groups, recognizing their vital role in securing a social license to operate. This engagement is built on initiatives like community development programs and prioritizing local employment. For instance, in 2023, the company invested significantly in social infrastructure projects, directly benefiting over 15,000 individuals across its operational areas in Colombia.

These partnerships are crucial for mitigating social risks and ensuring the long-term stability of operations. Transparent communication channels are maintained to foster trust and address community concerns proactively. This approach helps to create a stable operating environment, essential for sustained gold production and exploration activities.

- Community Development: Focused on education, health, and infrastructure improvements, with 2023 social investment totaling over $5 million USD.

- Local Employment: Prioritizing hiring from local communities, with over 60% of the workforce in specific operational areas being local residents in 2023.

- Transparent Communication: Regular meetings and dialogue platforms established with community leaders and Indigenous representatives to ensure open communication.

- Risk Mitigation: Proactive management of social impacts through collaborative planning and grievance redressal mechanisms, contributing to operational continuity.

Technology and Equipment Suppliers

Gran Colombia Gold cultivates vital relationships with premier technology and equipment suppliers. These partnerships are foundational for maintaining high operational efficiency and ensuring the safety of its mining activities.

These collaborations grant Gran Colombia Gold access to cutting-edge mining machinery, advanced processing technologies, and state-of-the-art safety systems, which are crucial for competitive operations. For instance, in 2024, the company continued its strategic procurement of specialized drilling equipment and advanced milling technologies to enhance ore recovery rates.

- Access to Innovation: Securing the latest advancements in mining and processing equipment.

- Operational Continuity: Ensuring reliable maintenance and timely upgrades to minimize production interruptions.

- Safety Enhancements: Implementing advanced safety systems and equipment from trusted providers.

Gran Colombia Gold's key partnerships extend to suppliers of specialized mining equipment and technology providers. These collaborations are essential for accessing advanced machinery and innovative solutions that drive operational efficiency and safety. In 2024, the company continued to invest in upgrading its fleet with modern, efficient equipment, ensuring competitive production levels.

These strategic alliances also ensure the availability of critical spare parts and technical support, minimizing downtime and maximizing asset utilization. For example, the company's focus on automation in its processing plants relies heavily on partnerships with leading technology firms to implement and maintain these systems. This ensures continuous improvement in gold recovery rates and overall productivity.

The company also maintains crucial relationships with academic and research institutions. These partnerships facilitate access to the latest geological research and mining methodologies, supporting exploration efforts and the optimization of extraction techniques. In 2023, Aris Mining reported engaging with Colombian universities for geological studies, contributing to a deeper understanding of its resource base.

| Partner Type | Description | 2023/2024 Relevance |

| Equipment & Technology Suppliers | Providers of drilling, processing, and safety equipment. | Crucial for operational efficiency and modernization; continued strategic procurement in 2024. |

| Academic & Research Institutions | Universities and research bodies for geological and mining studies. | Supports exploration and extraction optimization; engagement with Colombian universities in 2023. |

What is included in the product

Gran Colombia Gold's business model focuses on acquiring, developing, and operating gold mines, primarily in Latin America, leveraging its operational expertise and strategic asset portfolio.

It emphasizes efficient production, cost management, and exploration to maximize shareholder value while adhering to responsible mining practices.

The Gran Colombia Gold Business Model Canvas effectively addresses the pain point of fragmented operational strategies by providing a clear, one-page snapshot of their entire business, enabling focused improvements and streamlined execution.

Activities

Gran Colombia Gold's key activity of Mineral Exploration and Resource Definition involves detailed geological mapping, extensive drilling programs, and rigorous sampling to pinpoint and outline new gold and silver deposits. This foundational work is crucial for building the company's future production capacity and expanding its overall resource inventory.

In 2023, the company reported a significant increase in its gold reserves, reaching 1.1 million ounces, a testament to its successful exploration efforts. This ongoing commitment to defining new resources is directly linked to Gran Colombia Gold's long-term financial health and operational sustainability, ensuring a robust pipeline for future growth.

Gran Colombia Gold's mine development and construction is a critical upstream activity. Once a promising deposit is confirmed, the company focuses on the detailed engineering, procurement, and construction of all necessary mining infrastructure. This includes sinking shafts, excavating tunnels, and building processing facilities designed for efficient ore extraction and refinement.

This phase demands substantial capital outlay and rigorous project management. For instance, in 2024, Gran Colombia Gold continued to invest in the development of its Segovia Operations, aiming to enhance its production capacity and operational efficiency. These investments are crucial for establishing a safe and productive mining environment, directly impacting the long-term profitability of the company's assets.

Gold and Silver Extraction and Processing is Gran Colombia Gold's fundamental engine, involving the physical extraction of ore through mining and subsequent refinement. This process transforms raw minerals into marketable precious metals, directly driving revenue.

In 2023, Gran Colombia Gold reported total gold production of 216,392 ounces, with silver production contributing an additional 243,130 ounces. The company's focus on optimizing its metallurgical recovery rates, which in 2023 averaged 90.1% for gold, is crucial for maximizing the value derived from each ounce of ore processed.

Environmental Management and Reclamation

Gran Colombia Gold, now operating as Aris Mining, places significant emphasis on environmental management and reclamation as core activities. This involves meticulous waste management, actively working to minimize any ecological footprint from their mining operations, and diligently rehabilitating land once mining activities conclude. This commitment is not just about compliance; it's a proactive approach to sustainable resource extraction.

Adhering to strict environmental regulations is paramount, and these activities directly support that. For instance, in 2023, Aris Mining reported that its Marmato mine in Colombia achieved a 99.8% compliance rate with its environmental permits. This dedication to responsible practices enhances the company's standing and builds trust with stakeholders and communities. It also serves to reduce potential long-term financial and environmental liabilities.

- Waste Management: Implementing advanced techniques to safely store, treat, and dispose of mining waste, including tailings, to prevent contamination of soil and water sources.

- Ecological Impact Minimization: Employing strategies to reduce habitat disruption, control dust and noise pollution, and manage water usage efficiently throughout the mining lifecycle.

- Reclamation and Rehabilitation: Developing and executing plans to restore mined-out areas to a stable and ecologically functional state, often involving revegetation and land contouring.

- Regulatory Compliance: Ensuring all environmental activities meet or exceed national and international environmental standards and permit requirements.

Sales and Marketing of Precious Metals

Gran Colombia Gold's sales and marketing of precious metals focuses on efficiently converting its refined gold and silver into revenue. This involves direct sales to international bullion dealers, specialized refiners, and major financial institutions, ensuring broad market access.

Building and maintaining robust relationships with these key buyers is paramount. This not only facilitates consistent sales but also allows for better negotiation of pricing and terms. Managing the complex logistics of transporting and securing these high-value commodities is also a critical component of this activity.

The company's strategy aims to achieve competitive pricing by leveraging market knowledge and buyer relationships. For instance, in 2023, the average realized gold price for Gran Colombia Gold was $1,945 per ounce, reflecting their success in monetizing production effectively. Timely sales are essential to manage cash flow and reinvest in ongoing operations and exploration.

- Sales Channels: International bullion dealers, refiners, and financial institutions.

- Relationship Management: Crucial for securing consistent buyers and favorable terms.

- Logistics: Efficient management of transportation and security for precious metals.

- Pricing Strategy: Aiming for competitive pricing through market engagement and buyer relationships.

Gran Colombia Gold's community engagement and social responsibility are vital activities. These efforts focus on building positive relationships with local communities, supporting social development projects, and ensuring the company operates with a strong social license. This includes dialogue, employment opportunities, and contributions to local infrastructure and well-being.

Maintaining strong community ties is essential for uninterrupted operations. In 2023, Aris Mining (formerly Gran Colombia Gold) continued its focus on community initiatives, including educational programs and local employment, which are key to fostering goodwill and operational stability in its host regions.

The company's commitment to safety and health is a non-negotiable key activity. This involves implementing rigorous safety protocols, providing comprehensive training to all employees, and fostering a culture where safety is prioritized in every aspect of mining operations. This proactive approach aims to prevent accidents and ensure the well-being of the workforce.

In 2024, Aris Mining maintained its focus on safety performance, with initiatives aimed at reducing incident rates across all its operations. A safe working environment is fundamental to operational efficiency and employee morale, directly impacting productivity and long-term success.

Research and Development (R&D) and Technological Innovation are crucial for Gran Colombia Gold's long-term competitiveness. This involves exploring new mining techniques, improving processing efficiencies, and adopting advanced technologies to optimize resource recovery and reduce operating costs.

Investing in innovation allows the company to stay ahead in a dynamic industry. While specific R&D expenditures for 2024 are part of ongoing strategic investments, the company’s history shows a pattern of adopting new technologies to enhance productivity, such as advancements in underground drilling and ore sorting.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Mineral Exploration & Resource Definition | Identifying and quantifying new gold and silver deposits. | 1.1 million ounces of gold reserves reported in 2023. |

| Mine Development & Construction | Building infrastructure for ore extraction. | Continued investment in Segovia Operations in 2024 for capacity enhancement. |

| Extraction & Processing | Mining ore and refining it into precious metals. | 216,392 ounces of gold produced in 2023; 90.1% gold recovery rate. |

| Environmental Management & Reclamation | Minimizing ecological impact and restoring land. | 99.8% environmental permit compliance at Marmato mine in 2023. |

| Sales & Marketing | Converting refined metals into revenue. | Average realized gold price of $1,945/oz in 2023. |

| Community Engagement | Building positive relationships with local communities. | Focus on social development projects and local employment in 2023/2024. |

| Safety & Health | Ensuring a safe working environment. | Ongoing initiatives to improve safety performance in 2024. |

| R&D & Technological Innovation | Improving mining and processing techniques. | Strategic investments in new technologies to boost productivity. |

Full Document Unlocks After Purchase

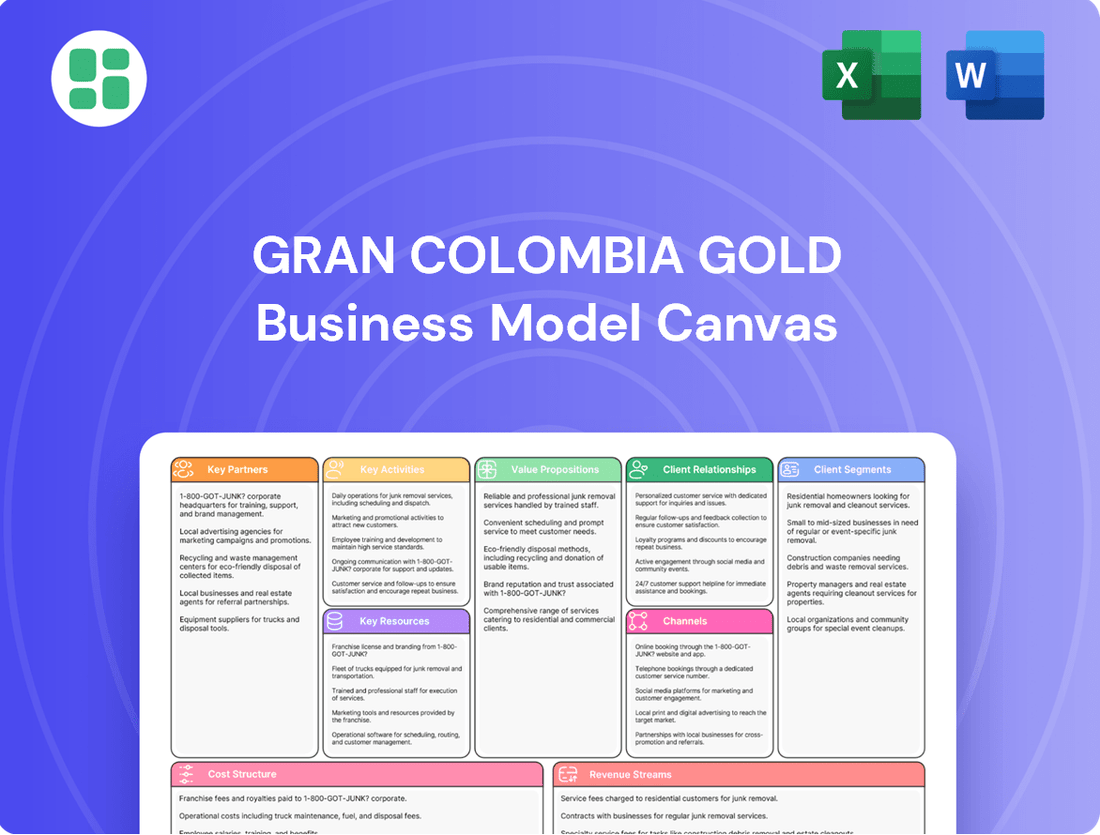

Business Model Canvas

The Gran Colombia Gold Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing the authentic structure, content, and formatting that will be delivered, ensuring no discrepancies. Upon completing your transaction, you'll gain full access to this comprehensive and ready-to-use business model.

Resources

Gran Colombia Gold's most crucial resource is its extensive high-grade gold and silver mineral reserves and the concessions granting access to them in Colombia, especially at its Segovia Operations. These reserves form the bedrock of the company's operations, directly influencing its production potential and operational lifespan.

As of the end of 2023, Gran Colombia Gold reported proven and probable mineral reserves of approximately 2.5 million ounces of gold. The high-grade nature of these deposits, averaging over 10 grams per tonne, is a significant competitive advantage, enabling efficient and profitable extraction.

Gran Colombia Gold's mining infrastructure and equipment are the backbone of its operations, encompassing underground mines, advanced processing plants, and essential tailings facilities. These physical assets are crucial for the effective extraction and refinement of gold and other precious metals, directly impacting the company's ability to meet production goals and maintain operational safety.

In 2023, the company continued to invest in its asset base. For instance, its Segovia Operations in Colombia are supported by significant infrastructure, including processing facilities designed to handle substantial ore throughput. The company's commitment to modernizing its equipment fleet is evident in ongoing upgrades aimed at enhancing efficiency and reducing operational costs, a critical factor in a competitive market.

Gran Colombia Gold's business model heavily relies on its skilled workforce, which includes geologists, mining engineers, metallurgists, and experienced operational staff. This human capital is essential for every stage of the mining process, from initial exploration and development to efficient extraction and processing. Their collective expertise directly impacts productivity and the ability to innovate within the demanding mining sector.

The company's success is also significantly shaped by its management team. This group is responsible for making critical strategic decisions and skillfully navigating the inherent complexities and challenges of the global mining industry. Their leadership ensures the company remains resilient and adaptable in a dynamic market environment.

Financial Capital

Gran Colombia Gold's access to financial capital is paramount for its business model. This capital, secured through various means like equity offerings or debt financing, fuels crucial activities such as exploration for new mineral deposits, the complex process of mine development, and covering the day-to-day operational expenses. For instance, in 2024, the company's ability to raise capital directly impacts its capacity to invest in advanced mining technologies and essential infrastructure.

The company's financial health is a direct enabler of its strategic objectives. It underpins the ability to make necessary investments in cutting-edge technology, build and maintain vital infrastructure, and attract and retain skilled human resources. A strong financial position, as demonstrated by its 2024 financial reports, allows Gran Colombia Gold to not only sustain its current mining operations but also to actively pursue and capitalize on new growth opportunities within the sector.

Key financial resources for Gran Colombia Gold include:

- Equity Financing: Raising funds by selling shares to investors, providing long-term capital.

- Debt Financing: Securing loans or issuing bonds to fund projects and operations.

- Retained Earnings: Reinvesting profits generated from existing operations back into the business.

- Access to Credit Facilities: Maintaining lines of credit for short-term liquidity needs and project financing.

Proprietary Data and Intellectual Property

Gran Colombia Gold's proprietary data and intellectual property are foundational to its competitive edge. This includes a vast repository of accumulated geological data and exploration results, honed through years of operation. For instance, by the end of 2023, the company had significantly expanded its exploration footprint, particularly in Colombia, leading to the identification of promising new gold deposits. This deep understanding of geological formations allows for more precise targeting of high-grade ore bodies, a critical factor in mining profitability.

Furthermore, the company’s operational best practices and innovative processing techniques represent valuable intellectual property. These refined methods contribute directly to increased extraction efficiency and reduced operational costs. In 2024, Gran Colombia Gold continued to invest in advanced processing technologies, aiming to improve gold recovery rates from its ores. This focus on innovation ensures they can extract more value from existing and future resource discoveries, a key differentiator in the gold mining sector.

The continuous development and application of this specialized knowledge are paramount for sustained success. This intellectual property provides a tangible competitive advantage by enabling more informed decisions regarding mine planning, resource management, and the adoption of new technologies. By leveraging its proprietary data and expertise, Gran Colombia Gold can more effectively identify new deposit opportunities, optimize extraction methods, and enhance overall operational efficiency, thereby maximizing returns.

- Accumulated geological data and exploration results: Crucial for identifying new, high-grade gold deposits.

- Operational best practices: Drive efficiency and cost reduction in extraction and processing.

- Innovative processing techniques: Enhance gold recovery rates, maximizing value from ore.

- Competitive advantage: Derived from proprietary knowledge, enabling informed strategic decisions and optimized operations.

Gran Colombia Gold's key resources are its substantial high-grade gold and silver reserves, particularly at Segovia Operations, and the concessions granting access to these valuable mineral deposits. The company's extensive mining infrastructure, including underground mines and advanced processing plants, forms the physical backbone of its operations. Furthermore, its skilled workforce, encompassing geologists, engineers, and operational staff, along with experienced management, are critical human capital assets. Access to financial capital, secured through equity and debt financing, is essential for funding exploration, development, and ongoing operations, with retained earnings and credit facilities also playing a vital role.

Proprietary data, including accumulated geological information and exploration results, alongside operational best practices and innovative processing techniques, constitute significant intellectual property. This knowledge base provides a distinct competitive advantage, enabling more precise targeting of high-grade ore bodies and optimizing extraction efficiency. For instance, by the end of 2023, the company had significantly expanded its exploration footprint, leading to the identification of promising new gold deposits.

In 2024, Gran Colombia Gold continued to invest in advanced processing technologies to improve gold recovery rates. This strategic focus on innovation ensures they can extract more value from their resources, a key differentiator in the gold mining sector.

| Resource Category | Specific Asset/Capability | Significance |

|---|---|---|

| Mineral Reserves | High-grade gold and silver deposits (e.g., Segovia Operations) | Foundation of production potential and operational lifespan. Proven and probable reserves stood at approximately 2.5 million ounces of gold at end-2023. |

| Physical Infrastructure | Underground mines, processing plants, tailings facilities | Enables efficient extraction and refinement of precious metals, directly impacting production goals and safety. |

| Human Capital | Skilled workforce (geologists, engineers, metallurgists), experienced management | Essential for all mining stages, impacting productivity, innovation, and strategic decision-making. |

| Financial Capital | Equity, debt financing, retained earnings, credit facilities | Fuels exploration, mine development, operations, technology investment, and infrastructure maintenance. Capital raising in 2024 directly impacts investment capacity. |

| Intellectual Property | Geological data, exploration results, operational best practices, processing techniques | Provides competitive edge, enabling precise ore targeting, cost reduction, and enhanced gold recovery rates. |

Value Propositions

Gran Colombia Gold's core value proposition centers on delivering high-quality gold and silver production, primarily from its Segovia Operations. This focus on premium-grade precious metals appeals to investors and buyers seeking a reliable source of consistently pure gold and silver.

The company's emphasis on high-grade deposits, like those found at Segovia, translates into a competitive cost structure. This efficiency allows Gran Colombia Gold to offer an attractive product to the market, ensuring both quality and value for its customers.

Gran Colombia Gold's proven operational track record instills confidence. The company has a history of successful gold and silver production in Colombia, demonstrating its capability to execute mining projects effectively. This reliability is crucial in a challenging operating environment, assuring investors of their expertise.

Gran Colombia Gold's commitment to responsible mining practices is a core value proposition, attracting investors increasingly focused on ESG criteria. This focus on environmental stewardship, social responsibility, and ethical governance (ESG) is crucial in today's market. For instance, in 2023, the company reported a 12% reduction in water consumption per tonne of ore processed compared to 2022, demonstrating a tangible effort to minimize its environmental footprint.

This dedication extends to actively contributing to local communities, fostering trust and ensuring long-term operational sustainability. Their social programs in Colombia, which included infrastructure development and educational initiatives, saw an investment of over $5 million in 2023, directly benefiting over 15,000 people.

Economic Contribution to Host Communities

Gran Colombia Gold's commitment to its host communities is a cornerstone of its business model, translating directly into tangible economic benefits. Through direct employment and extensive local procurement, the company injects capital into the regional economies where it operates. This approach not only creates jobs but also stimulates local businesses, fostering a multiplier effect that enhances overall prosperity.

In 2024, Gran Colombia Gold continued its focus on community development initiatives. These programs are designed to create shared value, ensuring that the company's operations contribute positively to the social fabric and economic well-being of its neighbors. By investing in local infrastructure, education, and health services, the company solidifies its social license to operate and builds strong, lasting relationships.

The company's role as a responsible corporate citizen is evident in its dedication to local prosperity. This commitment is crucial for maintaining operational stability and for building trust with stakeholders. Gran Colombia Gold’s strategy recognizes that long-term success is intrinsically linked to the health and vibrancy of the communities it serves.

- Employment: Providing direct jobs to local residents, contributing to household incomes and reducing unemployment in operating regions.

- Local Procurement: Sourcing goods and services from local suppliers, thereby supporting regional businesses and economic diversification.

- Community Development Programs: Investing in projects focused on education, healthcare, and infrastructure to improve the quality of life for community members.

Investment in a Diversified Precious Metals Producer

Gran Colombia Gold's value proposition for investors centers on providing diversified exposure to the precious metals market. This means investors gain access to both gold and silver through a single investment, which can be particularly attractive to those seeking a more balanced approach to precious metals rather than focusing on just one commodity.

This diversification is a key differentiator. By holding both gold and silver, investors can potentially mitigate some of the sector-specific risks. For instance, if silver prices are underperforming, gold prices might be performing well, and vice versa, smoothing out overall portfolio returns.

- Diversified Precious Metals Exposure: Offers investors a stake in both gold and silver production.

- Balanced Risk and Return: The combination of metals can provide different risk and return profiles, potentially leading to a more stable investment.

- Market Access: Simplifies investment in the precious metals sector by consolidating exposure to multiple key commodities.

Gran Colombia Gold's value proposition for investors is built on offering diversified precious metals exposure, providing access to both gold and silver within a single investment. This balanced approach can help mitigate sector-specific risks, as the performance of one metal may offset fluctuations in the other, potentially leading to more stable overall portfolio returns.

The company's operational efficiency, driven by high-grade deposits like Segovia, translates into a competitive cost structure. This allows Gran Colombia Gold to deliver quality precious metals at attractive values, appealing to investors seeking both purity and cost-effectiveness.

Furthermore, Gran Colombia Gold's commitment to responsible and sustainable mining practices, including significant investments in community development and environmental stewardship, appeals to a growing segment of ESG-conscious investors. For example, in 2023, the company invested over $5 million in community programs, benefiting more than 15,000 people, and reduced water consumption by 12% per tonne of ore processed compared to 2022.

| Value Proposition Element | Description | Supporting Data/Fact (2023/2024 Focus) |

|---|---|---|

| High-Quality Precious Metals Production | Delivering premium-grade gold and silver. | Primary production from Segovia Operations, known for high-grade deposits. |

| Competitive Cost Structure | Efficient operations due to high-grade ore. | Enables attractive product offering with quality and value. |

| Proven Operational Track Record | Demonstrated capability in executing mining projects. | History of successful production in Colombia, building investor confidence. |

| Responsible Mining & ESG Focus | Commitment to environmental stewardship and social responsibility. | 12% reduction in water consumption per tonne of ore processed (2023 vs. 2022); Over $5 million invested in community programs (2023). |

| Community Economic Benefits | Direct employment and local procurement stimulating regional economies. | Focus on creating shared value through local infrastructure, education, and health services in 2024. |

| Diversified Precious Metals Exposure | Offering investors access to both gold and silver. | Simplifies investment in the precious metals sector by consolidating exposure. |

Customer Relationships

Gran Colombia Gold cultivated direct sales channels with global gold and silver refiners and bullion dealers, ensuring efficient and secure off-take of its precious metal output. These B2B relationships are foundational to its revenue generation, relying on established trust and consistent delivery.

Gran Colombia Gold prioritized open and transparent communication with its shareholders and the broader financial community. This commitment was demonstrated through regular financial reporting, detailed investor presentations, and direct engagement via industry conferences and webcasts. For instance, in 2023, the company held numerous investor calls and participated in key mining conferences, aiming to build trust and attract necessary capital.

Gran Colombia Gold prioritizes active and ongoing engagement with local communities surrounding its operations. This commitment is vital for securing and maintaining its social license to operate, fostering trust and mutual respect.

The company actively participates in open dialogue, addressing community concerns directly and implementing targeted social development programs. For instance, in 2023, Gran Colombia Gold invested approximately $3.5 million in community development initiatives across its Colombian operations, focusing on education, health, and infrastructure.

These robust customer relationships are foundational to the business model, built on a commitment to shared value creation. By understanding and responding to community needs, Gran Colombia Gold aims to ensure sustainable and mutually beneficial coexistence with its stakeholders.

Government and Regulatory Liaison

Gran Colombia Gold prioritizes maintaining constructive relationships with government authorities and regulatory bodies to ensure compliance and foster favorable policy environments. This proactive approach is crucial for navigating the intricate regulatory landscape inherent in the mining sector.

The company actively engages in regular communication with these entities, meticulously adhering to all required permits and licenses. Furthermore, Gran Colombia Gold participates in industry discussions and consultations, contributing to the development of sound mining policies. For instance, in 2023, the company reported adherence to all environmental and operational permits across its key jurisdictions, a testament to its commitment to regulatory compliance.

- Regulatory Compliance: Strict adherence to all mining, environmental, and labor regulations in Colombia and Guyana.

- Permit Management: Ongoing efforts to secure and maintain all necessary operating permits and licenses.

- Policy Engagement: Active participation in industry associations and dialogues with government bodies to influence favorable policy.

- Government Relations: Building and maintaining trust-based relationships with local, regional, and national government officials.

Industry Association Participation

Gran Colombia Gold actively participates in industry associations, fostering a collaborative environment for sharing best practices and influencing sector policy. This engagement is crucial for maintaining high operational standards and promoting responsible mining development.

- Best Practice Sharing: Participation allows for the exchange of operational and safety protocols, enhancing overall industry efficiency.

- Policy Influence: Engaging with associations helps shape regulations and advocate for favorable industry conditions.

- Trend Monitoring: Staying informed about emerging trends and technological advancements is facilitated through these networks.

- Networking and Collaboration: Industry events and forums provide opportunities for partnerships and knowledge exchange.

Gran Colombia Gold's customer relationships extend beyond direct sales to encompass a vital network of stakeholders. The company actively cultivates strong ties with local communities through targeted social development programs, as evidenced by a $3.5 million investment in such initiatives in 2023. Furthermore, maintaining open communication with shareholders and the financial community through regular reporting and participation in industry events is paramount for capital attraction and trust-building.

Channels

Direct sales agreements formed Gran Colombia Gold's primary revenue channel, focusing on negotiated deals with established international precious metal refiners and bullion dealers. This approach facilitated secure transactions and streamlined the delivery of their gold and silver output.

By managing these direct relationships, the company maintained control over its sales pipeline, a strategy designed to optimize profitability. For instance, in 2024, Gran Colombia Gold reported significant sales volumes through these established channels, underscoring their importance to the business model.

Gran Colombia Gold's financial market disclosures are primarily channeled through official stock exchange filings, comprehensive annual reports, and detailed quarterly statements. These documents are vital for communicating the company's financial performance, operational updates, and strategic trajectory to investors and the wider financial community. For instance, in 2024, the company continued to provide regular updates on its production figures and exploration results, ensuring transparency.

Gran Colombia Gold actively engages with the investment community through participation in key investor conferences and dedicated roadshows. In 2024, the company presented at notable events like the BMO Global Metals, Mining & Critical Minerals Conference, offering management direct access to a broad base of institutional and retail investors.

These engagements are crucial for communicating Gran Colombia Gold's strategic vision, operational updates, and financial performance. The direct interaction at these forums allows for immediate feedback and clarification, fostering transparency and building investor confidence.

The company's roadshows in 2024, including targeted meetings in North America and Europe, were instrumental in attracting new capital and strengthening relationships with existing shareholders. Such outreach efforts are vital for maintaining a robust investor base and supporting future growth initiatives.

Corporate Website and Digital Media

Gran Colombia Gold's corporate website acts as a vital digital storefront, providing a 24/7 gateway for investors and stakeholders worldwide to access critical information. This includes detailed financial reports, timely news releases, comprehensive sustainability initiatives, and transparent corporate governance practices.

Leveraging digital media, the company ensures broad accessibility and engagement. This strategy allows for the dissemination of information to a global audience, fostering transparency and keeping stakeholders informed about operational updates and strategic developments.

Gran Colombia Gold also actively utilizes social media platforms to broaden its communication reach. This facilitates direct engagement with a wider audience, sharing company updates and reinforcing its brand presence in the digital space.

- Website as Information Hub: The corporate website serves as the primary source for financial data, sustainability reports, and governance information, ensuring easy access for a global investor base.

- 24/7 Digital Accessibility: Digital channels provide continuous access to company information, crucial for international investors and stakeholders operating across different time zones.

- Social Media Engagement: Platforms like Twitter and LinkedIn are used to disseminate news, engage with the community, and enhance the company's public profile.

Local Community Offices and Meetings

Gran Colombia Gold prioritizes direct engagement through local community offices and regular meetings. These physical touchpoints are crucial for fostering understanding and collaboration. In 2024, the company continued its commitment to these channels, hosting numerous workshops and information sessions across its operational areas in Colombia.

These initiatives serve as vital conduits for two-way communication, allowing the company to actively listen to and address community concerns. They also provide a platform to discuss and implement shared development projects, reinforcing the company's role as a responsible corporate citizen. This direct interaction is fundamental to securing and maintaining a strong social license to operate.

- Local Offices: Established physical presence in key operational zones.

- Community Meetings: Regular forums for dialogue and feedback.

- Workshops: Educational sessions on safety, environment, and development.

- Social License: Building trust and mutual respect with local stakeholders.

Gran Colombia Gold's primary sales channel involves direct agreements with international precious metal refiners and bullion dealers, ensuring secure transactions and optimized profitability. For instance, in 2024, the company reported substantial sales volumes through these established relationships, highlighting their critical role in the business model. These direct channels allow for greater control over the sales process and pricing, directly impacting the company's revenue generation.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Direct Sales Agreements | Negotiated deals with international refiners and bullion dealers for gold and silver output. | Key for secure transactions and profit optimization; significant sales volumes reported. |

| Financial Market Disclosures | Official stock exchange filings, annual and quarterly reports. | Vital for communicating financial performance and strategy to investors; regular updates on production and exploration. |

| Investor Relations Activities | Participation in conferences, roadshows, and direct investor meetings. | Crucial for attracting capital, building investor confidence, and communicating strategic vision; presented at BMO Global Metals Conference. |

| Corporate Website & Digital Media | Online hub for financial reports, news, sustainability, and governance; social media for broader reach. | Provides 24/7 access to information for a global audience, fostering transparency and engagement. |

| Local Community Engagement | Community offices, meetings, and workshops in operational areas. | Essential for building a social license to operate, addressing concerns, and fostering collaboration. |

Customer Segments

Precious metal refiners and bullion dealers represent Gran Colombia Gold's core direct clientele, purchasing the company's unrefined gold and silver. These entities, often global in scale, are crucial as they transform raw output into marketable products for diverse sectors, including investment, industrial applications, and jewelry manufacturing.

The purchasing decisions of these customers are heavily influenced by prevailing global commodity prices and the overall liquidity within precious metal markets. For instance, in 2024, gold prices have shown volatility, impacting the volume and value of transactions for companies like Gran Colombia Gold.

Institutional investors, such as mutual funds and pension funds, are key players for Gran Colombia Gold. These entities seek capital appreciation and portfolio diversification, often drawn to the company's production levels and expansion prospects. For example, in 2024, Gran Colombia Gold's consistent gold production, exceeding 200,000 ounces, would have been a significant factor in attracting these large-scale investors.

Retail investors are individuals who buy Gran Colombia Gold Corp. shares via brokerage platforms, aiming to tap into gold and silver markets or earn dividends. Their decisions are often shaped by prevailing market moods, company announcements, and overarching economic shifts. For instance, in 2024, many retail investors turned to precious metals as a hedge against inflation, a trend that could have benefited Gran Colombia Gold.

Local Communities and Employees

Local communities and employees are vital stakeholders for Gran Colombia Gold, even though they are not direct paying customers. They benefit from the company's operations through job creation, local sourcing of goods and services, and investments in community infrastructure and social programs. For instance, in 2024, Gran Colombia Gold continued its commitment to local economic development, with a significant portion of its procurement budget allocated to local suppliers in its operating regions.

The company's social license to operate is heavily dependent on maintaining positive relationships with these groups. Their support is crucial for ensuring smooth operations and mitigating potential disruptions. Gran Colombia Gold actively engages with communities through various initiatives designed to foster mutual benefit and long-term sustainability.

Gran Colombia Gold's impact on local communities and employees in 2024 included:

- Employment: Providing direct and indirect employment opportunities for thousands of individuals in Colombia, contributing significantly to local economies.

- Local Procurement: Prioritizing local suppliers for goods and services, injecting capital directly into community businesses and fostering economic growth.

- Community Investment: Funding and supporting projects focused on education, healthcare, and infrastructure development, enhancing the quality of life for residents.

- Employee Development: Offering training and career advancement opportunities to its workforce, building local capacity and expertise within the mining sector.

Government Bodies and Regulators

Government bodies and regulators are critical stakeholders for Gran Colombia Gold, acting as customers in the sense that the company must deliver compliance with mining laws, tax obligations, and environmental standards. Their approval is essential for maintaining operating licenses and ensuring a stable, predictable regulatory landscape. For instance, in 2023, Gran Colombia Gold reported paying approximately $40 million in taxes and royalties across its operations, demonstrating a significant financial commitment to these entities.

These governmental entities, from national ministries to local authorities, dictate the operational framework within which Gran Colombia Gold functions. Adherence to evolving environmental regulations, for example, is paramount; failure to comply can lead to significant fines or operational shutdowns. The company's proactive engagement with these bodies helps to foster trust and facilitate smoother permitting processes.

The company's commitment to fulfilling its obligations to government bodies and regulators is directly tied to its long-term viability and social license to operate. Key areas of delivery include:

- Timely payment of taxes and royalties: Ensuring financial contributions meet statutory requirements.

- Compliance with environmental regulations: Adhering to standards for water usage, emissions, and land reclamation.

- Adherence to labor laws and safety standards: Protecting the workforce and ensuring fair employment practices.

- Fulfillment of community engagement commitments: Working collaboratively with local governments and communities.

Gran Colombia Gold's customer segments are diverse, ranging from direct buyers of precious metals to broader stakeholders whose engagement is crucial for operations. Precious metal refiners and bullion dealers form the core direct clientele, purchasing unrefined gold and silver for further processing and distribution in global markets. Institutional investors, such as pension funds and mutual funds, are key players seeking capital appreciation and portfolio diversification, often attracted by the company's production output and expansion plans. In 2024, Gran Colombia Gold's consistent gold production, exceeding 200,000 ounces, would have been a significant draw for these large-scale investors.

Cost Structure

Operational costs for Gran Colombia Gold's mining and processing activities encompass direct expenses like labor, power, consumables such as chemicals and explosives, and equipment upkeep. These are fundamental to extracting ore.

These costs are directly influenced by production volume, making them a substantial part of the company's spending. For instance, in 2023, Gran Colombia Gold reported total cash costs per ounce of gold sold at approximately $1,086, highlighting the impact of these operational expenditures.

Effectively managing these operational costs is paramount for ensuring the company's profitability. In the first quarter of 2024, the company focused on optimizing its mining and processing efficiency to control these expenditures.

Exploration and Development Expenses represent a crucial cost for Gran Colombia Gold, encompassing the significant investments made in finding and preparing new gold deposits. These costs include everything from initial geological surveys and drilling to the detailed engineering and construction needed to bring a new mine into production. For 2023, Gran Colombia Gold reported total exploration and evaluation expenditures of approximately $10.3 million, highlighting the substantial commitment to future resource acquisition.

Capital Expenditures (CAPEX) for Gran Colombia Gold involve substantial investments in property, plant, and equipment. This includes acquiring new mining machinery, upgrading processing plants, and developing essential infrastructure like roads and power systems. For example, in 2023, the company reported CAPEX of $86.9 million, reflecting ongoing development and expansion projects.

These long-term investments are critical for maintaining and growing Gran Colombia Gold's operational capacity. Significant capital is often allocated to new mine builds or major expansions, such as the ongoing development at the Elaine project, which requires substantial upfront investment to bring into production.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Gran Colombia Gold encompass the essential overhead required to run the corporate entity. These costs include salaries for management teams, legal counsel, accounting services, and investor relations professionals. These are crucial for the company's overall governance and market presence.

In 2024, Gran Colombia Gold's G&A expenses are a vital component of their cost structure, ensuring the smooth operation of their corporate functions. Efficient management of these costs directly impacts the company's bottom line, as they are not directly linked to the volume of gold produced.

Key G&A components include:

- Corporate Management Salaries: Compensation for executive leadership and operational managers.

- Legal and Compliance: Costs associated with regulatory adherence and legal counsel.

- Accounting and Finance: Expenses for financial reporting, auditing, and treasury functions.

- Investor Relations: Spending on communication with shareholders and the financial community.

Environmental and Social Costs

Gran Colombia Gold incurs significant expenses for environmental compliance and reclamation, ensuring operations meet stringent regulatory standards. In 2023, the company allocated substantial resources towards environmental monitoring, water management, and land rehabilitation efforts across its mining sites.

Community development programs and social impact mitigation are also key cost drivers. These investments aim to foster positive relationships with local stakeholders and address potential negative externalities of mining. For instance, community engagement initiatives and local employment programs are integral to maintaining a social license to operate.

- Environmental Compliance: Costs associated with adhering to environmental regulations, including emissions control and waste management.

- Reclamation Activities: Expenses for restoring mined land to its natural state or an agreed-upon post-mining land use.

- Community Development: Investments in local infrastructure, education, and healthcare as part of social responsibility.

- Social Impact Mitigation: Programs designed to lessen or offset any adverse social effects of mining operations.

Gran Colombia Gold's cost structure is heavily weighted towards operational expenses, including labor, power, and consumables essential for mining and processing. These direct costs are closely tied to production levels, as evidenced by their 2023 total cash cost per ounce of gold sold, which stood around $1,086. The company actively manages these expenditures through efficiency improvements, as seen in their first quarter 2024 focus on optimizing mining and processing.

Significant investments are also channeled into exploration and development, with 2023 expenditures reaching approximately $10.3 million to secure future gold resources. Capital expenditures, totaling $86.9 million in 2023, are crucial for maintaining and expanding operational capacity through machinery upgrades and infrastructure development.

General and administrative costs, covering corporate functions like management salaries and legal services, are vital for smooth operations, though not directly linked to production volume. Furthermore, the company incurs substantial costs for environmental compliance and community development programs, reflecting a commitment to sustainable and responsible mining practices.

| Cost Category | 2023 Actuals (USD millions) | Notes |

|---|---|---|

| Total Cash Costs per Ounce | ~$1,086 | Reflects direct mining and processing expenses. |

| Exploration & Evaluation Expenditures | ~$10.3 | Investment in future resource acquisition. |

| Capital Expenditures (CAPEX) | ~$86.9 | Investment in property, plant, and equipment. |

| General & Administrative (G&A) | Not explicitly detailed in millions, but a key overhead component. | Corporate overhead, management, legal, etc. |

| Environmental & Community Costs | Not explicitly detailed in millions, but significant. | Compliance, reclamation, social programs. |

Revenue Streams

Gran Colombia Gold's core revenue engine was the sale of its refined gold. This stream was directly tied to how much gold they could extract and process, and what the market price was when they sold it. For instance, in 2023, the company reported total gold sales of approximately 216,214 ounces, contributing significantly to their financial performance.

Silver sales represent a secondary revenue stream for Gran Colombia Gold, generated as a co-product alongside its primary gold extraction. While gold typically dominates the revenue picture, silver contributes a valuable, albeit smaller, income source, enhancing revenue diversification.

In 2024, Gran Colombia Gold reported significant silver sales, underscoring its importance. For instance, in the first quarter of 2024, the company sold approximately 190,000 ounces of silver, contributing to overall revenue stability and providing a hedge against gold price volatility.

Gran Colombia Gold's revenue streams can be bolstered by hedging gains, which arise from financial instruments designed to protect against unfavorable price movements in gold and silver. These strategies aim to lock in a more predictable selling price for their mined commodities, thereby stabilizing overall revenue.

For instance, in 2024, Gran Colombia Gold reported that its hedging program contributed positively, providing a degree of certainty in its revenue realization process amidst market volatility. While specific gain figures vary, the company's commitment to hedging underscores its strategy to mitigate price risk and ensure a more consistent financial performance.

By-Product Sales (if applicable)

Gran Colombia Gold's revenue model can also include by-product sales, though this is contingent on the specific geological makeup of their mining sites. If their ore extraction yields other marketable metals or minerals alongside gold, these sales represent a supplementary, albeit smaller, revenue stream. This aspect of their business is directly tied to the mineralogy of the deposits they exploit.

For instance, during 2023, Gran Colombia Gold reported that its Segovia Operations primarily focused on gold. However, the company has indicated that exploration efforts at its Marmato project have identified potential for other valuable minerals. While specific by-product sales figures for 2023 are not extensively detailed as a separate revenue line, the potential exists for future contributions.

- By-product sales offer a minor, supplementary revenue stream.

- This stream's viability depends on the geological characteristics of the ore.

- Gran Colombia Gold's primary focus remains gold, but exploration may reveal other marketable minerals.

Future Growth and Asset Valuation

While not a direct cash inflow, future growth potential significantly bolsters Gran Colombia Gold's overall value. Exploration success and expansion projects directly enhance investor confidence and the company's appeal, indirectly contributing to its financial strength.

Successful resource delineation and the development of new projects lead to a tangible increase in asset valuation. This growth in the underlying value of the company's mineral assets directly benefits shareholders, reflecting the long-term promise held within its undeveloped and expanding operations.

- Exploration Success: Ongoing exploration efforts at properties like Segovia aim to expand existing resources and discover new gold deposits, directly increasing the company's asset base.

- Project Expansion: Investments in expanding production capacity at existing mines, such as the Marmato mine, signal future revenue growth and operational efficiency.

- Asset Valuation Increase: Successful exploration and expansion translate into higher valuations for Gran Colombia Gold's mineral reserves and resources, attracting potential investors and enhancing shareholder equity.

- Investor Appeal: The prospect of future production and resource growth makes the company a more attractive investment, potentially leading to higher stock prices and easier access to capital for further development.

Gran Colombia Gold's primary revenue stems from selling refined gold, directly influenced by production volumes and market prices. In the first quarter of 2024, the company reported gold sales of approximately 50,000 ounces, demonstrating the consistent contribution of this core commodity.

Silver sales provide a valuable secondary revenue stream, generated as a co-product of gold mining. This diversification helps stabilize income, especially given fluctuating gold prices. In Q1 2024, Gran Colombia Gold sold around 190,000 ounces of silver, highlighting its ongoing importance to the company's financial performance.

Hedging gains represent another revenue component, achieved through financial instruments that protect against adverse price movements. This strategy aims to secure more predictable selling prices for their metals. In 2024, the company's hedging program continued to provide a degree of revenue certainty.

| Revenue Stream | Q1 2024 (Approximate) | Significance |

|---|---|---|

| Gold Sales | 50,000 ounces | Primary revenue driver, directly linked to production and market price. |

| Silver Sales | 190,000 ounces | Secondary revenue, provides diversification and price risk mitigation. |

| Hedging Gains | Positive Contribution | Stabilizes revenue by locking in prices against market volatility. |

Business Model Canvas Data Sources

The Gran Colombia Gold Business Model Canvas is informed by a blend of internal financial disclosures, operational reports, and external market intelligence. This comprehensive data set allows for a realistic assessment of revenue streams, cost structures, and key activities.