Gran Colombia Gold Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gran Colombia Gold Bundle

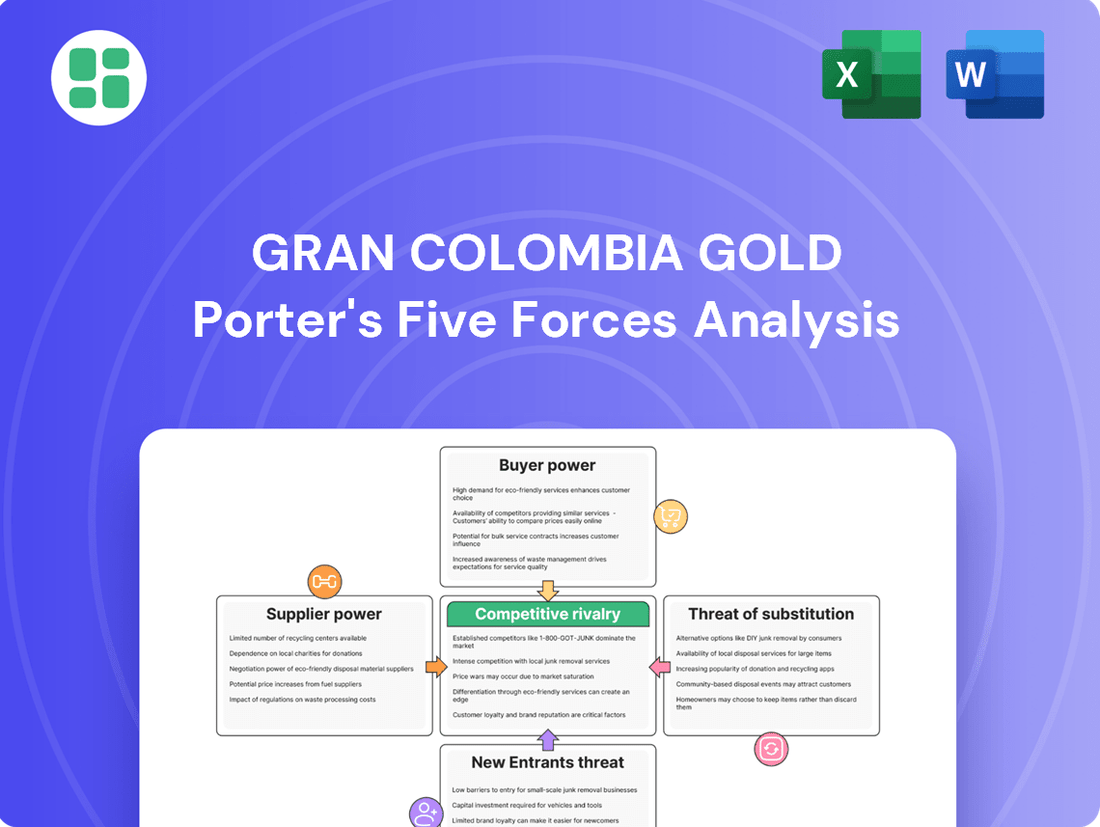

Our Porter's Five Forces analysis for Gran Colombia Gold reveals the intense competitive landscape, highlighting the significant bargaining power of buyers and the moderate threat of substitutes in the gold mining sector. Understanding these forces is crucial for navigating the market effectively.

The complete report reveals the real forces shaping Gran Colombia Gold’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The mining sector, including companies like Aris Mining, often depends on a select group of specialized equipment and technology providers. This concentration means these suppliers, if few in number, can dictate terms and pricing, directly affecting Aris Mining's operational expenses. Think of essential items like advanced drilling rigs or specific processing chemicals; if only a handful of companies worldwide produce them, their bargaining power is considerable.

Suppliers who offer unique or proprietary technologies, like specialized drilling equipment or particular processing chemicals, often wield more influence. For instance, if Aris Mining's high-grade Segovia operations depend on these kinds of specialized inputs, the suppliers of these items gain leverage.

The power of these suppliers is further amplified if Aris Mining faces significant costs or disruptions when trying to switch to alternative suppliers. The ease with which a company can change suppliers without incurring substantial expenses is a key factor in determining how much power suppliers can exert.

High switching costs for Aris Mining significantly bolster supplier bargaining power. Consider the substantial expenses involved in retooling mining equipment, retraining skilled personnel on new machinery, or the lengthy process of re-certifying alternative raw materials. These financial and operational barriers make it difficult and costly for Aris Mining to change suppliers, effectively locking them into existing relationships and granting suppliers greater leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into mining operations, while less common for major players, could significantly shift power dynamics. For instance, specialized technology providers might offer integrated mining-as-a-service solutions, reducing the need for Gran Colombia Gold to own every aspect of its operations and potentially giving these service providers more leverage. This is particularly relevant for niche, high-tech segments of the mining process.

The potential for forward integration by suppliers, especially in specialized areas, presents a nuanced threat. While a large equipment manufacturer isn't likely to suddenly start operating mines, a provider of advanced geological surveying technology could potentially offer a comprehensive service package that includes data interpretation and even operational oversight. This would effectively allow them to capture a larger portion of the value chain, thereby increasing their bargaining power.

- Forward Integration Threat: Suppliers moving into the mining operations themselves increases their power.

- Niche Service Providers: Specialized tech firms could offer mining-as-a-service, altering the balance.

- Value Chain Capture: Such integration allows suppliers to claim more of the mining process's economic benefits.

Labor Market Dynamics

The availability of skilled labor, such as engineers, geologists, and experienced mine workers, directly impacts Gran Colombia Gold's operational costs and efficiency. In 2023, the global mining industry faced ongoing challenges with labor shortages, particularly for specialized roles. This scarcity can empower the workforce, increasing wage demands and potentially impacting project timelines.

Regions experiencing robust economic growth or facing significant infrastructure development can also see increased competition for skilled mining personnel. This heightened demand further strengthens the bargaining position of these essential human capital ‘suppliers’. For instance, a 2024 report indicated that average wages for experienced mining engineers in key Latin American markets saw an uptick of 5-8% compared to the previous year, reflecting this dynamic.

- Skilled Labor Availability: Shortages of specialized mining professionals enhance labor's bargaining power.

- Union Influence: Strong labor unions can negotiate for better wages and working conditions, increasing operational costs.

- Wage Inflation: In 2023, average wages for mining engineers in Latin America rose by 5-8%, indicating upward pressure.

- Regional Competition: Competition for talent in developing regions can further empower workers.

Suppliers of specialized mining equipment and critical raw materials hold significant leverage over Gran Colombia Gold. This is especially true when there are few alternative providers or when switching costs are high, as seen with proprietary processing chemicals essential for their Segovia operations.

The bargaining power of suppliers is amplified by Gran Colombia Gold's substantial costs and operational disruptions associated with changing suppliers. This includes expenses for retooling equipment, retraining staff, and recertifying materials, making it difficult to switch.

Furthermore, the threat of suppliers integrating forward into mining services, such as offering mining-as-a-service for niche technological segments, could increase their influence by capturing more of the value chain.

Labor, particularly skilled engineers and geologists, also acts as a supplier. In 2023, global mining labor shortages, especially for specialized roles, increased wage demands. Reports for 2024 indicate a 5-8% increase in average wages for experienced mining engineers in key Latin American markets due to this demand.

| Factor | Impact on Gran Colombia Gold | Supporting Data/Trend |

|---|---|---|

| Supplier Concentration | High bargaining power for few specialized providers | Dependence on proprietary processing chemicals |

| Switching Costs | Limits Gran Colombia Gold's ability to change suppliers | Costs of retooling, retraining, recertification |

| Forward Integration Threat | Suppliers may offer integrated services, increasing leverage | Potential for mining-as-a-service in niche tech areas |

| Skilled Labor Shortage | Increased labor costs and wage demands | 5-8% wage increase for mining engineers in LatAm (2024 estimate) |

What is included in the product

This analysis unpacks the competitive forces shaping Gran Colombia Gold's operating environment, examining industry rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize competitive intensity and identify key strategic vulnerabilities with a dynamic, interactive Porter's Five Forces model for Gran Colombia Gold.

Gain clarity on industry dynamics and anticipate market shifts with a comprehensive, yet easily digestible, framework for Gran Colombia Gold's competitive landscape.

Customers Bargaining Power

The primary customers for gold and silver, like those Gran Colombia Gold Corp. serves, are typically large refineries, central banks, financial institutions, and industrial users. If a few dominant buyers exist, they can significantly influence pricing by demanding lower rates.

However, for a globally traded commodity such as gold, the market is generally quite diversified. This broad base of buyers means that the power of any single customer to dictate terms is limited, which is a favorable condition for producers like Gran Colombia Gold.

Gold and silver are essentially commodities, meaning Aris Mining's products are very similar to what other companies offer. This lack of unique features makes it easier for buyers to switch suppliers if they find a better price, thereby increasing customer bargaining power.

While individual customers might have limited leverage because the global market sets prices, large industrial buyers or major jewelry manufacturers can still exert influence. For instance, in 2024, the average price of gold fluctuated significantly, with peaks and troughs that would have allowed savvy buyers to negotiate terms based on market timing.

Gold and silver are vital commodities, serving as cornerstones for investment portfolios, the jewelry industry, and numerous industrial applications. For sectors like electronics manufacturing or financial institutions, these precious metals are often indispensable raw materials.

While their utility is undeniable, the fungible characteristic of gold and silver means that individual customer importance doesn't automatically translate into significant bargaining power. This is because customers can often source these metals from various suppliers, diminishing the leverage any single supplier holds.

Customer Switching Costs

Customer switching costs for raw gold and silver are notably low. Buyers can readily source these precious metals from a multitude of global suppliers, meaning Aris Mining has limited ability to charge higher prices based on customer retention. In 2024, the global gold market saw significant price volatility, with prices fluctuating between approximately $2,000 and $2,400 per ounce, underscoring the competitive landscape where price is a primary driver for buyers.

This low barrier to switching directly impacts Aris Mining's pricing power. Customers are not locked into contracts or dependent on Aris Mining's specific offerings, as alternative producers and refiners are readily available. This competitive environment means that Aris Mining must remain price-competitive to retain its customer base.

The ease with which customers can shift their business to other gold and silver producers is a key factor in the bargaining power of buyers. For instance, a major industrial consumer of silver in 2024 might have had the option to purchase from over a dozen established mining companies and numerous smaller operations worldwide, making supplier loyalty less of a factor in their procurement decisions.

- Low Switching Costs: Customers can easily move between gold and silver suppliers.

- Price Sensitivity: Buyers prioritize competitive pricing due to readily available alternatives.

- Limited Pricing Power: Aris Mining cannot leverage customer loyalty for premium pricing.

- Global Market Access: Buyers have access to a wide array of global sources for precious metals.

Threat of Backward Integration by Customers

The threat of customers integrating backward into Gran Colombia Gold's mining operations is quite low. This is primarily because establishing a mine requires massive upfront capital, specialized geological and engineering knowledge, and navigating a complex web of environmental and governmental regulations. For instance, the average cost to develop a new gold mine can range from hundreds of millions to over a billion dollars, a significant barrier for most customers.

This high barrier to entry significantly diminishes the bargaining power customers possess concerning backward integration. It's simply not feasible for most buyers of gold or related services to replicate the extensive resources and expertise Gran Colombia Gold possesses.

- Immense Capital Requirements: Developing a new mine often costs upwards of $500 million to $1 billion, deterring potential customer integration.

- Technical Expertise Needed: Sophisticated geological surveying, extraction techniques, and processing require specialized skills not readily available to most customers.

- Regulatory Hurdles: Obtaining mining permits and adhering to environmental and safety standards involves lengthy and complex processes.

The bargaining power of customers for Gran Colombia Gold is moderate, primarily driven by the commodity nature of gold and silver and low switching costs. Buyers, such as refineries and industrial users, can easily source these metals from numerous global producers, limiting Gran Colombia Gold's ability to command premium prices. For example, in 2024, the price of gold saw significant fluctuations, creating opportunities for buyers to negotiate based on market timing and available supply from various sources.

While individual customers may have limited leverage, large industrial consumers or major jewelry manufacturers can exert more influence due to their purchasing volume. The lack of product differentiation means that price is a key determinant in customer purchasing decisions, forcing producers to remain competitive. The ease of switching suppliers means that customer loyalty is not a significant factor in pricing power.

Backward integration by customers is unlikely due to the substantial capital investment, technical expertise, and regulatory hurdles involved in mining operations. The cost to develop a new gold mine can easily exceed hundreds of millions of dollars, presenting a formidable barrier for most buyers. This high barrier effectively shields Gran Colombia Gold from direct competitive threats from its customer base.

| Factor | Impact on Gran Colombia Gold | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Customer Concentration | Low to Moderate | Global gold market has many buyers, but large industrial users can have concentrated demand. |

| Switching Costs | Low | Buyers can readily switch between numerous global gold producers. |

| Price Sensitivity | High | Gold is a commodity; buyers prioritize competitive pricing. |

| Backward Integration Threat | Very Low | Mine development costs: $500 million to $1 billion+; requires specialized expertise and permits. |

Full Version Awaits

Gran Colombia Gold Porter's Five Forces Analysis

This preview showcases the complete Gran Colombia Gold Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors. The document you see here is precisely what you'll receive, fully formatted and ready for immediate download and use after purchase, ensuring no discrepancies or missing information. This comprehensive analysis is designed to provide actionable insights for strategic decision-making regarding Gran Colombia Gold's competitive landscape.

Rivalry Among Competitors

The global gold and silver mining sector is a crowded space, featuring a wide array of companies from colossal multinational corporations to nimble, localized operations. Aris Mining, by concentrating its efforts on Latin America and particularly its high-grade Colombian assets, finds itself in direct competition with this broad spectrum of entities, each possessing different scales of operation and market reach.

The gold mining industry's growth rate is a crucial factor influencing competitive rivalry. While gold prices have shown strength, with projections indicating continued increases through 2024 and into 2025, the pace of new discoveries is slowing. This scarcity of new, economically viable gold deposits means that companies are increasingly competing for existing resources and existing production capacity, thereby heightening the intensity of competition.

Gold and silver are essentially commodities, meaning there's very little to distinguish one producer's product from another's. This forces companies like Gran Colombia Gold to compete mainly on price, how efficiently they can produce, and the sheer size of their operations.

Because the product is so similar, buyers don't face significant hurdles or costs when switching from one gold or silver supplier to another. This lack of switching costs really heats up the competition, pushing miners to constantly find ways to lower their production costs to stay competitive.

Exit Barriers

High exit barriers in the gold mining sector, like Gran Colombia Gold's substantial investments in mines and processing facilities, can trap capital and prolong the presence of even struggling firms. This means companies might continue operating at a loss, intensifying rivalry. For instance, the significant upfront investment required for a new mine, often in the hundreds of millions of dollars, makes divesting a complex and costly undertaking.

These barriers also include long-term contractual commitments, such as supply agreements or debt obligations, and substantial environmental rehabilitation costs that must be factored in upon closure. These financial and regulatory hurdles make a swift exit from the industry practically impossible, forcing companies to endure challenging market conditions rather than cutting their losses.

The capital-intensive nature of gold mining, where assets like underground mines and sophisticated processing plants represent immense fixed costs, is a primary driver of these high exit barriers.

- Significant Fixed Assets: Mines and processing plants represent sunk costs that are difficult to recover.

- Long-Term Contractual Obligations: Agreements with suppliers, buyers, or lenders can lock companies into operations.

- Environmental Rehabilitation Costs: Post-mining site restoration can involve millions of dollars, acting as a deterrent to closure.

- Capital Intensity: The sheer scale of investment required makes exiting the industry a daunting financial prospect.

Strategic Objectives of Competitors

Competitive rivalry in the gold mining sector is intensified by the distinct strategic objectives of various players. These can range from pursuing aggressive expansion and securing market share dominance to focusing on cost leadership. For instance, Aris Mining's strategic moves, such as its expansion initiatives in Segovia and Marmato, clearly signal a competitive push for higher production volumes and an augmented market presence.

This drive for expansion is not unique; many companies in the sector are actively seeking to grow their operations. For example, in 2023, Eldorado Gold reported a significant increase in its production guidance, aiming for between 475,000 and 525,000 ounces of gold, reflecting a broader industry trend of scaling up operations. Such strategic maneuvers directly influence the competitive landscape for companies like Gran Colombia Gold.

- Strategic Focus: Competitors may prioritize aggressive expansion, market share gains, or cost leadership.

- Aris Mining's Strategy: Expansion in Segovia and Marmato highlights a drive for increased production and market presence.

- Industry Trend: Companies like Eldorado Gold are also increasing production, with guidance for 475,000-525,000 ounces in 2023, underscoring broader competitive pressures.

Competitive rivalry within the gold mining sector is fierce due to the commodity nature of gold, leading companies to compete primarily on production efficiency and scale. The slowing pace of new discoveries, coupled with strong gold prices projected through 2025, intensifies competition for existing resources and production capacity. High exit barriers, stemming from massive capital investments in mines and processing facilities, also keep companies in the market, even during downturns, further fueling rivalry.

| Company | 2023 Gold Production (koz) | 2024 Production Guidance (koz) | Key Assets |

| Gran Colombia Gold | 236.1 | 240-260 | Segovia, Marmato (Colombia) |

| Aris Mining | N/A (Acquired Marmato from GCM) | N/A | Marmato, Soto Norte (Colombia) |

| Eldorado Gold | 479.1 | 475-525 | Kisladag, Efemcukuru (Turkey) |

SSubstitutes Threaten

For investors looking beyond precious metals, a wide array of alternative assets presents a significant competitive threat to gold and silver. Equities, for instance, have historically offered growth potential, with the S&P 500 seeing a notable 26.3% total return in 2023. Bonds also compete, providing income streams, and real estate continues to be a tangible asset many favor.

The appeal of these substitutes is dynamic. For example, as of early 2024, interest rate expectations influence bond yields, making them more or less attractive compared to gold's non-yielding nature. Similarly, the volatility of cryptocurrencies, with Bitcoin experiencing significant price swings, can draw or repel investors depending on their risk tolerance, directly impacting demand for traditional safe-haven assets like gold.

Recycled gold and silver significantly influence the market by offering a substantial alternative to newly mined supply. This recycled material, often sourced from jewelry and industrial scrap, directly competes with primary production. For instance, in 2023, the World Gold Council reported that recycled gold supply reached approximately 1,000 tonnes, demonstrating its considerable impact.

The availability and pricing of this recycled metal can exert downward pressure on the demand for newly extracted gold and silver, particularly when market prices for precious metals are elevated. This dynamic can affect Gran Colombia Gold's sales volumes and pricing power, as consumers may opt for more readily available and potentially cheaper recycled options.

In industrial applications, particularly in electronics and solar panels, gold and silver face a significant threat from substitutes. If prices for these precious metals escalate, or if new technologies emerge offering more cost-effective solutions, manufacturers may shift to alternatives. For instance, advancements in conductive inks and pastes are creating viable substitutes for gold plating in certain electronic components.

Silver, while also used in solar panels and electronics, has a broader range of potential substitutes compared to gold due to gold's unique properties in highly specialized applications. For example, copper is a common substitute for silver in electrical wiring and connectors, and its price stability makes it an attractive alternative. In 2024, the price of silver averaged around $24 per ounce, while gold hovered near $2,300 per ounce, highlighting the cost differential that can drive substitution.

Jewelry Alternatives

The threat of substitutes for traditional gold and silver jewelry is a significant consideration. Consumers can opt for other precious metals such as platinum and palladium, or even explore non-metal alternatives like high-quality stainless steel, titanium, or ethically sourced gemstones. These substitutes can appeal to different consumer segments based on style, durability, and ethical sourcing concerns.

Fashion trends and evolving consumer preferences play a crucial role in the adoption of jewelry substitutes. For instance, a growing emphasis on sustainable and ethically sourced materials could push consumers towards alternatives perceived as more environmentally friendly than mined gold. Price sensitivity also remains a key driver; when gold prices surge, consumers may find platinum or even well-crafted fashion jewelry more accessible.

The impact of these substitutes on gold demand is notable. While gold holds its traditional appeal, the market for alternative precious metals and innovative non-metal materials is expanding. For example, the global platinum jewelry market was valued at approximately $3.5 billion in 2023, demonstrating a substantial consumer base for alternatives. Similarly, the market for fashion jewelry, often incorporating less precious materials, continues to grow, representing a direct challenge to traditional precious metal jewelry sales.

- Platinum and Palladium: These metals offer a bright white luster and are often used in engagement rings and high-end jewelry, providing a direct substitute for white gold.

- Non-Metal Alternatives: Materials like stainless steel, titanium, ceramic, and wood are increasingly popular for their durability, hypoallergenic properties, and modern aesthetic.

- Gemstone Jewelry: While not a direct metal substitute, the prominence of colored gemstones and diamonds in jewelry designs can divert consumer spending away from plain metal pieces.

- Fashion and Costume Jewelry: This segment offers a wide array of styles at lower price points, catering to consumers seeking trend-driven pieces or those with budget constraints.

Behavioral and Economic Factors

The inclination for buyers to switch from gold and silver is heavily influenced by prevailing economic conditions. When economic stability wavers, or inflation concerns rise, the traditional safe-haven status of gold and silver becomes more attractive. This increased demand for precious metals as a hedge against uncertainty naturally diminishes the threat of substitutes for investment purposes.

Conversely, during periods of robust economic growth and low inflation, investors may find other assets offering higher potential returns. For instance, in 2024, while geopolitical tensions contributed to gold's appeal, the performance of technology stocks in the US, which saw significant gains, presented a compelling alternative for capital seeking growth. This highlights how the perceived risk and reward of various asset classes directly impact substitution decisions.

- Economic Stability: During stable economic periods, the threat of substitutes for gold and silver increases as investors may favor growth-oriented assets.

- Inflation Concerns: Rising inflation typically drives demand for gold and silver, reducing the likelihood of substitution due to their perceived store of value.

- Geopolitical Risks: Heightened geopolitical uncertainty often boosts the safe-haven appeal of precious metals, making substitution less probable for investment purposes.

- Investment Alternatives: The performance of other investment classes, such as equities or bonds, directly influences the attractiveness of gold and silver as substitutes or primary holdings.

The threat of substitutes for Gran Colombia Gold's core products, gold and silver, is multifaceted, encompassing alternative investments, industrial materials, and jewelry options. The attractiveness of these substitutes shifts with economic conditions and technological advancements, directly impacting the demand for newly mined precious metals.

In the investment realm, equities and bonds offer yield and growth potential, with the S&P 500 returning 26.3% in 2023. Recycled gold, amounting to approximately 1,000 tonnes in 2023, provides a direct supply alternative. For industrial uses, copper can substitute silver in electrical applications, and advancements in conductive inks challenge gold's role in electronics.

The jewelry market sees substitutes like platinum, palladium, stainless steel, and titanium, with the platinum jewelry market valued at $3.5 billion in 2023. Consumer preferences for sustainability and price sensitivity also drive adoption of these alternatives, impacting gold's market share.

| Substitute Category | Key Examples | 2023/2024 Data Point | Impact on Gold/Silver Demand |

|---|---|---|---|

| Investment Assets | Equities (S&P 500), Bonds, Real Estate, Cryptocurrencies | S&P 500 total return: 26.3% (2023) | Offers alternative growth and income, reducing safe-haven appeal during stable economic periods. |

| Recycled Precious Metals | Jewelry scrap, industrial waste | Recycled gold supply: ~1,000 tonnes (2023) | Directly competes with primary supply, especially at elevated market prices. |

| Industrial Materials | Copper, conductive inks, advanced composites | Silver price: ~$24/oz, Gold price: ~$2,300/oz (early 2024) | Cost differentials and technological advancements can drive manufacturers to cheaper or more efficient alternatives. |

| Jewelry Alternatives | Platinum, Palladium, Stainless Steel, Titanium, Gemstones | Platinum jewelry market value: ~$3.5 billion (2023) | Appeals to different consumer segments based on style, durability, and price, diverting spending from traditional gold and silver. |

Entrants Threaten

The gold and silver mining sector demands substantial upfront investment, often running into hundreds of millions, if not billions, of dollars for exploration, mine development, and processing infrastructure. For instance, major gold mine projects can easily exceed $500 million in capital expenditure. This immense financial hurdle significantly limits the number of new companies that can realistically enter the market and compete effectively.

The mining sector, especially in jurisdictions like Colombia where Gran Colombia Gold operates, faces significant regulatory and permitting challenges. Obtaining environmental and social licenses is a complex, lengthy process, acting as a substantial barrier to entry for new competitors seeking to establish operations.

The scarcity of high-grade, economically viable gold and silver deposits presents a significant barrier to new entrants in the mining sector. Established companies, such as Aris Mining, often possess extensive land packages and crucial mineral rights, which they have secured over years of exploration and development. This concentration of resources means that new players face considerable difficulty in identifying and acquiring promising exploration targets, directly impacting their ability to enter the market competitively.

Economies of Scale and Experience

Existing gold mining giants, like those operating in Gran Colombia's sphere, leverage significant economies of scale. This means they can produce gold at a lower cost per ounce due to bulk purchasing of supplies and optimized processing facilities. For instance, major producers often have integrated supply chains that reduce transportation and logistics expenses.

New companies entering the gold mining sector face a substantial hurdle in matching these cost efficiencies. Without the established infrastructure and high-volume operations, a new entrant would likely incur higher per-unit production costs, putting them at a competitive disadvantage from the outset. This barrier is amplified by the need for extensive operational experience to navigate complex extraction and refining processes effectively.

- Economies of Scale: Established players benefit from lower per-ounce production costs through bulk purchasing and optimized operations.

- Experience Advantage: Existing companies possess deep operational knowledge crucial for efficient and cost-effective mining.

- Capital Investment: New entrants require massive upfront capital to achieve comparable scale and efficiency, posing a significant barrier.

- Cost Disadvantage: Start-ups will likely face higher production costs compared to seasoned operators.

Brand Loyalty and Distribution Channels

Established gold miners benefit from strong brand loyalty and deep-rooted distribution networks. For instance, major players often have long-standing relationships with key refineries and financial institutions, which are crucial for processing and selling their output. These existing ties create significant barriers for newcomers.

New entrants face the daunting task of replicating these established relationships and building credibility within the industry. The process of securing reliable offtake agreements and financing can be lengthy and capital-intensive, effectively deterring many potential new competitors from entering the market.

- Established relationships with refineries and financial institutions offer a competitive edge.

- New entrants must invest time and capital to build similar networks.

- Brand loyalty among buyers and distributors further solidifies the position of incumbent firms.

The threat of new entrants into the gold mining sector, particularly in regions like Colombia, is significantly mitigated by substantial capital requirements, often exceeding $500 million for major projects. Furthermore, stringent regulatory environments and the difficulty in securing prime mineral rights, already held by established firms like Aris Mining, create formidable barriers. These factors, combined with the economies of scale enjoyed by incumbents, which allow for lower per-ounce production costs, make it exceedingly challenging for new players to compete effectively.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | Projects require hundreds of millions to billions of dollars for exploration and development. | High barrier, limiting the number of well-funded entrants. |

| Regulatory Hurdles | Complex and lengthy permitting processes for environmental and social licenses. | Significant delays and costs for new operations. |

| Resource Scarcity | Control of high-grade deposits by established companies limits exploration opportunities. | Difficulty in acquiring viable mining targets. |

| Economies of Scale | Incumbents benefit from lower production costs due to high-volume operations. | New entrants face a cost disadvantage from the outset. |

Porter's Five Forces Analysis Data Sources

Our Gran Colombia Gold Porter's Five Forces analysis is built upon a foundation of robust data, including the company's annual reports and SEC filings, alongside industry-specific research from reputable sources like S&P Global Market Intelligence and Wood Mackenzie.