Gates Industrial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gates Industrial Bundle

Gates Industrial possesses significant strengths in its diversified product portfolio and established global presence, but faces potential threats from economic downturns and intense competition. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Gates Industrial's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Gates Industrial Corporation’s extensive global footprint, spanning over 130 countries, is a significant strength. This broad reach helps to buffer the company against localized economic downturns or market-specific challenges. In 2024, a substantial 60% of Gates' revenue was generated internationally, underscoring the importance of its global operations.

Furthermore, this widespread presence enables Gates to cater to a highly diversified customer base. The company serves critical sectors such as industrial manufacturing, automotive, agriculture, and infrastructure development. This diversification across end markets is key to maintaining market stability and resilience, as weakness in one sector can be offset by strength in others.

Gates Industrial's significant strength lies in its deep focus on the replacement market, which accounts for nearly two-thirds of its total sales. This strategic emphasis provides a substantial buffer against the inherent volatility of economic cycles, offering a more predictable and resilient revenue stream than businesses heavily reliant on original equipment manufacturers (OEMs).

The company's robust presence in the replacement sector was further underscored by positive growth trends observed in early 2025, particularly within the automotive aftermarket and the burgeoning personal mobility segments. This indicates a sustained demand for Gates' products as vehicles and equipment age and require ongoing maintenance and component replacement.

Gates Industrial has showcased a notably strong financial performance, evidenced by a substantial 180 basis point improvement in its gross margin during 2024. This upward trend continued into the first quarter of 2025, where the company achieved a gross margin of 40.7%.

The company's commitment to financial discipline is further highlighted by its successful efforts to reduce debt. Alongside this, Gates has actively engaged in stock repurchases, signaling confidence in its valuation and a strategic approach to capital deployment. These actions collectively bolster the company's balance sheet, ensuring robust liquidity and a healthy financial standing.

Highly Engineered and Innovative Solutions

Gates Industrial is a global leader in creating highly engineered and innovative solutions for power transmission and fluid power. Their extensive product range, featuring belts, hoses, and specialized components, is designed to perform crucial functions in diverse applications, enhancing efficiency and performance for their clientele.

This engineering prowess is a significant strength, allowing Gates to maintain a competitive edge. For instance, in their 2023 fiscal year, Gates reported net sales of $3.7 billion, with a substantial portion driven by their ability to deliver these specialized, high-performance products that are critical to their customers' operations.

- Focus on Mission-Critical Components: Gates specializes in products like belts and hoses that are essential for the smooth operation of machinery across various industries.

- Broad Application Portfolio: Their solutions are utilized in diverse sectors, from automotive and industrial to agriculture and energy, demonstrating broad market relevance.

- Innovation in Engineering: The company consistently invests in research and development to create advanced solutions that improve efficiency and durability for end-users.

Operational Efficiency and Enterprise Initiatives

Gates Industrial has been a strong performer in operational efficiency, with enterprise initiatives directly boosting manufacturing results, pricing strategies, and product mix. This focus has led to steady improvements in their profit margins.

Management has conveyed a high degree of certainty in reaching their previously set margin targets by the close of 2026. This confidence holds even if their key markets don't fully rebound.

These internal drive for improvement highlight Gates Industrial's dedication to enhancing profitability and maintaining rigorous operational standards.

- Consistent Margin Improvement: The company has seen ongoing gains in profit margins due to successful enterprise initiatives.

- Confident Outlook: Management expects to meet 2026 margin targets, regardless of market conditions.

- Operational Discipline: Internal efforts underscore a commitment to efficiency and profitability.

Gates Industrial's engineering expertise is a core strength, allowing them to develop highly engineered solutions for power transmission and fluid power applications. This innovation is reflected in their product portfolio, which includes essential components like belts and hoses critical for machinery performance. In fiscal year 2023, Gates reported net sales of $3.7 billion, a testament to the value derived from these specialized, high-performance products.

The company's strategic focus on the replacement market, which generates approximately two-thirds of its sales, offers significant resilience. This segment demonstrated positive growth in early 2025, particularly in the automotive aftermarket and personal mobility sectors, indicating sustained demand for maintenance and component replacements.

Gates exhibits strong financial discipline, evidenced by an 180 basis point improvement in gross margin in 2024, reaching 40.7% in Q1 2025. They have also successfully reduced debt and engaged in stock repurchases, strengthening their financial position and liquidity.

Their extensive global presence, operating in over 130 countries, diversifies revenue streams and mitigates risks from localized economic downturns. In 2024, international sales accounted for 60% of Gates' revenue, highlighting the importance of this broad operational reach across various critical sectors like industrial manufacturing and automotive.

| Metric | 2023 | Q1 2025 |

|---|---|---|

| Net Sales | $3.7 billion | N/A |

| Gross Margin Improvement | 180 basis points (2024) | 40.7% |

| International Revenue % | N/A | 60% (2024) |

What is included in the product

Delivers a strategic overview of Gates Industrial’s internal and external business factors, highlighting its market strengths and potential threats.

Offers a clear, actionable framework for identifying and mitigating potential threats to Gates Industrial's growth.

Weaknesses

Gates Industrial's performance is significantly tied to the health of its end markets. In 2024, the company saw weaker demand in crucial sectors like agriculture and construction, directly impacting its net and core sales.

While the automotive segment offered some support, the ongoing softness in these industrial and original equipment manufacturer (OEM) markets is expected to persist into the first half of 2025. This dependence on cyclical industries means Gates is vulnerable to shifts in overall economic activity and industrial output.

The Fluid Power segment experienced a notable underperformance in early 2025. Sales in this division declined by 2.9% year-over-year in the first quarter of 2025, contrasting with the strength seen in the Power Transmission segment. This downturn suggests specific challenges within the fluid power market that are impacting Gates Industrial's performance.

Further compounding these concerns, the Fluid Power segment's core revenue growth remained stagnant, indicating a lack of expansion in its primary operations. This stagnation, coupled with the sales dip, points to a potential weakening of demand or increased competition within this specific business area.

Adding to the pressure, the segment's adjusted EBITDA margin saw a contraction. This narrowing margin implies that the company faced increased costs or was unable to maintain pricing power, impacting the profitability of its fluid power offerings.

Gates Industrial has been grappling with elevated inventory levels, a situation that presents a notable weakness. This buildup poses a significant risk, particularly if the expected recovery in demand does not materialize as anticipated.

The consequence of these high inventories is a substantial tying up of capital. This not only reduces financial flexibility but also increases carrying costs, which can directly impact profitability, especially if the market remains sluggish.

For instance, as of the first quarter of 2024, Gates Industrial reported inventory levels that were a concern for analysts, reflecting a cautious outlook on immediate demand despite long-term strategic positioning.

Net Margin Below Industry Standards

Gates Industrial's net margin of 7.31% in the first quarter of 2024 falls short of industry averages, signaling potential issues with overall profitability. This suggests that while the company is managing its cost of goods sold effectively, as evidenced by improving gross margins, it faces hurdles in controlling other operational expenses.

The disparity between gross and net margins highlights areas where cost management could be more robust.

- Net Margin Lag: Gates Industrial's 7.31% net margin in Q1 2024 is below industry benchmarks.

- Profitability Concerns: This indicates potential difficulties in translating revenue into net profit compared to competitors.

- Cost Control Challenges: Despite improved gross margins, the lower net margin points to broader operational cost inefficiencies.

Exposure to Raw Material and Foreign Exchange Fluctuations

Gates Industrial faces significant vulnerability to swings in the cost of its essential raw materials. For instance, the company experienced a notable increase in these costs during the first quarter of 2024, directly impacting its operational expenses.

Furthermore, the company is bracing for foreign exchange rate shifts, with projections indicating a negative impact of $34 million on its adjusted EBITDA for the 2025 fiscal year. These currency headwinds can significantly affect international sales and profitability.

These combined external pressures, both in raw material pricing and currency fluctuations, have the potential to diminish Gates' profit margins and introduce considerable unpredictability into its financial performance reports.

- Raw Material Cost Increases: Observed in Q1 2024, impacting operational expenses.

- Foreign Exchange Headwinds: Projected to reduce 2025 adjusted EBITDA by $34 million.

- Profitability Erosion: External cost pressures and currency impacts can squeeze margins.

- Financial Volatility: These factors introduce unpredictability into financial results.

Gates Industrial's reliance on cyclical end markets, particularly agriculture and construction, presents a significant weakness, as demonstrated by weaker demand in these sectors during 2024 which is expected to continue into early 2025. The Fluid Power segment's underperformance, marked by a 2.9% sales decline year-over-year in Q1 2025 and stagnant core revenue growth, highlights specific challenges within this division. Furthermore, elevated inventory levels tie up capital and increase carrying costs, posing a risk if demand recovery falters, with Q1 2024 inventory levels already a concern for analysts.

| Weakness | Description | Impact | Data Point |

| End Market Dependence | Vulnerability to agricultural and construction sector downturns. | Reduced net and core sales. | Weak demand in agriculture/construction in 2024. |

| Fluid Power Segment Performance | Sales decline and stagnant core revenue. | Drag on overall company performance. | Q1 2025 Fluid Power sales down 2.9% YoY. |

| Inventory Levels | High inventory tying up capital and increasing costs. | Reduced financial flexibility, potential profitability erosion. | Analysts flagged inventory levels as a concern in Q1 2024. |

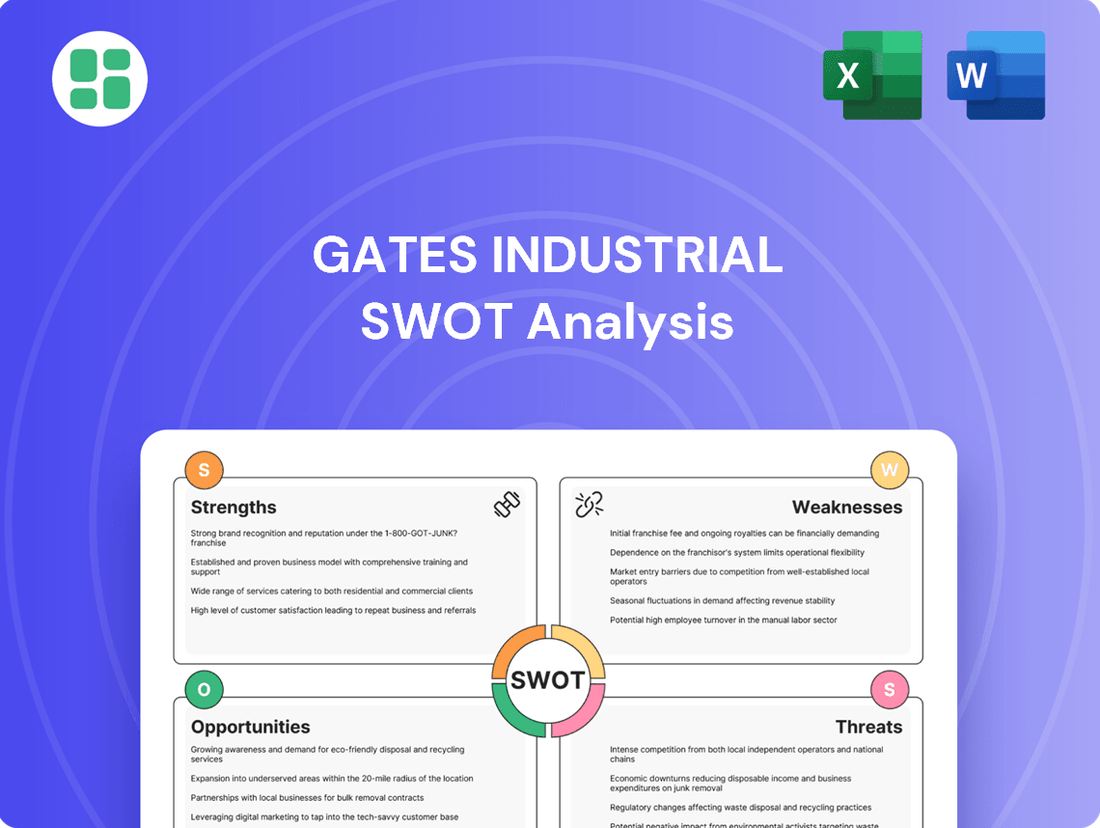

Preview Before You Purchase

Gates Industrial SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You can see the core strengths, weaknesses, opportunities, and threats for Gates Industrial. Purchase now to unlock the complete, in-depth analysis.

Opportunities

The automotive replacement and personal mobility sectors are presenting significant growth avenues for Gates. In Q1 2025, these markets were notable contributors to the company's core sales expansion, underscoring their importance.

With continued stabilization and recovery anticipated in these key areas, Gates is well-positioned for future revenue growth. The company's established presence in automotive aftermarket and personal mobility applications provides a strong base to leverage increasing consumer and industrial demand.

Gates Industrial is strategically positioning itself to capitalize on emerging technological trends, notably by entering the data center cooling market through collaborations like the one with Cool IT. This move taps into the rapidly expanding digital infrastructure sector.

The company sees substantial growth potential in Industry 4.0 advancements, which are driving the adoption of smart manufacturing. Gates is focused on developing and implementing energy-efficient solutions that align with these smart manufacturing initiatives, enhancing operational performance for its clients.

Strategic partnerships and potential acquisitions offer Gates Industrial significant avenues for growth, enabling the introduction of new products and expansion into untapped sectors. This approach has historically bolstered revenue, and continuing this strategy can further diversify its product portfolio and broaden its market presence. For instance, Gates' 2022 acquisition of Vi-Tech, a manufacturer of specialized hoses and fittings, expanded its offerings in the industrial hydraulics market.

Leveraging Global Manufacturing Footprint

Gates Industrial's 'in-region, for-region' manufacturing strategy offers significant advantages. This localized production model helps to keep logistics costs down and provides a buffer against potential tariffs, which is crucial in today's global trade environment. For instance, in 2023, the company reported that a substantial portion of its revenue was generated from regions where it also manufactured, highlighting the effectiveness of this approach in managing operational expenses and market access.

This decentralized manufacturing approach also bolsters supply chain resilience. By having production facilities closer to key markets, Gates can respond more quickly to shifts in regional demand and potential disruptions. This agility is a key differentiator, enabling them to maintain consistent product availability and meet customer needs efficiently. In 2024, the company emphasized its ongoing investments in expanding these regional capabilities to further enhance responsiveness.

The benefits of this strategy are evident in operational efficiency and market responsiveness:

- Reduced Logistics Costs: Proximity of manufacturing to end markets minimizes transportation expenses.

- Tariff Mitigation: Localized production lessens the impact of international trade duties.

- Enhanced Supply Chain Resilience: Diversified manufacturing bases reduce vulnerability to single-point disruptions.

- Improved Market Responsiveness: Ability to quickly adapt to regional demand fluctuations.

Continued Margin Improvement Initiatives

Gates Industrial is actively driving further cost reductions and productivity enhancements. These internal programs are designed to optimize its operational footprint and are key to achieving its target of a 24.5% EBITDA margin by 2026. This focus on efficiency is expected to yield substantial savings and bolster profitability, even if market conditions become less favorable.

The company's commitment to these margin improvement initiatives provides a strong foundation for sustained financial performance. By concentrating on internal operational efficiencies, Gates is building resilience against external market volatility. These efforts are projected to unlock significant value and contribute to a stronger bottom line.

- Targeted EBITDA Margin: 24.5% by 2026.

- Key Initiatives: Cost reduction, productivity improvements, footprint optimization.

- Expected Outcome: Significant savings and sustained profitability.

- Resilience Factor: Less dependence on broader market conditions.

Gates Industrial is strategically expanding into high-growth sectors like data center cooling, evidenced by its collaboration with Cool IT, tapping into the burgeoning digital infrastructure market. The company is also capitalizing on Industry 4.0 trends by developing energy-efficient solutions for smart manufacturing, aligning with the increasing demand for operational optimization.

Furthermore, Gates is leveraging its proven strategy of strategic partnerships and acquisitions to broaden its product portfolio and market reach, as seen with the 2022 acquisition of Vi-Tech, which strengthened its industrial hydraulics segment.

Threats

Gates Industrial faces significant headwinds from macroeconomic factors, including a fluctuating global demand landscape and the ever-present risk of economic slowdowns. The business environment has grown increasingly unpredictable since the beginning of 2025, directly impacting the reliability of sales projections and the company's bottom line.

For instance, the International Monetary Fund (IMF) revised its global growth forecast downwards to 2.9% for 2025 in its October 2024 World Economic Outlook, signaling a more challenging operating environment. This uncertainty makes it harder for Gates to accurately forecast demand for its industrial products, potentially leading to inventory mismatches or missed revenue opportunities.

Gates Industrial faces significant competition from major players like Parker-Hannifin and Continental in both the power transmission and fluid power markets. These established companies possess strong brand recognition and extensive distribution networks, creating a challenging environment for market share growth.

The intense rivalry necessitates ongoing investment in research and development to maintain a competitive edge and introduce innovative solutions. Failure to innovate can lead to price erosion and a decline in profitability, as customers may opt for lower-cost alternatives from competitors.

In 2023, the industrial sector, where Gates operates, saw continued consolidation and strategic partnerships among competitors, further intensifying the competitive landscape. This trend is expected to persist through 2024 and 2025, demanding agile strategies and a sharp focus on product differentiation to counter pricing pressures.

Rising costs for key materials like steel and rubber present a significant challenge for Gates, potentially eroding the benefits of their efficiency programs. For instance, global steel prices saw considerable volatility throughout 2024, impacting manufacturing expenses across the industrial sector.

Furthermore, ongoing geopolitical tensions and logistical bottlenecks in 2024 and early 2025 continue to pose risks to supply chain stability. These disruptions can delay shipments and increase freight costs, directly affecting Gates' ability to meet customer demand and maintain profitability.

Geopolitical Risks and Trade Policies

Gates, as a global company, faces significant threats from geopolitical instability and evolving trade policies. The imposition of tariffs, like those seen in recent years impacting various manufactured goods, can directly increase the cost of raw materials and finished products, squeezing profit margins. For instance, trade disputes between major economies in 2023 and early 2024 led to increased uncertainty for manufacturers relying on international supply chains.

These geopolitical uncertainties can severely disrupt global trade flows, impacting Gates' ability to efficiently move its products and source necessary components. For example, the ongoing conflicts and trade tensions in regions like Eastern Europe and parts of Asia have already demonstrated the vulnerability of extended supply chains, potentially affecting demand and operational costs across different markets. This disruption can lead to higher logistics expenses and longer lead times, impacting customer satisfaction and sales.

Furthermore, shifts in trade policies, such as protectionist measures or changes in import/export regulations, can alter market access and competitive landscapes. A significant portion of Gates' revenue is derived from international sales, making it susceptible to these policy changes. For example, a sudden imposition of tariffs on automotive or industrial components in a key market could significantly reduce demand or force price adjustments, thereby impacting the company's global revenue streams.

- Tariff Impact: Increased costs for imported materials and components, potentially reducing profit margins.

- Supply Chain Disruption: Geopolitical events can interrupt the flow of goods, leading to higher logistics costs and delays.

- Market Access Changes: Evolving trade policies can restrict access to or increase the cost of doing business in key international markets.

- Demand Volatility: Regional economic slowdowns or political instability can dampen demand for industrial and automotive products.

Technological Advancements from Competitors

Rapid technological shifts, particularly in areas like electric vehicle (EV) technology, present a significant threat. These advancements can quickly reshape demand for Gates' traditional power transmission and fluid power solutions. For instance, the increasing adoption of EVs directly impacts the market for components used in internal combustion engine vehicles.

To counter this, Gates must maintain aggressive investment in research and development. Staying ahead of market trends and competitive innovations is crucial for preserving market relevance. In 2023, Gates reported R&D expenses of $201.6 million, a critical investment to navigate these evolving technological landscapes.

- EV Transition Impact: The accelerating shift to electric vehicles could reduce demand for certain traditional powertrain components.

- Competitor Innovation: Competitors introducing novel technologies could capture market share if Gates doesn't innovate at a similar pace.

- R&D Investment: Gates' commitment to R&D, evidenced by its 2023 spending, is vital for developing next-generation solutions.

- Market Adaptability: Failure to adapt to new technological paradigms, like advanced materials or digital integration, poses a substantial risk.

Gates Industrial contends with significant threats from macroeconomic volatility, including a projected 2.9% global growth for 2025 according to the IMF, which can dampen industrial demand. Intense competition from players like Parker-Hannifin and Continental necessitates continuous innovation, as seen in the sector's 2023 consolidation trends. Rising material costs, exemplified by steel price fluctuations in 2024, and ongoing supply chain disruptions due to geopolitical tensions in 2024-2025 directly impact operational expenses and delivery timelines.

SWOT Analysis Data Sources

This Gates Industrial SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry commentary to ensure a thoroughly informed perspective.