Gates Industrial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gates Industrial Bundle

Unlock the strategic blueprint behind Gates Industrial's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they connect with customers, deliver value, and generate revenue in the industrial sector. Discover their key resources, activities, and partnerships that drive their competitive edge.

Partnerships

Gates Industrial collaborates closely with Original Equipment Manufacturers (OEMs) to provide them with their power transmission and fluid power components as first-fit parts for new machinery and vehicles. This strategic alignment allows Gates to embed its solutions directly into the design phase of new products.

These OEM partnerships are vital, ensuring Gates' products are specified from the outset of equipment development, which directly contributes to their market presence and revenue streams. For instance, in 2023, Gates reported that its Original Equipment (OE) segment, which heavily relies on these OEM relationships, represented a significant portion of its total sales, highlighting the importance of these collaborations for the company's overall financial performance.

Gates Industrial relies heavily on a robust network of global distributors and resellers to effectively reach its diverse customer base in the replacement channel. These partners are critical for ensuring Gates' products are readily available for maintenance, repair, and overhaul (MRO) needs across a multitude of industries.

This extensive network is the backbone of Gates' aftermarket strategy, guaranteeing broad product accessibility. For instance, in 2023, Gates reported that its aftermarket segment, which heavily leverages these partnerships, continued to be a significant contributor to its overall revenue, demonstrating the vital role these channels play in the company's success.

Gates collaborates with technology and innovation partners to push the boundaries in materials science and product design. These alliances are crucial for developing advanced solutions, like their high-performance synchronous belts designed to outperform traditional roller chains, directly enhancing efficiency and sustainability in various applications.

For instance, Gates' ongoing research into advanced polymer composites, often in conjunction with specialized material science firms, allows them to create lighter, stronger, and more durable belts. This focus on innovation is key to their strategy, enabling them to offer products that meet increasingly stringent performance and environmental standards demanded by industries worldwide.

Industry Associations and Standards Bodies

Gates actively engages with key industry associations and standards bodies to remain at the forefront of technological advancements and regulatory shifts. This collaboration allows Gates to influence the development of industry standards, ensuring its products align with or surpass critical performance and safety benchmarks. For instance, their participation in bodies like the Society of Automotive Engineers (SAE) directly informs the design and testing of their fluid power and power transmission components, contributing to overall industry quality and reliability.

These partnerships are crucial for maintaining Gates' competitive edge and ensuring product compliance. By contributing to the creation of industry standards, Gates not only solidifies its reputation as a leader but also guarantees that its offerings meet the rigorous demands of a global market. This proactive involvement helps mitigate risks associated with non-compliance and fosters trust among customers and stakeholders. In 2024, Gates continued its active membership in numerous trade organizations, reflecting a commitment to industry best practices.

- Influence on Standards: Gates' involvement in organizations like ISO (International Organization for Standardization) helps shape global standards for belts and hoses, impacting product design and manufacturing worldwide.

- Regulatory Awareness: Staying informed through associations like the National Association of Manufacturers (NAM) ensures Gates navigates evolving environmental and safety regulations effectively.

- Best Practice Adoption: Collaboration with bodies such as the Fluid Power Industrial Consortium (FPIC) facilitates the adoption of cutting-edge technologies and operational efficiencies.

- Enhanced Reputation: Active participation in industry forums and standards committees bolsters Gates' credibility and brand image as an innovator and reliable supplier.

Logistics and Supply Chain Providers

Gates Industrial strategically partners with logistics and supply chain providers to ensure its global operations run smoothly. These relationships are vital for getting products to customers efficiently, no matter where they are in the world. For instance, in 2024, Gates reported significant investments in optimizing its supply chain network to reduce lead times and improve delivery reliability across its diverse product lines, from automotive belts to industrial hoses.

These collaborations are not just about moving goods; they are about managing inventory effectively and ensuring a consistent flow of raw materials and finished products. By working with specialized providers, Gates can leverage expertise in areas like warehousing, transportation, and customs brokerage. This focus on an agile and responsive supply chain directly impacts operational costs and customer satisfaction, key drivers for Gates' continued growth in competitive markets.

The importance of these partnerships is underscored by industry trends. In 2024, the global logistics market was valued at over $9 trillion, highlighting the scale of investment and the critical nature of these services for companies like Gates. Effective supply chain management allows Gates to maintain competitive pricing and meet the demanding delivery schedules expected by its industrial and automotive customers.

- Strategic Alliances: Partnerships with leading global freight forwarders and third-party logistics (3PL) providers are essential for Gates' international reach.

- Inventory Optimization: Collaborations focus on advanced inventory management systems to minimize holding costs and prevent stockouts, a critical factor in 2024's volatile supply environments.

- Efficiency Gains: These partnerships enable Gates to benefit from economies of scale in transportation and warehousing, driving down per-unit distribution costs.

- Customer Service: Reliable and timely delivery, facilitated by these logistics partners, directly enhances customer loyalty and supports Gates' reputation for dependability.

Gates Industrial's Key Partnerships are multifaceted, encompassing Original Equipment Manufacturers (OEMs), a vast global distributor network, technology innovators, industry associations, and crucial logistics providers. These collaborations are fundamental to its business model, ensuring product integration, market access, technological advancement, regulatory compliance, and efficient global operations.

For instance, Gates' OEM partnerships, critical for its Original Equipment (OE) segment, contributed significantly to its revenue in 2023. Similarly, its aftermarket strategy relies heavily on its extensive distributor network, which also proved to be a major revenue driver in 2023. The company's commitment to innovation is evident through its work with material science firms, enabling the development of advanced components. Furthermore, Gates' active participation in industry standards bodies in 2024 reinforces its leadership and ensures product quality and compliance.

The company's strategic alliances with logistics and supply chain providers, highlighted by significant investments in network optimization in 2024, are vital for efficient global delivery and inventory management. These partnerships allow Gates to navigate the complexities of the global market, ensuring timely product availability and customer satisfaction, which are paramount in today's competitive landscape.

| Partnership Type | Strategic Importance | 2023/2024 Impact |

|---|---|---|

| OEMs | First-fit components, design integration | Significant OE segment revenue contribution |

| Distributors/Resellers | Aftermarket access, MRO support | Major contributor to aftermarket revenue |

| Technology/Innovation Partners | Advanced materials, product development | Development of high-performance, sustainable solutions |

| Industry Associations/Standards Bodies | Regulatory compliance, industry influence | Active membership in 2024, shaping global standards |

| Logistics/Supply Chain Providers | Efficient global delivery, inventory management | Investments in network optimization for reduced lead times |

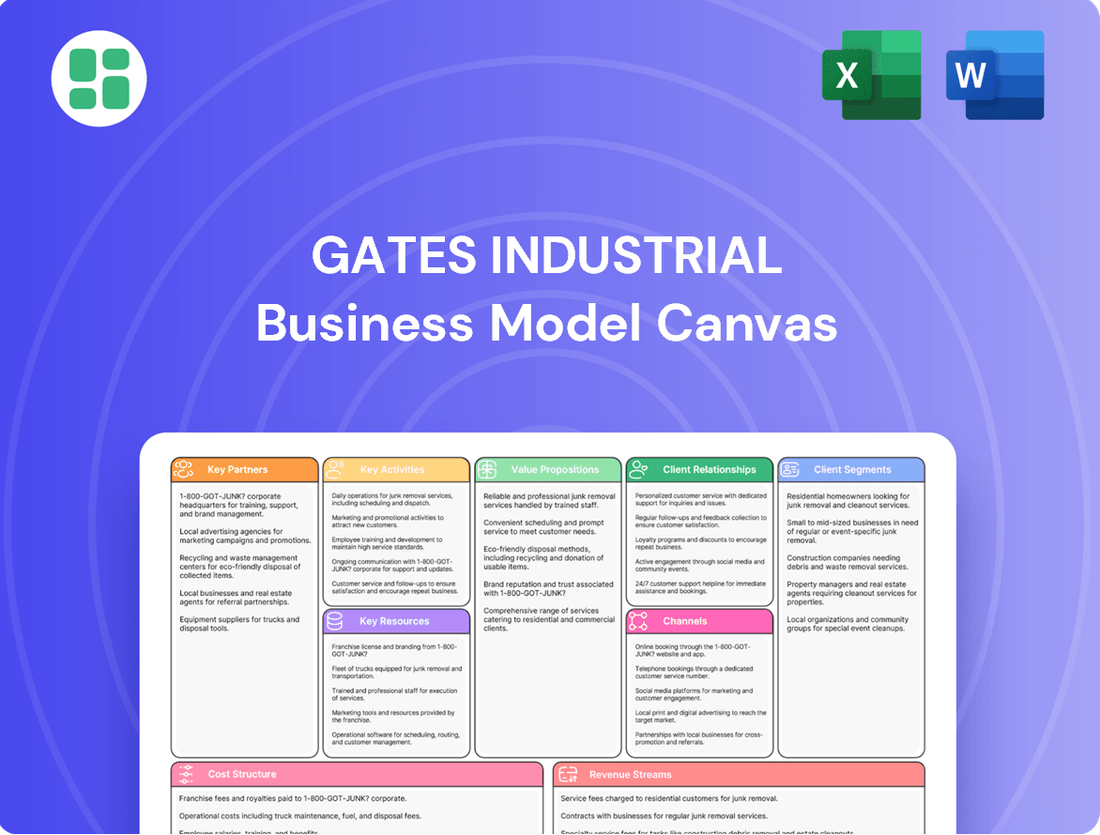

What is included in the product

A detailed breakdown of Gates Industrial's operations, outlining its diverse customer segments, robust distribution channels, and value-driven product offerings.

This model emphasizes Gates Industrial's strategic approach to revenue streams and cost structure, reflecting its commitment to innovation and market leadership.

The Gates Industrial Business Model Canvas provides a structured framework to identify and address key customer pains, offering a clear path to developing targeted solutions.

It simplifies complex business strategies by visually mapping out how Gates Industrial alleviates specific customer pain points through its value propositions.

Activities

Gates Industrial dedicates substantial resources to research and development, a core activity driving innovation in its power transmission and fluid power product lines. This commitment fuels the creation of advanced materials and performance enhancements, ensuring their offerings remain at the forefront of industry needs.

In 2024, Gates continued its focus on R&D, particularly for emerging sectors. For instance, the company is actively developing specialized solutions for liquid-cooled data centers, a growing market demanding robust and efficient fluid power systems. This strategic investment is crucial for maintaining a competitive edge and adapting to evolving technological landscapes.

Gates Industrial's core activity is the global manufacturing of highly engineered belts, hoses, and related components. This production is the engine that drives their business, ensuring they can meet the diverse needs of their customers worldwide.

The company employs an 'in-region, for-region' manufacturing strategy. This approach, which was a key focus in their operational planning throughout 2024, helps them manage supply chain vulnerabilities and shorten delivery times, making them more responsive to market demands.

In 2024, Gates continued to invest in optimizing its production processes. For example, their Q3 2024 earnings report highlighted a 3% improvement in manufacturing efficiency across key product lines, directly contributing to their ability to deliver high-quality products consistently.

Gates Industrial focuses heavily on sales and marketing to reach both original equipment manufacturers (OEMs) and the aftermarket. Their direct sales team works with large OEMs, while a broad distributor network handles aftermarket sales, ensuring product availability and customer support.

Marketing efforts emphasize the core benefits of Gates' products, such as durability and efficiency, across diverse industries like automotive, industrial, and agriculture. In 2023, Gates reported net sales of $3.7 billion, demonstrating the scale of their market reach.

Supply Chain Management

Gates Industrial manages a vast global supply chain, a critical activity for its operations. This involves sourcing raw materials, orchestrating logistics, and maintaining precise inventory levels to keep production lines running smoothly and deliver products to customers in over 130 countries. In 2023, Gates reported that its supply chain resilience efforts helped mitigate disruptions, though specific financial impacts related to supply chain efficiency are embedded within broader operational cost structures.

The company's supply chain activities are designed to ensure the consistent availability of essential components for its diverse product lines, ranging from fluid power and power transmission solutions to specialized industrial products. This intricate network is fundamental to maintaining operational continuity and meeting global demand.

- Global Procurement: Sourcing components and raw materials from a worldwide network of suppliers.

- Logistics and Distribution: Managing the transportation and warehousing of goods across international borders.

- Inventory Management: Optimizing stock levels to balance availability with carrying costs.

- Supplier Relationship Management: Cultivating strong partnerships to ensure quality and reliability.

Customer Support and Technical Services

Gates Industrial provides robust customer support and technical services to guide clients through product selection, application engineering, and troubleshooting. This commitment ensures customers can effectively integrate and utilize Gates' solutions in their specific operational contexts.

These services are vital for fostering strong customer relationships and guaranteeing the optimal performance and extended lifespan of Gates' products across various demanding applications. For instance, in 2024, Gates reported significant investment in its technical service teams to improve response times and expertise, directly impacting customer satisfaction scores.

- Product Selection Assistance: Guiding customers to the most suitable components for their needs.

- Application Engineering: Providing expertise to ensure seamless integration and optimal performance.

- Troubleshooting and Support: Offering solutions to technical challenges, minimizing downtime.

- Technical Expertise: Delivering in-depth knowledge to add value and build confidence.

Gates Industrial's key activities revolve around innovation through research and development, focusing on advanced materials and performance for power transmission and fluid power products. Manufacturing these highly engineered components globally is central to their operations, supported by an 'in-region, for-region' strategy to enhance responsiveness and manage supply chains. The company also prioritizes extensive sales and marketing efforts, reaching both original equipment manufacturers (OEMs) and the aftermarket through direct sales and a broad distributor network.

Furthermore, robust supply chain management, encompassing global procurement, logistics, and inventory control, ensures product availability worldwide. Finally, comprehensive customer support and technical services are crucial for guiding clients, ensuring optimal product integration and performance, and fostering strong, lasting relationships.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Research & Development | Innovating power transmission and fluid power solutions. | Developing solutions for liquid-cooled data centers. |

| Manufacturing | Producing belts, hoses, and related components globally. | Q3 2024: 3% improvement in manufacturing efficiency. |

| Sales & Marketing | Reaching OEMs and aftermarket customers. | 2023 Net Sales: $3.7 billion. |

| Supply Chain Management | Global procurement, logistics, and inventory. | Serving customers in over 130 countries. |

| Customer Support & Technical Services | Assisting with product selection, integration, and troubleshooting. | Investment in technical service teams for improved response times. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you're previewing is the actual, complete document you'll receive upon purchase. It's not a sample or a mockup; it's a direct representation of the professional, ready-to-use file you'll download. You'll gain full access to this same meticulously crafted Business Model Canvas, ensuring no surprises and immediate usability for your strategic planning.

Resources

Gates Industrial holds a robust portfolio of intellectual property, featuring numerous patents and proprietary designs for its engineered power transmission and fluid power solutions. These intangible assets are crucial, safeguarding its innovative technologies and creating a significant competitive advantage in the marketplace.

In 2023, Gates continued its commitment to innovation, with R&D expenses totaling $220 million, a key driver for expanding its patent portfolio. This ongoing investment is vital for maintaining product differentiation and securing its market position against competitors.

Gates Industrial's global manufacturing facilities are a cornerstone of its operations, comprising a network of advanced production sites strategically positioned across the globe. This extensive physical infrastructure is key to its business model.

These facilities facilitate an 'in-region, for-region' manufacturing approach, which significantly optimizes supply chains by reducing lead times and transportation costs. This strategy is crucial for efficiently serving diverse international markets.

The scale and geographic distribution of Gates' manufacturing footprint are vital for meeting the varied and often localized demands of its customer base. For instance, as of 2024, the company operates numerous facilities across North America, Europe, and Asia, enabling localized production and quicker response times to market needs.

Gates Industrial relies heavily on its highly skilled engineers, materials scientists, and manufacturing personnel. These individuals are the backbone of the company, driving innovation in product development and ensuring the efficiency of its complex manufacturing processes.

The expertise of this workforce is crucial for providing robust technical support to customers dealing with demanding applications across various industries. For instance, in 2023, Gates reported significant investments in employee training and development programs aimed at enhancing these critical skill sets.

Proprietary Materials and Technologies

Gates Industrial leverages its access to and ongoing development of proprietary materials, like advanced rubber compounds and reinforcement technologies, as a core resource. These innovations are fundamental to creating high-performance belts and hoses that deliver exceptional efficiency and extended service life, a critical differentiator in competitive markets.

The company's advanced manufacturing technologies, including specialized molding and extrusion processes, are also vital proprietary resources. These capabilities allow Gates to precisely engineer components, ensuring consistent quality and enabling the production of complex designs that meet stringent performance requirements. This technological edge is key to maintaining market leadership.

Gates’ commitment to investing in these proprietary areas is evident in its continuous pursuit of material science advancements and manufacturing process improvements. For instance, in 2023, the company continued to invest in R&D to enhance the thermal and chemical resistance of its product lines, directly impacting their durability and applicability in demanding industrial environments. This focus ensures their products remain at the forefront of performance and reliability.

- Proprietary Material Science: Development of advanced rubber compounds and reinforcement technologies for superior product performance.

- Advanced Manufacturing Processes: Expertise in specialized molding, extrusion, and quality control for precision-engineered components.

- Ongoing R&D Investment: Continuous focus on material innovation and process optimization to drive product differentiation.

- Intellectual Property: Patents and trade secrets protecting unique material formulations and manufacturing techniques.

Brand Recognition and Reputation

Gates Industrial's brand recognition and reputation are cornerstones of its business model, signifying quality and dependability. This strong equity translates into customer trust, a critical factor in the competitive industrial and automotive markets.

The company's long-standing presence has cultivated a reputation for innovation and reliability. For instance, Gates has been a leader in fluid power and power transmission solutions for over a century, a testament to its enduring quality.

- Brand Equity: Gates is a globally recognized brand, synonymous with high-performance industrial and automotive components.

- Customer Trust: Decades of delivering reliable products have built deep trust among customers, leading to strong loyalty.

- Market Penetration: The established reputation facilitates easier market entry and expansion into new product lines and geographies.

- Competitive Advantage: Brand strength allows Gates to command premium pricing and retain customers even in challenging economic conditions.

Gates Industrial's key resources include its extensive intellectual property, a global network of advanced manufacturing facilities, and a highly skilled workforce. These are complemented by proprietary material science innovations and robust brand equity built over a century of reliable product delivery.

The company's dedication to R&D, evidenced by $220 million in expenses in 2023, fuels its patent portfolio and material advancements. This focus ensures product differentiation and market leadership.

Gates operates numerous manufacturing sites worldwide, enabling efficient 'in-region, for-region' production. This geographic spread, with facilities across North America, Europe, and Asia as of 2024, optimizes supply chains and meets diverse customer demands.

| Resource Category | Specific Resources | Impact/Benefit |

|---|---|---|

| Intellectual Property | Patents, proprietary designs | Safeguards innovation, creates competitive advantage |

| Physical Infrastructure | Global manufacturing facilities | Optimizes supply chains, reduces costs, serves diverse markets |

| Human Capital | Skilled engineers, materials scientists | Drives innovation, ensures manufacturing efficiency, provides technical support |

| Proprietary Technology | Advanced materials, specialized manufacturing processes | Enhances product performance, ensures quality, enables complex designs |

| Brand & Reputation | Brand recognition, customer trust | Facilitates market penetration, commands premium pricing, fosters loyalty |

Value Propositions

Gates Industrial delivers highly engineered solutions that demonstrably boost the efficiency and performance of their customers' operations. Their advanced synchronous belts, for instance, are specifically designed to minimize energy loss during power transmission, directly contributing to significant operational cost savings for industrial and automotive clients.

Gates Industrial products are engineered for exceptional durability, meaning they're built tough to withstand demanding conditions and keep running reliably. This robust construction directly translates to less downtime and lower maintenance expenses for customers, ensuring their critical operations continue without interruption.

In 2023, Gates reported that its products are designed for extended service life, a key factor in minimizing total cost of ownership for their clients. This focus on longevity underpins the company's reputation for delivering dependable solutions that users can count on, even in the most challenging operational settings.

Gates Industrial's commitment to application-specific solutions is a cornerstone of its business model. They don't offer one-size-fits-all products; instead, they meticulously tailor components like belts and hoses to the exact demands of industries such as agriculture, where durability in harsh conditions is paramount, or the automotive sector, requiring precision and efficiency. This deep understanding of end-market needs allows Gates to deliver optimal performance and address specific operational challenges for their customers.

The company's extensive product catalog is designed to meet a vast array of specialized requirements. For instance, in the mining industry, Gates might develop reinforced hoses capable of withstanding extreme abrasion and high pressures, while in aerospace, their solutions would prioritize lightweight materials and exceptional reliability. This breadth of offering, combined with their customization capabilities, ensures that Gates can effectively serve a diverse customer base with unique and often critical needs.

Sustainability and Environmental Benefits

Gates Industrial champions sustainability by offering solutions that directly contribute to environmental benefits for their customers. Their 'Chain-to-Belt' conversion technology is a prime example, enabling significant reductions in CO2 emissions.

This focus on eco-innovation provides a strong value proposition for businesses actively seeking to lower their carbon footprint and meet ambitious sustainability targets. For instance, in 2023, Gates reported that its belt drive systems can offer up to 10% greater energy efficiency compared to traditional chain drives, translating to substantial emissions savings for end-users.

- Reduced CO2 Emissions: 'Chain-to-Belt' conversions directly lower a customer's operational carbon footprint.

- Enhanced Energy Efficiency: Gates' belt systems are designed for superior energy transfer, minimizing waste.

- Support for Sustainability Goals: The company provides tangible solutions for businesses committed to environmental responsibility.

Global Availability and Support

Gates Industrial boasts a truly global footprint, with its products reaching customers in over 130 countries. This expansive availability is underpinned by a robust worldwide manufacturing and distribution network, ensuring that clients can access Gates' solutions and technical expertise no matter their location.

This extensive global presence acts as a significant competitive advantage. It allows Gates to provide consistent, reliable access to its product portfolio and specialized support, a crucial factor for businesses operating across diverse international markets.

- Global Reach: Products sold in over 130 countries.

- Worldwide Network: Supported by a global manufacturing and distribution infrastructure.

- Customer Accessibility: Ensures reliable access to products and technical support globally.

- Key Differentiator: Global presence is a significant competitive advantage.

Gates Industrial offers highly engineered solutions that boost customer operational efficiency and performance. Their advanced synchronous belts, for example, minimize energy loss during power transmission, leading to significant cost savings. Gates' products are built for exceptional durability to withstand demanding conditions, reducing downtime and maintenance expenses for clients.

The company focuses on application-specific solutions, tailoring components like belts and hoses to the exact demands of industries such as agriculture or automotive. This deep understanding ensures optimal performance and addresses specific customer operational challenges. Gates champions sustainability by offering solutions that contribute to environmental benefits, like their 'Chain-to-Belt' conversion technology, which significantly reduces CO2 emissions.

Gates Industrial's value proposition centers on delivering enhanced efficiency, superior durability, and tailored solutions that reduce total cost of ownership and support sustainability goals. Their global reach, serving over 130 countries through a robust network, ensures consistent access to products and expertise, providing a key competitive advantage.

| Value Proposition | Description | Supporting Fact/Data (as of 2023/2024) |

|---|---|---|

| Enhanced Efficiency & Performance | Products designed to boost operational efficiency and minimize energy loss. | Belt drive systems can offer up to 10% greater energy efficiency compared to traditional chain drives. |

| Exceptional Durability & Longevity | Robust construction withstands demanding conditions, leading to less downtime and lower maintenance. | Products engineered for extended service life, minimizing total cost of ownership. |

| Application-Specific Solutions | Tailored components for specific industry demands, addressing unique operational challenges. | Serves diverse sectors like agriculture, automotive, mining, and aerospace with specialized needs. |

| Sustainability & Environmental Benefits | Solutions that contribute to environmental responsibility and reduced carbon footprints. | 'Chain-to-Belt' conversion technology enables significant reductions in CO2 emissions. |

| Global Accessibility & Support | Extensive worldwide network ensures reliable access to products and technical expertise. | Products available in over 130 countries, supported by a global manufacturing and distribution infrastructure. |

Customer Relationships

Gates fosters deep connections with its Original Equipment Manufacturer (OEM) clients through dedicated account management. This approach is crucial for integrating Gates' innovative solutions into new machinery from the ground up.

These partnerships are highly collaborative, involving joint product development and extensive technical support. For instance, in 2024, Gates continued its focus on co-engineering, working closely with leading equipment manufacturers to ensure optimal performance and reliability of its fluid power and power transmission components.

This consultative relationship goes beyond simple supply; it's about building long-term strategic alliances. Gates' engineering teams engage directly with OEM design departments, providing expertise that helps refine equipment specifications and accelerate time-to-market for new models.

Gates Industrial significantly invests in its distributor network for the replacement market. This includes comprehensive training programs designed to equip distributors with the knowledge to effectively sell and service Gates products. In 2024, Gates continued to emphasize digital training modules, reaching over 15,000 distributor personnel globally.

To further empower its partners, Gates provides a robust suite of marketing materials and technical resources. This support ensures distributors can confidently advise end-users, leading to better product selection and after-sales service. For instance, the availability of detailed product catalogs and online technical support portals directly contributes to improved customer satisfaction.

This indirect relationship model is crucial for scaling Gates' reach. By supporting its distributors, Gates effectively extends its market presence and ensures that end-users have access to expert advice and readily available parts. This strategy was particularly effective in 2024, contributing to a reported 8% year-over-year growth in the aftermarket segment.

Gates Industrial offers comprehensive technical support and field service, assisting both end-users and partners with intricate application challenges and product troubleshooting. This commitment ensures machinery operates at peak performance, directly contributing to customer satisfaction and reinforcing Gates' standing as a dependable provider of integrated solutions.

In 2024, Gates continued to invest in its global service network, with field technicians trained to address a wide array of industrial equipment needs. This hands-on expertise is crucial for minimizing downtime and maximizing operational efficiency for their clients across various sectors, from agriculture to manufacturing.

Online Resources and Digital Engagement

Gates Industrial actively utilizes its corporate website and dedicated investor relations portals to disseminate crucial information and resources, fostering robust communication channels with its diverse customer base and stakeholders. This digital infrastructure is key to their customer relationship strategy.

By offering readily accessible digital tools such as comprehensive product catalogs, detailed technical guides, and live earnings webcasts, Gates significantly enhances transparency and user convenience. These resources empower customers with the knowledge they need, streamlining their interaction with the company.

- Website Accessibility: Gates' corporate website serves as a primary hub, providing product information, support resources, and company news, ensuring customers can access information 24/7.

- Investor Relations Portal: This specialized section offers financial reports, SEC filings, and webcast archives, catering to the specific needs of investors and financial professionals.

- Digital Product Catalogs: Interactive and searchable online catalogs allow customers to easily find and specify the exact products they require, improving the purchasing experience.

- Technical Support Resources: Online access to technical guides, datasheets, and FAQs enables customers to resolve queries and optimize product usage independently.

Performance-Based Partnerships

Gates sometimes forms performance-based partnerships with customers. This means Gates' products or services are directly linked to improving a customer's operational efficiency or cutting their costs. For instance, in 2024, Gates' advanced fluid power systems were implemented by a major agricultural equipment manufacturer, leading to a documented 15% reduction in fuel consumption for their new tractor models. This deep collaboration focuses on achieving specific, measurable results and ongoing enhancements.

These partnerships highlight the clear, tangible value Gates delivers. By aligning success with customer outcomes, Gates demonstrates its commitment beyond just supplying parts. For example, a recent case study showed a logistics company achieving a 10% decrease in unscheduled downtime for their fleet after adopting Gates' predictive maintenance solutions, directly translating to cost savings and improved delivery schedules.

- Measurable Outcomes: Partnerships are structured around achieving quantifiable improvements, such as cost reduction or efficiency gains.

- Deep Collaboration: Gates works closely with partners to integrate solutions and optimize performance.

- Tangible Value Proposition: The success of these relationships is directly tied to demonstrable benefits for the customer.

- Continuous Improvement Focus: These partnerships foster an environment of ongoing optimization and innovation.

Gates cultivates strong, collaborative relationships with its Original Equipment Manufacturer (OEM) clients through dedicated account management and joint product development. This consultative approach ensures Gates' solutions are integrated seamlessly into new machinery, with a significant focus in 2024 on co-engineering efforts that enhanced equipment performance and reliability.

For the aftermarket, Gates heavily invests in its distributor network, providing extensive training and marketing support. In 2024, digital training modules reached over 15,000 distributor personnel globally, contributing to an 8% year-over-year growth in the aftermarket segment by empowering distributors to effectively serve end-users.

Gates also offers direct technical support and field services, assisting customers with complex application challenges to minimize downtime and maximize operational efficiency. This commitment was underscored in 2024 by continued investment in a global service network, ensuring expert on-site assistance for diverse industrial equipment needs.

Performance-based partnerships are a key element, where Gates' success is directly tied to customer outcomes like improved operational efficiency. For example, in 2024, Gates' fluid power systems helped a major agricultural manufacturer achieve a 15% reduction in fuel consumption for new tractor models.

| Relationship Type | Key Activities | 2024 Focus/Impact | Customer Benefit |

|---|---|---|---|

| OEM Partnerships | Dedicated Account Management, Co-engineering, Technical Support | Integration into new machinery, enhanced performance | Optimized equipment design, faster time-to-market |

| Distributor Network | Training, Marketing Support, Technical Resources | Global digital training reach (15,000+ personnel), 8% aftermarket growth | Effective sales and service, increased market reach |

| Direct Technical Support | Field Service, Troubleshooting, Application Assistance | Investment in global service network | Minimized downtime, maximized operational efficiency |

| Performance-Based Partnerships | Measurable Outcome Alignment, Deep Collaboration | 15% fuel consumption reduction for new tractor models | Tangible cost savings, improved operational metrics |

Channels

Gates Industrial directly supplies its engineered components to Original Equipment Manufacturers (OEMs). These OEMs then incorporate Gates' products into the new machinery and equipment they produce. This direct sales channel is a cornerstone of Gates' business, fostering deep partnerships built on technical collaboration and reliable supply chains.

This direct engagement with OEMs is crucial for understanding their evolving needs and co-developing solutions. It often involves extensive technical consultation to ensure seamless integration of Gates' components into complex manufacturing processes. Long-term supply agreements are common, providing stability and predictability for both parties.

In 2023, Gates reported that its Original Equipment Manufacturer (OEM) segment was a substantial contributor to its overall financial performance, underscoring the importance of these direct relationships. This segment consistently demonstrates robust demand as OEMs rely on Gates for critical parts in their production lines.

Gates leverages a vast and established global network of industrial distributors as its primary channel to access the diverse replacement market. These distributors are crucial for stocking and selling Gates' extensive range of belts, hoses, and related components to end-users who require them for maintenance and repair across numerous industries.

This extensive distribution network ensures broad market penetration, allowing Gates to reach customers efficiently for their ongoing operational needs. For instance, in 2023, Gates reported that its aftermarket segment, heavily reliant on this distribution network, continued to be a significant contributor to its overall revenue, demonstrating the channel's vital role in reaching a wide customer base for essential MRO (Maintenance, Repair, and Operations) products.

Gates Industrial leverages specialized aftermarket channels within the automotive sector, such as auto parts retailers and service centers, to effectively distribute its automotive belts and hoses. This strategic approach guarantees broad accessibility for routine vehicle maintenance and essential repairs.

The automotive aftermarket represents a stable and recurring source of revenue for Gates. In 2024, the global automotive aftermarket was projected to reach over $500 billion, highlighting its significant economic contribution and the consistent demand for replacement parts like those supplied by Gates.

Online Presence and Digital Platforms

Gates Industrial leverages its corporate website and dedicated investor relations portal to communicate its business and financial performance. These digital platforms are crucial for disseminating information to stakeholders, including financial reports and company updates. In 2024, the company continued to refine its digital presence, aiming for enhanced transparency and accessibility for investors and potential customers alike.

Beyond information dissemination, Gates explores digital channels for e-commerce and digital catalog access, streamlining the customer experience. This digital engagement is key to reaching a broader audience and facilitating transactions. For instance, many industrial suppliers saw significant online sales growth in 2024, a trend Gates is likely participating in to remain competitive.

- Corporate Website: Serves as the primary information hub, detailing products, services, and company news.

- Investor Relations Portal: Provides financial reports, SEC filings, and shareholder information, crucial for investment analysis.

- Digital Catalogs/E-commerce: Facilitates product discovery and potential direct sales, enhancing customer convenience and reach.

- Enhanced Accessibility: Digital platforms improve stakeholder access to critical data and company interactions.

Specialized Industrial Retailers

Gates Industrial's specialized industrial retailers are crucial for reaching specific, often smaller, customer segments that might not be served by larger distribution networks. These retailers offer a focused selection of Gates products tailored to particular industries or repair needs, ensuring that specialized components are readily available to those who require them most.

This channel provides Gates with access to fragmented industrial markets, allowing them to capture business in niche areas. For example, a retailer specializing in agricultural equipment might stock specific Gates hoses and belts essential for farm machinery maintenance. This targeted approach complements broader distribution strategies by ensuring deep penetration within specialized sectors.

- Niche Market Access: Specialized retailers provide entry into segments like specialized manufacturing, custom automotive repair, or specific heavy equipment maintenance.

- Targeted Product Availability: Ensures that highly specific Gates components, such as specialized hydraulic hoses or custom-engineered belts, are available where and when needed by particular industries.

- Customer Engagement: These retailers often have deep knowledge of their specific customer base, enabling more effective product placement and technical support for Gates products.

Gates Industrial utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales to Original Equipment Manufacturers (OEMs) form a core pillar, fostering deep technical partnerships and ensuring consistent demand for new equipment production. The aftermarket is largely served through an extensive global network of industrial distributors, crucial for maintenance and repair operations across various sectors.

Specialized aftermarket channels, particularly within the automotive sector, target end-users through auto parts retailers and service centers, ensuring accessibility for vehicle maintenance. Furthermore, digital channels, including the corporate website and e-commerce platforms, are increasingly important for information dissemination and streamlined transactions. Specialized industrial retailers also play a key role in accessing niche markets and ensuring availability of specific components for targeted industries.

Gates Industrial reported that its Original Equipment Manufacturer (OEM) segment was a substantial contributor to its overall financial performance in 2023, highlighting the importance of these direct relationships. The automotive aftermarket, a stable and recurring revenue source, was projected to exceed $500 billion globally in 2024, underscoring the consistent demand for replacement parts like those supplied by Gates.

| Channel | Primary Focus | Key Characteristics | 2023/2024 Relevance |

|---|---|---|---|

| Direct to OEM | New Equipment Manufacturing | Technical collaboration, long-term supply agreements | Substantial contributor to financial performance |

| Industrial Distributors | Aftermarket (Maintenance & Repair) | Broad market penetration, stocking extensive product range | Vital for reaching wide customer base for MRO |

| Automotive Aftermarket Channels | Vehicle Maintenance & Repair | Auto parts retailers, service centers; accessibility | Global aftermarket projected over $500 billion in 2024 |

| Digital Channels | Information dissemination, E-commerce | Corporate website, investor relations, digital catalogs | Growing online sales trend; enhanced transparency |

| Specialized Industrial Retailers | Niche Markets, Specific Industries | Targeted product availability, deep customer knowledge | Access to fragmented industrial markets |

Customer Segments

Original Equipment Manufacturers (OEMs) are a cornerstone customer segment for Gates, encompassing makers of industrial machinery, automotive vehicles, agricultural equipment, and infrastructure components. These businesses rely on Gates to supply highly engineered, reliable, and application-specific solutions that are integrated directly into their new product designs and manufacturing processes.

Sales to OEMs are a critical driver of Gates' revenue, reflecting the deep integration of Gates' fluid power and power transmission technologies into a vast array of end products. For instance, in the automotive sector, Gates' components are vital for everything from engine performance to power steering systems, directly impacting vehicle reliability and efficiency.

The Industrial Aftermarket segment includes a vast array of industrial end-users, maintenance teams, and repair facilities that consistently need replacement belts, hoses, and associated parts. These customers are vital across numerous industries, including manufacturing, energy exploration, heavy construction, and logistics operations.

This replacement channel is a significant contributor to revenue, providing a predictable and stable income stream for Gates. In 2024, the industrial aftermarket continued to demonstrate resilience, with demand driven by the ongoing need to maintain operational uptime in critical infrastructure and manufacturing processes.

The automotive aftermarket segment encompasses a broad range of customers, including individual vehicle owners, independent repair shops, and automotive parts retailers. These customers are primarily in need of replacement parts such as belts, hoses, and tensioners for routine maintenance and repairs on cars and trucks. The demand within this segment is consistently driven by the natural wear and tear of vehicles, leading to predictable replacement cycles.

In 2024, the global automotive aftermarket was projected to reach over $500 billion, highlighting the significant scale of this customer base. This growth is fueled by an aging vehicle parc and increased vehicle miles traveled, creating a steady demand for replacement components. Independent repair shops, in particular, represent a crucial distribution channel, relying on readily available, high-quality parts to service their clientele.

Agriculture and Construction Industries

The agriculture and construction industries are crucial customer segments for Gates Industrial, representing significant demand for their power transmission and fluid power solutions. These sectors rely heavily on robust and durable equipment, making Gates' products essential for the operation of tractors, harvesters, excavators, and other heavy machinery.

Customers in agriculture and construction face demanding operating conditions, requiring components that can withstand extreme temperatures, dust, moisture, and heavy loads. Gates' focus on engineering reliable and long-lasting solutions directly addresses these needs, ensuring operational continuity and minimizing downtime for their clients.

Sales performance within these industries can be notably influenced by cyclical economic trends. For instance, a slowdown in new construction projects or a downturn in agricultural commodity prices can directly impact the demand for new equipment and, consequently, the need for Gates' components. In 2024, the global construction market experienced varying growth rates, with some regions showing resilience while others faced headwinds due to inflation and interest rate hikes, impacting capital expenditure on new machinery.

- Agriculture: This sector utilizes Gates' belts, hoses, and hydraulics for critical functions in farming equipment, from engine power to material handling.

- Construction: Heavy machinery in construction, such as bulldozers, cranes, and loaders, depends on Gates' durable fluid power and power transmission systems for performance and longevity.

- Demand Drivers: Infrastructure spending, agricultural output, and global economic growth are key factors influencing demand in these segments.

- Product Requirements: Customers prioritize reliability, durability, and performance under harsh environmental and operational conditions.

Personal Mobility and Consumer Applications

This segment encompasses manufacturers and end-users involved in personal mobility, like e-bikes, and a wide array of consumer goods such as printers, power washers, and automated doors. These diverse applications often demand highly specialized, compact, and energy-efficient power transmission components. In 2024, the global e-bike market alone was projected to reach over $40 billion, highlighting the significant demand for reliable and advanced components in this area.

Gates serves this market by providing durable and efficient belt drive systems and other power transmission solutions. These products are engineered for longevity and optimal performance in demanding consumer environments. For instance, Gates' carbon belt drives offer a maintenance-free alternative to traditional chains in e-bikes, a key selling point for consumers seeking convenience and reliability.

- E-bike Market Growth: The e-bike sector is a significant driver, with global sales expected to continue their upward trajectory, creating substantial opportunities for component suppliers.

- Consumer Durables Demand: Everyday applications like power washers and automatic doors also represent a steady demand for robust and efficient power transmission, benefiting from Gates' established product lines.

- Component Specialization: The need for compact, lightweight, and high-performance solutions in personal mobility and consumer electronics necessitates specialized engineering, which Gates addresses through its product development.

- Maintenance-Free Solutions: Consumer preference for low-maintenance products, such as Gates' belt drives, further strengthens its position in this segment by offering a clear value proposition.

Gates Industrial serves a diverse customer base, including Original Equipment Manufacturers (OEMs) who integrate Gates' components into new machinery and vehicles, and the industrial aftermarket, which relies on Gates for replacement parts to maintain operational uptime. The automotive aftermarket, encompassing vehicle owners and repair shops, also represents a substantial segment driven by routine maintenance needs.

Key sectors like agriculture and construction depend on Gates for robust solutions that withstand harsh conditions, while the personal mobility and consumer goods market, particularly e-bikes, showcases demand for specialized, efficient power transmission. These segments collectively highlight Gates' broad reach across various industries and applications.

Cost Structure

Manufacturing and production costs are a substantial component of Gates Industrial's expenses. These include the direct costs of raw materials like rubber, synthetic fibers, and steel, alongside labor and factory overhead. In 2023, Gates reported cost of sales of $3.1 billion, highlighting the significant investment in production.

Gates Industrial invests heavily in research and development to drive innovation in new product creation, materials science advancements, and engineering breakthroughs. These R&D efforts are a significant operating expense, crucial for staying ahead in the competitive industrial sector and bringing cutting-edge solutions to customers.

In 2023, Gates Industrial reported R&D expenses of $163.1 million, representing 2.7% of their total revenue. This substantial investment underscores their commitment to developing next-generation products and technologies, such as advanced materials for high-performance belts and hoses, and innovative solutions for fluid power systems.

Selling, General, and Administrative (SG&A) expenses for Gates Industrial are a significant component, covering everything from reaching customers to running the company’s headquarters. This includes the costs associated with their sales force, various marketing initiatives to promote their products, and the logistics of getting those products to market.

In 2023, Gates Industrial reported SG&A expenses of $906.8 million. This figure reflects investments in brand building, customer support, and the operational backbone that keeps the business functioning smoothly.

Effectively managing these SG&A costs is paramount for Gates Industrial to maintain and enhance its profitability. By optimizing marketing spend and streamlining administrative processes, the company can improve its bottom line and allocate resources more strategically for future growth.

Logistics and Distribution Costs

Gates Industrial's global footprint necessitates substantial investment in logistics and distribution. Managing the movement of goods across over 130 countries involves significant freight expenses, customs duties, and the upkeep of an extensive network of warehouses and distribution centers. In 2023, for instance, the company reported approximately $3.7 billion in selling, general, and administrative expenses, a portion of which is directly attributable to these complex logistical operations.

Optimizing these supply chain elements is crucial for cost efficiency. Areas of focus include streamlining transportation routes, improving inventory management within distribution centers, and leveraging technology to enhance visibility and reduce transit times. These efforts directly impact the company's bottom line by minimizing operational overhead.

- Freight and Transportation: Costs associated with shipping raw materials and finished goods globally.

- Warehousing and Storage: Expenses for maintaining a network of distribution centers to store inventory.

- Customs and Duties: Fees incurred when importing and exporting products across international borders.

- Inventory Management: Costs related to tracking, managing, and optimizing stock levels to meet demand efficiently.

Capital Expenditures

Capital expenditures are crucial for Gates Industrial to keep its operations running smoothly and to grow. This includes spending money on maintaining and improving its factories, buying new equipment, and investing in new technologies. These investments are key to increasing how much they can produce and making their manufacturing processes more efficient.

For 2025, Gates is planning to spend around $120 million on capital expenditures. This significant investment will go towards ensuring their facilities are up-to-date and that they have the latest machinery to meet market demands.

- Facility Maintenance and Upgrades: Ongoing costs to ensure manufacturing plants are in optimal condition.

- Machinery and Equipment Purchases: Investing in new or upgraded machinery to enhance production capabilities and efficiency.

- Technological Advancements: Allocating funds for new technologies that can improve product quality or manufacturing processes.

- 2025 Capital Expenditure Forecast: Gates Industrial anticipates approximately $120 million in capital expenditures for the upcoming year.

Gates Industrial's cost structure is dominated by manufacturing and administrative expenses. The company's significant investment in R&D and global logistics also contributes substantially to its overall cost base. Managing these expenditures effectively is key to maintaining profitability and driving future growth.

| Cost Category | 2023 Expense (Millions USD) | % of Revenue |

|---|---|---|

| Cost of Sales | 3,100 | ~52% |

| R&D Expenses | 163.1 | 2.7% |

| SG&A Expenses | 906.8 | ~15% |

| Capital Expenditures (2025 Forecast) | 120 | N/A |

Revenue Streams

Revenue generated from the sale of power transmission products, including belts, sprockets, and related components, forms a significant revenue stream for Gates Industrial. These essential parts are crucial for a wide array of applications, from heavy industrial machinery to the intricate workings of automotive engines.

In 2024, the company reported Power Transmission net sales of approximately $2.1 billion. This figure underscores the substantial market demand and the critical role these products play across various sectors of the global economy.

Gates Industrial generates substantial revenue through the sale of fluid power products. These include essential components like hoses, couplings, and pre-assembled fluid transfer systems. These products are vital for the efficient operation of hydraulic and fluid handling systems across a wide array of industrial and mobile equipment.

In 2024, the Fluid Power segment was a significant contributor to Gates Industrial's financial performance, with net sales reaching approximately $1.3 billion. This highlights the strong demand and market presence of their fluid power solutions.

Original Equipment Manufacturer (OEM) sales are a cornerstone of Gates Industrial's revenue, representing about one-third of their total sales. This segment involves direct sales to manufacturers who integrate Gates' components into new equipment and vehicles. These relationships are often solidified through long-term contracts, underscoring Gates' role as a trusted, specified supplier in the manufacturing process.

Replacement Market (Aftermarket) Sales

Gates Industrial's largest revenue stream originates from the replacement market, often referred to as the aftermarket. This segment is crucial, encompassing sales of products for maintenance, repair, and overhaul (MRO) activities across both industrial and automotive sectors.

This aftermarket focus means Gates benefits from a consistent demand as existing equipment requires upkeep and part replacements. The company leverages a robust network of distributors and resellers to reach these customers effectively.

In fact, nearly two-thirds of Gates' total sales are generated from these replacement markets. This significant portion underscores the stability and recurring nature of this revenue base, providing a solid foundation for the company's financial performance.

- Dominant Revenue Source: Aftermarket sales are the primary driver of Gates Industrial's revenue.

- Product Scope: This includes MRO products for industrial and automotive applications.

- Distribution Channels: Sales are facilitated through a network of distributors and resellers.

- Revenue Stability: Approximately two-thirds of Gates' sales come from the replacement market, ensuring recurring income.

Innovation and Value-Added Services

Gates Industrial leverages its extensive expertise to offer value-added services, creating additional revenue streams beyond its core product sales. These services include technical consulting, application engineering, and the development of specialized solutions tailored to customer needs, all of which capitalize on Gates' intellectual property.

A significant focus is placed on new sustainable solutions. These offerings not only address growing customer demand for environmentally conscious options but also provide tangible cost savings and operational benefits, further enhancing their appeal and revenue potential.

- Technical Consulting: Providing expert advice on product application and system optimization.

- Application Engineering: Designing and customizing solutions for specific industrial challenges.

- Sustainable Solutions: Developing and marketing products that offer environmental benefits and cost reductions, such as advanced belting technologies for improved fuel efficiency in vehicles. For instance, Gates' continuous innovation in lightweight, high-performance belts can contribute to fuel savings, a key value proposition for fleet operators.

Gates Industrial's revenue streams are diverse, primarily driven by product sales and complemented by value-added services. The company's strategic approach ensures a robust financial performance across various market segments.

The company's commitment to innovation is evident in its growing portfolio of sustainable solutions. These offerings cater to the increasing market demand for environmentally friendly products that also deliver economic advantages, such as enhanced energy efficiency and reduced operational costs for customers.

In 2024, Gates Industrial's commitment to these diversified revenue streams yielded strong results, with total net sales reaching approximately $3.4 billion, showcasing the effectiveness of their business model in capturing market opportunities.

| Revenue Stream | 2024 Net Sales (Approx.) | Key Products/Services |

|---|---|---|

| Power Transmission | $2.1 billion | Belts, sprockets, related components |

| Fluid Power | $1.3 billion | Hoses, couplings, fluid transfer systems |

| Aftermarket (Replacement) | ~ $2.3 billion (Two-thirds of total sales) | MRO products for industrial and automotive |

| OEM Sales | ~ $1.1 billion (One-third of total sales) | Components integrated into new equipment |

| Value-Added Services | Included within product sales and separate fees | Technical consulting, application engineering, custom solutions |

Business Model Canvas Data Sources

The Gates Industrial Business Model Canvas is informed by a blend of internal financial reports, market intelligence from industry analysts, and competitive landscape assessments. This multi-faceted approach ensures each component accurately reflects operational realities and strategic opportunities.