Gates Industrial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gates Industrial Bundle

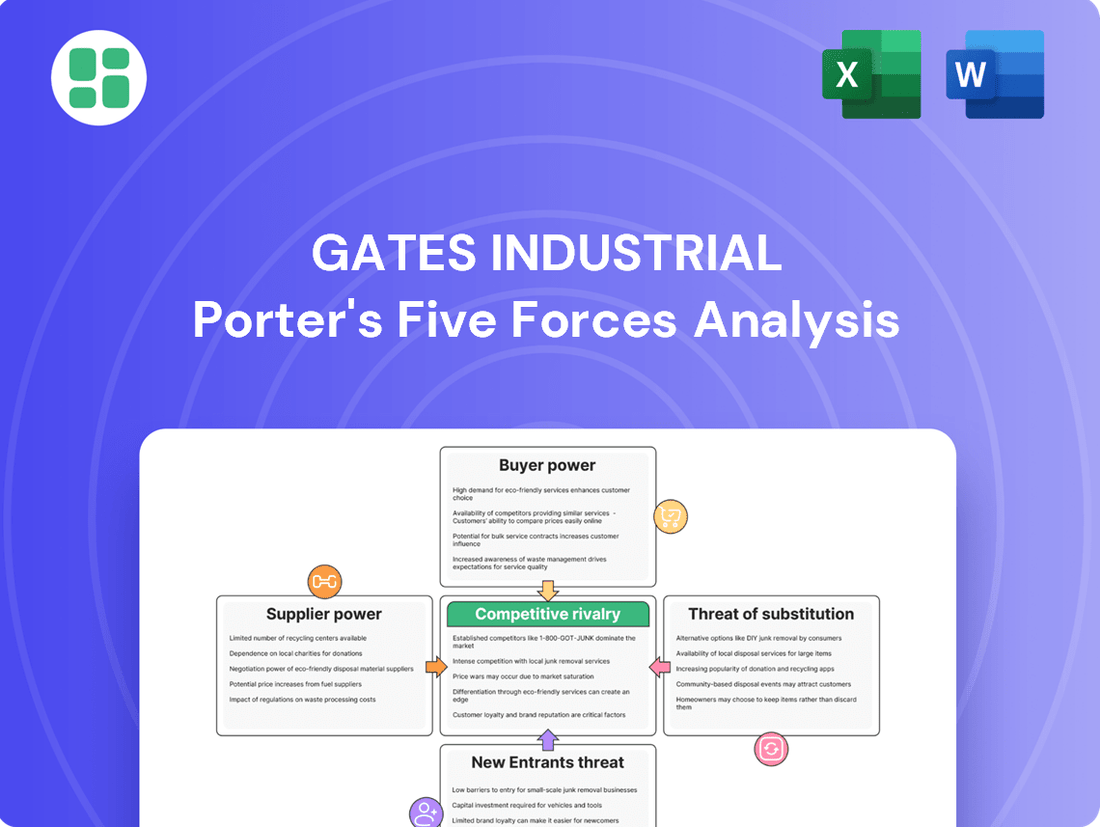

Gates Industrial operates within a competitive landscape shaped by several key forces. Understanding the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry is crucial for strategic planning.

The complete report reveals the real forces shaping Gates Industrial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gates Industrial, a key player in power transmission and fluid power, depends on materials like rubber, specialty chemicals, and metals. Supplier bargaining power escalates significantly when these inputs are scarce, highly specialized, or sourced from a limited number of dominant providers.

The global economic landscape, including trade policies, directly impacts this. For instance, the imposition of tariffs on essential imports, such as synthetic rubber and plastic resins, as seen in recent trade disputes, can inflate production expenses for companies like Gates. This cost pressure can, in turn, amplify the leverage of suppliers, potentially compelling manufacturers to absorb higher prices or pass them on to consumers.

The cost and complexity for Gates to switch suppliers for critical components significantly influence supplier power. If changing suppliers necessitates substantial retooling, rigorous quality control recalibrations, or lengthy requalification procedures, existing suppliers gain considerable leverage. For instance, Gates' reliance on specialized, high-performance materials for its industrial products, such as advanced alloys for hydraulic pumps, can make supplier transitions extremely costly and time-consuming.

Suppliers gain leverage when they offer inputs that are unique or significantly differentiated, especially if these are critical for Gates Industrial's specialized product lines. For example, if a limited number of suppliers can provide proprietary rubber compounds essential for Gates' high-performance belts or advanced composite materials for their industrial hoses, these suppliers would possess substantial bargaining power. Gates' emphasis on developing highly engineered solutions naturally increases its dependence on such specialized and often proprietary inputs.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into manufacturing power transmission or fluid power components themselves could indeed boost their leverage. This scenario is more plausible for specialized component makers who hold unique intellectual property. For instance, a supplier of a critical, proprietary bearing might explore manufacturing the final assembly if they believe they can capture more value.

However, the significant capital investment and the need to establish a strong market presence present substantial hurdles to such forward integration. Consider the high costs associated with setting up advanced manufacturing facilities for power transmission components, which can easily run into tens or hundreds of millions of dollars. Furthermore, breaking into an established market dominated by players like Gates Industrial requires considerable time and resources to build brand recognition and distribution networks.

- Supplier Forward Integration Risk: While a theoretical threat, suppliers integrating forward into power transmission component manufacturing is generally a high-barrier entry.

- Proprietary Technology as a Driver: Suppliers with unique, proprietary technology are more likely to consider forward integration to capture greater value.

- Capital Intensity and Market Entry: The substantial capital required for manufacturing and the challenge of competing with established players like Gates Industrial limit the feasibility of this threat.

- Limited Real-World Impact: For most raw material or standard component suppliers, the threat of forward integration is minimal due to these economic and market realities.

Importance of Gates to Suppliers

The bargaining power of suppliers for Gates Industrial is influenced by how crucial Gates is to a supplier's overall business. If Gates accounts for a large chunk of a supplier's sales, that supplier might have less room to dictate terms. However, if Gates is just one of many clients for a supplier, its individual influence diminishes.

Gates Industrial's vast global reach, operating in over 130 countries, positions it as a significant customer for many of its suppliers. This scale likely provides Gates with leverage, helping to temper the bargaining power of individual suppliers. For instance, in 2023, Gates reported approximately $4.7 billion in revenue, indicating substantial purchasing volume across its diverse product lines.

- Revenue Dependence: Suppliers heavily reliant on Gates' business may have reduced bargaining power.

- Customer Diversification: If Gates is a small client for a large supplier, its individual leverage is lower.

- Global Scale: Gates' presence in over 130 countries suggests significant purchasing power, potentially offsetting supplier influence.

- 2023 Financials: Gates' reported revenue of around $4.7 billion in 2023 underscores its substantial presence in the supply chain.

Suppliers' bargaining power for Gates Industrial is amplified when their products are critical and difficult to substitute, especially if they possess unique technology. This is evident in the need for specialized rubber compounds for high-performance belts, where limited suppliers can dictate terms.

The cost and time involved in switching suppliers for specialized inputs, like advanced alloys for hydraulic pumps, significantly enhance supplier leverage. Gates' substantial global revenue, around $4.7 billion in 2023, provides some counter-leverage, but dependence on niche suppliers remains a key factor.

While supplier forward integration is a theoretical risk, high capital requirements and market entry barriers for power transmission components make it a low probability for most. Proprietary technology is the most significant driver for suppliers to consider such moves.

| Factor | Impact on Gates Industrial | Supporting Data/Examples |

| Input Scarcity/Specialization | Increased supplier power | Reliance on proprietary rubber compounds and advanced alloys. |

| Switching Costs | Increased supplier power | High costs for retooling and quality recalibration for specialized components. |

| Supplier Diversification | Reduced supplier power | Gates' large customer base may limit individual supplier leverage. |

| Gates' Scale | Reduced supplier power | Revenue of ~$4.7 billion in 2023 indicates significant purchasing volume. |

| Forward Integration Threat | Low probability for most suppliers | High capital investment and market entry barriers. |

What is included in the product

This analysis dissects the competitive forces impacting Gates Industrial, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its industries.

Instantly visualize the competitive landscape for Gates Industrial with a dynamic, interactive Porter's Five Forces model, simplifying complex strategic pressures.

Customers Bargaining Power

The bargaining power of customers for Gates Industrial is notably influenced by customer concentration and purchase volume. If Gates serves a limited number of large, key customers, such as major automotive original equipment manufacturers (OEMs) or substantial industrial equipment producers, their leverage increases significantly.

These substantial clients often represent a considerable portion of Gates' revenue. For instance, in 2024, a substantial percentage of Gates' sales are directed towards OEMs, who, due to their sheer purchasing volume, can effectively negotiate for lower prices, more favorable contract terms, or even demand bespoke product modifications to suit their specific needs.

When it's easy and inexpensive for Gates Industrial's customers to switch to a rival's offerings, their ability to negotiate better terms goes up. For specialized parts like engineered belts and hoses, switching can involve significant costs such as re-engineering, rigorous testing, and the risk of production interruptions.

However, Gates' products often fit into natural replacement cycles, particularly in the aftermarket for ongoing maintenance. This suggests that for routine replacements, the switching costs for customers might be relatively low, further empowering their bargaining position.

Gates Industrial leverages product differentiation as a key strategy to mitigate the bargaining power of its customers. By focusing on superior performance, unwavering quality, and continuous technological innovation, Gates aims to create offerings that stand out in the market.

The company manufactures highly engineered solutions designed to significantly improve efficiency and operational performance for its clients. This focus on differentiated value makes Gates' products less susceptible to direct substitution and, consequently, reduces customer sensitivity to price changes.

For instance, in the industrial hydraulics sector, Gates' advanced hose and coupling technologies, which offer enhanced durability and higher pressure ratings, command a premium. This differentiation allows Gates to maintain stronger pricing power, even with large industrial buyers who might otherwise exert significant pressure.

Threat of Backward Integration by Customers

Customers can leverage their bargaining power by threatening to produce critical components in-house, particularly if they possess substantial manufacturing capabilities. This threat of backward integration is a significant consideration in supplier-customer relationships.

For Gates Industrial, the specialized engineering and complex manufacturing processes involved in producing belts, hoses, and related fluid power and power transmission components make backward integration economically unfeasible for the vast majority of its customers. While extremely large original equipment manufacturers (OEMs) might explore such options for certain parts, the high capital investment and technical know-how required are typically prohibitive.

- Customer Bargaining Power: Threat of Backward Integration

- Customers may threaten to produce components themselves if they are critical and the customer has significant manufacturing capabilities.

- The specialized engineering and manufacturing expertise for Gates' products makes backward integration economically unfeasible for most customers.

- For example, the complex rubber compounding and precision molding for automotive belts or hydraulic hoses demand specific knowledge not readily available to most end-users or even many OEMs.

Price Sensitivity of Customers

Customer price sensitivity for Gates Industrial products hinges on how significant the component's cost is within the customer's overall expenses. For instance, if a Gates hydraulic pump represents a small fraction of a large industrial machine's total build cost, customers are less likely to haggle over its price.

The importance of Gates' components to the customer's final product also plays a crucial role. In sectors like aerospace or heavy manufacturing, where component failure can lead to catastrophic consequences, customers often prioritize Gates' renowned quality and reliability over seeking the absolute lowest price, thereby lowering their price sensitivity.

- Cost as a Percentage of Total Product Cost: If Gates' products constitute a minor expense in a customer's larger project, price sensitivity decreases.

- Component Criticality: When Gates' components are vital for a customer's product performance or operational efficiency, customers exhibit lower price sensitivity.

- Switching Costs: High switching costs for customers to adopt alternative suppliers can also reduce their price sensitivity towards Gates.

The bargaining power of Gates Industrial's customers is moderated by the company's successful product differentiation and the high switching costs associated with its specialized engineered solutions. While some customers, particularly large OEMs, can exert pressure due to purchase volume, Gates' focus on superior performance and reliability in areas like industrial hydraulics and automotive components often reduces price sensitivity. The threat of backward integration is largely mitigated by the complex manufacturing processes and technical expertise required for Gates' products, making it economically unfeasible for most customers.

| Factor | Impact on Customer Bargaining Power | Gates Industrial's Mitigation Strategy |

|---|---|---|

| Customer Concentration & Volume | High for large OEMs | Product differentiation, value-added services |

| Switching Costs | Moderate to Low (aftermarket) | Emphasis on integrated solutions, brand loyalty |

| Threat of Backward Integration | Low | Specialized engineering and manufacturing expertise |

| Price Sensitivity | Lower for critical, high-performance components | Superior quality, reliability, and innovation |

What You See Is What You Get

Gates Industrial Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive analysis delves into the competitive landscape of Gates Industrial, meticulously examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You can trust that the insights presented here are precisely what you'll gain access to, empowering your strategic decision-making.

Rivalry Among Competitors

The power transmission and fluid power sectors where Gates Industrial operates are characterized by a significant number of substantial global competitors. Companies such as Parker-Hannifin, Timken, and ITT are prominent players, demonstrating a concentrated yet competitive market structure.

This presence of multiple large, established firms, in addition to a host of smaller, niche specialists, fuels a high degree of competitive rivalry. For instance, Parker-Hannifin, a major competitor, reported revenues of approximately $14.3 billion in fiscal year 2023, highlighting the scale of the players Gates must contend with.

A slower industry growth rate typically fuels more intense competition among existing players. When the overall market isn't expanding rapidly, companies often fight harder for every sale to maintain or increase their market share. This dynamic can lead to price wars or increased marketing spend.

The fluid power industry, for instance, has seen a downturn with declining shipment trends observed in late 2024 and continuing into early 2025. Projections for 2025 indicate a flat or slightly declining market, creating a more challenging environment where rivalry for customer business is significantly amplified.

Gates Industrial's competitive rivalry is significantly influenced by product differentiation and the associated switching costs. While Gates emphasizes highly engineered, application-specific solutions, the perceived uniqueness of these products by customers and the effort required to change suppliers play a crucial role in shaping competition. If customers view Gates' offerings as interchangeable, price-based competition intensifies.

Gates' strategic approach to counter this involves enhancing service levels and expanding its product range. This aims to create a stronger perceived value and make it more challenging for customers to switch to competitors. For instance, in 2024, Gates reported a revenue of $3.7 billion, demonstrating its market presence and the scale of its differentiated offerings.

Exit Barriers

High exit barriers can significantly increase competitive rivalry. When it's difficult or costly for companies to leave an industry, even unprofitable ones may remain, continuing to compete fiercely for market share. This is particularly true in capital-intensive sectors like the manufacturing of fluid power and power transmission components, where specialized assets and significant investments make exiting the market a challenging prospect.

For a company like Gates Industrial, operating in this space means facing potential rivals who are locked into the industry due to these high exit barriers. These barriers can include:

- Specialized Assets: Manufacturing facilities and machinery for fluid power and power transmission are often highly specialized and have limited alternative uses, making them difficult to sell or repurpose.

- Long-Term Contracts: Existing supply agreements or customer commitments can obligate companies to continue operations even if they are not generating optimal returns.

- Employee Severance Costs: Significant costs associated with laying off a specialized workforce can deter companies from closing down operations.

- Brand Reputation and Customer Loyalty: The effort and time invested in building a brand and customer relationships can also act as a deterrent to exiting the market.

Strategic Commitments of Competitors

Competitors in the industrial sector, including those in fluid power, often demonstrate strong strategic commitments. These commitments can involve substantial investments in research and development, the establishment of new manufacturing facilities, or aggressive market expansion initiatives. Such actions frequently signal a competitive intent to gain or maintain market share, thereby intensifying the rivalry.

The fluid power industry, for instance, is witnessing continuous innovation. Companies are investing heavily in smart technologies, such as IoT integration for predictive maintenance and enhanced control, and in solutions focused on energy efficiency. For example, Parker Hannifin, a major player, has consistently highlighted its R&D spending, which in fiscal year 2023 reached $481.5 million, demonstrating a commitment to technological advancement and product development to stay ahead.

- Significant R&D Investment: Competitors are channeling substantial funds into developing next-generation fluid power technologies, including advanced hydraulics and pneumatics.

- New Facility Development: Investments in modern manufacturing plants and supply chain infrastructure are being made to increase production capacity and improve operational efficiency.

- Market Expansion Strategies: Companies are pursuing growth through geographic expansion and by entering new application segments within the industrial market.

- Focus on Smart and Efficient Solutions: Innovation is heavily directed towards integrating digital capabilities and improving energy efficiency in fluid power systems.

The competitive rivalry within Gates Industrial's operating sectors is intense, driven by numerous large, established global players like Parker-Hannifin and Timken, alongside many smaller, specialized firms. This dynamic is amplified by a slower industry growth rate, particularly noted in the fluid power sector with flat to declining market projections for 2025, forcing companies to fight harder for market share.

The perceived differentiation of products and associated switching costs significantly influence this rivalry; if Gates' offerings are seen as interchangeable, price competition escalates. Gates counters this by enhancing service and expanding its product range, as evidenced by its $3.7 billion revenue in 2024, aiming to increase perceived value and customer stickiness.

High exit barriers, such as specialized assets and long-term contracts in this capital-intensive industry, keep competitors engaged even in challenging market conditions, intensifying rivalry. Strategic commitments, including substantial R&D investments like Parker Hannifin's $481.5 million in fiscal year 2023, further fuel this competition through continuous innovation and market expansion.

SSubstitutes Threaten

The threat of substitutes for Gates Industrial's offerings, particularly in power transmission and fluid power, is intensifying. A key concern is the price-performance trade-off offered by these alternatives. For example, as electrification gains traction in industrial machinery and automotive sectors, it presents a viable substitute to traditional hydraulic and mechanical systems. In 2024, the global electric vehicle market saw significant growth, with sales reaching approximately 17 million units, indicating a growing acceptance of electrified powertrains which could reduce demand for certain hydraulic components.

Customer willingness to adopt substitutes for Gates Industrial's products hinges on tangible benefits. If alternative fluid power or power transmission solutions offer significant cost savings, seamless integration into existing systems, or demonstrably superior performance or sustainability features, customers will be more inclined to switch.

The evolving landscape of industrial technology presents potential substitutes. For instance, advancements in digital fluid power, which promises greater precision and energy efficiency, or smart pneumatic systems offering enhanced control and monitoring, could lure customers away from traditional options. Electro-hydraulic alternatives also represent a growing area that might challenge Gates' market share if they deliver compelling advantages.

For 2024, the industrial automation market, a key sector for Gates, saw continued investment in efficiency and sustainability. Companies are actively seeking solutions that reduce energy consumption, with some studies indicating potential energy savings of up to 30% with advanced digital control systems in hydraulics, directly impacting the cost-benefit analysis for customers considering substitutes.

Rapid technological advancements are significantly increasing the threat of substitutes for traditional industrial components. For instance, the development of more efficient electric motors and advanced battery technologies in 2024 offers compelling alternatives to hydraulic and pneumatic systems, potentially reducing demand for Gates Industrial's core products.

The integration of the Internet of Things (IoT), artificial intelligence (AI), and widespread electrification within industrial automation presents new substitute solutions. These technologies can perform functions previously reliant on mechanical or hydraulic power transmission, impacting sectors where Gates Industrial has a strong presence.

In 2024, the global industrial automation market is projected to reach over $200 billion, with a substantial portion driven by these emerging technologies. This growth highlights the increasing viability and adoption of substitutes that could displace conventional components.

Indirect Substitution through System Redesign

Customers may not simply swap one belt for another, but rather rethink their entire machinery setup. This means they could engineer their systems to bypass the need for belts and hoses entirely. For instance, advancements in direct-drive motor technology or novel energy transfer mechanisms in industrial equipment present a significant indirect substitution threat to Gates Industrial's traditional product lines.

This strategic shift by customers to eliminate belt-driven components can be seen as a more profound threat than direct product-for-product substitution. It fundamentally alters the demand landscape for Gates' core offerings.

- System Redesign Threat: Customers can re-engineer machinery to eliminate the need for belts and hoses.

- Direct Drive Alternatives: Technologies like direct-drive motors offer a belt-free power transfer solution.

- Energy Transfer Innovation: New methods of transferring energy in machinery can bypass traditional belt systems.

- Impact on Gates: These indirect substitutions directly challenge the demand for Gates Industrial's established product portfolio.

Regulatory and Environmental Factors

Increasingly stringent environmental regulations and a growing global emphasis on sustainability are compelling industries to explore and adopt alternative technologies. This shift directly impacts the fluid power sector, as companies seek more energy-efficient and eco-friendly solutions.

The push for sustainability, particularly in areas like hydraulic systems, is a significant trend. For instance, the development and adoption of eco-friendly hydraulic fluids and the broader move towards electrification in industrial machinery represent key substitutes driven by these environmental concerns. By 2024, many manufacturers are investing heavily in research and development for these greener alternatives, anticipating a market where compliance and environmental performance are paramount.

- Growing Demand for Eco-Friendly Hydraulics: The market for environmentally friendly hydraulic fluids is projected to see substantial growth, with some reports indicating a compound annual growth rate (CAGR) of over 5% in the coming years, driven by regulatory pressures and corporate sustainability goals.

- Electrification as a Substitute: In many applications, electric-powered systems are increasingly seen as a viable substitute for traditional hydraulic systems, offering potential energy savings and reduced environmental impact. The global industrial automation market, which includes electrification solutions, was valued in the hundreds of billions of dollars in 2024.

- Regulatory Impact on Fluid Power: Regulations concerning emissions, fluid biodegradability, and energy consumption are directly influencing the design and material choices within the fluid power industry, pushing innovation towards substitutes that meet these evolving standards.

The threat of substitutes for Gates Industrial's power transmission and fluid power products is escalating due to technological advancements and shifting industry priorities. Electrification, for instance, offers a compelling alternative to traditional hydraulic and mechanical systems, especially as the global electric vehicle market expanded significantly in 2024, reaching approximately 17 million units sold. This trend suggests a growing customer base open to electrified powertrains, potentially reducing demand for certain hydraulic components.

Customers are increasingly willing to adopt substitutes when offered clear advantages in cost, integration, or performance. Advances in digital fluid power and smart pneumatic systems, promising greater precision and efficiency, are emerging as direct competitors. In 2024, the industrial automation market, a key sector for Gates, saw continued investment in efficiency, with some digital control systems in hydraulics offering potential energy savings of up to 30%, directly influencing the cost-benefit analysis for customers considering alternatives.

Beyond direct product replacement, customers are re-engineering machinery to bypass traditional belt and hose systems entirely. Direct-drive motor technology and novel energy transfer mechanisms represent significant indirect substitution threats. The industrial automation market, valued in the hundreds of billions of dollars in 2024, is a strong indicator of the growing adoption of these advanced, often electric-driven, solutions that can displace conventional components.

Entrants Threaten

The power transmission and fluid power sectors, where Gates Industrial operates, demand significant upfront investment. Manufacturing advanced components requires substantial capital for state-of-the-art facilities, specialized machinery, and ongoing research and development to stay competitive. For instance, establishing a new, modern manufacturing plant for engineered components can easily run into tens or even hundreds of millions of dollars.

Established players like Gates Industrial leverage significant economies of scale, particularly in manufacturing and global procurement. This allows them to command lower per-unit production costs. For instance, in 2024, Gates Industrial's extensive supply chain network likely enabled them to negotiate more favorable terms with suppliers compared to a new entrant.

Newcomers would face a substantial hurdle in matching these cost efficiencies. Achieving comparable volume to spread fixed costs across a larger production base would require immense upfront investment, making price competition a formidable challenge for any aspiring competitor in the industrial products sector.

Gates Industrial benefits from deeply entrenched global distribution networks, reaching customers in over 130 countries across both replacement markets and original equipment manufacturers (OEMs). This extensive reach, built over years, represents a significant barrier for any new competitor seeking to establish a similar presence.

New entrants would need to invest heavily and spend considerable time forging relationships with distributors and OEMs worldwide. The cost and effort involved in replicating Gates' established network are substantial, making it difficult for newcomers to gain comparable access to these vital sales channels.

Proprietary Technology and Expertise

Gates Industrial's focus on highly engineered solutions presents a significant barrier to new entrants due to its reliance on proprietary technology and deep technical expertise. Developing comparable levels of engineering know-how and protecting intellectual property, such as patents in power transmission and fluid power, requires substantial investment and time. This specialization creates a formidable hurdle for potential competitors aiming to enter the market with comparable product offerings and performance standards.

The threat of new entrants is considerably mitigated by the high capital requirements and specialized knowledge needed to replicate Gates Industrial's established technological capabilities. For instance, the intricate design and manufacturing processes for advanced belt drives and fluid power components demand significant upfront investment in research and development, as well as specialized manufacturing equipment. This financial and technical commitment deters many smaller or less capitalized firms from entering the same competitive space.

- Proprietary Technology: Gates Industrial holds numerous patents related to material science and product design in its core segments, making it difficult for new entrants to offer equivalent performance without infringing on existing intellectual property.

- Technical Expertise: The company's long-standing history and continuous investment in R&D have cultivated a deep pool of specialized engineering talent, a resource that is time-consuming and costly for new players to develop.

- High R&D Spending: In 2023, Gates Industrial invested over $200 million in research and development, underscoring the significant ongoing commitment required to maintain its technological edge, a figure that new entrants would need to match or exceed.

Brand Identity and Customer Loyalty

An established brand like Gates, renowned for its reliability and performance in demanding industrial applications, enjoys significant customer loyalty. This trust, built over years of consistent product quality and service, presents a substantial hurdle for newcomers. For instance, in the automotive aftermarket, where Gates has a strong presence, brand recognition plays a crucial role in purchasing decisions, often outweighing minor price differences.

New entrants face the daunting task of replicating this hard-won reputation. They would need to commit substantial resources to marketing campaigns and ensuring superior product quality to even begin to erode Gates' established customer preference. In 2024, the industrial components market continues to see brand loyalty as a key differentiator, with companies like Gates leveraging their long-standing relationships to maintain market share.

- Brand Loyalty: Gates' reputation for durability in sectors like power transmission and fluid transfer fosters repeat business.

- Marketing Investment: New entrants must allocate significant capital to build brand awareness and communicate product superiority.

- Quality Perception: Overcoming the perception that established brands offer inherently better quality requires demonstrable proof and consistent performance.

- Customer Trust: In critical applications, customers are often hesitant to switch from a trusted supplier, even for potential cost savings.

The threat of new entrants for Gates Industrial is significantly low due to substantial capital requirements for manufacturing and R&D, coupled with established economies of scale that lower per-unit costs for incumbents. Replicating Gates' extensive global distribution networks and proprietary technology, built over decades, also presents a formidable barrier. Furthermore, strong brand loyalty and customer trust in critical industrial applications make it challenging for newcomers to gain market traction.

| Barrier to Entry | Impact on New Entrants | Gates Industrial Advantage (2024) |

|---|---|---|

| Capital Requirements | High; significant investment needed for facilities and machinery. | Established, scaled manufacturing operations. |

| Economies of Scale | Difficult to match; higher per-unit costs for smaller volumes. | Lower production costs due to high output and procurement power. |

| Distribution Networks | Costly and time-consuming to build; requires forging many relationships. | Global reach in over 130 countries, serving OEMs and aftermarket. |

| Proprietary Technology & Expertise | Requires substantial R&D investment and time to develop comparable capabilities. | Patented technologies and deep engineering talent cultivated over years. |

| Brand Loyalty & Reputation | Challenging to build; requires significant marketing and proven quality. | Renowned for reliability, fostering repeat business and customer trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gates Industrial leverages data from financial reports, industry-specific market research, and trade association publications. This ensures a comprehensive understanding of competitive intensity and industry structure.