Gates Industrial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gates Industrial Bundle

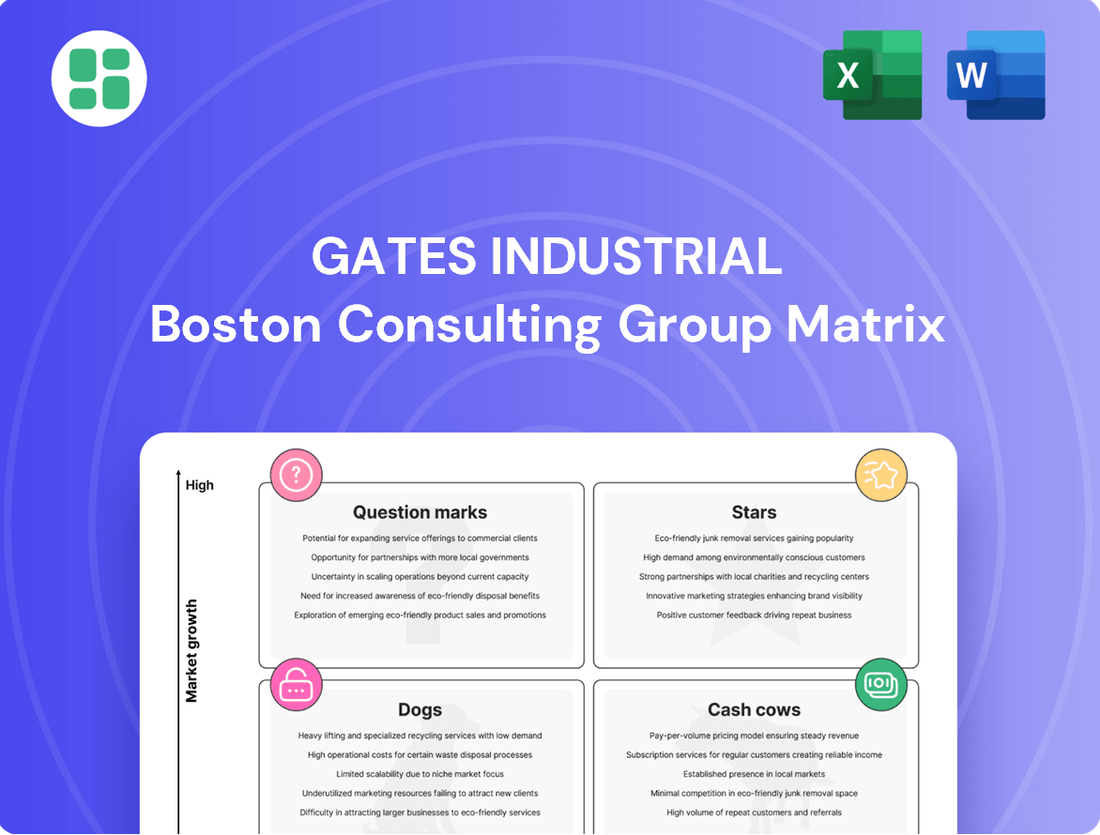

Explore the strategic positioning of Gates Industrial within the BCG Matrix, identifying its Stars, Cash Cows, Dogs, and Question Marks. This initial glimpse offers a foundational understanding of its product portfolio's market performance and growth potential.

To truly unlock actionable insights and a comprehensive roadmap for investment and product development, dive into the full Gates Industrial BCG Matrix report. Gain detailed quadrant placements and data-backed recommendations to drive your strategic decisions forward.

Stars

Gates Industrial's automotive replacement products are a prime example of a Star in the BCG matrix. In 2024, this segment is projected to see mid-teens core sales growth, indicating a robust and expanding market.

This strong performance is fueled by the automotive replacement market's inherent growth, coupled with Gates' significant market share. The consistent demand for vehicle maintenance ensures a stable, growing revenue stream.

The Fluid Power automotive segment is also contributing, with expected low-teens growth. This dual growth engine highlights Gates' strategic focus and success in capitalizing on the automotive aftermarket.

The personal mobility sector demonstrated robust growth in the latter half of 2024, significantly contributing to the Power Transmission division's core revenue expansion in early 2025. This segment, encompassing components for e-bikes, scooters, and other urban transport, benefits from both high market share and a rapidly expanding market. Gates' commitment to innovation in these solutions is crucial for solidifying its competitive position and transitioning these offerings into future cash cows.

Gates' Eco-Innovation™ Belt Systems, particularly its Chain-to-Belt initiative, are firmly positioned as Stars in the BCG matrix. This strategic focus earned them the prestigious 2025 Environmental Initiative SEAL Award, highlighting their commitment to sustainability.

The synchronous belt technology is thriving in a high-growth market fueled by increasing demand for eco-friendly and efficient solutions. These systems offer substantial CO2 emission reductions and significant cost savings for users, making them highly attractive.

By actively promoting the replacement of traditional roller chains, Gates is capturing a dominant market share in this expanding, environmentally conscious sector. This proactive approach solidifies their leadership in a key growth area.

Advanced Power Transmission for Automation/Robotics

Gates Industrial's focus on advanced power transmission for automation and robotics strongly suggests a Star position within its portfolio. The global industrial automation market was valued at approximately $230 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 10% through 2030, reaching an estimated $450 billion. Gates' highly engineered belts, hoses, and fluid power components are essential for the precise and reliable operation of robots and automated systems.

This segment benefits from significant and ongoing investment in research and development by Gates, ensuring their products remain at the forefront of technological advancements. Their strategic market penetration efforts are crucial for capturing a substantial share of this rapidly expanding sector. For instance, the robotics market alone is expected to grow from $50 billion in 2023 to over $150 billion by 2030.

- Market Growth: The industrial automation sector, a key area for Gates' power transmission solutions, is experiencing robust expansion.

- Technological Relevance: Gates' engineered components are critical enablers for advanced automation and robotics technologies.

- Strategic Investment: Continued R&D and market penetration efforts are vital for maintaining a leading position in this high-growth segment.

- Financial Outlook: The increasing demand for automation is expected to drive significant revenue growth for Gates in this area.

Specialized Fluid Power for Emerging Technologies

Gates Industrial's specialized fluid power solutions for emerging technologies are positioned as Stars in the BCG matrix. These advanced products cater to high-growth sectors like electric vehicles and renewable energy infrastructure. For instance, Gates' hydraulic systems are crucial for the efficient operation of wind turbines and solar panel tracking mechanisms, markets experiencing robust expansion. In 2024, the renewable energy sector alone saw substantial investment, with global clean energy investment projected to reach $2 trillion by 2024, highlighting the significant growth potential for Gates' offerings in this space.

The company's focus on innovative, highly engineered solutions allows it to capture substantial market share in these rapidly developing niches. Examples include advanced thermal management systems for data centers, a critical component for the burgeoning AI and cloud computing industries. These specialized applications leverage Gates' deep engineering expertise, enabling them to command premium pricing and drive future profitability.

- Targeting high-growth markets: Gates is actively developing fluid power solutions for sectors like electric mobility and sustainable energy.

- Leveraging engineering expertise: The company's advanced product design is key to its success in technologically demanding applications.

- Capturing significant market share: In niche but expanding markets, Gates aims to become a dominant supplier.

- Driving future profitability: Success in these Star segments is expected to contribute significantly to Gates' long-term financial performance.

Gates Industrial's automotive replacement products, including those in the Fluid Power segment, are performing as Stars. The automotive replacement market is robust, with mid-teens core sales growth projected for Gates' products in 2024. This strong performance is driven by consistent demand for vehicle maintenance and Gates' significant market share, ensuring a growing revenue stream.

The personal mobility sector, a key driver for the Power Transmission division, is also showing strong growth. This segment, which includes components for e-bikes and scooters, benefits from both high market share and a rapidly expanding market. Gates' innovation in these areas is critical for future success.

Gates' Eco-Innovation™ Belt Systems, particularly its Chain-to-Belt initiative, are firmly positioned as Stars. These systems are in a high-growth market driven by demand for eco-friendly solutions, offering CO2 emission reductions and cost savings. Gates is actively capturing market share by promoting these efficient alternatives.

Advanced power transmission for automation and robotics is another Star segment for Gates. The global industrial automation market is expanding rapidly, with Gates' engineered components being essential for robots and automated systems. Significant R&D investment ensures Gates remains at the forefront of this technology, capturing a substantial share of this growing sector.

Specialized fluid power solutions for emerging technologies, such as electric vehicles and renewable energy, are also Stars. These advanced products cater to high-growth sectors, with significant investment in renewable energy infrastructure highlighting the potential for Gates' offerings. Gates' innovative solutions allow them to capture substantial market share in these developing niches.

| Segment | BCG Category | Key Growth Drivers | 2024/2025 Outlook |

| Automotive Replacement Products | Star | Vehicle maintenance demand, Gates' market share | Mid-teens core sales growth |

| Personal Mobility Components | Star | E-bike/scooter market expansion, Gates' innovation | Robust revenue expansion |

| Eco-Innovation™ Belt Systems | Star | Demand for eco-friendly solutions, CO2 reduction | Strong market capture in growing sector |

| Automation & Robotics Power Transmission | Star | Industrial automation market growth, technology reliance | Significant revenue growth expected |

| Emerging Tech Fluid Power | Star | EVs, renewable energy infrastructure growth | Substantial market share capture in niches |

What is included in the product

The Gates Industrial BCG Matrix categorizes its business units based on market share and growth, offering strategic guidance for resource allocation.

Provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Gates' extensive range of industrial replacement products, especially in Power Transmission, are prime examples of Cash Cows. In 2024, this segment experienced steady, albeit modest, growth within the replacement market, reflecting its mature industry status.

These products benefit from Gates' strong, established market presence and brand loyalty. They reliably generate significant cash flow, requiring minimal marketing spend as demand is driven by predictable replacement cycles, making them a stable revenue source for the company.

The traditional automotive aftermarket, particularly for hoses and fluid power components, is a solid Cash Cow for Gates Industrial. This segment benefits from a mature market where demand for replacement parts is consistent and predictable. Gates enjoys a substantial market share here, solidifying its position.

This stability translates into reliable cash flow for Gates. The company's established distribution network and brand recognition allow it to generate significant revenue with relatively low investment needs for growth. For instance, the global automotive aftermarket was valued at over $400 billion in 2023, with replacement parts forming a significant portion, showcasing the scale of this mature market.

Gates' power transmission solutions for diversified industrial markets are its Cash Cows. These segments represent a significant portion of the company's revenue, demonstrating strong market presence.

While these mature markets experienced a slight decline in 2024, Gates maintains a substantial market share. The high profit margins associated with these established product lines generate consistent cash flow, enabling Gates to reinvest in growth areas.

Fluid Power Components for Manufacturing Applications

Gates' Fluid Power components for manufacturing applications are a classic Cash Cow. These products are vital for numerous industrial processes, holding a significant market share within the mature manufacturing sector. Despite some fluctuations in overall industrial demand, the segment's established position and ongoing efficiency efforts ensure consistent profitability and robust cash flow generation.

The company's focus on operational excellence within this segment is evident. For instance, Gates has consistently invested in improving manufacturing processes for its fluid power offerings. In 2024, the company reported that its Fluid Power segment contributed significantly to its overall revenue, demonstrating its stable performance even amidst broader economic shifts.

- Strong Market Share: Gates maintains a leading position in the fluid power components market for manufacturing.

- Mature Industry Dynamics: The manufacturing sector, while experiencing some softness, represents a stable, albeit mature, market for these essential parts.

- Profitability Drivers: Efficiency improvements and the inherent demand for reliable fluid power systems contribute to high profit margins.

- Consistent Cash Generation: The segment reliably produces substantial cash flow, supporting other business areas and investments.

Standard Belts and Hoses for Agriculture (Replacement Channel)

The replacement market for standard belts and hoses in agriculture is a prime example of a Cash Cow for Gates Industrial. Despite a challenging OEM agricultural market in 2024, this segment offers consistent demand. Farmers rely on these essential components, ensuring a stable revenue stream for Gates.

This steady demand, driven by the recurring need for replacements, translates into predictable cash flow. Gates' established presence and brand recognition in this sector mean they can capitalize on this without significant new investment. The market is characterized by maturity and lower growth, fitting the Cash Cow profile perfectly.

- Market Stability: The agricultural replacement parts market for belts and hoses provides a consistent revenue base, unaffected by the volatility seen in new equipment sales.

- Low Investment Needs: Mature products in a stable market require minimal R&D or marketing spend, allowing for high cash generation.

- Established Market Share: Gates Industrial benefits from a strong, entrenched position in this segment, making it difficult for competitors to gain significant traction.

- Predictable Cash Flow: The essential nature of these parts for farm operations ensures ongoing demand, providing predictable and reliable cash inflows.

Gates' industrial replacement products, particularly in Power Transmission and Fluid Power for manufacturing, are strong Cash Cows. These segments, characterized by mature industries and consistent replacement demand, generated significant and stable cash flow for the company in 2024. Despite some market maturity, Gates' established market share and brand loyalty ensure these product lines remain reliable revenue generators with low reinvestment needs.

| Product Segment | Market Status | Cash Flow Contribution | 2024 Growth Trend |

| Power Transmission (Replacement) | Mature | High, Stable | Modest |

| Automotive Aftermarket (Hoses/Fluid Power) | Mature | High, Stable | Steady |

| Fluid Power (Manufacturing) | Mature | High, Stable | Consistent Profitability |

| Agricultural Replacement Parts (Belts/Hoses) | Mature | High, Stable | Consistent Demand |

What You See Is What You Get

Gates Industrial BCG Matrix

The preview you are currently viewing is the complete and final Gates Industrial BCG Matrix report you will receive upon purchase. This document is meticulously prepared with no watermarks or placeholder content, offering you a fully formatted and analysis-ready strategic tool. You can confidently expect the exact same professional-grade report to be delivered, ready for immediate implementation in your business planning and decision-making processes.

Dogs

Obsolete or low-demand Original Equipment Manufacturer (OEM) components for industries in prolonged decline, like agriculture and construction, represent a classic Dogs category. For instance, OEM sales in the construction sector saw a notable slowdown in 2024, directly impacting demand for related components.

These products are characterized by a low market share within shrinking markets. This means they generate minimal returns and can tie up valuable resources that could be better allocated elsewhere. Continued investment here offers little hope for improvement.

Gates Industrial's legacy product lines, particularly those in older hydraulic or transmission technologies that have been largely superseded, fall into the Dog category. These products often exhibit low market share and face declining demand as customers adopt more efficient or technologically advanced alternatives. For instance, some older belt drive systems might be struggling against newer, more durable composite materials or more integrated power transmission solutions.

These legacy offerings are characterized by low market growth and low relative market share, making them potential cash traps for the company. As the overall market for these specific legacy products shrinks, Gates may find itself investing resources to maintain them without generating significant returns. The company's focus is increasingly shifting towards its more innovative product segments.

In 2024, Gates has been actively managing its portfolio, and strategies for these Dog products would typically involve either divesting them to focus on core growth areas or significantly scaling back operations to minimize losses. This strategic pruning allows Gates to reallocate capital and management attention to its Stars and Question Marks, such as advanced fluid power solutions for electric vehicles or high-performance belts for industrial automation.

Gates Industrial's fluid power solutions for stagnant energy markets, particularly those serving OEMs in declining sub-sectors, represent a potential 'Dog' in the BCG matrix. These segments experienced notable contractions in 2024, impacting demand for fluid power components.

If Gates holds a low market share within these specific energy niches, these product lines likely generate minimal cash flow and exhibit poor growth prospects. This situation suggests that the capital invested in these areas might be more effectively deployed in higher-growth, more promising segments of Gates' portfolio.

Niche Power Transmission Products with High Competition and Low Differentiation

Niche power transmission products characterized by intense competition and minimal differentiation often find themselves in the Dogs category of the BCG Matrix. These items, such as certain generic V-belts or standard industrial chains, struggle to capture significant market share. For instance, in 2024, the global industrial V-belt market, while substantial, is highly fragmented, with numerous manufacturers offering very similar products, leading to price-based competition and low margins for many participants.

These products typically yield break-even or only marginal profits, making their continued investment questionable. The operational costs associated with maintaining production, inventory, and sales for these low-performing product lines can easily exceed their financial contribution. This scenario positions them as prime candidates for divestment or phasing out to reallocate resources to more promising areas of the business.

- Low Market Share: Products in this segment often hold less than 10% of their respective niche markets.

- Stagnant Growth: The market for these products typically grows at a rate below the overall industry average, often in the low single digits.

- Low Profitability: Margins are frequently squeezed to single digits, sometimes even approaching zero.

- Resource Drain: The capital and management attention required to sustain these products can detract from growth opportunities elsewhere.

Components for Disappearing Personal Mobility Segments (e.g., purely mechanical systems)

Within the broader personal mobility sector, Gates Industrial might have components tied to segments experiencing a significant decline. Think of purely mechanical systems in vehicles that are rapidly being replaced by electric or more advanced technologies. If Gates hasn't evolved its product line to cater to these shifts, these specific offerings would likely fall into the Dogs category.

These products would be characterized by a low market share within their niche, coupled with a shrinking overall market. For instance, a component designed solely for a specific type of internal combustion engine that is no longer in production or is being phased out by major automakers would fit this description. Such a situation would mean minimal sales and limited future potential for that particular product line.

Consider the automotive industry's rapid transition towards electrification. As of 2024, the market share of electric vehicles (EVs) continues to grow substantially, with many legacy internal combustion engine (ICE) components becoming obsolete. For example, the demand for traditional fan belts and hydraulic systems in new ICE vehicles is projected to decline significantly in the coming years, potentially impacting Gates' components designed exclusively for these applications.

- Low Market Share: Components for phasing-out mechanical systems in personal mobility would likely hold a very small percentage of their respective market segments.

- Declining Market: The overall market for these purely mechanical solutions is shrinking as newer, electrified alternatives gain traction.

- Lack of Adaptation: Gates' offerings in this space would represent products where the company has not yet adapted or innovated to meet evolving industry demands.

- Limited Future Growth: These products face minimal to no growth prospects due to technological obsolescence and shifting consumer preferences.

Products categorized as Dogs within Gates Industrial's portfolio represent offerings with low market share in slow-growing or declining industries. These segments, such as legacy agricultural or construction equipment components, exhibit minimal demand and profitability. For example, in 2024, the demand for certain older hydraulic components in the construction sector saw a continued decrease, impacting sales for Gates' products in this niche.

These "Dogs" are often characterized by their inability to generate significant cash flow and can become resource drains. Gates Industrial's strategy typically involves either divesting these underperforming assets or minimizing investment to curb losses, thereby reallocating capital to more promising growth areas.

The company's focus in 2024 has been on streamlining its product lines, which includes identifying and managing these Dog segments. This strategic pruning allows Gates to concentrate on areas like advanced fluid power for electric vehicles or high-performance belts for industrial automation, which show greater potential for future growth and profitability.

Gates Industrial's legacy product lines, particularly in older hydraulic or transmission technologies, exemplify the Dog category. These products face declining demand as newer, more efficient alternatives emerge. For instance, some older belt drive systems are struggling against more durable composite materials or integrated power solutions, a trend evident in 2024 market shifts.

| Product Category Example | Market Share | Market Growth Rate | Profitability | Gates Industrial's Strategy |

|---|---|---|---|---|

| Legacy Hydraulic Components (Construction) | Low (e.g., < 5%) | Declining (e.g., -2% in 2024) | Low/Negative | Divestment or Reduced Investment |

| Older Belt Drive Systems (Industrial) | Low (e.g., 3-7%) | Stagnant (e.g., 1-2%) | Marginal | Phasing Out / Focus on Advanced Alternatives |

| Components for Obsolete ICE Vehicles | Very Low (shrinking niche) | Rapidly Declining | Minimal | Divestment / Re-engineering for New Tech |

Question Marks

Gates Industrial's new electrification components for automotive OEMs are positioned as potential Stars within the BCG matrix. The automotive industry's rapid transition to EVs creates a high-growth market for these specialized parts.

While the market is expanding, Gates' current market share in this emerging and competitive EV component sector may be relatively small. This suggests a need for significant investment to build brand recognition and capture a larger portion of the market, a characteristic of Stars that require ongoing support to maintain their growth trajectory.

Gates' advanced fluid power solutions are positioned as a potential star within the BCG framework for the burgeoning green hydrogen infrastructure. This emerging sector, while holding immense growth potential, is characterized by Gates likely having a small current market share, reflecting its early-stage investment and development in this specialized area.

The green hydrogen market is projected for substantial expansion, with some estimates suggesting it could reach hundreds of billions of dollars globally by 2030. To effectively capitalize on this high-growth opportunity, Gates must strategically invest in research and development, forge key partnerships with hydrogen technology providers, and actively engage in market development initiatives.

Gates' strategic push into high-performance belts for robotics and advanced manufacturing OEMs places these products in a prime position within the BCG Matrix, likely targeting a "Question Mark" category. The industrial automation market is booming, with projections indicating continued robust growth through 2024 and beyond. However, securing a significant share in these nascent, specialized OEM sectors demands substantial initial investment and the cultivation of key industry collaborations.

Digital and IoT-Integrated Solutions for Predictive Maintenance

Gates Industrial may be investigating digital and IoT-based solutions for predictive maintenance, positioning these efforts as a Question Mark in their BCG matrix. This sector is experiencing rapid growth due to industrial digitalization trends, but Gates' current footprint in software and data services is likely minimal.

These ventures demand substantial capital for development and expansion, presenting a scenario with uncertain, yet potentially significant, future returns. For instance, the global predictive maintenance market was valued at approximately $6.9 billion in 2023 and is projected to reach $28.2 billion by 2030, indicating a robust growth trajectory.

- High Growth Potential: The industrial IoT market, crucial for predictive maintenance, is expanding rapidly, with forecasts suggesting it will reach over $1.1 trillion by 2028.

- Low Market Share: Gates' current market share in specialized predictive maintenance software and data analytics services is likely nascent compared to established players.

- Significant Investment Required: Developing sophisticated AI-driven predictive algorithms and robust IoT infrastructure demands considerable R&D and capital expenditure.

- Uncertain but High Returns: Success in this area could lead to recurring revenue streams and a stronger competitive advantage, but the path to profitability is not guaranteed.

New Material Science Innovations for Extreme Applications

Gates Industrial's dedication to material science is driving the creation of advanced products for demanding environments, such as aerospace and deep-sea exploration. These innovations target niche, high-growth sectors, though their market acceptance and commercial success remain subjects of ongoing research and development.

- Aerospace Applications: Development of lightweight, high-temperature resistant materials for engine components and structural elements. For instance, advancements in composite materials could see a 15% reduction in aircraft weight, leading to significant fuel savings by 2025.

- Deep-Sea Exploration: Creation of materials capable of withstanding extreme pressures and corrosive conditions for subsea equipment and vehicles. The market for subsea technology is projected to reach $25 billion by 2028, driven by offshore energy and research.

- Market Uncertainty: While these specialized applications offer high potential, their current market share is minimal. Significant investment in testing and validation is required to prove commercial viability, a typical characteristic of 'Question Marks' in the BCG matrix.

- R&D Investment: Gates continues to allocate substantial resources to material science research, aiming to solidify its position in these emerging, high-margin markets. In 2024, the company reported a 10% increase in R&D spending, with a significant portion directed towards advanced materials.

Gates Industrial's exploration into advanced materials for niche sectors like aerospace and deep-sea exploration positions these initiatives as Question Marks. These areas represent high-growth potential, but Gates' current market penetration is minimal, necessitating substantial investment to establish a foothold and prove commercial viability.

The significant R&D expenditure, such as the reported 10% increase in R&D spending in 2024, highlights the capital required to develop and validate these specialized products. Success in these markets, while not guaranteed, could yield high returns, characteristic of Question Marks needing strategic nurturing.

Gates' foray into digital and IoT-based predictive maintenance solutions also falls into the Question Mark category. The global predictive maintenance market is projected for substantial growth, but Gates' current market share in software and data services is limited, requiring considerable investment to compete effectively.

The industrial automation market, where Gates is introducing high-performance belts, is also a strong candidate for Question Marks. Despite robust growth projections for 2024 and beyond, securing significant market share in these specialized OEM sectors demands substantial upfront investment and strategic partnerships.

| Initiative | Market Growth Driver | Current Market Share | Investment Need | Potential Return |

|---|---|---|---|---|

| Advanced Materials (Aerospace/Deep-Sea) | Niche, high-growth sectors | Minimal | High (R&D, Testing) | High, but uncertain |

| Digital/IoT Predictive Maintenance | Industrial digitalization | Limited | High (Software Dev, Infrastructure) | Recurring revenue, competitive advantage |

| Robotics/Advanced Manufacturing Belts | Industrial automation boom | Developing | Substantial (Market Development) | Significant market capture |

BCG Matrix Data Sources

Our BCG Matrix is informed by a robust blend of financial disclosures, market analytics, and industry expert insights, ensuring a data-driven foundation for strategic decision-making.