Gates Industrial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gates Industrial Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Gates Industrial's trajectory. Our expertly crafted PESTLE analysis provides the essential intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain a decisive advantage in your strategic planning.

Political factors

Global trade policies, including tariffs and trade agreements, directly impact Gates Industrial's supply chain and the cost of its raw materials. For example, as of early 2024, ongoing trade tensions between major economies continue to create uncertainty, potentially leading to higher import duties on key components. This can directly affect Gates' cost of goods sold and necessitate a review of its global sourcing strategies.

The US-China trade relationship, a significant factor for many industrial manufacturers, has seen fluctuating tariff rates impacting various goods. These shifts can force companies like Gates to re-evaluate their sourcing locations, potentially accelerating reshoring or nearshoring initiatives. Such strategic adjustments can influence where Gates manufactures and sources its components, ultimately affecting operational efficiency and overall profitability.

Geopolitical instability, exemplified by ongoing conflicts in Eastern Europe and the Middle East, significantly impacts global supply chains. These disruptions can lead to increased transportation costs and scarcity of essential raw materials, directly affecting manufacturers like Gates. For instance, the ongoing conflict in Ukraine has continued to strain global energy and commodity markets throughout 2024, impacting shipping routes and material availability.

Gates, as a global manufacturer with operations and suppliers worldwide, is inherently exposed to these geopolitical risks. Production delays and elevated operational expenses are direct consequences of supply chain disruptions. The company's reliance on a global network means that regional conflicts can ripple through its entire manufacturing and distribution process, affecting product availability and profitability.

In response, companies are prioritizing supply chain resilience. This involves diversifying suppliers, increasing inventory levels for critical components, and exploring nearshoring or reshoring options. For Gates, building a more robust and agile supply chain is crucial to mitigate the financial and operational impacts of an unpredictable geopolitical landscape, a trend that gained further momentum in 2024 as companies reassessed their global dependencies.

Government industrial policies significantly shape the operational landscape for companies like Gates. For instance, the US Inflation Reduction Act (IRA), enacted in 2022, offers substantial tax credits and incentives for clean energy manufacturing and adoption, potentially driving demand for Gates' products in sectors like electric vehicles and renewable energy infrastructure. This act allocated over $370 billion towards climate and energy security initiatives, directly impacting manufacturing investments.

Regulatory Environment Stability

The stability of the regulatory landscape is paramount for Gates Industrial, given its global manufacturing and distribution footprint. Fluctuations in trade policies, environmental standards, and labor laws across its key operating regions, including North America, Europe, and Asia, can significantly impact operational costs and market access. For instance, changes in tariffs or import/export regulations directly affect the cost of raw materials and the competitiveness of its finished goods. A predictable regulatory environment fosters confidence for long-term capital investments in new facilities or technology upgrades, which is essential for Gates' growth strategy.

In 2024, Gates, like many industrial manufacturers, is navigating a complex web of evolving regulations. For example, the European Union's ongoing efforts to harmonize product safety standards and its focus on sustainability initiatives, such as the upcoming Ecodesign for Sustainable Products Regulation (ESPR), require continuous adaptation. Gates' ability to maintain compliance across diverse jurisdictions, from adhering to REACH chemical regulations in Europe to navigating differing emissions standards in the United States and China, directly influences its operational efficiency and market penetration. The company's proactive approach to monitoring and adapting to these changes is a key factor in mitigating risks and capitalizing on opportunities presented by regulatory shifts.

The stability of the regulatory environment directly impacts Gates Industrial's operational costs and strategic planning.

- Increased Compliance Costs: Frequent regulatory changes, such as those related to emissions or material sourcing, can necessitate costly adjustments to manufacturing processes and supply chains.

- Operational Complexity: Navigating differing regulations across countries, like the varying safety standards for industrial components in the US versus the EU, adds layers of complexity to Gates' global operations.

- Investment Certainty: A stable regulatory framework provides the predictability needed for Gates to commit to long-term investments in research and development or new production facilities, supporting sustained growth and innovation.

Nationalism and Protectionism

Rising economic nationalism and protectionist policies globally present a significant challenge for Gates Industrial. For instance, the US imposed tariffs on steel and aluminum imports in 2018, impacting manufacturing costs for many industries, including those Gates serves. This trend can erect barriers to market entry and necessitate local content requirements, potentially forcing Gates to adapt its global supply chains and production strategies.

These shifts can lead to increased operational costs and complexity for Gates. The company might need to invest in new manufacturing facilities or partnerships in different regions to comply with local sourcing mandates. This localization drive could alter Gates' established operational model, which has historically relied on globalized production and efficient cross-border logistics.

- Increased Tariffs: Many nations have raised tariffs on imported goods, impacting the cost of raw materials and finished products for companies like Gates.

- Local Content Rules: Governments are increasingly mandating that a certain percentage of products sold within their borders must be manufactured locally.

- Supply Chain Reconfiguration: Protectionist measures may compel Gates to diversify its supplier base and potentially shorten its supply chains to mitigate risks.

- Market Access Limitations: Trade barriers can restrict Gates' ability to export its products to certain key markets, affecting revenue streams.

Government stability and the rule of law are foundational for Gates Industrial's operations. In 2024, regions experiencing political unrest or frequent changes in governance pose significant risks, potentially disrupting supply chains and impacting investment decisions. For example, ongoing political instability in certain parts of Africa and the Middle East can affect the availability and cost of raw materials, as well as the security of transportation routes. A stable political environment, conversely, fosters investor confidence and allows for predictable long-term planning, which is crucial for a global industrial manufacturer like Gates.

The impact of government policies on trade, such as tariffs and sanctions, directly influences Gates Industrial's global market access and profitability. As of early 2024, the continuation of certain trade disputes and the imposition of new sanctions by various nations can create significant headwinds. For instance, if a key market imposes new import duties on industrial components, Gates may face increased costs or be forced to seek alternative suppliers, potentially impacting its competitive pricing and market share. The company's ability to navigate these evolving trade landscapes is critical for maintaining its global footprint.

Government industrial policies, including subsidies and incentives for specific sectors, can create both opportunities and challenges for Gates. The push towards green energy and infrastructure development in many countries, supported by government funding and tax credits, presents a growth area for Gates' products. For example, the US Bipartisan Infrastructure Law, with its significant allocation towards modernizing infrastructure, is expected to drive demand for industrial components. Gates' strategic alignment with these government-driven initiatives can unlock new revenue streams and market positions.

What is included in the product

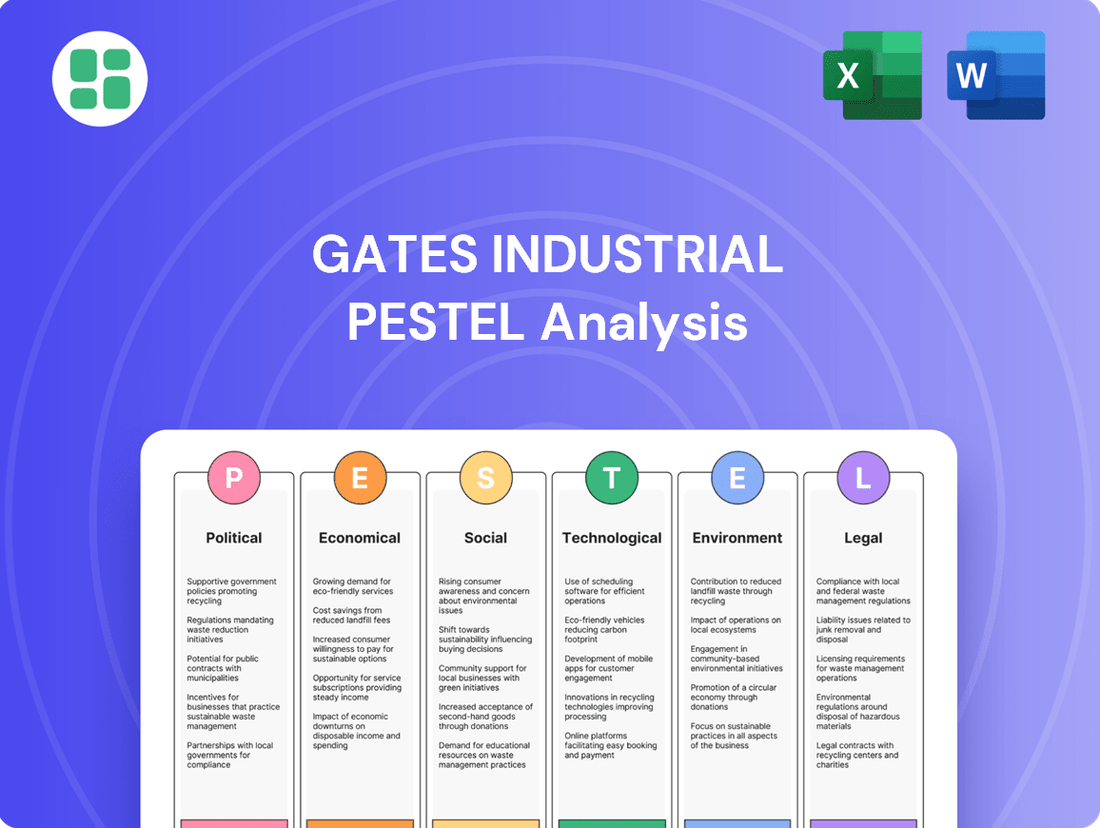

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting Gates Industrial, covering Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and threats.

Provides a concise version of the Gates Industrial PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on external factors impacting the business.

Helps support discussions on external risk and market positioning during planning sessions by summarizing the Gates Industrial PESTLE analysis, thereby alleviating concerns about comprehensive understanding.

Economic factors

Gates Industrial's fortunes are intrinsically linked to the health of the global economy and the pace of industrial production. Its diverse customer base across industrial, automotive, agriculture, and infrastructure sectors means that any slowdown in these areas directly impacts demand for Gates' original equipment and replacement parts.

Through 2024, many of Gates' key end markets have experienced softening demand. For instance, the industrial sector, a significant revenue driver, saw global manufacturing output growth hover around 1.5% in early 2024, a notable deceleration from previous years, according to data from the IMF and OECD.

Looking ahead to 2025, there are indications of a potential rebound, with forecasts suggesting a modest uptick in global industrial output growth to around 2.5%. This projected recovery could provide a much-needed boost to Gates Industrial's sales volumes, particularly in sectors like automotive and infrastructure development.

High inflation and rising interest rates present significant challenges for Gates Industrial. Elevated inflation directly increases operational expenses, impacting the cost of raw materials, energy, and transportation. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in early 2024, reflecting these persistent cost pressures.

Furthermore, the Federal Reserve's efforts to combat inflation through interest rate hikes, with rates reaching multi-year highs in 2023 and remaining elevated into 2024, can dampen demand. Businesses often postpone capital expenditures, like purchasing new industrial machinery, when borrowing costs are high, directly affecting Gates' sales pipeline.

While inflation has shown signs of moderating from its peak, the costs of essential input materials for Gates' manufacturing processes, such as steel and specialized alloys, have remained stubbornly high throughout 2024, squeezing profit margins.

Gates Industrial, like many manufacturers, continues to grapple with elevated supply chain costs. For instance, global shipping rates, while easing from 2021 peaks, remained higher than pre-pandemic levels throughout much of 2024, impacting the cost of raw materials and finished goods. Potential disruptions from geopolitical events, such as trade disputes or regional conflicts, pose ongoing risks to material availability and transportation efficiency.

These persistent challenges directly influence Gates' operational expenses and its capacity to meet customer demand in a timely manner. The company's ability to navigate these complexities is crucial for maintaining its competitive edge and profitability in the 2024-2025 period.

Raw Material Price Volatility

Fluctuations in the prices of essential raw materials like steel, aluminum, and other industrial commodities directly impact Gates' manufacturing expenses and profitability. For instance, the S&P GSCI Industrial Metals Index saw significant swings in 2024, reflecting global supply chain pressures and demand shifts.

Geopolitical events and imbalances between supply and demand are primary drivers of this price volatility. These external forces can rapidly alter the cost of inputs for Gates' products, affecting their competitive pricing and overall financial performance.

To counter these risks, companies like Gates are increasingly focused on diversifying their supplier base. This strategy aims to reduce reliance on single sources and create more resilience against price shocks and supply disruptions.

- Steel prices: Global steel prices experienced an average increase of approximately 15% in the first half of 2024 compared to the same period in 2023, according to industry reports.

- Aluminum costs: Aluminum prices have been volatile, with LME aluminum futures trading within a range of $2,200 to $2,500 per metric ton for much of 2024, influenced by energy costs and production levels in key regions.

- Supply chain diversification: Gates has publicly stated its ongoing efforts to onboard new suppliers in Southeast Asia and Eastern Europe to mitigate risks associated with traditional sourcing regions.

Currency Exchange Rate Fluctuations

As a global player, Gates Industrial’s financial performance is directly influenced by currency exchange rate fluctuations. When earnings from international operations are translated back into its primary reporting currency, unfavorable shifts can significantly reduce reported revenues and profitability. For instance, in Q1 2024, Gates reported that foreign currency headwinds reduced net sales by approximately 0.7% compared to the prior year, highlighting the tangible impact of these movements.

These currency dynamics introduce a layer of financial risk that Gates must actively manage through hedging strategies and careful financial planning. The volatility in major currency pairs, such as the Euro against the US Dollar, can create unpredictable swings in the company's bottom line. For example, the Euro depreciated by roughly 2% against the US Dollar in the first half of 2024, impacting companies with substantial European sales like Gates.

The company's exposure is multifaceted, affecting not only reported profits but also the cost of imported components and the competitiveness of its products in different markets. Effective management of these risks is crucial for maintaining stable financial results and investor confidence.

- Global Operations Exposure: Gates Industrial operates in numerous countries, making it susceptible to currency volatility.

- Impact on Reported Earnings: Unfavorable exchange rate movements can decrease the value of foreign earnings when converted to the reporting currency.

- Financial Risk Management: The company employs strategies to mitigate the impact of currency fluctuations on its financial results.

- Q1 2024 Impact: Foreign currency headwinds reduced Gates' net sales by about 0.7% in Q1 2024.

Economic factors significantly influence Gates Industrial's performance, with global industrial production growth projected to reach around 2.5% in 2025, a slight improvement from the 1.5% seen in early 2024, according to IMF and OECD forecasts. However, persistent inflation, with producer prices for manufactured goods remaining elevated in early 2024, continues to pressure operational costs, impacting raw material and energy expenses. Rising interest rates, maintained at multi-year highs through 2024, also dampen demand for capital expenditures, potentially slowing sales of industrial equipment.

Fluctuations in key commodity prices, such as steel and aluminum, directly affect Gates' manufacturing expenses. For instance, steel prices saw an approximate 15% increase in the first half of 2024 year-over-year, while aluminum prices traded between $2,200 and $2,500 per metric ton for much of the year. These cost pressures are compounded by elevated supply chain expenses, with global shipping rates remaining higher than pre-pandemic levels throughout 2024.

Currency exchange rate volatility also poses a risk, as demonstrated by a roughly 2% depreciation of the Euro against the US Dollar in the first half of 2024, which reduced Gates' net sales by approximately 0.7% in Q1 2024 due to unfavorable currency headwinds.

What You See Is What You Get

Gates Industrial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Gates Industrial delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain a thorough understanding of the external forces shaping Gates Industrial's business landscape, enabling informed strategic planning.

Sociological factors

Gates Industrial faces evolving workforce demographics, with an aging population in many developed nations contributing to a shrinking pool of experienced manufacturing and technical talent. This trend, coupled with a persistent shortage of skilled labor, directly impacts Gates' ability to maintain production levels and integrate advanced technologies. For instance, in 2024, the U.S. manufacturing sector continued to grapple with unfilled positions, with the Manufacturing Institute reporting over 800,000 job openings in the sector alone.

These labor challenges necessitate strategic investments in employee training and development programs to upskill the existing workforce and attract new talent. Furthermore, adopting automation and advanced manufacturing techniques becomes crucial to offset potential capacity constraints and enhance operational efficiency, a trend observed across the industrial sector as companies adapt to these demographic shifts.

Societal expectations for worker well-being are intensifying, pushing companies like Gates Industrial to prioritize health and safety. This means ongoing investment in comprehensive safety programs and strict adherence to protocols to protect employees.

Gates has shown a commitment to improving workplace safety, evidenced by a reported reduction in its Total Recordable Incident Rate (TRIR) by 15% in 2023 compared to 2022. Maintaining these high standards is not only vital for employee health but also for building and preserving a strong corporate image.

Consumers and industries alike are increasingly prioritizing solutions that boost efficiency and overall performance. This societal shift toward optimizing operations directly fuels innovation in areas like power transmission and fluid power systems. For instance, the global industrial automation market, a key sector for Gates, was projected to reach $247.5 billion in 2024, highlighting the significant demand for advanced solutions.

Societal Expectations for Corporate Responsibility

Societal expectations for companies to be good corporate citizens are definitely on the rise. This means more than just making a profit; it includes how ethically a company operates, how it engages with its local communities, and the positive social impact it aims to create. For instance, a 2024 survey by Cone Communications revealed that 79% of consumers consider corporate social responsibility (CSR) when making purchasing decisions.

Gates Industrial actively embraces this by participating in various community initiatives and highlighting environmental stewardship as a core part of its sustainability strategy. This commitment not only bolsters its brand reputation but also plays a significant role in attracting top talent that values socially responsible employers. In 2023, Gates reported contributing over $5 million to community programs and educational initiatives globally.

- Growing consumer demand for ethical practices: Consumers increasingly factor a company's social and environmental record into their buying choices, influencing brand loyalty and market share.

- Talent attraction and retention: A strong CSR profile makes companies more appealing to potential employees, particularly younger generations who prioritize working for organizations with a clear social purpose.

- Enhanced brand reputation and trust: Demonstrating genuine commitment to social responsibility builds trust with stakeholders, including customers, investors, and the public.

- Risk mitigation: Proactive engagement with societal expectations can help companies avoid reputational damage and regulatory scrutiny associated with perceived irresponsibility.

Adaptation to Automation and AI in the Workforce

The increasing integration of automation and artificial intelligence (AI) within the manufacturing sector, a core area for Gates Industrial, is fundamentally reshaping the nature of work. This societal shift necessitates a proactive approach to workforce adaptation, focusing on the development of new skill sets to complement advanced technological systems. For instance, a 2024 report indicated that over 60% of manufacturing tasks could be automated by 2030, highlighting the urgency for reskilling initiatives.

Gates' workforce must embrace continuous learning and development programs to effectively collaborate with AI-powered machinery and sophisticated automation. This includes training in areas like data analysis, robotics operation, and AI system maintenance. By 2025, it's projected that demand for workers with digital skills in manufacturing will rise by 25%, underscoring the need for such programs.

- Reskilling Initiatives: Gates needs to invest in training programs to equip its employees with the skills required to operate and maintain automated systems, a trend accelerated by the pandemic's impact on supply chains and the push for efficiency.

- Labor Relations Impact: The rise of automation can influence labor relations, potentially leading to discussions around job security, wage structures, and the definition of human versus machine roles within the factory environment.

- Skill Gap: A significant skill gap exists, with many manufacturing roles requiring new competencies in digital literacy and advanced technical understanding, a challenge cited by many industry leaders in late 2024 surveys.

Societal expectations for corporate responsibility are growing, pushing companies like Gates Industrial to focus on ethical operations and community engagement. This trend is reflected in consumer purchasing decisions, with a significant portion of buyers considering a company's social and environmental impact, as indicated by a 2024 Cone Communications survey showing 79% of consumers factoring CSR into their choices.

Gates' commitment to community initiatives and sustainability, evidenced by over $5 million contributed to global programs in 2023, not only enhances its brand image but also appeals to talent seeking socially conscious employers. This focus on corporate citizenship is becoming a key differentiator in attracting and retaining skilled employees.

The increasing demand for efficiency and performance across industries directly fuels innovation in Gates' core product areas, such as power transmission and fluid power systems. The industrial automation market, a significant sector for Gates, was projected to reach $247.5 billion in 2024, underscoring the societal drive for optimized operations.

Technological factors

Gates Industrial is heavily influenced by ongoing breakthroughs in power transmission and fluid power. This includes the integration of novel materials, refined designs, and intelligent components that enhance product capabilities. For instance, in 2024, the company continued to emphasize R&D for solutions that boost energy efficiency and extend product lifespan across various industrial applications.

The company's strategy centers on creating products that deliver superior efficiency, robustness, and performance. This translates to advancements in hydraulic and pneumatic systems, alongside the development of next-generation belt and hose technologies. Gates reported a significant increase in sales for its high-performance fluid power components in early 2025, driven by demand for more reliable and efficient industrial machinery.

The manufacturing sector is rapidly embracing Industry 4.0, with widespread adoption of technologies like the Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning. This digital transformation is fundamentally reshaping how products are made, leading to increased automation and data-driven decision-making. For instance, by 2024, it's estimated that over 70% of new industrial machinery will be connected, enabling real-time data exchange.

Gates can capitalize on these advancements to significantly boost its production efficiency. Implementing AI for process optimization and predictive maintenance, which anticipates equipment failures before they occur, can reduce downtime and operational costs. By 2025, companies leveraging predictive maintenance are expected to see a reduction in maintenance costs by up to 25%, according to industry reports.

Furthermore, the integration of digital twins, virtual replicas of physical assets, allows for enhanced product design, simulation, and performance monitoring. This enables Gates to offer more sophisticated, connected solutions to its customers, potentially creating new revenue streams through services like remote diagnostics and performance management. The global digital twin market is projected to reach $71.7 billion by 2028, indicating substantial growth in this area.

The drive for sustainability is a major technological force, pushing innovation towards energy efficiency. Gates' own Eco-Innovation™ process is a prime example, focusing on developing products that lessen environmental impact.

For instance, Gates' belts are engineered to deliver substantial CO2 emission reductions when compared to traditional chain drives, a key selling point in today's market. This aligns directly with increasing customer and regulatory pressure for greener industrial alternatives.

Digitalization and Data Analytics

The industrial sector is rapidly embracing digitalization and advanced data analytics, creating significant opportunities for companies like Gates. By leveraging data generated from its products operating in the field, Gates can gain crucial insights to optimize performance and drive innovation in new product development. This data-driven approach also allows for the creation of enhanced value-added services for customers.

For instance, the adoption of Industrial Internet of Things (IIoT) solutions is projected to grow significantly. A report from MarketsandMarkets in 2024 estimated the IIoT market to reach $111.2 billion by 2025, up from $77.3 billion in 2020, indicating a strong trend towards connected industrial assets. Gates can tap into this by equipping its products with sensors and connectivity to gather real-time operational data.

- Data Utilization: Gates can analyze data on wear patterns, operating conditions, and failure rates from its products to predict maintenance needs, improving uptime for its clients.

- Product Development: Insights from field data can directly inform the design of more durable and efficient components, aligning product roadmaps with actual market demands.

- Service Innovation: Offering predictive maintenance services based on data analytics can create new revenue streams and strengthen customer relationships.

- Competitive Edge: Companies that effectively integrate data analytics into their operations, as seen with industry leaders in predictive maintenance, are better positioned to gain a competitive advantage in the evolving industrial landscape.

Development of Advanced Materials

Gates Industrial's product performance and lifespan are significantly influenced by advancements in materials science. Innovations in areas like high-performance polymers and composite materials are crucial for developing lighter, stronger, and more resilient belts and hoses. These material upgrades directly translate to enhanced product capabilities and the potential for new market applications.

The drive towards more sustainable and efficient manufacturing processes also fuels material innovation. For instance, research into bio-based or recycled composite materials could offer Gates a competitive edge by reducing environmental impact while maintaining or improving product quality. This focus on advanced materials is a key technological factor shaping Gates' product development pipeline.

- Material Innovation: Continued R&D in polymers and composites directly impacts the strength, weight, and durability of Gates' core products.

- Performance Enhancement: New materials allow for belts and hoses that can withstand higher temperatures, pressures, and stresses, expanding their use cases.

- Sustainability Focus: The development of eco-friendly materials, such as those derived from renewable resources or recycled content, is becoming increasingly important.

- Market Differentiation: Superior material properties can provide a significant competitive advantage, enabling premium pricing and market leadership.

Technological advancements are fundamentally reshaping the industrial landscape, driving efficiency and innovation for companies like Gates Industrial. The increasing adoption of Industry 4.0 technologies, such as the Industrial Internet of Things (IIoT) and artificial intelligence (AI), is leading to more automated and data-driven manufacturing processes. By 2024, it's estimated that over 70% of new industrial machinery will be connected, enabling real-time data exchange and predictive maintenance capabilities that can reduce operational costs by up to 25% by 2025.

Gates is strategically positioned to leverage these technological shifts by focusing on R&D for solutions that enhance energy efficiency and product lifespan. The company's emphasis on developing next-generation belt and hose technologies, coupled with advancements in hydraulic and pneumatic systems, has led to a significant increase in sales for high-performance fluid power components in early 2025. Furthermore, the integration of digital twins, which are virtual replicas of physical assets, allows for enhanced product design and performance monitoring, tapping into a global digital twin market projected to reach $71.7 billion by 2028.

Materials science innovations are also critical, with advancements in high-performance polymers and composite materials enabling the development of lighter, stronger, and more resilient products for Gates. This focus on advanced materials, including the exploration of bio-based or recycled composites, is crucial for reducing environmental impact and gaining a competitive edge in a market increasingly driven by sustainability. The company’s Eco-Innovation™ process, for example, highlights the development of products like belts engineered for substantial CO2 emission reductions compared to traditional chain drives, aligning with growing customer and regulatory demands for greener industrial solutions.

| Key Technological Trends | Impact on Gates Industrial | Supporting Data/Projections |

| Industry 4.0 & Digitalization | Increased automation, data-driven decision-making, predictive maintenance, enhanced product design through digital twins. | 70% of new industrial machinery connected by 2024; predictive maintenance reducing costs by up to 25% by 2025; digital twin market to reach $71.7 billion by 2028. |

| Materials Science Advancements | Development of lighter, stronger, more durable belts and hoses; focus on sustainable materials. | Significant sales increase in high-performance fluid power components in early 2025; R&D in bio-based/recycled composites for reduced environmental impact. |

| Energy Efficiency & Sustainability | Development of products that lessen environmental impact and improve energy efficiency. | Gates' belts engineered for substantial CO2 emission reductions compared to chain drives. |

Legal factors

Gates Industrial must navigate a complex web of product safety and quality regulations globally. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) reported over $1.9 billion in recalls, highlighting the significant financial and reputational risks of non-compliance. Adherence to standards like ISO 9001 and specific industry certifications is crucial for maintaining market access and preventing costly liabilities.

The company's commitment to quality directly impacts its operational costs and market competitiveness. Failure to meet stringent automotive safety standards, such as those set by the European Union's General Safety Regulation (GSR), could lead to product rejection and severe penalties. Gates' proactive approach to ensuring its industrial and automotive components meet or exceed these evolving requirements is a key legal imperative.

Gates Industrial faces increasing pressure from evolving environmental regulations globally, impacting areas like emissions, waste management, and the use of specific chemicals. For instance, the European Union's proposed PFAS restriction, aiming to limit thousands of per- and polyfluoroalkyl substances, could significantly affect material sourcing and product design for manufacturers like Gates, requiring substantial investment in compliance and potential product reformulation.

Navigating this complex web of legislation, including updated Environmental Protection Agency (EPA) rules in the United States and new directives from the EU, creates significant compliance and reporting burdens. These regulatory shifts demand continuous monitoring and adaptation, potentially increasing operational costs and requiring robust data collection and disclosure mechanisms to demonstrate adherence.

Intellectual property (IP) protection is paramount for Gates Industrial, a company deeply invested in engineered solutions and product innovation. Strong legal safeguards for patents, trademarks, and trade secrets are vital to maintain its edge against infringement worldwide. Gates actively monitors and enforces these protections to secure its competitive advantage.

Labor Laws and Employment Regulations

Gates Industrial must navigate a complex web of global labor laws, impacting everything from minimum wage requirements to workplace safety standards. For instance, in 2024, the US Department of Labor continued to enforce regulations like the Fair Labor Standards Act (FLSA), which dictates overtime pay and child labor provisions. Failure to comply with these diverse legal frameworks across its manufacturing and distribution centers can result in significant fines and reputational damage.

Changes in employment regulations, such as those concerning unionization or employee benefits, directly influence Gates' operational costs and HR strategies. For example, as of early 2025, several European nations are considering or implementing stricter regulations on contractor classification, potentially increasing labor expenses for companies like Gates that utilize contingent workforces. Adapting to these evolving legal landscapes is crucial for maintaining competitive labor costs and effective workforce management.

Key legal considerations for Gates Industrial include:

- Compliance with minimum wage laws globally, which saw an average increase of 4% across OECD countries in 2024.

- Adherence to workplace safety regulations, with OSHA in the US issuing over 100,000 citations in 2023 for various violations.

- Navigating regulations on collective bargaining and labor relations, impacting employee representation and dispute resolution.

- Staying updated on data privacy laws related to employee information, such as GDPR in Europe, which carries fines up to 4% of annual global turnover.

International Trade Laws and Sanctions

Gates Industrial's global operations necessitate strict adherence to a complex web of international trade laws, customs regulations, and economic sanctions. For instance, in 2024, the United States continued to maintain significant sanctions against countries like Russia and Iran, impacting supply chains and market access for companies with international dealings. Failure to comply can result in substantial fines, reputational damage, and operational disruptions, as seen with various companies facing penalties for violating export controls.

The company must actively monitor evolving geopolitical landscapes that shape trade policies. For example, ongoing trade disputes and the rise of protectionist measures in various regions in 2024 and early 2025 could introduce new tariffs or restrictions on imported components or finished goods. Gates' ability to navigate these changes efficiently is crucial for maintaining cost competitiveness and ensuring the smooth flow of its products across borders.

- Global Trade Compliance: Gates must ensure all international transactions align with regulations in over 30 countries where it operates.

- Sanctions Monitoring: In 2024, the US Treasury Department's Office of Foreign Assets Control (OFAC) actively enforced sanctions, requiring robust internal controls for companies like Gates.

- Supply Chain Resilience: Disruptions due to trade restrictions can impact the availability of critical raw materials, affecting production schedules and delivery times.

- Market Access: Non-compliance can lead to the loss of access to key international markets, limiting revenue growth opportunities.

Gates Industrial must navigate a complex landscape of product safety and quality regulations globally, with significant financial implications for non-compliance. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) reported over $1.9 billion in recalls, underscoring the need for strict adherence to standards like ISO 9001 to avoid costly liabilities and maintain market access.

Adherence to evolving automotive safety standards, such as the EU's General Safety Regulation (GSR), is critical. Failure to meet these requirements can lead to product rejection and severe penalties, making proactive compliance a key legal imperative for Gates' industrial and automotive components.

Environmental regulations concerning emissions, waste management, and chemical usage are increasingly stringent. The EU's proposed PFAS restriction, for example, could necessitate substantial investment in compliance and product reformulation for manufacturers like Gates, impacting material sourcing and design.

Gates Industrial faces increasing legal obligations related to data privacy, particularly concerning employee information. Regulations like GDPR in Europe can impose fines up to 4% of annual global turnover for non-compliance, highlighting the importance of robust data protection practices.

| Legal Area | 2024/2025 Relevance | Potential Impact |

|---|---|---|

| Product Safety & Quality | CPSC recalls exceeded $1.9B in 2024; EU GSR compliance | Financial penalties, reputational damage, market access restrictions |

| Environmental Regulations | EU PFAS restriction proposal | Increased compliance costs, product redesign, supply chain adjustments |

| Labor Laws | US FLSA enforcement; EU contractor classification changes | Increased labor costs, HR strategy adjustments, potential fines |

| Data Privacy | GDPR enforcement | Significant fines (up to 4% global turnover), reputational risk |

Environmental factors

Growing global awareness of climate change is intensifying regulatory scrutiny on industrial emissions. Manufacturers like Gates face increasing pressure to decarbonize, a trend projected to accelerate through 2025 and beyond.

Gates is proactively addressing these pressures by investing in renewable energy sources and implementing energy efficiency measures across its facilities. For instance, in 2023, the company reported a 5% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2022 baseline, a key indicator of its commitment to sustainability.

This strategic focus on decarbonization is not merely a compliance issue but a long-term imperative, influencing operational strategies and capital allocation as the world moves towards a lower-carbon economy.

Gates Industrial faces increasing pressure regarding resource scarcity, particularly for metals and rare earth elements vital for its manufacturing processes. The global demand for critical minerals, like copper and lithium, used in electrification and advanced machinery, continues to rise, potentially impacting availability and price volatility. For instance, the International Energy Agency (IEA) projected in 2024 that demand for critical minerals could surge by 40% by 2040, driven by clean energy technologies.

Environmental regulations and growing societal pressure are compelling industries like Gates Industrial to adopt more robust waste management practices and embrace circular economy principles. This means actively reducing what goes to landfills and finding ways to reuse or recycle materials.

Gates is demonstrating this commitment by aiming to decrease hazardous waste generation and increase the number of zero-waste facilities. For instance, in 2023, the company reported a reduction in its total waste generated, with a specific focus on diverting more waste from landfills through recycling and reuse programs.

A key aspect of this shift involves product design, with an increasing emphasis on creating items that are not only durable but also easier to disassemble and recycle at the end of their life cycle. This forward-thinking approach aligns with global trends towards sustainability and resource efficiency.

Water Usage and Conservation

Water scarcity is a growing concern in many industrial regions, prompting stricter management regulations. This necessitates that companies like Gates Industrial prioritize water conservation. For instance, in 2024, several key manufacturing hubs for industrial equipment experienced below-average rainfall, leading to increased scrutiny on water usage by local authorities.

Gates Industrial is actively implementing strategies to reduce its water footprint. These efforts are particularly focused on facilities located in water-stressed areas. The company aims to minimize its environmental impact by adopting more efficient water usage practices across its global operations.

Key conservation initiatives include:

- Implementing closed-loop water systems in manufacturing processes to recycle and reuse water.

- Upgrading equipment to more water-efficient models, a trend that saw a 15% increase in adoption among industrial manufacturers in 2024.

- Conducting regular water audits to identify and address areas of high consumption.

Customer Demand for Sustainable Products

Customer demand for sustainable products is a significant environmental factor influencing Gates Industrial. Across its various markets, from agriculture to mining, there's a clear upward trend in consumers seeking products with a lower environmental footprint. This is not just a preference; it's becoming a core purchasing criterion.

Gates' Eco-Innovation™ process directly addresses this by focusing on developing solutions that offer tangible environmental benefits. Think about products designed for improved energy efficiency or those that help reduce emissions during operation. For instance, advancements in hydraulic systems that minimize fluid loss or improve operational efficiency can lead to substantial energy savings for end-users, directly aligning with sustainability goals.

This focus on sustainability provides Gates with a distinct competitive advantage. In 2024, for example, the global market for sustainable manufacturing is projected to reach trillions, with a significant portion driven by consumer and business demand for eco-friendly components and systems. Companies like Gates that proactively invest in and highlight their sustainable offerings are better positioned to capture market share and build brand loyalty in this evolving landscape.

- Growing Consumer Preference: Surveys in late 2023 and early 2024 consistently show a majority of consumers are willing to pay more for sustainable products.

- Regulatory Tailwinds: Environmental regulations are tightening globally, pushing industries to adopt more sustainable practices and products, which Gates' innovations support.

- Competitive Differentiation: Companies with strong sustainability credentials, like Gates' Eco-Innovation™, are increasingly favored by B2B customers seeking to meet their own ESG targets.

Intensifying climate change concerns are driving stricter regulations on industrial emissions, pushing companies like Gates to prioritize decarbonization efforts. The company's 2023 progress in reducing greenhouse gas emissions by 5% highlights its commitment to this critical environmental shift.

Resource scarcity, particularly for critical minerals, presents a challenge, with demand projected to surge 40% by 2040 according to the IEA. Gates is also focusing on waste reduction and circular economy principles, aiming to decrease hazardous waste and increase zero-waste facilities.

Water conservation is another key environmental factor, with Gates implementing closed-loop systems and upgrading to water-efficient equipment, a trend seeing 15% adoption growth among manufacturers in 2024.

Customer demand for sustainable products is a significant driver, with Gates' Eco-Innovation™ process developing energy-efficient solutions. This focus provides a competitive edge, as the global sustainable manufacturing market is projected to reach trillions in 2024.

| Environmental Factor | Impact on Gates Industrial | Key Data/Initiative |

| Climate Change & Emissions | Increased regulatory scrutiny, pressure to decarbonize | 5% reduction in Scope 1 & 2 GHG emissions (2023) |

| Resource Scarcity | Potential impact on availability and price volatility of critical minerals | IEA projection: 40% surge in critical mineral demand by 2040 |

| Waste Management & Circularity | Need for robust waste practices and recycling | Focus on reducing hazardous waste and increasing zero-waste facilities |

| Water Management | Stricter regulations on water usage in industrial regions | Implementing closed-loop systems; 15% increase in water-efficient equipment adoption (2024) |

| Customer Demand for Sustainability | Growing preference for eco-friendly products and solutions | Eco-Innovation™ process; Global sustainable manufacturing market valued in trillions (2024 projection) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Gates Industrial is built on a robust foundation of data from leading financial institutions, government agencies, and respected industry analysis firms. We integrate economic indicators, regulatory updates, technological advancements, and socio-cultural trends to provide a comprehensive view.