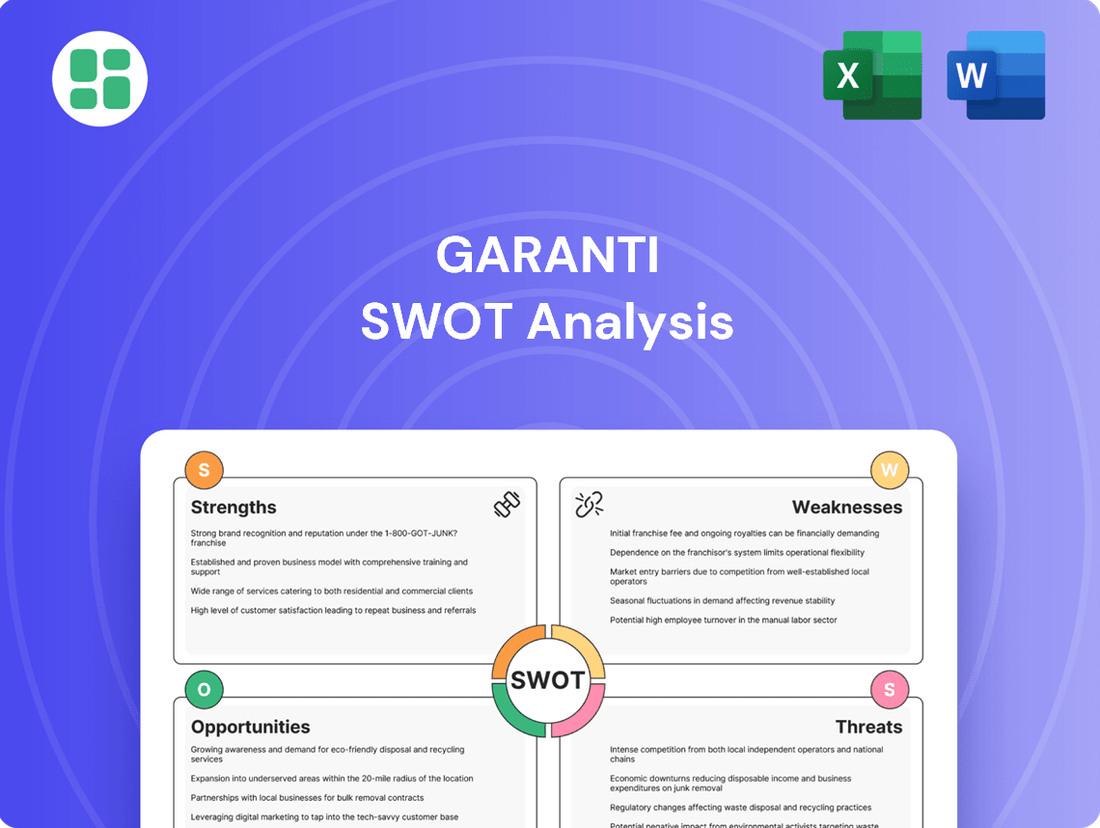

Garanti SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Garanti Bundle

Garanti's robust digital infrastructure and strong brand loyalty are key strengths, but emerging fintech competitors pose a significant threat. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Garanti's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Garanti BBVA boasts an extensive service portfolio, encompassing retail, commercial, corporate, and investment banking. This broad spectrum allows them to serve a diverse clientele, from individual consumers to large corporations, addressing a wide array of financial requirements. For instance, by the end of 2024, Garanti BBVA reported a significant increase in its loan portfolio across all segments, demonstrating the breadth of its service penetration.

Garanti BBVA stands out for its exceptional leadership in digital banking. As of the first quarter of 2025, the bank boasts nearly 17 million active mobile customers, a testament to its widespread digital adoption.

The bank's commitment to digital channels is further highlighted by the fact that 98% of all banking transactions are now conducted through non-branch channels. This significant shift underscores their successful strategy in moving customers to more efficient and accessible digital platforms.

Recent innovations, such as the integration of a generative AI-powered smart assistant named 'Ugi' and the introduction of features like 'Secure Call' within their mobile app, demonstrate a clear focus on enhancing customer experience and driving technological advancement. These efforts solidify Garanti BBVA's position as a frontrunner in the digital banking landscape.

Garanti BBVA demonstrates a formidable capital position, underscored by its impressive financial performance. In the first quarter of 2025, the bank reported a net income of TL 25.40 billion, showcasing its profitability. Total assets have swelled to TL 3.50 trillion, reflecting significant growth and market presence.

The bank’s robust capital adequacy ratio, standing at a healthy 16.2% as of Q1 2025, significantly exceeds regulatory minimums. This strong ratio is a testament to Garanti BBVA's resilience, providing a solid foundation to navigate economic uncertainties and sustain its lending activities.

Leadership in Sustainable Finance

Garanti BBVA stands out as a leader in sustainable finance, demonstrating a strong commitment to environmental, social, and governance (ESG) principles. The bank has already achieved significant milestones, surpassing its initial 2025 sustainable finance target by mobilizing TL 386.5 billion as of March 2025, exceeding the TL 400 billion goal.

This forward-thinking approach is further solidified by their ambitious new target of mobilizing TL 3.5 trillion in sustainable finance by 2029. Their proactive engagement in green finance, including the development of new green products and a strategic move to phase out coal-related financing, positions them favorably for sustained growth in an increasingly ESG-conscious market.

- Exceeded 2025 Target: Mobilized TL 386.5 billion in sustainable finance by March 2025, surpassing the TL 400 billion goal.

- Ambitious Future Goals: Set a new target to mobilize TL 3.5 trillion by 2029.

- Green Finance Initiatives: Actively developing new green products and phasing out coal financing.

Strong Market Share and Customer Base

Garanti BBVA boasts a formidable market position in Türkiye, holding a substantial 11.3% share of customer deposits. This strong foothold is further solidified by its leadership in Turkish Lira lending among private banks, highlighting its significant role in the domestic financial ecosystem.

The bank's extensive customer base, exceeding 28 million individuals, underscores its deep penetration into the Turkish market. This means that roughly one in every two banking customers in the country chooses Garanti BBVA, a testament to its robust brand loyalty and established customer relationships.

- Market Share: 11.3% in customer deposits.

- Lending Leadership: Top private bank in Turkish Lira lending.

- Customer Reach: Over 28 million customers, serving half of Türkiye's banking population.

Garanti BBVA's extensive service portfolio, covering retail, commercial, corporate, and investment banking, allows it to cater to a wide range of financial needs. This broad reach is evidenced by its significant loan portfolio growth across all segments by the end of 2024. Furthermore, the bank's strong market position in Türkiye, with an 11.3% share of customer deposits and leadership in Turkish Lira lending among private banks, highlights its deep domestic penetration and established customer relationships, serving over 28 million individuals.

| Strength | Description | Supporting Data (Q1 2025 unless stated otherwise) |

|---|---|---|

| Diverse Service Portfolio | Offers a comprehensive suite of banking services. | Significant loan portfolio increase across all segments (End of 2024). |

| Digital Banking Leadership | Pioneering digital innovations and customer adoption. | Nearly 17 million active mobile customers; 98% of transactions via non-branch channels. |

| Robust Capital Position | Strong financial health and profitability. | Net income of TL 25.40 billion; Total assets of TL 3.50 trillion; Capital Adequacy Ratio of 16.2%. |

| Sustainable Finance Leader | Commitment to ESG principles and green initiatives. | Mobilized TL 386.5 billion in sustainable finance by March 2025 (exceeding TL 400 billion goal). |

| Dominant Market Presence | Significant share and customer base in Türkiye. | 11.3% customer deposit market share; Over 28 million customers. |

What is included in the product

Delivers a strategic overview of Garanti’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Streamlines complex Garanti strategic analysis into an actionable, easy-to-understand format.

Weaknesses

Garanti BBVA's operations are intrinsically linked to the Turkish economy, which has shown considerable volatility. For instance, Turkey's inflation rate remained elevated, averaging around 50% in 2023 and projected to be in the high 30s for 2024, creating a challenging operating landscape. This economic backdrop, marked by fluctuating interest rates and currency pressures, can directly affect the bank's profitability and the quality of its loan portfolio.

The unpredictable nature of the Turkish economy necessitates robust risk management and agile balance sheet strategies for Garanti BBVA. High inflation erodes the real value of assets and earnings, while interest rate swings impact lending margins and funding costs. Navigating these economic uncertainties is a key challenge for the bank's sustained performance and strategic decision-making.

The banking sector is observing a concerning uptick in non-performing loans (NPLs), especially within retail segments like consumer credit cards. This trend could translate into a higher cost of risk for financial institutions.

Garanti BBVA's NPL ratio stood at 2.4% as of the first quarter of 2025. While this figure is currently manageable, the bank must remain proactive in monitoring and addressing any potential erosion in its loan portfolio quality to mitigate future financial strain.

Garanti operates in a highly competitive Turkish banking landscape, facing pressure from both established traditional banks and agile fintech startups. This intense rivalry necessitates ongoing investment in digital capabilities and customer experience to maintain market share and profitability.

The banking sector saw significant digital adoption in 2024, with fintechs rapidly expanding their service offerings, potentially eroding traditional banks' customer bases. Garanti's ability to innovate and adapt its digital strategies will be crucial to counter this competitive threat and retain its customer loyalty.

Regulatory and Macroprudential Measures Impact

Garanti BBVA, like other Turkish banks, faces a significant challenge from the Central Bank of the Republic of Turkey's (CBRT) ongoing macroprudential measures. These regulations, designed to ensure financial stability, can directly squeeze bank margins by limiting certain lending activities or increasing reserve requirements. For instance, the CBRT has frequently adjusted reserve ratios and loan growth caps in recent years to manage inflation and credit expansion, directly impacting how much banks can earn on their loan portfolios.

The dynamic nature of these regulatory shifts also imposes a considerable compliance burden. Banks must continually adapt their strategies and operational frameworks to meet evolving requirements, which can divert resources from growth initiatives. This can translate into slower expansion of lending volumes or a need for increased capital allocation to meet new prudential standards. In 2024, the CBRT's continued focus on disinflationary policies means such measures are likely to persist, creating an environment of uncertainty for profitability.

- Regulatory Tightening: CBRT’s macroprudential policies can restrict loan growth and impact net interest margins.

- Compliance Costs: Adapting to new regulations requires significant investment in systems and personnel.

- Growth Constraints: Measures like credit growth caps can limit Garanti BBVA's ability to expand its loan book.

- Profitability Pressure: Increased reserve requirements or other prudential tools can directly reduce a bank's profitability.

Reliance on Customer Deposits as Primary Funding Source

Garanti's significant reliance on customer deposits, which constituted 73% of its assets in Q1 2025, presents a potential weakness. While this indicates strong customer loyalty, a slowdown in deposit growth or increased competition for these funds could strain liquidity. Diversifying funding streams would bolster resilience against such market shifts.

Garanti BBVA's heavy reliance on customer deposits, making up 73% of its assets in Q1 2025, is a notable vulnerability. This dependence means that any slowdown in deposit growth or intensified competition for funding could significantly impact the bank's liquidity. Developing more diverse funding sources would enhance its ability to withstand market fluctuations.

Preview the Actual Deliverable

Garanti SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting an accurate glimpse into the comprehensive Garanti SWOT analysis. Purchase unlocks the entire in-depth version, so you know exactly what you're getting.

Opportunities

Garanti BBVA’s continued investment in digital platforms and advanced AI, like the generative AI upgrade for its virtual assistant 'Ugi,' offers a prime opportunity to elevate customer experience and personalize services. This strategic focus on digital enhancement is projected to attract new customer segments and simultaneously drive down operational costs.

The bank’s commitment to digital transformation is already yielding results, with digital channels accounting for a significant portion of transactions. For instance, in Q1 2024, Garanti BBVA reported that over 90% of its customer transactions were conducted through digital channels, highlighting the effectiveness of its digital strategy.

Garanti BBVA's robust commitment to sustainable finance presents a significant avenue for growth, underscored by its ambitious target of TL 3.5 trillion in sustainable finance by 2029. This focus aligns perfectly with the increasing global demand for environmentally and socially responsible investments.

The bank can further capitalize on this by developing innovative green and social finance products. This strategic move will not only attract a growing segment of environmentally conscious investors and businesses but also solidify Garanti BBVA's position as a leader in the burgeoning ESG market.

Garanti BBVA's vast customer base, exceeding 20 million active users as of early 2024, coupled with its extensive digital transaction volume, provides a rich dataset. This data can be harnessed through sophisticated analytics to create highly tailored financial products and services.

By understanding individual customer behavior and preferences, Garanti BBVA can develop personalized marketing campaigns that resonate more effectively, driving higher engagement rates. This also opens avenues for increased cross-selling opportunities, as offerings can be precisely matched to customer needs.

Growth in Underserved Segments or Niche Markets

Garanti BBVA can capitalize on growth by identifying and targeting underserved market segments. This includes focusing on specific Small and Medium-sized Enterprise (SME) niches or expanding into new financial product categories like specialized digital payments or embedded finance, which could unlock fresh revenue streams. The bank's existing strategy, evidenced by its focus on micro-SME loans, positions it well to pursue these opportunities.

Opportunities exist in developing tailored financial solutions for specific industries or demographic groups that are currently overlooked by competitors. For instance, the bank could explore offering specialized financing for green technology adoption among SMEs or developing digital banking platforms catering to the unique needs of freelancers and gig economy workers.

- Targeting niche SME sectors: Expanding lending and advisory services to sectors like sustainable agriculture or advanced manufacturing, which often require specialized financial products.

- Digital payment innovation: Developing and integrating advanced digital payment solutions for e-commerce platforms and subscription services, tapping into the growing digital economy.

- Embedded finance solutions: Partnering with non-financial businesses to offer banking services directly at the point of sale or within their digital ecosystems.

- Financial inclusion for underserved demographics: Creating accessible and user-friendly banking products for populations with limited access to traditional financial services.

Potential for Economic Stability and Recovery in Türkiye

Should Türkiye's economic program successfully lead to increased stability, a decline in inflation, and sustained economic growth, Garanti BBVA stands to benefit significantly. A more predictable macroeconomic environment would inherently reduce operational risks for the bank. This stability is also expected to foster stronger loan demand across various sectors, simultaneously improving the overall asset quality of the bank's loan portfolio.

The Turkish economy has shown resilience, with inflation showing a downward trend from its peak. For instance, while inflation remained elevated in early 2024, projections for the latter half of 2024 and into 2025 suggest a moderation. This economic stabilization directly translates into a more favorable operating landscape for Garanti BBVA.

- Reduced Inflationary Pressures: Lower inflation can decrease the cost of funding for Garanti BBVA and improve the real returns on its lending activities.

- Increased Consumer and Business Confidence: Economic stability typically boosts confidence, leading to higher demand for credit for investments and consumption.

- Improved Loan Demand: As the economy recovers and stabilizes, businesses are more likely to seek financing for expansion, and consumers for purchases, boosting Garanti BBVA's core lending business.

- Enhanced Asset Quality: A stable economy generally correlates with lower default rates, leading to a healthier loan book for the bank.

Garanti BBVA's digital leadership, evidenced by over 90% of transactions in Q1 2024 occurring digitally, provides a strong foundation for enhanced customer experience and operational efficiency through AI. The bank's significant push into sustainable finance, targeting TL 3.5 trillion by 2029, aligns with growing ESG demands and offers opportunities for innovative green product development.

Leveraging its 20+ million customer base and extensive digital data, Garanti BBVA can create highly personalized financial products and marketing campaigns, boosting engagement and cross-selling. Furthermore, targeting underserved market segments, such as specialized SME niches or digital payment solutions for the gig economy, presents clear avenues for revenue growth.

| Opportunity Area | Key Initiatives | Potential Impact |

|---|---|---|

| Digital Transformation & AI | Generative AI for virtual assistant Ugi | Enhanced customer experience, personalized services, cost reduction |

| Sustainable Finance | Target of TL 3.5 trillion by 2029 | Attract ESG investors, solidify leadership in green finance |

| Data Analytics & Personalization | Leveraging 20M+ customer data | Tailored products, effective marketing, increased cross-selling |

| Market Expansion | Targeting niche SMEs, digital payments, embedded finance | New revenue streams, financial inclusion for underserved groups |

Threats

Persistent inflationary pressures in Türkiye, with the annual inflation rate reaching 75.45% in April 2024 according to TurkStat, directly threaten Garanti's net interest margins. This high inflation environment necessitates a careful balancing act between managing funding costs and maintaining competitive lending rates.

The potential for continued interest rate volatility, as the Central Bank of the Republic of Türkiye (CBRT) has kept its policy rate at 50% since March 2024, introduces significant risk to Garanti's financial planning. Fluctuations in borrowing costs can directly impact the bank's profitability and its ability to manage its cost of funds effectively.

Unpredictable shifts in monetary policy, influenced by both domestic economic conditions and global trends, could disrupt Garanti's asset quality and overall financial performance. Such unpredictability makes it challenging to forecast loan performance and manage potential credit risks in a dynamic economic landscape.

Garanti BBVA, like all financial institutions, faces the ongoing challenge of increased regulatory scrutiny. New regulations, particularly concerning capital adequacy ratios and data privacy, are constantly being introduced. For instance, the Basel III framework, which has been progressively implemented, demands higher capital reserves, impacting lending capacity.

These evolving requirements translate directly into higher compliance costs for Garanti. The bank must invest in robust systems and personnel to ensure adherence to directives on consumer protection and cybersecurity, which have become paramount. Failure to comply can result in significant fines and reputational damage, adding to the operational burden.

As a deeply digital bank, Garanti BBVA is a constant target for cyber threats and data breaches. These attacks can result in major financial losses, damage to its reputation, and a significant loss of customer confidence. For instance, the global financial sector experienced an average of 130 cyberattacks per organization in 2023, highlighting the persistent nature of these risks.

Geopolitical Risks and Regional Instability

Geopolitical tensions in the surrounding regions pose a significant threat to Garanti BBVA. Increased instability can trigger capital flight from Turkey, leading to a weaker Turkish Lira and diminished foreign investment. This directly impacts the bank’s ability to access international funding and can increase the cost of doing business.

For example, ongoing conflicts or political disputes in neighboring countries could disrupt trade routes and supply chains, indirectly affecting the Turkish economy and the borrowing capacity of Garanti's corporate clients. A notable instance in 2024 involved heightened tensions in Eastern Europe, which contributed to global economic uncertainty and a cautious approach from international investors towards emerging markets like Turkey.

The potential for currency depreciation, a common consequence of geopolitical shocks, directly erodes the value of assets and liabilities denominated in foreign currencies. This can negatively affect Garanti BBVA's profitability and capital adequacy ratios, particularly if a significant portion of its balance sheet is exposed to currency fluctuations.

The banking sector's reliance on foreign capital inflows makes it particularly vulnerable. In 2024, while Turkey saw some FDI, geopolitical events created headwinds. For instance, a 10% depreciation of the Turkish Lira against the US Dollar in a short period could significantly impact a bank’s net worth if not properly hedged.

Intensified Competition from Non-Bank Financial Institutions

The financial landscape is increasingly shaped by agile non-bank financial institutions, particularly fintech firms. These companies are adept at offering specialized services in areas like digital payments, online lending, and wealth management, effectively disintermediating traditional banking functions. This trend poses a significant threat to established players like Garanti BBVA, as these nimble competitors can quickly capture market share in lucrative niches, potentially eroding the comprehensive service model of larger banks.

For instance, the global fintech market was projected to reach over $1.1 trillion by 2023, with significant growth expected to continue through 2024 and 2025. In Turkey, digital payment systems and online lending platforms have seen substantial user adoption. Garanti BBVA faces the challenge of these specialized entities offering more tailored and often lower-cost alternatives, which can attract customers away from their broader banking relationships.

The threat is amplified by the ability of fintechs to leverage technology for faster, more user-friendly experiences. Consider these points:

- Disintermediation: Fintechs bypass traditional banking infrastructure for specific services like payments and loans.

- Niche Market Capture: They focus on specific customer needs, offering specialized and often more competitive products.

- Agility and Innovation: Their lean structures allow for rapid adaptation and deployment of new technologies.

- Customer Experience: Fintechs often prioritize seamless digital interfaces, attracting digitally-native customers.

The intensifying competition from agile fintech firms presents a significant threat, as they increasingly disintermediate traditional banking services like payments and lending. This trend, evidenced by the global fintech market's projected growth beyond $1.1 trillion by 2023 and continuing into 2024-2025, allows these nimble players to capture niche markets with specialized, often lower-cost offerings.

Garanti BBVA must contend with the potential for increased regulatory burdens and compliance costs. Evolving regulations, such as those stemming from Basel III, necessitate higher capital reserves, potentially impacting lending capacity and requiring continuous investment in systems for data privacy and consumer protection to avoid penalties.

Persistent high inflation in Türkiye, with annual rates around 75% in early 2024, directly squeezes net interest margins. Coupled with interest rate volatility, as the CBRT maintained a 50% policy rate through March 2024, this creates significant challenges for financial planning and managing funding costs effectively.

Geopolitical instability in surrounding regions poses a risk, potentially leading to capital flight, currency depreciation, and reduced foreign investment. This can hinder Garanti's access to international funding and increase the cost of business, impacting both the bank and its corporate clients.

SWOT Analysis Data Sources

This analysis is built on a foundation of robust data, including Garanti's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.