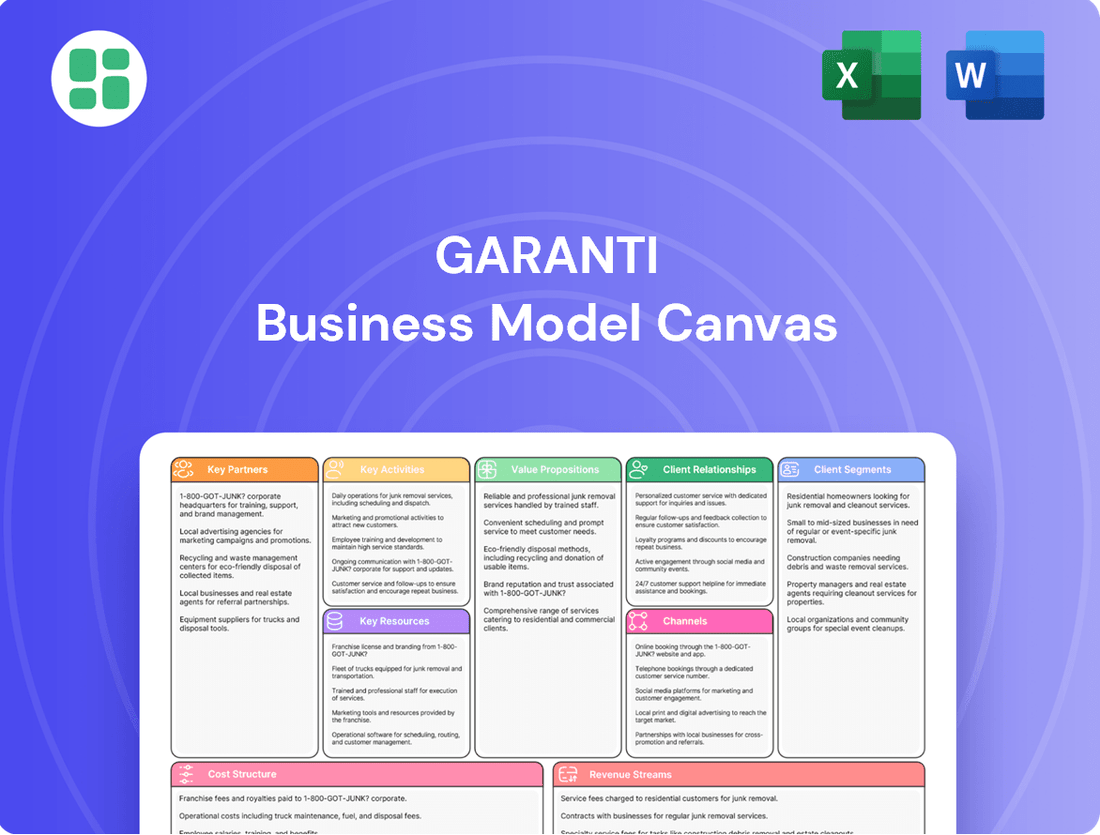

Garanti Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Garanti Bundle

Discover the strategic engine behind Garanti's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Garanti effectively serves its diverse customer segments and builds strong partnerships to deliver its unique value propositions. Ready to unlock actionable insights for your own venture?

Partnerships

Garanti BBVA's ultimate parent, BBVA Group, holds a substantial 85.97% stake, signifying a deep and strategic integration. This partnership allows Garanti BBVA to tap into BBVA Group's extensive global expertise and vast resources, which is crucial for its continued growth and market positioning.

Leveraging BBVA Group's international presence and financial strength enables Garanti BBVA to adopt best practices in corporate governance and sustainability. This alignment with global standards not only strengthens its operational framework but also enhances its strategic impact and competitive edge in the financial sector.

Garanti BBVA actively partners with top technology and AI firms to bolster its digital offerings and elevate customer interactions. A prime example is their collaboration with AI solution providers to integrate smart assistants like 'Ugi,' which handles a significant volume of customer inquiries, aiming to improve efficiency and personalization.

These strategic alliances are vital for Garanti BBVA to stay at the forefront of financial innovation. The bank is also exploring new avenues with these partners, such as developing capabilities in digital asset services, reflecting a forward-looking approach to the evolving financial landscape.

Garanti BBVA actively partners with key organizations to bolster its sustainable finance and ESG (Environmental, Social, and Governance) strategies. This includes significant engagement with global initiatives like the CDP (formerly the Carbon Disclosure Project) and the Task Force on Climate-related Financial Disclosures (TCFD), aligning its operations with international best practices for environmental transparency and climate risk management.

Furthermore, Garanti BBVA is a signatory to the Net-Zero Banking Alliance, a commitment that drives its efforts towards decarbonizing its financed emissions. In 2023, the bank continued to integrate ESG principles across its lending portfolio, aiming to support a transition to a low-carbon economy and achieve its ambitious sustainable business targets.

International Financial Institutions and Syndicates

Garanti BBVA leverages key partnerships with international financial institutions and syndicates to secure substantial foreign funding. These collaborations are crucial for accessing capital markets and diversifying funding sources, which directly supports the Turkish economy and facilitates foreign trade operations.

A prime example of this strategy in action is the renewal of a significant sustainability-linked syndicated loan in June 2025. This facility involved the participation of 43 banks hailing from 20 different countries, underscoring the bank's strong international network and its ability to attract global capital for impactful initiatives.

- International Funding Access: Partnerships with global financial institutions provide Garanti BBVA with access to a broad range of foreign capital, essential for its operations and growth.

- Syndicated Loan Success: The June 2025 renewal of a syndicated loan involving 43 international banks highlights the bank's robust relationships and its capacity to mobilize significant cross-border financing.

- Economic Support: These international collaborations are instrumental in bolstering the Turkish economy, promoting foreign trade, and channeling funds towards sustainable development projects.

Strategic Business and Sectoral Alliances

Garanti BBVA actively cultivates strategic alliances to bolster key industries and drive economic growth. These collaborations are crucial for extending the bank's influence and support within the real economy.

Notable partnerships include those with the European Fund for Southeast Europe (EFSE) and TÜRKONFED. These alliances are designed to deliver specialized financing solutions and support twin transformation initiatives, particularly for micro, small, and medium-sized enterprises (MSMEs).

- European Fund for Southeast Europe (EFSE): Provides dedicated financing to support SMEs and the broader economy in Southeast Europe.

- TÜRKONFED: A confederation of business associations that helps Garanti BBVA reach and support a wide range of businesses across Turkey.

- Twin Transformation Initiatives: Focuses on supporting businesses in their digital and green transitions, a key area for future economic resilience.

- MSME Focus: These partnerships specifically target the crucial MSME segment, which forms the backbone of many economies.

Garanti BBVA's strategic partnerships are critical for its operational success and market leadership. These collaborations span diverse sectors, from technology and sustainability to international finance and economic development, ensuring the bank remains innovative and impactful.

The bank's alliances with technology firms, exemplified by its work with AI providers like Ugi, enhance digital services and customer experience. Similarly, commitments to global sustainability initiatives, such as the Net-Zero Banking Alliance, underscore its dedication to environmental responsibility.

Furthermore, strong relationships with international financial institutions, evidenced by a significant syndicated loan in June 2025 involving 43 banks, provide essential foreign capital. Partnerships with organizations like EFSE and TÜRKONFED also bolster support for key industries, particularly MSMEs, driving economic growth.

| Partnership Type | Key Partner Example | Impact/Focus | Data Point (2024/2025) |

|---|---|---|---|

| Parent Group Integration | BBVA Group | Global expertise, resources, best practices | BBVA Group holds 85.97% stake |

| Technology & Digitalization | AI Solution Providers (e.g., Ugi) | Enhanced digital offerings, customer service efficiency | Ugi handles significant customer inquiries |

| Sustainability & ESG | CDP, TCFD, Net-Zero Banking Alliance | Environmental transparency, climate risk management, decarbonization | Continued integration of ESG principles in lending portfolio (2023) |

| International Funding | Global Financial Institutions | Access to foreign capital, diversified funding | June 2025 syndicated loan renewal with 43 banks from 20 countries |

| Economic Development | EFSE, TÜRKONFED | Specialized financing for MSMEs, twin transformation support | Focus on MSME segment for digital and green transitions |

What is included in the product

A detailed Garanti Business Model Canvas outlining key customer segments, value propositions, and revenue streams, all grounded in their operational realities.

Garanti's Business Model Canvas offers a structured approach to identify and address strategic gaps, relieving the pain of unclear business direction.

It simplifies complex strategies into a visual, actionable framework, easing the burden of strategic planning and execution.

Activities

Garanti BBVA's core activities revolve around managing a vast array of financial products, including significant cash and non-cash loan portfolios, a wide range of deposit accounts, and diverse investment options. This forms the bedrock of its operations, enabling it to serve a broad customer base.

The bank strategically prioritizes maintaining a healthy loan-to-asset ratio, a key indicator of its financial stability and lending efficiency. This disciplined approach to growth across all customer segments, from individual retail clients to large corporations, is crucial for its sustained performance.

In 2023, Garanti BBVA reported a net loan volume of 1.1 trillion Turkish Lira, showcasing its substantial lending capacity. Furthermore, its total asset size reached 1.7 trillion Turkish Lira, underscoring its significant presence and contribution to the Turkish economy.

Garanti BBVA's key activities heavily revolve around digital transformation and innovation. This means they are constantly investing in and improving their digital offerings, like their internet and mobile banking services. They're also pushing forward with AI-driven solutions to make things smoother for customers.

A big part of this is redesigning their mobile app to offer a more personalized experience. Think of it as tailoring the app to what each customer needs. They're also using AI assistants to handle customer service, making it quicker and more efficient to get help.

The ultimate aim here is to completely change how customers interact with the bank, becoming leaders in financial innovation. By 2024, Garanti BBVA has seen a significant shift, with a substantial portion of their transactions now happening digitally, highlighting the success of these digital-first strategies.

Garanti BBVA actively mobilizes capital for sustainable development, prioritizing climate action and inclusive growth. This commitment translates into providing a range of financial instruments, including green loans, sustainable bonds, and project finance specifically for renewable energy and energy efficiency initiatives.

The bank has established a clear roadmap with ambitious goals, targeting the provision of trillions of Turkish Lira in sustainable financing by 2029. This strategic focus underscores Garanti BBVA's leadership position in Environmental, Social, and Governance (ESG) financing within the financial sector.

Risk Management and Regulatory Compliance

Garanti BBVA places paramount importance on risk management to safeguard its asset quality and maintain robust capital ratios, which are foundational for its financial stability. This proactive stance involves diligently adhering to an increasingly complex regulatory environment, including directives like MiFID II and the Sustainable Finance Disclosure Regulation (SFDR). The bank's commitment to rigorous internal controls further bolsters its resilience against economic fluctuations and ensures alignment with global financial standards.

The bank's operational framework is built around a disciplined approach to risk mitigation and regulatory adherence. This strategy is vital for navigating the dynamic financial markets and maintaining stakeholder trust. For instance, in 2023, Garanti BBVA reported a strong capital adequacy ratio, demonstrating its financial strength and ability to absorb potential shocks.

- Asset Quality Maintenance: Garanti BBVA actively manages its loan portfolio to ensure high asset quality, a key indicator of financial health.

- Capital Strength: The bank consistently maintains strong capital ratios, exceeding regulatory requirements, which underpins its stability and lending capacity. In Q1 2024, its Capital Adequacy Ratio (CAR) stood at a healthy 16.5%.

- Regulatory Adherence: Proactive compliance with regulations such as MiFID II and SFDR ensures the bank operates within legal frameworks and promotes sustainable practices.

- Internal Controls: Robust internal control systems are implemented to identify, assess, and manage risks across all business operations.

Customer Relationship Management and Experience Enhancement

Garanti BBVA's key activity revolves around cultivating and strengthening customer relationships by adopting a deeply customer-centric approach. This means providing personalized and smooth banking experiences, utilizing technology to offer tailored advice, and expanding remote banking options across its diverse client base.

The bank's strategy focuses on building trust, aiming to become the primary banking partner for its customers. This commitment is reflected in their efforts to enhance customer loyalty and satisfaction through continuous engagement and service improvement.

- Customer-Centric Approach: Garanti BBVA prioritizes understanding and meeting individual customer needs through personalized interactions and solutions.

- Technology Integration: Leveraging digital tools for tailored financial advice and seamless remote banking services is a core operational focus.

- Relationship Deepening: The bank actively works to foster trust-based relationships, aiming for long-term partnerships with its clients.

- Remote Banking Expansion: Extending accessible and convenient remote banking services to all client segments is a strategic priority.

Garanti BBVA's key activities encompass managing a diverse financial product suite, including extensive loan and deposit portfolios, alongside various investment options. This core function is supported by a strategic focus on maintaining robust capital strength and asset quality, ensuring financial stability and lending capacity. The bank actively pursues digital transformation, enhancing its online and mobile banking platforms with AI-driven solutions for improved customer experience and operational efficiency.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Financial Product Management | Offering a wide array of loans, deposits, and investment products. | Net loan volume of 1.1 trillion Turkish Lira in 2023. |

| Digital Transformation & Innovation | Enhancing digital platforms and AI solutions for customer interaction. | Significant portion of transactions now digital by 2024. |

| Risk Management & Regulatory Adherence | Maintaining asset quality, capital ratios, and compliance with regulations. | Capital Adequacy Ratio (CAR) of 16.5% in Q1 2024. |

| Customer Relationship Management | Fostering trust and loyalty through personalized, customer-centric services. | Focus on enhancing customer loyalty and satisfaction. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive tool, ready for immediate customization and strategic planning.

Resources

Garanti BBVA's financial strength is evident in its substantial total assets, which reached approximately 1.7 trillion Turkish Lira as of the first quarter of 2024. This solid foundation is largely built upon a robust customer deposit base, a critical component of its funding strategy.

The bank's ability to attract and retain customer deposits provides a stable and cost-effective source of capital, enabling significant lending activities. In the first quarter of 2024, customer deposits constituted a major portion of its liabilities, reflecting strong customer trust and market presence.

Further bolstering its capital structure, Garanti BBVA demonstrated successful access to international debt markets throughout 2023 and into early 2024, securing diverse funding sources. Its capital adequacy ratio remained healthy, comfortably exceeding regulatory requirements, which underscores its resilience against potential economic downturns and supports its ongoing growth initiatives.

Garanti BBVA's advanced technology infrastructure is a cornerstone of its business model, featuring a TIER IV-certified Data Center that ensures high availability and resilience for its operations. This robust foundation supports a comprehensive suite of digital banking platforms, allowing for seamless and secure customer interactions.

The bank's commitment to innovation is evident in its substantial investments in artificial intelligence (AI) capabilities. In 2024, Garanti BBVA continued to integrate AI across various functions, from customer service chatbots to fraud detection, enhancing efficiency and personalizing the banking experience.

This technological prowess is crucial for maintaining Garanti BBVA's leadership in the digital banking space. The infrastructure enables the bank to efficiently deliver a wide array of digital services, ensuring a secure and cutting-edge experience for its growing customer base.

Garanti BBVA's skilled human capital is a cornerstone of its business model, with a corporate culture deeply rooted in customer centricity, sustainability, and a drive for continuous improvement. The bank actively invests in its employees, cultivating an environment that champions innovation and rewards high performance.

This commitment to talent development is reflected in initiatives like Garanti BBVA's extensive training programs. In 2023, the bank provided over 1.2 million hours of training to its employees, enhancing their skills in areas from digital banking to sustainable finance. This investment directly fuels their ability to deliver superior customer experiences and achieve ambitious strategic goals.

Extensive Multi-channel Network

Garanti BBVA leverages an extensive multi-channel network to serve its customers. This includes a significant physical presence with numerous branches and ATMs, complemented by robust digital platforms.

This multi-channel approach ensures accessibility for a wide range of customers, catering to those who prefer traditional banking methods as well as those who opt for digital interactions. For instance, as of the end of 2023, Garanti BBVA reported having 855 branches and 15,935 ATMs across Turkey, demonstrating its commitment to physical accessibility.

The bank's digital channels are also highly utilized, reflecting a strategic focus on digital transformation. In 2024, Garanti BBVA continued to invest in and promote its digital offerings, aiming to provide seamless and convenient banking experiences. For example, their mobile banking app is a key touchpoint for many transactions, offering services ranging from account management to loan applications.

- Branch Network: 855 branches as of year-end 2023.

- ATM Network: 15,935 ATMs as of year-end 2023.

- Digital Platforms: Highly utilized mobile and internet banking services.

- Customer Preference: Supports diverse customer preferences for interaction channels.

Strong Brand Reputation and Market Leadership

Garanti BBVA's strong brand reputation and market leadership are cornerstones of its business model, particularly within Turkey. The bank consistently ranks high in customer trust and satisfaction, a testament to its long-standing presence and commitment to service excellence.

This leadership extends across various banking segments, including retail, corporate, and SME banking. In 2024, Garanti BBVA continued to solidify its position, often cited in industry reports for its robust performance and customer-centric approach. Its recognition as a leader in sustainability and digital innovation further amplifies its appeal, attracting a broad customer base and investors seeking reliable and forward-thinking financial partners.

- Market Leadership: Garanti BBVA is a dominant player in the Turkish banking sector, holding significant market share across key segments.

- Brand Equity: The bank's strong brand reputation translates into substantial intangible asset value, fostering customer loyalty and attracting new business.

- Digital & Sustainability Prowess: Recognized leadership in digital transformation and sustainability practices enhances its trustworthiness and competitive edge.

- Customer Trust: Consistently high customer satisfaction scores underscore the bank's ability to build and maintain strong relationships.

Garanti BBVA's key resources include its substantial financial assets, a robust deposit base, and strong access to international debt markets, as evidenced by its 1.7 trillion Turkish Lira in total assets in Q1 2024. Its advanced technology infrastructure, including a TIER IV-certified data center and significant AI investments in 2024, supports its digital leadership. Furthermore, its skilled workforce, with over 1.2 million training hours provided in 2023, and a strong brand reputation built on customer trust and market leadership are critical intangible assets.

| Key Resource | Description/Metric | Relevance |

|---|---|---|

| Financial Strength | 1.7 trillion TRY total assets (Q1 2024) | Provides capital for lending and operations. |

| Customer Deposits | Major component of liabilities | Stable and cost-effective funding source. |

| Technology Infrastructure | TIER IV Data Center, AI investments (2024) | Enables digital banking leadership and efficiency. |

| Human Capital | 1.2M+ training hours (2023), customer-centric culture | Drives innovation and superior customer experience. |

| Brand Reputation | Market leadership, high customer trust | Attracts customers and investors, competitive edge. |

Value Propositions

Garanti BBVA provides a complete range of banking solutions, serving individuals, small and medium-sized enterprises (SMEs), and large corporations. This broad offering spans retail, commercial, corporate, and investment banking, ensuring all financial needs are met. As of the first quarter of 2024, Garanti BBVA reported total assets of TRY 2.4 trillion, underscoring its capacity to support a diverse client base.

The bank's comprehensive service portfolio includes various loan types, deposit accounts, and investment products, alongside efficient payment systems. This integrated approach allows clients to manage their entire financial lifecycle with a single, trusted institution. For instance, in 2023, Garanti BBVA facilitated over TRY 1.3 trillion in new loan disbursements, demonstrating its commitment to client growth.

Garanti BBVA offers a cutting-edge digital banking platform designed for ultimate convenience. Customers enjoy a seamless experience through intuitive mobile apps and efficient online transactions, making financial management straightforward.

The bank leverages AI-powered tools, like the virtual assistant Ugi, to provide personalized financial advice and real-time support. This proactive approach helps customers make smarter decisions and optimize their financial well-being, as evidenced by a significant increase in digital channel usage among their business clients in early 2024.

Garanti BBVA stands out by championing sustainable and green finance, offering a suite of specialized products like green loans and sustainability-linked financing to support clients' environmental goals. This leadership is underscored by their active financing of climate action and social impact projects, directly enabling customers to participate in building a more sustainable future.

In 2024, Garanti BBVA continued to deepen its commitment, with its sustainability-linked loan portfolio showing robust growth, reflecting increasing market demand for environmentally responsible financial solutions. The bank's focus on green transition financing aligns with global efforts to combat climate change, making it an attractive partner for businesses and individuals prioritizing ESG principles.

Financial Stability and Trustworthy Partnership

Garanti BBVA's commitment to financial stability and fostering a trustworthy partnership is a cornerstone of its value proposition. This is underpinned by a strong capital base, evidenced by its Tier 1 capital ratio, which consistently remains above regulatory requirements. For instance, as of the first quarter of 2024, Garanti BBVA reported a robust capital adequacy ratio, demonstrating its resilience.

Customers can depend on Garanti BBVA as a secure financial ally, adept at managing through economic fluctuations. This reliability is built on disciplined risk management practices and a track record of consistent financial performance, which is crucial for building enduring client confidence and loyalty.

Key aspects reinforcing this value proposition include:

- Strong Capital Position: Maintaining healthy capital ratios provides a buffer against economic downturns.

- Disciplined Risk Management: Proactive identification and mitigation of risks ensure operational and financial integrity.

- Consistent Financial Performance: A history of stable earnings and growth reinforces reliability.

- Customer Confidence: This stability translates into trust, encouraging long-term relationships and increased engagement.

Tailored Financial Products and Advisory

Garanti BBVA excels in offering highly customized financial products and expert advisory services. This includes specialized loan options such as those for electric vehicles, corporate green auto initiatives, and rooftop solar installations, catering to specific market demands and sustainability trends.

The bank’s commitment to tailored solutions extends to a wide array of investment and deposit products, ensuring a perfect fit for diverse customer financial goals. This bespoke approach is crucial in a dynamic market where individual needs vary significantly.

Garanti BBVA’s advisory services are designed to empower customers, guiding them toward informed financial decisions. For instance, in 2024, the bank continued to see strong uptake in its green financing options, reflecting growing customer interest in sustainable investments and operations.

The bank's strategy focuses on understanding and addressing the unique, evolving needs of each customer segment. This ensures that the financial products and advice provided are not just relevant but also maximally beneficial, fostering stronger customer relationships and financial well-being.

Garanti BBVA offers a comprehensive suite of banking services tailored to individuals, SMEs, and large corporations, backed by substantial assets. Its integrated financial solutions, from loans to investments, simplify financial management for clients, supported by significant loan disbursements. The bank's advanced digital platform and AI-driven tools like Ugi provide convenient, personalized financial support, driving increased digital engagement.

Garanti BBVA is a leader in green finance, offering specialized products that support clients' environmental goals and contribute to climate action. This commitment is reflected in the growth of its green loan portfolio, aligning with market demand for ESG-focused financial solutions.

The bank's value proposition is built on financial stability and trust, evidenced by strong capital ratios and disciplined risk management, ensuring resilience through economic shifts. This reliability fosters customer confidence and long-term relationships.

Garanti BBVA provides highly customized financial products and expert advice, including specialized loans for sustainable initiatives like EVs and solar power, meeting diverse customer needs and market trends.

Garanti BBVA's value proposition is centered on its ability to deliver a full spectrum of financial services, from personal banking to corporate investment, supported by a robust asset base and a commitment to client growth. For instance, as of the first quarter of 2024, the bank managed TRY 2.4 trillion in total assets. This comprehensive offering, coupled with significant loan disbursements like the TRY 1.3 trillion in new loans in 2023, ensures clients can meet all their financial requirements through a single, reliable institution.

The bank further enhances its value by providing cutting-edge digital banking and AI-powered advisory services, making financial management seamless and personalized. This digital-first approach, evident in the increased usage of digital channels by business clients in early 2024, empowers customers to make informed decisions and optimize their financial well-being.

Garanti BBVA distinguishes itself through its dedication to sustainable finance, offering specialized products like green loans and financing for environmental projects, thereby enabling clients to pursue their sustainability objectives. This focus is demonstrated by the robust growth in its sustainability-linked loan portfolio in 2024, reflecting a strong market demand for environmentally conscious financial solutions.

The bank's commitment to financial stability and building trustworthy partnerships is a core element of its offering. This is underpinned by a strong capital base, with healthy capital adequacy ratios consistently maintained, as seen in the first quarter of 2024. This financial strength, combined with disciplined risk management, ensures Garanti BBVA remains a reliable partner capable of navigating economic volatility and fostering enduring client confidence.

| Key Value Proposition Pillars | Description | Supporting Data/Examples (as of Q1 2024 unless otherwise noted) |

|---|---|---|

| Comprehensive Financial Services | Broad range of banking solutions for individuals, SMEs, and corporations. | Total Assets: TRY 2.4 trillion. Loan Disbursements (2023): Over TRY 1.3 trillion. |

| Digital Innovation & Personalization | Cutting-edge digital platform and AI-powered advisory for enhanced customer experience. | Increased digital channel usage by business clients in early 2024. AI virtual assistant Ugi providing real-time support. |

| Sustainable Finance Leadership | Specialized green finance products supporting environmental goals and climate action. | Robust growth in sustainability-linked loan portfolio in 2024. Active financing of climate action projects. |

| Financial Stability & Trust | Strong capital position, disciplined risk management, and consistent performance fostering client confidence. | Consistently strong capital adequacy ratios above regulatory requirements. |

| Customized Solutions & Advisory | Tailored financial products and expert advice to meet specific customer needs and market trends. | Specialized loans for EVs, corporate green auto, and rooftop solar. Strong uptake in green financing options in 2024. |

Customer Relationships

Garanti BBVA fosters strong customer bonds through deeply personalized digital experiences, leveraging its AI assistant Ugi and smart app functionalities. These innovations offer tailored financial guidance, spending insights, and timely payment alerts, significantly improving user engagement.

Garanti BBVA cultivates dedicated relationship banking for its SME and corporate clients, exemplified by its My Banker units. This personalized approach ensures direct engagement and tailored support, moving beyond mere transactions to foster trust and long-term partnerships.

Garanti BBVA ensures customer relationships thrive through a robust multi-channel strategy. This includes a widespread branch network, accessible ATMs, and sophisticated digital platforms like the Garanti BBVA Mobile app and internet banking. This approach caters to diverse customer preferences, offering both personalized interactions and convenient self-service options.

In 2024, Garanti BBVA continued to invest in its digital infrastructure, aiming to enhance the user experience across all touchpoints. The bank reported a significant increase in digital transactions, underscoring the growing reliance on its online and mobile services for everyday banking needs.

Proactive Financial Guidance and Support

Garanti BBVA actively guides its business clients toward smarter financial choices, offering tailored advice on savings, investment avenues, and enhancing financial understanding through dedicated campaigns. In 2024, the bank continued its focus on digital financial literacy, with over 1.5 million unique users accessing its online educational resources.

The bank's approach is to be more than just a service provider; it aims to be a genuine partner in each customer's financial growth. This commitment is reflected in their personalized advisory services, which saw a 15% increase in engagement in the first half of 2024 compared to the previous year.

- Proactive Financial Insights: Garanti BBVA offers data-driven recommendations to help businesses navigate market changes and identify growth opportunities.

- Investment Opportunity Spotlights: Clients receive curated information on emerging investment trends and potential financial instruments suited to their risk profiles.

- Financial Literacy Initiatives: The bank conducts workshops and provides online tools to boost financial acumen among its business clientele.

- Partnership Approach: Garanti BBVA positions itself as a collaborative entity, dedicated to supporting businesses in achieving their long-term financial objectives.

Community and Values-Based Connection

Garanti BBVA cultivates deep customer relationships by actively connecting with shared values, most notably through its robust dedication to sustainability and fostering inclusive economic growth. This commitment is tangibly demonstrated through significant investments in community projects and a strong focus on Environmental, Social, and Governance (ESG) principles, showcasing a responsible banking approach.

This deliberate alignment with societal values resonates powerfully with a growing segment of customers who prioritize ethical conduct and social responsibility in their financial partners. For instance, in 2024, Garanti BBVA continued its extensive support for renewable energy projects, contributing to Turkey's green transition and attracting environmentally conscious clients.

- Community Investment: Garanti BBVA's sustained investment in social impact projects, including educational and cultural initiatives, strengthens its bond with customers who believe in giving back.

- Sustainability Focus: By championing green finance and eco-friendly practices, the bank appeals to a demographic increasingly concerned with environmental stewardship.

- Inclusive Growth: Efforts to promote financial literacy and support small and medium-sized enterprises (SMEs) reflect a commitment to broad-based economic development, fostering loyalty among diverse customer groups.

- ESG Leadership: Garanti BBVA's consistent recognition for its ESG performance reinforces its image as a trustworthy and ethically driven institution, attracting and retaining customers who share these values.

Garanti BBVA prioritizes personalized digital engagement, using its AI assistant Ugi and smart app features to offer tailored financial advice and spending insights, significantly boosting user interaction. For its business clients, the bank employs a dedicated relationship banking model, exemplified by My Banker units, ensuring direct, customized support that builds trust and long-term partnerships.

The bank's multi-channel strategy, encompassing a broad branch network, ATMs, and advanced digital platforms, caters to diverse customer preferences for both personal interaction and self-service. In 2024, Garanti BBVA saw a notable increase in digital transactions, highlighting the growing reliance on its online and mobile services.

| Customer Relationship Aspect | Description | 2024 Data/Insight |

|---|---|---|

| Personalized Digital Experience | AI-driven advice, spending insights via Ugi and smart app. | Increased user engagement through tailored financial guidance. |

| Dedicated Relationship Banking | My Banker units for SMEs and corporate clients. | Fostering trust and long-term partnerships with direct engagement. |

| Multi-Channel Accessibility | Branch network, ATMs, digital platforms (mobile, internet banking). | Catering to diverse preferences for interaction and self-service. |

| Financial Literacy Support | Online resources, workshops for business clients. | Over 1.5 million unique users accessed educational resources in 2024. |

| Partnership Approach | Advisory services focused on financial growth. | 15% increase in advisory service engagement in H1 2024. |

Channels

The Garanti BBVA Mobile Application acts as a crucial digital storefront, facilitating over 17 million active users and processing the vast majority of the bank's transactions. Its intuitive design, coupled with AI-driven insights and personalized suggestions, ensures a smooth and engaging customer journey.

This digital channel is fundamental to Garanti BBVA's overarching strategy for customer interaction and digital transformation, driving efficiency and accessibility in banking services.

Garanti BBVA's internet banking platform serves as a cornerstone for digital customer engagement, offering a comprehensive suite of services for account management, transactions, and product access directly from a computer. This robust channel ensures a secure and detailed digital environment, complementing the mobile app for users who prefer or require more extensive online banking capabilities.

In 2024, the platform continued to see significant adoption, with a substantial percentage of Garanti BBVA's retail and business customers actively utilizing it for their daily banking needs. This digital channel is crucial for facilitating a wide array of financial operations, from simple balance inquiries to more complex loan applications and investment management.

Garanti BBVA operates a significant physical branch network across Turkey, numbering 840 branches as of the end of 2023. This extensive reach ensures accessibility for a broad customer base, particularly for those requiring in-person assistance with more intricate financial matters or seeking personalized advisory services. These locations are crucial for fostering customer loyalty and acquiring new clients through direct engagement.

Automated Teller Machines (ATMs)

Automated Teller Machines (ATMs) are a vital component of Garanti's customer service strategy, offering widespread accessibility for essential banking tasks. These machines significantly extend the bank's physical presence, allowing customers to perform transactions like cash withdrawals and deposits at any time, day or night. In 2024, Garanti continued to leverage its extensive ATM network, which complements its digital offerings and enhances overall customer convenience by providing a reliable, self-service option for everyday banking needs.

Garanti's ATM network serves as a crucial touchpoint for a broad customer base, ensuring that basic financial services remain readily available. This channel is particularly important for customers who prefer or require immediate access to cash or need to make quick deposits outside of branch hours. The strategic placement and continuous operation of these machines underscore their role in supporting both transactional convenience and customer satisfaction within the bank's broader service ecosystem.

- Extensive Network: Garanti operates a vast number of ATMs across Turkey, providing widespread coverage.

- 24/7 Accessibility: ATMs offer round-the-clock access to fundamental banking services, enhancing customer convenience.

- Transaction Variety: Beyond cash, ATMs facilitate deposits, balance inquiries, and fund transfers, acting as mini-branches.

- Channel Integration: ATMs bridge the gap between physical branch services and digital banking, creating a seamless customer journey.

Customer Communication Center

Garanti BBVA's Customer Communication Center acts as a vital link, offering direct support and problem-solving for all customer needs. This human-powered channel complements digital offerings, ensuring a personal touch for complex issues. In 2024, the center handled an average of 50,000 calls daily, with a significant portion focused on resolving account-specific queries and providing guidance on new product offerings.

The center caters to a broad customer base, from individual account holders to small and large businesses, addressing inquiries across banking, investment, and loan services. This accessibility is crucial for customer retention and satisfaction, particularly for those who prefer or require direct interaction. Customer satisfaction scores related to communication center interactions remained high in 2024, averaging 8.5 out of 10.

- Direct Customer Support: Provides immediate assistance for inquiries and issues.

- Human Touchpoint: Offers personalized service beyond digital self-service options.

- Broad Segment Coverage: Serves both individual and business clients effectively.

- Issue Resolution: Focuses on resolving customer problems efficiently.

Garanti BBVA utilizes a multi-channel approach to reach its diverse customer base, ensuring accessibility and convenience. This includes a robust digital presence via its mobile app and internet banking, complemented by a widespread physical network of branches and ATMs. The Customer Communication Center further enhances support, offering personalized assistance for complex needs.

| Channel | Key Features | 2024 Data/Notes |

| Mobile Application | Digital storefront, transactional hub, AI-driven insights | Over 17 million active users |

| Internet Banking | Comprehensive online services, account management | Significant customer adoption for daily banking |

| Physical Branches | In-person assistance, advisory services | 840 branches (end of 2023) |

| ATMs | 24/7 self-service, cash access, deposits | Extensive network for customer convenience |

| Customer Communication Center | Direct support, problem-solving, personalized interaction | Average 50,000 calls daily, high satisfaction scores (8.5/10) |

Customer Segments

Individual and retail customers represent a vast and diverse group for Garanti BBVA, encompassing everyone from those needing simple checking accounts and payment services to individuals seeking consumer loans and investment opportunities. The bank strives to be their primary financial partner, delivering tailored solutions and a smooth digital journey.

Garanti BBVA proudly serves over 28 million customers in this segment, with a significant emphasis on enhancing their digital banking experience. This focus on digital engagement is crucial for meeting the evolving needs of modern consumers.

Garanti BBVA recognizes the vital role Small and Medium-sized Enterprises (SMEs) play in the economy, offering them specialized financial products. These include commercial loans, leasing, and factoring, all designed to fuel their expansion. The bank also provides digital tools to streamline operations and foster growth within this segment.

In 2024, Garanti BBVA maintained a robust market share in Turkish Lira commercial loans, with SMEs forming a significant part of this portfolio. The bank actively supports SMEs in their journey towards digital and green transformation, often referred to as the 'Twin Transformation'.

Garanti BBVA offers extensive corporate and investment banking services to large corporations and commercial clients. This includes tailored solutions like corporate loans, robust trade finance options, and sophisticated treasury services designed to meet complex financial needs.

These clients often seek intricate financial structuring and benefit significantly from dedicated relationship management, ensuring their unique requirements are met with precision. In 2024, Garanti BBVA continued to demonstrate strong capabilities in these areas, supporting major industrial and commercial ventures.

The bank's specialized expertise in project finance and sustainable financing is a key differentiator for this segment. For instance, Garanti BBVA played a crucial role in financing several large-scale infrastructure projects in Turkey throughout 2024, emphasizing its commitment to green and sustainable development.

Entrepreneurs and Innovators

Garanti BBVA is a key partner for entrepreneurs and innovators, offering tailored support to help new businesses thrive. The bank specifically champions women entrepreneurs and technology-focused ventures, recognizing their significant potential to drive economic progress.

This commitment translates into tangible assistance, including financial backing, expert mentorship, and dedicated acceleration programs. These initiatives are designed to nurture innovation and facilitate robust business growth, aligning perfectly with Garanti BBVA's broader economic development strategy and its embrace of forward-thinking business models.

In 2024, Garanti BBVA continued its strong support for the entrepreneurial ecosystem. For instance, through its various programs, it facilitated access to capital for over 5,000 startups and SMEs, with a notable portion specifically targeting women-led businesses and tech innovators. The bank's acceleration programs have seen a significant success rate, with participating companies reporting an average revenue increase of 30% within the first year post-program completion.

- Financial Support: Providing access to loans, credit lines, and investment opportunities for early-stage and growing businesses.

- Mentorship and Guidance: Connecting entrepreneurs with experienced professionals and industry experts for strategic advice.

- Acceleration Programs: Offering structured programs designed to fast-track business development, market penetration, and funding rounds.

- Focus on Innovation: Prioritizing support for technology-driven ventures and businesses with disruptive potential.

Sustainability-Focused Businesses and Individuals

This segment encompasses businesses and individuals prioritizing environmental, social, and governance (ESG) principles. They actively seek financial products and services that align with their sustainability goals, including green finance options and investments in low-carbon transitions. Garanti BBVA's commitment to sustainable finance, evidenced by its extensive green product portfolio, directly addresses this growing demand.

Garanti BBVA aims to be a key partner for these clients, facilitating their journey towards more sustainable operations. The bank's strategic focus includes channeling substantial capital towards climate action and inclusive growth projects, reflecting a deep understanding of this segment's aspirations.

In 2023, Garanti BBVA reported significant progress in its sustainability efforts, including a €1.7 billion increase in its sustainable loan portfolio, reaching €10.5 billion. This growth highlights the bank's dedication to supporting clients in their environmental and social transitions.

- Growing Demand for ESG: Businesses and individuals are increasingly prioritizing investments and financial services that demonstrate strong ESG performance.

- Garanti BBVA's Green Offerings: The bank provides a range of green financial products designed to attract and support clients committed to sustainability.

- Capital Allocation: Garanti BBVA is strategically directing significant funds towards initiatives that promote climate action and inclusive economic development.

- Market Trends: The global sustainable finance market is expanding rapidly, with institutions like Garanti BBVA positioning themselves to capture this growth.

Garanti BBVA serves a broad spectrum of customers, from individual retail clients to large corporations and specialized segments like entrepreneurs and those focused on sustainability.

The bank's strategy involves providing tailored digital experiences for retail customers and essential financial tools for SMEs, reinforcing its role as a comprehensive financial partner.

For corporate clients, Garanti BBVA offers sophisticated financial solutions, including project finance and sustainable financing, demonstrating its capacity to handle complex needs.

The bank actively supports entrepreneurs and innovators, particularly women and tech ventures, through financial backing and mentorship programs.

| Customer Segment | Key Offerings | 2024 Focus/Data Point |

|---|---|---|

| Individual & Retail | Checking, Loans, Investments, Digital Banking | Enhancing digital experience for over 28 million customers |

| SMEs | Commercial Loans, Leasing, Factoring, Digital Tools | Robust market share in TL commercial loans; supporting Twin Transformation |

| Corporate & Investment Banking | Corporate Loans, Trade Finance, Treasury Services, Project Finance | Strong capabilities in financing large infrastructure projects |

| Entrepreneurs & Innovators | Financial Backing, Mentorship, Acceleration Programs | Facilitated capital access for over 5,000 startups/SMEs; 30% avg. revenue increase for program participants |

| Sustainability-Focused | Green Finance, ESG Investments, Low-Carbon Transitions | €10.5 billion sustainable loan portfolio in 2023; €1.7 billion increase |

Cost Structure

Garanti BBVA's operational and administrative expenses represent a substantial part of its cost structure. These include employee salaries, the upkeep of its extensive branch network, utility costs, and general overhead necessary for daily business operations.

For instance, in 2024, the bank continued its focus on optimizing these expenditures. Efficient management of these costs is paramount for sustaining profitability, particularly given the fluctuating economic conditions prevalent in the banking sector.

Garanti BBVA actively pursues strategies aimed at enhancing operational efficiency and controlling administrative costs. This ongoing commitment is vital for maintaining a competitive edge and ensuring robust financial performance.

Garanti BBVA significantly invests in its technology infrastructure, digital platforms, artificial intelligence, and cybersecurity. These expenditures cover crucial areas like software development, hardware upgrades, data center upkeep, and the salaries of essential IT personnel. For instance, in 2023, Garanti BBVA reported that its technology and digitalization investments played a key role in its operational efficiency and customer experience enhancements, though specific figures for this category are often embedded within broader operational expenses.

Funding costs, mainly interest paid on customer deposits and other borrowings, are a significant expense for Garanti. In 2024, interest expenses represented a substantial portion of their operating costs, directly impacting profitability.

Effectively managing these interest expenses is crucial for Garanti to maintain strong net interest margins. Their strategy of attracting stable, low-cost retail deposits helps to keep these funding costs down, providing a competitive advantage.

Risk Management and Compliance Costs

Garanti BBVA dedicates resources to robust risk management, covering credit, market, and operational risks. These expenses are crucial for maintaining financial stability and protecting against potential losses.

Compliance costs are significant, encompassing adherence to a complex web of national and international financial regulations. This includes investments in sophisticated risk assessment systems and the generation of detailed regulatory reports.

Internal audit functions are a key component of these costs, ensuring that all operations align with regulatory requirements and internal policies. By prioritizing proactive compliance, Garanti BBVA aims to avoid costly penalties and safeguard its reputation.

- Risk Assessment Systems: Investments in technology and expertise to identify and quantify potential risks.

- Regulatory Reporting: Costs associated with data collection, analysis, and submission to financial authorities.

- Internal Audit: Expenses for personnel and processes to ensure operational integrity and compliance.

- Compliance Training: Ongoing education for staff to stay abreast of evolving regulatory landscapes.

Marketing, Sales, and Customer Acquisition Costs

Garanti BBVA invests significantly in marketing, sales, and customer acquisition to drive growth across its varied customer segments. These expenditures are crucial for building brand recognition, launching new financial products, and securing its position in a competitive market. The bank's digital marketing strategy and broad advertising campaigns are central to these efforts.

In 2024, the banking sector, including major players like Garanti BBVA, saw continued investment in digital channels. For instance, Turkish banks collectively spent billions on digital transformation initiatives, a significant portion of which is allocated to marketing and customer acquisition through online platforms. Garanti BBVA's focus on enhancing its digital presence, from mobile banking apps to targeted online advertising, directly impacts these cost categories. The bank's commitment to customer experience also translates into costs associated with sales teams and customer support, vital for retaining and expanding its customer base.

- Marketing Campaigns: Expenditures on advertising, public relations, and promotional activities to enhance brand visibility and attract new customers.

- Sales Force Activities: Costs associated with maintaining and compensating sales personnel, including branch staff and specialized sales teams focused on business clients.

- Customer Acquisition Initiatives: Investments in onboarding new customers, including referral programs, introductory offers, and the operational costs of acquiring and setting up new accounts.

- Digital Marketing & Brand Visibility: Spending on online advertising, social media engagement, search engine optimization, and content creation to maintain a strong digital footprint and brand presence.

Garanti BBVA's cost structure is significantly influenced by its funding costs, primarily interest paid on customer deposits and borrowings. In 2024, interest expenses formed a substantial part of its operating costs, directly impacting profitability.

The bank also incurs substantial operational and administrative expenses, including employee salaries, branch network upkeep, and utilities. Investments in technology, digital platforms, and cybersecurity are also key cost drivers, essential for maintaining efficiency and customer experience.

Furthermore, Garanti BBVA allocates resources to robust risk management and compliance with financial regulations, which include expenses for risk assessment systems and regulatory reporting. Marketing and sales efforts to acquire and retain customers also contribute to the overall cost base.

| Cost Category | Key Components | Impact |

|---|---|---|

| Funding Costs | Interest on deposits, borrowings | Directly affects net interest margin and profitability. |

| Operational & Administrative Expenses | Salaries, branch upkeep, utilities, overhead | Essential for daily operations and overall efficiency. |

| Technology & Digitalization | Software, hardware, AI, cybersecurity | Drives operational efficiency and customer experience. |

| Risk Management & Compliance | Risk assessment, regulatory reporting, internal audit | Ensures financial stability and adherence to regulations. |

| Marketing & Sales | Advertising, sales force, customer acquisition | Crucial for growth, brand building, and market position. |

Revenue Streams

Net Interest Income (NII) is Garanti BBVA's most significant revenue source. It's the profit made from the spread between the interest the bank earns on its lending and investments and the interest it pays out on customer deposits and other borrowings. This core banking activity directly reflects the bank's ability to manage its assets and liabilities effectively.

Garanti BBVA's robust loan portfolio, encompassing a wide range of business and retail lending, is a primary engine for NII. Coupled with disciplined pricing strategies that ensure favorable interest rate differentials, the bank consistently maximizes its earnings from these core operations. For instance, in the first quarter of 2024, Garanti BBVA reported strong NII growth, underscoring the effectiveness of its lending and deposit management strategies.

Net fees and commissions are a significant and expanding revenue driver for Garanti, especially from its payment systems and digital banking offerings. This diversification away from solely interest income highlights the bank's success in generating income from non-lending services. In 2024, Garanti's fee and commission income demonstrated robust growth, reflecting increased transaction volumes and the expanding adoption of its digital platforms.

Garanti BBVA generates substantial income from a diverse portfolio of loan products. This includes consumer loans, general purpose loans, and specialized offerings like green loans, catering to a broad customer base.

The bank earns revenue not only through the interest charged on these loans but also from various associated fees. This dual income stream from lending activities is a core component of its financial performance.

Garanti BBVA's strong market position, particularly in Turkish lira loans, directly contributes to its significant revenue generation from its loan products. For instance, as of the first quarter of 2024, the bank’s total loan volume reached approximately TRY 1.5 trillion, demonstrating the scale of its lending operations.

Investment Banking and Portfolio Management Income

Garanti's revenue streams are significantly bolstered by its investment banking and portfolio management activities. This includes income generated from advisory fees for mergers and acquisitions, underwriting fees for capital markets transactions, and profits from trading various financial instruments. These services are crucial for corporate clients seeking capital or strategic advice.

Furthermore, the bank earns substantial fees from managing assets and investment portfolios for both institutional and individual clients. Garanti's subsidiaries play a key role in expanding its reach and capabilities in these areas, offering specialized investment solutions. This diversification moves revenue generation beyond traditional loan interest.

- Investment Banking Fees: Advisory, underwriting, and trading gains contribute significantly to this revenue stream.

- Portfolio Management Income: Fees collected from managing client assets and investment portfolios.

- Diversification Benefit: Reduces reliance on interest income from lending activities.

- Subsidiary Contributions: Specialized investment and asset management services provided by group entities.

Payment Systems Revenue

Payment systems are a cornerstone of Garanti BBVA's revenue generation, contributing substantially to its non-interest income. This revenue stream is primarily driven by a high volume of credit and debit card transactions, alongside robust point-of-sale (POS) services and a growing portfolio of digital payment solutions. The bank’s strategic focus on enhancing its digital infrastructure directly translates into increased revenue from these payment activities.

Garanti BBVA's dominant position in the credit card market is a key factor in its payment systems revenue. By leveraging its extensive customer base and advanced digital platforms, the bank effectively captures a significant share of consumer spending. This strong market presence allows Garanti BBVA to generate consistent income from transaction fees and interchange revenues.

- Credit and Debit Card Transactions: Garanti BBVA processes millions of card transactions daily, earning revenue through interchange fees and service charges.

- Point-of-Sale (POS) Services: The bank provides POS terminals and related services to a vast network of merchants, generating income from rental fees and transaction commissions.

- Digital Payment Solutions: Revenue is also derived from innovative digital payment platforms and mobile banking services, catering to evolving consumer preferences.

- Market Share in Credit Cards: As of early 2024, Garanti BBVA continues to maintain a leading market share in Turkey's credit card sector, underscoring the significance of this revenue stream.

Garanti BBVA's revenue is multifaceted, extending beyond its core Net Interest Income. The bank actively generates income from fees and commissions, particularly through its robust payment systems and digital banking services. This diversification strategy is crucial, as evidenced by the consistent growth in fee and commission income throughout 2024, driven by increased transaction volumes and the widespread adoption of its digital platforms.

Investment banking and portfolio management also represent significant revenue streams. Income is derived from advisory services for mergers and acquisitions, underwriting capital markets transactions, and profits from trading financial instruments. Furthermore, fees from managing assets and investment portfolios for both institutional and individual clients, often facilitated by specialized subsidiaries, contribute substantially to non-interest income.

The bank's payment systems are a major contributor to its non-interest income, fueled by a high volume of credit and debit card transactions and extensive point-of-sale services. Garanti BBVA's leading market share in Turkey's credit card sector, a position it continued to hold in early 2024, directly translates into substantial revenue from transaction fees and interchange revenues.

| Revenue Stream | Description | Key Drivers | 2024 Data Highlight |

|---|---|---|---|

| Net Interest Income (NII) | Profit from interest rate spreads on loans and deposits | Loan portfolio size, deposit base, interest rate differentials | Strong NII growth in Q1 2024 |

| Net Fees and Commissions | Income from non-lending services | Payment systems, digital banking, transaction volumes | Robust growth in fee and commission income |

| Investment Banking & Portfolio Management | Income from advisory, underwriting, trading, and asset management fees | Market activity, client asset growth, subsidiary services | Significant contribution to non-interest income |

| Payment Systems | Revenue from card transactions and POS services | Credit card market share, transaction volume, merchant network | Leading market share in credit cards |

Business Model Canvas Data Sources

The Garanti Business Model Canvas is built upon a foundation of extensive market research, internal financial data, and customer feedback analysis. These diverse data sources ensure a comprehensive and accurate representation of Garanti's strategic positioning and operational realities.