Garanti Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Garanti Bundle

Garanti's competitive landscape is shaped by the interplay of buyer and supplier power, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for navigating the banking sector.

The complete report reveals the real forces shaping Garanti’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Garanti BBVA's reliance on customer deposits, which represented 69.5% of its total assets as of June 2025, grants these depositors considerable bargaining power. This significant deposit base means that changes in deposit rates can directly impact the bank's cost of funds and overall profitability.

The bank's financial health is also heavily influenced by the Central Bank of the Republic of Turkey's (CBRT) monetary policies and interest rate decisions. These external factors directly dictate Garanti BBVA's funding costs, impacting its net interest margins and overall profitability.

Furthermore, evolving regulatory requirements for capital adequacy play a crucial role in shaping the cost and accessibility of capital from financial markets. Stricter regulations can necessitate higher capital reserves, potentially increasing borrowing costs for the bank.

Technology and software vendors wield considerable influence over banks like Garanti BBVA, especially as the financial sector embraces digitalization. Garanti BBVA's significant investments in digital platforms, AI, and cybersecurity mean they depend heavily on these specialized providers. For instance, the global banking software market was projected to reach over $50 billion in 2024, highlighting the scale of this reliance.

The critical nature of core banking, payment processing, and data analytics software translates into substantial switching costs for banks. This dependence is amplified by the relentless pace of technological advancement, compelling institutions to partner with leading tech firms to stay competitive. Failure to adopt new technologies could leave a bank like Garanti BBVA lagging behind competitors.

Garanti BBVA's reliance on skilled human capital, especially in digital banking, cybersecurity, and data science, places significant bargaining power with these specialized professionals. The intense competition for top talent in the financial and tech industries, with average salaries for data scientists in Turkey potentially reaching upwards of 40,000 TRY per month in 2024, directly impacts wage costs. Attracting and retaining experienced individuals is paramount for Garanti BBVA's ability to innovate and maintain efficient operations within a demanding regulatory landscape.

Regulatory Bodies

Regulatory bodies like the Banking Regulation and Supervision Agency (BRSA) and the Central Bank of the Republic of Turkey (CBRT) exert significant bargaining power over Garanti BBVA. These entities act as gatekeepers, controlling operating licenses and defining the entire regulatory landscape. Their pronouncements on crucial matters such as capital adequacy ratios, lending limitations, and interest rate policies directly shape the bank's operational capacity and financial performance.

The influence of these regulatory bodies translates into substantial costs and strategic constraints for Garanti BBVA. For instance, in 2023, Turkish banks, including Garanti BBVA, faced evolving reserve requirement ratios and a tightening monetary policy stance from the CBRT, impacting lending volumes and profitability. Adapting to these ever-changing rules necessitates ongoing investment in compliance infrastructure and personnel, representing a non-negotiable operational expense that reduces financial flexibility.

- BRSA and CBRT as Key Regulators: They grant operating licenses and set the rules for Turkish banks.

- Impact on Business Model: Decisions on capital, lending, and interest rates directly affect Garanti BBVA's operations and profits.

- Compliance Costs: Adapting to new regulations is a significant and unavoidable expense for the bank.

- Strategic Flexibility: Regulatory changes can limit Garanti BBVA's ability to pursue certain business strategies or expand into new areas.

Payment System Networks

Major payment networks and infrastructure providers are crucial for banks like Garanti BBVA, enabling everything from credit card swipes to digital wallet transactions. These networks are the backbone of modern commerce, and their established infrastructure and widespread acceptance grant them significant bargaining power. In 2024, the reliance on these established systems means banks often have limited alternatives for efficient, global transaction processing, leading to substantial fees and service terms dictated by the networks themselves.

- Network Dominance: Companies like Visa and Mastercard control vast transaction volumes, making them indispensable for any bank operating in the retail space.

- Interoperability Standards: These networks set the technical standards, forcing banks to adapt to their systems rather than the other way around.

- Transaction Fees: In 2023, interchange fees, a primary revenue source for payment networks, continued to be a significant cost for merchants and indirectly for banks, highlighting the networks' pricing power.

Suppliers to Garanti BBVA, particularly those providing essential technology and specialized financial services, hold significant bargaining power. This is due to the high switching costs and the critical nature of their offerings in a digitally-driven banking environment.

The global banking software market's projected growth to over $50 billion in 2024 underscores the substantial investment banks make in these systems, reinforcing supplier leverage. Garanti BBVA's reliance on these specialized vendors for core banking, payment processing, and data analytics means that changes in their pricing or service terms can directly impact the bank's operational efficiency and competitiveness.

Furthermore, the intense competition for top talent, with data scientists in Turkey potentially earning up to 40,000 TRY monthly in 2024, highlights the bargaining power of skilled employees. Garanti BBVA's need to attract and retain these professionals for digital innovation and cybersecurity directly influences its wage costs and operational capacity.

| Supplier Type | Key Dependencies | Impact on Garanti BBVA | Market Trend (2024) | Example Data Point |

|---|---|---|---|---|

| Technology Vendors | Core Banking Software, AI Platforms, Cybersecurity Solutions | High switching costs, operational efficiency, innovation pace | Global Banking Software Market: Projected >$50 billion | Reliance on specialized software for digital services |

| Skilled Human Capital | Digital Banking Experts, Data Scientists, Cybersecurity Professionals | Wage costs, talent acquisition/retention, innovation capacity | High demand for tech talent in finance | Data Scientist salaries in Turkey: ~40,000 TRY/month |

| Payment Networks | Transaction Processing, Interoperability Standards | Transaction fees, operational costs, customer reach | Continued dominance of major networks | Interchange fees impact bank revenue streams |

What is included in the product

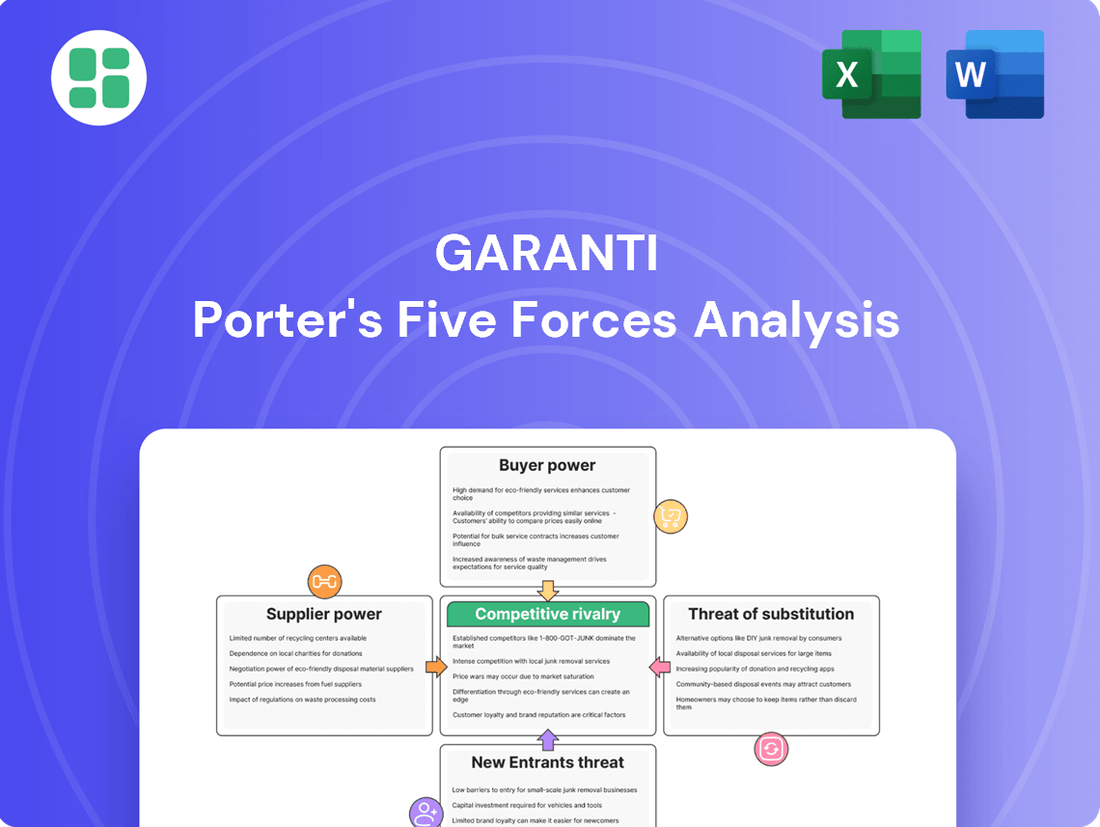

Garanti's Porter's Five Forces analysis meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector.

This analysis provides a comprehensive understanding of the competitive forces shaping Garanti's strategic environment and impacting its profitability.

Effortlessly identify and prioritize competitive threats with a visual representation of all five forces, streamlining strategic planning.

Customers Bargaining Power

Garanti BBVA's customer base is quite varied, encompassing individual retail clients, small and medium-sized enterprises (SMEs), and large corporations. This diversity means the bargaining power of its customers isn't uniform across the board.

For individual customers, their power might seem limited on an individual basis. However, the sheer volume of retail clients means their collective ability to move their accounts to a competitor offering better rates or services represents a significant force. For instance, in 2023, the Turkish banking sector saw continued competition in deposit rates, with some banks offering up to 45% on TRY deposits, highlighting the sensitivity of retail customers to pricing.

Conversely, larger corporate clients and institutional investors wield considerably more bargaining power. These entities manage substantial transaction volumes and hold large deposit balances, allowing them to negotiate more favorable terms, such as lower fees, preferential interest rates, and tailored financial solutions. Their ability to shift significant amounts of business makes them key players in influencing the bank's service offerings and pricing strategies.

The ease with which customers can switch financial providers, particularly in retail banking, is significantly amplified by low switching costs in digital channels. The widespread availability of digital banking platforms and mobile applications means customers can readily compare offerings from various institutions. For instance, in 2024, studies indicated that over 70% of retail banking customers in developed markets actively use mobile banking apps, facilitating quick comparisons of products, rates, and services. This easy comparison empowers customers to move their accounts or pursue better deals with minimal friction, directly impacting the bargaining power of customers.

Customers today wield significant power due to readily available online information and comparison tools. This allows them to easily research and compare financial products, forcing banks like Garanti BBVA to offer competitive pricing and superior service to attract and retain business. In 2024, for instance, the proliferation of fintech apps and comparison websites has made it simpler than ever for consumers to find the best rates on savings accounts and loans, directly impacting a bank's ability to command premium pricing.

Rise of Fintech Alternatives

The rise of fintech alternatives significantly bolsters the bargaining power of customers for banks like Garanti BBVA. Numerous fintech firms are now offering specialized services, from streamlined payment solutions and peer-to-peer lending to user-friendly digital wallets. This proliferation of options means customers are no longer solely reliant on traditional banks, giving them greater leverage.

This increased competition from non-bank entities is actively reshaping customer expectations. Consumers now demand greater convenience, faster transaction speeds, and notably lower fees, directly challenging incumbent financial institutions. For instance, by mid-2024, the global digital payments market was projected to reach over $2.5 trillion, highlighting the significant shift towards fintech-driven convenience.

- Increased Choice: Fintechs provide specialized services like digital wallets and P2P lending, offering alternatives to traditional banking.

- Elevated Expectations: Customers now expect enhanced convenience, speed, and lower fees due to fintech competition.

- Competitive Pressure: Garanti BBVA must continually innovate its digital offerings to meet these evolving customer demands and retain market share.

Regulatory Focus on Consumer Protection

Recent regulations in the Turkish banking sector, particularly those concerning digital banking and payment systems, have placed a significant emphasis on consumer protection. For instance, the Law on Payment and Electronic Money Institutions, enacted in 2019 and further refined through subsequent regulations, mandates increased transparency and security measures, directly benefiting customers.

This robust regulatory environment empowers customers by granting them more rights and providing clearer avenues for recourse when issues arise. Banks are now required to adhere to stringent guidelines regarding fair treatment, data privacy, and dispute resolution, which collectively enhance the bargaining power of consumers in their dealings with financial institutions.

- Increased Transparency: Regulations compel banks to clearly disclose fees, terms, and conditions, reducing information asymmetry.

- Enhanced Data Security: Stricter rules on data protection empower customers with greater control over their personal financial information.

- Improved Dispute Resolution: Established procedures for handling complaints offer customers more effective channels for addressing grievances.

- Digital Banking Safeguards: Specific regulations for digital platforms ensure a safer and more user-friendly experience for consumers.

The bargaining power of customers for Garanti BBVA is substantial, driven by increased choice, evolving expectations, and regulatory support. Customers can easily switch providers, especially with digital banking, and fintech innovations offer compelling alternatives, forcing banks to offer competitive terms.

| Customer Segment | Bargaining Power Factors | Impact on Garanti BBVA |

|---|---|---|

| Retail Customers | High volume, price sensitivity, digital comparison tools | Forces competitive pricing and service; risk of attrition |

| SMEs | Moderate transaction volume, need for tailored services | Negotiate for better fees and product bundles |

| Large Corporations/Institutions | Significant transaction volumes, large deposits | Strong negotiation power for preferential rates and custom solutions |

Preview the Actual Deliverable

Garanti Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Garanti's competitive landscape through an in-depth analysis of Porter's Five Forces, covering threats of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry within the banking sector. This professionally crafted report is ready for your immediate use.

Rivalry Among Competitors

The Turkish banking sector is a highly competitive arena, featuring a substantial number of participants. Garanti BBVA contends with large state-owned banks, other prominent private institutions like Akbank and Yapı Kredi, and an expanding presence of digital-only banks. This crowded landscape demands constant adaptation and robust marketing efforts to secure and grow market share and profitability.

Competitive rivalry is intense, especially in digital banking, where major banks are pouring resources into mobile apps, AI financial advice, and cutting-edge payment solutions. This aggressive push for digital leadership means constant innovation to provide superior customer experiences.

Garanti BBVA exemplifies this trend, boasting nearly 17 million active mobile customers, highlighting its strong position in the digital banking landscape. The rapid pace of digital service evolution compels banks to continuously enhance their platforms to remain competitive and meet evolving customer demands.

The banking sector in 2024 is characterized by intense competition, exacerbated by regulatory lending caps and elevated funding costs. These factors directly squeeze net interest margins, a critical profitability driver for banks, making sustained financial performance a significant challenge.

Banks must actively offer competitive interest rates on both loans and deposits to attract and retain customers. While this is essential for business, it inherently erodes profit margins, even as institutions strive to boost income from fees and commissions.

Market Share Dynamics

Garanti BBVA is locked in a fierce competition for market share across key banking products like consumer loans, SME financing, and customer deposits. This ongoing struggle for customer acquisition and retention is particularly evident in its efforts to grow its Turkish Lira lending and deposit base. The competitive landscape is further intensified by the significant role public banks play in driving credit growth within the Turkish market.

In 2024, the Turkish banking sector saw dynamic shifts in market share. For instance, Garanti BBVA's performance in attracting new customers and increasing its deposit volume directly reflects its success in navigating this competitive environment. Public banks, such as Ziraat Bankası and Halkbank, have historically been major players, and their continued influence on credit expansion means Garanti BBVA must consistently innovate and offer competitive products to maintain and grow its position.

- Garanti BBVA's market share in consumer loans and SME lending is a key indicator of its competitive strength.

- The bank's ability to attract Turkish Lira deposits is crucial for its funding and profitability amidst intense competition.

- Public banks remain significant competitors, influencing overall credit market dynamics and customer acquisition strategies.

Regulatory Influence on Competition

Regulatory bodies significantly shape competitive dynamics within the banking sector. For instance, in 2024, measures like monthly loan growth caps and specific requirements for Turkish Lira deposit shares directly impacted how banks could operate and expand. These regulations, while intended for economic stability, create a distinct competitive environment.

These regulatory levers can alter a bank's strategic focus, influencing their capacity for lending and overall growth. Consequently, success in this market often hinges as much on adept compliance and strategic adaptation to evolving regulatory frameworks as it does on traditional competitive pressures. Banks that can navigate these rules efficiently gain a distinct advantage.

- Loan Growth Caps: Regulations limiting monthly loan expansion directly constrain a bank's ability to increase its market share through aggressive lending in 2024.

- Deposit Share Rules: Mandates regarding the proportion of Turkish Lira deposits influence a bank's funding costs and liquidity management strategies.

- Strategic Adaptation: Banks must proactively adjust their business models to comply with and leverage regulatory changes, turning potential hurdles into competitive opportunities.

- Compliance as a Differentiator: Superior regulatory compliance can enhance a bank's reputation and operational efficiency, setting it apart from less agile competitors.

Competitive rivalry in the Turkish banking sector is fierce, with Garanti BBVA facing strong competition from state-owned banks, other major private banks, and increasingly, digital-only players. This intense competition, particularly in digital offerings, necessitates continuous innovation and investment in customer experience to maintain market share and profitability.

The 2024 environment further intensifies this rivalry due to regulatory lending caps and rising funding costs, which compress net interest margins. Banks must balance offering competitive rates for loans and deposits with the need to enhance fee-based income, all while navigating a market where public banks actively drive credit growth.

| Competitor Type | Key Players | Competitive Focus |

|---|---|---|

| State-Owned Banks | Ziraat Bankası, Halkbank | Credit expansion, broad market reach |

| Major Private Banks | Akbank, Yapı Kredi | Digital services, customer acquisition, diverse product offerings |

| Digital-Only Banks | Various emerging fintechs | Agile technology, specialized services, lower cost structures |

SSubstitutes Threaten

Fintech payment solutions are rapidly emerging as a potent substitute for traditional bank-led systems. Companies like Stripe, Square, and PayPal, along with innovative non-bank providers, are capturing market share by offering streamlined, often cheaper, transaction services. This directly challenges banks' established revenue streams from payment processing and account fees.

The proliferation of digital wallets and instant transfer systems, such as Zelle in the US or Faster Payments in the UK, allows consumers and businesses to bypass traditional banking infrastructure for many everyday transactions. For instance, in 2024, global digital payment transaction volume was projected to exceed $10 trillion, a significant portion of which bypasses conventional bank channels for the end-user experience.

This shift directly impacts banks' fee income. For example, the average interchange fee, a primary revenue source for banks on card transactions, faces pressure as alternative payment methods gain traction. The convenience and cost-effectiveness of these fintech alternatives represent a substantial threat, forcing banks to innovate or risk losing a critical part of their business.

Peer-to-peer (P2P) lending platforms, while still developing in Turkey, represent a growing threat of substitutes to traditional banking services. These platforms can offer alternative funding avenues for small and medium-sized enterprises (SMEs) and individuals seeking capital, often with potentially quicker approval processes and more tailored terms than conventional loans.

Despite being subject to increasing regulation in Turkey, P2P platforms can bypass traditional financial intermediaries. This disintermediation allows them to offer competitive rates and faster access to funds, directly challenging the established banking model, particularly for underserved segments of the market.

While regulatory oversight currently moderates their direct competitive impact, the inherent flexibility and speed of P2P lending suggest a significant future disruptive potential. As the market matures and regulations evolve, these platforms are poised to capture a larger share of the lending market, forcing traditional banks to adapt their offerings.

Cryptocurrencies and blockchain solutions, while facing regulatory hurdles such as restrictions on their use in payments by the Central Bank of the Republic of Turkey (CBRT), pose a potential long-term threat to traditional banking models. The increasing global adoption and innovation in digital assets, including the exploration of central bank digital currencies like a Digital Turkish Lira, could fundamentally change how value is transferred and invested.

While cryptocurrencies are not yet a widespread substitute for everyday banking transactions in Turkey, their underlying technology and the evolving digital currency landscape present a significant disruptive force. For instance, by the end of 2024, global cryptocurrency market capitalization remained substantial, indicating continued investor interest and technological development that could eventually challenge incumbent financial services.

Embedded Finance and Neo-banks

Embedded finance, integrating financial services into non-financial platforms like e-commerce, offers a significant threat by bypassing traditional banking channels. For instance, the global embedded finance market was projected to reach over $7 trillion by 2030, indicating a substantial shift in how consumers access financial products.

Neobanks and challenger banks, with their digital-first approach and often lower operating costs, present a direct competitive threat. In 2024, neobanks continued to gain traction, with some reporting millions of active users and offering specialized services that appeal to digitally native customers seeking convenience and better rates.

- Embedded Finance Market Growth: The embedded finance market is expected to expand significantly, offering a seamless alternative to traditional banking for everyday transactions.

- Neobank Adoption: Neobanks are attracting a growing customer base, particularly younger demographics, due to their user-friendly digital interfaces and competitive offerings.

- Competition Intensification: These digital alternatives reduce customer loyalty to incumbent financial institutions, thereby increasing the threat of substitutes.

Direct Investment Platforms

The threat of substitutes for traditional bank investment services is significant, primarily from direct investment platforms. These platforms, including robo-advisors and online brokerage firms, offer a compelling alternative by providing direct access to capital markets and a wide array of investment products. For instance, the assets under management (AUM) for robo-advisors globally were projected to reach over $3.9 trillion by the end of 2024, a substantial increase from previous years, highlighting their growing appeal.

Customers increasingly turn to these specialized platforms when seeking potentially higher returns or greater control over their investment portfolios. This shift directly reduces their reliance on banks for investment advice and product access. The ease of use and often lower fee structures of these digital alternatives make them particularly attractive to a growing segment of investors.

Consequently, banks are compelled to significantly enhance their own investment banking solutions to remain competitive. This includes improving digital offerings, expanding product variety, and potentially lowering fees to retain clients who might otherwise migrate to fintech alternatives. The competitive pressure from these substitutes is a key driver for innovation within the banking sector's investment arms.

- Robo-advisor AUM Growth: Global robo-advisor AUM is expected to exceed $3.9 trillion by the end of 2024.

- Investor Preference Shift: Investors are increasingly prioritizing platforms offering direct market access and control.

- Bank Response: Traditional banks must innovate their investment services to counter the threat of specialized platforms.

Fintech payment solutions and digital wallets are increasingly bypassing traditional bank channels for transactions. By the end of 2024, global digital payment transaction volume was projected to exceed $10 trillion, with a significant portion attributable to these alternative methods. This directly impacts banks' revenue from interchange fees and payment processing.

Embedded finance, integrating financial services into non-financial platforms, represents another substantial threat. The global embedded finance market is projected to exceed $7 trillion by 2030, demonstrating a clear shift in how consumers access financial products away from traditional banking interfaces.

Neobanks and challenger banks are also gaining traction, offering user-friendly digital experiences and competitive rates. These digital-first institutions are attracting customers, particularly younger demographics, forcing incumbent banks to enhance their own digital offerings and service models to retain market share.

| Substitute Type | Key Characteristics | Impact on Banks | 2024 Data/Projections |

|---|---|---|---|

| Fintech Payment Solutions & Digital Wallets | Streamlined, often cheaper transactions, bypass traditional infrastructure | Reduced fee income from payment processing | Global digital payment transaction volume projected to exceed $10 trillion |

| Embedded Finance | Financial services integrated into non-financial platforms | Disintermediation, reduced reliance on bank channels | Global market projected to exceed $7 trillion by 2030 |

| Neobanks/Challenger Banks | Digital-first, lower operating costs, specialized services | Customer acquisition, pressure on traditional banks to innovate | Continued growth in user base and specialized service offerings |

Entrants Threaten

The Turkish banking sector presents a formidable barrier to new entrants, primarily due to the substantial capital requirements mandated by regulatory bodies like the Banking Regulation and Supervision Agency (BRSA) and the Central Bank of the Republic of Turkey (CBRT).

Establishing a new bank necessitates a significant financial outlay, often in the hundreds of millions of US dollars, to meet minimum capital adequacy ratios and operational reserves. For instance, as of early 2024, the minimum capital requirement for newly established banks in Turkey remained a robust figure, designed to ensure financial stability and absorb potential losses.

Beyond capital, prospective entrants must navigate a complex and lengthy licensing process. This involves meticulous scrutiny of business plans, management expertise, and risk management frameworks, alongside ongoing compliance obligations related to anti-money laundering, data privacy, and consumer protection, all of which significantly deter potential new players.

Established brand loyalty and trust significantly deter new entrants. Incumbent banks like Garanti BBVA have cultivated strong brand recognition and deep customer trust over many years. For instance, in 2024, Garanti BBVA reported a customer base of over 20 million, highlighting the scale of its established relationships. Newcomers must invest heavily to even begin to replicate this level of credibility in a sector where security is non-negotiable.

Traditional banks maintain a significant advantage through their vast physical infrastructure, including extensive branch networks and ATMs. This established presence represents a considerable barrier to entry for newcomers, requiring substantial capital investment to replicate. For instance, in 2024, major global banks continued to operate thousands of physical locations, a testament to the ongoing importance of this network.

While digital-only banks bypass the need for physical branches, they face their own infrastructure hurdles. Building and maintaining robust IT systems, ensuring top-tier cybersecurity, and developing a seamless digital distribution strategy demand significant financial outlay and specialized expertise. The ongoing investments in cloud computing and data analytics by established digital players highlight this ongoing challenge.

Emergence of Digital Banks and Fintechs

The threat of new entrants in Turkey's banking sector has seen a notable uptick, largely due to the formalization of digital banking regulations. This regulatory shift has paved the way for new, digital-only banks to enter the market, challenging traditional players. For instance, as of early 2024, Turkey has seen a surge in fintech startups focusing on digital payments and lending, with some aiming to secure full banking licenses.

Fintech companies, even when initially focused on specific niches, possess the agility to scale rapidly. They can effectively capture particular segments of financial services, such as remittances or small business loans, thereby posing a significant threat. This segment growth can eventually lead them to evolve into comprehensive banking alternatives, further intensifying competition.

- Regulatory Formalization: Turkey's updated digital banking regulations in 2023-2024 have lowered entry barriers for tech-focused financial institutions.

- Fintech Scalability: Companies like Papara and Monta, which began with niche services, have demonstrated rapid user base growth, reaching millions of users by late 2024.

- Competitive Landscape Shift: The emergence of these digital players creates a more dynamic and competitive environment, forcing incumbent banks to innovate.

Talent Acquisition and Market Knowledge

New entrants face a significant hurdle in acquiring and retaining talent possessing crucial market knowledge and technical skills. The competition for experienced professionals in specialized financial and technological sectors is intense, making it difficult for new players to assemble robust teams capable of navigating the Turkish market's intricacies.

For instance, in 2024, the demand for AI and data analytics specialists in Turkey's financial sector saw a notable increase, with reported salary hikes of up to 20% for highly sought-after professionals. This talent scarcity directly impacts the ability of new entrants to establish a competitive foothold.

- Talent Scarcity: Difficulty in finding and keeping skilled professionals in finance and technology.

- Market Expertise: New entrants need individuals who understand the nuances of the Turkish financial landscape.

- Competitive Salaries: Rising compensation for specialists makes attracting top talent costly for newcomers.

- Impact on Entry: The inability to secure skilled personnel can significantly hinder a new entrant's operational effectiveness and market penetration.

The threat of new entrants into Turkey's banking sector is moderately high, primarily due to evolving digital regulations and the rise of agile fintech firms. While traditional barriers like capital requirements and established brand loyalty remain significant, the regulatory shift towards digital banking has opened avenues for tech-savvy players. These newcomers, often unburdened by legacy systems, can rapidly capture market share in specific financial niches, forcing incumbents to adapt.

| Factor | Description | Impact on New Entrants | 2024 Data/Trend |

|---|---|---|---|

| Capital Requirements | High minimum capital mandated by BRSA and CBRT. | Significant financial barrier. | Minimum capital remains substantial, in the hundreds of millions USD. |

| Regulatory Hurdles | Complex licensing and ongoing compliance. | Time-consuming and costly to navigate. | Formalization of digital banking regulations in 2023-2024 has eased some aspects for tech firms. |

| Brand Loyalty & Trust | Established incumbents enjoy deep customer relationships. | Difficult for newcomers to build credibility. | Garanti BBVA's customer base exceeding 20 million in 2024 highlights incumbent strength. |

| Fintech Agility | Digital-first companies can scale quickly. | Threaten specific market segments. | Fintechs like Papara and Monta saw rapid user growth, reaching millions by late 2024. |

| Talent Acquisition | Competition for skilled finance and tech professionals. | Hiring experienced staff is expensive and challenging. | Demand for AI/data specialists saw up to 20% salary hikes in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, leveraging annual reports, industry-specific market research, and financial statements from key players. This comprehensive approach ensures a thorough understanding of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.