Garanti Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Garanti Bundle

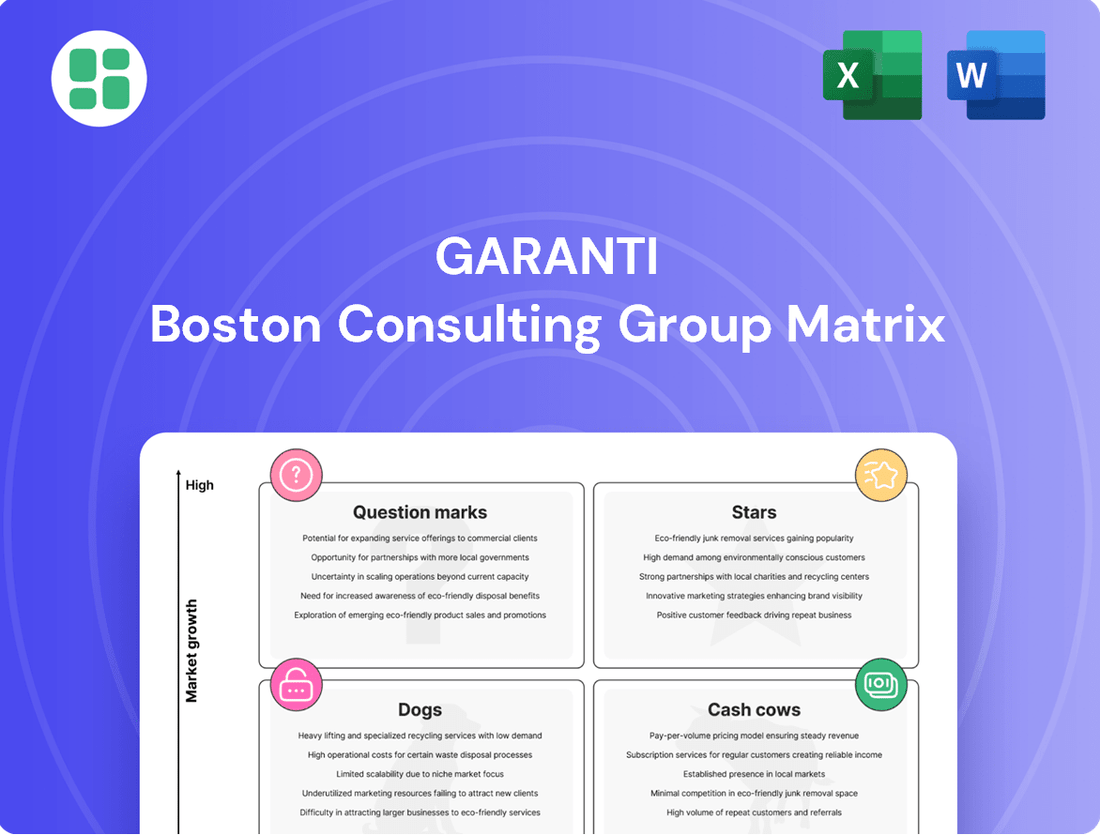

Uncover the strategic positioning of this company's product portfolio with our Garanti BCG Matrix preview. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the core dynamics driving its market performance.

Ready to transform this insight into action? Purchase the full Garanti BCG Matrix report for a comprehensive breakdown, including data-driven recommendations and a clear roadmap for optimizing your investments and product strategy.

Stars

Garanti BBVA's Digital Banking Platform, represented by Garanti BBVA Mobile, is a clear Star in the BCG matrix. With over 17 million active users by Q1 2025, it shows immense market share and strong growth potential.

The platform's activity is staggering, recording over 2.7 billion logins in the first half of 2024 alone. This high engagement underscores its position as a leading digital financial service.

The success of the digital platform is evident in its ability to handle almost all banking operations off-branch, with a remarkable 86% of product sales occurring digitally, showcasing a strong competitive advantage.

Garanti BBVA has significantly advanced its sustainable finance efforts, surpassing its initial TL 400 billion goal for the 2018-2025 period well ahead of schedule. This achievement underscores the bank's strong commitment and market penetration in the burgeoning sustainable finance sector.

Building on this success, Garanti BBVA has set a new, ambitious target to direct TL 3.5 trillion towards sustainable development initiatives by the close of 2029. This substantial increase in green and social financing demonstrates a strategic focus on leading this critical and expanding market segment.

Garanti BBVA's investment in AI, exemplified by its assistant UGI, has facilitated over 63 million customer interactions, a testament to its success in enhancing customer experience. This aggressive innovation in AI-powered solutions positions it as a high-growth star in the banking sector, driving digital transformation and a competitive advantage.

Payment Systems Business

Garanti BBVA's payment systems business is a clear star in its portfolio, demonstrating exceptional growth. In the first half of 2024, net fees and commissions from this segment tripled compared to the previous year. This surge is attributed to a significant increase in transaction volumes and the successful expansion of fee-generating services, underscoring a dominant market position.

The bank's strategic focus and operational excellence in payments are further validated by external recognition. Garanti BBVA was honored as the Best Cash Management Bank, a testament to its robust infrastructure and customer-centric solutions. This award reinforces the business's strong market share and its ability to thrive in the dynamic payments sector.

- Exceptional Growth: Net fees and commissions from payment systems tripled in H1 2024.

- Drivers of Success: Increased transaction volumes and diversified fee streams.

- Market Leadership: Indicated by a high market share in a rapidly evolving landscape.

- Industry Recognition: Awarded 'Best Cash Management Bank'.

Consumer Loans (Romania)

Consumer loans in Romania represent a significant growth area for financial institutions. In 2024, Garanti BBVA Romania observed a substantial 33.9% increase in its consumer loan volumes, marking it as the fastest-growing segment for the bank.

This robust performance indicates a dynamic market with increasing demand for credit. Garanti BBVA's success in this segment suggests effective strategies for portfolio expansion and market share capture.

- Consumer Loan Growth: Garanti BBVA Romania's consumer loans grew by 33.9% in 2024.

- Market Position: This growth highlights a high-demand market where the bank is gaining traction.

- Revenue Contribution: The expansion in consumer lending is a key driver of the bank's overall revenue.

- Future Outlook: Consistent demand suggests a positive trajectory for this lending category.

Stars in the Garanti BBVA portfolio represent business segments with high market share and high growth potential. These are the areas where the bank is a leader and the market itself is expanding rapidly, demanding significant investment to maintain momentum.

Garanti BBVA's digital banking platform, with over 17 million active users by Q1 2025 and 2.7 billion logins in H1 2024, exemplifies a Star. Similarly, its payment systems business, which saw net fees and commissions triple in H1 2024, is a prime example of a Star due to its exceptional growth and market leadership.

The bank's AI initiatives, like the UGI assistant facilitating over 63 million customer interactions, also point to Star status, indicating strong growth in a technologically advancing sector. Furthermore, consumer loans in Romania, showing a 33.9% growth in 2024, highlight a Star segment driven by high market demand and effective expansion strategies.

| Business Segment | Market Share | Growth Potential | Key Performance Indicator |

|---|---|---|---|

| Digital Banking Platform | High | High | 17M+ active users (Q1 2025), 2.7B+ logins (H1 2024) |

| Payment Systems | High | High | Net fees/commissions tripled (H1 2024) |

| AI Initiatives (UGI) | Emerging/High | High | 63M+ customer interactions |

| Consumer Loans (Romania) | Growing | High | 33.9% growth (2024) |

What is included in the product

The Garanti BCG Matrix categorizes business units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth rate.

This framework guides strategic decisions on investment, divestment, and resource allocation for each category.

Visualize your portfolio's health, identifying underperformers and stars for strategic resource allocation.

Cash Cows

Turkish Lira customer deposits are a clear Cash Cow for Garanti BBVA. These deposits are the bank's most reliable funding, making up around 70-73% of its total assets. This stability means they consistently bring in significant cash with minimal need for further investment to keep them running.

Garanti BBVA holds a substantial slice of the Turkish Lira deposit market among private banks. This strong position ensures a steady and substantial cash flow. In the first quarter of 2025, this vital segment saw growth of 21.4%, reinforcing Garanti BBVA's standing as the leading private bank for TL deposits.

Garanti BBVA's established mortgage loan portfolio is a prime example of a cash cow. As of March 2025, the bank commanded an impressive 28.8% market share in consumer mortgage loans among private banks, underscoring its significant presence in this mature market.

This lending segment consistently generates substantial interest income, providing a stable and predictable revenue stream for Garanti BBVA. Although not characterized by rapid expansion, its entrenched market position ensures it acts as a reliable source of cash, supporting other business initiatives.

General Purpose Loans, a key component of Garanti's portfolio, function as a Cash Cow. The bank’s strong standing, evidenced by a 19.7% market share among private banks in consumer general purpose loans as of March 2025, highlights its dominance in this segment, which includes overdrafts.

This segment is a consistent revenue generator due to its high volume and predictable nature, underpinning the bank's core profitability. Its established customer base and operational efficiency further solidify its status as a reliable income stream.

Corporate and Commercial Banking Relationships

Garanti BBVA's corporate and commercial banking relationships are a significant cash cow, characterized by deep-rooted client connections and a comprehensive suite of financial products. This maturity translates into predictable, consistent revenue streams, requiring less intensive marketing spend compared to growth-focused segments.

These established segments benefit from the trust built over years, leading to recurring business and stable cash flow generation. The bank's extensive product portfolio further solidifies these relationships, making it a go-to financial partner for businesses.

- Stable Revenue: Long-standing relationships ensure consistent cash flow with lower marketing costs.

- Client Trust: Established trust drives recurring business and reduces client acquisition expenses.

- Product Breadth: Extensive offerings cater to diverse corporate needs, enhancing client stickiness.

- Romanian Growth: Garanti BBVA Romania saw a 14% increase in corporate loans in 2024, highlighting ongoing strength in this segment.

Extensive Branch and ATM Network

Garanti BBVA's extensive physical network, comprising 797 branches and 5,909 ATMs as of March 2025, acts as a significant cash cow. This widespread infrastructure ensures accessibility for a diverse customer base, even with the digital banking trend. These physical touchpoints continue to generate stable revenue through traditional transactions and customer support, requiring minimal additional investment for maintenance.

The enduring utility of this physical presence is evident in its role as a primary channel for many customers.

- Branch Network: 797 locations as of March 2025.

- ATM Network: 5,909 machines as of March 2025.

- Revenue Generation: Consistent income from traditional banking services.

- Low Marginal Investment: Stable returns with minimal need for further capital outlay.

Garanti BBVA's Turkish Lira customer deposits stand as a prime Cash Cow, forming the bedrock of its funding with 70-73% of total assets. This stability translates into consistent, significant cash generation with minimal reinvestment needs. The bank's leading position in the private sector TL deposit market, evidenced by a 21.4% growth in Q1 2025, ensures a robust and reliable cash flow stream.

The bank's established mortgage loan portfolio, holding a 28.8% market share among private banks as of March 2025, is another key Cash Cow. This mature segment consistently generates substantial interest income, providing a predictable revenue stream that supports other business initiatives without requiring aggressive expansion efforts.

General Purpose Loans, including overdrafts, also function as a Cash Cow for Garanti BBVA. With a 19.7% market share in consumer general purpose loans among private banks as of March 2025, this segment's high volume and predictable nature solidify its role as a consistent revenue generator and a cornerstone of the bank's profitability.

Corporate and commercial banking relationships are a significant Cash Cow due to deep-rooted client connections and a comprehensive product suite. This maturity yields predictable, stable revenue streams with lower marketing costs, reinforced by recurring business and client trust. Garanti BBVA Romania's 14% corporate loan growth in 2024 further underscores the strength in this segment.

Garanti BBVA's extensive physical network, with 797 branches and 5,909 ATMs as of March 2025, acts as a substantial Cash Cow. This infrastructure ensures consistent revenue from traditional banking services, requiring minimal additional investment for maintenance and continuing to serve as a primary channel for many customers.

| Business Segment | BCG Category | Key Metric | Data Point | Implication |

|---|---|---|---|---|

| TL Customer Deposits | Cash Cow | % of Total Assets | 70-73% | Stable, reliable funding source |

| Mortgage Loans | Cash Cow | Market Share (Private Banks) | 28.8% (March 2025) | Consistent interest income |

| General Purpose Loans | Cash Cow | Market Share (Private Banks) | 19.7% (March 2025) | Predictable, high-volume revenue |

| Corporate/Commercial Banking | Cash Cow | Romania Corporate Loan Growth | 14% (2024) | Strong, recurring business |

| Physical Network (Branches/ATMs) | Cash Cow | Number of Branches/ATMs | 797 / 5,909 (March 2025) | Consistent revenue from traditional services |

What You’re Viewing Is Included

Garanti BCG Matrix

The Garanti BCG Matrix preview you are viewing is the identical, fully functional document you will receive upon purchase. This means you'll get the complete strategic analysis, ready for immediate implementation, without any watermarks or limitations. Our commitment is to provide you with the exact, professionally formatted Garanti BCG Matrix report, enabling you to make informed decisions and drive business growth from the moment of acquisition.

Dogs

Certain physical transaction services within bank branches can be classified as dogs in the Garanti BCG Matrix. These are services that, despite the branch network being a cash cow overall, haven't kept pace with digital advancements. They often involve significant manual effort for tasks that are now rarely requested by customers.

With a staggering 98% of banking transactions happening outside of physical branches, services that heavily depend on in-person, paper-based methods are experiencing a sharp decline in both use and profitability. For instance, services like manual check clearing or specific types of paper-based loan applications, if still offered, fall into this category.

These outdated services are resource drains, consuming operational costs and staff time without generating substantial returns or exhibiting any meaningful growth potential. Their continued existence represents an inefficient allocation of capital within the bank's broader service portfolio.

Within a bank's operations, older, less efficient IT components not central to its core business can be categorized as dogs in the Garanti BCG Matrix. These systems often carry substantial maintenance expenses while offering little in terms of innovation or a competitive edge.

For instance, a bank might still rely on outdated mainframe systems for administrative tasks or customer data archiving that are costly to maintain and difficult to integrate with newer technologies. In 2024, many financial institutions are still grappling with the expense of maintaining such systems, with some reports indicating that up to 70% of IT budgets can be consumed by legacy system maintenance, diverting funds from crucial digital initiatives.

The strategic implication is that these legacy IT assets tie up valuable financial and human resources that could be more effectively deployed in areas driving growth and customer engagement, such as the modernization of core banking platforms or the expansion of digital services, as seen in Romania's banking sector's digital transformation efforts.

Underperforming niche investment products, if they exist within a company's portfolio, would likely be categorized as Dogs in the BCG matrix. These are products that haven't captured investor interest or market share. For instance, a specialized biotech fund launched in early 2024 that saw minimal subscriptions by mid-year, despite significant marketing spend, would fit this description.

Such products often consume valuable resources for ongoing development, compliance, and marketing without generating substantial returns. Imagine a fintech product designed for a very specific, unproven market segment that failed to attract a critical mass of users by the end of 2024, resulting in a net operating loss. These situations represent inefficient capital allocation.

While specific public data on such niche failures is scarce, the general principle applies: products with low market share and low market growth are Dogs. For example, a hedge fund strategy focused on a highly illiquid asset class that saw its assets under management decline by 30% in 2024, falling below its operational break-even point, would be a prime candidate for this classification.

Declining Physical POS Terminal Usage

The physical POS terminal segment, often categorized as a Dog in the BCG Matrix, is showing signs of maturity or a slow decline. Data from December 2024 indicated 864,055 POS terminals, which saw a slight reduction to 842,251 by March 2025. This decrease, coupled with a marginal dip in acquiring volume market share, points to a business unit with low growth potential and a shrinking market presence.

The proliferation of digital and mobile payment alternatives is a key driver behind this trend. As consumers and businesses increasingly adopt newer, more convenient payment methods, the reliance on traditional physical POS terminals may be stagnating or even contracting.

- POS Terminals: Decreased from 864,055 (Dec 2024) to 842,251 (Mar 2025).

- Market Share: Experienced a marginal drop in acquiring volume.

- Growth Outlook: Low, indicating a mature or declining market.

- Strategic Consideration: Requires ongoing maintenance with minimal investment for growth.

Less Competitive, Non-Digitalized Micro-SME Services

Within the Garanti BBVA Garanti BCG Matrix, services specifically targeting micro-small and medium-sized enterprises (MSMEs) that remain largely non-digitalized and depend on personal, high-touch interactions with minimal transaction volume can be categorized as Dogs. These offerings often face significant challenges in the current market landscape.

These services may find it difficult to keep pace with the efficiency and reach of digital solutions provided by fintech companies and other more digitally-savvy financial institutions. This competitive disadvantage can lead to a shrinking market share and disproportionately high operating expenses when weighed against the revenue they generate.

- Low Market Share: Non-digitalized MSME services often struggle to attract and retain customers in an increasingly digital-first environment, leading to a diminished presence in the market.

- High Operational Costs: Traditional, high-touch service models for MSMEs typically involve more manual processes and personalized attention, driving up operational expenses. For instance, if a service requires extensive in-person consultations for each micro-loan, the cost per transaction is inherently higher than an automated digital process.

- Limited Scalability: The reliance on manual processes and individual client interactions inherently limits the scalability of these services, preventing them from efficiently serving a larger customer base.

- Declining Relevance: As MSMEs increasingly seek convenient, online solutions for their financial needs, these traditional, non-digitalized services risk becoming obsolete, further eroding their market position.

Products or services with low market share and low market growth are classified as Dogs in the Garanti BCG Matrix. These offerings typically consume resources without generating significant returns and have limited potential for future growth. For instance, a specific software module that was developed for a niche industrial application in early 2024, but saw minimal adoption by the end of the year, would be considered a Dog.

These "Dogs" often require ongoing maintenance and support, diverting capital that could be invested in more promising areas of the business. Consider a legacy data processing service that, as of Q3 2024, accounted for less than 0.5% of total revenue while still incurring substantial operational costs for its upkeep. The strategic decision is often to divest, harvest, or discontinue such offerings to streamline operations and reallocate resources.

In 2024, many companies are actively reviewing portfolios to identify and address these underperforming units. For example, a company might identify a product line that has seen its market share decline by 15% year-over-year and its overall market growth rate stagnate at 1%, making it a clear candidate for the Dog quadrant.

| Business Unit/Product | Market Share (2024) | Market Growth Rate (2024) | BCG Classification | Strategic Action |

|---|---|---|---|---|

| Legacy Software Module | 1.2% | -2% | Dog | Divest/Discontinue |

| Niche Consulting Service | 0.8% | 0% | Dog | Harvest/Phase Out |

| Outdated Hardware Component | 3.5% | 1% | Dog | Minimize Investment/Dispose |

Question Marks

Garanti BBVA Kripto, a new player in the rapidly expanding digital asset market, is positioned as a Question Mark in the BCG matrix. While the market itself shows immense growth potential, Garanti BBVA's current market share is still nascent.

The bank's strategic alliances with firms like Ripple and IBM for secure custody solutions highlight its commitment to building a robust infrastructure. However, significant investment will be crucial to increase its market penetration and transition Garanti BBVA Kripto from a Question Mark to a Star performer.

Garanti BBVA's "Partners Tech" program actively nurtures startups in burgeoning fields like generative AI and cybersecurity, aligning with the Stars quadrant of the BCG Matrix. These ventures, while in nascent markets with low current market share for the bank, represent significant future growth potential. For instance, in 2024, the fintech sector saw a 15% increase in venture capital funding for AI-driven solutions, highlighting the strategic importance of these collaborations.

Garanti BBVA's biometric credit card, the first of its kind in Turkey, represents a potential 'Question Mark' in the BCG matrix. It merges contactless technology with fingerprint security, addressing a clear market need for safer, more convenient transactions.

While this innovative product boasts significant potential, its current market share is relatively low, reflecting its novelty. As of early 2024, the adoption rate for biometric payment solutions globally is still developing, with many consumers yet to embrace the technology.

The success of this card hinges on consumer acceptance and the broader market's shift towards advanced security features. If adoption accelerates, it could transition into a 'Star,' driving future growth for Garanti BBVA.

Advanced AI-Driven Personalized Financial Advisory

The integration of advanced AI for truly personalized financial advice within mobile banking apps remains a significant question mark for Garanti. While efforts are underway to incorporate smarter features and tailored recommendations, the widespread adoption of sophisticated AI-driven advisory services is still in its early stages. This segment presents substantial growth opportunities, but it necessitates ongoing, substantial investment to capture meaningful market share and differentiate from competitors.

The potential for AI to offer proactive, predictive financial solutions, moving beyond simple chatbots, is a key area of uncertainty. Banks are investing in these capabilities, aiming to anticipate client needs and offer timely guidance. However, user trust and understanding of these advanced AI functions are still developing, making market penetration a challenge.

- Market Penetration: As of early 2024, less than 10% of retail banking customers actively utilize advanced AI-driven financial advisory features, indicating a nascent market.

- Investment Needs: Continued significant investment in AI research, development, and data infrastructure is crucial to maintain a competitive edge in this evolving space.

- Growth Potential: Analysts project the global AI in financial services market to reach over $50 billion by 2027, highlighting the substantial upside for early movers.

- Customer Adoption: Building user confidence and demonstrating tangible value are paramount for driving broader adoption of these sophisticated AI advisory tools.

'My Banker' Unit for Remote SME and Commercial Clients

Garanti BBVA's 'My Banker' unit, a novel approach to serving remote SME and commercial clients, fits squarely into the question mark category of the BCG matrix. This innovative model, aiming to provide personalized, remote banking, addresses a clear market demand for specialized business financial services. As a new entrant, it possesses a low market share, but the segment it targets is experiencing substantial growth, indicating significant future potential.

The 'My Banker' unit is designed to cater to the evolving needs of businesses seeking efficient and tailored financial solutions without the necessity of physical branch visits. This strategic move positions Garanti BBVA to capture a burgeoning market segment. For instance, by mid-2024, the digital onboarding rate for new SME clients at Garanti BBVA had already seen a notable increase, underscoring the demand for remote services.

- Low Market Share: As a recent launch, 'My Banker' currently serves a limited portion of the overall SME and commercial banking market.

- High Market Growth: The demand for remote, personalized banking services for businesses is expanding rapidly, driven by digital transformation.

- Significant Investment Required: To scale effectively and achieve market leadership, the unit necessitates substantial investment in technology and specialized personnel.

- Unproven Scalability: The long-term viability and scalability of this remote model are yet to be fully demonstrated in the market.

Question Marks represent business units or products with low market share in high-growth markets. Garanti BBVA Kripto, its biometric credit card, and advanced AI financial advice services exemplify this category. These ventures require significant investment to increase market share and transform into Stars.

The bank's strategic investments in areas like generative AI and cybersecurity, as seen in its 'Partners Tech' program, align with the high-growth potential of Question Marks. For instance, in 2024, venture capital funding for AI in fintech saw a 15% surge, underscoring the market's upward trajectory.

The success of these Question Marks hinges on strategic resource allocation and market adoption. For example, the adoption rate of biometric payment solutions globally was still developing in early 2024, with less than 10% of retail banking customers actively using advanced AI advisory features.

Garanti BBVA's 'My Banker' unit, targeting remote SME clients, also falls into the Question Mark quadrant. While it has a low market share due to its recent launch, the demand for personalized remote business banking is growing rapidly, with digital onboarding for SME clients at Garanti BBVA showing a notable increase by mid-2024.

| Product/Service | Market Growth | Market Share | Investment Need | Potential |

|---|---|---|---|---|

| Garanti BBVA Kripto | High | Low | High | Star |

| Biometric Credit Card | Developing | Low | Moderate | Star |

| AI Financial Advice | High | Low | High | Star |

| 'My Banker' Unit | High | Low | High | Star |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial statements, industry growth rates, and competitor analysis, to accurately position each business unit.