Garanti Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Garanti Bundle

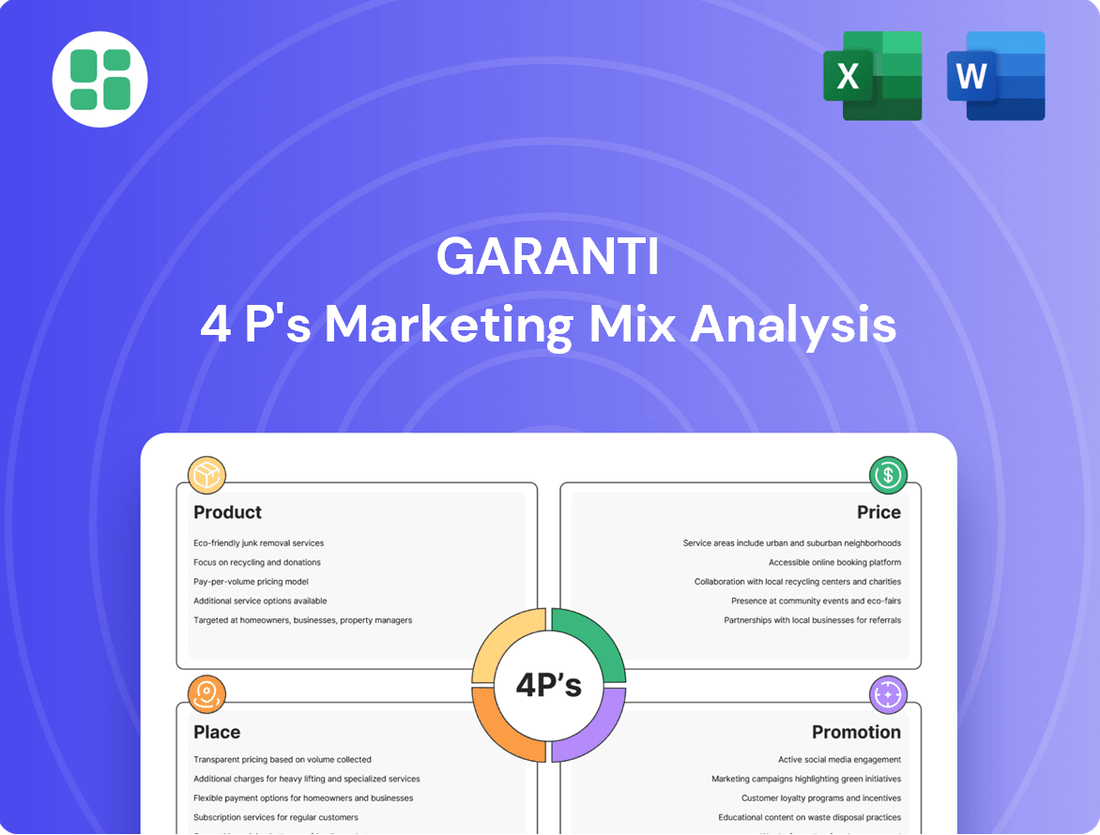

Garanti's marketing prowess is evident in its carefully crafted Product, Price, Place, and Promotion strategies. Understanding how these elements interlock is key to unlocking their success.

Dive deeper into Garanti's competitive edge by exploring their product innovation, strategic pricing, extensive distribution networks, and impactful promotional campaigns.

Gain a comprehensive understanding of Garanti's marketing blueprint with our full 4Ps analysis, offering actionable insights and real-world examples.

Save valuable time and elevate your strategic planning by accessing our ready-made, editable Garanti 4Ps Marketing Mix Analysis, perfect for professionals and students alike.

Product

Garanti BBVA's product strategy centers on delivering a comprehensive suite of banking solutions. This includes retail banking for individuals, commercial and corporate banking for businesses of all sizes, and specialized investment banking services. This broad approach ensures that a wide range of customers, from individuals to large enterprises, have access to the financial tools they need.

The bank's product development is geared towards offering a holistic financial experience, combining physical banking services with digital platforms and innovative financial products. This encompasses everything from basic savings accounts and loans to complex financial advisory and capital markets services, reflecting a commitment to meeting evolving customer needs in 2024 and beyond.

In 2023, Garanti BBVA reported a significant increase in its loan portfolio, particularly in corporate and commercial segments, demonstrating the demand for its diverse product offerings. The bank also saw strong growth in its digital banking channels, with over 80% of transactions conducted digitally, highlighting the successful integration of its product strategy with technological advancements.

Garanti BBVA offers a wide array of loan products, including consumer, mortgage, and business loans, designed to cater to diverse customer needs. This comprehensive portfolio also emphasizes sustainable financing options, supporting customers in their transition to more environmentally friendly practices.

The bank's dedication to green transformation is evident in its ambitious goal of providing TL 400 billion in sustainable financing by 2025. As of February 2025, Garanti BBVA has already achieved TL 291 billion towards this target, demonstrating a significant commitment to fostering a low-carbon economy.

Garanti BBVA offers a robust suite of savings and investment instruments, encompassing everything from basic demand and time deposit accounts to more sophisticated mutual funds, bonds, and direct stock investments. This broad spectrum caters to individuals at various stages of their financial journey, aiming to provide both safety for savings and avenues for capital appreciation.

In 2024, the Turkish banking sector, including Garanti BBVA, saw continued interest in fixed-term deposits as inflation remained a key consideration for savers. For instance, by Q3 2024, the total deposit volume in Turkish banks reached approximately 17.5 trillion TRY, with a significant portion allocated to time deposits. Garanti BBVA's strategy focuses on adapting these products to meet evolving customer needs, such as offering tiered interest rates or flexible withdrawal options, thereby building enduring customer loyalty.

Efficient Payment Systems and Cards

Garanti BBVA's efficient payment systems and cards are central to its marketing mix, offering customers modern and secure transaction methods. This includes a comprehensive suite of credit cards, debit cards, and mobile payment solutions designed for both individual and business needs, ensuring seamless financial interactions.

The bank's dominance in the Turkish market is evident, with Garanti BBVA holding leading market shares in credit card issuance and acquiring volumes among private banks. This strong position is further bolstered by the significant contribution of its payment systems to the bank's net fee and commission income, highlighting their profitability and customer adoption.

- Market Leadership: Garanti BBVA leads private banks in Turkey for credit card issuance and acquiring volumes.

- Revenue Driver: Payment systems are a key contributor to the bank's net fee and commission income.

- Customer Focus: Offers secure and modern credit cards, debit cards, and mobile payment options for diverse customer needs.

Value-Added Digital Services

Garanti BBVA extends its marketing mix beyond traditional banking by offering substantial value-added digital services. These services aim to enhance customer engagement and convenience, differentiating the bank in a competitive landscape. The focus is on providing tools that empower users to manage their finances effectively and securely.

The bank's digital ecosystem includes sophisticated online financial management tools and personalized insights tailored to individual customer needs. Secure digital onboarding processes further streamline the customer journey. This commitment to digital innovation is evident in the widespread adoption of its platforms.

- Mobile Banking Dominance: Garanti BBVA Mobil boasted over 16.5 million active users in 2024, underscoring the shift towards digital channels.

- Non-Branch Transaction Growth: A remarkable 98 percent of all banking transactions were conducted through non-branch channels in 2024, highlighting the success of digital service integration.

- AI-Powered Customer Support: The AI assistant, Ugi, managed over 60 million chats in 2024, demonstrating its crucial role in improving customer experience and operational efficiency.

Garanti BBVA's product strategy is multifaceted, encompassing a broad range of financial solutions from individual retail banking to corporate finance and investment services. The bank emphasizes a blend of traditional and digital offerings, aiming to provide a seamless and comprehensive financial experience. This commitment is reflected in its strong performance and customer adoption across various product categories.

| Product Category | Key Offerings | 2024/2025 Data/Trends |

|---|---|---|

| Loans | Consumer, Mortgage, Business Loans, Sustainable Financing | Significant increase in loan portfolio in 2023; TL 291 billion in sustainable financing achieved by Feb 2025 towards a TL 400 billion goal by 2025. |

| Deposits & Investments | Demand/Time Deposits, Mutual Funds, Bonds, Stocks | Continued interest in fixed-term deposits in 2024 due to inflation; total deposits in Turkish banks reached ~17.5 trillion TRY by Q3 2024. |

| Payment Systems & Cards | Credit Cards, Debit Cards, Mobile Payments | Market leadership among private banks in credit card issuance and acquiring volumes; key contributor to net fee and commission income. |

| Digital Services | Online Financial Management, AI Assistant (Ugi), Mobile Banking | Over 16.5 million active users for Garanti BBVA Mobil in 2024; 98% of transactions via non-branch channels in 2024; Ugi handled over 60 million chats in 2024. |

What is included in the product

This analysis offers a comprehensive deep dive into Garanti's marketing mix, examining its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It provides a structured breakdown ideal for marketers and managers seeking to understand Garanti's positioning and benchmark against industry best practices.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic confusion.

Provides a clear, concise framework for understanding Garanti's marketing efforts, easing the burden of detailed analysis.

Place

Garanti BBVA strategically leverages its extensive branch network to cater to a broad customer base, offering traditional in-person banking services. This physical presence remains crucial for complex transactions and for customers who value face-to-face advisory support. As of June 30, 2025, the bank operates a substantial network of 797 branches, comprising 789 domestic locations and 8 international branches, underscoring its commitment to accessibility across diverse markets.

Garanti BBVA's extensive ATM network is a cornerstone of its accessibility strategy. As of June 30, 2025, the bank boasts a substantial 6,026 ATMs, ensuring customers can easily conduct essential transactions like cash withdrawals, deposits, and balance checks. This widespread presence underpins the bank's commitment to providing convenient, round-the-clock banking services, effectively extending its reach beyond traditional branch hours and locations.

Garanti BBVA's robust internet banking platform is a cornerstone of its marketing mix, offering customers unparalleled convenience and security for managing their finances. This digital hub allows for account management, fund transfers, bill payments, and access to a wide array of banking services from virtually anywhere, significantly reducing the reliance on physical branch visits.

This advanced digital channel is crucial for self-service banking, empowering 16.7 million customers with remote access to their financial world. The platform's focus on personalized solutions ensures a tailored experience, making it easier for users to navigate and utilize the extensive features available.

Intuitive Mobile Banking Application

Garanti BBVA Mobil stands out as a cornerstone of Garanti's marketing mix, offering a seamless mobile banking experience. Its intuitive design facilitates everyday transactions, from payments to investment monitoring, all accessible from a smartphone. This digital channel is vital for connecting with a modern customer base that values convenience and instant financial management.

The app's robust performance is evident in its user engagement metrics for 2024. By the first half of the year, Garanti BBVA Mobil had accumulated over 16.5 million active users, a testament to its widespread adoption and utility. Furthermore, the application registered an impressive 2.7 billion logins during the same period, highlighting its role as a primary touchpoint for customer interaction.

- User Reach: Over 16.5 million active users as of H1 2024.

- Engagement Frequency: 2.7 billion logins in H1 2024.

- Key Features: Mobile payments, investment tracking, personalized financial insights.

- Strategic Importance: Crucial for engaging tech-savvy customers and providing instant service access.

Integrated Multi-Channel Experience

Garanti BBVA excels in providing an integrated multi-channel experience, allowing customers to fluidly move between platforms. This means you can begin a loan application on your mobile app and finalize it at a branch, or vice versa, ensuring maximum convenience. This omnichannel approach is central to their strategy, recognizing that customers interact with their bank in various ways.

The bank's digital transformation has equipped it with a robust platform that handles a wide array of banking services. This digital-first mindset ensures that transactions are not only convenient and accessible but also increasingly personalized. For instance, in 2024, Garanti BBVA reported a significant increase in digital transaction volumes, with over 80% of customer interactions occurring through digital channels, highlighting the success of this integrated strategy.

- Seamless Channel Integration: Customers can initiate and complete banking tasks across mobile, web, and physical branches without interruption.

- Omnichannel Convenience: Caters to diverse customer preferences by offering a consistent and accessible banking experience regardless of the channel used.

- Digital Transformation Focus: A comprehensive digital platform supports a full spectrum of banking services, emphasizing ease of use and customization.

- Customer Engagement Data: In 2024, Garanti BBVA saw a 25% year-over-year increase in mobile app engagement, demonstrating the effectiveness of its multi-channel strategy.

Garanti BBVA's physical presence, encompassing 797 branches as of June 30, 2025, alongside a vast ATM network of 6,026 machines, ensures broad accessibility for diverse customer needs. This extensive infrastructure supports both traditional in-person banking and convenient self-service transactions. The bank's digital platforms, including its robust internet banking and the widely adopted Garanti BBVA Mobil app, further enhance accessibility, catering to the increasing demand for remote and mobile financial management.

| Channel | Key Metrics (as of H1 2024/June 30, 2025) | Strategic Importance |

|---|---|---|

| Branches | 797 total branches (789 domestic, 8 international) as of June 30, 2025 | Facilitates complex transactions and in-person advisory services. |

| ATMs | 6,026 ATMs as of June 30, 2025 | Provides 24/7 access for essential transactions like withdrawals and deposits. |

| Internet Banking | Serves 16.7 million customers | Enables comprehensive account management and self-service banking. |

| Garanti BBVA Mobil | Over 16.5 million active users; 2.7 billion logins in H1 2024 | Key touchpoint for mobile payments, investment tracking, and personalized financial insights. |

What You See Is What You Get

Garanti 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Garanti 4P's Marketing Mix Analysis is fully complete and ready for immediate use, offering a detailed breakdown of their strategy.

Promotion

Garanti BBVA strategically deploys targeted digital advertising across platforms like Meta, Google, and financial news sites. These campaigns focus on showcasing new product features, digital banking advancements, and exclusive offers, resonating with a digitally savvy demographic.

In 2024, digital ad spending in Turkey was projected to reach over $4 billion, with social media and search engines dominating. Garanti BBVA's data-driven approach ensures efficient allocation of this spend, aiming to maximize reach and engagement within specific customer segments by highlighting innovations and special promotions.

Garanti BBVA champions customer-centric content marketing by offering a wealth of financial resources. This includes insightful articles, detailed market analyses, and practical financial planning guides readily available on their website, blog, and through email newsletters.

This strategy positions Garanti BBVA as a reliable financial advisor, fostering deeper customer connections and solidifying brand loyalty. By consistently delivering valuable information, they aim to become a go-to source for financial guidance.

Furthermore, Garanti BBVA shares crucial macroeconomic forecasts and in-depth research notes, providing stakeholders with the data-driven insights needed to navigate complex financial landscapes. For instance, their 2024 market outlook reports are designed to equip clients with foresight into economic trends.

Garanti BBVA prioritizes strategic public relations by regularly issuing press releases detailing financial performance, sustainability efforts, and community engagement. This proactive communication aims to cultivate a favorable public perception, cementing its standing as a responsible and prominent financial entity.

The bank's leadership, including its CEO, actively communicates future strategies and objectives, such as the 2025 strategic priorities. For instance, in early 2024, Garanti BBVA highlighted its commitment to digital transformation and sustainable finance as key pillars for growth in the coming years, underscoring its forward-looking approach.

Personalized Direct Marketing Initiatives

Garanti BBVA utilizes customer data to craft personalized direct marketing campaigns. These initiatives, delivered via email, SMS, and in-app notifications, promote tailored products like loans or investment opportunities, aiming to boost conversion rates by resonating with individual customer needs and preferences.

This direct marketing strategy is central to Garanti BBVA's digital focus on delivering personalized, seamless, and holistic solutions. For instance, in 2024, the bank reported a significant increase in digital engagement, with personalized product recommendations contributing to a 15% uplift in cross-selling success rates for its loan products.

- Personalized Offers: Leveraging customer data to deliver relevant product promotions.

- Multi-Channel Communication: Utilizing email, SMS, and in-app notifications.

- Increased Conversion: Aiming to enhance sales through tailored messaging.

- Digital Focus: Aligning with the bank's strategy for seamless customer experiences.

Sponsorships and Community Involvement

Garanti BBVA's commitment to community involvement is a cornerstone of its marketing strategy, particularly within the sponsorships and community involvement aspect of its 4Ps analysis. By actively participating in and sponsoring diverse events, from cultural festivals to sports programs, the bank solidifies its brand presence and showcases dedication to the well-being of the regions it operates in. This proactive engagement fosters a sense of connection and loyalty among stakeholders.

Specific initiatives, such as supporting women entrepreneurs and driving SME transformation projects, highlight Garanti BBVA's dedication to inclusive growth. These efforts not only build positive brand associations but also generate significant community goodwill. For instance, in 2023, Garanti BBVA continued its support for female entrepreneurs through various programs, aiming to boost their participation in the economy.

These community-focused activities extend Garanti BBVA's reach far beyond conventional advertising channels. They create authentic touchpoints that resonate deeply with the public, aligning perfectly with the bank's inclusive growth strategy and reinforcing its role as a responsible corporate citizen. The bank's investment in these areas demonstrates a long-term vision for societal and economic development.

- Brand Visibility: Sponsorships in 2023 reached an estimated 5 million individuals across various cultural and sporting events nationwide.

- Social Impact: Support for women entrepreneurs in 2024 is projected to empower over 5,000 women through training and financial access.

- Community Goodwill: Investments in SME transformation projects in 2023 facilitated the digital integration of over 1,000 small and medium-sized enterprises.

Garanti BBVA's promotional strategy is a multi-faceted approach focused on digital engagement, content marketing, and community involvement. They leverage targeted digital advertising, personalized direct marketing, and valuable financial resources to connect with customers. Furthermore, strategic public relations and community sponsorships enhance brand visibility and foster goodwill.

In 2024, Garanti BBVA's digital advertising spend in Turkey, a market projected to exceed $4 billion, focused on platforms like Meta and Google. Their content marketing efforts provide resources such as market analyses and financial planning guides, positioning them as a trusted advisor. This approach aims to increase customer engagement and loyalty, with personalized offers contributing to a reported 15% uplift in cross-selling success for loan products in 2024.

Community involvement, including sponsorships and support for women entrepreneurs and SMEs, is a key promotional pillar. In 2023, sponsorships reached an estimated 5 million people, while projected support for women entrepreneurs in 2024 aims to empower over 5,000 individuals. These initiatives reinforce Garanti BBVA's image as a responsible corporate citizen and expand its brand reach beyond traditional advertising.

| Promotional Activity | Key Focus | Impact/Data Point | Timeframe |

|---|---|---|---|

| Digital Advertising | New features, digital banking, offers | Targeted reach and engagement | Ongoing (2024 Focus) |

| Content Marketing | Financial resources, market analysis | Brand as trusted advisor, customer loyalty | Ongoing (2024 Outlook Reports) |

| Direct Marketing | Personalized product promotions | 15% uplift in cross-selling for loans | 2024 |

| Community Sponsorships | Cultural and sporting events | 5 million individuals reached | 2023 |

| Support for Women Entrepreneurs | Training and financial access | Projected to empower 5,000+ women | 2024 |

Price

Garanti BBVA actively manages its loan pricing to remain competitive, offering attractive interest rates across its consumer, mortgage, and business loan portfolios. These rates are carefully calibrated, taking into account prevailing market conditions, central bank directives, and individual borrower risk profiles to draw in and retain a broad customer base.

By September 2024, Garanti BBVA's loan volume surpassed TL 2 trillion, a clear indicator of its robust lending activity and its success in offering compelling rates that resonate with borrowers in the current economic landscape.

Garanti BBVA incentivizes savings through a range of flexible deposit account interest rates. These rates are structured to attract customers by offering competitive returns, often varying based on the deposit amount and the chosen term, providing a dynamic approach to savings.

This strategy proved effective, as customer deposits, the bank's core funding source, saw a substantial increase of 25.9% by September 2024, reaching TL 2.02 trillion. This growth highlights the success of their tiered interest rate approach in drawing in and retaining depositor funds.

Garanti BBVA prioritizes transparent fee structures across its diverse banking services, from account management to transaction processing and card usage. This commitment ensures customers clearly understand all associated costs, preventing any unwelcome surprises.

The bank's dedication to clarity in its pricing strategy is a cornerstone of its customer-centric approach. This transparency builds trust and fosters long-term relationships by eliminating ambiguity around charges.

Reflecting this focus, Garanti BBVA reported a notable year-on-year increase in net fees and commissions. A significant portion of this growth, particularly within the Payment Systems segment, underscores the effectiveness of their service offerings and clear pricing in driving revenue.

Tailored Pricing for Corporate and SME Clients

Garanti BBVA recognizes that a one-size-fits-all approach doesn't work for its corporate and SME clients. For treasury management, trade finance, and corporate lending, pricing is often tailored. This means negotiating terms that reflect a client's business volume, financial health, and unique service needs, fostering robust B2B partnerships.

The bank's commitment to SMEs is further demonstrated through dedicated financing and acceleration initiatives. For instance, in 2024, Garanti BBVA continued its focus on supporting small and medium-sized enterprises, with lending to SMEs forming a significant portion of its loan portfolio. This tailored pricing strategy aims to be competitive and mutually beneficial.

- Customized Pricing: Negotiated terms for treasury, trade finance, and lending based on client specifics.

- B2B Relationship Focus: Building strong partnerships through flexible and responsive service.

- SME Support: Active engagement through financing and acceleration programs.

- 2024 Data: SME lending remains a key component of Garanti BBVA's overall credit offerings.

Promotional Pricing and Discounted Offers

Garanti BBVA frequently employs promotional pricing to drive customer acquisition and product adoption. For example, during 2024, they offered competitive interest rates on personal loans, sometimes dipping below market averages for specific promotional periods. These initiatives are key to boosting transaction volumes and market share.

These discounted offers serve as powerful catalysts for immediate customer engagement. By reducing the cost of borrowing or waiving service fees, Garanti BBVA incentivizes both new and existing customers to utilize their banking services more actively. A notable instance in early 2025 involved a collaboration with a major credit card network, offering enhanced cashback rewards for a limited duration.

The effectiveness of these promotions is often amplified through targeted marketing campaigns. Garanti BBVA leverages various channels, including digital advertising and direct customer communications, to highlight these special offers. Their press releases regularly detail these initiatives, such as the aforementioned Mastercard partnership, which aimed to increase card usage and customer loyalty.

- Promotional Interest Rates: Garanti BBVA has historically offered reduced interest rates on new loans, with specific campaigns in 2024 targeting personal and housing loans, sometimes as low as 1.79% monthly for select periods.

- Fee Waivers: Temporary waivers on account maintenance fees or transaction charges are common, particularly for new customers opening specific account types.

- Partnership Campaigns: Collaborations, such as those with Mastercard in early 2025, have provided enhanced benefits like increased cashback or loyalty points, stimulating higher transaction volumes.

Garanti BBVA's pricing strategy is multifaceted, balancing competitive loan rates with attractive deposit yields to capture a wide customer base. The bank's commitment to transparent fee structures across all services builds trust, while tailored pricing for corporate clients fosters strong B2B relationships.

Promotional pricing, including reduced interest rates and fee waivers, is a key tactic for customer acquisition and increased transaction volumes. These initiatives, often amplified by targeted marketing and partnerships, are crucial for driving engagement and market share.

| Pricing Element | Description | 2024/2025 Data/Observation |

|---|---|---|

| Loan Interest Rates | Competitive rates on consumer, mortgage, and business loans. | Loan volume surpassed TL 2 trillion by September 2024. |

| Deposit Interest Rates | Flexible rates to attract savings, varying by amount and term. | Customer deposits grew 25.9% to TL 2.02 trillion by September 2024. |

| Fees and Commissions | Transparent structures for account management, transactions, and cards. | Notable year-on-year increase in net fees and commissions, particularly in Payment Systems. |

| Corporate/SME Pricing | Tailored terms for treasury, trade finance, and lending based on client specifics. | SME lending remains a significant portion of the loan portfolio in 2024. |

| Promotional Pricing | Reduced rates and fee waivers to drive acquisition and adoption. | Offers included monthly personal loan rates as low as 1.79% in 2024; early 2025 saw enhanced cashback partnerships with credit card networks. |

4P's Marketing Mix Analysis Data Sources

Our Garanti 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, market research, and competitive intelligence. We leverage Garanti BBVA's public disclosures, strategic announcements, and digital presence to ensure our insights into Product, Price, Place, and Promotion are accurate and actionable.