Galliford Try SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galliford Try Bundle

Galliford Try's strategic positioning reveals a company with strong operational capabilities and a clear focus on infrastructure and construction. However, understanding the nuances of their market challenges and potential growth avenues requires a deeper dive. Our comprehensive SWOT analysis uncovers the full strategic landscape, offering actionable insights into their competitive advantages and areas for development.

Want the full story behind Galliford Try's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Galliford Try is showing impressive financial strength. For the first half of the 2025 financial year, their pre-tax profit soared by 54% to £20 million, accompanied by a 13% revenue increase, reaching £923 million.

This robust performance has led the company to raise its full-year profit outlook, now anticipating results at the higher end of market expectations for the year ending June 2025. This upward revision highlights strong operational execution and a positive trend in their profitability.

Galliford Try boasts a robust order book, valued at £4.1 billion as of June 2025, demonstrating significant market strength.

Approximately 90% of this order book is secured through long-term frameworks, particularly within the stable public and regulated sectors, highlighting strategic client relationships.

Recent successes in water and infrastructure frameworks further bolster this pipeline, ensuring strong revenue visibility and a predictable workload for years to come.

Galliford Try's financial health is a significant advantage, underscored by a robust balance sheet. In fiscal year 2025, the company maintained an average month-end cash balance of £178.7 million, concluding the period with £237.6 million in cash at the end of June 2025.

This strong liquidity is further enhanced by the absence of drawn bank debt. Furthermore, Galliford Try operates without any defined benefit pension liabilities, a rarity that significantly bolsters its financial flexibility and competitive edge in securing new projects and fostering strong relationships with its supply chain partners.

Clear Sustainable Growth Strategy to 2030

Galliford Try has a well-defined Sustainable Growth Strategy aiming for significant expansion by 2030. This plan targets revenues surpassing £2.2 billion, coupled with a divisional operating margin of 4%. The company is committed to disciplined growth, strategically prioritizing higher-margin projects within its core building and infrastructure segments. Furthermore, it intends to broaden its reach into related sectors to capture new revenue streams.

Key aspects of this strategy include:

- Revenue Target: Exceeding £2.2 billion by 2030.

- Margin Goal: Achieving a 4% divisional operating margin.

- Focus Areas: Disciplined growth in building and infrastructure.

- Expansion: Developing opportunities in adjacent sectors.

Commitment to Sustainability and ESG Leadership

Galliford Try demonstrates a strong commitment to sustainability, setting ambitious net-zero targets: Scope 1 and 2 emissions by 2030, and all scopes by 2045. This forward-thinking approach positions them as a leader in the construction sector's transition towards environmental responsibility.

The company's consistent reporting on its Environmental, Social, and Governance (ESG) performance underscores its dedication to transparency and accountability. These efforts are validated by strong ESG ratings, reinforcing Galliford Try's reputation as a conscientious and reliable partner.

- Net-Zero Targets: Scope 1 & 2 by 2030, all scopes by 2045.

- ESG Reporting: Consistent and transparent progress updates.

- Strong Ratings: Recognition for responsible contractor practices.

Galliford Try's financial performance is a clear strength, with a 54% surge in pre-tax profit to £20 million in H1 2025 and a 13% revenue increase to £923 million. This robust performance has led to an upward revision of their full-year profit outlook for the year ending June 2025.

The company's substantial £4.1 billion order book as of June 2025, with 90% secured through long-term frameworks in stable sectors, provides excellent revenue visibility. Furthermore, their strong liquidity, evidenced by an average month-end cash balance of £178.7 million in FY25 and ending with £237.6 million, coupled with no drawn bank debt or pension liabilities, offers significant financial flexibility.

Galliford Try's strategic focus on sustainable growth, aiming for over £2.2 billion in revenue by 2030 with a 4% divisional operating margin, showcases a clear vision for expansion. Their commitment to ambitious net-zero targets by 2030 and 2045, alongside transparent ESG reporting and strong ratings, highlights their dedication to environmental responsibility and positions them as a reliable partner.

| Metric | H1 2025 | FY 2025 (End June) | FY 2030 Target |

|---|---|---|---|

| Pre-Tax Profit | £20 million | N/A | N/A |

| Revenue | £923 million | N/A | > £2.2 billion |

| Order Book | £4.1 billion | N/A | N/A |

| Cash Balance (End of Period) | N/A | £237.6 million | N/A |

| Divisional Operating Margin | N/A | N/A | 4% |

What is included in the product

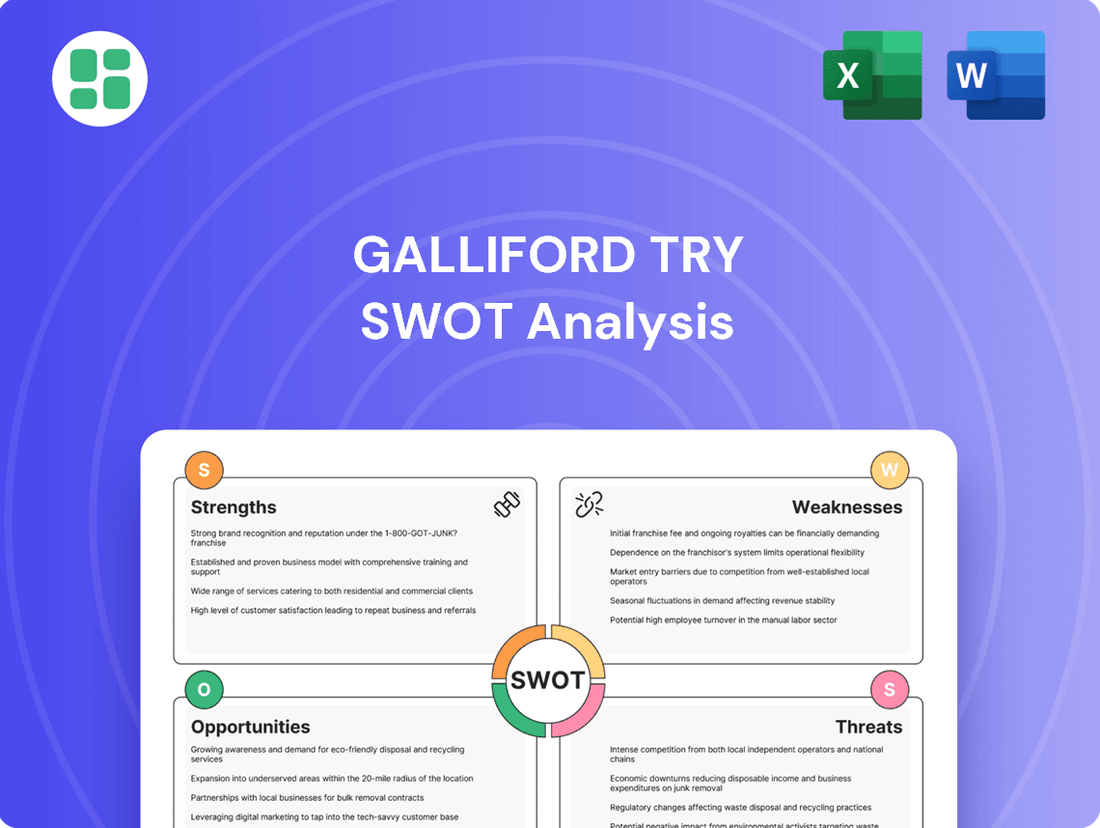

Delivers a strategic overview of Galliford Try’s internal and external business factors, highlighting its strengths in infrastructure and construction, weaknesses in project execution, opportunities in public sector investment, and threats from market competition.

Offers a clear, structured framework to identify and address Galliford Try's strategic challenges, turning potential weaknesses into actionable improvements.

Weaknesses

Galliford Try's significant reliance on public and regulated sector frameworks, which constituted approximately 90-91% of its order book as of early 2024, presents a notable weakness. This concentration, while offering a degree of stability, makes the company highly susceptible to fluctuations in government spending and policy shifts.

Any adverse changes in public sector investment, such as unexpected budget cuts or project delays, could directly and materially impact Galliford Try's future project pipeline and revenue streams. This dependence necessitates careful monitoring of the political and economic landscape for potential disruptions.

As Galliford Try operates exclusively within the United Kingdom, its financial performance is highly susceptible to fluctuations in the UK's economic climate. A slowdown in GDP growth, elevated interest rates, or a dip in consumer confidence can significantly dampen demand for new construction projects, directly impacting the company's order book and profitability.

For instance, the Bank of England's base rate, which stood at 5.25% in early 2024, increases borrowing costs for clients, potentially delaying or scaling back capital expenditure on infrastructure and property development. This reliance on the domestic market makes Galliford Try less diversified than international competitors, concentrating its exposure to UK-specific economic headwinds.

Galliford Try faces significant headwinds from ongoing cost inflation within the UK construction industry. Material prices, such as steel and timber, saw substantial increases throughout 2024, and labor shortages continue to drive up wages. For instance, the Office for National Statistics reported construction material price inflation at 7.5% in the year to April 2024.

These persistent inflationary pressures directly impact Galliford Try's ability to achieve its targeted margin improvements. The company's efforts to secure profitable contracts are complicated by the need to accurately forecast and price in these volatile cost increases, potentially squeezing margins on fixed-price agreements.

Challenges in Attracting and Retaining Skilled Labor

The UK construction sector grapples with a persistent shortage of skilled workers, a challenge that directly impacts companies like Galliford Try. This deficit can drive up labor costs as firms compete for talent, potentially squeezing profit margins. Furthermore, the inability to secure enough qualified personnel can lead to significant project delays, affecting timelines and client satisfaction.

This structural decline in the construction workforce is an ongoing concern. For instance, in 2023, the Office for National Statistics reported that vacancies in construction remained elevated, highlighting the difficulty in filling roles. This scarcity makes it harder for Galliford Try to consistently staff its diverse range of projects with the necessary expertise, from engineers to specialized trades.

- Skilled Labor Shortage: The UK construction industry continues to face a critical shortage of skilled workers, impacting project delivery and cost efficiency.

- Increased Wage Costs: Competition for scarce talent drives up wages, adding to operational expenses for construction firms.

- Project Delays: Insufficient skilled labor directly contributes to project delays, affecting profitability and client relationships.

- Structural Workforce Decline: The ongoing reduction in the available construction workforce presents a long-term strategic challenge for talent acquisition.

Potential Impact of Regulatory Complexities and Delays

Galliford Try, like many in the construction sector, faces challenges from new and evolving regulations. The Building Safety Act, for instance, imposes greater scrutiny and compliance demands, which can directly affect project schedules and overall expenses. For the fiscal year ending June 30, 2023, Galliford Try reported that its Construction division’s operating profit was impacted by ongoing site remediation and compliance activities, reflecting the real-world cost of these regulatory shifts.

Furthermore, industry-wide issues such as protracted planning approval processes and uncertainty surrounding new legislative frameworks can impede project advancement. These delays can create a ripple effect, impacting resource allocation and the ability to commence new projects efficiently. For example, the UK government's commitment to improving planning system efficiency, announced in late 2023, aims to address these bottlenecks, but the full impact on companies like Galliford Try will take time to materialize.

- Increased Compliance Costs: New regulations necessitate investment in training, updated processes, and potentially new materials or technologies to meet standards.

- Project Timeline Disruptions: Delays in obtaining necessary approvals or clarifying regulatory requirements can push back project completion dates, leading to increased holding costs and potential penalties.

- Uncertainty and Risk: Ambiguity in new legislation can create a risk of non-compliance or the need for costly rework, impacting financial forecasting and project viability.

- Competitive Disadvantage: Companies less equipped to navigate complex regulatory landscapes may find themselves at a disadvantage compared to more agile competitors.

Galliford Try's significant reliance on the UK public sector, representing around 90-91% of its order book in early 2024, exposes it to government spending shifts and policy changes. This concentration makes the company vulnerable to budget cuts or project delays, directly impacting its future revenue. The company's performance is also closely tied to the UK's economic health, with factors like GDP growth and interest rates influencing demand for construction projects.

Persistent cost inflation, particularly for materials and labor, continues to challenge Galliford Try's ability to maintain healthy profit margins. For example, construction material prices saw a 7.5% increase in the year to April 2024, according to the Office for National Statistics, squeezing profitability on fixed-price contracts.

The construction sector's ongoing skilled labor shortage, with elevated vacancies reported in 2023, directly affects Galliford Try by increasing labor costs and potentially causing project delays. Furthermore, evolving regulations like the Building Safety Act add compliance costs and can disrupt project timelines, as evidenced by the impact on Galliford Try's Construction division's operating profit in FY23.

Preview Before You Purchase

Galliford Try SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The UK government's commitment to infrastructure development presents a significant opportunity, with plans to invest between £700 billion and £775 billion over the next decade. This substantial funding is earmarked for crucial upgrades across transport, utilities, and energy sectors. Galliford Try is well-positioned to capitalize on this extensive pipeline of projects, leveraging its expertise in delivering complex infrastructure solutions.

The water sector is experiencing a significant uplift thanks to the AMP8 frameworks, with the total budget now reaching approximately £104 billion, effectively doubling from previous periods. This substantial investment signals a robust period of growth and opportunity for companies like Galliford Try.

Galliford Try is strategically positioned to benefit from this expansion, having already secured key positions within AMP8 frameworks with several major water companies. These early wins demonstrate the company's established expertise and strong relationships within the sector, enabling it to effectively leverage the increased spending.

Galliford Try is making a strategic move back into the affordable housing sector, with plans to construct over 1,200 homes each year. This initiative is projected to bring in approximately £250 million in revenue by the year 2030.

This re-entry perfectly aligns with the UK government's ambitious target of building 1.5 million new homes by 2030. Such a large-scale national objective creates a substantial and ongoing demand, presenting a significant growth avenue for Galliford Try.

Diversification into Higher-Margin Adjacent Markets

Galliford Try's Sustainable Growth Strategy actively targets expansion into higher-margin adjacent markets. This includes ventures into capital maintenance and asset optimization within the water sector, alongside opportunities in green retrofit projects. These moves are designed to bolster overall profitability and lessen dependence on the often tighter margins of traditional construction work.

Specialist services represent another key area for diversification. Galliford Try is focusing on sectors such as fire protection and active security, which typically command better margins than general contracting. This strategic pivot aims to create a more resilient and profitable business model.

For the fiscal year ending June 30, 2023, Galliford Try reported a strong performance, with revenue reaching £3.1 billion. The company's focus on these higher-margin areas is a core component of its strategy to achieve sustainable growth and improve its financial standing in the coming years.

- Targeting Water Sector: Expanding into capital maintenance and asset optimization within the water industry.

- Green Retrofit Focus: Capitalizing on the growing demand for sustainable building solutions.

- Specialist Services Growth: Developing expertise in fire protection and active security for enhanced profitability.

- Margin Improvement: Aiming to reduce reliance on traditional construction margins through diversification.

Leveraging Digitalisation and Modern Methods of Construction

Galliford Try's embrace of digitalisation and Modern Methods of Construction (MMC) presents a significant opportunity. The company's ongoing investment in digital tools and off-site manufacturing capabilities, like its £10 million investment in its Leicestershire off-site manufacturing facility, is designed to enhance operational efficiencies and improve project delivery timelines. This strategic focus is expected to reduce waste and boost productivity, giving Galliford Try a competitive advantage in a market increasingly valuing speed and sustainability.

The adoption of MMC, including pre-fabricated components and modular construction, is a key driver for this opportunity. By integrating these modern techniques, Galliford Try can streamline its construction processes, leading to more predictable outcomes and potentially lower costs. This approach aligns with industry trends and client demands for faster, more sustainable building solutions.

- Enhanced Efficiency: Digitalisation and MMC can reduce project completion times by an estimated 20-30% compared to traditional methods.

- Waste Reduction: Off-site manufacturing typically generates 30-50% less waste than on-site construction.

- Improved Quality: Controlled factory environments for MMC lead to higher precision and quality control.

- Competitive Edge: Galliford Try's commitment to innovation in these areas positions it favorably against competitors less advanced in digital adoption.

The UK's infrastructure pipeline, with projected investment between £700 billion and £775 billion over the next decade, offers substantial opportunities for Galliford Try. The company is also well-positioned to benefit from the significant £104 billion AMP8 frameworks in the water sector, having already secured key positions. Furthermore, Galliford Try's strategic re-entry into the affordable housing market, aiming for over 1,200 homes annually and projected revenue of £250 million by 2030, aligns with the government's target of 1.5 million new homes by 2030.

| Opportunity Area | Key Data Point | Galliford Try's Position/Action |

|---|---|---|

| UK Infrastructure Investment | £700-£775 billion over 10 years | Well-positioned to secure projects across transport, utilities, energy. |

| Water Sector (AMP8) | £104 billion total budget | Secured key positions in AMP8 frameworks with major water companies. |

| Affordable Housing | 1.5 million new homes target by 2030 | Re-entering the market, aiming for 1,200+ homes/year, £250m revenue by 2030. |

| Higher-Margin Markets | Focus on capital maintenance, asset optimization, green retrofits | Diversifying revenue streams to improve profitability. |

| Specialist Services | Fire protection, active security | Targeting sectors with better margins than general contracting. |

| Digitalisation & MMC | £10m investment in Leicestershire facility | Enhancing efficiency, reducing waste, and improving project delivery. |

Threats

Galliford Try operates within a UK construction sector grappling with persistent inflation, particularly affecting material prices. For instance, in early 2024, construction material cost inflation remained a significant concern, impacting project budgets.

These escalating input costs, combined with potential fluctuations in interest rates, directly threaten to compress profit margins for Galliford Try. This squeeze on profitability can also cast doubt on the economic feasibility of undertaking new construction projects, a critical factor for future growth.

Galliford Try faces a fiercely competitive UK construction sector, populated by large, established entities and a multitude of smaller, agile businesses. This intense rivalry directly impacts tender pricing, often forcing margins down, and complicates the pursuit of lucrative, large-scale projects necessary for growth and market position.

Despite government initiatives to expedite approvals, planning and regulatory hurdles continue to be a persistent challenge within the UK construction industry. These delays can significantly impact project timelines and profitability for companies like Galliford Try.

The introduction of new legislation, such as the Building Safety Act 2022, while crucial for enhancing safety standards, introduces additional layers of complexity and potential uncertainty. This can lead to extended approval processes and a slower start for new projects, impacting the construction pipeline.

For instance, in the fiscal year ending June 30, 2023, construction output in the UK experienced a slight contraction, partly attributed to ongoing planning system inefficiencies and the adaptation to evolving regulatory frameworks. This environment necessitates robust risk management and proactive engagement with regulatory bodies.

Supply Chain Disruptions

Galliford Try, like much of the construction sector, faces ongoing threats from supply chain disruptions. Geopolitical tensions and global economic volatility continue to create an unpredictable environment for material availability and pricing.

These disruptions can manifest as significant delays in obtaining essential construction materials, leading to extended project timelines. Furthermore, the cost of these materials can fluctuate wildly, making accurate project budgeting and cost control a considerable challenge for the company.

- Material Shortages: Continued reliance on global supply chains means Galliford Try is susceptible to shortages of key materials like timber, steel, and cement, impacting project progress.

- Increased Lead Times: Suppliers may face backlogs, extending the time it takes to receive necessary components, thereby delaying construction schedules.

- Price Volatility: Unforeseen events can cause sharp increases in raw material costs, directly impacting Galliford Try's profit margins and the competitiveness of its bids. For instance, the construction materials price index saw significant upward movement in late 2023 and early 2024 due to global demand and energy costs.

Economic Slowdown and Reduced Private Sector Investment

A significant economic slowdown or a general reduction in private sector investment could pose a threat to Galliford Try. While the company has a strong presence in the public sector, a downturn in the broader economy can still affect the construction industry overall. This reduced investment can lead to fewer commercial and residential projects coming to market.

Weaker economic growth directly impacts the demand within the construction sector. This could shrink the pipeline of private sector work available to Galliford Try and limit future opportunities for expansion into these areas. For instance, a projected GDP growth of only 0.5% for the UK in 2025, as forecasted by the Bank of England in late 2024, signals a challenging environment for private sector development.

- Economic Downturn Impact: A recessionary environment could lead to project cancellations or delays, particularly in the private sector.

- Reduced Private Investment: Lower business confidence and tighter credit conditions can stifle private sector construction spending.

- Market Contraction: A general cooling of the economy might see a decrease in demand for new build properties and commercial spaces.

- Competitive Pressure: During economic slowdowns, competition for remaining projects intensifies, potentially impacting margins.

Galliford Try faces significant threats from ongoing inflation in construction materials, which directly impacts project profitability and the viability of new ventures. Intense competition within the UK construction market further pressures tender pricing, often leading to reduced margins.

Regulatory hurdles and the implementation of new legislation, such as the Building Safety Act 2022, introduce project delays and added complexity, affecting the construction pipeline and operational efficiency.

Supply chain disruptions, exacerbated by geopolitical instability and global economic volatility, lead to material shortages, increased lead times, and unpredictable price fluctuations, challenging cost control and project scheduling.

A potential economic slowdown and reduced private sector investment pose a threat by shrinking the pipeline of available work and intensifying competition for remaining projects, particularly impacting future growth opportunities.

SWOT Analysis Data Sources

This Galliford Try SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.