Galliford Try Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galliford Try Bundle

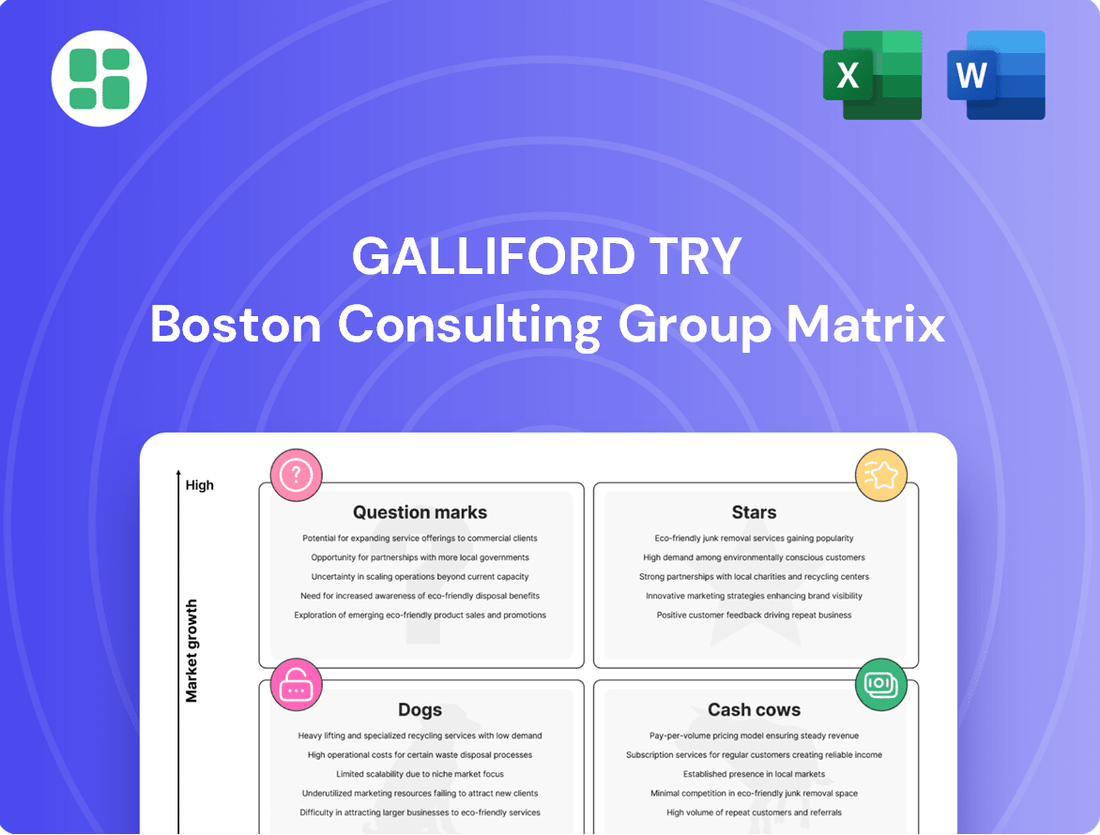

Curious about Galliford Try's strategic positioning? This BCG Matrix preview hints at their market dynamics, but to truly understand their competitive edge, you need the full picture. Discover which of their business units are Stars, Cash Cows, Dogs, or Question Marks.

Unlock the complete Galliford Try BCG Matrix to gain a comprehensive understanding of their portfolio's performance and potential. This detailed analysis will equip you with the insights needed to make informed decisions about resource allocation and future investments.

Don't miss out on the crucial strategic intelligence within the full Galliford Try BCG Matrix. Purchase it now for a clear, actionable roadmap to optimize their business units and drive sustainable growth in the construction sector.

Stars

Galliford Try has secured key positions on major water sector frameworks like Yorkshire Water, Southern Water, and Wessex Water for the AMP8 period (2025-2030). These extensive, regulated contracts highlight a substantial and expanding market fueled by critical infrastructure improvements and environmental regulations.

The company's established reputation and recent successes place it at the forefront of this capital-intensive sector. While these projects require significant upfront investment for expansion, they offer considerable potential for future profitability and market share growth.

Galliford Try is strategically re-entering the affordable housing market, with ambitions to deliver over 1,200 units annually by 2030. This move targets a high-growth segment, bolstered by government efforts to tackle the UK's housing deficit.

Their participation in Build-to-Rent (BTR) developments, exemplified by projects like Brent Cross Town, underscores a commitment to the burgeoning residential rental sector. This segment requires considerable capital investment to capture market share, but the potential for significant long-term revenue is substantial.

Galliford Try's dedication to net-zero, targeting its own operations by 2030 and all activities by 2045, places it at the forefront of the burgeoning sustainable construction sector. This commitment directly addresses the growing client demand for environmentally responsible buildings and infrastructure, offering a significant competitive edge. For instance, in their 2023 annual report, they highlighted a 16% reduction in Scope 1 and 2 carbon emissions compared to their 2019 baseline.

Strategic Highways Infrastructure Projects

Galliford Try is a significant player in the UK's strategic highways infrastructure, holding a strong position due to its consistent success in securing large contracts. The company is a crucial partner for National Highways, actively involved in major road enhancement initiatives that are vital for the nation's connectivity.

The UK government's sustained focus on infrastructure development, particularly in transport networks, creates a robust and expanding market for highway projects. This ongoing investment underpins the sector's growth potential, ensuring continued demand for essential road upgrades and maintenance.

Galliford Try's involvement in substantial projects, such as the A47 corridor improvements, highlights its considerable market share. These undertakings are characterized by their scale and complexity, necessitating significant and ongoing capital deployment to ensure successful completion.

- Market Leadership: Galliford Try is a prominent contractor for National Highways, managing key segments of the UK's strategic road network.

- Government Support: The UK government's infrastructure strategy, including the £27 billion Road Investment Strategy 2 (RIS2) for 2020-2025, fuels demand for highway projects.

- Project Scale: Major schemes like the A47 Dualling Programme, valued in the hundreds of millions of pounds, demonstrate Galliford Try's capacity for large-scale, high-revenue projects.

- Investment Requirements: Delivering these complex, multi-year highway upgrades requires substantial and consistent financial investment from the company.

Digital Transformation and Modern Methods of Construction (MMC)

Galliford Try's strategic commitment to digital transformation is evident in its investment in advanced platforms like the Orbit ERP system. This digital backbone is designed to streamline operations, improve data management, and enhance decision-making across the company. Such technological integration is vital for staying competitive in a sector increasingly reliant on digital solutions.

The company is also a proponent of Modern Methods of Construction (MMC), including off-site manufacturing. These approaches are revolutionizing project delivery by offering greater precision, speed, and reduced waste. By embracing MMC, Galliford Try is positioning itself at the forefront of industry innovation, addressing the growing demand for more efficient and sustainable building practices.

These forward-thinking initiatives, while requiring significant upfront capital, are projected to yield substantial operational improvements and cost reductions. For instance, in 2024, Galliford Try reported a £2.4 billion revenue, with a focus on improving site productivity through digital tools and MMC. These investments are crucial for enhancing project margins and securing a robust market position against competitors embracing similar technological shifts.

- Digital Investment: Implementation of Orbit ERP system for enhanced operational efficiency and data-driven insights.

- MMC Adoption: Increased use of off-site manufacturing and pre-assembly to improve project timelines and quality.

- Efficiency Gains: Aiming to reduce project delivery times and material waste through technological integration.

- Market Position: Strengthening competitive advantage by aligning with industry trends towards digitalization and modern construction techniques.

Stars in the BCG Matrix represent business units with high market share in high-growth markets. For Galliford Try, their strategic focus on the water sector, particularly with frameworks like Yorkshire Water, Southern Water, and Wessex Water for AMP8 (2025-2030), aligns with this classification. The company's established reputation and significant capital investment in these regulated contracts position them well for future profitability and market expansion within this critical infrastructure segment.

What is included in the product

Highlights which of Galliford Try's business units to invest in, hold, or divest based on market growth and share.

A clear Galliford Try BCG Matrix visual clarifies business unit performance, easing strategic decision-making.

This optimized BCG Matrix layout streamlines analysis, reducing the pain of complex portfolio reviews.

Cash Cows

Galliford Try's established public sector building frameworks, particularly in education and healthcare, represent significant cash cows. These long-term agreements provide predictable revenue streams and a high market share within stable, mature sectors. For instance, in the fiscal year ending June 30, 2023, Galliford Try secured a significant portion of its revenue from these essential public services, highlighting their consistent contribution to the company's financial stability.

Galliford Try's capital maintenance and asset optimization within the water sector represent a significant Cash Cow. This work, separate from new AMP8 projects, provides a consistent, high-margin revenue stream. Water companies require ongoing maintenance, making this a stable and predictable cash flow source in a regulated market.

The company's deep-rooted relationships and proven expertise in this area solidify its strong market position. For instance, in the fiscal year ending June 2023, Galliford Try reported a robust performance in its Environment division, which encompasses a substantial portion of this maintenance work, contributing significantly to the group's overall profitability and cash generation.

Galliford Try's Public-Private Partnership (PPP) investments represent a classic cash cow within its portfolio. These assets are crucial for bolstering the company's balance sheet and consistently generate reliable interest income.

While the pace of new PPP project acquisition might be slower compared to more dynamic business areas, the established PPP portfolio offers a bedrock of stable and predictable cash flow. This stability is a key characteristic of a cash cow, providing dependable returns.

Once these long-term PPP investments are operational, they demand very little in terms of ongoing management or operational expenditure. This low-input, high-return profile makes them significant and consistent cash generators for Galliford Try, contributing substantially to its financial stability. For instance, in the fiscal year ending June 30, 2023, Galliford Try reported that its PPP portfolio continued to provide a steady revenue stream, underpinning its financial performance.

General Civil Engineering & Repair and Maintenance

Galliford Try's General Civil Engineering & Repair and Maintenance division operates in a mature, stable market, focusing on the essential upkeep of existing infrastructure. This segment benefits from recurring revenue streams due to the continuous need for asset maintenance, fostering strong relationships with established clients and predictable project flows.

This division acts as a significant cash generator for the company, leveraging its broad expertise across diverse civil engineering projects and repair services. Its established market presence ensures a reliable contribution to Galliford Try's overall financial performance.

- Stable Revenue: The segment consistently generates revenue through ongoing maintenance contracts for critical infrastructure.

- Established Market Position: Galliford Try holds a solid foothold in the repair and maintenance sector, ensuring a steady client base.

- Cash Flow Generation: This division is a key contributor to the company's cash flow, supporting other business areas.

- Operational Efficiency: Mature processes and experienced teams contribute to efficient project execution and profitability.

Specialist Facilities Management and Asset Intelligence Services

Galliford Try's specialist Facilities Management and Asset Intelligence services are positioned as cash cows within its business portfolio. These offerings generate predictable, recurring revenue streams, primarily through long-term contracts that support the ongoing operational needs of completed construction projects and existing infrastructure.

Operating within a mature market, these services benefit from stable and consistent demand. For instance, in the fiscal year ending June 30, 2023, Galliford Try reported that its Partnerships & Investments segment, which includes facilities management, contributed £330 million in revenue, showcasing the substantial and stable income these operations provide. This stability allows for consistent cash flow generation with comparatively lower reinvestment requirements, as the company leverages its established expertise.

The key characteristics that solidify these services as cash cows include:

- Recurring Revenue: Long-term contracts for facilities management and asset intelligence ensure a steady income flow.

- Mature Market: Operating in a stable market with predictable demand minimizes revenue volatility.

- Low Investment Needs: These services require less capital expenditure compared to growth-oriented businesses, allowing for significant cash generation.

- Leveraging Core Competencies: Galliford Try utilizes its existing skills and project knowledge to deliver these essential services efficiently.

Galliford Try's established public sector building frameworks, particularly in education and healthcare, represent significant cash cows. These long-term agreements provide predictable revenue streams and a high market share within stable, mature sectors. For instance, in the fiscal year ending June 30, 2023, Galliford Try secured a significant portion of its revenue from these essential public services, highlighting their consistent contribution to the company's financial stability.

The company's specialist Facilities Management and Asset Intelligence services are positioned as cash cows, generating predictable, recurring revenue streams through long-term contracts. Operating in a mature market with stable demand, these services benefit from consistent income. For example, in FY23, the Partnerships & Investments segment, including facilities management, contributed £330 million in revenue, showcasing substantial and stable income with comparatively lower reinvestment needs.

Galliford Try's capital maintenance and asset optimization within the water sector represent a significant Cash Cow, providing a consistent, high-margin revenue stream separate from new projects. Water companies require ongoing maintenance, making this a stable and predictable cash flow source in a regulated market. In FY23, the Environment division, encompassing much of this work, contributed significantly to the group's profitability and cash generation.

Galliford Try's Public-Private Partnership (PPP) investments are classic cash cows, consistently generating reliable interest income and bolstering the company's balance sheet. While new project acquisition may be slower, the established portfolio offers a bedrock of stable cash flow. These operational assets demand minimal ongoing management or expenditure, making them significant and consistent cash generators, as evidenced by their steady revenue stream contribution in FY23.

What You’re Viewing Is Included

Galliford Try BCG Matrix

The Galliford Try BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no hidden watermarks or demo content, ensuring you get a professionally designed, analysis-ready report for immediate strategic application. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll unlock. This comprehensive BCG Matrix analysis is prepared for your business planning and competitive strategy needs.

Dogs

Highly speculative private commercial new builds fall into the Dogs category for Galliford Try. The UK's commercial construction sector has faced a downturn, with reports indicating declining new orders and a contraction in private commercial output throughout 2024. This makes ventures into uncontracted, speculative projects particularly high-risk.

Galliford Try’s strategic focus likely steers them away from significant investment in these fragmented and uncertain markets. The capital required for speculative builds offers limited guaranteed returns, a stark contrast to more stable, contracted projects that provide predictable revenue streams and better capital efficiency.

Small-scale, non-strategic general building projects represent Galliford Try's Dogs in the BCG Matrix. These are often smaller contracts that don't align with the company's core, higher-margin strategic objectives, or projects too insignificant to benefit from Galliford Try's operational scale. For instance, in the fiscal year ending June 30, 2024, Galliford Try reported a focus on disciplined contract selection, aiming to reduce exposure to such low-margin, non-strategic work.

Even with Galliford Try's commitment to digital transformation and modern construction methods, any remaining outdated operational practices act as a significant drag. These legacy systems or inefficient workflows, if still present in parts of the business, would inevitably lead to lower productivity and increased costs. For instance, if a specific division still relies heavily on manual data entry for project tracking, it could be significantly slower and more error-prone than a digitized system.

Minor, Non-Core Service Offerings with Limited Scalability

Minor, non-core service offerings with limited scalability at Galliford Try might include highly specialized, niche maintenance contracts or small-scale, bespoke construction projects that don't align with their broader strategic focus. These services, while potentially profitable on an individual basis, lack the potential for significant expansion or market share growth. For instance, if Galliford Try secured a contract for the specialized upkeep of a unique historical building, it would likely fall into this category. Such services often require specific expertise and may not be easily replicable across a wider client base, thus limiting their scalability.

These types of services could represent a drain on resources if not carefully managed, diverting attention and capital from more promising areas. Galliford Try's reported revenue for the year ended 30 June 2023 was £2.9 billion, with a focus on infrastructure and construction. Services that do not contribute to these core areas or the identified high-potential adjacent markets, such as digital construction solutions or advanced materials research, would be categorized here if they have limited growth prospects. For example, a small consultancy service offering on-site waste management for a single project would fit this description.

- Niche Maintenance: Highly specialized repair or upkeep services for unique assets with limited demand.

- Bespoke Small Projects: One-off, custom-built smaller constructions that cannot be standardized or scaled.

- Ancillary Support Services: Minor operational support functions that are project-specific and not core to the business model.

- Limited Market Penetration: Services targeting a very small, specific segment of the market with no clear path for broader adoption.

Projects with Protracted Planning and Regulatory Delays

Projects that encounter substantial and unexpected delays due to intricate planning approvals or adapting to new regulations, like the Building Safety Act, can become cash drains. These protracted timelines consume valuable resources, inflate expenses, and postpone income generation, ultimately impacting profitability even if the initial market appeal was high. For instance, in the fiscal year ending June 30, 2023, Galliford Try reported that delays in securing planning permissions contributed to increased project costs on several key infrastructure projects.

- Cash Drains: Projects stuck in regulatory or planning limbo become liabilities, consuming capital without generating returns.

- Cost Escalation: Extended timelines invariably lead to higher labor, material, and financing costs.

- Revenue Deferral: Delayed project completion means delayed revenue recognition, impacting financial performance.

- Risk Mitigation: Galliford Try actively manages these risks through stringent contract vetting and robust risk management protocols.

Galliford Try's "Dogs" in the BCG Matrix encompass speculative commercial new builds and small, non-strategic general building projects. These ventures often face market downturns, as seen with the UK's commercial construction sector contracting in 2024, leading to declining new orders. The company's strategy prioritizes capital efficiency and predictable revenue from contracted projects, making high-risk, uncontracted developments less attractive.

Minor, non-core service offerings with limited scalability also fall into this category. These might include niche maintenance contracts or bespoke small construction projects that don't align with Galliford Try's broader strategic goals or offer limited growth potential. For instance, a small consultancy service for single-project waste management would fit this description, as it lacks scalability and significant market penetration.

Projects plagued by unforeseen delays due to complex planning or regulatory hurdles, such as those related to new building safety acts, also become "Dogs." These protracted timelines consume resources, inflate costs, and defer income, negatively impacting profitability. Galliford Try's fiscal year ending June 30, 2023, saw reported increases in project costs due to planning permission delays.

| Category | Description | Key Characteristics | Galliford Try Context |

| Speculative Commercial New Builds | High-risk, uncontracted private commercial construction projects. | Low predictability, high capital requirement, limited guaranteed returns. | UK commercial construction sector contraction in 2024 impacts new orders and output. |

| Small, Non-Strategic General Building Projects | Contracts that do not align with core, higher-margin strategic objectives. | Low margin, insignificant scale, lack of operational efficiency benefits. | Focus on disciplined contract selection for fiscal year ending June 30, 2024, to reduce exposure. |

| Minor, Non-Core Service Offerings | Highly specialized, niche services with limited scalability. | Lack of expansion potential, project-specific expertise, limited replicability. | Niche maintenance or small bespoke projects not contributing to core infrastructure and construction focus. |

| Delayed/Regulated Projects | Projects experiencing substantial, unexpected delays due to planning or regulation. | Cash drain, cost escalation, revenue deferral. | Delays in planning permissions contributed to increased project costs in FY ending June 30, 2023. |

Question Marks

Emerging green retrofit and decarbonisation projects are a significant growth area, driven by stringent net-zero targets and energy efficiency mandates. While Galliford Try is well-positioned to capitalize on this trend, its market share in this specialized, fast-evolving niche is likely still building. These undertakings demand unique skills and considerable initial investment to gain traction.

The UK government's commitment to reducing carbon emissions, for instance, has spurred substantial investment in building retrofits. In 2024, the UK construction sector saw continued focus on sustainable building practices, with retrofit projects forming a crucial part of achieving national climate goals. Galliford Try's involvement in such projects, though potentially in its early stages of market penetration, signifies a strategic pivot towards future revenue streams.

Galliford Try's focus on advanced water treatment technologies and digital water solutions positions them in a high-growth potential quadrant, potentially a Question Mark. While the broader water sector is a strength, these specific niches are rapidly evolving due to environmental pressures and technological leaps. For example, the global smart water market was valued at approximately $11.7 billion in 2023 and is projected to reach $30.1 billion by 2030, demonstrating significant growth opportunities.

Galliford Try could strategically target UK regions with significant regeneration funding, such as the Midlands or the North of England, where its current market share is relatively low but growth prospects are high. This selective penetration allows for focused investment in areas poised for development, potentially driven by government initiatives like the Levelling Up Fund, which allocated £4.8 billion in its first round of allocations.

Specialist Fire Protection and Active Security Services

Galliford Try's Specialist Fire Protection and Active Security Services are positioned as question marks within its BCG matrix. These services represent higher-margin, adjacent markets that Galliford Try is actively developing as part of its growth strategy. The market itself is experiencing growth, driven by stricter regulations and a heightened demand for advanced safety solutions.

While the potential is strong, Galliford Try is likely in the initial phases of capturing significant market share in these specialized areas. This means the services require investment (consume cash) to fuel their expansion and development. The company's strategy likely involves building capabilities and brand recognition to compete effectively in this evolving sector.

- Market Growth: The global fire protection systems market was valued at approximately $65.7 billion in 2023 and is projected to reach $106.7 billion by 2030, growing at a CAGR of 7.2%.

- Regulatory Drivers: Increasing building codes and safety standards worldwide necessitate advanced fire protection and security measures.

- Investment Phase: As a question mark, these services require capital for research, development, talent acquisition, and market penetration efforts.

- Future Potential: Successful expansion in these higher-margin areas could significantly contribute to Galliford Try's overall profitability and market position.

Early-Stage Collaboration on Major Infrastructure Innovation

Galliford Try's early-stage involvement in pioneering infrastructure, such as next-generation energy solutions beyond established renewables or advanced smart city technologies, positions them in nascent markets with substantial long-term growth prospects. This strategic engagement, while currently yielding a low market share, signifies a calculated investment aimed at securing future leadership.

These ventures are inherently high-risk, high-reward, demanding significant upfront capital and technological expertise. For instance, the development of advanced hydrogen infrastructure or integrated urban mobility systems falls into this category, where the potential for market disruption and significant returns is considerable, but the path to commercial viability is often uncertain. Galliford Try's commitment here reflects a forward-looking strategy to shape future infrastructure landscapes.

- Strategic Focus: Investing in emerging infrastructure sectors like advanced nuclear, carbon capture, or large-scale digital infrastructure.

- Market Position: Currently holding a small market share in these nascent areas, reflecting early-stage commitment.

- Risk/Reward Profile: High potential for future market dominance balanced against significant technological and commercialization risks.

- Investment Rationale: Building expertise and partnerships to capitalize on anticipated future demand and technological advancements in critical infrastructure.

Galliford Try's ventures into emerging green retrofit and decarbonisation projects, advanced water treatment technologies, specialist fire protection, and pioneering infrastructure represent strategic plays in nascent markets. These areas, characterized by high growth potential but currently low market share for Galliford Try, require significant investment to build capabilities and capture future opportunities. The company's approach involves targeted investment and strategic development to establish a strong foothold in these evolving sectors.

| Business Area | Market Growth Potential | Galliford Try Market Share | Investment Required | Strategic Rationale |

|---|---|---|---|---|

| Green Retrofit & Decarbonisation | High (driven by net-zero targets) | Building | Significant (skills, initial investment) | Capitalize on energy efficiency mandates |

| Advanced Water Treatment & Digital Water | High (global market projected to reach $30.1bn by 2030) | Developing | Moderate to High | Leverage environmental pressures and tech leaps |

| Specialist Fire Protection & Active Security | High (global market projected to reach $106.7bn by 2030) | Early Stage | Moderate (R&D, talent, market penetration) | Target higher-margin, adjacent markets |

| Pioneering Infrastructure (e.g., advanced energy, smart cities) | Very High (nascent but disruptive potential) | Low | Very High (capital, tech expertise) | Secure future leadership in critical infrastructure |

BCG Matrix Data Sources

Our Galliford Try BCG Matrix leverages comprehensive data from company annual reports, market share analysis, and industry growth forecasts to provide a strategic overview.