Galliford Try Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galliford Try Bundle

Galliford Try operates in a construction sector influenced by moderate buyer power and significant threat from new entrants due to the industry's capital intensity. The bargaining power of suppliers is also a key consideration, as is the availability of substitutes for traditional construction methods.

The complete report reveals the real forces shaping Galliford Try’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The UK construction sector, including firms like Galliford Try, is navigating a landscape where material supply is gradually improving, though not without lingering concerns. While material price inflation has shown signs of easing in 2024, the threat of supplier insolvencies remains a factor, especially for those still feeling the pinch of economic instability.

This situation grants a degree of leverage to key material suppliers. A concentrated supply base for certain essential components means these providers can exert moderate power over construction companies. This can translate into less favorable terms for contractors if supply chains remain fragile or if a few dominant suppliers control critical resources, impacting Galliford Try's procurement costs and project timelines.

The UK construction sector faces a deepening skilled labour shortage, projected to worsen by 2025. This scarcity elevates the bargaining power of skilled tradespeople, including specialists like HVAC technicians, who are essential for projects undertaken by firms such as Galliford Try.

The demand for experienced workers outstrips supply, particularly as access to overseas labour becomes more restricted and the existing workforce ages. Consequently, construction companies are compelled to enhance their investments in training and apprenticeship programs to ensure a stable and skilled workforce, directly impacting their operational costs and project timelines.

For highly specialized construction projects, such as complex infrastructure or water projects where Galliford Try has a strong presence, the pool of qualified subcontractors and specialized equipment providers can be limited. This scarcity grants these niche suppliers higher bargaining power, as switching costs for Galliford Try could be substantial if they need to change a specialized provider mid-project.

Galliford Try's significant involvement in the UK's water sector, a market characterized by long-term frameworks, underscores the critical need for dependable, specialized supply chains. For instance, in 2023, the company secured significant contracts within the water industry, highlighting its reliance on these specialized suppliers.

Inflationary Pressures on Input Costs

While inflation has seen some moderation in the UK, the construction sector, including companies like Galliford Try, continues to grapple with elevated input costs. These pressures manifest in higher prices for materials, energy, and labor, rippling through the entire supply chain. This dynamic directly impacts Galliford Try's ability to manage its cost of goods sold.

Despite a stabilization in tender price inflation, underlying issues such as persistent labor shortages mean suppliers retain a degree of power to pass on their increased expenses. This situation directly influences Galliford Try's profitability, as it must absorb or negotiate these higher supplier costs.

- Elevated Input Costs: Construction materials, energy, and labor costs remain a significant factor impacting the supply chain.

- Persistent Labor Shortages: These shortages continue to underpin supplier pricing power, even as tender inflation stabilizes.

- Profitability Impact: Galliford Try's margins are susceptible to the extent it can pass on or absorb these increased supplier costs.

Reliance on Framework Agreements

Galliford Try's reliance on long-term government building and infrastructure frameworks significantly influences supplier bargaining power. These frameworks often pre-approve suppliers and set negotiated terms, offering Galliford Try stability but potentially limiting its ability to switch to cheaper alternatives. For instance, in 2024, a substantial portion of Galliford Try's secured pipeline was tied to these frameworks, meaning fewer opportunities to renegotiate pricing with a broad supplier base.

This dependence can empower suppliers already within these established agreements. They benefit from guaranteed work and the reduced competitive pressure from external sourcing. Consequently, suppliers within these frameworks may command higher prices or more favorable contract terms, as Galliford Try's flexibility to find alternative, potentially lower-cost, suppliers is constrained.

- Framework Dependence: Long-term government frameworks provide a stable, albeit less flexible, supply chain for Galliford Try.

- Supplier Power: Pre-vetted suppliers within these frameworks may hold increased bargaining power due to limited alternative sourcing options for Galliford Try.

- Pricing Impact: Contractual lock-ins can prevent Galliford Try from achieving cost savings through competitive bidding outside of established framework relationships.

Suppliers in the UK construction sector, particularly for specialized materials and skilled labor, continue to wield moderate to high bargaining power. This is driven by ongoing labor shortages, which were projected to worsen by 2025, and the concentrated nature of suppliers for critical components. For Galliford Try, this translates to less favorable terms and potentially higher procurement costs, especially within long-term government frameworks where supplier flexibility is limited.

| Factor | Impact on Galliford Try | Data Point (2024/2025 Projection) |

|---|---|---|

| Material Supply Chain Fragility | Moderate supplier power due to potential insolvencies and concentrated supply. | Easing material price inflation reported, but supplier insolvencies remain a concern. |

| Skilled Labour Shortage | High supplier power for specialized trades due to demand exceeding supply. | UK construction sector faces a deepening skilled labour shortage, projected to worsen by 2025. |

| Specialized Subcontractors/Equipment | Higher bargaining power for niche providers due to limited alternatives. | Switching costs can be substantial for specialized project providers. |

| Government Framework Dependence | Empowered suppliers with pre-negotiated terms and limited competition. | Substantial portion of Galliford Try's 2024 pipeline tied to these frameworks. |

What is included in the product

This analysis delves into the competitive intensity within the construction sector, examining the bargaining power of Galliford Try's customers and suppliers, the threat of new entrants, and the availability of substitutes for its services.

Effortlessly identify and address competitive threats by visualizing the intensity of each Porter's Force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Galliford Try's customer base is heavily skewed towards the public sector and regulated industries, with these clients representing around 90% of its projects. This dominance grants them considerable leverage.

Government bodies and regulated utilities, such as water companies, typically engage in large-scale, long-term projects. Their significant procurement power stems from the critical and extensive nature of the infrastructure they commission.

These influential clients often possess the ability to set project specifications and negotiate payment terms, thereby exerting substantial bargaining power over contractors like Galliford Try.

Galliford Try's significant order book, much of it built on long-term frameworks in areas like water, defense, and education, highlights a procurement strategy where clients use these agreements. This often means clients have considerable sway over pricing and service standards due to competitive bidding processes within these frameworks.

Clients in the UK construction sector, despite cautious optimism, often exhibit significant price sensitivity, especially for substantial projects. This heightened awareness of costs puts pressure on contractors like Galliford Try.

While there's been a slight uptick in tender prices and contractor profit margins, clients continue to scrutinize project expenditures closely. For instance, in the fiscal year ending June 30, 2023, Galliford Try reported revenue of £1,242.4 million, underscoring the scale of projects involved and the importance of client cost vigilance.

Galliford Try faces the challenge of offering competitive pricing to secure work while simultaneously pursuing its strategic goal of improving operating margins. This delicate balance is crucial for sustained profitability in a competitive market.

Availability of Alternative Contractors

The UK construction sector's fragmentation is a key factor. With numerous major players and a vast number of smaller firms, clients possess considerable choice. For instance, in 2023, the UK construction output was valued at approximately £170 billion, indicating a substantial market with many participants.

This wide array of available contractors directly enhances customer bargaining power. Clients can readily solicit competitive bids, driving down project costs. Galliford Try, while a significant entity, operates within this environment where alternative, capable firms are always an option for potential clients.

- Market Fragmentation: The UK construction market features a mix of large, established contractors and a substantial number of smaller, specialized firms.

- Client Choice: This diversity means clients can typically identify multiple suitable contractors for most projects, strengthening their negotiating position.

- Competitive Bidding: The ease with which clients can obtain multiple quotes encourages competitive pricing among contractors, including Galliford Try.

- Impact on Galliford Try: While Galliford Try's reputation and financial stability are strengths, the competitive landscape necessitates competitive pricing to secure contracts.

Long-term Relationships and Repeat Business

Galliford Try's strategy of building long-term frameworks and securing repeat business with its major clients significantly strengthens its position. These enduring relationships allow for more collaborative contracting, where clients, while still having leverage, are less inclined to engage in aggressive price wars due to the established trust and proven delivery record.

This focus on partnership reduces the probability of clients switching to competitors for marginal cost savings. For instance, in the financial year ending June 30, 2023, Galliford Try reported that its order book stood at £3.4 billion, indicating a substantial base of ongoing and future work, much of which is likely derived from these established client relationships.

- Long-term frameworks reduce client churn.

- Repeat business fosters collaborative contracting.

- Established relationships temper aggressive price negotiations.

- Galliford Try's order book was £3.4 billion as of June 30, 2023.

Galliford Try's customer base, heavily weighted towards the public sector and regulated utilities, grants these clients significant bargaining power. Their large-scale, long-term projects and ability to dictate terms mean they can exert considerable influence over pricing and specifications.

The UK construction market's fragmentation, with numerous contractors available, further empowers clients. They can easily solicit competitive bids, driving down costs for projects. For example, UK construction output was around £170 billion in 2023, highlighting the competitive landscape.

While Galliford Try's focus on long-term frameworks and repeat business fosters collaboration and can temper aggressive price negotiations, clients still scrutinize expenditures closely, as seen in their continued vigilance over project costs.

| Factor | Impact on Galliford Try | Supporting Data (as of FYE June 30, 2023) |

|---|---|---|

| Customer Concentration | High leverage for public/regulated clients (approx. 90% of projects) | N/A (Qualitative) |

| Market Fragmentation | Clients have ample choice, driving competitive pricing | UK Construction Output: ~£170 billion (2023) |

| Long-term Relationships | Reduced price sensitivity due to trust and proven delivery | Order Book: £3.4 billion |

| Price Sensitivity | Clients scrutinize costs, pressuring margins | Revenue: £1,242.4 million |

Preview Before You Purchase

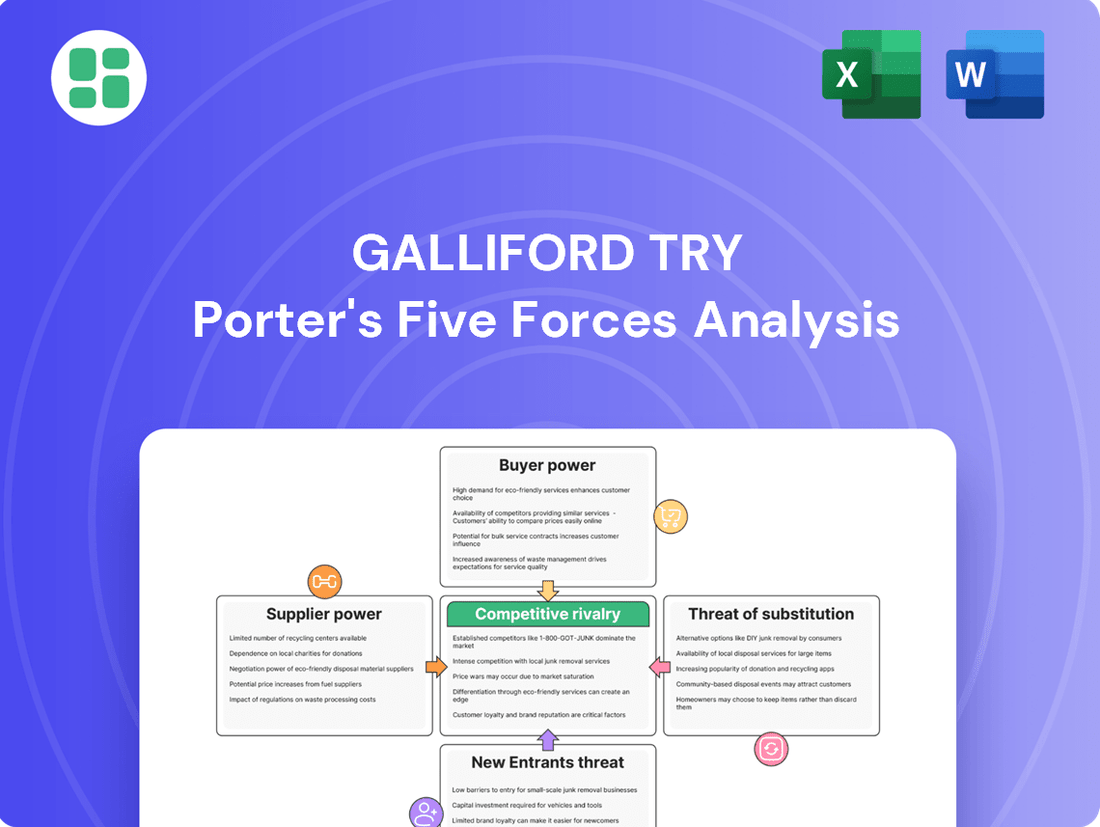

Galliford Try Porter's Five Forces Analysis

This preview showcases the complete Galliford Try Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. You're viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring you receive precisely the content you expect. This detailed analysis will equip you with a strategic understanding of the forces shaping Galliford Try's industry.

Rivalry Among Competitors

The UK construction sector is a battleground with numerous participants, from giants like Galliford Try to smaller, specialized outfits. This sheer number of competitors fuels a fierce fight for every contract.

This intense rivalry often drives down bid prices, squeezing profit margins for all involved. In 2023, the construction industry faced significant cost inflation, further intensifying this margin pressure as companies tried to absorb rising material and labor expenses while remaining competitive.

The UK construction sector, despite facing challenges in 2024, is projected to see a return to modest growth in 2025. This anticipated uptick is largely driven by significant government investment in infrastructure, energy, and water projects, creating a robust project pipeline.

With an estimated £700-775 billion earmarked for infrastructure investment over the next decade, the competitive rivalry among construction firms intensifies. Companies are vying for these substantial opportunities, seeking to secure their share of the expanding market.

Galliford Try's competitive rivalry is significantly shaped by its success in securing positions on long-term frameworks. These frameworks are vital for ensuring a steady stream of work and mitigating the intensity of direct competition. The company's substantial £3.9 billion order book, largely comprised of these framework agreements, underscores their strategic importance.

The competition for these lucrative frameworks is intense, as they offer contractors like Galliford Try a degree of stability and predictable future revenue. This makes them a primary focus for major players in the construction sector, driving a high level of rivalry for these coveted contracts.

Differentiation Through Specialisation and Sustainability

Galliford Try actively combats intense price competition by specializing in niche sectors such as water infrastructure, highways, and defense projects. This specialization allows them to cultivate deep expertise and offer tailored solutions, appealing to clients who prioritize technical proficiency and reliability. For example, their significant involvement in the water sector, evidenced by numerous framework agreements, demonstrates a commitment to sector-specific excellence.

Furthermore, Galliford Try emphasizes sustainability as a key differentiator, integrating environmental considerations into their project delivery. This focus on high-quality, sustainable construction resonates with an increasing number of clients, particularly public sector bodies and large corporations with strong ESG mandates. This strategic approach moves the competitive focus away from a pure price war towards value-added services and long-term client relationships.

- Sector Specialisation: Galliford Try focuses on water, highways, custodial, and defence sectors.

- Sustainability Focus: Commitment to high-quality, environmentally conscious construction.

- Client Value Proposition: Attracting clients who value expertise and ESG commitments over lowest price.

- Competitive Edge: Differentiation strategy aims to build a strong market position beyond price.

Impact of Economic Conditions and Insolvencies

Challenging economic conditions, marked by high interest rates and persistent inflation, have significantly impacted the UK construction sector. This has resulted in a notable increase in company failures, with the sector experiencing the highest rate of insolvencies across the economy. For instance, in the 12 months leading up to the end of March 2024, there were 4,193 construction insolvencies, a 15% increase compared to the previous year.

This heightened financial pressure can directly intensify competitive rivalry. Companies facing financial distress may resort to aggressive bidding strategies to secure work, potentially driving down margins for all participants. Conversely, financially robust firms like Galliford Try, which maintain strong balance sheets, are better positioned to navigate these turbulent times. They can leverage their financial stability to secure more desirable contracts and maintain strong relationships with their supply chains, attracting skilled labor and reliable subcontractors.

- Increased Insolvencies: The UK construction sector saw 4,193 insolvencies in the 12 months to March 2024, a 15% rise year-on-year.

- Economic Headwinds: High interest rates and inflation are key drivers of this financial strain within the industry.

- Aggressive Bidding: Struggling firms may lower bids to win contracts, impacting overall market profitability.

- Galliford Try's Advantage: Strong financial health allows Galliford Try to secure better contracts and maintain a stable supply chain.

The UK construction market is highly competitive, with a large number of players vying for contracts. This intense rivalry often leads to price wars, putting pressure on profit margins, especially as companies grapple with rising costs. For instance, the sector's high insolvency rate, with 4,193 construction insolvencies in the 12 months to March 2024, highlights the financial strain that fuels aggressive bidding.

Galliford Try mitigates this by focusing on long-term frameworks and specializing in sectors like water and highways, where its expertise offers a competitive edge. This strategy aims to differentiate itself beyond price, emphasizing quality and sustainability to secure a stable order book, which stood at £3.9 billion.

| Metric | Value | Context |

|---|---|---|

| UK Construction Insolvencies (12 months to March 2024) | 4,193 | 15% increase year-on-year, indicating intense financial pressure. |

| Galliford Try Order Book (as of latest report) | £3.9 billion | Primarily composed of framework agreements, providing revenue stability. |

| Government Infrastructure Investment (next decade) | £700-775 billion | Drives competition for significant project opportunities. |

SSubstitutes Threaten

The rise of modular and off-site construction poses a significant threat of substitutes for Galliford Try's traditional on-site building services. These modern methods of construction (MMC) are gaining traction due to their potential for quicker project completion and enhanced quality, directly competing with established building approaches. For instance, the UK government has set ambitious targets to increase the use of MMC in social housing projects, signaling a market shift that could impact traditional contractors.

Innovations in advanced materials and construction technologies pose a significant threat of substitution for Galliford Try. For instance, the rise of modular construction and prefabrication, utilizing advanced composite materials, can significantly speed up project timelines and reduce on-site labor costs, directly competing with traditional building methods where Galliford Try operates.

The push for sustainability is also a key driver. New eco-friendly materials, such as advanced recycled composites or bio-based building components, offer alternatives that might reduce the reliance on traditional concrete and steel, core elements of many large infrastructure projects Galliford Try undertakes. While these materials can be more expensive initially, their long-term benefits in terms of durability and environmental impact could make them increasingly attractive substitutes.

Consider the UK's net-zero targets; by 2024, the construction sector is increasingly focused on embodied carbon reduction. This trend favors materials and methods that minimize carbon footprints, potentially displacing conventional approaches that Galliford Try has historically employed. For example, timber frame construction, utilizing engineered wood products, is gaining traction as a sustainable alternative for mid-rise buildings, directly substituting concrete and steel structures.

The increasing sophistication of digital tools and AI in construction project management, design, and planning presents a potential threat of substitutes. These technologies can automate tasks traditionally handled by project managers, potentially reducing the need for certain external services.

For instance, AI-powered platforms can optimize scheduling, resource allocation, and risk assessment, streamlining operations. This efficiency might allow clients to manage more project aspects internally or utilize specialized, smaller tech firms rather than engaging traditional, full-service construction management companies.

While these digital solutions are often adopted by construction firms themselves, their accessibility could empower clients to bypass certain traditional contractor roles. This shift could redefine the scope of services required from established players, impacting demand for conventional project management expertise.

Repair, Maintenance, and Retrofit Solutions

The increasing emphasis on repairing, maintaining, and retrofitting existing buildings, particularly for energy efficiency and safety upgrades, poses a threat of substitution for new construction projects. This shift is fueled by stringent sustainability goals and evolving building safety regulations, potentially diverting capital and resources that might otherwise be allocated to new builds. For instance, as of early 2024, the UK government has been actively promoting retrofitting initiatives to improve the energy performance of the nation's housing stock, with significant investment earmarked for these programs.

This trend creates a competitive pressure on traditional new build segments, as clients may opt for cost-effective and environmentally conscious upgrades to their current assets rather than undertaking entirely new developments. While Galliford Try offers maintenance services, a stronger market push towards R&M could mean a reduced pipeline for its new construction divisions if clients prioritize refurbishment. This is particularly relevant in sectors like social housing and public buildings where upgrade mandates are becoming more common.

- Increased investment in energy efficiency retrofits: Government incentives and rising energy costs are driving demand for R&M.

- Building safety remediation: Post-Grenfell regulations are necessitating extensive safety upgrades, presenting an alternative to new builds.

- Sustainability targets: Corporate and governmental environmental goals favor extending the life of existing structures.

- Potential impact on new build pipelines: A shift in focus to R&M could reduce opportunities for new construction contracts.

Client Self-Performance or Alternative Service Models

For certain clients, particularly large public sector organizations or major private developers, the threat of substitutes arises from their capacity to self-perform certain construction tasks or engage with alternative service models. This can bypass the need for a traditional general contractor like Galliford Try. While complex, large-scale projects typically still require specialized expertise, the increasing availability of modular construction or advanced project management software could enable some clients to manage aspects of their projects internally.

For instance, a large infrastructure client might possess the in-house engineering and project management teams to oversee significant portions of a project, contracting out only highly specialized elements. This insourcing capability, or the adoption of highly specialized consultancy models that manage multiple subcontractors directly, represents a substitute for the comprehensive service offering of a general contractor. In 2024, the construction industry continued to see innovation in project delivery, with some clients exploring integrated project delivery (IPD) or design-build models that shift risk and responsibility, potentially reducing reliance on traditional contracting structures.

- Client Self-Performance: Large clients with substantial internal resources might undertake specific construction phases themselves.

- Alternative Service Models: Clients could opt for specialized consultancies or direct contracting with multiple trades, bypassing a general contractor.

- Modular and Offsite Construction: These methods can reduce the on-site labor and management required from a general contractor.

- Technological Advancements: Project management software and digital twins empower clients with greater oversight and control, potentially enabling self-management of certain project aspects.

The threat of substitutes for Galliford Try is amplified by advancements in modular construction and off-site building methods. These approaches, such as prefabrication, offer faster project completion and potentially lower costs, directly challenging traditional on-site construction. The UK government's commitment to increasing modular building in social housing by 2024 underscores this shift.

Innovations in sustainable materials and digital project management also present substitute threats. Eco-friendly materials like engineered timber can replace concrete and steel, aligning with 2024's focus on reducing embodied carbon. Furthermore, AI-powered project management tools could enable clients to manage projects with less reliance on traditional contractors.

The growing emphasis on retrofitting and maintaining existing structures, driven by energy efficiency goals and safety regulations, acts as a substitute for new construction. In early 2024, UK retrofitting initiatives are diverting capital that might otherwise fund new builds, impacting Galliford Try's new construction pipeline.

Entrants Threaten

The construction sector, particularly for major infrastructure and building projects, necessitates substantial upfront capital for machinery, advanced technology, and operational expenses. For instance, securing a large public infrastructure contract often requires extensive pre-qualification, including demonstrating financial capacity and access to significant working capital, which can run into hundreds of millions of pounds for complex projects.

This substantial financial hurdle discourages new companies from entering the market, as they would need considerable funding to match the existing capabilities and scale of established firms like Galliford Try. The ability of established players to leverage existing assets and secure favorable financing further amplifies this barrier to entry.

Galliford Try's deep-rooted relationships with public sector clients and its prominent position on long-term frameworks act as a formidable barrier to new entrants. These established connections, built on trust and a history of successful project delivery, are not easily replicated by newcomers.

New companies struggle to gain access to the lucrative and stable project pipelines that Galliford Try benefits from due to these pre-qualification processes and proven track records. This makes it challenging for them to compete effectively.

The UK construction industry faces significant regulatory challenges, particularly with evolving building safety standards following the Grenfell Tower disaster. New entrants must navigate these complex rules, which can add considerable time and expense to projects, acting as a deterrent.

Skills and Experience Shortages

The construction sector in the UK faces a significant challenge with a persistent shortage of skilled labor. This scarcity acts as a formidable barrier to entry for new companies, as they would find it incredibly difficult to attract and retain the qualified personnel needed for intricate projects. Established players, such as Galliford Try, benefit from their existing, experienced workforces and well-developed training initiatives, which provides them a distinct advantage in securing vital talent.

The implications of these skill shortages for new entrants are substantial:

- Talent Acquisition Difficulty: New companies will struggle to compete with established firms for a limited pool of skilled workers, potentially leading to higher recruitment costs and longer project timelines.

- Operational Capacity Constraints: Without sufficient skilled staff, new entrants may be unable to take on larger or more complex projects, limiting their growth potential and market reach.

- Training Investment Burden: New entrants would need to invest heavily in training programs to develop their own workforce, a significant upfront cost that established firms have already absorbed.

- Impact on Project Quality: A lack of experienced personnel could compromise the quality of work, potentially damaging a new entrant's reputation and future business prospects.

Brand Reputation and Track Record

The threat of new entrants is significantly mitigated by the importance of brand reputation and an established track record in the construction sector. Galliford Try benefits from decades of successful project delivery, building trust with clients, especially in public and regulated sectors where reliability is non-negotiable.

New competitors struggle to replicate this deep-seated trust, which is crucial for winning large-scale infrastructure and building contracts. For instance, Galliford Try's involvement in significant projects, such as the ongoing A14 upgrade, showcases their capacity and reliability, setting a high bar for newcomers.

- Brand Reputation: Galliford Try's established name signifies quality and dependable project execution.

- Track Record: A history of completing complex projects builds client confidence, a difficult asset for new firms to acquire quickly.

- Client Trust: Particularly in public sector bidding, a proven history is often a prerequisite, limiting new entrants.

The threat of new entrants into the UK construction sector, particularly for large-scale projects where Galliford Try operates, is considerably low. This is primarily due to the immense capital requirements, with major infrastructure projects often demanding hundreds of millions in upfront investment for machinery, technology, and operational costs. New companies also face significant hurdles in building the necessary brand reputation and client trust, which are crucial for securing lucrative contracts, especially within the public sector.

| Barrier | Impact on New Entrants | Example (Galliford Try) |

|---|---|---|

| Capital Requirements | High; substantial upfront investment needed for equipment and operations. | Securing a major infrastructure contract can require hundreds of millions in capital. |

| Brand Reputation & Track Record | Low; difficult to replicate decades of successful project delivery and client trust. | Galliford Try's involvement in projects like the A14 upgrade demonstrates proven reliability. |

| Regulatory Compliance | High; navigating complex and evolving standards (e.g., building safety) adds significant cost and time. | Post-Grenfell safety regulations increase compliance burdens for all firms. |

| Skilled Labor Shortage | High; difficulty in attracting and retaining experienced personnel compared to established firms. | Galliford Try benefits from existing experienced workforces and training programs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Galliford Try is built upon a foundation of robust data, drawing from the company's annual reports, investor presentations, and industry-specific market research from sources like Glenigan and Barbour ABI. We also incorporate data from regulatory bodies and economic indicators to provide a comprehensive view of the competitive landscape.