Galliford Try PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galliford Try Bundle

Gain a strategic advantage by understanding the external forces shaping Galliford Try's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company's operations and future growth. Equip yourself with actionable intelligence to navigate market complexities and identify opportunities.

Unlock critical insights into how government policies, economic fluctuations, and technological advancements are influencing Galliford Try. This comprehensive PESTEL analysis provides the clarity you need for robust business planning and competitive analysis. Download the full version now for immediate access to expert-level market intelligence.

Political factors

Government infrastructure spending is a major driver for Galliford Try, directly influencing the company's project pipeline. Recent UK government commitments to infrastructure, including significant investment in water and highways, are expected to continue supporting the sector. For instance, the Water Services Regulation Authority (Ofwat) has outlined investment plans for AMP7 (2020-2025) and is transitioning towards AMP8 (2025-2030), signaling sustained opportunities.

Government policies focused on boosting housing supply, especially affordable homes, are a key driver for Galliford Try. The company has strategically re-entered the affordable housing sector, setting ambitious targets for annual unit delivery, aiming to build on the 2024/2025 housing market trends.

For instance, the UK government's commitment to building 300,000 new homes annually, with a significant portion designated as affordable, presents a substantial opportunity. Galliford Try's renewed focus on this segment, evidenced by their project pipelines for the 2024-2025 fiscal year, directly aligns with these national objectives.

Shifts in planning regulations and evolving housing targets can significantly shape the landscape for residential construction. For Galliford Try, adapting to these changes, such as the recent adjustments in planning policy observed in late 2024, is crucial for capitalizing on emerging opportunities and mitigating potential challenges in their project development.

The Building Safety Act 2022, fully enacted in 2022, significantly reshapes construction industry responsibilities, directly impacting companies like Galliford Try. This legislation mandates higher safety standards throughout a building's lifecycle, placing greater accountability on developers and contractors for fire and structural safety. Failure to comply can lead to substantial fines and reputational damage.

Galliford Try's compliance with these stringent regulations influences project planning and execution, potentially increasing construction costs due to enhanced materials and processes. For instance, the Act requires detailed "golden thread" information to be maintained for higher-risk buildings, adding administrative and digital infrastructure overhead. The company's 2024 financial reports will likely reflect ongoing investment in systems and training to meet these demands.

Public and Regulated Sector Frameworks

Galliford Try's business is significantly shaped by its deep engagement with public and regulated sectors, often secured through multi-year frameworks. These long-term agreements, such as those with NEPO for civil engineering and Yorkshire Water, offer a predictable revenue stream, insulating the company from some of the sharper swings seen in more volatile markets. This strategic focus on public infrastructure and regulated utilities is a cornerstone of their operational stability.

Government procurement policies and the ongoing evolution of these frameworks are critical political determinants for Galliford Try. Changes in public spending priorities, regulatory approvals, and the tendering processes directly influence the pipeline of projects available. For instance, the UK government's commitment to infrastructure investment, including the ongoing HS2 project and network upgrades, presents opportunities, but also requires adaptation to evolving procurement criteria and environmental standards.

The company's ability to secure a substantial portion of its revenue through these established relationships underscores the importance of political stability and consistent government policy. As of their interim results for the six months ended 31 December 2023, Galliford Try reported a strong order book, with a significant percentage underpinned by these long-term public sector agreements. This provides a robust foundation, with approximately 80% of their £3.7 billion order book secured for the financial year 2024.

Key political factors impacting Galliford Try include:

- Government Infrastructure Spending: National and regional investment plans in areas like transportation, water, and energy directly affect project availability.

- Procurement Policy Reforms: Changes in how public contracts are awarded can impact competition and the types of companies that succeed.

- Regulatory Environment: The specific regulations governing utilities and infrastructure projects, such as those from the Environment Agency or Ofwat, dictate project scope and compliance requirements.

- Political Stability and Election Cycles: Government stability influences the continuity of long-term infrastructure programs and investment commitments.

Brexit and Trade Policies

The enduring consequences of Brexit, particularly concerning revised trade agreements and labor mobility, continue to shape the UK's construction sector. While Galliford Try's operations are exclusively within the UK, these evolving policies directly influence its operating environment by affecting supply chain expenses, the accessibility of materials, and the availability of skilled workers. For instance, the UK government's commitment to new trade deals post-Brexit could introduce both opportunities and challenges for material sourcing.

Furthermore, relevant trade policies such as the UK's impending Carbon Border Adjustment Mechanism (CBAM) are set to impact the cost of imported construction materials. This mechanism, designed to level the playing field for domestic industries by pricing carbon emissions on imports, could lead to increased material costs for companies like Galliford Try. The Office for Budget Responsibility (OBR) has projected that while the precise impact of CBAM is still developing, it is intended to align the UK with international carbon pricing efforts.

- Brexit Impact on Labour: Post-Brexit immigration rules have tightened the availability of skilled labor, a critical component for construction projects.

- Supply Chain Costs: Changes in trade relationships and potential tariffs can increase the cost of imported building materials and components.

- Material Availability: New trade barriers or regulations could disrupt the consistent supply of essential construction materials.

- UK CBAM: The introduction of the UK's Carbon Border Adjustment Mechanism is expected to increase the cost of carbon-intensive imported construction materials, potentially affecting project budgets.

Government infrastructure spending remains a primary driver for Galliford Try, with the UK government's continued investment in water and highways providing a stable project pipeline. The transition from Ofwat's AMP7 to AMP8 (2025-2030) signifies ongoing opportunities in the regulated water sector, underpinning predictable revenue streams.

Policy shifts, such as the government's commitment to building 300,000 new homes annually, with a focus on affordable housing, directly benefit Galliford Try's strategic re-entry into this market. Adapting to evolving planning regulations, like those observed in late 2024, is crucial for maximizing project development opportunities.

The Building Safety Act 2022 imposes stricter compliance requirements, impacting construction processes and potentially increasing costs, as evidenced by the need for detailed 'golden thread' information for higher-risk buildings. Galliford Try's 2024 financial reports will reflect investments in systems and training to meet these enhanced safety standards.

Political stability and consistent government policy are vital, as approximately 80% of Galliford Try's £3.7 billion order book as of their interim results for the six months ended 31 December 2023, is secured through long-term public sector agreements, highlighting the importance of these relationships.

What is included in the product

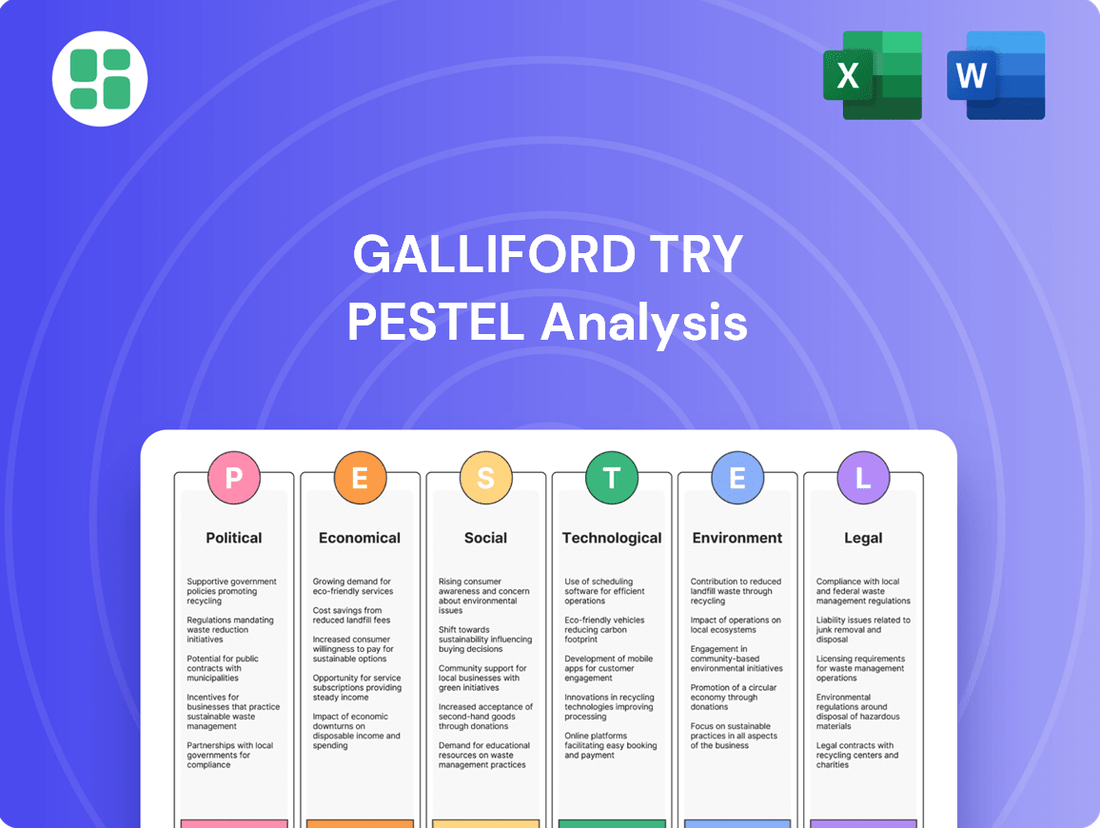

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Galliford Try, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the construction sector.

A Galliford Try PESTLE analysis presented in a visually segmented format, categorized by Political, Economic, Social, Technological, Environmental, and Legal factors, allows for quick interpretation and identification of external influences impacting the business.

This analysis serves as a pain point reliever by providing a clear, summarized version of external risks and opportunities, enabling informed strategic decisions and proactive mitigation planning for Galliford Try.

Economic factors

Inflation remains a significant concern for the construction sector, directly impacting material costs. While the sharp increases seen in 2022 began to moderate through 2023 and into early 2024, prices for key materials like steel, timber, and concrete are still notably higher than pre-pandemic figures. For instance, the Office for National Statistics reported that construction material price indices, while showing signs of easing, remained elevated compared to 2020 averages.

Galliford Try's financial health is intrinsically linked to its capacity to navigate these persistent cost pressures. Effective risk management strategies, including forward purchasing and securing long-term supply agreements, are vital. The company's success in fostering strong relationships with its supply chain partners will be a key determinant in its ability to mitigate the impact of these elevated material costs on project profitability and overall financial performance through 2024 and beyond.

Elevated interest rates, such as the Bank of England's base rate holding at 5.25% through early 2024, can significantly dampen private sector investment and the housing market. Higher borrowing costs make new construction projects more expensive and reduce affordability for potential homebuyers, impacting demand for Galliford Try's services in these sectors.

However, a projected easing of interest rates in late 2024 and into 2025 could stimulate a recovery in project starts, benefiting construction firms like Galliford Try. The company's robust balance sheet and substantial cash reserves, reported at £349 million as of the end of fiscal year 2023, provide a buffer against economic uncertainties and allow for continued strategic investment despite fluctuating interest rate environments.

The UK's economic performance is a key driver for Galliford Try, as it directly impacts demand across all construction sectors. A healthy economy typically translates to more investment in infrastructure, housing, and commercial buildings.

Looking ahead, forecasts suggest a gradual pickup in UK economic growth from 2025. This anticipated acceleration is expected to bolster activity in both public and private construction projects, offering a more favorable environment for companies like Galliford Try. For instance, the Office for Budget Responsibility (OBR) projected UK GDP growth of 1.7% in 2025 in their March 2024 forecast.

A robust economy fosters greater confidence among consumers and businesses. This improved sentiment often leads to increased spending and investment, which in turn fuels the demand for new construction and development, benefiting Galliford Try's order book.

Public Private Partnership (PPP) Assets

Galliford Try's portfolio of Public Private Partnership (PPP) assets is a significant component of its financial structure, contributing to balance sheet strength and generating consistent interest income. The economic climate and the government's ongoing commitment to these long-term public service contracts directly influence the valuation and performance of these investments. As of early 2025, the UK government continued to emphasize infrastructure investment, providing a supportive backdrop for these types of assets.

These PPP assets are crucial for Galliford Try's financial resilience, offering a stable and predictable revenue stream. This stability is particularly valuable in a fluctuating economic environment. The company’s 2024 annual report highlighted that its PPP investments provided a reliable income source, underpinning its overall financial performance.

- Stable Revenue: PPP assets typically provide long-term, contracted revenue streams, offering predictability.

- Balance Sheet Strength: These investments bolster Galliford Try's asset base and financial standing.

- Economic Sensitivity: Performance is linked to broader economic health and government fiscal policies.

- Interest Income Generation: A portion of the returns from PPPs is recognized as interest income.

Market Competition and Margins

The UK construction sector is characterized by intense competition, which frequently squeezes profit margins on projects. This environment demands rigorous cost management and strategic bidding from companies like Galliford Try.

Galliford Try has set a target to achieve a sustainable operating margin of 4% by the year 2030. This ambitious goal is being pursued through a dual approach of meticulously selecting profitable contracts and driving operational efficiencies across its business.

The company's financial performance in 2024, marked by strong results, and an improved outlook for 2025, indicate positive momentum towards these margin targets. These achievements are noteworthy given the persistent industry-wide challenges that continue to affect many construction firms.

- Competitive Landscape: The UK construction market is highly competitive, impacting profitability.

- Margin Target: Galliford Try aims for a 4% sustainable operating margin by 2030.

- Strategy: This is to be achieved through careful contract selection and operational excellence.

- Performance: Strong 2024 results and a positive 2025 outlook show progress despite industry headwinds.

Persistent inflation continues to affect construction material costs, with prices remaining elevated compared to pre-pandemic levels, although the sharpest increases have moderated through early 2024. Elevated interest rates, such as the Bank of England's base rate holding at 5.25% through early 2024, can dampen private sector investment and housing demand.

The UK economy is projected to see gradual growth, with the Office for Budget Responsibility forecasting 1.7% GDP growth in 2025, which should boost construction activity. Galliford Try's robust balance sheet, with £349 million in cash reserves at the end of FY2023, provides resilience against economic fluctuations.

The competitive UK construction market necessitates rigorous cost management, with Galliford Try targeting a 4% sustainable operating margin by 2030 through selective contracting and operational efficiencies. Strong 2024 performance and an improved 2025 outlook indicate progress towards this goal, despite industry headwinds.

| Economic Factor | Impact on Galliford Try | Data/Forecast |

| Inflation | Increased material costs | Prices elevated vs. pre-pandemic; moderation from 2022 highs |

| Interest Rates | Dampened private investment & housing demand | Bank of England base rate at 5.25% (early 2024); potential easing late 2024/2025 |

| UK Economic Growth | Drives demand for construction services | OBR forecast: 1.7% GDP growth in 2025 |

| Competition | Pressure on profit margins | Galliford Try target: 4% operating margin by 2030 |

Preview Before You Purchase

Galliford Try PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a comprehensive PESTLE analysis of Galliford Try. This detailed document covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

The UK construction sector is grappling with a substantial skills deficit, impacting project timelines and budgets. This shortage, partly due to Brexit and an aging demographic, means companies like Galliford Try must focus on training current employees, recruiting new talent, and expanding apprenticeship programs to meet workforce demands.

The construction sector, including companies like Galliford Try, faces a significant challenge with an aging workforce and a reduced reliance on overseas labor following Brexit. This demographic shift necessitates a strategic response to ensure a sustainable talent pipeline.

To counter these trends, Galliford Try must actively foster diversity and inclusion, making the industry more appealing to a wider range of individuals. This includes attracting more women and younger generations into construction roles, thereby broadening the talent pool.

In 2023, the UK construction industry reported that approximately 12% of its workforce was aged over 60, highlighting the aging demographic. Furthermore, data from the Office for National Statistics indicated a notable decrease in EU-born workers in the construction sector post-Brexit, underscoring the reliance on overseas labor that has diminished.

Investing in comprehensive training and development programs is crucial for Galliford Try to upskill its existing workforce and equip new entrants with the necessary skills, effectively addressing the evolving demographic landscape.

Societal expectations and regulatory emphasis on health and safety in the construction sector are increasingly stringent, notably influenced by legislation such as the Building Safety Act. This heightened focus directly impacts companies like Galliford Try, demanding unwavering commitment to safeguarding all individuals involved in their operations.

Galliford Try's proactive approach to health, safety, and wellbeing is a cornerstone of its operational philosophy. In 2023, the company reported a Lost Time Injury Frequency Rate (LTIFR) of 0.25, demonstrating a continuous effort to minimize workplace incidents and reinforce a robust safety culture.

Maintaining high safety standards is not merely a compliance issue; it is critical for preserving Galliford Try's reputation and ensuring uninterrupted business operations. A strong safety record builds trust with clients, employees, and the wider public, directly contributing to long-term business sustainability and success.

Community Engagement and Impact

Galliford Try’s construction activities profoundly shape local environments, necessitating strong community engagement. The company's commitment to social responsibility, including local job creation and minimizing disruption, is crucial for maintaining its social license to operate. For instance, in the 2023 financial year, Galliford Try reported investing £1.4 million in community initiatives across its projects, demonstrating a tangible commitment to social impact.

Positive community relations are not just about reputation; they directly influence project delivery and long-term sustainability. By actively involving local stakeholders and addressing their concerns, Galliford Try can foster goodwill, which can translate into smoother project approvals and reduced opposition. This approach aligns with broader corporate sustainability goals, enhancing the company's overall social performance and stakeholder value.

- Community Investment: Galliford Try invested £1.4 million in community initiatives during FY23, supporting local causes and development.

- Local Employment: The company prioritizes local hiring, contributing to economic growth in the areas where it operates.

- Stakeholder Dialogue: Proactive engagement with residents and local groups helps mitigate potential project conflicts and builds trust.

- Social Footprint: Consideration of the social impact of construction, from noise reduction to local supply chain support, is integral to responsible operations.

Public Perception of the Industry

The construction industry often faces scrutiny regarding its environmental footprint, safety standards, and the availability of appealing career paths, directly impacting Galliford Try's ability to attract skilled workers and maintain positive relationships with the public and investors. A 2023 report indicated that while public awareness of construction's environmental impact is growing, with 65% of respondents expressing concern, the industry still lags behind sectors like renewable energy in perceived sustainability. This presents an opportunity for companies like Galliford Try to differentiate themselves.

Galliford Try's proactive approach to sustainable building practices, exemplified by its commitment to achieving net-zero carbon emissions across its operations by 2030, directly addresses these public concerns. Their emphasis on delivering high-quality projects, such as the recent £100 million A9 Dualling Programme in Scotland which improved road safety and connectivity, helps to reshape perceptions. Furthermore, fostering a progressive workplace culture that highlights apprenticeships and diverse career progression pathways is crucial for attracting new talent.

- Public Concern: Surveys in 2023 revealed that over 60% of the UK public view the construction sector as having a significant environmental impact.

- Sustainability Focus: Galliford Try aims for net-zero carbon operations by 2030, aligning with increasing public demand for eco-friendly business practices.

- Project Showcase: Highlighting successful, community-benefiting projects, like infrastructure upgrades, can improve the industry's image and Galliford Try's reputation.

- Talent Attraction: A 2024 industry outlook suggests a 15% increase in demand for skilled construction professionals, making positive perception vital for recruitment.

Societal expectations regarding corporate responsibility and ethical conduct significantly influence construction firms like Galliford Try. Public perception of the industry's impact on communities and the environment is a key consideration. For instance, in 2023, public discourse heavily focused on the safety of building materials, directly impacting how companies are viewed and regulated.

Galliford Try's commitment to social value, demonstrated by its £1.4 million investment in community initiatives during FY23, aims to build positive relationships. This focus on local job creation and minimizing disruption is vital for maintaining its social license to operate and fostering trust among stakeholders.

The construction sector's ability to attract and retain a skilled workforce is increasingly tied to its reputation as an employer. With an aging workforce, as noted by the 12% of those over 60 in the sector in 2023, companies like Galliford Try must actively promote diverse and inclusive career paths to secure future talent.

Public concern over construction's environmental impact is growing, with over 60% of the UK public expressing this in 2023 surveys. Galliford Try's goal of net-zero carbon operations by 2030 directly addresses this, aligning with societal demands for sustainability and enhancing its brand image.

Technological factors

The construction industry's ongoing embrace of digitalisation, particularly Building Information Modelling (BIM), presents substantial avenues for Galliford Try to boost efficiency, refine project oversight, and foster better teamwork. This technological shift is crucial for streamlining operations and delivering enhanced value.

Galliford Try's strategic commitment to digital and technical innovations is designed to not only improve client outcomes but also to actively reduce the environmental footprint of their projects. This focus on sustainability through technology is a key differentiator.

By fully integrating these advanced technologies, Galliford Try can expect to see tangible improvements in project execution timelines and a strengthened competitive edge in the market. For instance, the UK government mandates BIM Level 2 for all public projects, creating a clear incentive for widespread adoption and demonstrating its growing importance in securing future work.

The construction industry's embrace of Modern Methods of Construction (MMC), particularly off-site and modular building, is gaining significant momentum. This shift promises quicker project completion, a smaller environmental footprint through reduced waste, and lower carbon emissions. For Galliford Try, strategically integrating MMC can unlock greater efficiency, elevate build quality, and align with ambitious sustainability goals, addressing some of the sector's persistent hurdles.

Advances in material science are rapidly pushing the construction industry towards sustainable and low-carbon options. This trend is further amplified by growing regulatory pressure. For instance, the UK government has set ambitious net-zero targets, influencing building codes and material specifications.

Galliford Try must actively integrate innovative materials such as cross-laminated timber, recycled steel, and advanced sustainable composites into its projects. By doing so, the company not only aligns with environmental objectives but also addresses the increasing client demand for eco-friendly structures. This strategic adoption is crucial for maintaining competitiveness in a market prioritizing green credentials.

Automation and Robotics

Automation and robotics offer significant potential in construction, from managing site logistics to sophisticated prefabrication. This can directly combat the ongoing labour shortages plaguing the industry. For instance, the UK construction sector faced a deficit of around 225,000 workers in 2024, highlighting the need for technological solutions.

Galliford Try should actively investigate how these advancements can be incorporated into its projects. By leveraging robotics for tasks like bricklaying or drone-based site surveys, the company can boost productivity and enhance worker safety. The global construction robotics market was valued at approximately $3.5 billion in 2023 and is projected to grow substantially, indicating a clear industry trend.

- Addressing Labour Shortages: The UK construction industry reported a shortage of approximately 225,000 workers in 2024, making automation crucial.

- Improving Efficiency and Safety: Robotics can automate repetitive or hazardous tasks, reducing accidents and increasing output.

- Technological Integration: Galliford Try should explore solutions like autonomous vehicles for site transport and robotic systems for component assembly.

- Market Growth: The global construction robotics market is expanding, with projections indicating significant future growth, underscoring the strategic importance of this technology.

Data Analytics and AI in Project Management

Galliford Try can leverage data analytics and AI to significantly enhance project management, risk assessment, and predictive maintenance. This technological integration allows for optimized project outcomes and improved operational performance by identifying patterns and potential issues before they escalate. For instance, in 2024, the construction industry saw a notable increase in the adoption of AI-powered tools for site monitoring and resource allocation, with some firms reporting up to a 15% reduction in project delays.

By utilizing data-driven insights, Galliford Try can make more informed strategic decisions, leading to better risk mitigation and superior client delivery. This approach fosters a proactive rather than reactive management style. A 2025 industry survey indicated that companies employing advanced analytics in project planning experienced an average of 10% higher profit margins compared to those relying on traditional methods.

The application of these technologies offers several key advantages:

- Enhanced Risk Prediction: AI algorithms can analyze historical project data to predict potential risks with greater accuracy, allowing for timely intervention.

- Optimized Resource Allocation: Data analytics helps in efficiently deploying labor, materials, and equipment, minimizing waste and maximizing productivity.

- Improved Project Scheduling: Predictive modeling can refine timelines and identify critical path activities, ensuring projects stay on schedule.

- Predictive Maintenance: For infrastructure projects, AI can forecast maintenance needs, reducing downtime and extending asset life.

The ongoing digital transformation within construction, particularly the adoption of Building Information Modelling (BIM), offers Galliford Try significant opportunities to enhance project efficiency, oversight, and collaboration. This digital shift is vital for streamlining operations and delivering greater value to clients.

Galliford Try's investment in digital and technical innovation aims to improve client results and reduce the environmental impact of its projects. This focus on sustainability through technology is a key strategic advantage.

Integrating advanced technologies like BIM, which is mandated for all public projects in the UK (BIM Level 2), provides Galliford Try with a competitive edge and ensures compliance, facilitating future contract wins.

The increasing use of Modern Methods of Construction (MMC), such as modular building, promises faster project delivery and reduced waste, aligning with Galliford Try's sustainability goals and improving build quality.

Advances in material science, driven by the UK's net-zero targets, are pushing the industry towards sustainable options like cross-laminated timber, which Galliford Try can leverage to meet client demand for eco-friendly structures.

Automation and robotics are crucial for addressing the UK construction sector's labour shortage, estimated at 225,000 workers in 2024. Galliford Try can boost productivity and safety by adopting robotic systems for tasks like bricklaying or drone surveys.

The global construction robotics market, valued at approximately $3.5 billion in 2023, is projected for substantial growth, highlighting the strategic imperative for Galliford Try to invest in these technologies.

Data analytics and AI can significantly improve Galliford Try's project management and risk assessment. Companies using advanced analytics in project planning saw an average of 10% higher profit margins in a 2025 survey.

| Technology Area | Galliford Try Opportunity | Industry Trend/Data (2024/2025) |

|---|---|---|

| Digitalisation (BIM) | Enhanced project efficiency, collaboration, and compliance | BIM Level 2 mandated for all UK public projects |

| Modern Methods of Construction (MMC) | Faster delivery, reduced waste, improved quality | Growing momentum in off-site and modular building |

| Automation & Robotics | Addressing labour shortages, improving safety and productivity | UK construction labour shortage ~225,000 workers (2024); Global construction robotics market ~$3.5bn (2023) |

| Data Analytics & AI | Improved risk prediction, resource allocation, and project scheduling | AI-powered tools adoption increasing; 10% higher profit margins for analytics users (2025 survey) |

Legal factors

The Building Safety Act 2022 significantly reshapes construction, especially for high-risk buildings. It introduces new rules for competence, duty-holder roles, and places greater responsibility for safety flaws. Galliford Try needs to meticulously adhere to these, including new building control processes and remediation orders, to steer clear of legal issues and protect its standing.

The UK's commitment to achieving net-zero carbon emissions by 2050 significantly shapes the construction industry. Evolving environmental legislation, including the Environment Act 2021, mandates practices like biodiversity net gain and enhanced energy efficiency for new builds. Galliford Try must adapt its construction methods to meet these stringent requirements, which also include mandatory carbon reporting.

Changes in planning legislation, such as the introduction of simplified planning zones and updated Environmental Impact Assessment (EIA) requirements, can significantly impact project timelines. For instance, the UK government's drive towards faster planning decisions, aiming to reduce approval times for major infrastructure projects, could benefit Galliford Try by accelerating project starts.

Galliford Try must remain agile in adapting to evolving planning laws, including updates to the National Planning Policy Framework (NPPF). The NPPF's emphasis on sustainable development and brownfield site utilization directly influences where and how construction can proceed, requiring careful legal navigation for the company's extensive portfolio.

Employment Law and Labour Regulations

UK employment laws, covering worker rights, health and safety, and immigration, significantly influence Galliford Try's approach to managing its workforce. These regulations dictate everything from hiring practices to workplace safety standards, ensuring fair treatment and operational integrity. For instance, the Health and Safety Executive (HSE) reported 69,000 non-fatal injuries to workers in the construction sector in 2022/23, highlighting the critical nature of compliance for companies like Galliford Try.

The persistent skills shortage within the UK construction industry, a sector Galliford Try operates in, is also a key factor. Government initiatives aimed at boosting training and apprenticeships, such as the Construction Skills Certification Scheme (CSCS) card requirements, directly interact with employment regulations. These programs are designed to upskill the workforce and address labour gaps, impacting recruitment and development strategies for construction firms.

Compliance with these multifaceted employment laws is not merely a legal obligation but a cornerstone for maintaining fair labour practices and ensuring operational stability. Failure to adhere to regulations can lead to significant penalties, reputational damage, and disruptions to projects. Galliford Try's commitment to robust HR policies and safety protocols is therefore essential for its sustained success and its ability to attract and retain talent in a competitive market.

- Worker Rights: UK legislation mandates minimum wage, holiday pay, and protection against unfair dismissal, directly affecting Galliford Try's payroll and HR processes.

- Health and Safety: Strict adherence to HSE guidelines is crucial in construction, with significant fines for breaches impacting operational costs and project timelines.

- Immigration: Changes in immigration policy, such as visa requirements for foreign workers, can affect Galliford Try's ability to recruit skilled labour.

- Skills Initiatives: Government-backed apprenticeship levy and training programs influence Galliford Try's investment in workforce development to combat industry-wide skills shortages.

Contract Law and Standard Forms

Contract law is a cornerstone of Galliford Try's operations, dictating the terms of engagement for every project. The recent introduction of the JCT Design and Build Contract 2024 signifies a crucial update, impacting risk allocation and dispute resolution mechanisms. Galliford Try must ensure its standard forms are aligned with these evolving legal frameworks to maintain operational efficiency and mitigate potential legal challenges.

Compliance with new legislation, such as the Building Safety Act (BSA), adds another layer of legal complexity. The BSA, for instance, introduces significant new duties and responsibilities for duty holders throughout the design and construction process, directly affecting how projects are managed. For Galliford Try, adhering to these new regulations is paramount to avoid penalties and maintain its reputation in the industry.

The allocation of risk within construction contracts is a particularly sensitive area. Updates to standard forms often aim to clarify or rebalance this, and Galliford Try's contractual strategies need to reflect these shifts. For example, changes in how liability for defects or unforeseen ground conditions are handled can have substantial financial implications for the company.

- JCT Contract Updates: The 2024 edition of the JCT Design and Build Contract introduces revised clauses on payment, termination, and dispute resolution, requiring careful review and adaptation by Galliford Try.

- Building Safety Act (BSA) Impact: The BSA's focus on the entire lifecycle of a building means Galliford Try must integrate safety considerations more deeply into its contractual obligations and project management from inception.

- Risk Allocation: Contractual clauses concerning latent defects and site conditions are continually scrutinized, and Galliford Try's standard forms must provide clarity to manage these risks effectively.

- Dispute Resolution: Evolving legal requirements for dispute resolution, including mandatory mediation or adjudication, influence the procedures Galliford Try must follow when disagreements arise on projects.

The legal landscape for construction firms like Galliford Try is constantly evolving, with new legislation directly impacting operations and risk management. For instance, the Building Safety Act 2022 continues to shape safety standards and duty-holder responsibilities, demanding rigorous compliance. Similarly, updates to standard contract forms, such as the JCT suite, necessitate careful review to align with revised clauses on risk, payment, and dispute resolution.

The UK's commitment to net-zero emissions is reinforced by environmental legislation, requiring Galliford Try to embed sustainable practices and carbon reporting into its projects. Furthermore, employment law dictates workforce management, with a strong emphasis on health and safety, as evidenced by the 69,000 non-fatal injuries reported in the construction sector in 2022/23, underscoring the critical need for adherence to HSE guidelines.

| Legal Area | Key Legislation/Update | Impact on Galliford Try | Relevant Data/Statistic |

|---|---|---|---|

| Building Safety | Building Safety Act 2022 | Enhanced duty-holder responsibilities, stricter safety standards for high-risk buildings. | New registration process for higher-risk buildings commenced in October 2023. |

| Environmental | Environment Act 2021 | Mandatory biodiversity net gain, increased focus on energy efficiency and carbon reporting. | Biodiversity net gain requirement for new developments is set to become mandatory from early 2024. |

| Contract Law | JCT Design and Build Contract 2024 | Revised clauses on payment, termination, and dispute resolution, impacting risk allocation. | The 2024 edition introduces updated clauses for prompt payment and revised termination provisions. |

| Employment Law | Health and Safety Executive (HSE) Guidelines | Strict adherence to workplace safety regulations to prevent injuries and penalties. | 69,000 non-fatal injuries in construction sector in 2022/23; HSE fines can reach up to 10% of turnover. |

Environmental factors

Galliford Try is deeply impacted by the global imperative to address climate change, a factor that significantly shapes its operational and strategic landscape. The company has committed to achieving net-zero emissions across all scopes by 2045, a bold target underscoring its dedication to environmental sustainability.

To achieve this overarching goal, Galliford Try has established crucial interim targets, including the reduction of scope 1 and 2 emissions by 2030. This focus on decarbonisation is not merely an environmental aspiration but a core tenet of its Sustainable Growth Strategy, driving innovation and investment in greener practices.

The company's commitment extends to scope 3 emissions, with a target for their reduction also set for 2045. This comprehensive approach acknowledges the full lifecycle impact of its operations and supply chain, reflecting a mature understanding of its environmental responsibilities.

Minimising construction waste and embracing a circular economy are paramount environmental goals for Galliford Try. The company has set an ambitious target of achieving zero construction waste to landfill by 2026, a move that necessitates highly efficient material usage, robust recycling programmes, and meticulous, responsible disposal methods across all its operational sites.

This commitment translates into practical actions like exploring innovative uses for recycled aggregates and diverting materials from landfill. For instance, in the 2023 financial year, Galliford Try reported a significant reduction in waste, with 94% of its waste being diverted from landfill, demonstrating progress towards its zero-waste objective.

New regulations effective January 2024 require all developments, including those by Galliford Try, to achieve a minimum 10% biodiversity net gain. This means projects must leave biodiversity in a better state than before. Galliford Try must embed BNG principles into its planning and design processes to ensure positive ecological contributions and compliance with environmental policy.

Energy Efficiency and Sustainable Building Materials

The drive towards energy efficiency and sustainable building materials is a significant environmental factor shaping the construction industry. Growing environmental regulations and a stronger preference from clients for greener solutions are pushing companies like Galliford Try to innovate.

Galliford Try is actively responding by prioritizing the delivery of buildings with a lower carbon footprint and enhanced performance. This involves integrating energy-efficient designs and championing the adoption of sustainable composite materials in their projects.

This strategic focus directly supports adherence to evolving standards, such as the UK's Future Homes Standard, which mandates higher energy performance for new dwellings. For instance, by 2025, new homes in England will need to be future-proofed with low-carbon heating and high levels of insulation, a trend Galliford Try is preparing for.

- Increasing Demand: Client and regulatory pressure for energy-efficient and sustainable buildings is a key trend.

- Galliford Try's Strategy: Focus on lower carbon, superior buildings through energy-efficient design and sustainable composites.

- Regulatory Alignment: Commitment to standards like the Future Homes Standard, which sets new benchmarks for home energy performance.

- Market Shift: The construction sector is increasingly valuing materials and methods that minimize environmental impact.

Water Management and Pollution Control

Effective water management and pollution control are paramount for Galliford Try, particularly given its significant role in water infrastructure. This involves strict adherence to environmental legislation such as the Environmental Protection Act 1990, ensuring responsible handling of water resources and discharges across all project sites.

Galliford Try's participation in the Anglian Water AMP7 framework, which ran from 2020 to 2025, and its anticipated involvement in AMP8, underscores its commitment to enhancing environmental infrastructure. These frameworks often mandate stringent targets for water quality improvement and pollution reduction, directly impacting operational practices and investment decisions.

- Regulatory Compliance: Adherence to the Environmental Protection Act 1990 and other environmental regulations is critical.

- Water Usage and Discharge: Careful management of water on-site, including minimizing abstraction and controlling discharge quality.

- AMP Frameworks: Involvement in AMP7 (2020-2025) and AMP8 signifies a strategic focus on water infrastructure and environmental improvements.

- Pollution Prevention: Implementing measures to prevent and mitigate water pollution from construction activities.

Galliford Try faces increasing pressure to adopt sustainable practices, driven by climate change concerns and evolving regulations. The company aims for net-zero emissions by 2045, with interim targets to cut scope 1 and 2 emissions by 2030, aligning with its Sustainable Growth Strategy.

A key objective is eliminating construction waste to landfill by 2026, a target supported by diverting 94% of waste in FY23. Furthermore, new regulations from January 2024 mandate a 10% biodiversity net gain for all developments, requiring integration of ecological enhancements into project planning.

The company is also responding to the demand for energy-efficient buildings, exemplified by its preparation for the UK's Future Homes Standard, which will require new homes to have low-carbon heating and enhanced insulation by 2025.

Galliford Try's water management practices are guided by legislation like the Environmental Protection Act 1990, with significant efforts directed towards improving water quality and reducing pollution as part of its involvement in water infrastructure frameworks like Anglian Water's AMP7 (2020-2025) and the upcoming AMP8.

| Environmental Target | Current Status/Progress | Target Year |

|---|---|---|

| Net-Zero Emissions | Commitment made | 2045 |

| Scope 1 & 2 Emissions Reduction | Interim targets set | 2030 |

| Zero Construction Waste to Landfill | 94% waste diverted from landfill (FY23) | 2026 |

| Biodiversity Net Gain | Mandatory 10% minimum from Jan 2024 | Ongoing |

| Future Homes Standard Compliance | Preparation underway | 2025 (for new homes) |

PESTLE Analysis Data Sources

Our Galliford Try PESTLE Analysis is meticulously constructed using a blend of public domain data, including government publications, industry-specific reports, and economic indicators. We also incorporate insights from reputable market research firms and reputable news outlets to ensure a comprehensive and current understanding of the external environment.