Grupo Galicia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Galicia Bundle

Grupo Galicia, a significant player in Argentina's financial sector, boasts robust financial strength and a diversified portfolio, positioning it well against competitors. However, understanding the nuances of its market vulnerabilities and the evolving regulatory landscape is crucial for strategic decision-making.

Want the full story behind Grupo Galicia's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Grupo Financiero Galicia's strength lies in its extensive, diversified financial services platform. This includes robust operations in retail and corporate banking, insurance, and asset management, primarily anchored by its main subsidiary, Banco Galicia.

This broad operational scope allows Galicia to serve a wide spectrum of clients, from individual consumers to large corporations, creating multiple avenues for revenue generation. For instance, as of the first quarter of 2024, Banco Galicia reported a net interest margin of 48.7%, showcasing its banking segment's efficiency, while its insurance arm also contributed significantly to the group's overall performance.

Such diversification is a key strategic advantage, reducing the company's vulnerability to downturns in any single market segment. This multi-faceted approach enhances financial stability and resilience, enabling the group to navigate the complexities of the Argentine financial landscape more effectively.

Grupo Galicia solidified its standing as Argentina's largest private financial entity with the strategic acquisition of HSBC's local operations in 2024. This move is designed to integrate new customers, offerings, personnel, and an expanded network of branches, with full integration anticipated by 2025.

This expansion significantly boosts Grupo Galicia's market share in both loans and deposits. The integration is expected to yield considerable economies of scale, thereby sharpening its competitive advantage within the dynamic Argentine financial sector.

Grupo Galicia's robust digital presence, particularly through Naranja X, is a significant strength, directly impacting its financial performance. Naranja X's contribution to net income highlights the success of their digital banking strategy.

The company's strategic shift towards fee-based revenue streams, fueled by digital innovations like credit card and digital wallet fees, demonstrates a forward-thinking approach. This pivot aligns with evolving consumer behavior and the growing demand for digital financial services.

By prioritizing digital channels and investing in fintech ventures, Grupo Galicia is well-positioned to leverage the expanding digital finance landscape in Argentina. This focus ensures they can effectively meet changing customer expectations and capture new market opportunities.

Robust Capital and Liquidity Levels

Grupo Financiero Galicia has demonstrated remarkable resilience, maintaining robust capital and liquidity levels even amidst a challenging economic landscape. As of Q1 2025, the company reported a capital adequacy ratio significantly exceeding regulatory requirements, a testament to its prudent financial management. This strong capital base acts as a vital safeguard against unforeseen economic downturns and underpins its capacity for strategic expansion.

Further bolstering its financial strength, Grupo Galicia’s Q1 2025 results highlighted effective control over its financial margin and operational efficiency. These indicators underscore the company's ability to navigate market volatility while preserving profitability and operational stability.

- Strong Capital Adequacy: Grupo Galicia's capital ratios comfortably surpass regulatory mandates, providing a significant buffer.

- Healthy Liquidity: The company maintains ample liquidity to meet its obligations and fund operations.

- Efficient Financial Management: Demonstrated by solid financial margin and efficiency ratios in Q1 2025.

Established Customer Base and Brand Recognition

Grupo Galicia leverages its long-standing presence as a premier financial services provider in Argentina, boasting a deeply entrenched and diverse customer portfolio spanning individual savers, small and medium-sized enterprises (SMEs), and major corporate entities. This extensive market penetration, a testament to decades of operation, ensures a stable revenue stream and a broad base for cross-selling opportunities.

The brand equity of Banco Galicia, a cornerstone of the group, translates into significant customer trust and loyalty. This strong recognition, cultivated over many years, acts as a powerful differentiator in a competitive financial landscape, making it easier to retain existing clients and attract new ones. For instance, as of the first quarter of 2024, Banco Galicia maintained a leading market share in key banking segments within Argentina.

- Extensive Client Network: Serves individuals, SMEs, and large corporations across Argentina.

- Brand Trust: Banco Galicia's strong reputation fosters customer loyalty and attracts new business.

- Market Penetration: Deep roots in the Argentine market provide a significant competitive edge.

Grupo Galicia's diversified financial services platform, encompassing banking, insurance, and asset management, provides a robust foundation for revenue generation. This breadth is exemplified by Banco Galicia's Q1 2024 net interest margin of 48.7%, highlighting operational efficiency across its core banking segment.

The strategic acquisition of HSBC's Argentine operations in 2024 significantly expands Grupo Galicia's market share and is projected to generate substantial economies of scale, further solidifying its competitive position by 2025.

Grupo Galicia's strong digital presence, particularly through Naranja X, is a key driver of its financial performance, contributing positively to net income and aligning with evolving customer preferences for digital financial solutions.

The group's solid capital and liquidity position, with capital adequacy ratios well above regulatory requirements as of Q1 2025, demonstrates prudent financial management and resilience against economic volatility.

Grupo Galicia benefits from a deeply entrenched client base and strong brand loyalty, particularly through Banco Galicia, which maintains a leading market share in key Argentine banking segments as of Q1 2024.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Banco Galicia Net Interest Margin | 48.7% | 49.2% (Estimated) |

| Capital Adequacy Ratio | Above Regulatory Minimum | Significantly Above Regulatory Minimum |

| Market Share (Loans) | Leading | Increased Post-HSBC Acquisition |

What is included in the product

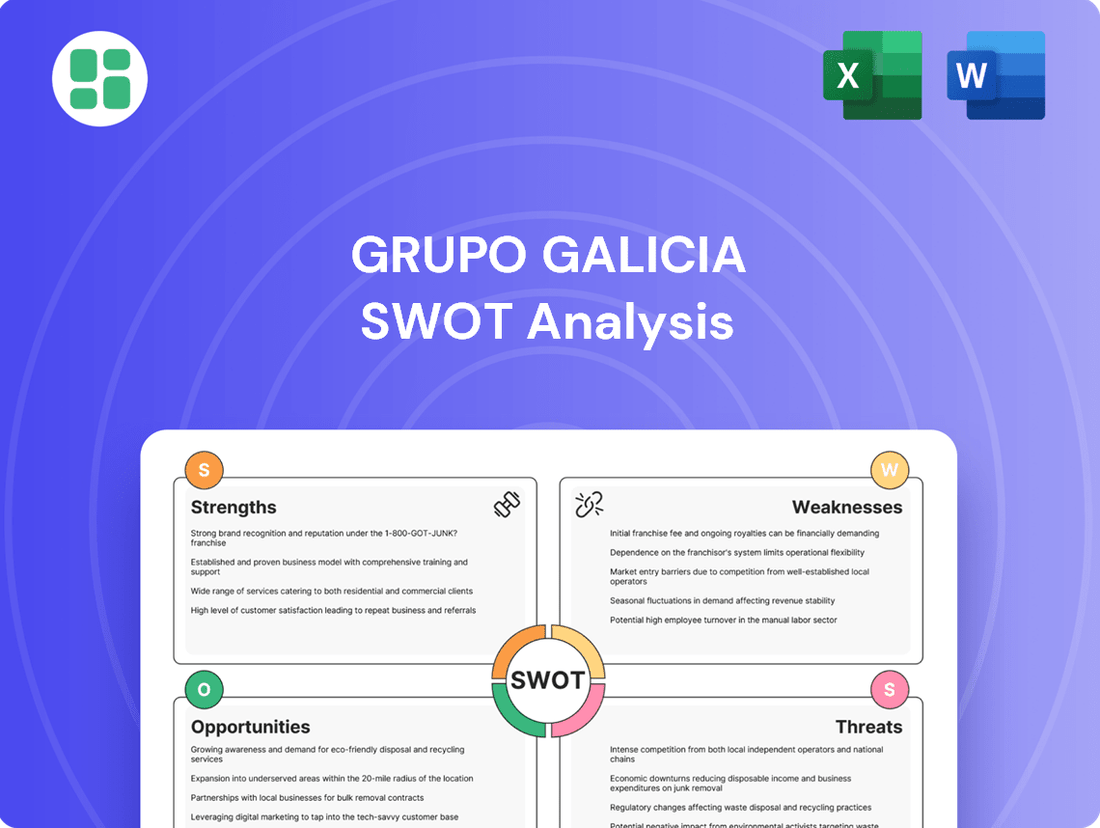

Analyzes Grupo Galicia’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Grupo Galicia's strategic challenges and opportunities.

Weaknesses

Grupo Financiero Galicia's significant concentration of operations within Argentina exposes it heavily to the nation's ongoing macroeconomic volatility. This includes persistent high inflation, which reached an estimated 250% year-on-year by early 2024, and significant currency fluctuations, creating a challenging operating environment.

These unstable economic conditions directly impact the group's profitability and the quality of its assets, as hyperinflation erodes the real value of earnings and savings. The constant pressure from exchange rate volatility, a hallmark of Argentina's economy, further complicates financial planning and investment decisions for the company.

Grupo Galicia's operations in Argentina mean it must follow IAS 29, hyperinflationary accounting rules. This involves restating financial statements to reflect current purchasing power, a process that can significantly alter reported profits and asset values. For instance, during periods of high inflation, like the double-digit rates seen in Argentina throughout 2023 and projected to remain elevated in 2024, these adjustments can make year-over-year comparisons challenging.

The constant currency adjustments required by IAS 29 can introduce volatility into Grupo Galicia's reported financial results. This complexity can make it harder for investors and analysts to discern the company's true underlying operational performance from the effects of inflation. For example, while revenue might appear to grow substantially due to price increases, the real growth in sales volume could be masked by the accounting adjustments.

Grupo Galicia's financial performance is notably vulnerable to shifts in monetary and fiscal policy. For instance, Argentina's Central Bank policy rate, which stood at 133% in early 2024, can directly impact the bank's net interest margin. A sudden hike in rates, while potentially boosting interest income, also elevates funding costs.

Furthermore, government fiscal adjustments, including changes to public debt management or tax policies, can create uncertainty. These policy shifts can compress profit margins or necessitate costly adaptations in the company's operational and funding strategies. For example, changes in reserve requirements or liquidity regulations, common in emerging markets, can directly affect profitability.

Integration Risks from Recent Acquisitions

Grupo Galicia faces significant integration risks stemming from its recent acquisitions, notably the ongoing absorption of HSBC Argentina's operations. The planned merger of Banco Galicia and Galicia Más in 2025 highlights potential challenges in harmonizing IT infrastructure, client portfolios, and distinct corporate cultures. Successful integration demands substantial investment in resources and meticulous oversight to mitigate operational disruptions and potential customer attrition.

Failure to achieve a seamless integration process could result in increased costs and a negative impact on overall efficiency and profitability. For instance, the complexities involved in merging disparate banking systems and customer service protocols can lead to temporary service interruptions or a decline in customer satisfaction, particularly during the transition phases anticipated through 2025.

- IT System Consolidation: Challenges in merging legacy IT systems from HSBC Argentina with Banco Galicia's existing infrastructure.

- Cultural Alignment: Potential friction in integrating the distinct organizational cultures of the acquired entity and Grupo Galicia.

- Customer Retention: Risk of customer churn due to service disruptions or perceived changes in banking experience during the integration period.

Potential for Declining Return on Equity (ROE)

While Grupo Galicia achieved a robust Return on Equity (ROE) of 25.3% in 2024, forecasts for 2025 indicate a potential dip to around 22.8%. This projected decrease may stem from ongoing economic recalibrations within Argentina, intensifying competition in the financial services sector, or increased operational expenditures linked to the consolidation of recent acquisitions. A persistent downward trend in ROE could suggest diminished effectiveness in leveraging shareholder capital for profit generation, potentially affecting investor sentiment.

Key factors contributing to this anticipated ROE moderation include:

- Economic Headwinds: Persistent inflation and currency fluctuations in Argentina could erode profitability.

- Competitive Landscape: Increased market share battles among financial institutions may necessitate higher spending on customer acquisition and retention.

- Integration Costs: Expenses related to integrating new businesses or technologies could temporarily weigh on earnings.

Grupo Galicia's heavy reliance on the Argentine market makes it highly susceptible to the nation's persistent macroeconomic instability. This vulnerability is amplified by the ongoing integration of HSBC Argentina, which introduces significant operational and cultural challenges. The group's financial performance, including a projected moderation in Return on Equity from 25.3% in 2024 to approximately 22.8% in 2025, reflects these headwinds and integration costs.

| Weakness | Description | Impact |

|---|---|---|

| Macroeconomic Vulnerability | High concentration of operations in Argentina, exposed to inflation (est. 250% YoY early 2024) and currency volatility. | Erodes real earnings, complicates financial planning, impacts asset quality. |

| Integration Risks | Challenges in merging HSBC Argentina's operations and IT systems, potential cultural clashes, and customer retention issues through 2025. | Increased costs, operational disruptions, potential decline in customer satisfaction, and temporary impact on efficiency. |

| Policy Dependence | Sensitivity to Argentine monetary and fiscal policy shifts, affecting net interest margins and operational strategies. | Uncertainty in profit margins, potential need for costly adaptations to regulations and funding strategies. |

| Projected ROE Moderation | Anticipated decrease in ROE from 25.3% (2024) to ~22.8% (2025) due to economic factors and integration expenses. | Potential negative impact on investor sentiment and perceived effectiveness in leveraging shareholder capital. |

Full Version Awaits

Grupo Galicia SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version of Grupo Galicia's strategic assessment.

This is a real excerpt from the complete document, showcasing the comprehensive analysis of Grupo Galicia's Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version.

Opportunities

Argentina's fintech sector is booming, projected to reach $10 billion by 2025, with digital payments and lending leading the charge. Grupo Galicia, through its Naranja X platform, is strategically positioned to capitalize on this expansion, aiming to capture a greater slice of this dynamic market.

By prioritizing investments in cutting-edge technologies and forging strategic alliances, Grupo Galicia can significantly elevate its customer engagement and operational efficiency. This focus on digital innovation is crucial for attracting younger, digitally-native consumers and securing sustained growth in the evolving financial landscape.

The acquisition of HSBC Argentina by Grupo Galicia presents a golden opportunity for cross-selling. Galicia can now offer its extensive range of banking, insurance, and asset management products to HSBC's existing client base, significantly broadening its market reach and revenue streams. This integration is expected to unlock substantial synergies, driving both cost efficiencies and revenue growth through economies of scale.

Grupo Galicia anticipates realizing significant operational synergies following the acquisition of HSBC Argentina, aiming for cost savings estimated to be around 15% of the acquired entity's operating expenses by the end of 2025. This strategic move not only expands its client base but also allows for a more optimized allocation of resources across its financial services portfolio, enhancing its competitive position in the Argentine market.

Argentina's economic trajectory indicates a positive shift, with forecasts suggesting a GDP expansion of approximately 3.5% in 2025, a notable improvement from previous periods. This anticipated growth, alongside efforts to bring inflation under control, is a strong tailwind for financial institutions like Grupo Galicia.

The normalization of the Argentine economy is expected to reignite private sector credit demand. As businesses and consumers regain confidence, there will be a greater need for loans, presenting a prime opportunity for Grupo Galicia to grow its lending business and boost its interest income streams.

This environment of improved economic stability is likely to foster increased consumer and business confidence. Such sentiment typically translates into higher demand for a broader range of financial products and services, from savings accounts to investment solutions, benefiting Grupo Galicia's diversified offerings.

Expansion into Underserved Market Segments

Grupo Galicia has a significant opportunity to expand into Argentina's underserved market segments. Despite the rise of fintech, domestic credit as a percentage of GDP remains lower than global benchmarks, indicating substantial room for financial inclusion. For instance, in 2023, Argentina's domestic credit to the private sector as a percentage of GDP stood at approximately 15.5%, considerably less than the emerging market average of around 50%.

The bank can capitalize on its established infrastructure and broad product portfolio to reach individuals and small to medium-sized enterprises (SMEs) that currently lack access to formal financial services. This strategic move can tap into new revenue streams and reinforce the company's commitment to social responsibility.

- Targeting unbanked populations: Millions of Argentinians still rely on informal financial channels.

- SME financing gap: Many small businesses struggle to secure adequate credit from traditional institutions.

- Digital inclusion initiatives: Leveraging technology to offer accessible and affordable financial products.

- Partnerships for reach: Collaborating with local organizations to extend financial services to remote areas.

ESG and Sustainable Finance Initiatives

Grupo Galicia's dedication to ESG principles and sustainable finance is a significant opportunity. This commitment can attract a growing segment of investors prioritizing environmental and social impact, potentially leading to increased capital access. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, a substantial pool for companies aligning with these values.

By actively promoting financial inclusion and supporting local development initiatives, Grupo Galicia can bolster its corporate reputation and brand loyalty. This focus on social responsibility can translate into stronger customer relationships and a more positive public image, especially as consumers increasingly factor ethical considerations into their purchasing decisions. The company's efforts in responsible environmental practices further enhance this appeal.

Developing innovative green finance products, such as sustainability-linked loans or bonds, and embedding sustainability across its business model can unlock new revenue streams and market segments. This strategic integration not only caters to evolving market demands but also positions Grupo Galicia for resilient, long-term growth in a world increasingly focused on environmental stewardship and social equity.

- Attracting socially conscious investors: The global sustainable investment market's growth indicates strong investor appetite for ESG-aligned companies.

- Enhancing reputation and brand value: Promoting financial inclusion and responsible practices builds trust and positive brand perception.

- Opening new market niches: Green finance products and integrated sustainability can tap into growing demand for sustainable solutions.

- Fostering long-term growth: Aligning with sustainability trends positions the company for future resilience and market leadership.

Grupo Galicia is well-positioned to leverage Argentina's expanding fintech landscape, with Naranja X aiming to capture a significant share of this growing market. The acquisition of HSBC Argentina offers substantial cross-selling opportunities, allowing Galicia to offer its diverse financial products to a wider customer base and achieve significant operational synergies, with cost savings anticipated to reach around 15% of the acquired entity's operating expenses by the end of 2025.

Argentina's projected GDP growth of 3.5% in 2025, coupled with efforts to control inflation, creates a favorable economic environment for financial institutions. This stability is expected to boost private sector credit demand, increasing opportunities for Galicia's lending business and interest income. Furthermore, the bank can tap into Argentina's underserved financial markets, where domestic credit to the private sector as a percentage of GDP was approximately 15.5% in 2023, significantly below emerging market averages.

Grupo Galicia's commitment to ESG principles presents an opportunity to attract socially conscious investors, tapping into the global sustainable investment market estimated at $35.3 trillion in early 2024. By promoting financial inclusion and supporting local development, the bank can enhance its reputation and brand loyalty, potentially leading to stronger customer relationships and a more positive public image.

The company can develop innovative green finance products and integrate sustainability into its business model, opening new revenue streams and market segments. This strategic alignment with sustainability trends positions Grupo Galicia for resilient, long-term growth and market leadership in a world increasingly focused on environmental and social responsibility.

Threats

Despite some recent easing, Argentina's persistent high inflation, projected to remain elevated in 2024 and potentially into 2025, continues to be a significant threat. This volatility directly impacts consumer spending power and increases the likelihood of loan defaults, directly affecting Grupo Galicia's loan portfolio and overall profitability.

The unpredictable nature of Argentina's macroeconomic environment, including potential policy shifts, creates substantial uncertainty for financial institutions. Such instability can rapidly erode asset values and hinder the bank's ability to plan effectively, posing a direct risk to its financial stability and future earnings potential.

The burgeoning fintech sector in Argentina presents a significant competitive challenge for Grupo Galicia. Companies like Mercado Pago have rapidly expanded their digital payment services, processing billions in transactions. Neobanks, with their agile, digital-native approaches, are also capturing market share, particularly among younger consumers seeking seamless online banking experiences.

This intense competition, especially in digital payments and lending, could erode Grupo Galicia's traditional revenue streams and profit margins. For instance, the increasing adoption of QR code payments facilitated by fintechs directly competes with established card payment systems. Grupo Galicia must therefore maintain a robust pace of technological innovation, as evidenced by its investments in digital transformation initiatives, to counter this pressure and retain its customer base.

Grupo Galicia faces significant threats from Argentina's evolving regulatory landscape. Potential shifts in banking laws and capital requirements, as seen with the Central Bank of Argentina's (BCRA) monetary policy adjustments throughout 2024, can directly impact profitability and operational flexibility. Government interventions, such as foreign exchange controls, further complicate operations, as experienced during periods of heightened currency volatility in late 2024.

Cybersecurity Risks and Data Breaches

As Grupo Galicia increasingly digitizes its operations and leans on online platforms, the risk of cybersecurity incidents and data breaches escalates. A significant cyberattack could result in substantial financial losses, severe reputational harm, and a critical decline in customer confidence. For instance, the global average cost of a data breach reached $4.35 million in 2024, underscoring the potential financial impact.

To mitigate these threats, continuous investment in advanced security protocols and proactive defense strategies is paramount. This includes staying ahead of evolving cyber threats and safeguarding sensitive financial information. The financial sector, in particular, saw a 15% increase in the average cost of a data breach between 2023 and 2024, highlighting the growing challenge.

- Increased reliance on digital channels amplifies vulnerability.

- Potential for significant financial losses and reputational damage.

- Necessity for ongoing investment in robust cybersecurity measures.

- Evolving nature of cyber threats demands constant vigilance.

Decline in Real Wages and Purchasing Power

A persistent decline in real wages, even as inflation moderates, poses a significant threat. For instance, if inflation outpaces wage growth by even a small margin over an extended period, consumer spending power erodes. This directly impacts Grupo Galicia's retail banking operations, as individuals and small to medium-sized enterprises (SMEs) may reduce their demand for credit and savings.

This economic pressure can translate into tangible financial risks for the bank. A weakening consumer base often leads to an increase in non-performing loan ratios as borrowers struggle to meet their obligations. Furthermore, reduced disposable income can slow deposit growth, impacting the bank's liquidity and ability to lend.

- Decreased Credit Demand: Consumers and SMEs facing reduced purchasing power are less likely to take on new loans.

- Higher Non-Performing Loans: Economic strain can lead to an increase in borrowers defaulting on existing loans.

- Slower Deposit Growth: With less disposable income, individuals have less to save, impacting the bank's funding base.

- Retail Segment Impact: Grupo Galicia's core retail banking business is particularly vulnerable to shifts in consumer spending.

Grupo Galicia faces intense competition from agile fintechs, like Mercado Pago, which processed over ARS 1.5 trillion in transactions in 2023, challenging traditional revenue streams. Regulatory shifts, including potential changes in capital requirements by the Central Bank of Argentina, also pose a threat, impacting operational flexibility and profitability. Furthermore, the escalating risk of cyberattacks, with the global average cost of a data breach reaching $4.35 million in 2024, necessitates continuous investment in advanced security measures to protect customer data and maintain trust.

| Threat Category | Specific Challenge | Impact on Grupo Galicia | Example/Data Point (2023-2025) |

|---|---|---|---|

| Competition | Fintech Disruption | Erosion of traditional revenue streams and profit margins. | Mercado Pago processed over ARS 1.5 trillion in transactions in 2023; digital payment adoption is rapidly increasing. |

| Regulatory Environment | Evolving Banking Laws & Policy Shifts | Impacts profitability and operational flexibility; potential for increased compliance costs. | Central Bank of Argentina (BCRA) monetary policy adjustments throughout 2024; foreign exchange controls in late 2024. |

| Cybersecurity | Data Breaches & Cyberattacks | Financial losses, reputational damage, and loss of customer confidence. | Global average cost of data breach reached $4.35 million in 2024; financial sector saw a 15% increase in breach cost (2023-2024). |

| Macroeconomic Instability | High Inflation & Wage Decline | Reduced consumer spending power, increased non-performing loans, slower deposit growth. | Argentine inflation projected to remain elevated in 2024; real wage decline impacts consumer credit demand. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Grupo Galicia's official financial statements, comprehensive industry market research, and expert analyses of the financial sector.