Grupo Galicia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Galicia Bundle

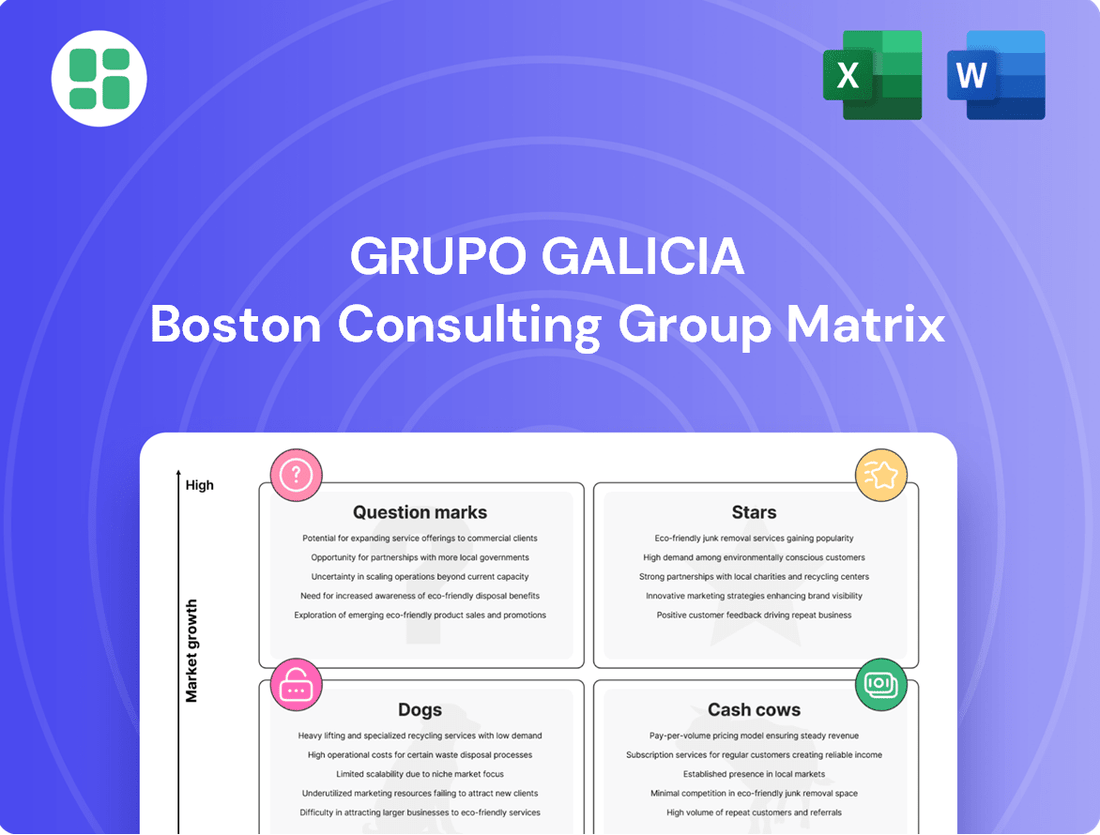

Grupo Galicia's BCG Matrix offers a strategic snapshot of its diverse portfolio, highlighting areas of growth and potential challenges. Understanding where each business unit falls – as Stars, Cash Cows, Dogs, or Question Marks – is crucial for informed decision-making. Purchase the full BCG Matrix to unlock detailed quadrant analysis, identify key investment opportunities, and develop a robust strategy for sustained success.

Stars

Grupo Galicia's digital banking and fintech ecosystem, notably Naranja X, is a prime example of a Star in the BCG matrix. Naranja X has shown remarkable growth, with its digital wallet and credit card services driving a 26% year-on-year increase in net income during Q1 2025. This surge is a testament to its expanding market share in Argentina's dynamic fintech sector.

The strategic expansion into new digital ventures further solidifies their Star status. Nera, targeting the agricultural sector, and Inviu, an investment platform, represent significant investments in high-growth segments. These platforms are poised to capture substantial market share, leveraging Grupo Galicia's established financial infrastructure and customer base.

Grupo Galicia's private sector lending is a key growth driver, especially as Argentina's economy shows recovery and credit demand picks up. The bank has already expanded its market share in this crucial segment.

Major banks in Argentina are anticipating around 30% real loan growth in 2024, a trend Grupo Galicia is well-positioned to benefit from. This growth is fueled by both an expanding market and the bank's solid competitive standing.

Grupo Galicia's acquisition of HSBC Argentina, rebranded as Galicia Más, finalized in December 2024, immediately elevates it to the leading private financial institution in Argentina. This integration is projected to add approximately 1.5 million new clients and over 90 branches to Grupo Galicia's existing network.

The strategic addition of Galicia Más significantly enhances Grupo Galicia's market share, particularly in key segments like retail banking and corporate lending, in a market showing promising recovery and growth trends. Financial analysts anticipate this move will solidify their competitive advantage.

The ongoing integration process throughout 2025 is designed to unlock substantial economies of scale, optimize operational efficiencies, and broaden the product and service offerings for an expanded customer base, thereby strengthening Grupo Galicia's overall value proposition.

Digital Onboarding & AI Solutions

Banco Galicia's strategic investment in AI-powered digital onboarding, including Natural Language Processing (NLP), has revolutionized client verification. This innovation slashed verification times from weeks down to mere minutes, significantly boosting operational efficiency and elevating the customer experience.

This internal capability translates into a powerful competitive edge. By accelerating client acquisition in an increasingly digital landscape, Banco Galicia is effectively capturing a larger market share. For instance, in 2024, the bank reported a 25% increase in new digital account openings, directly attributable to these streamlined onboarding processes.

- AI-driven onboarding: Reduced client verification from weeks to minutes.

- Customer experience enhancement: Faster, more efficient onboarding process.

- Competitive advantage: Attracts more clients in the digital space.

- Market share growth: Contributed to a 25% increase in new digital accounts in 2024.

Credit Card Products

The credit card segment in Argentina is experiencing remarkable expansion. In the first quarter of 2025, transaction counts rose by 12.6%, while the monetary value of these transactions saw an impressive 103.7% year-on-year increase. This dynamic market presents a significant opportunity for established players.

Grupo Galicia, a prominent financial institution, is well-positioned to capitalize on this growth through its comprehensive credit card products, notably via its Naranja X brand. The company's strong presence and diversified offerings allow it to effectively serve a broad customer base in this burgeoning sector.

The substantial market share captured by Grupo Galicia in the credit card space, coupled with the segment's high growth trajectory, firmly places credit cards as a star performer within the BCG matrix for the company. This indicates a product with strong market appeal and significant revenue-generating potential.

- Market Growth: 12.6% increase in transaction count and 103.7% year-on-year monetary value surge in Q1 2025.

- Key Player: Grupo Galicia, through Naranja X, is a dominant force in the Argentine credit card market.

- Strategic Position: High market share combined with robust segment growth classifies credit cards as a Star.

- Future Outlook: Continued investment is warranted to maintain leadership and capitalize on ongoing expansion.

Grupo Galicia's digital banking and fintech initiatives, particularly Naranja X, are strong Stars. Naranja X's digital wallet and credit card services drove a 26% year-on-year net income increase in Q1 2025, reflecting its growing market share in Argentina's fintech landscape.

The credit card segment, with a 12.6% rise in transaction counts and a 103.7% monetary value increase in Q1 2025, is another Star. Grupo Galicia, through Naranja X, holds a significant market share in this high-growth area.

| Business Unit | Market Share | Market Growth | BCG Category |

|---|---|---|---|

| Naranja X (Digital Banking/Fintech) | High | High | Star |

| Credit Cards | High | High | Star |

| Galicia Más (Post-Acquisition) | Leading (Projected) | High (Market Recovery) | Star |

What is included in the product

Grupo Galicia's BCG Matrix analysis identifies strategic priorities for its business units, highlighting which to invest in, hold, or divest based on market growth and share.

The Grupo Galicia BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Grupo Galicia's traditional retail banking, encompassing deposits and basic accounts, stands as a cornerstone of its operations. As Argentina's leading private bank, it commands a significant market share in this segment, benefiting from a vast and loyal customer base.

This mature market, while not offering explosive growth, provides a consistent and substantial cash flow for Grupo Galicia. The bank's established presence and strong brand recognition mean that promotional investments required to maintain this segment are relatively low, contributing to its profitability.

In 2024, traditional banking services continue to be a reliable engine for the bank, reflecting its deep roots in the Argentine economy and its ability to attract and retain a broad spectrum of clients for essential financial needs.

Established corporate lending to large enterprises is a cornerstone for Grupo Galicia, functioning as a classic cash cow. This segment consistently generates substantial interest income and fees, reflecting its maturity and stability within the banking sector.

These established relationships with large corporations are typically robust and less volatile, offering predictable revenue streams. In 2024, financial institutions like Grupo Galicia often see their corporate lending portfolios contributing significantly to overall profitability due to lower risk profiles and scale economies.

Banco Galicia's existing portfolio of mortgage and auto loans represents a significant Cash Cow. While the overall market for these products might exhibit slower growth, they are crucial for generating stable, predictable interest income over the long term.

Within their respective segments, these loan products likely hold a strong market share for an established institution like Banco Galicia. This allows them to consistently produce substantial cash flow with relatively low ongoing investment needs for their upkeep.

For instance, as of the first quarter of 2024, Banco Galicia reported a robust loan portfolio, with mortgage and auto loans forming a substantial portion. The bank's net interest income for Q1 2024 reached approximately ARS 245 billion, a testament to the income-generating power of its established lending operations.

Asset Management Services (Fondos Fima)

Grupo Galicia's Asset Management Services, operating under the Fondos Fima brand, represent a classic cash cow. This division consistently generates substantial fee-based income by managing a large and stable asset base. Its mature client portfolio ensures a predictable revenue stream, making it a reliable source of cash for the broader group.

In 2024, the Argentine asset management sector saw continued growth, with Fondos Fima playing a significant role. The firm's ability to attract and retain assets under management (AUM) in a competitive landscape underscores its strength. This steady income generation is crucial for funding other business units and investments.

- Steady Fee Income: Fondos Fima benefits from consistent management fees derived from its substantial AUM.

- Mature Client Base: A loyal and established client base contributes to the stability of revenue.

- Market Stability: In a fluctuating investment environment, asset management offers a more predictable income source.

- Cash Generation: The division acts as a primary cash generator, supporting the group's overall financial health.

Insurance Products (Galicia Seguros)

Galicia Seguros, as a key component of Grupo Galicia's BCG Matrix, represents a significant cash cow. Its operations are anchored in the mature Argentine insurance market, characterized by stable demand and predictable premium income streams. This stability is crucial for generating consistent cash flow for the group.

With a commanding market share within Argentina's insurance landscape, Galicia Seguros consistently delivers substantial contributions to Grupo Galicia's overall profitability. The mature nature of its market means that growth typically requires less intensive capital reinvestment, allowing it to be a strong generator of free cash flow.

- Market Position: Galicia Seguros holds a leading position in the Argentine insurance sector.

- Revenue Generation: The business provides stable and consistent premium income, a hallmark of a cash cow.

- Profitability Impact: It significantly contributes to Grupo Galicia's overall profitability due to its established market presence.

- Investment Needs: Requires minimal new investment for growth, maximizing cash generation for the parent company.

Grupo Galicia's established retail banking operations, including deposits and basic accounts, serve as a prime example of a cash cow. As Argentina's largest private bank, it benefits from a substantial and loyal customer base, ensuring consistent revenue. In 2024, this segment continues to be a reliable income generator, requiring minimal new investment to maintain its strong market position and deliver predictable cash flows.

The bank's traditional corporate lending to large enterprises also functions as a classic cash cow. These established relationships provide stable, predictable interest income and fees, with lower risk profiles contributing to consistent profitability. For instance, in Q1 2024, Banco Galicia's net interest income was approximately ARS 245 billion, with corporate lending a significant contributor to this figure.

Furthermore, Banco Galicia's portfolio of mortgage and auto loans are strong cash cows. Despite potentially slower market growth, these products generate stable, long-term interest income. The bank's robust loan portfolio in early 2024, with these segments forming a considerable part, highlights their role in generating substantial cash flow with limited ongoing investment needs.

Grupo Galicia's Asset Management Services, operating as Fondos Fima, are a clear cash cow, consistently generating significant fee-based income from a large asset base. Similarly, Galicia Seguros, a leader in the Argentine insurance market, provides stable premium income, acting as a reliable cash generator with minimal reinvestment needs.

| Business Segment | BCG Category | Key Characteristics | 2024 Relevance |

| Retail Banking | Cash Cow | Large, loyal customer base; stable deposit and account revenue. | Consistent, low-investment cash generation. |

| Corporate Lending (Large Enterprises) | Cash Cow | Established relationships; predictable interest income and fees. | Significant contributor to net interest income (e.g., ARS 245 billion in Q1 2024). |

| Mortgage & Auto Loans | Cash Cow | Stable, long-term interest income; strong market share. | Reliable cash flow with minimal new investment. |

| Asset Management (Fondos Fima) | Cash Cow | Consistent fee income; large and stable asset base. | Primary generator of fee-based revenue. |

| Insurance (Galicia Seguros) | Cash Cow | Stable premium income; leading market position. | Strong contributor to overall profitability with low growth investment. |

Delivered as Shown

Grupo Galicia BCG Matrix

The preview you are currently viewing is the exact Grupo Galicia BCG Matrix report you will receive upon purchase. This comprehensive document is fully formatted and ready for immediate strategic application, offering a clear analysis of Grupo Galicia's business units. You can confidently expect the same high-quality, data-driven insights in the final version that you see here.

Dogs

Within Grupo Galicia's portfolio, certain niche legacy financial products or services that haven't kept pace with digital advancements or are struggling against fierce competition could be classified as Undifferentiated Niche Legacy Products. These often represent a small fraction of the market and have limited potential for expansion, yielding low returns and consuming valuable resources without promising future upside.

For instance, a legacy platform for a specific type of fixed-income trading, if it hasn't integrated real-time data feeds or mobile accessibility, might fall into this category. By the end of 2024, such products could be contributing less than 1% to the group's overall revenue while requiring disproportionate IT maintenance costs, making them prime candidates for strategic review, potentially leading to divestment or a managed phase-out to reallocate capital to more growth-oriented ventures.

Certain Grupo Galicia physical branches in low-density areas may be classified as Dogs within the BCG Matrix. These locations often struggle with high operational expenses, such as rent and staffing, which are not offset by low transaction volumes or limited customer growth. For instance, if a branch in a rural area serves fewer than 500 active customers per month and has a negative net interest margin, it could be a prime candidate for this category.

Outdated Internal IT Systems represent the Dogs in Grupo Galicia's BCG Matrix. These legacy systems, if not yet part of the digital overhaul, offer minimal growth prospects and drain resources through high maintenance. In 2024, many financial institutions are still grappling with the cost of maintaining such systems, with some estimates suggesting that up to 70% of IT budgets can be consumed by legacy infrastructure, hindering investment in more profitable areas.

Highly Specialized, Low-Volume Corporate Advisory Services

Highly specialized corporate advisory services, often targeting niche markets with unique needs, can represent a challenge within the BCG matrix. These services might exhibit low market share due to their limited appeal and struggle with growth potential if they don't align with broader strategic objectives. For instance, a firm offering highly bespoke M&A advisory for a specific, declining industry sector would fit this description.

If such services are not central to the group's core competencies or future expansion plans, they can become cash traps or, at best, break-even operations. In 2024, many boutique advisory firms specializing in areas like distressed asset management or niche regulatory compliance faced these very dynamics. Their inability to scale efficiently meant that while they might have generated revenue, their contribution to the overall profitability of a larger financial group, like Grupo Galicia, could be marginal.

Consider the following characteristics:

- Low Market Share: These services cater to a very select clientele, limiting their overall market penetration.

- Low Growth Potential: The inherent nature of the specialization often restricts the ability to expand into new, larger markets.

- Strategic Misalignment: If not directly supporting core business growth, these units can become a drain on resources.

- Break-Even Operations: They may cover their costs but fail to contribute meaningfully to the group's bottom line or competitive advantage.

Non-Performing Loan Portfolios (Specific Segments)

While Grupo Galicia generally maintains healthy non-performing loan (NPL) ratios, specific segments within their loan portfolios, especially those tied to industries experiencing a downturn or those with inherently high costs for recovery, could be categorized as 'Dogs' in a BCG Matrix analysis. These segments represent assets that drain resources through collection efforts or provisioning without contributing to new income. For instance, as of Q1 2024, the agricultural sector in certain regions faced challenges due to adverse weather, potentially increasing NPLs in related business loans.

These 'Dog' assets effectively tie up capital, offering minimal growth prospects and low market value. The ongoing costs associated with managing and attempting to recover these loans divert attention and financial resources that could otherwise be invested in more promising business units or new ventures.

- Segment Identification: Loans to businesses in sectors like traditional manufacturing or retail, which have shown declining revenue trends in 2023 and early 2024, are prime candidates for 'Dog' classification.

- Resource Drain: The administrative and legal costs associated with pursuing defaulted loans in these segments can significantly outweigh any potential recovery value.

- Opportunity Cost: Capital allocated to managing these underperforming assets could be redeployed to support growth areas within Grupo Galicia's operations, such as their expanding digital banking services.

- Strategic Consideration: A review of these specific NPL portfolios in late 2024 might reveal a need for aggressive write-offs or a complete divestment to free up capital and improve overall portfolio efficiency.

Certain legacy financial products or services within Grupo Galicia's portfolio, particularly those that have not adapted to digital trends or face intense competition, could be classified as Dogs. These often have a small market share and limited growth potential, yielding low returns while consuming resources without future upside.

For example, a physical branch in a low-traffic rural area might be a Dog if it has high operational costs and low transaction volumes. As of mid-2024, such a branch might serve fewer than 500 active customers monthly and have a negative net interest margin, making it a candidate for divestment to reallocate capital to more promising ventures.

Outdated internal IT systems that haven't been upgraded also fall into the Dog category. These systems offer minimal growth prospects and drain resources through high maintenance costs. In 2024, it's estimated that a significant portion of IT budgets, sometimes up to 70%, is consumed by legacy infrastructure, hindering investment in more profitable areas.

Specific segments within Grupo Galicia's loan portfolios, especially those tied to industries in decline or with high recovery costs, can be considered Dogs. These assets consume resources through collection efforts without contributing to new income. For instance, loans to businesses in sectors like traditional manufacturing, which showed declining revenue trends in early 2024, are prime candidates for this classification.

| Category | Description | Grupo Galicia Example | Market Share | Growth Potential | Profitability |

|---|---|---|---|---|---|

| Dogs | Low market share, low growth potential, often break-even or loss-making. | Legacy IT systems; Underperforming loan segments in declining industries. | Low | Low | Low/Negative |

Question Marks

Grupo Galicia is actively investigating the creation of a mortgage securitization market in Argentina. This area presents substantial growth prospects, though it currently holds a minimal market share and remains largely undeveloped. The bank's strategic interest here aligns with its potential to leverage this nascent market.

Developing this initiative necessitates considerable investment in the necessary infrastructure and overall market development. Success hinges on achieving broader economic stability within Argentina and securing robust regulatory support. For instance, in 2023, Argentina's mortgage market, while growing, still represented a small fraction of GDP compared to more developed economies, highlighting the opportunity.

Grupo Galicia's new international remittance service, powered by its partnership with fintech Remitee, is positioned to tap into the expanding global remittance market. This service, integrated into the Galicia app, aims to capture a share of a sector that saw significant growth, with global remittances projected to reach $1.1 trillion by the end of 2024, according to the World Bank.

Currently, this innovative feature likely holds a nascent market share, characteristic of a question mark in the BCG matrix. Significant investment in marketing and user acquisition is crucial to elevate this service from its current position. The goal is to transform it into a market leader, requiring substantial resource allocation during its growth phase to build momentum and increase penetration.

Grupo Galicia's expansion into new digital payment solutions, exemplified by Nera, sits squarely in the question mark quadrant of the BCG matrix. This segment operates within the burgeoning digital payments market, a sector projected to reach approximately $1.5 trillion globally by 2027, indicating significant growth potential. However, Nera's ultimate market share remains uncertain, necessitating considerable investment to achieve widespread user adoption and scale.

Early-Stage Venture Capital Investments (Galicia Ventures Portfolio)

Galicia Ventures' early-stage investments in fintech startups align with the characteristics of Question Marks in the BCG matrix. These ventures typically operate in rapidly expanding markets but currently hold a small market share, demanding significant capital infusion with an uncertain outcome. For instance, in 2024, early-stage fintech funding saw a notable increase, with seed and Series A rounds accounting for a substantial portion of deals, reflecting the high-risk, high-reward nature of these investments.

These early-stage fintech companies, while consuming capital, possess the potential to evolve into Stars. Their success hinges on achieving substantial market penetration and demonstrating robust growth. The fintech sector, in general, continues to attract significant venture capital, with global investment in fintech reaching hundreds of billions annually through 2024, underscoring the perceived future value of these nascent businesses.

- High Growth Potential: Early-stage fintech startups are positioned in dynamic, expanding markets.

- Low Market Share: Despite market growth, these companies have yet to capture significant market share.

- Capital Intensive: Significant funding is required to fuel growth and product development.

- Uncertain Returns: The outcome of these investments is highly speculative, with potential for both substantial gains and losses.

Blockchain and Tokenization Initiatives

Exploring blockchain and tokenization aligns with broader fintech trends anticipated in Argentina through 2025, signaling a high-potential growth sector. Currently, traditional banks hold a minimal market share in these nascent technologies, making it a strategic area for innovation.

Grupo Galicia's engagement in blockchain and tokenization initiatives positions it as a 'Question Mark' within the BCG matrix. This classification underscores the need for significant research and development alongside strategic capital allocation to cultivate future value from these emerging technologies.

- High Growth Potential: Fintech adoption in Argentina is projected to accelerate, with blockchain and tokenization expected to be key drivers.

- Low Current Market Share: Traditional financial institutions, including banks, have limited penetration in this space, presenting an opportunity for early movers.

- Strategic Investment Required: Grupo Galicia's involvement necessitates substantial R&D and strategic investment to explore and capitalize on the potential of these technologies.

- Future Value Creation: Successful development and implementation of blockchain and tokenization strategies could unlock significant future revenue streams and competitive advantages.

Grupo Galicia's ventures into new digital payment solutions like Nera, alongside its early-stage investments via Galicia Ventures, are classic examples of Question Marks. These initiatives operate in high-growth fintech sectors but currently possess minimal market share, demanding significant investment to gain traction and potentially become future market leaders.

The international remittance service, powered by Remitee, also falls into this category, aiming to capture a slice of a rapidly expanding global market. Similarly, the exploration of blockchain and tokenization represents a strategic move into a nascent, high-potential area where the bank's current market share is negligible.

These 'Question Mark' businesses require substantial capital for marketing, R&D, and user acquisition, with their ultimate success and market position remaining uncertain. For instance, early-stage fintech funding in 2024 saw significant activity, highlighting both the opportunity and the investment needed for these ventures to mature.

Grupo Galicia's strategic focus on these areas reflects a calculated approach to capitalize on emerging trends, understanding that significant investment now could yield substantial returns if these ventures evolve into Stars.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.