Grupo Galicia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Galicia Bundle

Unlock the strategic advantages of Grupo Galicia by understanding the critical political, economic, social, technological, legal, and environmental factors shaping its landscape. Our comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify growth opportunities. Don't guess; know. Purchase the full analysis now and gain the foresight needed to excel.

Political factors

The administration of President Javier Milei in Argentina is pursuing aggressive fiscal consolidation and economic liberalization. These policies, while intended to foster long-term stability, have led to considerable short-term economic adjustments, including a significant devaluation of the peso and efforts to curb inflation, which stood at an annual rate of 276.4% as of April 2024.

The success of these reforms hinges on sustained political will and public backing, especially with mid-term elections scheduled for October 2025. These elections could potentially alter the government's capacity to implement its reform agenda, influencing investor confidence and the overall economic trajectory.

The Central Bank of Argentina (BCRA) actively shapes the financial landscape through evolving regulations. In 2024, the BCRA continued to emphasize enhanced cybersecurity measures for financial institutions, a trend that saw increased scrutiny following global data breaches. Furthermore, adjustments to capital requirements, such as the ongoing review of Basel III implementation, directly impact Grupo Galicia's operational capacity and risk management strategies.

Recent legislative actions in Argentina, particularly in late 2023 and early 2024, have brought about stricter Anti-Money Laundering (AML) laws. These reforms necessitate more robust due diligence processes and reporting mechanisms for financial entities like Grupo Galicia. Additionally, changes to minimum cash reserve requirements, which fluctuated throughout 2024 based on inflation targets, directly influence liquidity management and lending capabilities for the bank.

Grupo Galicia's strategic imperative involves constant adaptation to this dynamic regulatory environment. Failure to comply with updated AML statutes or capital adequacy directives could result in significant penalties and reputational damage. The bank's ability to navigate these changes, including the implementation of new technological solutions for compliance, is paramount for maintaining operational stability and fostering investor confidence throughout 2024 and into 2025.

Argentina's history is marked by significant capital controls and fluctuating exchange rates. While a positive shift occurred in April 2025, with some foreign exchange restrictions on dividend repatriation eased for earnings post-January 1, 2025, the government still maintains certain currency controls.

These ongoing policies directly influence Grupo Galicia's capacity to manage its foreign currency exposures and streamline international transactions for its customer base.

Fiscal Policy and Public Spending

Argentina's government has implemented a strict 'zero-deficit' fiscal rule, eliminating money printing by the Central Bank and leading to significant reductions in public spending. This austerity measure has resulted in a primary surplus, a notable achievement after many years, aimed at stabilizing the economy and curbing inflation. For Grupo Galicia, this fiscal discipline is expected to foster a more predictable macroeconomic landscape.

The impact of these spending cuts on demand for Grupo Galicia's credit products is a key consideration. Reduced public sector activity, a direct consequence of austerity, could temper demand for certain financial services. For instance, infrastructure projects funded by the government, which often drive demand for corporate loans, may see a slowdown.

Key fiscal data points to consider for 2024/2025 include:

- Projected fiscal deficit reduction: The government aims to maintain a fiscal surplus throughout 2024 and 2025, a significant shift from previous years.

- Inflation targets: The Central Bank's monetary policy, aligned with fiscal discipline, targets a substantial decrease in inflation rates by year-end 2024 and continuing into 2025.

- Public investment levels: While overall spending is cut, strategic public investments in certain sectors might be prioritized, influencing credit demand in those specific areas.

International Relations and Debt Negotiations

Argentina's ongoing dialogue with international financial institutions, particularly the International Monetary Fund (IMF), significantly influences its economic path. A pivotal agreement reached in April 2025, which includes debt restructuring and the provision of new financing, is designed to bolster the Central Bank's foreign currency reserves and foster economic stability.

Successful debt negotiations and robust international relationships are paramount for reducing the country's risk profile and encouraging foreign capital inflows. This, in turn, directly benefits financial entities such as Grupo Galicia by creating a more favorable investment climate.

- IMF Agreement (April 2025): Focused on debt restructuring and new loans to enhance Central Bank reserves.

- Impact on Country Risk: Positive international relations are key to lowering perceived risk for investors.

- Foreign Investment Attraction: Improved stability and reduced risk are crucial for drawing foreign direct investment into Argentina's financial sector.

The political landscape in Argentina, under President Javier Milei's administration, is characterized by aggressive fiscal consolidation and economic liberalization policies. These reforms, including efforts to curb inflation which was 276.4% annually in April 2024, aim for long-term stability but create short-term economic adjustments. The success of these policies will be significantly influenced by political will and public support, especially with mid-term elections slated for October 2025.

The Central Bank of Argentina (BCRA) continues to shape the financial environment through evolving regulations, with a focus on cybersecurity and adjustments to capital requirements like Basel III implementation. Furthermore, stricter Anti-Money Laundering (AML) laws enacted in late 2023 and early 2024 necessitate robust compliance for financial institutions like Grupo Galicia.

Argentina's government is adhering to a strict 'zero-deficit' fiscal rule, eliminating money printing by the Central Bank and leading to public spending reductions. This austerity has resulted in a primary surplus, fostering a more predictable macroeconomic environment. However, reduced public sector activity could temper demand for credit products.

Argentina's relationship with international financial institutions, particularly the IMF, is crucial. A key agreement in April 2025, involving debt restructuring and new financing, aims to bolster foreign currency reserves and economic stability, thereby improving the country's risk profile and attracting foreign capital.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Grupo Galicia across political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats shaped by current market and regulatory dynamics.

A clear, actionable summary of Grupo Galicia's PESTLE factors, presented in an easily digestible format, alleviates the pain of complex strategic analysis by providing immediate insights for decision-making.

Economic factors

Argentina's inflation has seen a dramatic fall, from exceeding 200% in 2023 to an anticipated rate below 30% by 2025. This trend is mirrored by the Central Bank's steady reduction of its benchmark interest rate, a direct response to moderating price increases.

For Grupo Galicia, these shifting economic tides are significant. A declining inflation rate and lower interest rates are expected to create a more stable environment for lending. This could, in turn, boost demand for private credit and enhance consumer spending power, though the pace of this improvement may not be uniform.

Argentina's economy demonstrated a notable recovery trajectory starting in the latter half of 2024, with preliminary data for early 2025 indicating positive Gross Domestic Product (GDP) growth. This rebound, accompanied by an uptick in industrial production, suggests a strengthening economic environment.

The fiscal austerity measures and disinflationary policies enacted are credited with driving this economic resurgence. For Grupo Galicia, this recovery translates into increased opportunities, as businesses and individuals are likely to engage more actively in financial transactions, boosting demand for the bank's diverse range of services.

The Argentine Peso's ongoing devaluation, managed through a crawling peg with a set monthly depreciation, presents a dynamic environment for Grupo Galicia. This policy, while intended to curb volatility, can lead to real exchange rate appreciation, potentially impacting the competitiveness of Argentine exports and the nation's ability to build foreign reserves. For Grupo Galicia, these currency shifts directly influence the valuation of its assets and the cost and profitability of its international operations.

Consumer Purchasing Power and Credit Demand

Initial public spending cuts in early 2024 significantly impacted consumer purchasing power, contributing to higher poverty rates. However, as disinflation takes hold, there's a projected recovery in real wages, which is anticipated to bolster consumption and stimulate demand for private credit denominated in pesos. Grupo Galicia's retail banking operations are directly exposed to these shifts, as consumer financial well-being directly influences their capacity and inclination to engage with new credit products.

The Argentine government reported an inflation rate of 4.2% in April 2024, a notable decrease from previous months, signaling a potential turning point for consumer confidence. This disinflationary trend, coupled with forecasts for real wage growth in the latter half of 2024, suggests a gradual improvement in household disposable income. Consequently, this economic environment could lead to an uptick in demand for credit, particularly within the retail banking sector where Grupo Galicia holds a substantial presence.

- Disinflation Trend: Argentina's monthly inflation rate fell to 4.2% in April 2024, down from 11.0% in March 2024.

- Real Wage Projections: Analysts predict a potential increase in real wages by 5-10% in the second half of 2024, contingent on sustained disinflation.

- Credit Demand Sensitivity: Grupo Galicia's retail banking segment performance is closely tied to consumer credit uptake, which is expected to benefit from improved purchasing power.

Access to International Capital Markets

Argentina's historical struggle with high public debt and elevated country risk has significantly constrained its access to international capital markets. This situation directly impacts Grupo Galicia, affecting its capacity to raise funds abroad and support its corporate clients in cross-border financial activities. As of early 2024, Argentina's country risk premium remained a critical factor influencing borrowing costs.

While recent fiscal adjustments and an IMF agreement have fostered a degree of cautious optimism, the challenge of attracting substantial foreign investment persists. Grupo Galicia's strategic positioning is therefore contingent on Argentina's improving creditworthiness and its ability to reintegrate into global financial flows. The success of the government's economic program in 2024 and 2025 will be crucial indicators.

- Argentina's Country Risk: A key determinant of borrowing costs and investor confidence.

- IMF Agreement Impact: Provides a framework for fiscal discipline, potentially improving market access.

- Grupo Galicia's Role: Facilitating international capital for clients hinges on Argentina's global financial standing.

Argentina's economic landscape is marked by a significant disinflationary trend, with monthly inflation falling to 4.2% in April 2024. This is projected to be accompanied by real wage growth of 5-10% in the latter half of 2024, boosting consumer purchasing power and credit demand for banks like Grupo Galicia. However, the country's high public debt and country risk premium continue to limit access to international capital markets, impacting borrowing costs and cross-border activities.

| Economic Indicator | Value/Projection | Period |

|---|---|---|

| Monthly Inflation Rate | 4.2% | April 2024 |

| Real Wage Growth Projection | 5-10% | H2 2024 |

| Country Risk Premium | Elevated | Early 2024 |

What You See Is What You Get

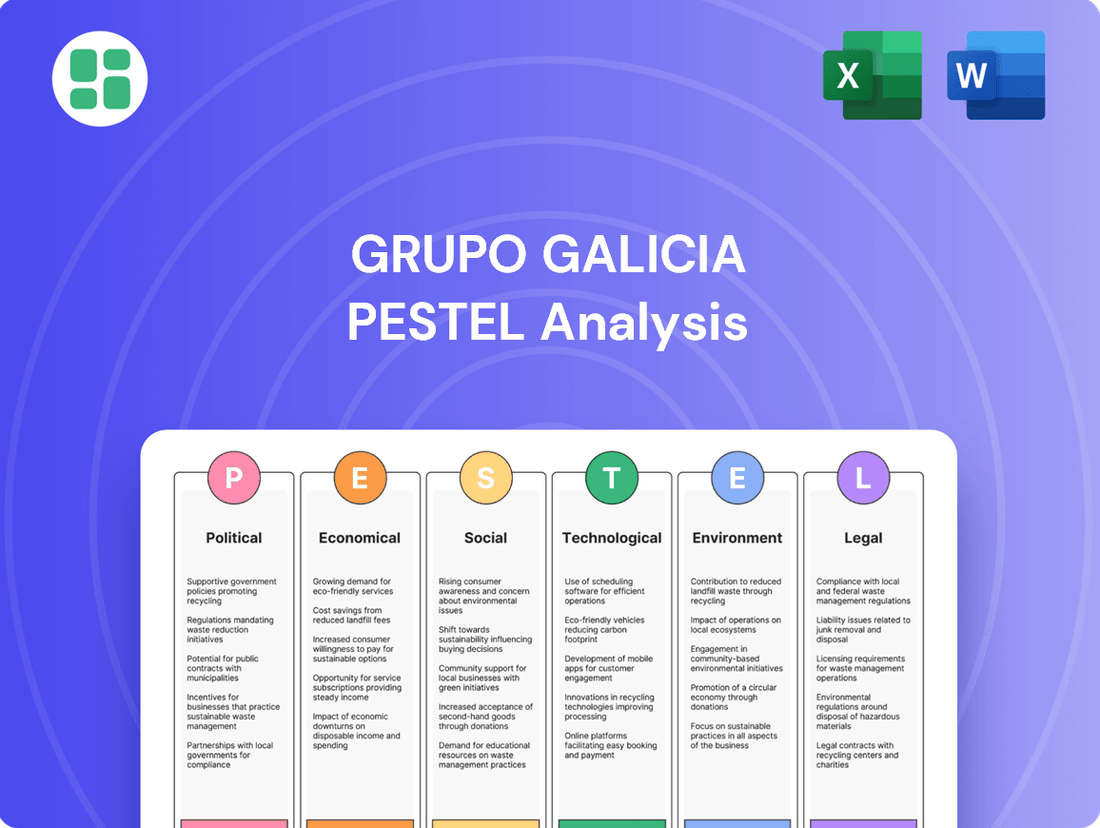

Grupo Galicia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Grupo Galicia.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Grupo Galicia.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external environment affecting Grupo Galicia's strategic decisions.

Sociological factors

Argentina's financial landscape is transforming, with over 60% of adults now utilizing digital banking services, a significant leap towards full financial inclusion. This surge is fueled by the rapid expansion of fintech and digital payment platforms, reshaping how Argentinians manage their money.

This widespread digital adoption presents a prime opportunity for Grupo Galicia. By leveraging its subsidiary Naranja X, the company can effectively broaden its customer reach and foster deeper relationships through its digital offerings, capitalizing on this evolving consumer behavior.

Argentine consumers are increasingly embracing digital financial tools. By late 2024, a significant portion of transactions are expected to be conducted via digital wallets and real-time payment systems such as Transferencias 3.0, reflecting a growing comfort with mobile-first financial interactions.

The trajectory indicates that digital wallets will likely surpass traditional payment methods in both online and in-person retail environments within the next few years. This presents a clear opportunity for financial institutions like Grupo Galicia to capture market share.

To stay competitive, Grupo Galicia needs to prioritize ongoing investment in intuitive digital platforms and seamless omnichannel strategies. This proactive approach is crucial for meeting evolving customer expectations and fostering long-term loyalty in a rapidly digitizing market.

Argentina's demographic structure is evolving, with a notable aging population. This shift directly impacts demand for financial products, driving increased interest in retirement planning services and wealth management for older demographics, while youth-oriented accounts may see less growth.

Recent labor market trends in Argentina, including significant job losses, particularly within the public sector, present challenges. For instance, a substantial portion of public sector jobs were impacted by government austerity measures in early 2024, potentially reducing disposable income and affecting credit quality across the population. Grupo Galicia must adapt its strategies to address these economic realities and manage associated credit risks.

Income Inequality and Poverty Levels

Despite Argentina's economic recovery efforts, poverty remains a significant social challenge. While poverty levels saw a decline in late 2024 and early 2025 from previous record highs, a substantial portion of the population continues to experience economic hardship. For instance, by the end of 2024, estimates suggested that around 40% of the population was still living below the poverty line, a figure that improved slightly to approximately 37% by mid-2025.

High income inequality directly impacts the market for financial products and services. A significant gap between the wealthiest and poorest segments of the population means that demand for sophisticated financial instruments may be concentrated among a smaller elite, while basic financial services are crucial for a larger, lower-income demographic. This disparity necessitates a nuanced approach for entities like Grupo Galicia.

Grupo Galicia's strategic planning must acknowledge and adapt to these diverse economic realities. Offering tailored financial solutions that cater to different income segments is paramount. This could involve developing accessible savings products for lower-income individuals and more complex investment vehicles for higher-net-worth clients, ensuring broader market penetration and customer retention.

- Poverty Decline: Poverty levels, while still elevated, showed a reduction from record highs, dropping from an estimated 40% in late 2024 to around 37% by mid-2025.

- Income Disparity: Significant income inequality persists, influencing the demand for various financial products and services across different socioeconomic strata.

- Strategic Adaptation: Grupo Galicia needs to consider this economic stratification, potentially by offering segmented financial products.

- Market Segmentation: Tailored solutions for both affluent and less affluent client bases are crucial for comprehensive market engagement.

Trust in the Financial System

Despite ongoing regulatory efforts to bolster controls and foster a conservative banking environment, a notable portion of the Argentine population continues to harbor skepticism towards the traditional financial system. This sentiment is often rooted in the lingering effects of past economic upheavals and periods of instability. For instance, a 2023 survey indicated that while digital financial services are growing, a significant percentage of respondents still prefer cash transactions due to trust concerns, highlighting a persistent gap.

The burgeoning adoption of digital banking platforms and innovative fintech solutions presents a tangible opportunity to gradually restore public confidence. These services often emphasize enhanced transparency and greater accessibility, directly addressing some of the historical pain points that eroded trust in conventional institutions. By offering user-friendly interfaces and clear transaction histories, fintech can demystify financial processes for a broader audience.

Grupo Galicia must therefore prioritize the cultivation and sustained maintenance of customer trust. This involves a dual approach: implementing state-of-the-art security measures to safeguard customer assets and data, and consistently delivering reliable, high-quality financial services. Demonstrating unwavering dependability is paramount in a market where past experiences have made consumers cautious.

- Persistent Distrust: A segment of the population retains distrust in traditional finance due to historical economic crises, impacting adoption rates of conventional banking services.

- Fintech's Role: Digital banking and fintech are seen as crucial in rebuilding trust through increased transparency and accessibility in financial services.

- Grupo Galicia's Imperative: The bank needs to focus on robust security and service reliability to foster and maintain customer confidence in the evolving financial landscape.

- Data Point: Reports from late 2023 and early 2024 suggest that while digital financial inclusion is growing, a significant minority still favors cash, underscoring the ongoing trust deficit.

Argentina's evolving demographic structure, marked by an aging population, directly influences financial product demand. This trend is driving increased interest in retirement planning and wealth management services for older demographics, while growth in youth-oriented accounts may moderate.

Labor market shifts, including public sector job reductions in early 2024, have impacted disposable income and credit quality. Grupo Galicia must adapt its strategies to manage these economic realities and associated credit risks effectively.

Persistent income inequality shapes the market for financial products. A substantial gap between socioeconomic strata means demand for sophisticated instruments is concentrated among a smaller elite, necessitating tailored solutions for different income segments.

Despite poverty reduction efforts, with levels estimated around 37% by mid-2025, economic hardship remains a significant social factor. Grupo Galicia's strategic planning must acknowledge this stratification to ensure broad market engagement.

| Sociological Factor | Impact on Grupo Galicia | Data/Trend (2024/2025) |

| Aging Population | Increased demand for retirement and wealth management services. | Demographic shifts are ongoing, influencing product development. |

| Labor Market Changes | Potential impact on credit quality and disposable income; need for risk management. | Public sector job reductions in early 2024 affected income. |

| Income Inequality | Market segmentation required; tailored products for different income levels. | Significant disparity necessitates nuanced financial service offerings. |

| Poverty Levels | Need for accessible financial products for lower-income segments. | Poverty estimated at ~37% by mid-2025, a slight improvement but still significant. |

Technological factors

Argentina's banking landscape is rapidly evolving, driven by a significant digital transformation where institutions like Banco Galicia are making substantial technology investments. This shift is crucial for adapting to changing customer expectations and operational efficiencies.

The nation's fintech sector is booming, with a notable surge in companies providing digital lending, payment solutions, and cryptocurrency services. This vibrant ecosystem presents both opportunities and challenges for traditional banks.

To maintain its competitive edge and foster innovation, Grupo Galicia must sustain its digital infrastructure development and explore strategic collaborations or integrations with promising fintech entities. This proactive approach is vital for navigating the dynamic financial technology environment.

The accelerating digital shift and the escalating frequency of cyber threats demand strong cybersecurity. In 2024, global spending on cybersecurity solutions is projected to reach over $215 billion, highlighting the growing importance of digital defense.

Argentina is actively strengthening its cybersecurity regulations to better shield both individuals and businesses from digital risks. This regulatory evolution aims to create a more secure digital ecosystem for all participants.

For Grupo Galicia, a significant investment in cutting-edge threat detection, rapid response systems, and unwavering data privacy is paramount. This ensures the protection of customer data and sustains trust in an environment marked by increasing digital vulnerabilities.

Artificial intelligence and machine learning are rapidly transforming financial services, driving significant improvements in operational efficiency, customer engagement, and fraud detection. For instance, by mid-2024, many leading banks reported a 20-30% reduction in processing times for loan applications through AI-powered automation.

Financial institutions are actively embedding AI into their cybersecurity frameworks and customer service platforms. This trend is expected to accelerate, with a projected 40% increase in AI adoption for customer support roles in the financial sector by the end of 2025.

Grupo Galicia can strategically harness AI and automation to optimize internal workflows, deliver highly personalized customer experiences, and bolster its defenses against evolving cyber threats. This adoption is crucial for maintaining a competitive edge in the dynamic financial landscape.

Mobile Banking and Payment System Innovation

Mobile banking penetration in Argentina is high, with a significant portion of the population actively using digital platforms for financial transactions. This trend is further amplified by interoperable digital payment systems, such as the widely adopted Transferencias 3.0, which have fundamentally reshaped the payments landscape by enabling instant, real-time money transfers between different financial institutions. The rapid growth of QR code payments, now a common sight across various retail and service sectors, underscores the increasing consumer comfort and preference for contactless and efficient payment methods.

Grupo Galicia's commitment to innovation in its mobile applications and payment infrastructure serves as a crucial competitive advantage. To maintain this edge and meet evolving consumer expectations for fluid digital experiences, continuous development and enhancement of these platforms are paramount. For instance, by the end of 2023, over 70% of Argentinians were estimated to have a smartphone, providing a substantial user base for mobile banking services.

- Mobile Banking Adoption: Argentina has seen a significant surge in mobile banking usage, with many consumers preferring digital channels for everyday financial management.

- Interoperability and Real-Time Payments: Systems like Transferencias 3.0 have made cross-institutional, instant payments a reality, boosting efficiency for users and businesses.

- QR Code Growth: The widespread adoption of QR code payments highlights a shift towards convenient, touch-free transaction methods.

- Grupo Galicia's Competitive Edge: Continuous innovation in mobile banking and payment solutions is essential for Grupo Galicia to retain and grow its market share in the digital financial ecosystem.

Blockchain and Cryptocurrency Integration

Argentina stands out globally for its high cryptocurrency adoption rates, with a significant portion of the population turning to digital assets as a shield against persistent inflation. This trend highlights a strong underlying demand for alternative financial tools.

Local financial institutions, including banks and fintech companies, are actively exploring and integrating blockchain technology. This integration aims to bolster security measures and pave the way for novel financial products and services, reflecting a growing industry recognition of blockchain's potential.

Grupo Galicia must proactively evaluate the evolving landscape of blockchain and cryptocurrencies. This includes understanding the opportunities for developing new service offerings, such as digital asset management or payments, and navigating the complex regulatory environment that governs these technologies in Argentina.

- High Adoption: Argentina consistently ranks among the top countries for crypto usage, driven by inflation hedging needs.

- Fintech Integration: Argentine banks and fintech firms are increasingly adopting blockchain for enhanced security and new product development.

- Strategic Imperative: Grupo Galicia needs to analyze blockchain and crypto opportunities and regulatory frameworks to innovate and maintain competitiveness.

Technological advancements are fundamentally reshaping Argentina's financial sector, with Grupo Galicia at the forefront of digital transformation. The nation's robust fintech ecosystem, coupled with high mobile banking penetration, necessitates continuous investment in digital infrastructure and cybersecurity. By mid-2024, global cybersecurity spending was projected to exceed $215 billion, underscoring the critical need for robust digital defenses.

AI and machine learning are driving efficiency and personalization, with many banks reporting 20-30% reductions in loan processing times by mid-2024. Grupo Galicia's strategic adoption of these technologies is key to optimizing operations and enhancing customer experiences. Furthermore, Argentina's high cryptocurrency adoption, driven by inflation concerns, presents opportunities for blockchain integration and innovative financial products.

| Technology Area | 2024/2025 Trend/Data | Impact on Grupo Galicia |

|---|---|---|

| Digital Transformation | Significant investment in digital infrastructure; high mobile banking adoption (over 70% smartphone penetration by end of 2023) | Essential for maintaining competitive edge and meeting evolving customer expectations. |

| Fintech Growth | Booming fintech sector; surge in digital lending, payments, and crypto services | Opportunities for collaboration/integration; need to adapt to new market entrants. |

| Cybersecurity | Global spending projected over $215 billion in 2024; strengthening regulations in Argentina | Paramount investment in threat detection, response, and data privacy to protect customer data and trust. |

| AI & Machine Learning | 20-30% reduction in loan processing times reported by mid-2024; 40% projected increase in AI for customer support by end of 2025 | Optimize internal workflows, personalize customer experiences, and bolster cyber defenses. |

| Blockchain & Crypto | High adoption rates in Argentina for inflation hedging; increasing integration by financial institutions | Evaluate opportunities for new service offerings (digital asset management) and navigate regulatory landscape. |

Legal factors

The Central Bank of Argentina (BCRA) dictates stringent rules for banks, including capital adequacy and liquidity. For instance, as of early 2024, the BCRA maintained a reference interest rate that significantly influences lending and deposit costs, impacting Grupo Galicia's financial operations.

Recent BCRA directives have broadened the scope of eligible financial instruments for reserve requirements, offering banks more flexibility. Grupo Galicia must navigate these evolving regulations, ensuring full compliance to maintain its license and avoid potential sanctions.

Argentina's recent overhaul of its anti-money laundering and terrorist financing system, enacted in early 2024, expands the scope of the Financial Intelligence Unit (UIF) to include virtual asset service providers as 'Obligated Subjects'. This move signifies a significant tightening of regulatory oversight in the financial sector.

Grupo Galicia must proactively adapt its Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols to align with these enhanced regulations. Failure to do so could result in substantial fines and reputational damage, impacting its operations and market standing.

Regulatory bodies are increasingly strengthening consumer protection and data privacy laws. This is to shield individuals from privacy breaches and financial fraud, ensuring personal data is secured against unauthorized access and misuse. For instance, in 2023, Argentina's Personal Data Protection Directorate (DNPDP) issued new guidelines emphasizing stricter consent requirements for data processing, reflecting a global trend towards enhanced data security.

While specific policies mirroring the European Union's GDPR are still developing in many regions, the overarching aim is to safeguard consumer information. Grupo Galicia must therefore embed data privacy and consumer rights at the core of its operational strategy, particularly as digital engagement with customers continues to grow. This proactive approach is crucial for maintaining trust and compliance in an evolving regulatory landscape.

Taxation Laws for Financial Institutions

Taxation laws significantly shape the financial landscape for institutions like Grupo Galicia. Recent modifications to Argentina's wealth tax regime, for instance, directly influence the investment strategies of both the bank and its clientele. Grupo Galicia must remain agile, adapting its advisory services and internal tax management to comply with these evolving regulations.

Furthermore, the implementation of tax amnesty programs presents both opportunities and challenges. These programs can encourage capital repatriation but also require careful navigation to ensure compliance and mitigate associated risks for the bank and its customers. Grupo Galicia's ability to effectively communicate and implement strategies around these amnesties is crucial for maintaining client trust and operational efficiency.

The dividend distribution policies of subsidiaries, such as Banco Galicia, are directly impacted by withholding tax regulations. For example, in 2023, Banco Galicia's dividend distributions were subject to specific withholding tax rates, underscoring the direct link between tax law and financial institution operations. Staying informed about these rates is essential for accurate financial planning and client guidance.

- Wealth Tax Modifications: Changes to Argentina's wealth tax directly affect investment portfolios managed by Grupo Galicia and its clients.

- Tax Amnesty Programs: The introduction of tax amnesties requires Grupo Galicia to provide updated guidance on compliance and risk management for clients.

- Withholding Taxes on Dividends: Banco Galicia's dividend payouts are subject to withholding taxes, impacting net returns for shareholders.

- Regulatory Compliance: Grupo Galicia must ensure its operations and client advice align with all current and upcoming tax legislation to avoid penalties and maintain market credibility.

Competition Law and Fintech Regulation

The burgeoning fintech sector has significantly intensified competition within Argentina's financial services, compelling regulatory bodies like the BCRA (Central Bank of Argentina) to prioritize interoperability and ensure a level playing field. This regulatory shift directly impacts Grupo Galicia, necessitating agile strategies to navigate the evolving market dynamics and preserve its competitive edge.

The BCRA's ongoing efforts, including the issuance of regulations for Payment Service Providers (PSPCPs) and the exploration of open finance frameworks, are reshaping the operational landscape. These developments are crucial for Grupo Galicia as they foster an environment where new players can emerge, potentially challenging established market positions.

- Increased Competition: Fintech adoption in Argentina grew substantially, with digital payment transactions reaching an estimated ARS 25 trillion in 2024, up from ARS 18 trillion in 2023, according to industry reports.

- Regulatory Focus: The BCRA's PSPCP regulations aim to standardize operations for digital payment providers, impacting how companies like Grupo Galicia interact with and compete against these entities.

- Open Finance Initiatives: Argentina's move towards open finance, mirroring global trends, could unlock new partnership opportunities and data-sharing possibilities, requiring Grupo Galicia to adapt its technological infrastructure and business models.

Argentina's legal framework for financial institutions is dynamic, with the Central Bank of Argentina (BCRA) imposing strict capital and liquidity requirements on banks, influencing Grupo Galicia's operational costs and lending capabilities. For instance, the BCRA's reference interest rate, a key monetary policy tool, significantly impacts borrowing and deposit rates throughout early 2024, directly affecting Grupo Galicia's financial performance.

Recent regulatory adjustments by the BCRA have introduced greater flexibility in reserve requirements, allowing banks more options for compliance. Grupo Galicia must diligently adhere to these evolving directives to maintain its banking license and avoid penalties.

Furthermore, strengthened anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, including expanded oversight of virtual asset service providers by the Financial Intelligence Unit (UIF) as of early 2024, necessitate robust compliance protocols for Grupo Galicia. Consumer protection and data privacy laws are also tightening, with new guidelines on data processing consent issued by Argentina's Personal Data Protection Directorate (DNPDP) in 2023, requiring Grupo Galicia to prioritize data security and client privacy.

Taxation laws, including modifications to wealth tax and the implementation of tax amnesty programs, directly influence investment strategies and require Grupo Galicia to provide updated client guidance. Withholding tax regulations on dividends, such as those affecting Banco Galicia's distributions in 2023, also impact net returns for shareholders, underscoring the need for continuous adaptation to tax legislation.

Environmental factors

While Argentina doesn't mandate ESG disclosures for public firms, the global shift towards sustainable finance is undeniable. Grupo Galicia, as a major financial player, is actively fostering sustainable practices through its social and environmental investment programs, aligning with this international momentum.

By proactively embracing ESG principles, Grupo Galicia can significantly bolster its corporate image and appeal to the increasing number of investors prioritizing responsible and ethical investments. This strategic alignment is crucial for long-term value creation in the evolving financial landscape.

Climate change presents significant risks for Grupo Galicia, encompassing physical threats like extreme weather events that could impact its agricultural clients, and transition risks stemming from policy shifts towards a low-carbon economy. Financial institutions are now under increasing pressure to evaluate and manage these climate-related risks within their investment portfolios. For instance, as of early 2024, the World Meteorological Organization reported that 2023 was the warmest year on record, underscoring the growing urgency of these physical risks.

Grupo Galicia must proactively assess how climate change could affect its lending and investment strategies, particularly in sectors that are highly susceptible to climate impacts. This includes understanding the potential for stranded assets in carbon-intensive industries and the opportunities in green finance. By mid-2024, many global financial regulators were implementing stricter disclosure requirements for climate-related financial risks, signaling a critical need for robust risk management frameworks.

Grupo Galicia, like all financial institutions, faces increasing scrutiny regarding its environmental footprint, particularly concerning energy consumption in data centers and office spaces. While the direct impact might seem less pronounced than in manufacturing, operational efficiency and sustainable resource management are becoming crucial for cost control and brand reputation. For instance, in 2024, the financial services sector globally saw a rise in investor demands for transparency on Scope 1 and 2 emissions, pushing companies like Galicia to assess and potentially reduce their energy usage.

The company's commitment to reducing waste and implementing energy-efficient practices, such as optimizing IT infrastructure and promoting remote work where feasible, directly influences its operational costs and public perception. As environmental regulations tighten and stakeholder expectations evolve, proactive measures in resource utilization can offer a competitive advantage and mitigate risks associated with climate change impacts on business operations.

Stakeholder Pressure for Green Initiatives

Grupo Galicia is experiencing growing pressure from various stakeholders, including investors, customers, and employees, to adopt more environmentally responsible business practices. This heightened awareness is directly shaping corporate strategies, pushing for greater sustainability across operations. For instance, by the end of 2023, sustainable finance commitments globally reached over $150 trillion, indicating a strong market signal for companies like Grupo Galicia to integrate green initiatives.

Financial institutions are increasingly expected to champion and fund sustainable development projects. This trend means Grupo Galicia's approach to environmental, social, and governance (ESG) factors is under scrutiny, with a clear expectation for financial backing of green ventures. The growing demand for ESG-compliant investments saw a significant rise in 2024, with many funds actively seeking out companies demonstrating strong environmental stewardship.

Grupo Galicia's proactive engagement in social and environmental programs can be a significant differentiator. This commitment not only meets evolving stakeholder expectations but also positions the company favorably in a market increasingly prioritizing sustainability. Companies with robust ESG frameworks are often rewarded with better access to capital and enhanced brand reputation.

- Investor Demand: A 2024 survey indicated that over 70% of institutional investors consider ESG factors when making investment decisions.

- Consumer Preference: Millennials and Gen Z consumers, who represent a significant purchasing power, show a strong preference for brands with clear sustainability commitments.

- Employee Engagement: Studies in 2024 show that a strong corporate social responsibility (CSR) program can improve employee retention by up to 30%.

- Financial Sector Trends: Green bond issuance, a key indicator of financial support for environmental projects, saw a 25% increase globally in early 2025 compared to the previous year.

Environmental Regulations and Compliance

Grupo Galicia, while primarily a financial services group, is subject to general environmental regulations like waste management and energy efficiency. For instance, in 2024, Argentina, where Galicia operates, continued to emphasize sustainable practices, with national policies encouraging reduced energy consumption across all sectors. This means the group must ensure its own operations are compliant, impacting its overhead costs and operational procedures.

Broader environmental legislation also indirectly affects Grupo Galicia through its client base. As clients in sectors like agriculture or manufacturing face stricter emission standards or water usage regulations, their financial health can be impacted. This, in turn, influences the group's loan portfolio and the necessity for robust risk assessment to account for environmental liabilities and opportunities within its lending practices. For example, new regulations on carbon emissions in 2025 could reshape the financing needs of industrial clients.

- Waste Management: Compliance with national and local waste disposal and recycling mandates.

- Energy Efficiency: Adherence to standards for reducing energy consumption in corporate facilities.

- Client Impact: Indirect influence through environmental regulations affecting the financial stability of borrowers.

- Risk Assessment: Incorporating environmental factors into credit analysis and portfolio management.

Grupo Galicia faces growing stakeholder pressure to adopt environmentally responsible practices, with global sustainable finance commitments exceeding $150 trillion by the end of 2023. This trend is further amplified by investor demand, where over 70% of institutional investors consider ESG factors, and a significant preference for sustainability shown by younger consumer demographics, impacting brand reputation and capital access.

Climate change poses tangible risks, with 2023 being the warmest year on record, affecting agricultural clients and necessitating a focus on transition risks as economies move towards low-carbon models. Financial regulators globally are intensifying scrutiny on climate-related financial risks, pushing institutions like Galicia to integrate robust management frameworks and assess impacts on lending and investment strategies.

Operational environmental factors, such as energy consumption in data centers and offices, are also under scrutiny, with a rise in investor demands for transparency on Scope 1 and 2 emissions in 2024. Proactive measures in resource utilization, like waste reduction and energy efficiency, are crucial for cost control and competitive advantage.

Grupo Galicia must navigate environmental regulations, including waste management and energy efficiency mandates, while also considering the indirect impact of client-sector environmental legislation on its loan portfolio. This necessitates robust risk assessment to account for environmental liabilities and opportunities, especially as new carbon emission regulations emerge.

| Factor | 2024/2025 Data Point | Impact on Grupo Galicia |

|---|---|---|

| Global Sustainable Finance Commitments | Exceeded $150 trillion (End of 2023) | Drives demand for green initiatives and ESG integration. |

| Institutional Investor ESG Consideration | Over 70% (2024 Survey) | Influences investment decisions and capital access. |

| Warmest Year on Record | 2023 (WMO) | Increases physical climate risks for clients, especially in agriculture. |

| Investor Demand for Emission Transparency | Rising (2024) | Requires focus on operational energy efficiency and reporting. |

| Green Bond Issuance Growth | 25% increase globally (Early 2025 vs. prior year) | Indicates growing financial support for environmental projects. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Grupo Galicia is built on a comprehensive review of official Argentinian government data, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific publications. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.