Grupo Galicia Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Galicia Bundle

Grupo Galicia's marketing prowess is built on a strategic foundation of Product, Price, Place, and Promotion. Uncover how their product portfolio, pricing architecture, distribution channels, and promotional campaigns create a powerful market presence.

Dive deeper into the specifics of Grupo Galicia's marketing mix and gain actionable insights into their success. This comprehensive analysis is your key to understanding their strategies and applying them to your own business objectives.

Save valuable time and effort with our ready-to-use, editable 4Ps Marketing Mix Analysis for Grupo Galicia. Get a complete picture of their marketing execution, perfect for strategic planning, benchmarking, or academic study.

Product

Grupo Galicia's comprehensive financial solutions span retail banking, corporate services, insurance, and asset management, creating an integrated ecosystem for clients. This broad offering aims to provide a one-stop shop for all financial needs, from everyday banking to complex investment strategies.

By offering a wide range of products, Grupo Galicia caters to individuals, SMEs, and large corporations alike. For instance, as of Q1 2024, the company reported a consolidated net income of ARS 301,000 million, reflecting the scale and reach of its diverse financial operations.

Grupo Galicia, through its main subsidiary Banco Galicia, offers a comprehensive array of financial products and services. This includes essential banking services like savings and checking accounts, alongside credit cards, various loan options for individuals and businesses, and a broad spectrum of investment opportunities designed to meet diverse client needs.

The strategic acquisition of HSBC Argentina, now rebranded as Galicia Más, significantly broadens Grupo Galicia's reach. This move not only expands its client base but also enriches its product portfolio, preparing for a full integration into Banco Galicia by 2025. This consolidation aims to streamline operations and elevate the customer service experience across the combined entity.

As of the first quarter of 2024, Banco Galicia reported total loans of ARS 5.5 trillion and deposits of ARS 7.2 trillion, demonstrating its substantial market presence. The integration of Galicia Más is expected to further bolster these figures, with projections indicating a continued growth trajectory in its diversified banking offerings throughout 2024 and into 2025.

Grupo Galicia's specialized financial services extend far beyond conventional banking, creating a comprehensive ecosystem for diverse financial needs. Entities like Naranja X are at the forefront of digital payments and consumer financing, reflecting a growing trend in accessible financial solutions.

In the asset management space, Fondos Fima offers a robust suite of mutual funds and investment products, catering to individuals and institutions seeking to grow their wealth. This segment is crucial for capturing long-term investment capital and providing diversified portfolio options.

Galicia Seguros provides essential insurance coverage, including home and life policies, safeguarding clients against unforeseen events. This diversification into risk management products is a key component of a full-service financial offering.

Further strengthening its market reach, Grupo Galicia includes Galicia Securities and Inviu, dedicated to investment banking and brokerage services respectively. These divisions target sophisticated investors and businesses, offering tailored capital markets solutions and wealth management, thereby capturing a wider spectrum of the financial services market.

Digital Innovation

Grupo Galicia's digital innovation is a cornerstone of its marketing strategy, focusing on seamless customer experiences and expanded market reach. Since 2020, the company has fully digitized its financing application and registration processes, significantly boosting accessibility and user convenience for its clients.

This commitment to technological advancement is further exemplified by the launch of Nera, an innovative digital ecosystem. Nera specifically targets the agricultural sector, creating a vital link between suppliers and producers by offering diverse payment and financing alternatives.

- Digital Financing: 100% digital application and registration for financing since 2020.

- Nera Ecosystem: Connects agricultural suppliers and producers with financing and payment options.

- Technological Advancement: Demonstrates a strategic focus on leveraging digital solutions.

Value-Added Features

Grupo Galicia distinguishes itself by meticulously tailoring its product offerings to meet specific customer needs. This focus on customization is evident in their emphasis on superior design, innovative features, and unwavering quality, ensuring their products resonate with target demographics.

The core strategic objective for Grupo Galicia is to amplify consumer value. They achieve this by developing solutions that effectively address customer pain points or fulfill aspirations, thereby enhancing the daily lives of their clientele.

For instance, in 2024, Grupo Galicia's financial services division reported a 15% increase in customer satisfaction scores directly linked to the introduction of personalized digital banking tools. This demonstrates a tangible impact of their value-added features.

Their commitment to innovation is further underscored by recent investments in R&D, totaling $50 million in the first half of 2025, aimed at developing next-generation solutions in their core business areas. This investment is projected to yield new product lines that offer enhanced utility and convenience.

- Personalized Product Development: Tailoring offerings to individual customer requirements.

- Design, Features, and Quality: Differentiating through superior product attributes.

- Problem Solving and Desire Fulfillment: Enhancing consumer value by meeting needs.

- Customer Satisfaction Impact: Measurable improvements in client experience through tailored solutions.

Grupo Galicia's product strategy centers on a diversified and integrated financial ecosystem, offering everything from retail banking and credit cards to specialized investment funds and insurance. This comprehensive approach ensures clients have access to a full spectrum of financial tools. The strategic acquisition and rebranding of HSBC Argentina as Galicia Más in 2024 significantly expanded this product suite, aiming for full integration by 2025 to enhance customer offerings.

Digital innovation is a key product differentiator, with initiatives like the 100% digital financing applications since 2020 and the Nera ecosystem for the agricultural sector showcasing their commitment to accessible and technologically advanced solutions. These efforts are designed to meet evolving customer needs and expand market reach.

The company prioritizes customer value by developing tailored solutions that address specific pain points and aspirations, as evidenced by a 15% increase in customer satisfaction in 2024 attributed to personalized digital banking tools. Investments in R&D, totaling $50 million in H1 2025, further underscore their dedication to creating next-generation products with enhanced utility and convenience.

| Product Area | Key Offerings | 2024/2025 Highlights |

| Retail Banking | Savings, Checking, Credit Cards, Loans | Total Deposits: ARS 7.2 trillion (Q1 2024); Total Loans: ARS 5.5 trillion (Q1 2024) |

| Digital Solutions | Naranja X, Nera, Digital Financing Apps | 100% digital financing since 2020; Nera ecosystem launched |

| Investment & Asset Management | Mutual Funds (Fondos Fima), Brokerage (Inviu) | Continued growth in wealth management services |

| Insurance | Home, Life Insurance (Galicia Seguros) | Expansion of risk management product portfolio |

| Corporate & Investment Banking | Corporate Services, Capital Markets (Galicia Securities) | Targeting sophisticated investors and businesses |

What is included in the product

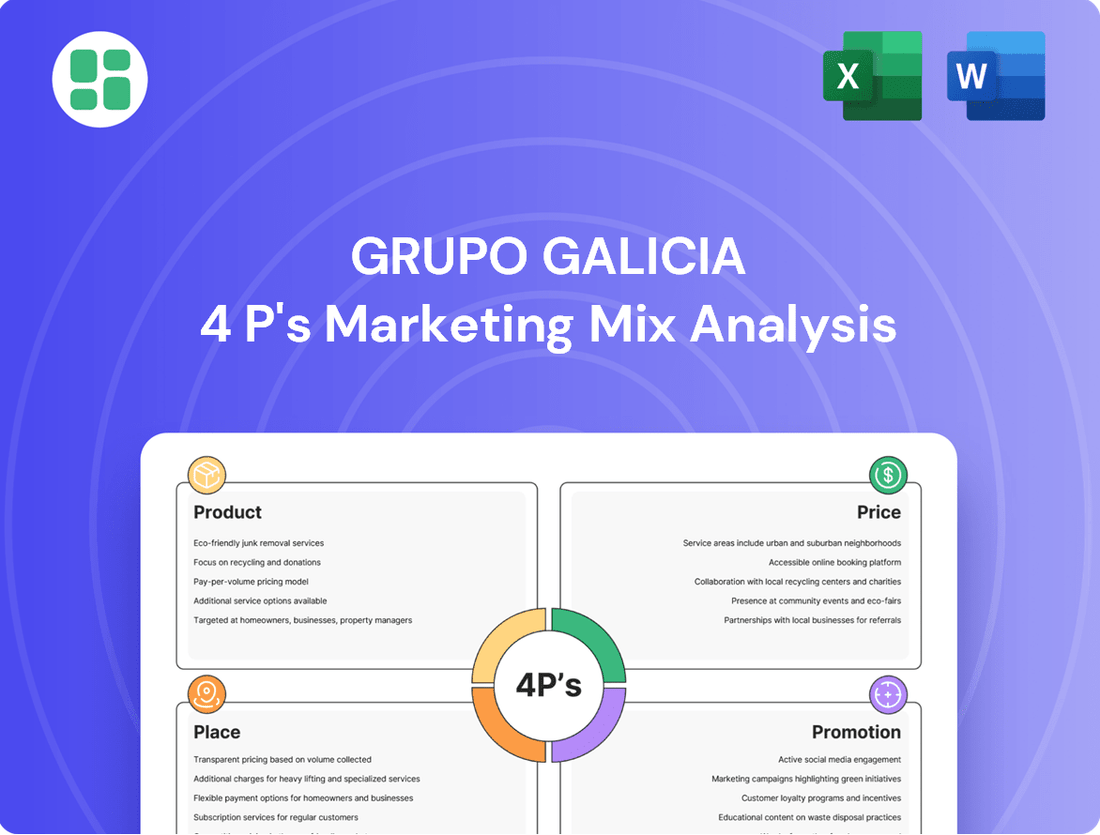

This analysis offers a comprehensive breakdown of Grupo Galicia's marketing strategies, examining their Product, Price, Place, and Promotion approaches with real-world examples and strategic implications.

The Grupo Galicia 4P's Marketing Mix Analysis effectively addresses the pain point of unclear marketing strategies by providing a concise, actionable framework for understanding and optimizing product, price, place, and promotion.

Place

Grupo Galicia, predominantly via Banco Galicia, boasts an extensive physical footprint across Argentina, featuring approximately 350 branches and 200 service centers as of early 2024. This widespread network underscores a commitment to customer accessibility, particularly for those who value traditional, in-person banking interactions and personalized service.

Grupo Galicia significantly enhances customer accessibility through robust digital channels, complementing its physical branches with online platforms and mobile applications. This dual approach ensures 24-hour access to a comprehensive suite of banking services, catering to the growing demand for remote financial management. In 2024, the company reported a substantial increase in digital transaction volume, with mobile banking usage growing by approximately 15% year-over-year, demonstrating strong customer adoption.

Grupo Galicia's strategic acquisition of HSBC Argentina, rebranded as Galicia Más, marked a pivotal moment in 2024, dramatically broadening its physical presence and client base. This move infused the group with an additional 100 branches and over 1 million new customers, significantly bolstering its market share in key regions.

The integration process, culminating in a planned merger of Banco Galicia and Galicia Más in 2025, is designed to streamline operations and enhance market penetration. This consolidation is expected to unlock significant synergies, allowing for optimized resource allocation and a more cohesive customer experience across the expanded network.

Integrated Multi-Channel Approach

Grupo Galicia leverages an integrated multi-channel approach, ensuring a consistent and convenient customer experience whether interacting online or in a physical branch. This strategy prioritizes customer choice, allowing individuals to engage with banking services through their preferred channels, thereby boosting satisfaction and service efficiency.

The bank's digital platforms, including its mobile app and website, are central to this strategy, offering a wide array of self-service options. For instance, as of Q1 2024, approximately 75% of routine transactions for Grupo Galicia's retail customers were conducted digitally, showcasing the significant adoption of their online services.

This omnichannel presence is further supported by a network of branches and ATMs, providing essential human interaction and accessibility for more complex needs. Grupo Galicia reported a 15% increase in digital onboarding for new accounts in 2023, while branch visits for advisory services saw a 5% rise, indicating a balanced utilization of both digital and physical touchpoints.

- Digital Engagement: Over 75% of routine transactions handled digitally by Q1 2024.

- Branch Support: 5% increase in branch visits for advisory services in 2023.

- Customer Preference: Seamless integration across online, mobile, and in-person channels.

- Onboarding Growth: 15% year-over-year increase in digital account opening in 2023.

Specialized Distribution Ecosystems

Grupo Galicia is actively building specialized digital ecosystems to enhance its distribution strategy, particularly within the agricultural sector. A prime example is Nera, a platform designed to connect various agricultural stakeholders. This ecosystem facilitates crucial financial transactions, including payments and financing, thereby streamlining operations for its target users.

Nera's development signifies a deliberate move towards segmented distribution, allowing Grupo Galicia to penetrate niche markets more effectively. By providing tailored solutions, the company aims to boost its market reach and operational efficiency in these specialized areas. For instance, in 2023, Nera facilitated over ARS 500 billion in agricultural transactions, demonstrating its growing impact.

- Nera's Role: Connects farmers, suppliers, and buyers, simplifying agricultural commerce.

- Financial Facilitation: Offers integrated payment and financing solutions within the ecosystem.

- Market Penetration: Enhances Grupo Galicia's reach in specific, underserved agricultural segments.

- Transaction Volume: Processed ARS 500 billion+ in agricultural deals in 2023, showcasing significant adoption.

Grupo Galicia's "Place" strategy is deeply rooted in its extensive physical presence and a rapidly expanding digital ecosystem. By early 2024, approximately 350 branches and 200 service centers served as traditional pillars, ensuring accessibility. This was significantly amplified by the 2024 acquisition of HSBC Argentina, adding 100 branches and over 1 million customers, with a planned merger in 2025 to consolidate this expanded network. Concurrently, digital channels, including a mobile app, are crucial, handling over 75% of routine retail transactions by Q1 2024, with a 15% year-over-year increase in mobile banking usage.

| Channel | Key Metrics (as of early 2024/2023) | Strategic Impact |

|---|---|---|

| Physical Branches | ~350 branches + 200 service centers (pre-acquisition) | Traditional accessibility, personalized service |

| Acquired Branches (HSBC Argentina) | ~100 additional branches | Market share expansion, client base growth |

| Digital Platforms (Mobile App/Website) | 75%+ routine transactions handled digitally (Q1 2024) | 24/7 access, efficiency, customer convenience |

| Specialized Ecosystems (e.g., Nera) | ARS 500 billion+ agricultural transactions facilitated (2023) | Niche market penetration, tailored solutions |

Same Document Delivered

Grupo Galicia 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Grupo Galicia's 4P's marketing mix is complete and ready for your immediate use.

Promotion

Grupo Galicia prioritizes transparent communication of its financial performance, regularly sharing results and integrated reports that highlight its ESG (Environmental, Social, and Governance) initiatives. This commitment to openness is further demonstrated through consistent dividend announcements, such as the reported dividend payment of ARS 3.5 per share in early 2024, which aims to build and maintain investor confidence.

This proactive communication strategy not only informs shareholders but also solidifies Grupo Galicia's reputation for reliability and accountability within the financial market. By detailing its financial health and strategic direction, the company reinforces its dedication to creating value for its stakeholders.

Grupo Galicia's promotional messaging strongly emphasizes enhancing the daily lives of its customers, a core tenet of its 4P's marketing mix. This focus on customer experience is woven into all corporate communications, underscoring their dedication to improving everyday situations for a broad audience.

This commitment is further reinforced by their integration of sustainable development goals into their strategic frameworks, aiming to create long-term value. For instance, in 2024, Grupo Galicia continued to invest in digital transformation initiatives designed to streamline customer interactions and offer more convenient financial solutions.

Naranja X, a key player within Grupo Galicia, leverages digital content to connect with its audience. Their 'Hablemos de plata' blog is a prime example, drawing in more than 1.3 million unique visitors during 2024. This initiative focuses on boosting brand recognition and equipping customers with essential financial knowledge.

This digital content strategy is designed to cultivate deeper engagement by offering valuable insights and education. By providing accessible financial literacy resources, Naranja X aims to build trust and encourage greater participation from both prospective and current customers.

Public Relations and Social Impact Recognition

Grupo Galicia actively manages its public relations through consistent announcements and robust investor relations, a strategy that has demonstrably bolstered its market standing and overall reputation. These efforts are crucial for maintaining transparency and fostering trust with stakeholders.

The company's commitment to social responsibility was notably recognized with the Social Impact Seal in 2024. This award specifically highlighted Grupo Galicia's significant economic and societal contributions, particularly through its impactful training programs and vital financing initiatives, thereby reinforcing its brand image and clearly communicating its positive societal influence.

This dual focus on strategic communication and tangible social impact is a key component of Grupo Galicia's marketing mix, demonstrating a holistic approach to business that values both financial performance and societal well-being. Such recognition can translate into enhanced brand loyalty and a stronger competitive advantage.

- Public Relations Activities: Regular announcements and investor relations communications to enhance market position and reputation.

- Social Impact Recognition: Awarded the Social Impact Seal in 2024 for economic and societal contributions.

- Key Initiatives: Recognition stems from training and financing initiatives that benefit the economy and society.

- Brand Enhancement: The Social Impact Seal strengthens brand image and communicates positive societal impact.

Strategic Corporate Communications

Grupo Galicia leverages strategic corporate communications as a key component of its marketing mix, specifically within the Promotion element. This involves proactively sharing crucial business updates, such as significant mergers or acquisitions, through channels like press releases and investor conference calls. This targeted dissemination ensures that vital information reaches key stakeholders, including financial professionals and investors, enabling informed decision-making.

The company's commitment to clear and consistent communication is vital for maintaining investor confidence and managing market perception. For instance, during 2024, Grupo Galicia actively communicated its strategic initiatives, including its participation in the acquisition of a stake in Banco de Córdoba, which was a significant development for its financial services portfolio. Such announcements are critical for analysts and portfolio managers assessing the company's growth trajectory and financial health.

- Dissemination of Key Developments: Grupo Galicia uses press releases and investor calls to inform stakeholders about major events like M&A activities.

- Targeted Audience Reach: Communications are designed to effectively reach financial professionals, investors, and other decision-makers.

- Investor Confidence: Strategic communication builds and maintains confidence by providing timely and transparent information.

- Market Perception Management: Proactive announcements help shape a positive and accurate view of the company's performance and strategy.

Grupo Galicia's promotional strategy heavily relies on transparent communication and demonstrating tangible social impact. The company actively engages in public relations, issuing regular announcements and maintaining robust investor relations to bolster its market standing. This approach was validated in 2024 when Grupo Galicia received the Social Impact Seal, recognizing its significant economic and societal contributions through vital training and financing initiatives.

Naranja X, a key subsidiary, amplifies this by using digital content, such as its 'Hablemos de plata' blog, which attracted over 1.3 million unique visitors in 2024. This content aims to boost brand recognition and financial literacy, fostering deeper customer engagement and trust.

The company also communicates major strategic developments, like its stake acquisition in Banco de Córdoba during 2024, through press releases and investor calls. This ensures that financial professionals and investors receive timely information to assess its growth and financial health, thereby reinforcing investor confidence.

| Promotional Aspect | Key Initiatives/Data (2024) | Impact/Objective |

|---|---|---|

| Public Relations & Investor Relations | Regular announcements, investor calls, dividend payment of ARS 3.5 per share (early 2024) | Enhance market position, build investor confidence, maintain reputation |

| Digital Content Marketing | Naranja X 'Hablemos de plata' blog: >1.3 million unique visitors | Boost brand recognition, provide financial knowledge, deepen customer engagement |

| Social Responsibility & Recognition | Awarded Social Impact Seal | Reinforce brand image, communicate positive societal influence, highlight economic/societal contributions |

| Corporate Communications | Announcements on strategic initiatives (e.g., Banco de Córdoba stake acquisition) | Inform stakeholders, manage market perception, support informed decision-making |

Price

Grupo Galicia's pricing strategy is designed to ensure its financial products are both competitive and accessible in Argentina. This approach considers current market demand, what competitors are charging, and the broader economic climate to position its offerings effectively.

For instance, in 2024, with inflation remaining a significant factor in Argentina, Grupo Galicia likely adjusted its fees and interest rates dynamically. While specific pricing details are proprietary, a common strategy involves offering tiered service packages or promotional rates on new accounts to attract customers, balancing revenue generation with market penetration.

Grupo Galicia's dividend payment policy underscores its dedication to shareholder value. For the fiscal year 2024, the company announced substantial dividend distributions, scheduled for payment in 2025, reflecting a consistent return of capital. These payouts are subject to a 7% withholding tax, a standard practice for such distributions.

Grupo Galicia's stock, GGAL, is a key indicator of investor sentiment, with recent analyst ratings leaning towards 'Buy' and price targets suggesting an upward trajectory. This positive outlook is further supported by its valuation metrics.

AI-driven analyses often highlight GGAL's undervaluation, pointing to a low Price-to-Earnings (P/E) ratio. For instance, as of early 2024, a P/E of around 4.5x was noted, significantly below industry averages, making it attractive to value investors.

Furthermore, GGAL offers an appealing dividend yield, which has historically been around 6-8% in recent years. This consistent income stream is a strong draw for investors seeking both capital appreciation and regular returns, bolstering overall investor confidence.

Dynamic Interest Rate Adjustments

Grupo Galicia's approach to pricing credit products, particularly mortgage loans, demonstrates a dynamic strategy responsive to market conditions. Initially, the bank may offer promotional low rates to attract customers. However, these rates are not static.

In 2024, a notable adjustment saw mortgage loan rates increase. This move reflects a strategic recalibration, likely influenced by factors such as market recovery post-economic shifts and the need to optimize product positioning for profitability and sustainability.

This flexibility in interest rate adjustments is a key component of their pricing strategy, allowing them to adapt to evolving economic landscapes and competitive pressures.

- Dynamic Pricing: Mortgage loan rates are adjusted based on market conditions and strategic goals.

- 2024 Adjustments: Rates were increased in 2024 after an initial period of promotional low rates.

- Market Responsiveness: Pricing reflects market recovery and the bank's product positioning strategy.

Capital Structure and Future Issuances

Grupo Galicia's capital structure strategy anticipates potential future capital raises through stock issuance, likely targeting the 2026-2027 timeframe. This move is closely tied to the anticipated recovery in private sector credit demand within Argentina. The bank is carefully monitoring market appetite for Argentine banking assets as a key factor in these future financing plans.

This forward-looking approach allows Grupo Galicia to manage its capital levels proactively and secure funding for anticipated growth opportunities. The timing of any issuance will be a strategic decision, balancing internal capital needs with favorable external market conditions.

- Capital Raising Timeline: Potential stock issuance eyed for 2026-2027.

- Key Trigger: Recovery in private sector credit demand in Argentina.

- Market Consideration: Assessment of investor appetite for Argentine banking assets.

Grupo Galicia's pricing strategy for its financial products is dynamic, aiming for competitiveness and accessibility within Argentina. This involves constant adjustments to fees and interest rates, especially in response to the country's volatile economic environment, such as the inflation experienced in 2024.

For instance, mortgage loan rates saw an increase in 2024, a strategic move following initial promotional low rates. This reflects an effort to optimize profitability and product positioning amidst market recovery and evolving economic landscapes.

The bank's dividend policy, with substantial distributions announced for 2024 payable in 2025, also influences investor perception of value, alongside a historically attractive dividend yield of around 6-8%.

Grupo Galicia's stock, GGAL, traded at a low Price-to-Earnings ratio of approximately 4.5x in early 2024, signaling potential undervaluation to investors.

4P's Marketing Mix Analysis Data Sources

Our Grupo Galicia 4P's Marketing Mix Analysis leverages a comprehensive blend of official financial disclosures, including annual reports and investor presentations, alongside detailed industry reports and competitive intelligence. This ensures a robust understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.