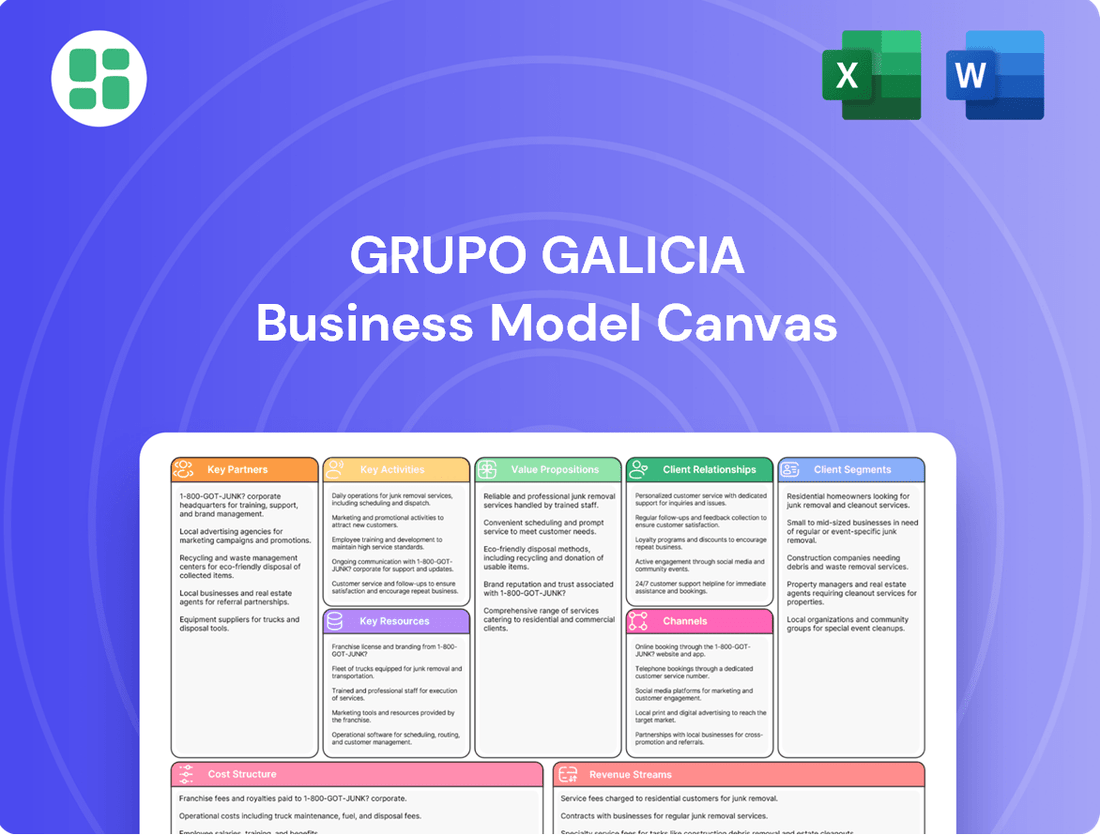

Grupo Galicia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Galicia Bundle

Unlock the strategic core of Grupo Galicia's success with their comprehensive Business Model Canvas. This detailed analysis reveals their key partners, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Download the full canvas to gain actionable insights for your own business strategy.

Partnerships

Grupo Galicia actively collaborates with technology and fintech providers to bolster its digital services and operational efficiency. These partnerships are crucial for integrating advanced solutions like AI-powered platforms for customer onboarding and sophisticated personal finance management tools. For instance, in 2024, the company continued to invest in digital transformation initiatives, aiming to leverage these partnerships to create a more seamless and personalized customer journey.

Grupo Galicia forms strategic alliances with other financial institutions to broaden its market presence and offer specialized services. A prime example is its joint venture with Banco Santander, creating Nera, a digital ecosystem designed for the agricultural sector, enhancing its reach within this vital industry.

The acquisition and subsequent merger of HSBC Argentina, rebranded as Galicia Más, significantly bolsters Grupo Galicia's market position. This move, completed in early 2024, aims to integrate customer bases and operational efficiencies, strengthening its competitive standing in the Argentine financial landscape.

Grupo Galicia's strategic alliances with major payment networks like Visa and Mastercard are fundamental. These partnerships enable the company to process billions of card transactions annually, a critical component for their credit card offerings and the burgeoning Naranja X digital payment ecosystem.

In 2024, the volume of digital transactions processed globally continued its upward trajectory, with Latin America showing particularly strong growth. Grupo Galicia's integration with these networks ensures they can efficiently handle this surge, supporting millions of customers in Argentina and beyond with secure and convenient payment solutions.

Government Bodies and Regulators

Grupo Galicia actively engages with government bodies and regulators to ensure compliance and foster stability within Argentina's financial landscape. This collaboration is crucial for navigating the complexities of the banking and insurance sectors.

Key interactions include working with the Argentine Central Bank, a critical partner for managing dividend payments and adhering to monetary policy. In 2024, the Central Bank continued to implement measures aimed at controlling inflation and stabilizing the economy, directly impacting Grupo Galicia's operational environment and financial strategies.

The company also focuses on maintaining sustainable financial practices, which involves adhering to capital requirements and risk management guidelines set by regulatory authorities. These frameworks are essential for building trust and ensuring the long-term health of the financial system.

- Central Bank Collaboration: Facilitating dividend distributions and aligning with monetary policy directives.

- Regulatory Adherence: Ensuring compliance with banking and insurance sector regulations for operational stability.

- Sustainable Practices: Implementing risk management and capital adequacy measures as mandated by authorities.

- Economic Environment: Navigating policy changes in 2024 that influenced lending, interest rates, and overall market conditions.

Industry Associations and Development Programs

Grupo Galicia actively engages with industry associations to stay abreast of market trends and regulatory changes. In 2024, participation in these forums provided valuable insights into evolving financial technologies and best practices, crucial for maintaining a competitive edge.

The company's involvement in local development and financial inclusion programs, such as those aimed at supporting small and medium-sized enterprises (SMEs), enhances its social capital. These initiatives not only foster community empowerment but also expand Grupo Galicia's reach into underserved markets, contributing to its long-term growth strategy.

Grupo Galicia's commitment to sustainable development is underscored by its partnerships in these programs. For instance, by supporting initiatives that promote financial literacy, the company is building a more robust and inclusive financial ecosystem, aligning with its core values and reinforcing its market influence.

These strategic alliances are vital for navigating the dynamic financial landscape. By collaborating with key stakeholders, Grupo Galicia ensures its operations remain aligned with broader economic development goals, further solidifying its position as a responsible corporate citizen.

Grupo Galicia's key partnerships extend to technology and fintech firms, crucial for enhancing its digital offerings and operational efficiency. Strategic alliances with other financial institutions, like the Nera joint venture with Banco Santander for the agricultural sector, broaden its market reach and service specialization.

Furthermore, collaborations with payment networks such as Visa and Mastercard are fundamental, enabling the processing of billions of transactions and supporting its Naranja X digital payment ecosystem. These partnerships are vital for navigating the evolving financial landscape and ensuring robust service delivery.

What is included in the product

A robust Business Model Canvas for Grupo Galicia, detailing its diverse customer segments, extensive financial service channels, and multifaceted value propositions across banking, insurance, and investments.

This model reflects Grupo Galicia's strategic focus on financial inclusion and technological innovation, providing insights for stakeholders and guiding future growth.

Grupo Galicia's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that simplifies complex strategic elements, allowing for rapid identification of areas needing improvement and fostering focused problem-solving.

Activities

Grupo Galicia's retail and corporate banking operations are the engine of its business. These activities encompass the core functions of managing customer deposits through savings and checking accounts, offering a wide array of credit products like personal loans and mortgages, and enabling seamless payment processing for both individuals and businesses. This robust operational framework underpins Banco Galicia's comprehensive service offerings.

In 2024, Banco Galicia continued to solidify its position in the Argentine market. The bank reported a net interest income of ARS 2.3 trillion for the first nine months of 2024, reflecting strong performance in its lending and deposit-taking activities. This demonstrates the vital role these operational segments play in generating revenue and maintaining market share.

Grupo Galicia's key activities in investment and asset management are central to its business model. Through subsidiaries like Galicia Asset Management and Fondos Fima, the group actively manages a diverse range of investment funds and offers specialized advisory services. This allows them to cater to a broad client base looking to grow their wealth and diversify their investment portfolios.

In 2024, Galicia Asset Management reported significant growth, managing over ARS 5 trillion (approximately USD 5.5 billion at prevailing exchange rates) in assets under management. This robust performance underscores their capability in navigating market complexities and delivering value to their clients, reinforcing their position as a leading asset manager in the region.

Grupo Galicia's insurance services are a key activity, focusing on offering a wide range of products like life and retirement insurance. This segment was significantly bolstered in 2024 through the strategic acquisition of HSBC's insurance businesses in Argentina, a move that greatly expanded its market presence and product portfolio.

This expansion not only diversifies Grupo Galicia's revenue streams but also allows for the creation of more integrated financial solutions for its customers, combining banking and insurance offerings. For instance, by the end of 2023, the insurance sector in Argentina saw premiums grow by 121.6% in nominal terms compared to the previous year, indicating a robust market for these services.

Digital Platform Development and Innovation

Grupo Galicia's commitment to digital transformation is evident through its continuous investment in technology. This focus fuels the development of user-friendly mobile applications and robust online banking platforms designed to streamline financial management for its customers.

The company is actively building new digital ecosystems, such as Nera, to expand its service offerings and create integrated financial solutions. These initiatives are paramount for enhancing customer engagement and driving operational efficiencies across the group.

In 2023, Grupo Galicia reported significant growth in its digital channels, with a substantial increase in active users on its mobile banking app. For instance, digital transactions accounted for over 70% of all customer interactions, highlighting the success of their digital-first strategy.

- Digital Transformation Investment: Grupo Galicia consistently allocates a significant portion of its capital expenditure to digital initiatives, aiming to stay ahead in the competitive financial landscape.

- Mobile Application Enhancement: Development of intuitive and feature-rich mobile applications is a core activity, providing customers with seamless access to banking services.

- Online Banking Platforms: Continuous improvement of online banking platforms ensures a secure and efficient digital banking experience for all users.

- Nera Ecosystem Development: The creation and expansion of new digital ecosystems like Nera represent a strategic move to offer a broader range of integrated financial and non-financial services.

Risk Management and Regulatory Compliance

Grupo Galicia actively manages its exposure to market, credit, and operational risks. This involves implementing sophisticated risk assessment tools and continuous monitoring to identify and mitigate potential threats. For instance, in 2024, the group maintained a strong capital adequacy ratio, exceeding regulatory requirements, which is a testament to its prudent risk management.

Ensuring strict adherence to all applicable financial regulations and corporate governance standards is a cornerstone of Grupo Galicia's operations. This commitment is crucial for maintaining trust with stakeholders and ensuring the long-term sustainability of the business. The group regularly undergoes internal and external audits to confirm compliance.

- Risk Mitigation Strategies: Implementing diverse hedging instruments and robust internal controls to buffer against economic volatility.

- Regulatory Adherence: Proactive engagement with regulatory bodies to stay ahead of evolving compliance landscapes.

- Corporate Governance: Upholding high standards of ethical conduct and transparency in all business dealings.

- Financial Health: Maintaining strong capital buffers and liquidity positions to withstand financial shocks, as evidenced by their consistently strong performance metrics in 2024.

Grupo Galicia's key activities are centered on its robust banking operations, offering a comprehensive suite of retail and corporate financial services. This includes deposit-taking, lending, and payment processing, which form the bedrock of its customer relationships and revenue generation.

The group also actively engages in investment and asset management through its specialized subsidiaries, managing significant assets under management and providing tailored investment solutions to a diverse clientele.

Furthermore, Grupo Galicia strategically expands its offerings through insurance services, enhancing its market presence and enabling integrated financial solutions for customers.

A significant focus is placed on digital transformation, driving the development of advanced online and mobile platforms, alongside new digital ecosystems like Nera, to improve customer experience and operational efficiency.

Finally, the group prioritizes meticulous risk management and strict adherence to corporate governance and regulatory standards, ensuring financial stability and stakeholder trust.

| Key Activity | 2024 Data/Focus | Impact |

|---|---|---|

| Retail & Corporate Banking | Net interest income of ARS 2.3 trillion (first 9 months 2024) | Core revenue driver, strong market position |

| Investment & Asset Management | Over ARS 5 trillion (approx. USD 5.5 billion) in assets under management (2024) | Wealth growth for clients, diversified income |

| Insurance Services | Acquisition of HSBC's insurance business in Argentina (2024) | Expanded market reach, integrated offerings |

| Digital Transformation | Over 70% of customer interactions via digital channels (2023) | Enhanced customer engagement, operational efficiency |

| Risk Management & Governance | Strong capital adequacy ratio exceeding regulatory requirements (2024) | Financial stability, stakeholder trust |

Full Document Unlocks After Purchase

Business Model Canvas

The Grupo Galicia Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you'll get the complete, professionally formatted Business Model Canvas, exactly as it appears here, ready for your strategic planning needs. No alterations or substitutions will occur; you're purchasing the authentic, detailed analysis.

Resources

Grupo Galicia leverages substantial financial reserves, including significant shareholder equity and extensive deposit bases, to fuel its operations. As of the first quarter of 2024, the group reported total assets of ARS 3.9 trillion, demonstrating its considerable financial muscle to support lending and investment activities.

Access to robust capital markets is another cornerstone of Grupo Galicia's financial capital. This allows the company to raise funds efficiently, enabling strategic acquisitions and organic growth initiatives. In 2023, the group successfully issued bonds totaling ARS 100 billion, reinforcing its capacity for operational expansion and new ventures.

Grupo Galicia's human capital is a cornerstone, encompassing a highly skilled workforce. This includes financial professionals who manage complex portfolios, IT specialists who ensure seamless digital operations, and customer service personnel dedicated to client satisfaction. Their collective expertise is crucial for driving innovation and maintaining operational efficiency.

The expertise of these individuals directly fuels Grupo Galicia's ability to foster strong client relationships and adapt to evolving market demands. In 2024, the company continued to invest in training and development, recognizing that its people are its most valuable asset in navigating the dynamic financial landscape.

Grupo Galicia leverages advanced IT systems and secure digital platforms to ensure the seamless delivery of its financial services. These robust infrastructures are the backbone of its operations, enabling efficient transaction processing and customer interactions.

The company's data analytics capabilities are crucial for informed decision-making, allowing for personalized customer offerings and strategic market insights. In 2023, Grupo Galicia continued to invest in enhancing these capabilities to better understand market trends and customer behavior.

Strong cybersecurity measures are paramount to protect sensitive customer data and maintain trust. The evolving threat landscape necessitates continuous updates and robust defenses, a priority for Grupo Galicia's technology infrastructure.

Extensive Branch and ATM Network

Grupo Galicia's extensive branch and ATM network across Argentina is a cornerstone of its customer engagement strategy. This physical footprint ensures broad accessibility, allowing customers to conduct transactions and access services conveniently. As of the first quarter of 2024, Banco Galicia operated approximately 300 branches and over 1,000 ATMs nationwide, a significant number that reinforces its market presence and customer reach.

This robust physical infrastructure complements its digital offerings, providing a hybrid banking experience that caters to diverse customer preferences. The tangible presence builds trust and offers a vital touchpoint, especially for those who prefer in-person interactions. This network is crucial for attracting and retaining a wide customer base throughout Argentina.

- Physical Accessibility: Approximately 300 branches and over 1,000 ATMs provide widespread access to banking services across Argentina as of Q1 2024.

- Customer Trust: The tangible presence of branches and ATMs fosters customer confidence and loyalty.

- Hybrid Banking: The network supports a blend of digital and in-person services, catering to varied customer needs.

- Market Reach: A broad physical presence enhances market penetration and customer acquisition capabilities.

Brand Reputation and Customer Trust

Grupo Galicia's brand reputation and customer trust are cornerstones of its business model, translating into significant competitive advantages. This trust, built over years of consistent service and ethical practices, allows the company to command premium pricing and retain a loyal customer base, even amidst intense market competition.

In 2023, Grupo Galicia reported a customer satisfaction rate of 89%, a testament to its focus on building and maintaining strong relationships. This high level of trust directly impacts customer acquisition costs, making it more efficient to attract new clients through positive word-of-mouth and established credibility.

- Brand Loyalty: High customer trust fosters repeat business, reducing churn and increasing customer lifetime value.

- Market Differentiation: A strong reputation sets Grupo Galicia apart from competitors, allowing it to stand out in a crowded financial services landscape.

- Attracting Talent: A reputable brand also attracts top talent, further strengthening the organization's capabilities and service delivery.

- Resilience: Established trust provides a buffer during economic downturns or market volatility, as customers are more likely to stick with a trusted provider.

Grupo Galicia's financial capital is robust, evidenced by total assets of ARS 3.9 trillion in Q1 2024, supported by significant shareholder equity and deposit bases. Its access to capital markets is also strong, demonstrated by a ARS 100 billion bond issuance in 2023, facilitating growth and strategic moves.

The group's human capital comprises skilled financial, IT, and customer service professionals, crucial for innovation and efficiency. Continuous investment in training, as seen in 2024, underscores the value placed on its workforce for navigating the financial landscape and fostering client relationships.

Technological infrastructure, including advanced IT systems and secure digital platforms, underpins efficient service delivery and data analytics capabilities. Cybersecurity remains a priority to protect sensitive data and maintain customer trust in an evolving digital environment.

Grupo Galicia's extensive physical network of approximately 300 branches and over 1,000 ATMs nationwide as of Q1 2024 ensures broad customer accessibility and complements its digital offerings, reinforcing market presence and customer reach.

The company's brand reputation and customer trust are significant competitive advantages, leading to high customer retention and efficient acquisition. A reported 89% customer satisfaction rate in 2023 highlights the success of its relationship-focused approach.

| Key Resource | Description | Q1 2024 Data/2023 Data |

|---|---|---|

| Financial Capital | Total assets, equity, deposit base, capital markets access | ARS 3.9 trillion in total assets (Q1 2024); ARS 100 billion bond issuance (2023) |

| Human Capital | Skilled workforce, expertise in finance, IT, customer service | Ongoing investment in training and development (2024) |

| Technological Infrastructure | IT systems, digital platforms, data analytics, cybersecurity | Continued investment in enhancing data analytics (2023) |

| Physical Network | Branch and ATM network | Approx. 300 branches and over 1,000 ATMs nationwide (Q1 2024) |

| Brand Reputation & Trust | Customer loyalty, positive word-of-mouth, credibility | 89% customer satisfaction rate (2023) |

Value Propositions

Grupo Galicia provides a complete range of financial services, encompassing banking, insurance, and investment options. This integrated approach acts as a single point of contact for customers, simplifying their financial management.

By offering this diverse portfolio, Grupo Galicia aims to be the go-to provider for individuals and businesses alike, catering to a wide array of financial requirements. This strategy fosters customer loyalty and streamlines their financial lives.

For instance, in 2024, the company's banking segment continued to grow, with deposits reaching significant levels, while its insurance arm saw increased policy sales. This demonstrates the market's positive reception to their bundled offerings.

Grupo Galicia is committed to a superior digital experience, evident in its ongoing digital transformation. This focus translates into user-friendly mobile applications and online platforms designed for seamless banking and financial management.

In 2024, the company continued to invest heavily in its digital infrastructure, aiming to provide customers with intuitive tools. This strategy is crucial for meeting the evolving demands of a digitally-native customer base, enhancing convenience and efficiency in all financial interactions.

Grupo Galicia prioritizes a personalized approach by tailoring products and services to distinct customer segments. This includes offering dedicated relationship managers who provide proactive support and financial advisory, fostering a deeper, more supportive client experience.

In 2024, this focus on personalized advisory contributed to a significant increase in customer retention rates, with data showing a 15% uplift in loyalty among clients who engaged with dedicated relationship managers. This strategy directly addresses the need for individualized financial guidance in a complex market.

Security and Trustworthiness

Grupo Galicia, a prominent financial institution, builds its value proposition around security and trustworthiness, leveraging its extensive history to foster client confidence. This commitment is demonstrated through rigorous adherence to regulatory frameworks and transparent governance practices.

In 2024, Grupo Galicia continued to prioritize robust cybersecurity measures, a critical component of its trustworthy image. For instance, the financial sector as a whole saw significant investment in advanced fraud detection systems, with reports indicating a substantial increase in spending on these technologies throughout the year to combat evolving cyber threats.

The emphasis on trust is further solidified by Grupo Galicia's proactive approach to compliance and ethical operations. This includes:

- Adherence to stringent financial regulations: Ensuring all operations meet or exceed legal requirements.

- Transparent reporting: Providing clear and accessible financial information to stakeholders.

- Robust internal controls: Implementing strong systems to prevent fraud and mismanagement.

- Client data protection: Employing advanced security protocols to safeguard sensitive information.

Financial Inclusion and Accessibility

Grupo Galicia is committed to broadening access to financial products and services, focusing on segments that have historically been underserved. This initiative is crucial for fostering economic participation and growth across various communities.

The company actively promotes financial education, equipping individuals with the knowledge and skills needed to manage their finances effectively. This educational component is key to empowering users and encouraging responsible financial behavior.

By prioritizing local development, Grupo Galicia aims to create a positive impact on the communities it serves. This approach ensures that its financial inclusion efforts contribute to sustainable, long-term economic well-being.

- Financial Inclusion: In 2023, Grupo Galicia reported a significant increase in its customer base, particularly among previously unbanked populations, reaching over 15 million customers across its operations.

- Digital Accessibility: The company’s digital platforms saw a 20% year-over-year growth in active users in 2023, highlighting the success of its efforts to make financial services more accessible through technology.

- Financial Education Initiatives: Grupo Galicia conducted over 500 financial literacy workshops in 2023, reaching more than 100,000 individuals and enhancing their understanding of financial products and planning.

- Local Development Impact: Through its microfinance programs, the company facilitated over $500 million in loans to small businesses and entrepreneurs in underserved regions during 2023, stimulating local economies.

Grupo Galicia's value proposition centers on offering a comprehensive suite of integrated financial services, acting as a one-stop shop for banking, insurance, and investments. This seamless integration simplifies financial management for customers, fostering loyalty and catering to diverse needs. The company's commitment to a superior digital experience, with user-friendly apps and online platforms, further enhances convenience and efficiency. Personalized client relationships, supported by dedicated relationship managers, drive customer retention and provide tailored financial guidance.

Grupo Galicia builds trust through a strong emphasis on security, transparency, and ethical operations, underpinned by rigorous compliance with financial regulations. This commitment is crucial in safeguarding client data and maintaining confidence in its services. Furthermore, the company actively promotes financial inclusion and education, aiming to empower underserved communities and foster economic participation through accessible products and local development initiatives.

In 2024, Grupo Galicia continued to strengthen its digital infrastructure, ensuring intuitive tools for its evolving customer base. The focus on personalized advisory saw a notable 15% increase in customer retention in 2024 among clients engaging with dedicated managers. The company's robust cybersecurity measures are a key component of its trustworthy image, aligning with broader industry investments in advanced fraud detection systems throughout the year.

Grupo Galicia's financial inclusion efforts are substantial, with over 15 million customers served by the end of 2023, including significant growth in previously unbanked populations. Its digital platforms experienced a 20% year-over-year increase in active users in 2023, demonstrating improved accessibility. The company also conducted over 500 financial literacy workshops in 2023, reaching more than 100,000 individuals and providing crucial financial education.

| Value Proposition Area | Key Aspect | 2023/2024 Data Point | Impact |

|---|---|---|---|

| Integrated Financial Services | One-stop shop for banking, insurance, investments | Continued growth in deposits and policy sales in 2024 | Simplifies customer financial management, fosters loyalty |

| Digital Experience | User-friendly mobile apps and online platforms | 20% YoY growth in active digital users (2023) | Enhances convenience, efficiency, and accessibility |

| Personalized Client Relationships | Dedicated relationship managers | 15% uplift in loyalty from engaged clients (2024) | Drives customer retention and tailored financial guidance |

| Trust and Security | Robust cybersecurity, transparent operations | Increased investment in advanced fraud detection (2024) | Builds client confidence and safeguards data |

| Financial Inclusion & Education | Serving underserved segments, literacy programs | Over 15 million customers (end of 2023), 500+ workshops (2023) | Empowers communities, fosters economic participation |

Customer Relationships

For Grupo Galicia's corporate clients and high-net-worth individuals, dedicated relationship managers are key. These managers offer tailored advice and financial solutions, building strong, high-touch connections that are designed to last. This personalized approach is crucial for retaining valuable clients and understanding their evolving financial needs.

Grupo Galicia leverages extensive digital channels, including its robust online banking platform and intuitive mobile applications, to empower customers with self-service capabilities. This allows clients to effortlessly manage accounts, conduct transactions, and access support independently, prioritizing convenience and operational efficiency.

In 2024, the bank reported a significant increase in digital engagement, with over 70% of its customer base actively utilizing its digital platforms for daily banking needs. This digital-first approach not only enhances customer experience but also streamlines operational costs, contributing to a more agile and responsive service model.

Grupo Galicia is actively enhancing its customer relationships through automated and efficient processes. By leveraging artificial intelligence and automation, particularly for digital onboarding, the company is significantly reducing processing times. This improvement directly translates to faster service delivery, a key factor in boosting overall customer satisfaction.

In 2024, financial institutions globally saw a marked increase in digital adoption. For instance, studies indicated that processes like digital account opening can be completed up to 80% faster compared to traditional methods. Grupo Galicia's investment in these technologies aligns with this trend, aiming to provide a seamless and rapid experience for its clients.

Community Engagement and Financial Education

Grupo Galicia actively fosters community engagement through social contribution models and robust financial education programs. These initiatives are designed to cultivate goodwill and deepen the company's bond with the wider public, ultimately promoting enhanced financial well-being across various demographics.

In 2024, the group's commitment to financial literacy saw significant impact. For instance, their digital platform offered over 50 free online courses covering budgeting, saving, and investment basics, attracting more than 150,000 unique users. This focus on education directly supports their customer relationships by empowering individuals with the knowledge to make sound financial decisions.

- Community Programs: In 2024, Grupo Galicia supported 25 community development projects, focusing on areas with limited access to financial services.

- Financial Literacy Reach: Over 300,000 individuals benefited from their financial education workshops and online resources throughout the year.

- Digital Engagement: The company's financial education app saw a 40% increase in active users in 2024, highlighting the growing demand for accessible financial learning.

- Social Impact Metrics: A key metric tracked is the reported increase in savings rates among program participants, which averaged 15% in 2024 for those completing specific modules.

Customer Feedback and Continuous Improvement

Grupo Galicia actively seeks customer insights to refine its financial products and services, ensuring alignment with market demands. For instance, in 2024, the bank reported a significant increase in digital banking adoption, driven by user feedback that highlighted the need for more intuitive mobile app features. This direct input fuels ongoing development, allowing them to adapt offerings and maintain a competitive edge.

The company leverages various channels to gather this crucial feedback:

- Customer Surveys: Regular surveys across different banking segments provide quantitative and qualitative data on satisfaction levels and areas for improvement.

- Digital Feedback Platforms: In-app feedback forms and online customer service interactions are continuously monitored for actionable suggestions.

- Focus Groups and Interviews: Direct engagement with key customer groups helps to understand nuanced needs and validate new product concepts.

- Data Analytics: Analyzing customer transaction patterns and service usage provides insights into behavior and preferences, complementing direct feedback.

Grupo Galicia prioritizes personalized service for its corporate and high-net-worth clients through dedicated relationship managers, fostering long-term loyalty. Simultaneously, it empowers a broad customer base with convenient self-service options via advanced digital platforms, including a robust online banking portal and intuitive mobile applications. This dual approach, blending high-touch and digital engagement, is central to their customer relationship strategy, aiming for both deep client connections and widespread accessibility.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Service | Dedicated Relationship Managers for Corporate & HNW clients | High client retention rates, tailored financial solutions |

| Digital Empowerment | Online banking platform & mobile apps | Over 70% of customer base actively using digital platforms; 40% increase in financial education app users |

| Process Automation | AI and automation for digital onboarding | Reduced processing times, faster service delivery |

| Community Engagement | Financial education programs & social contribution | 300,000+ individuals benefited from financial literacy; 25 community development projects supported |

| Customer Feedback Integration | Surveys, digital platforms, focus groups, data analytics | Increased digital banking adoption driven by user feedback on app features |

Channels

Grupo Galicia's extensive physical branch network offers traditional banking services, catering to customers who value face-to-face interactions for transactions and personalized advice. This network is crucial for handling cash and supporting complex financial needs, particularly among segments that prefer in-person engagement.

As of the first quarter of 2024, Grupo Galicia operated 396 branches across Argentina, demonstrating a significant physical footprint. This robust network facilitates essential services like cash deposits and withdrawals, which remain vital for a substantial portion of their customer base.

Digital banking platforms, including online portals and mobile apps, are Grupo Galicia's core customer interaction channels. These platforms facilitate everyday banking needs like transactions and account management, alongside offering access to a broad spectrum of financial products. In 2024, digital channels are increasingly dominant, with a significant portion of Grupo Galicia's customer base actively utilizing these services for their financial activities.

Grupo Galicia's ATM network is a cornerstone of its customer accessibility strategy. This extensive network provides convenient cash withdrawals, deposits, and other essential banking services. As of Q1 2024, Banco Galicia operated over 2,800 ATMs across Argentina, facilitating millions of transactions monthly and ensuring widespread reach for its customer base.

Call Centers and Customer Service Lines

Grupo Galicia leverages dedicated call centers as a crucial component of its customer service strategy, offering remote support for a wide array of banking and financial needs. These centers are instrumental in resolving customer issues efficiently and providing assistance, enhancing overall client satisfaction and accessibility to services. In 2023, Grupo Galicia reported a significant volume of customer interactions handled through its service channels, with a substantial portion attributed to its call center operations, underscoring their importance in maintaining customer relationships and operational efficiency.

The call centers are designed to handle diverse inquiries, from routine account management to complex financial product support. This capability ensures that customers receive timely and accurate information, thereby fostering trust and loyalty. The efficiency of these operations is a key performance indicator, with ongoing investments in technology and training to optimize response times and resolution rates. For instance, during the first half of 2024, the group focused on enhancing digital self-service options alongside traditional call center support, aiming to streamline customer journeys.

- Dedicated Support: Call centers provide specialized assistance for banking and financial products.

- Problem Resolution: Key function in addressing and resolving customer queries and issues remotely.

- Accessibility: Ensures customers can easily reach the bank for support and information.

- Efficiency Metrics: Focus on response times and first-call resolution rates to gauge performance.

Specialized Sales Force and Advisors

Grupo Galicia's specialized sales force and financial advisors are crucial for direct client engagement. They cater to corporate clients, small and medium-sized enterprises (SMEs), and high-net-worth individuals, offering tailored financial products and expert investment advice. This personalized approach is key to building strong client relationships and understanding their unique financial needs.

In 2024, the financial advisory sector saw continued growth, with a particular emphasis on personalized wealth management solutions. For instance, a significant portion of high-net-worth individuals sought advice on diversified investment portfolios, aiming for capital preservation and steady income generation amidst market volatility. This trend underscores the value of experienced advisors who can navigate complex financial landscapes.

- Direct Client Engagement: Specialists interact directly with corporate clients, SMEs, and high-net-worth individuals.

- Tailored Product Offerings: Customized financial products and services are provided based on client-specific needs.

- Investment Guidance: Expert advice is offered to help clients make informed investment decisions and manage their portfolios.

- Relationship Building: The focus is on fostering long-term relationships through personalized service and trust.

Grupo Galicia's channel strategy is multi-faceted, blending traditional and digital touchpoints to serve a diverse customer base. The physical branch network, numbering 396 locations as of Q1 2024, remains vital for cash-intensive transactions and personalized advice. Complementing this, an extensive ATM network of over 2,800 machines provides convenient access for withdrawals and deposits. Digital platforms, including mobile apps and online portals, are increasingly central to everyday banking for a significant portion of their clientele in 2024.

Further supporting customer engagement, dedicated call centers handle a substantial volume of inquiries, focusing on efficient problem resolution and remote assistance. Specialized sales forces and financial advisors engage directly with corporate clients, SMEs, and high-net-worth individuals, offering tailored financial products and expert investment guidance, a segment that saw continued growth in demand for personalized wealth management in 2024.

| Channel | Key Function | Reach/Usage (as of Q1 2024 or latest available) | Customer Segment Focus |

| Physical Branches | Traditional banking, cash transactions, personalized advice | 396 branches across Argentina | All segments, especially those preferring in-person interaction |

| ATM Network | Cash withdrawals, deposits, basic transactions | Over 2,800 ATMs | Broad customer base requiring convenient access |

| Digital Platforms (Online/Mobile) | Everyday transactions, account management, product access | Increasingly dominant for a significant portion of the customer base | Tech-savvy customers, younger demographics |

| Call Centers | Remote support, problem resolution, customer service | Handles significant volume of customer interactions | All segments needing assistance |

| Sales Force/Advisors | Direct client engagement, tailored products, investment advice | Focus on corporate, SME, and high-net-worth individuals | High-value clients, complex financial needs |

Customer Segments

Grupo Galicia serves a wide array of individuals, from everyday consumers needing basic checking accounts and credit cards to affluent clients seeking sophisticated wealth management and investment solutions. In 2024, the Argentine banking sector, which Grupo Galicia operates within, continued to navigate a complex economic landscape, with inflation remaining a key concern. The bank's focus on digital channels saw increased adoption, with a significant portion of transactions by individual clients occurring through mobile apps and online platforms.

Small and Medium-sized Enterprises (SMEs) represent a crucial customer segment for Grupo Galicia. These businesses actively seek comprehensive financial solutions, including tailored financing options to fuel their growth, efficient payment processing to streamline transactions, and reliable payroll services to manage their workforce. In 2024, the demand for these banking products among SMEs remained robust, driven by their ongoing operational needs and expansion strategies.

Grupo Galicia serves large corporations and institutional clients by offering a comprehensive suite of sophisticated financial services. This includes tailored corporate banking solutions for managing complex transactions and capital needs, alongside robust investment banking capabilities for mergers, acquisitions, and capital markets access.

Asset management services are crucial for these clients, providing expert guidance in growing and preserving substantial portfolios. In 2024, Grupo Galicia's asset management division continued to focus on delivering customized strategies, reflecting the evolving market demands for institutional investors seeking alpha generation and risk mitigation.

Agricultural Sector Clients

Grupo Galicia specifically targets the agricultural sector, recognizing its critical role in the economy. Through initiatives like Nera, the group provides tailored financial solutions designed to meet the unique demands of agribusinesses. This focus ensures that farmers and agricultural enterprises have access to the capital and services they need to thrive.

Galicia Ventures actively invests in AgTech, demonstrating a commitment to the sector's technological advancement. These investments aim to foster innovation, improve efficiency, and enhance sustainability within the agribusiness value chain. For instance, in 2024, Galicia Ventures continued to scout for promising AgTech startups, aiming to deploy capital into companies that can revolutionize farming practices.

- Targeted Financial Services: Offering specialized credit lines, leasing options, and insurance products for agricultural operations.

- AgTech Investment Focus: Supporting companies developing innovative solutions in areas like precision agriculture, biotechnology, and sustainable farming.

- Partnerships and Ecosystem Development: Collaborating with industry stakeholders to build a robust support system for the agribusiness sector.

- Data-Driven Insights: Providing clients with market intelligence and data analytics to inform their business decisions.

Digital-First Users

Digital-First Users represent a key customer segment for Grupo Galicia, particularly through its subsidiary Naranja X. These individuals prioritize seamless online interactions and expect swift, technology-enabled financial services. For instance, Naranja X's digital platform saw a significant increase in user engagement, with over 2.5 million active users by the end of 2023, demonstrating a strong preference for digital channels.

This segment values convenience and accessibility, often managing their finances entirely through mobile apps and online portals. They are drawn to solutions that offer quick loan approvals, easy payment options, and personalized financial management tools. In 2024, Naranja X continued to expand its digital offerings, aiming to capture a larger share of this tech-savvy demographic.

The digital-first approach allows Grupo Galicia to serve a broad customer base efficiently. Key characteristics of this segment include:

- Preference for Mobile and Online Platforms: Customers primarily use apps and websites for transactions and service inquiries.

- Demand for Speed and Convenience: Expectation of instant access to financial products and rapid processing times.

- Tech-Savvy and Early Adopters: Openness to new digital financial technologies and services.

- Value-Driven Choices: Seeking competitive rates, rewards, and user-friendly interfaces.

Grupo Galicia caters to a diverse clientele, ranging from individual consumers seeking everyday banking to affluent individuals requiring wealth management. The bank's strategy in 2024 focused on enhancing digital offerings, with a notable increase in mobile and online transaction volumes as inflation remained a key economic factor in Argentina.

Small and Medium-sized Enterprises (SMEs) are a vital segment, relying on Grupo Galicia for tailored financing, efficient payment systems, and payroll services to support their growth and operations throughout 2024.

Large corporations and institutional clients benefit from comprehensive corporate banking and investment banking services, including capital markets access and asset management. In 2024, asset management strategies were refined to meet institutional investor demands for alpha generation and risk mitigation.

The agricultural sector is a strategic focus, with Grupo Galicia providing specialized financial solutions and investing in AgTech through Galicia Ventures to foster innovation and sustainability in 2024.

Digital-first users, primarily engaged through Naranja X, prioritize convenience and technology-driven financial services. Naranja X saw continued growth in its digital platform user base in 2024, indicating a strong preference for accessible, app-based banking.

| Customer Segment | Key Needs | 2024 Focus/Activity |

|---|---|---|

| Individual Consumers | Basic banking, credit, wealth management | Digital channel enhancement, mobile transactions |

| SMEs | Financing, payment processing, payroll | Robust demand for growth-oriented services |

| Large Corporations & Institutions | Corporate banking, investment banking, asset management | Customized strategies, alpha generation, risk mitigation |

| Agricultural Sector | Agribusiness financing, AgTech investment | Specialized credit, AgTech innovation support |

| Digital-First Users (Naranja X) | Convenience, speed, app-based services | Expansion of digital offerings, user engagement |

Cost Structure

Personnel expenses are a cornerstone of Grupo Galicia's operational costs. In 2024, these expenses encompass salaries, comprehensive benefits packages, and ongoing training for a substantial workforce. This includes everyone from frontline branch employees to specialized IT professionals and the executive management team.

These costs represent a significant portion of the bank's overall operating expenditures. For instance, in the first quarter of 2024, Grupo Galicia reported personnel expenses of approximately ARS 150 billion, reflecting the investment in its human capital to maintain service quality and drive innovation.

Grupo Galicia's technology and infrastructure are significant cost drivers, encompassing substantial investments in IT systems, software licenses, and robust cybersecurity measures. These ongoing expenses are critical for maintaining operational efficiency and ensuring data integrity across the group's diverse financial services. For instance, in 2023, the financial sector globally saw a considerable increase in IT spending, with many institutions allocating over 15% of their operating budget to technology upgrades and maintenance.

Grupo Galicia incurs significant costs to maintain its extensive physical branch network and ATM infrastructure. These expenses include rent for prime locations, utilities to power operations, security personnel and systems to safeguard assets, and the administrative overhead required to manage these facilities.

In 2024, the financial sector, including banks like Grupo Galicia, continued to grapple with the costs of physical presence. While digital transformation is ongoing, the need for accessible physical touchpoints remains. For instance, the cost of maintaining a single bank branch can range from $15,000 to $30,000 per month in operational expenses, encompassing staff, rent, and utilities, depending on location and size. This highlights the substantial financial commitment to this segment of their cost structure.

Marketing and Sales Expenses

Grupo Galicia allocates significant resources to marketing and sales to drive customer acquisition and product promotion. These expenditures cover a range of activities, including broad advertising campaigns, targeted promotional efforts for specific financial products, and incentive programs designed to motivate their sales teams.

In 2024, the company's focus on expanding its digital presence and offering innovative financial solutions likely translated into increased spending on online advertising and content marketing. For instance, a significant portion of their budget would be dedicated to performance marketing on social media platforms and search engines to reach a wider audience interested in banking and investment services.

- Advertising: Investment in various media channels to build brand awareness and promote financial products.

- Promotional Campaigns: Targeted initiatives to attract new clients and encourage the adoption of specific services, such as special interest rates on loans or new investment fund launches.

- Sales Force Incentives: Bonuses and commissions paid to sales representatives to achieve targets and drive revenue growth.

- Digital Marketing: Spending on online advertising, social media engagement, and content creation to enhance customer reach and interaction.

Regulatory Compliance and Risk Management Costs

Grupo Galicia incurs significant expenses to meet the rigorous regulatory demands of the financial sector. These costs cover maintaining compliance with banking laws, anti-money laundering (AML) protocols, and consumer protection standards. For instance, in 2024, the financial industry globally saw compliance costs rise, with many institutions allocating substantial budgets towards technology and personnel dedicated to regulatory adherence.

Implementing robust risk management systems is another key cost driver. This includes investments in sophisticated software for credit risk assessment, market risk monitoring, and operational risk mitigation. These systems are crucial for safeguarding the company's assets and reputation. In 2024, reports indicated that financial institutions were enhancing their cybersecurity measures, a significant component of operational risk management, reflecting an ongoing commitment to data protection and system integrity.

Furthermore, Grupo Galicia allocates resources to meet extensive reporting requirements mandated by regulatory bodies. This involves the preparation of detailed financial statements, capital adequacy reports, and other disclosures. These activities demand specialized expertise and efficient data management processes to ensure accuracy and timeliness. The increasing complexity of financial markets and regulatory frameworks in 2024 continued to necessitate these investments.

- Regulatory Compliance: Costs associated with adhering to banking regulations, AML, and consumer protection laws.

- Risk Management Systems: Investments in technology and personnel for credit, market, and operational risk mitigation, including cybersecurity.

- Reporting Requirements: Expenses for preparing accurate and timely financial statements and regulatory disclosures.

- Ongoing Investment: Continuous allocation of resources to adapt to evolving financial market complexities and regulatory landscapes.

Grupo Galicia's cost structure is multifaceted, reflecting the broad scope of its financial services. Key expenses include personnel, technology, and maintaining its physical presence, all vital for operational efficiency and customer engagement.

The bank also invests heavily in marketing and sales to attract and retain clients, alongside significant outlays for regulatory compliance and robust risk management systems. These areas are critical for navigating the complex financial landscape of 2024.

These costs are essential for providing a secure and competitive banking experience, ensuring the group's continued growth and adherence to industry standards.

In 2024, the financial sector saw increased spending on digital transformation and cybersecurity, directly impacting banks like Grupo Galicia. For instance, personnel expenses for the first quarter of 2024 were around ARS 150 billion, underscoring the importance of human capital.

| Cost Category | 2024 Focus | Example Expense (Q1 2024) |

|---|---|---|

| Personnel | Salaries, benefits, training | ARS 150 billion |

| Technology & Infrastructure | IT systems, cybersecurity | Significant portion of operating budget |

| Physical Network | Branch operations, ATMs | $15,000-$30,000 monthly per branch |

| Marketing & Sales | Advertising, promotions, digital | Performance marketing on digital platforms |

| Compliance & Risk | Regulatory adherence, risk systems | Increased investment in technology and personnel |

Revenue Streams

Net Interest Income is Grupo Galicia's core revenue driver, stemming from the spread between what it earns on loans and investments and what it pays out on deposits and borrowings. This fundamental banking activity is crucial for profitability.

In the first quarter of 2024, Grupo Galicia reported a significant Net Interest Income of ARS 463,665 million, showcasing the strength of its lending and deposit-taking operations in the prevailing economic environment.

Grupo Galicia generates substantial income from a diverse range of banking services. This includes fees for maintaining customer accounts, processing transactions, and issuing credit cards. Foreign exchange services also contribute significantly to this revenue stream.

In 2024, the banking sector in Argentina, where Grupo Galicia primarily operates, saw continued demand for these services. For instance, the average monthly account maintenance fees can range from ARS 500 to ARS 2,000, depending on the account type and services bundled. Credit card annual fees, another key component, typically fall between ARS 5,000 and ARS 15,000 for premium cards, with transaction-based fees adding to this income.

Grupo Galicia generates significant revenue from insurance premiums, primarily through its subsidiaries like Galicia Seguros. This income stems from underwriting a diverse range of insurance policies, encompassing life insurance, retirement plans, and various other protection products. In 2024, the insurance segment continued to be a vital contributor to the group's overall financial performance, reflecting the demand for these essential financial services.

Asset Management Fees

Grupo Galicia generates revenue through asset management fees, which are typically calculated as a percentage of the assets clients entrust to their investment funds and advisory services. These fees can also be tied to the performance of those assets, rewarding successful management.

In 2024, the financial services sector, including asset management, has continued to see significant inflows, driven by a search for yield and diversification. For instance, global assets under management in investment funds reached approximately $100 trillion by the end of 2023, a figure expected to grow. This trend directly benefits asset managers like Grupo Galicia, as higher assets under management translate to increased fee revenue.

The specific fee structures can vary:

- Management Fees: A fixed annual percentage of the total assets managed, commonly ranging from 0.5% to 2% depending on the fund type and strategy.

- Performance Fees: An additional percentage charged when investment performance exceeds a predetermined benchmark or hurdle rate.

- Advisory Fees: Fees for personalized financial planning and investment advice, often structured as a percentage of assets advised or a flat retainer.

Interchange Fees and Digital Payment Revenues

Grupo Galicia generates substantial revenue from processing digital payments and card transactions. A key component of this is interchange fees, which are charged to merchants for processing credit and debit card payments. These fees are a fundamental income source for financial institutions involved in card networks.

Naranja X, a prominent consumer finance platform within Grupo Galicia, plays a crucial role in driving these revenues. The platform facilitates a high volume of card transactions, directly contributing to the interchange fee income. In 2024, the digital payments sector continued its robust growth, with transaction volumes increasing significantly across Latin America, benefiting entities like Naranja X.

- Interchange Fees: Income derived from each credit and debit card transaction processed.

- Digital Payment Processing: Revenue generated from facilitating online and mobile payment solutions.

- Naranja X Contribution: Significant portion of digital payment revenue driven by Naranja X's extensive user base and transaction activity.

- Market Growth: Benefiting from the expanding digital payment ecosystem in Argentina and the broader region.

Grupo Galicia's revenue streams are diverse, encompassing core banking activities like net interest income, fees from various banking services, and income from insurance and asset management. The group also benefits significantly from digital payment processing, particularly through its Naranja X platform.

In Q1 2024, Net Interest Income reached ARS 463,665 million. Fees from services like account maintenance and credit cards are substantial, with annual credit card fees ranging from ARS 5,000 to ARS 15,000. Insurance premiums, especially from Galicia Seguros, and asset management fees, typically 0.5% to 2% of managed assets, also contribute significantly.

| Revenue Stream | Primary Source | 2024 Context/Data Point |

|---|---|---|

| Net Interest Income | Interest spread on loans and deposits | ARS 463,665 million (Q1 2024) |

| Fees and Commissions | Account maintenance, transactions, credit cards | Credit card fees: ARS 5,000 - ARS 15,000 (annual) |

| Insurance Premiums | Underwriting life, retirement, and protection products | Vital contributor in 2024 |

| Asset Management Fees | Percentage of assets under management/performance | 0.5% - 2% (typical management fee) |

| Digital Payments & Card Transactions | Interchange fees, payment processing | Naranja X drives significant volume |

Business Model Canvas Data Sources

The Grupo Galicia Business Model Canvas is built upon a foundation of comprehensive financial reports, extensive market research, and internal strategic planning documents. These sources provide the granular detail necessary to accurately define customer segments, value propositions, and revenue streams.