Giant Network Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Network Group Bundle

Giant Network Group is strategically positioned with strong brand recognition and a vast operational network, but faces intense competition and evolving technological landscapes. Understanding these dynamics is crucial for navigating the market effectively.

Want the full story behind Giant Network Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Giant Network Group commands a strong position in China's gaming landscape, particularly in MMORPGs and mobile games. This focus is strategically aligned with market realities, as mobile gaming accounted for approximately 68% of China's gaming revenue in 2024, demonstrating its significant market share.

The company's expertise in these popular genres allows it to tap into a vast and engaged player base. Their established track record in developing and operating successful MMORPGs and mobile titles provides a competitive edge and a robust platform for continued growth.

Giant Network Group showcases significant strengths in game creation and ongoing management, highlighted by the sustained success of its 'Journey' franchise, now two decades old. This deep-seated experience translates into a reliable pipeline of engaging content.

The company's operational prowess is further validated by the swift market acceptance of its latest release, 'Supernatural Action Team,' which debuted in the first half of 2025. Its rapid ascent to top positions on iOS free and best-selling charts demonstrates effective launch strategies and post-release support.

Giant Network Group's strategic investment in AI is a significant strength, evidenced by their development of an AI production system powered by self-developed large models starting in 2023. This proactive approach positions them at the forefront of technological advancements in the gaming industry.

Further bolstering this strength is their robust collaboration network with leading domestic AI providers, including Alibaba, Tencent, and ByteDance. These partnerships provide access to cutting-edge AI capabilities, enhancing their development pipeline.

The practical application of this AI focus is evident in improved game development efficiency and enriched content. Games like 'Space Kill' showcase innovative features such as intelligent NPCs and dynamic plot generation, demonstrating tangible benefits from their AI integration.

Resilient Financial Performance with Strong Net Income Growth

Giant Network Group has demonstrated remarkable financial resilience, underscored by a significant increase in its net income. In 2024, the company's net income attributable to shareholders saw an impressive year-on-year surge of 31.15%, reaching 1.425 billion yuan. This robust growth reflects the company's strong operational efficiency and effective management strategies.

Looking ahead, analysts project continued performance elasticity for Giant Network Group into 2025, suggesting a sustained positive trajectory for profitability. This outlook is a testament to the company's ability to consistently generate value and adapt to evolving market conditions.

- Net income attributable to shareholders grew by 31.15% year-on-year in 2024.

- The company reported a net income of 1.425 billion yuan in 2024.

- Analysts anticipate continued performance elasticity and profitability in 2025.

- This strong net income growth highlights Giant Network Group's value generation capabilities.

Successful Mini-Game Strategy and Strong Community Engagement

Giant Network Group's strategic focus on the mini-game segment has proven highly effective. Their 'Journey' mini-program game alone onboarded over 25 million new users in 2024, generating a substantial 0.6 billion yuan in annual revenue. This success highlights their ability to tap into popular gaming trends and attract a large user base.

Furthermore, the company demonstrates a knack for cultivating organic growth through community engagement. The game 'Supernatural Action Team' thrives on spontaneous content sharing within its player base, bypassing the need for extensive promotional campaigns. This approach underscores Giant Network Group's strength in building and leveraging loyal communities.

- Mini-Game Success: 'Journey' mini-program attracted over 25 million new users in 2024.

- Revenue Generation: 'Journey' contributed 0.6 billion yuan to annual revenue in 2024.

- Community-Driven Growth: 'Supernatural Action Team' thrives on organic community dissemination.

Giant Network Group's core strength lies in its deep expertise within China's gaming market, particularly in MMORPGs and mobile games, which represented a significant 68% of China's gaming revenue in 2024. This specialization is further amplified by the enduring success of its 'Journey' franchise, now in its third decade, showcasing a consistent ability to develop and operate engaging titles. The company's financial performance is robust, with net income attributable to shareholders increasing by 31.15% year-on-year in 2024, reaching 1.425 billion yuan, with analysts projecting continued strong performance into 2025.

| Key Strength Area | Supporting Fact (2024/2025 Data) | Impact |

|---|---|---|

| Market Specialization | Mobile gaming ~68% of China's gaming revenue (2024) | Strong alignment with market demand |

| Proven Game Franchises | 'Journey' franchise: 20+ years of success | Reliable revenue stream and brand recognition |

| Financial Performance | Net income growth: +31.15% YoY (2024) | Demonstrates operational efficiency and profitability |

| AI Integration | AI production system development (since 2023) | Enhances development efficiency and content innovation |

What is included in the product

Delivers a strategic overview of Giant Network Group’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities for growth.

Weaknesses

Giant Network Group's revenue showed some choppiness, with a slight dip in 2024 from 2023 figures. This indicates that while the company is managing its bottom line well, the overall sales generation might be facing challenges or is sensitive to market changes. Such revenue volatility can make it harder for investors to predict future performance and can complicate strategic financial planning.

Giant Network Group's primary focus on the domestic Chinese online gaming market presents a significant weakness. This concentration means the company is highly susceptible to China's specific regulatory environment, economic fluctuations, and intense local competition. For instance, in 2023, China's gaming market, while robust, saw shifts in approval timelines for new games, directly impacting companies heavily reliant on new releases.

Giant Network Group operates within a fiercely competitive Chinese gaming landscape, dominated by giants like Tencent and NetEase. These established players command significant market share, boasting vast resources, extensive user bases, and diversified gaming portfolios that present a formidable challenge for smaller competitors. In 2023, Tencent's gaming revenue alone reached approximately $22.3 billion, highlighting the sheer scale Giant Network Group must contend with to gain traction.

Slowing Growth in Domestic User Base

Giant Network Group faces a significant challenge with the slowing growth of its domestic user base. The Chinese gaming market, while vast, is showing signs of maturity, with overall user growth moderating considerably. This trend directly impacts the company's ability to acquire new players within its core territory.

Data from the first half of 2025 indicates a modest 0.72% increase in the total number of Chinese game users. This marks the fourth consecutive year where user growth has remained below 1%, underscoring a significant slowdown. Such a trend suggests that the pool of new, untapped gamers in China is shrinking.

This deceleration in new user acquisition poses a direct hurdle for Giant Network Group's expansion strategies within its primary market. The company may need to rely more heavily on retaining existing users or exploring international markets to achieve substantial growth.

- Maturing Market: Chinese game user growth has been below 1% for four consecutive years, indicating a saturated domestic market.

- Slower Acquisition: The 0.72% user increase in H1 2025 highlights a reduced influx of new players.

- Growth Constraints: This slowdown directly limits Giant Network Group's capacity to significantly expand its player base in China.

Rising User Acquisition Costs in Mobile Gaming

The mobile gaming sector, while massive in China, is grappling with escalating user acquisition costs. This means companies like Giant Network Group must spend more money to get new players to download and engage with their games.

This upward trend in marketing expenses directly squeezes profit margins. For free-to-play games, which depend on a large player base for in-game purchases, higher acquisition costs can significantly dent overall profitability.

- Rising Acquisition Costs: Industry-wide increases in the cost to acquire new mobile game users are a significant challenge.

- Profitability Impact: Higher marketing and promotional spending directly reduces the profitability of game operations.

- Margin Erosion: For free-to-play models, this trend can lead to substantial erosion of profit margins due to increased reliance on user volume.

- 2024/2025 Trend: Projections for 2024 and 2025 indicate continued pressure on user acquisition costs across major mobile gaming markets, including China.

Giant Network Group's reliance on the Chinese domestic market leaves it vulnerable to regulatory shifts and intense local competition. The company's revenue experienced a slight dip in 2024, reflecting market sensitivities and potential challenges in sales generation. Furthermore, the slowing growth of its user base in China, with user growth remaining below 1% for four consecutive years, directly limits expansion opportunities within its core territory.

The escalating cost of acquiring new users in the mobile gaming sector, particularly in China, presents a significant hurdle. This trend directly impacts profit margins, especially for free-to-play games that depend on a large player base for in-game purchases. Projections for 2024 and 2025 indicate continued pressure on these acquisition costs.

| Weakness | Description | Impact | 2024/2025 Data Point |

| Market Concentration | Heavy reliance on the Chinese domestic gaming market. | Vulnerability to regulatory changes and local competition. | China's gaming market saw shifts in approval timelines in 2023. |

| Slowing User Growth | Moderating user acquisition in China. | Limits expansion potential in the core market. | Chinese game user growth below 1% for four consecutive years (ending 2024). |

| Rising Acquisition Costs | Increasing expenses to acquire new mobile game players. | Erosion of profit margins, especially for F2P models. | Continued pressure on user acquisition costs projected for 2024-2025. |

Preview the Actual Deliverable

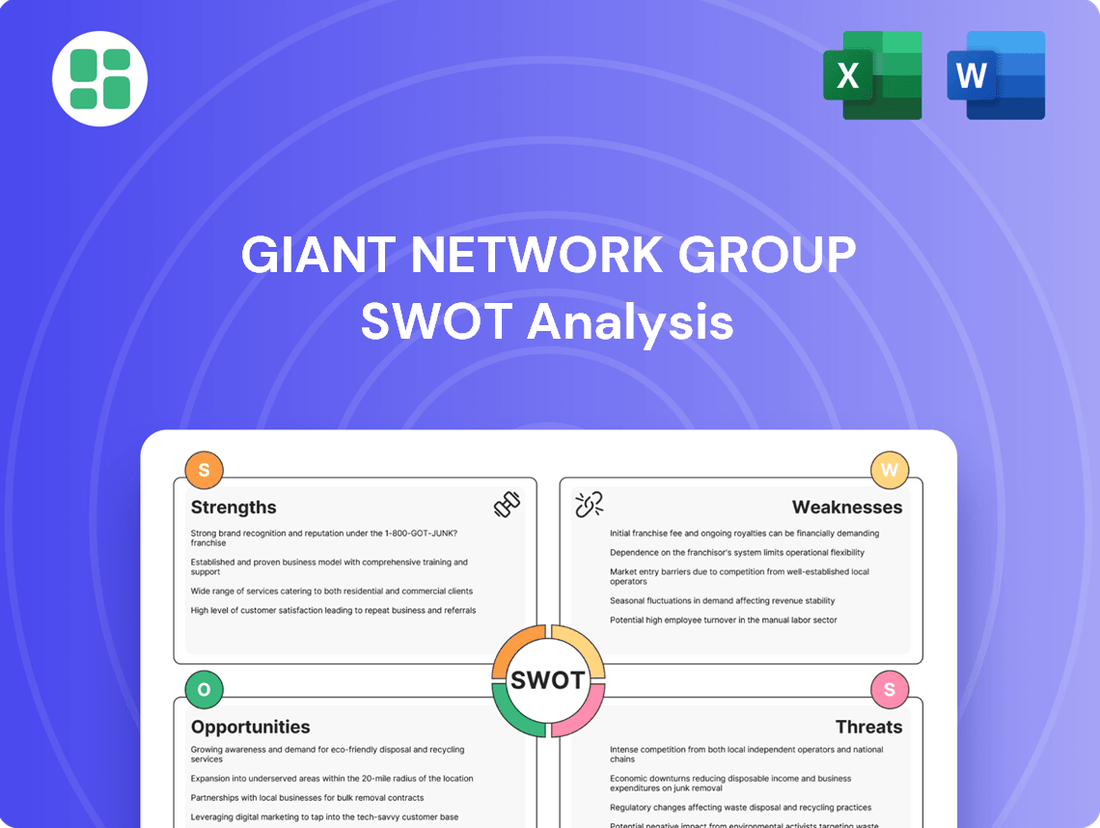

Giant Network Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Giant Network Group's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

Opportunities

The Chinese gaming market is a significant opportunity, with projections indicating it will reach USD 66.66 billion in 2025. This robust growth is expected to continue, with the market forecast to expand to USD 107.98 billion by 2030, demonstrating a compound annual growth rate of 10.13%.

This strong upward trend, fueled by consistent domestic demand, offers Giant Network Group a substantial avenue to boost its revenue streams and capture a larger share of this expanding market. The favorable industry outlook creates an encouraging landscape for strategic investments and business expansion.

China's gaming regulatory landscape is showing signs of significant relaxation, offering a more supportive environment for companies like Giant Network Group. The government's approval of 127 new game titles in April 2025, following a substantial 115 approvals in January 2024, demonstrates a clear shift towards fostering growth and innovation.

This easing of restrictions directly translates into reduced uncertainty for game developers and publishers, paving the way for more predictable revenue streams and expanded market access. The increased pace of approvals suggests new opportunities for game releases and diversified monetization strategies within the crucial Chinese market.

Console gaming in China is booming, with revenues jumping almost 30% in the first half of 2025 alone. This surge highlights a significant opportunity for Giant Network Group to expand its reach.

With projections indicating this segment will grow at a 14% compound annual growth rate through 2030, it's clearly the fastest-growing platform. Giant Network Group can capitalize by creating or distributing more games that work across multiple platforms, thereby accessing a fresh and eager audience.

Leveraging AI for Enhanced Game Development and Monetization

Giant Network Group can significantly boost its game development and monetization by integrating artificial intelligence. AI offers the potential to create more engaging gameplay through dynamic plot generation and smarter non-player characters, leading to higher player retention. For instance, AI can analyze player behavior to offer personalized in-game purchases, a strategy that saw the global in-game purchase market reach an estimated $125.5 billion in 2023.

Furthermore, AI can streamline the development process itself, reducing costs and time-to-market for new titles. This efficiency, coupled with AI-driven insights into player preferences, could unlock innovative monetization avenues, such as tiered subscription models or AI-curated content. Giant Network Group's prior investments in AI research and development provide a strong foundation to exploit these opportunities.

- Enhanced Game Design: AI can assist in procedural content generation and balancing, leading to more replayable and engaging experiences.

- Intelligent NPCs: Developing AI-powered NPCs that exhibit more complex behaviors and adaptive strategies can significantly deepen player immersion.

- Personalized Monetization: AI can analyze player data to tailor offers and in-game purchases, potentially increasing average revenue per user (ARPU).

- Development Efficiency: AI tools can automate tasks like bug testing and asset creation, accelerating the development lifecycle.

Globalization and Increased Revenue from Overseas Markets

The robust performance of Chinese self-developed games internationally presents a significant avenue for revenue growth. Overseas sales for these titles reached over $9.5 billion in the first half of 2025, marking an 11.07% increase year-on-year.

This escalating global demand offers Giant Network Group a prime opportunity to expand its reach beyond the domestic market. Diversifying revenue streams through international sales can bolster overall profitability and mitigate risks associated with market concentration.

- Expanding into new territories can tap into previously unreached player bases.

- Leveraging successful game IPs globally can drive significant revenue increases.

- Strategic partnerships in key overseas markets can accelerate market penetration.

- Adapting game content to local preferences can enhance player engagement and monetization.

The Chinese gaming market's projected growth to USD 66.66 billion by 2025 and USD 107.98 billion by 2030 presents a substantial revenue opportunity for Giant Network Group. This expansion is supported by a more relaxed regulatory environment, evidenced by 127 new game approvals in April 2025, which reduces development uncertainty and opens doors for new releases.

The console gaming segment in China is experiencing rapid growth, with revenues up nearly 30% in the first half of 2025 and a projected CAGR of 14% through 2030, offering Giant Network Group a chance to tap into this fast-growing platform. Furthermore, the increasing overseas sales of Chinese self-developed games, exceeding $9.5 billion in the first half of 2025, highlight a significant opportunity for international revenue diversification.

AI integration offers a dual benefit of enhancing game design through procedural content generation and intelligent NPCs, while also improving monetization via personalized player offers, a market that reached $125.5 billion in 2023. AI can also streamline development, reducing costs and time-to-market for new titles.

| Market/Technology | 2025 Projection | Growth Driver | Giant Network Group Opportunity |

|---|---|---|---|

| Chinese Gaming Market | USD 66.66 billion | Domestic Demand, Relaxed Regulations | Increased Revenue, Market Share Expansion |

| Console Gaming (China) | 14% CAGR (through 2030) | Surging Revenue Growth | Access to New Audiences, Cross-Platform Strategy |

| AI in Gaming | N/A (Technology Integration) | Player Engagement, Monetization Efficiency | Enhanced Gameplay, Streamlined Development, Personalized Revenue |

| Overseas Game Sales (China) | USD 9.5+ billion (H1 2025) | Global Demand for Chinese IPs | International Revenue Diversification, Risk Mitigation |

Threats

Despite recent indications of regulatory easing, the Chinese government continues to exert significant control over the gaming sector. This oversight focuses on areas like content censorship, restrictions on playtime for minors, and how games generate revenue. The possibility of abrupt policy changes or the reintroduction of stricter measures poses a substantial risk, as evidenced by prior regulatory proposals that previously destabilized the market.

These potential policy shifts could directly impede Giant Network Group's operational activities and negatively affect its income. For instance, in 2023, China issued new draft gaming regulations that, while later softened, initially caused a significant drop in the market capitalization of major gaming companies. Such volatility underscores the persistent threat of regulatory intervention impacting business continuity and financial performance.

The Chinese gaming landscape is becoming increasingly crowded, with new, dynamic studios emerging and rapidly gaining traction. These agile competitors are adept at creating fresh intellectual property (IP) that resonates quickly with players, posing a significant challenge to established companies like Giant Network Group.

For instance, by the end of 2024, reports indicated that over 30 new Chinese gaming studios had secured significant funding rounds, signaling a surge in new market entrants. This heightened competition means Giant Network Group must consistently invest in developing novel games and refreshing its existing IP portfolio to stay ahead.

The rapid pace of innovation driven by these emerging studios demands a proactive approach. Giant Network Group's ability to adapt and introduce compelling new content will be crucial in defending its market share against these agile challengers who are quickly capturing player interest with their unique IPs.

While China's gaming market continues to expand, the pace of new user acquisition has notably decelerated. This slowdown, with only a 0.72% rise in game users during the first half of 2025, signals a maturing industry.

This trend suggests that the market is approaching saturation, making it increasingly challenging for companies like Giant Network Group to rely solely on attracting new players for significant growth.

Consequently, moderated demand could impact revenue streams, necessitating a strategic shift towards retaining existing users and exploring new avenues for monetization beyond simple user base expansion.

Economic Uncertainties Impacting Consumer Spending

Broader macroeconomic uncertainties and shifts in consumer sentiment directly influence discretionary spending on entertainment, including online games and in-game purchases for companies like Giant Network Group. For instance, forecasts for global GDP growth in 2024 have been revised, with the IMF suggesting a modest 3.2% expansion, a figure that can be sensitive to geopolitical events and inflation. A downturn in the economy or a decline in consumer confidence, as seen in fluctuating consumer sentiment indices globally, could lead to reduced player spending, impacting Giant Network Group's revenue and profitability. The industry's performance is susceptible to wider economic pressures, with reports indicating that consumer spending on entertainment can contract by as much as 5-10% during periods of significant economic contraction.

- Global economic forecasts for 2024 indicate a growth rate of approximately 3.2%, highlighting potential vulnerabilities.

- Consumer sentiment, a key driver of discretionary spending, has shown volatility, impacting industries reliant on non-essential purchases.

- Economic downturns can lead to a direct reduction in player spending within the online gaming sector, affecting revenue streams.

- The gaming industry's susceptibility to broader economic pressures means that a significant economic contraction could see a decline in consumer expenditure on games.

Rapid Technological Evolution and Changing Player Preferences

The gaming sector is a whirlwind of technological change and shifting player tastes. Giant Network Group faces a significant threat if it can't keep pace with innovations like virtual reality (VR), augmented reality (AR), and cloud gaming. For instance, the global cloud gaming market was projected to reach approximately $11.5 billion in 2024, highlighting the importance of adapting to these new platforms.

Furthermore, player preferences are always on the move, demanding new game genres and monetization strategies. A failure to anticipate and respond to these evolving demands, such as the increasing popularity of free-to-play models with in-game purchases, could render existing offerings obsolete. The mobile gaming market, a key area for many companies, saw its revenue grow by an estimated 8.4% in 2024, reaching over $90 billion, underscoring the need for adaptable business models.

To stay competitive, continuous investment in research and development (R&D) and agile development practices are absolutely crucial. This includes exploring new game engines, AI integration for more dynamic gameplay, and understanding player data to inform future development. Companies that lag in R&D spending risk falling behind, as evidenced by the significant R&D investments made by leading gaming firms in 2024, often exceeding hundreds of millions of dollars.

- Technological Obsolescence: The risk of VR, AR, and cloud gaming technologies rapidly surpassing current offerings.

- Shifting Player Preferences: The challenge of adapting to new game genres and monetization models like subscription services or battle passes.

- R&D Investment Gap: The potential for competitors to gain an edge through superior technological innovation and faster development cycles.

Intensifying competition from agile new studios, often backed by significant funding as seen with over 30 new Chinese studios securing funding in late 2024, poses a direct threat to Giant Network Group's market share. These emerging players quickly capture player interest with fresh intellectual property, necessitating continuous innovation from established companies to maintain relevance.

SWOT Analysis Data Sources

This Giant Network Group SWOT analysis is built upon a robust foundation of data, drawing from their official financial reports, comprehensive market intelligence, and insights from industry experts to provide a well-rounded perspective.