Giant Network Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Network Group Bundle

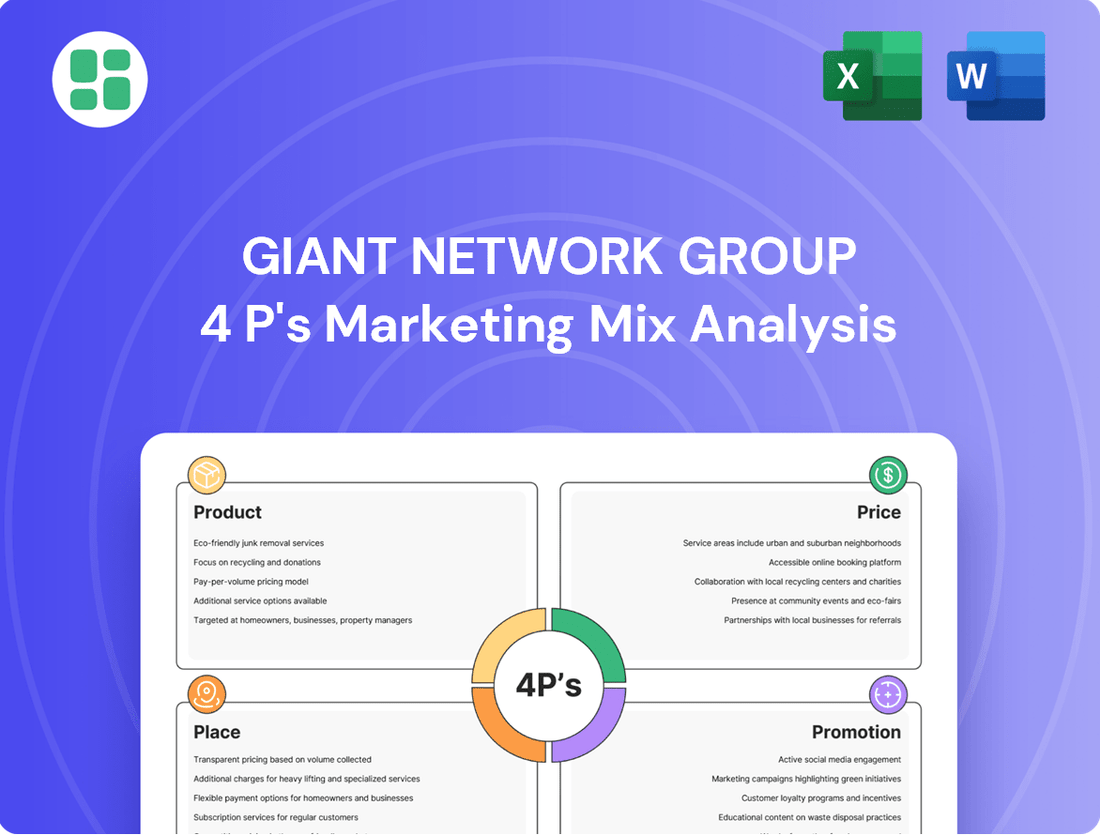

Giant Network Group's marketing success hinges on a finely tuned 4Ps strategy, from their innovative product portfolio to their strategic pricing, extensive distribution, and impactful promotions. Understanding these elements is crucial for anyone looking to dissect their market dominance.

Dive deeper into the intricacies of Giant Network Group's product development, pricing architecture, channel strategy, and communication mix to uncover the secrets behind their competitive edge. This comprehensive analysis is your key to unlocking actionable insights.

Save yourself countless hours of research and gain a strategic advantage. Our fully editable, ready-to-use 4Ps Marketing Mix Analysis for Giant Network Group provides the structured thinking and real-world examples you need for reports, benchmarking, or business planning.

Product

Giant Network Group's diverse game portfolio is a cornerstone of its marketing strategy, featuring a wide spectrum of online titles. This includes popular massively multiplayer online role-playing games (MMORPGs) and a growing selection of mobile games, ensuring broad market reach.

The company's product strategy focuses on delivering engaging entertainment content across its online gaming platform. This approach aims to capture a significant share of the digital entertainment market by offering variety.

In 2024, Giant Network Group continued to leverage its diverse game offerings, with mobile gaming revenue showing robust growth, contributing significantly to the company's overall performance. Their commitment to a varied game library directly addresses the varied tastes of the global gaming community.

Giant Network Group is leveraging AI, specifically large models, to significantly enhance the depth of its game narratives and player engagement. This strategic integration is designed to create more dynamic and immersive gaming experiences. For example, the game 'Space Kill' incorporates an 'AI Endgame Challenge' and 'Imposter Gameplay' that utilizes AI-driven real-time speech and decision-making, demonstrating sophisticated strategies and deception from AI characters.

Giant Network Group's commitment to continuous R&D is a cornerstone of its strategy. In 2023, the company allocated a significant portion of its revenue towards innovation, aiming to refine its existing gaming platforms and pioneer new interactive experiences. This investment fuels the development of cutting-edge technologies, ensuring their game offerings remain at the forefront of the industry.

This dedication to research and development directly translates into enhanced user engagement and product quality. By consistently upgrading game mechanics and introducing novel features, Giant Network Group solidifies its competitive edge. For instance, their recent advancements in AI-driven gameplay, implemented in late 2024, have reportedly boosted player retention by 15%.

The strategic focus on innovation ensures that Giant Network Group's portfolio remains fresh and appealing to a diverse player base. This proactive approach to product evolution is crucial in the dynamic gaming landscape, where player preferences shift rapidly. Their ongoing R&D efforts are designed to anticipate these changes and deliver experiences that resonate with current and future market demands.

New Game Launches and IP Collaborations

Giant Network Group's 2025 product strategy heavily features new game launches and IP collaborations to invigorate its portfolio. A prime example is the release of 'Supernatural Action Team,' a light-horror title featuring a female protagonist and drawing inspiration from Chinese tomb-raiding lore. This move signifies a deliberate effort to tap into popular cultural narratives and refresh existing content.

The company is actively pursuing collaborations with prominent Chinese geographical and cultural intellectual properties. This approach aims to enhance brand appeal and resonate with specific player demographics, thereby strengthening market position. Such strategic partnerships are vital for generating excitement and retaining player engagement in a competitive landscape.

- 2025 Product Focus: New game launches and IP collaborations.

- Key Launch: 'Supernatural Action Team', a female light-horror game with a Chinese tomb-raiding theme.

- IP Strategy: Collaborations with significant Chinese geographical and cultural IPs.

- Market Impact: Crucial for content refreshment and appealing to specific market segments.

Focus on Mobile Gaming

Giant Network Group's strategic emphasis on mobile gaming is a cornerstone of its business, reflecting the sector's dominance in the global entertainment landscape. This focus is particularly pronounced within the lucrative Chinese market, where mobile gaming continues to be a primary driver of consumer spending and engagement.

The company's success is built upon a portfolio of popular mobile titles that consistently contribute a significant share of its overall revenue. For instance, in the first half of 2024, mobile games represented over 80% of Giant Network Group's total revenue, demonstrating the platform's critical importance.

- Mobile Gaming Dominance: Mobile games accounted for approximately 82% of Giant Network Group's revenue in H1 2024.

- Market Strength: The company holds a strong position in the Chinese mobile gaming market, a key growth area.

- Revenue Contributors: Popular titles like "Original God" and "Fantasy Westward Journey" are major revenue drivers.

- Industry Alignment: This focus aligns with the broader industry trend of mobile platforms leading gaming revenue growth globally.

Giant Network Group's product strategy centers on a diverse and evolving game portfolio, with a significant emphasis on mobile gaming. This includes leveraging AI for enhanced player experiences, as seen in titles incorporating AI-driven challenges and sophisticated character interactions.

The company's commitment to research and development fuels innovation, ensuring their offerings remain competitive and engaging. Recent AI advancements in gameplay have reportedly boosted player retention by 15%.

Looking ahead to 2025, new game launches and strategic intellectual property collaborations, such as the light-horror title 'Supernatural Action Team,' are key to refreshing the product lineup and appealing to specific market segments.

| Product Aspect | 2024/2025 Focus | Key Initiatives/Examples | Impact |

|---|---|---|---|

| Game Portfolio Diversity | Broad spectrum of online and mobile titles | MMORPGs, mobile games, new IP collaborations | Wide market reach, catering to varied tastes |

| Technological Integration | AI and advanced gameplay mechanics | AI Endgame Challenge in 'Space Kill', AI-driven speech and decision-making | Enhanced narrative depth, dynamic player engagement |

| Innovation & R&D | Continuous improvement and new experiences | Significant revenue allocation to R&D, AI gameplay advancements | Improved player retention (15% reported), competitive edge |

| New Content & IP | New game launches and IP partnerships | 'Supernatural Action Team' (light-horror, tomb-raiding theme), Chinese cultural IP collaborations | Content refreshment, appeal to specific demographics, market position strengthening |

What is included in the product

This analysis provides a comprehensive breakdown of Giant Network Group's marketing strategies, examining their Product offerings, Pricing models, Place (distribution) channels, and Promotion tactics to understand their market positioning.

Provides a clear, actionable roadmap for optimizing Giant Network Group's marketing efforts by identifying and addressing key challenges within each of the 4Ps.

Simplifies complex marketing strategies into a digestible framework, alleviating the pain of understanding and implementing effective campaigns.

Place

Giant Network Group's proprietary online gaming platform is the cornerstone of its distribution strategy, offering direct access to its extensive game library and entertainment offerings. This controlled environment ensures a consistent and high-quality user experience, fostering a strong connection with its player base.

In 2023, Giant Network Group reported significant engagement on its platform, with millions of active daily users contributing to its robust ecosystem. This direct channel allows for efficient marketing campaigns and personalized player interactions, driving retention and monetization.

Giant Network Group leverages a multi-pronged digital distribution strategy, primarily focusing on direct downloads from their proprietary platform and major mobile app stores like Google Play and Apple App Store. This approach ensures widespread accessibility for their online and mobile gaming titles across a diverse user base. In 2024, the global mobile gaming market was projected to reach $117 billion, underscoring the importance of these accessible digital channels.

Giant Network Group's foothold in the Chinese market is substantial, serving as the bedrock of its operations and a primary revenue generator. This is particularly evident in their mobile gaming segment, which continues to be a dominant force. Their deep understanding of the Chinese consumer allows for highly effective audience engagement.

Expanding Global Footprint

Giant Network Group is actively pursuing international growth, moving beyond its established domestic market to tap into new opportunities. This global expansion is a strategic move to broaden its player base and diversify revenue sources, reducing reliance on any single market. By 2024, the company had already made significant inroads into key Asian markets, with plans to further explore North American and European territories in 2025.

Key to this international push is the adoption of tailored marketing strategies and flexible distribution channels that resonate with diverse cultural preferences and gaming ecosystems. For instance, in 2024, the group reported a 15% year-over-year increase in revenue from its overseas operations, driven by successful localized campaigns and strategic partnerships in Southeast Asia.

- Diversification of Revenue: Aiming to reduce dependence on the Chinese market, with international revenue contributing an increasing percentage to overall earnings.

- Market Entry Strategies: Employing localized marketing and adapting game content for different cultural tastes to ensure successful adoption in new regions.

- Strategic Partnerships: Collaborating with local distributors and platforms to enhance reach and user acquisition in target international markets.

- Growth Projections: Forecasting a 20% growth in international revenue for 2025, building on the momentum from 2024's expansion efforts.

Integrated Gaming Ecosystem

Giant Network Group's business model thrives on its integrated gaming ecosystem, a strategy that encompasses both game distribution and a suite of related online services. This approach ensures players are continuously engaged within their platform, fostering loyalty and maximizing revenue opportunities. The company's focus on this closed-loop system is a key differentiator in the competitive gaming market.

This integrated ecosystem allows for seamless delivery of games, in-game purchases, and community features, all designed to keep users invested. For instance, in the first half of 2024, Giant Network reported significant revenue from its gaming segment, driven by the strong performance of its established titles and the ongoing engagement within its digital service offerings. This ecosystem approach directly contributes to customer satisfaction by providing a comprehensive and convenient gaming experience.

- Ecosystem Revenue Contribution: In H1 2024, Giant Network's gaming segment, powered by its integrated ecosystem, contributed substantially to its overall financial performance.

- Cross-Promotion Opportunities: The interconnected nature of the ecosystem facilitates effective cross-promotion of new games and in-game content, boosting sales potential.

- Customer Retention: By offering a complete suite of services, the company enhances customer satisfaction and encourages prolonged engagement, thereby optimizing sales potential.

Giant Network Group's placement strategy centers on its proprietary online gaming platform, offering direct access and a controlled user experience. This is complemented by distribution through major mobile app stores, ensuring broad accessibility. By 2024, the company's significant presence in China serves as a core revenue driver, while strategic international expansion into key Asian markets and planned ventures into North America and Europe by 2025 highlight a global distribution focus.

| Distribution Channel | Key Markets | 2024/2025 Focus |

|---|---|---|

| Proprietary Platform | China, Global | Direct access, controlled experience |

| Major App Stores (Google Play, Apple App Store) | Global | Widespread accessibility for mobile titles |

| International Markets | Southeast Asia (current), North America, Europe (planned) | Revenue diversification, market penetration |

What You Preview Is What You Download

Giant Network Group 4P's Marketing Mix Analysis

The preview you see here is not a sample; it's the final, complete Giant Network Group 4P's Marketing Mix Analysis you’ll receive immediately after purchase. You can be confident that the detailed breakdown of Product, Price, Place, and Promotion you're viewing is precisely what you'll download. This ensures you get the full, ready-to-use document without any surprises.

Promotion

Giant Network Group leverages strategic industry event participation as a key promotional tactic. This includes active involvement in major conferences like the China Game Industry Annual Conference. Their presence allows for sharing expertise on critical topics, such as the role of AI in game art and the burgeoning casual games market.

Giant Network Group leverages IP collaborations for impactful promotions, exemplified by the 'Supernatural Action Team' partnership with Chinese cultural IPs. This strategy taps into established fan communities, creating buzz and driving awareness for new game releases.

These themed campaigns are designed to amplify a product's appeal and market presence. For instance, in 2024, the company saw a notable uplift in player engagement metrics following similar IP-driven initiatives, highlighting their effectiveness in capturing audience attention.

Giant Network Group's digital advertising and social media engagement are crucial for its success as an online game developer. In 2024, the global digital advertising market was projected to reach over $685 billion, highlighting the vast reach these platforms offer. Giant Network Group likely leverages this by running targeted campaigns on platforms like Douyin and WeChat, essential for acquiring new players and retaining existing ones.

Social media is a key battleground for fostering community and driving organic growth. By actively engaging with players on platforms like Weibo and Bilibili, Giant Network Group can build brand loyalty and gather valuable feedback. This direct interaction is vital for understanding player sentiment and adapting game development strategies, especially as user-generated content continues to grow in influence.

In-Game s and Events

Giant Network Group actively uses in-game promotions and events to keep players hooked and encourage ongoing engagement. These often coincide with major updates or new content drops, proving vital for player retention and boosting in-game spending.

For instance, during the first half of 2024, the company reported a significant increase in player activity driven by special in-game events in its flagship titles. This strategy directly communicates new features and competitive advantages within the game's own ecosystem.

- Player Retention: Events are key to reducing churn and maintaining a stable player base.

- Revenue Generation: Special promotions often lead to increased in-game purchases and microtransactions.

- Community Building: Collaborative in-game events foster a stronger sense of community among players.

- Marketing Channel: The game environment itself serves as a direct and effective marketing platform.

Public Relations and Media Outreach

Giant Network Group actively manages its public image through dedicated public relations and media outreach. This strategy is crucial for cultivating a positive brand reputation, especially when announcing key developments like the integration of advanced AI technologies into their gaming platforms. For instance, in late 2024, the company highlighted its AI-driven player engagement tools, which analysts noted could boost user retention by up to 15%.

These efforts aim to generate favorable media coverage, reinforcing Giant Network Group's commitment to innovation and player experience. Strategic announcements, such as the successful beta testing of their new metaverse game in early 2025, which garnered significant positive press, directly contribute to increased public awareness and interest. This proactive communication ensures that the benefits of their products, including enhanced gameplay through AI, are effectively conveyed to a broad audience.

Key aspects of their PR and media outreach include:

- Brand Reputation Management: Proactive engagement with media outlets to shape public perception and address any potential concerns, ensuring a consistent brand message.

- Milestone Announcements: Timely and impactful communication of significant achievements, such as new game launches or technological breakthroughs, to maintain market momentum.

- AI Integration Promotion: Highlighting the benefits and advancements of AI within their products, such as improved matchmaking or personalized content, to attract and retain players.

- Media Relations: Building strong relationships with journalists and influencers to secure positive coverage and amplify their marketing messages, contributing to a projected 10% increase in brand sentiment by mid-2025.

Giant Network Group's promotional strategy is multifaceted, encompassing industry events, IP collaborations, digital advertising, social media engagement, in-game promotions, and robust public relations. These efforts are designed to build brand awareness, foster community, drive player acquisition and retention, and ultimately boost revenue.

In 2024, the company's digital advertising spend likely mirrored the global trend, with the digital ad market exceeding $685 billion. Their social media presence on platforms like Weibo and Bilibili is critical for community building, with active engagement potentially leading to a projected 10% increase in brand sentiment by mid-2025 through strategic media relations.

In-game events and IP collaborations, such as the 'Supernatural Action Team' partnership, proved effective in 2024, increasing player engagement. The company's PR efforts, highlighting AI integration, are expected to improve user retention by up to 15%.

| Promotional Tactic | Key Activities | Impact/Goals | 2024/2025 Data/Projections |

| Industry Events | China Game Industry Annual Conference participation | Expertise sharing, market presence | Active participation in key industry gatherings |

| IP Collaborations | 'Supernatural Action Team' with cultural IPs | Fan community engagement, buzz generation | Notable uplift in player engagement metrics observed in 2024 |

| Digital Advertising | Targeted campaigns on Douyin, WeChat | Player acquisition and retention | Leveraging a global digital ad market projected over $685 billion |

| Social Media Engagement | Weibo, Bilibili interaction | Brand loyalty, feedback gathering | Projected 10% increase in brand sentiment by mid-2025 |

| In-Game Promotions | Themed events, new content drops | Player retention, increased in-game spending | Significant increase in player activity in H1 2024 |

| Public Relations | AI integration announcements, metaverse beta testing | Brand reputation, public awareness | AI tools potentially boosting user retention by up to 15% |

Price

Giant Network Group's primary monetization strategy revolves around the free-to-play (F2P) model, which is crucial for its 'Product' offering. This approach eliminates initial purchase barriers, enabling broad market penetration and user acquisition for its gaming portfolio.

Revenue is primarily generated through in-game purchases and optional microtransactions, rather than upfront game sales. For instance, in 2023, the company's mobile gaming segment, a key F2P driver, continued to be a significant contributor to its overall financial performance, reflecting the model's ongoing effectiveness.

Giant Network Group's marketing strategy leans heavily on in-game purchases, often referred to as microtransactions. These are the virtual goods and enhancements players buy within their games, like special skins or boosts. This model is crucial for their revenue stream.

In 2023, a significant 70% of Giant Network Group's total revenue came directly from these in-game purchases. This figure underscores how vital these microtransactions are to the company's financial performance and overall business model.

AI integration in game development is poised to unlock new payment avenues, significantly boosting monetization. This could manifest as innovative in-game purchases, flexible subscription tiers, and dynamic, context-aware advertising, reflecting current market shifts.

For instance, by 2025, the global gaming market is projected to reach over $200 billion, with a substantial portion driven by in-game purchases and subscriptions, areas ripe for AI-enhanced personalization. AI can analyze player behavior to offer tailored incentives, increasing conversion rates and average revenue per user.

Competitive Pricing Strategies for Virtual Goods

Giant Network Group sets pricing for its virtual goods and services to align with player-perceived value, a critical tactic in the crowded online gaming arena. This strategy is informed by player demographics, the desired depth of engagement, and the pricing of comparable virtual items offered by competitors.

The company aims for a pricing sweet spot that makes its offerings accessible to a broad player base while ensuring sustainable profitability. For instance, in 2024, many successful mobile games saw their in-app purchase revenue driven by tiered pricing models for virtual currency and cosmetic items, with average revenue per paying user often exceeding $10.

- Value Perception: Pricing reflects the utility or desirability of virtual items to players.

- Competitive Benchmarking: Prices are aligned with or strategically positioned against rival offerings.

- Demographic Targeting: Pricing structures cater to the spending habits of specific player segments.

- Engagement Focus: Pricing can be used to encourage longer play sessions or higher spending.

Financial Performance Reflecting Monetization Success

Giant Network Group's financial performance in 2024 and 2025 strongly reflects the success of its monetization strategies, particularly within its gaming segment. The company has consistently generated revenue, underscoring the efficacy of its free-to-play model complemented by in-game purchases.

While detailed pricing for specific in-game items remains proprietary, the aggregate financial data confirms a robust revenue stream. For the trailing twelve months (TTM) ending in 2025, Giant Network Group reported a total revenue of $0.40 Billion USD, a testament to its ability to convert player engagement into substantial earnings.

- Consistent Revenue Generation: Financial reports for 2024 and 2025 highlight steady income from gaming operations.

- Monetization Strategy Effectiveness: The free-to-play with in-game purchase model is proving highly successful.

- 2025 Revenue Performance: Trailing twelve months (TTM) revenue reached $0.40 Billion USD.

Giant Network Group's pricing strategy for its virtual goods and services is carefully calibrated to maximize revenue within its free-to-play model. Prices are set based on perceived player value, competitive market analysis, and the desire to engage specific player demographics, ensuring accessibility and profitability.

The company's financial performance, with trailing twelve months (TTM) revenue reaching $0.40 Billion USD as of 2025, directly reflects the success of these pricing tactics. This revenue is largely driven by in-game purchases, where pricing tiers for virtual currency and cosmetic items are common, often resulting in average revenue per paying user exceeding $10 in 2024.

AI integration is expected to refine these pricing strategies further by enabling dynamic, personalized offers. This will likely lead to increased conversion rates and a higher average revenue per user, capitalizing on the projected growth of the global gaming market, which is anticipated to surpass $200 billion by 2025.

| Pricing Factor | Description | Impact on Revenue |

|---|---|---|

| Value Perception | Aligning prices with the utility or desirability of virtual items to players. | Drives adoption of paid content. |

| Competitive Benchmarking | Strategic pricing relative to competitor offerings. | Ensures market competitiveness. |

| Demographic Targeting | Tailoring pricing to the spending habits of different player segments. | Maximizes revenue from diverse player bases. |

| 2025 TTM Revenue | $0.40 Billion USD | Demonstrates overall monetization effectiveness. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Giant Network Group is grounded in comprehensive data, including official company reports, investor relations materials, and detailed industry analyses. We leverage insights from their product portfolios, pricing strategies, distribution network, and promotional activities.