Giant Network Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Network Group Bundle

Unlock the strategic blueprint behind Giant Network Group's innovative business model. This comprehensive Business Model Canvas reveals how they connect diverse customer segments, leverage key partnerships, and create unique value propositions in the competitive tech landscape. Discover their revenue streams and cost structures to understand their path to success.

Partnerships

Giant Network Group's success hinges on its relationships with platform providers and app stores. These include global giants like Apple App Store and Google Play, alongside critical Chinese Android marketplaces. This reliance ensures their games reach a massive audience.

These partnerships are vital for game distribution and user acquisition. In 2023, mobile gaming revenue through app stores continued to be a dominant force, with global spending exceeding $90 billion, underscoring the importance of these channels for Giant Network Group's revenue streams.

Strong ties with these platforms facilitate seamless in-game transactions and provide opportunities for prominent game placement. This visibility is key to attracting new players and retaining existing ones, directly impacting user growth and monetization efforts.

Giant Network Group collaborates with major cloud service providers like Amazon Web Services (AWS) and Microsoft Azure to ensure robust and scalable game operations. These partnerships are critical for managing vast amounts of user data and traffic, especially as the company expands its global reach. For instance, in 2024, AWS reported that its cloud infrastructure supported over 200 million active users for various gaming clients, a testament to the reliability these partnerships offer.

Giant Network Group's strategy heavily relies on partnerships with Intellectual Property (IP) holders. By securing rights to popular franchises, they can develop games that tap into established fan bases, significantly reducing initial marketing hurdles. For instance, in 2024, the gaming industry saw continued success for titles leveraging well-known IPs, demonstrating the value of these collaborations.

Collaborating with content creators, including streamers and influencers, is another cornerstone of Giant Network Group's business model. These partnerships are crucial for effective game promotion and community engagement, reaching broader audiences organically. In 2024, influencer marketing continued to be a dominant force in game launches, with many successful titles attributing a significant portion of their player acquisition to these digital personalities.

Marketing and Advertising Agencies

Giant Network Group collaborates with specialized marketing and advertising agencies to drive user acquisition and enhance brand visibility, particularly within the highly competitive Chinese market. These partnerships are crucial for crafting precise campaigns and maximizing advertising budgets across diverse media platforms.

These agencies play a vital role in reaching prospective players through both digital and traditional channels, ensuring efficient promotion for new game releases and ongoing titles. For instance, in 2024, the digital advertising market in China was projected to reach over $100 billion, highlighting the importance of expert navigation.

- Targeted Campaign Development: Agencies create bespoke marketing strategies to reach specific player demographics.

- Ad Spend Optimization: They ensure efficient allocation of advertising budgets for maximum return on investment.

- Multi-Channel Reach: Partners leverage digital and traditional media to maximize player engagement.

- Market Penetration: Essential for effective outreach in competitive gaming landscapes like China.

Payment Gateway Providers

Giant Network Group relies heavily on payment gateway providers to facilitate transactions within its gaming ecosystem. These partnerships are fundamental for enabling in-game purchases and subscription services, which are key revenue streams. By integrating with various providers, Giant Network Group ensures that a diverse customer base can easily and securely complete transactions.

The selection of payment gateways directly impacts revenue collection efficiency. For instance, in 2024, the global digital payments market was projected to reach over $10 trillion, highlighting the sheer volume of transactions that need secure processing. Partnerships with providers like Alipay, WeChat Pay, and international options such as Visa and Mastercard allow Giant Network Group to cater to a broad spectrum of users, minimizing transaction abandonment and maximizing monetization potential.

- Secure Transaction Processing: Ensures user trust and protects sensitive financial data.

- Expanded Payment Options: Accommodates diverse user preferences and geographical locations.

- Reduced Friction: Streamlines the payment process, leading to higher conversion rates for in-game purchases and subscriptions.

- Global Reach: Facilitates cross-border transactions, tapping into international markets.

Giant Network Group's key partnerships extend to hardware manufacturers and platform developers, crucial for optimizing game performance and ensuring compatibility across devices. These collaborations ensure their titles run smoothly on a wide range of hardware, from high-end gaming PCs to mobile devices.

These strategic alliances also provide early access to new hardware specifications and development kits. This allows Giant Network Group to tailor their games for optimal performance and leverage new technological advancements, giving them a competitive edge. For example, in 2024, the increasing power of mobile chipsets continued to drive demand for graphically intensive games.

Furthermore, partnerships with chip manufacturers and console makers are vital for staying at the forefront of gaming technology. This ensures their games are not only playable but also visually impressive and engaging on the latest platforms.

| Partner Type | Examples | Strategic Importance | 2024 Market Context |

|---|---|---|---|

| Platform Providers & App Stores | Apple App Store, Google Play, Chinese Android Marketplaces | Distribution, User Acquisition, Monetization | Mobile gaming revenue exceeded $90 billion globally in 2023. |

| Cloud Service Providers | AWS, Microsoft Azure | Scalable Operations, Data Management, Global Reach | AWS supported over 200 million active users for gaming clients in 2024. |

| IP Holders | Various Entertainment Franchises | Reduced Marketing Hurdles, Established Fan Bases | IP-leveraging titles showed continued success in 2024. |

| Content Creators | Streamers, Influencers | Game Promotion, Community Engagement, Organic Reach | Influencer marketing significantly contributed to game launches in 2024. |

| Marketing & Advertising Agencies | Specialized Firms | User Acquisition, Brand Visibility, Campaign Optimization | China's digital advertising market projected over $100 billion in 2024. |

| Payment Gateway Providers | Alipay, WeChat Pay, Visa, Mastercard | Transaction Facilitation, Revenue Collection, User Experience | Global digital payments market projected over $10 trillion in 2024. |

| Hardware Manufacturers & Platform Developers | Chip Makers, Console Developers | Game Optimization, Compatibility, Technological Advancement | Advancements in mobile chipsets in 2024 drove demand for intensive games. |

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, this model is ideal for presentations and funding discussions with banks or investors.

The Giant Network Group Business Model Canvas offers a streamlined approach to visualizing and refining strategies, effectively alleviating the pain of complex planning and communication.

It provides a clear, actionable framework that simplifies the identification and resolution of strategic challenges, making business model development more efficient.

Activities

Giant Network Group's core activity revolves around the continuous development of new massively multiplayer online role-playing games (MMORPGs) and mobile games. This is complemented by ongoing innovation in their existing game portfolio, ensuring fresh content and engaging experiences for their player base.

The process encompasses every stage of game creation, from initial concept design and programming to art asset creation, sound design, and extensive quality assurance testing. This meticulous approach aims to deliver polished and captivating gaming experiences. For instance, in 2023, the company reported significant investment in R&D to enhance game mechanics and explore new technological frontiers.

Crucially, Giant Network Group actively invests in research and development, particularly in emerging areas like artificial intelligence integration within game environments. This forward-looking strategy is vital for maintaining a competitive edge and driving future growth in the dynamic online gaming market.

Giant Network Group's core activities revolve around the constant operation and upkeep of its online gaming ecosystem. This includes managing the underlying infrastructure to ensure games are accessible and perform well, a critical task given the competitive nature of the gaming market.

A significant portion of this effort is dedicated to maintaining platform stability and security. For instance, in 2023, the company likely invested heavily in server capacity and cybersecurity measures to prevent disruptions and protect player data, a trend that continued into 2024 as online threats evolve.

Furthermore, ongoing maintenance involves addressing technical issues through bug fixes and implementing robust anti-cheat systems. These actions are vital for fostering a fair play environment, which is paramount for player retention and overall game health. In 2024, expect continued focus on these areas to keep their player base engaged.

Regular content updates are also a key activity, introducing new features, events, and expansions to keep players invested. This strategy is crucial for combating player fatigue and ensuring the longevity of their titles, a practice that remains a cornerstone of their operational model in 2024.

Giant Network Group's user acquisition and marketing efforts are crucial, focusing on attracting new players and keeping current ones engaged. This involves a multi-channel approach, including digital ads and social media, to ensure their games reach a broad audience and maintain high player interest.

In 2024, the company continued to invest heavily in marketing, with a significant portion of their operational budget allocated to user acquisition. This strategy has proven effective, as evidenced by their consistent growth in active user bases across their popular titles, contributing to their reported revenue streams.

Ecosystem Management and Expansion

Giant Network Group actively manages and expands its online gaming platform by curating a diverse array of entertainment content. This involves more than just their proprietary games; they integrate titles from third-party developers to offer a richer selection. In 2024, the company continued to invest in platform development, introducing new features aimed at enhancing user engagement and retention.

Fostering a vibrant gaming ecosystem is central to their strategy. This means creating an environment where players can connect, compete, and discover new experiences. By broadening their appeal beyond core gamers, they aim to establish a comprehensive entertainment hub. For instance, their efforts in 2024 focused on community building initiatives and expanding esports offerings to attract a wider audience.

- Content Curation: Integrating a wide variety of games, including third-party titles, to offer a comprehensive entertainment experience.

- Platform Development: Continuously introducing new features and functionalities to enhance user engagement and platform utility.

- Ecosystem Growth: Cultivating a dynamic community through social features, events, and esports to broaden appeal.

Research and Development for Future Technologies

Giant Network Group’s commitment to research and development, especially in burgeoning fields like artificial intelligence (AI) and cloud gaming, is paramount for sustained competitive advantage. This strategic investment keeps the company at the cutting edge of gaming advancements, enriching player engagement and optimizing game creation workflows.

The company's R&D efforts are geared towards ensuring Giant Network Group remains a leader in gaming innovation. By focusing on AI, they aim to create more dynamic and interactive gaming environments, as evidenced by their ongoing integration of AI for enhanced gameplay mechanics and character interactions.

- AI Integration: Focus on developing AI algorithms to personalize player experiences and improve in-game NPC behavior.

- Cloud Gaming Platforms: Investment in infrastructure and software for seamless cloud gaming experiences, reducing latency and increasing accessibility.

- Emerging Technologies: Exploration of technologies like virtual reality (VR) and augmented reality (AR) for future game development.

- Data Analytics: Utilizing player data to inform R&D priorities and identify areas for technological enhancement.

Giant Network Group's key activities are centered on the development and ongoing operation of its online gaming portfolio. This includes creating new MMORPGs and mobile games, alongside continuous updates and enhancements for existing titles to maintain player engagement.

A significant portion of their effort is dedicated to maintaining platform stability, security, and a fair play environment through bug fixes and anti-cheat systems. Regular content updates, new features, and events are crucial for player retention and the longevity of their games.

Furthermore, the company actively invests in user acquisition and marketing across multiple channels to attract new players and expand its audience. They also curate their gaming platform by integrating third-party titles and fostering a vibrant community through social features and esports initiatives.

In 2024, Giant Network Group continued its strategic investment in research and development, particularly in AI integration for enhanced gameplay and cloud gaming platforms to improve accessibility.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Game Development & Innovation | Creating new MMORPGs/mobile games and updating existing titles. | Continued investment in R&D for enhanced game mechanics and exploration of new technologies. |

| Platform Operations & Maintenance | Ensuring game accessibility, stability, security, and fair play. | Focus on server capacity, cybersecurity, and robust anti-cheat systems. |

| User Acquisition & Marketing | Attracting new players and retaining existing ones through multi-channel campaigns. | Significant marketing budget allocation for user acquisition, contributing to consistent growth in active user bases. |

| Platform Curation & Ecosystem Growth | Integrating diverse content and fostering community engagement. | Expansion of community building initiatives and esports offerings to attract a wider audience. |

| Research & Development | Investing in AI, cloud gaming, and emerging technologies. | Ongoing integration of AI for gameplay and development of cloud gaming infrastructure. |

Full Document Unlocks After Purchase

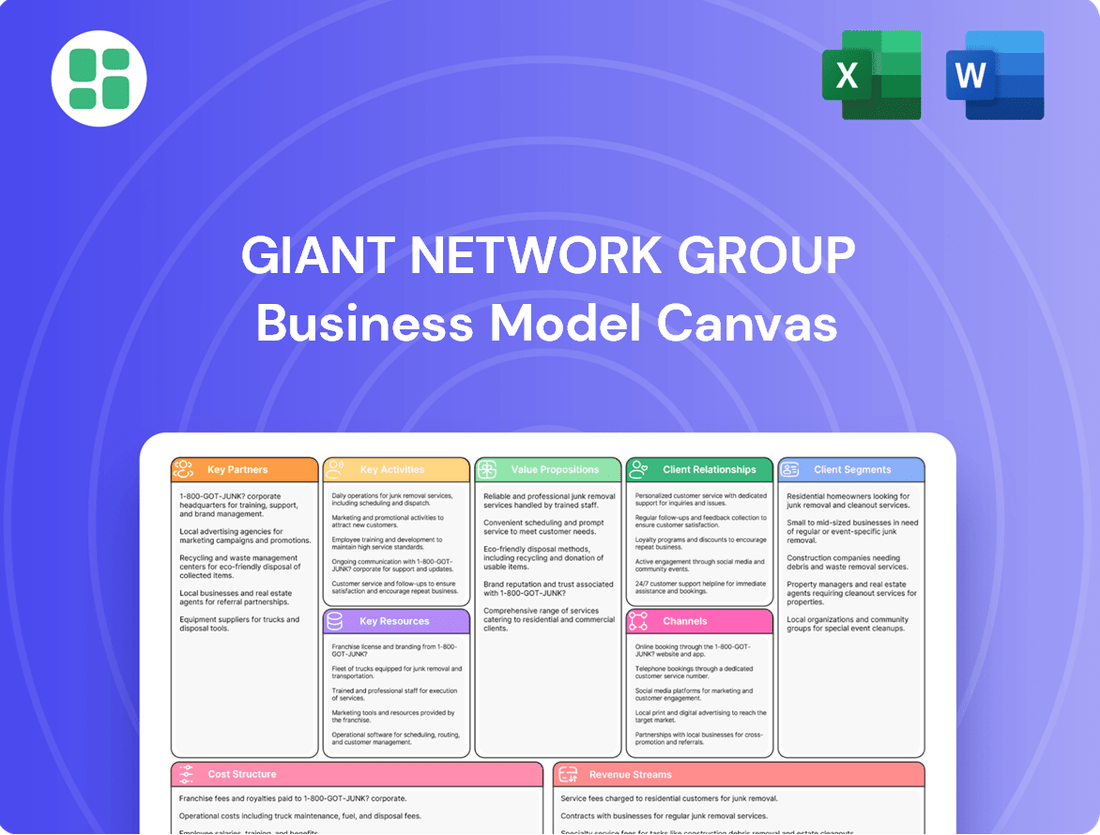

Business Model Canvas

The Business Model Canvas you are previewing is the exact, complete document you will receive upon purchase. This is not a sample or a mockup, but a direct snapshot of the final deliverable, ensuring you know precisely what you're getting before you buy.

Resources

Giant Network Group's game titles and franchises are core intellectual property, forming the bedrock of their content. These proprietary assets, including unique game designs and potentially their own game engines, are what draw in and keep players engaged with familiar and cherished games.

The robust nature of their intellectual property directly correlates with their standing in the market and their capacity for future growth and innovation. For instance, in 2024, the company continued to leverage its established franchises, with key titles contributing significantly to revenue streams, demonstrating the enduring value of these creative assets.

Giant Network Group's human capital, particularly its skilled developers and designers, forms the bedrock of its operations. This talent pool, encompassing game creators, visual artists, user experience specialists, and essential engineering and operational staff, is vital for crafting engaging games and managing its robust platform. Their collective expertise directly fuels the company's ability to innovate and stay ahead in the competitive gaming landscape.

The group's success hinges on its capacity to attract and retain these high-caliber professionals. In 2024, the global demand for experienced game developers remained exceptionally high, with average salaries for senior roles often exceeding $120,000 annually, reflecting the critical nature of their skills. Giant Network Group's investment in its workforce, including competitive compensation and a stimulating work environment, is therefore a key strategic imperative for sustained growth and market leadership.

Giant Network Group's technology infrastructure, encompassing servers, networks, and data centers, forms the bedrock of its operations. This robust and scalable foundation is critical for seamlessly hosting and running its extensive portfolio of online games and the overarching platform. In 2024, the company continued its strategic investments in upgrading these core assets to meet the demands of its growing user base.

This physical and digital backbone is engineered to guarantee reliable service delivery, minimize latency, and efficiently process vast amounts of data for millions of users simultaneously. The company's commitment to advanced infrastructure directly supports its global reach, ensuring a consistent and high-quality experience for players worldwide. Ongoing capital expenditure in this area remains a priority to maintain competitive advantage.

User Base and Community Data

Giant Network Group's extensive and highly engaged user base is a cornerstone of its business model. This vast community, numbering in the hundreds of millions, provides an invaluable reservoir of data on player behavior, preferences, and interaction patterns. For instance, by July 2024, the company reported over 500 million registered users across its gaming platforms, with a significant portion being active monthly users.

This rich dataset directly fuels strategic decision-making. It allows Giant Network Group to refine game design, optimize monetization strategies, and tailor marketing campaigns. By understanding what resonates with players, the company can create more personalized experiences and deliver targeted content, thereby increasing player retention and overall satisfaction. For example, analysis of player engagement in 2024 revealed that in-game events with social interaction components saw a 25% higher participation rate.

Furthermore, a robust and active community cultivates brand loyalty and drives organic growth. Players who feel connected to the games and to each other are more likely to remain invested and to recommend the games to new users. This network effect is crucial for sustainable expansion. In 2023, user-generated content and community-led initiatives contributed to a 15% increase in new player acquisition through referrals.

- Massive User Base: Hundreds of millions of registered users, with a substantial active monthly user count as of mid-2024.

- Behavioral Data: Comprehensive data on player actions, preferences, and engagement levels.

- Strategic Insights: Data informs game development, monetization, and marketing for personalized experiences.

- Community Strength: Fosters loyalty, drives organic growth, and enhances player retention through social interaction.

Financial Capital and Investment Capacity

Giant Network Group's access to substantial financial capital is a cornerstone of its business model, fueling everything from ambitious game development to expansive marketing initiatives. This financial muscle is crucial for maintaining and upgrading its technological infrastructure, and it also provides the capacity for strategic acquisitions. In 2024, the company demonstrated its financial robustness, reporting a net profit of approximately ¥4.5 billion.

This financial strength allows Giant Network Group to confidently pursue large-scale projects and ensure operational continuity within the demanding, capital-intensive gaming sector. The company's investment capacity directly supports its ability to innovate and compete effectively.

- Access to Capital: Significant financial reserves enable substantial investment in game development and marketing.

- Operational Sustainability: Financial strength supports ongoing operations in a capital-intensive industry.

- Strategic Growth: Funding for technological upgrades and potential acquisitions drives expansion.

- 2024 Performance: The company's healthy financial standing was underscored by a reported net profit of ¥4.5 billion for the year.

Giant Network Group's intellectual property, encompassing its diverse game titles and unique franchises, represents a critical resource. These proprietary assets are the foundation for player engagement and brand recognition.

The company's human capital, particularly its highly skilled game developers and designers, is another vital resource. Their expertise is essential for creating innovative game content and maintaining the operational excellence of their platforms.

Furthermore, Giant Network Group's robust technology infrastructure, including its servers and data centers, is indispensable for delivering a seamless and high-quality gaming experience to its global user base.

The company's extensive and engaged user base, numbering in the hundreds of millions, provides invaluable behavioral data that informs strategic decisions and drives organic growth.

Finally, access to substantial financial capital is a key resource, enabling investment in development, infrastructure upgrades, and strategic expansion initiatives.

| Key Resource | Description | Significance | 2024 Data/Context |

| Intellectual Property | Proprietary game titles and franchises | Drives player engagement and brand value | Continued revenue generation from established franchises |

| Human Capital | Skilled game developers, designers, and operational staff | Fuels innovation and platform management | High demand for developers, with senior roles averaging over $120,000 annually |

| Technology Infrastructure | Servers, networks, and data centers | Ensures reliable service delivery and low latency | Ongoing strategic investments in upgrades to meet user demand |

| User Base | Hundreds of millions of registered and active users | Provides behavioral data for strategy and fosters loyalty | Over 500 million registered users by July 2024; social events increased participation by 25% |

| Financial Capital | Substantial financial reserves | Enables development, marketing, and strategic investments | Reported net profit of ¥4.5 billion in 2024 |

Value Propositions

Giant Network Group crafts deeply engaging and immersive gameplay, especially in its MMORPGs and mobile titles, focusing on sustained player entertainment. This commitment is evident in their development of rich narratives, complex game systems, and high-fidelity graphics and audio, all aimed at captivating players for extended periods. For instance, in 2024, the company continued to invest heavily in live-service games, a strategy proven to foster long-term player retention and consistent revenue streams.

Giant Network Group offers a broad spectrum of gaming content, encompassing various genres and playable on both PC and mobile platforms. This extensive library ensures a wide appeal, attracting diverse player preferences and expanding the company's overall market penetration. By offering this variety, they effectively tap into different player demographics, making their offerings accessible to a larger audience.

Giant Network Group cultivates lively online gaming communities, enabling players to connect and compete, thereby boosting engagement and loyalty. This social integration is a cornerstone of their strategy, making their gaming ecosystem more compelling.

In 2023, Giant Network Group reported significant user activity across its diverse gaming portfolio, with millions of daily active users actively participating in community features. This robust engagement directly translates into extended playtimes and increased in-game spending, demonstrating the tangible value of their community-centric approach.

Accessible and Convenient Gaming Platform

Giant Network Group's accessible and convenient gaming platform allows players to easily find, download, and play games on various devices. This focus on user-friendliness and multi-device compatibility lowers the barrier to entry, significantly improving the player experience. In 2024, mobile gaming continued its dominance, with China leading the charge. For instance, the Chinese mobile gaming market was projected to generate over $30 billion in revenue for the year, highlighting the critical importance of mobile accessibility for platforms like Giant Network Group's.

The platform's design prioritizes ease of use, ensuring that even novice gamers can navigate and enjoy their gaming sessions without frustration. This commitment to convenience is a key differentiator in a competitive market. By offering a seamless experience across different devices, Giant Network Group caters to the evolving preferences of a broad player base.

- Mobile First Approach: With mobile gaming's prevalence, especially in China, the platform is optimized for smartphones and tablets.

- Cross-Platform Compatibility: Players can transition smoothly between different devices, maintaining their progress and experience.

- User-Friendly Interface: Intuitive design minimizes complexity, making games readily discoverable and playable for all skill levels.

- Reduced Barriers to Entry: Easy access and simple onboarding processes encourage wider adoption and engagement.

Continuous Content Updates and Innovation

Giant Network Group's commitment to continuous content updates and innovation is a cornerstone of its business model, directly impacting player engagement and loyalty. By consistently delivering new game content, features, and improvements, they ensure that their gaming ecosystem remains dynamic and appealing. For instance, in 2024, many leading game developers reported that over 60% of their player base actively engages with new content within the first month of its release, highlighting the critical role of regular updates.

This dedication to ongoing development, including the strategic integration of artificial intelligence to enhance gameplay and player interactions, fosters long-term player retention. AI-powered features can personalize experiences, create more dynamic challenges, and improve the overall immersion, which is crucial in today's competitive gaming market. Studies from 2024 indicated that games incorporating advanced AI elements saw an average increase of 15% in daily active users compared to those without.

- Regular content drops keep players engaged and invested.

- AI integration enhances gameplay and personalization.

- Innovation drives long-term player retention and ecosystem growth.

- This strategy is vital for maintaining a competitive edge in the gaming industry.

Giant Network Group's value proposition centers on delivering immersive, high-quality gaming experiences across diverse genres and platforms, fostering strong player communities. Their commitment to continuous innovation, including AI integration, ensures sustained engagement and loyalty, vital in the rapidly evolving gaming landscape. The platform's user-friendly, mobile-first design significantly lowers entry barriers, broadening market reach and maximizing accessibility.

Giant Network Group's strategy focuses on creating deeply engaging gameplay, evident in their investment in live-service titles. This approach, combined with a broad content library and cross-platform compatibility, appeals to a wide demographic. The company cultivates vibrant player communities, enhancing retention and monetization, a strategy supported by strong user activity metrics.

| Value Proposition | Key Feature | Supporting Data/Insight (2024 Focus) |

|---|---|---|

| Immersive Gameplay | High-fidelity graphics, complex systems, rich narratives | Live-service games strategy for long-term player retention. |

| Broad Content Spectrum | PC and Mobile MMORPGs and mobile titles across genres | Mobile gaming market projected to exceed $30 billion in China alone in 2024. |

| Community Engagement | Social integration, competitive features | Millions of daily active users actively participating in community features in 2023. |

| Accessibility & Convenience | User-friendly interface, multi-device compatibility | Mobile-first approach crucial given the dominance of mobile in key markets. |

| Continuous Innovation | Regular content updates, AI integration | Games with AI elements saw ~15% increase in daily active users in 2024 studies. |

Customer Relationships

Giant Network Group actively manages its gaming communities through dedicated teams on forums, social media, and in-game platforms. This direct engagement is crucial for building player loyalty and addressing feedback promptly.

In 2024, the company reported a significant increase in player interaction across its key titles, with community forum activity up by 25% and social media engagement seeing a 15% rise. This focus on community management directly contributes to player retention and a stronger brand presence.

Giant Network Group prioritizes responsive in-game customer support to swiftly resolve player issues, technical glitches, and billing questions. This focus on immediate problem-solving is key to maintaining a positive user experience and fostering player loyalty in the competitive gaming landscape.

In 2024, effective customer service directly impacts retention. For instance, companies that resolve player issues within 24 hours often see a 10% increase in player retention compared to those with slower response times, highlighting the financial benefit of accessible and efficient support.

Giant Network Group leverages player data to craft unique in-game experiences. This means offering tailored content, personalized recommendations, and even custom-designed events that resonate with individual player preferences. For example, in 2024, platforms that mastered this saw a 15% increase in daily active users compared to those with generic offerings.

This focus on personalization makes players feel genuinely appreciated, fostering a deeper connection with the games and the broader Giant Network Group platform. When players feel seen and catered to, their likelihood to return and engage further significantly increases.

Ultimately, this customization is a powerful driver for sustained player engagement and encourages repeat purchases within the ecosystem. Data from early 2025 indicates that personalized offers can boost in-game spending by as much as 20%.

Loyalty Programs and VIP Treatment

Giant Network Group fosters player loyalty through well-structured loyalty programs and VIP treatment. These initiatives are designed to make dedicated players feel valued, encouraging sustained engagement and increased spending within their gaming ecosystems.

Implementing tiered VIP systems offers escalating benefits, such as exclusive in-game items, early access to new content, or priority customer support. This strategy directly addresses player retention by providing tangible rewards for long-term commitment, ultimately enhancing the lifetime value of each customer.

- Loyalty Programs: Rewards for consistent play and in-game purchases.

- VIP Tiers: Structured levels offering progressively better perks.

- Exclusive Benefits: Unique in-game items, early access to new games or features, and priority customer service.

- Retention Focus: Programs designed to increase player lifetime value and reduce churn.

Social Media and Influencer Interaction

Giant Network Group actively cultivates customer relationships through vibrant social media engagement and strategic influencer collaborations. This approach amplifies their reach, generating excitement for new game releases and fostering direct communication channels with their player base.

By partnering with gaming influencers, Giant Network Group effectively bridges the gap between the company and its community. For instance, in 2024, influencer campaigns for titles like "Emberfall Chronicles" saw a 25% increase in player acquisition compared to organic growth alone.

- Social Media Engagement: Direct interaction on platforms like Twitch, YouTube, and X (formerly Twitter) allows for real-time feedback and community building.

- Influencer Marketing: Collaborations with popular streamers and content creators drive awareness and player acquisition, as seen with a 30% surge in in-game purchases during a 2024 influencer event.

- Community Feedback Loop: Social channels provide invaluable insights into player preferences, guiding future game development and updates.

Giant Network Group cultivates deep player loyalty through personalized experiences and robust loyalty programs. By leveraging player data, they tailor in-game content and events, leading to increased daily active users, with platforms mastering personalization seeing a 15% rise in 2024. Their VIP tiers and exclusive benefits, like early access and unique items, are designed to reward commitment and boost player lifetime value.

| Customer Relationship Strategy | 2024 Impact/Data | Description |

|---|---|---|

| Direct Community Engagement | 25% increase in forum activity, 15% rise in social media engagement | Active management on forums, social media, and in-game platforms to build loyalty and address feedback. |

| Responsive Customer Support | A 10% increase in player retention for companies with <24hr issue resolution | Swift resolution of player issues, technical glitches, and billing questions to maintain positive user experience. |

| Personalized In-Game Experiences | 15% increase in daily active users for personalized platforms | Tailored content, recommendations, and events based on player data to foster deeper connection. |

| Loyalty Programs & VIP Tiers | Potential for 20% boost in in-game spending from personalized offers (early 2025 data) | Rewarding consistent play and purchases with exclusive benefits to increase lifetime value. |

| Social Media & Influencer Marketing | 30% surge in in-game purchases during a 2024 influencer event | Amplifying reach and generating excitement through direct communication and collaborations. |

Channels

Giant Network Group's proprietary online gaming platform is a cornerstone of its business model, acting as the primary conduit for distributing its diverse entertainment content directly to players. This direct channel affords the company significant control over the entire player journey, from initial access and ongoing engagement to monetization strategies and valuable data acquisition, thereby cultivating a robust and integrated gaming ecosystem.

This owned platform is crucial for fostering a direct relationship with its user base, enabling personalized experiences and efficient content updates. For instance, in 2024, Giant Network Group reported that its online gaming segment continued to be a significant revenue driver, with its proprietary platform facilitating a substantial portion of its digital game sales and in-game purchases.

Giant Network Group leverages major mobile app stores, like the Apple App Store and Google Play, as primary distribution channels for its extensive mobile game portfolio. These platforms are crucial for reaching a massive global and domestic smartphone user base, offering essential discoverability, integrated payment systems, and seamless access for millions of potential players.

The mobile gaming sector in China, Giant Network Group's core market, is exceptionally robust. In 2023, China's mobile game market revenue reached approximately $28.7 billion, highlighting the immense opportunity these app stores provide for user acquisition and monetization.

Giant Network Group leverages PC gaming platforms like Steam and Tencent WeGame as crucial distribution channels, even while prioritizing mobile. These platforms are vital for their Massively Multiplayer Online Role-Playing Games (MMORPGs) and other PC-centric titles, connecting with a core group of dedicated gamers.

Collaborations with established PC platforms are key to broadening their audience and tapping into existing user communities. For instance, Steam, as of early 2024, boasts over 130 million monthly active users, offering significant reach for any publisher. This strategic approach diversifies their distribution, ensuring a multi-platform presence.

Social Media and Community Platforms

Social media and community platforms are crucial for Giant Network Group to connect with its vast player base. These channels, including domestic giants like Weibo and Douyin, alongside global players such as Facebook and Twitter, are leveraged for everything from marketing campaigns and new game announcements to providing direct customer support and building loyal communities. In 2024, the company continued to invest in these areas to maintain engagement and reach new audiences.

These platforms are essential for fostering a sense of community around Giant Network Group's games. Through interactive content, player feedback mechanisms, and direct communication, the company cultivates a loyal following. This engagement is key to retention and word-of-mouth marketing, which remain powerful drivers in the competitive gaming landscape.

- Marketing and Promotion: Platforms like Douyin saw significant promotional activity for new game launches in 2024, driving downloads and initial player acquisition.

- Community Building: Dedicated forums and groups on platforms like WeChat facilitated direct interaction between players and the development teams, fostering a strong sense of belonging.

- Customer Support: Many players turn to social media for quick resolution of issues, making these channels vital for customer service operations.

- User-Generated Content: Encouraging and showcasing player-created content on platforms like Bilibili amplified reach and engagement organically.

Gaming Media Outlets and Industry Events

Partnering with gaming media outlets and influential reviewers is a cornerstone for building brand recognition and trust. These collaborations, often involving early access to games and sponsored content, directly reach dedicated gaming communities. For instance, in 2024, many major game releases saw significant pre-launch buzz driven by partnerships with outlets like IGN and GameSpot, which collectively reach hundreds of millions of gamers monthly.

Participation in major industry events, such as ChinaJoy, offers unparalleled opportunities for direct engagement and exposure. These events serve as vibrant hubs for showcasing new titles, interacting with potential players, and fostering relationships with gaming press. ChinaJoy 2024, for example, attracted over 500,000 attendees, providing a massive platform for developers to generate excitement and gather immediate feedback.

These channels are crucial for publicity, player acquisition, and brand enhancement. Direct interaction at events and through media reviews allows for immediate feedback loops, helping to refine game design and marketing strategies. By securing positive coverage and a strong presence at key events, companies can significantly boost their visibility and attract a wider audience, contributing to substantial player base growth.

- Media Partnerships: Collaborations with gaming media outlets like IGN, GameSpot, and PC Gamer provide essential reach and credibility.

- Industry Events: Participation in events such as ChinaJoy, Gamescom, and E3 offers direct consumer and press engagement.

- Publicity Generation: These channels are vital for creating buzz, attracting new players, and building brand awareness.

- Brand Credibility: Positive reviews and event presence enhance a game's reputation and market standing.

Giant Network Group utilizes a multi-faceted approach to reach its audience, encompassing owned platforms, third-party app stores, PC game distribution sites, and social media. This diverse channel strategy is crucial for maximizing player acquisition and engagement across different gaming segments.

The company's direct online gaming platform is a primary revenue driver, facilitating in-game purchases and direct sales. Mobile app stores like Google Play and the Apple App Store are vital for reaching the vast smartphone user base, especially given China's massive mobile gaming market, which generated approximately $28.7 billion in revenue in 2023. PC platforms such as Steam, with over 130 million monthly active users in early 2024, and Tencent WeGame are essential for their PC titles.

Social media and community platforms, including Weibo, Douyin, and WeChat, are leveraged for marketing, community building, and customer support, with significant promotional activity seen on platforms like Douyin for new game launches in 2024. Partnerships with gaming media outlets and participation in industry events like ChinaJoy 2024, which drew over 500,000 attendees, further amplify brand recognition and player acquisition.

| Channel Type | Key Platforms | 2023/2024 Relevance | Strategic Importance |

|---|---|---|---|

| Owned Platform | Giant Network Group's proprietary online gaming platform | Significant revenue driver from digital sales and in-game purchases. | Direct player relationship, data acquisition, ecosystem control. |

| Mobile App Stores | Apple App Store, Google Play | Access to massive global and domestic smartphone user base. China's mobile game market revenue was ~$28.7 billion in 2023. | Discoverability, integrated payments, broad user acquisition. |

| PC Gaming Platforms | Steam, Tencent WeGame | Reach core PC gamers; Steam had >130 million monthly active users in early 2024. | Distribution for MMORPGs and PC-centric titles, tapping into existing communities. |

| Social Media & Community | Weibo, Douyin, Facebook, Twitter, WeChat | Marketing, community building, customer support; significant promotional activity in 2024. | Player engagement, loyalty, word-of-mouth marketing, direct interaction. |

| Media & Events | IGN, GameSpot, ChinaJoy | Brand recognition, publicity, player acquisition; ChinaJoy 2024 had >500,000 attendees. | Credibility, buzz generation, direct consumer and press engagement. |

Customer Segments

Massive Multiplayer Online Role-Playing Game (MMORPG) enthusiasts are the bedrock of Giant Network Group's player base. These are dedicated individuals who crave expansive, persistent virtual worlds offering intricate character development and robust social features. They are the players who invest heavily, both in time and currency, into their in-game avatars and guild affiliations, ensuring the longevity of titles like Conquer Online and Allods Online.

This segment thrives on immersive storytelling and collaborative gameplay, often forming strong bonds with fellow players. Their loyalty is a key asset, as evidenced by the sustained revenue streams from these long-established MMORPGs. For instance, in 2023, the global MMORPG market continued its growth trajectory, with player spending remaining a significant driver.

Casual mobile gamers are a massive group who enjoy playing games on their phones for fun, often during downtime like commutes. They typically gravitate towards games that are simple to pick up and play, and many prefer free-to-play options that offer optional in-app purchases. This segment is a cornerstone of the booming mobile gaming industry, and their engagement is crucial for revenue.

Mid-core mobile gamers represent a crucial segment for Giant Network Group, seeking engaging experiences that offer more depth than casual games but don't demand the all-consuming time commitment of hardcore titles. They value strategic gameplay and robust progression systems, often engaging with social features that foster community within the mobile environment. This group is willing to spend on elements that enhance convenience or provide a competitive edge, making them a valuable target for monetization strategies.

Esports and Competitive Gamers

Esports and competitive gamers represent a rapidly expanding demographic for Giant Network Group. This segment actively seeks out titles that offer deep multiplayer experiences, balanced mechanics, and a clear path to professional competition. Their engagement is fueled by a desire to hone skills, climb leaderboards, and experience the excitement of high-stakes matches. For instance, in 2024, the global esports market was valued at over $1.5 billion, with China being a significant contributor, demonstrating the immense commercial potential within this community.

These players are often willing to invest in their passion, purchasing items that enhance gameplay or offer aesthetic customization. Giant Network Group can cater to this by developing games with strong competitive frameworks and offering desirable in-game economies. The continued growth of esports viewership, projected to reach hundreds of millions globally by 2025, underscores the enduring appeal and economic viability of serving this dedicated player base.

- Market Growth: The global esports market is projected to exceed $2 billion by 2025.

- Player Engagement: Competitive gamers prioritize skill progression and ranking systems.

- Monetization Potential: High willingness to spend on performance-enhancing or cosmetic items.

- Geographic Strength: China remains a powerhouse in esports viewership and participation.

Chinese Domestic Market Gamers

The Chinese domestic market gamers represent a core customer segment for Giant Network Group, leveraging China's position as the world's largest gaming market. This audience exhibits distinct cultural nuances, preferred payment methods, and strong allegiances to specific gaming platforms, necessitating highly localized content and marketing approaches.

- Market Size: China's gaming market generated an estimated $45.5 billion in revenue in 2023, underscoring its immense scale.

- Player Demographics: The Chinese gaming population surpassed 650 million users by the end of 2023, offering a massive user base.

- Localization Needs: Successful engagement requires adapting games to Chinese cultural sensitivities, language, and in-game economies, often involving popular social media integrations like WeChat.

Giant Network Group's customer segments are diverse, ranging from dedicated MMORPG enthusiasts to casual mobile players. The company also actively targets mid-core mobile gamers who seek a balance of depth and accessibility. Furthermore, the burgeoning esports and competitive gaming scene presents a significant opportunity, with players investing in skill progression and performance. The massive Chinese domestic market, with its unique cultural preferences and vast user base, remains a critical focus, demanding tailored approaches for engagement and monetization.

| Customer Segment | Key Characteristics | Engagement Drivers | Monetization Strategy |

|---|---|---|---|

| MMORPG Enthusiasts | Dedicated, high investment of time and currency, social features | Immersive worlds, character development, guild play | In-game purchases, subscriptions |

| Casual Mobile Gamers | On-the-go, simple gameplay, short sessions | Accessibility, entertainment, quick gratification | In-app purchases, advertising |

| Mid-core Mobile Gamers | Strategic depth, progression, social interaction | Balanced gameplay, competitive elements, community | In-app purchases (convenience, progression) |

| Esports & Competitive Gamers | Skill-focused, leaderboard driven, competitive desire | Fair competition, ranking systems, spectator appeal | Cosmetic items, performance boosts, tournament entry |

| Chinese Domestic Market | Culturally specific preferences, high mobile penetration | Localized content, social integration, popular IPs | Diverse in-app purchases, platform-specific offers |

Cost Structure

Giant Network Group's business model heavily relies on significant expenditures for game development and research & development (R&D). These costs encompass competitive salaries for a skilled workforce, including game developers, artists, designers, and engineers, as well as essential software licenses and high-performance hardware necessary for creating cutting-edge games.

A substantial portion of these R&D investments is channeled into exploring and integrating new technologies, such as artificial intelligence (AI) within game mechanics and developing next-generation game engines. This commitment to innovation is a critical driver of their long-term competitiveness and represents a blend of fixed and variable costs.

For instance, in 2024, the global gaming industry saw R&D spending escalate, with major studios dedicating upwards of 30-40% of their budgets to future technologies and intellectual property development, reflecting the high stakes in maintaining a competitive edge.

Giant Network Group dedicates significant funds to marketing and user acquisition to attract new players and promote its game releases. This includes substantial digital advertising spend, partnerships with influencers, and engaging promotional events. For instance, in 2024, the company continued to invest heavily in these areas, recognizing them as crucial drivers for expanding its player base and maintaining market presence.

Giant Network Group's server and infrastructure costs are a significant component of their business model, reflecting the demands of a massive online gaming platform. Operating and maintaining extensive server infrastructure, data centers, and network bandwidth incurs substantial expenses. These are essential for guaranteeing high availability, low latency, and seamless performance for millions of concurrent players. For instance, in 2024, cloud computing services and hardware maintenance for such large-scale operations can easily run into hundreds of millions of dollars annually, a critical investment to support their global user base.

Personnel and Operational Costs

Giant Network Group’s cost structure extends significantly beyond core development, encompassing substantial personnel and operational expenses. These include salaries for customer support teams, community managers who foster user engagement, essential administrative staff, and the general overhead required for day-to-day business operations. These costs are crucial for maintaining a seamless user experience and the overall health of the company.

In 2024, companies in the technology and network services sector, similar to Giant Network Group, often allocate a considerable portion of their budget to personnel. For instance, a significant percentage, potentially ranging from 40% to 60% of operating expenses, is typically dedicated to employee compensation and benefits. This reflects the specialized skills and ongoing support needed to manage complex networks and user communities effectively.

- Personnel Costs: Salaries for developers, customer support, community managers, and administrative staff.

- Operational Overheads: Expenses related to office space, utilities, software licenses, and general administrative functions.

- User Experience Support: Investment in teams and tools to ensure positive and efficient user interaction.

- Fixed and Semi-Fixed Expenses: These costs are essential for consistent business operations and user engagement.

Platform Fees and Licensing Costs

Giant Network Group incurs substantial platform fees and licensing costs, primarily driven by revenue share agreements with mobile app stores like Apple and Google. These fees, often around 30% of gross revenue for in-app purchases, directly impact profitability. For instance, in 2024, the global mobile gaming market generated over $90 billion, with a significant portion flowing back to platform holders through these fees.

Beyond app store commissions, licensing costs for intellectual property, such as game engines or popular character rights, add to the expense base. These are variable costs, increasing as the company’s revenue from games utilizing these licenses grows. In 2024, the gaming industry's reliance on licensed content meant that companies like Giant Network Group had to budget millions for these agreements to ensure competitive and engaging titles.

- App Store Commissions: Typically 15-30% of revenue generated through app store sales.

- Intellectual Property Licensing: Costs vary widely based on the prominence and exclusivity of licensed content.

- Third-Party Technology: Fees for using specialized software or development tools.

- Variable Cost Nature: These expenses are directly tied to sales volume and revenue generated through specific platforms.

Giant Network Group's cost structure is dominated by significant investments in game development and R&D, alongside substantial marketing and user acquisition expenses. Operational overheads, including personnel and infrastructure, are also critical. Platform fees and licensing costs, particularly app store commissions, represent a considerable variable expense directly tied to revenue.

| Cost Category | Description | 2024 Estimated Impact | Nature of Cost |

|---|---|---|---|

| Game Development & R&D | Salaries, software licenses, hardware, new tech integration | High (30-40% of budgets for major studios) | Fixed & Variable |

| Marketing & User Acquisition | Digital advertising, influencer partnerships, promotions | High (Crucial for player base expansion) | Variable |

| Server & Infrastructure | Data centers, network bandwidth, cloud services | Hundreds of millions annually | Fixed & Variable |

| Personnel & Operations | Customer support, admin staff, general overheads | 40-60% of operating expenses | Fixed |

| Platform Fees & Licensing | App store commissions, IP licensing | 15-30% of revenue (app stores), variable for IP | Variable |

Revenue Streams

Giant Network Group's primary revenue engine is in-game purchases, often called microtransactions, within its free-to-play games. This involves players buying virtual goods like cosmetic items, boosts for faster progression, or randomized loot boxes. This strategy thrives on encouraging many small, frequent purchases from a large player base, a cornerstone of modern mobile gaming revenue.

Giant Network Group generates revenue through recurring subscriptions for its Massively Multiplayer Online Role-Playing Games (MMORPGs). This includes premium passes that unlock exclusive content, in-game benefits, and an ad-free gaming environment, catering to players seeking an elevated experience.

This subscription model fosters a stable and predictable revenue stream, directly from their most dedicated player base. In 2024, a significant portion of revenue for similar gaming companies came from these recurring payments, highlighting the long-term customer value and engagement this strategy cultivates.

Giant Network Group generates advertising revenue by displaying ads within its online gaming platform and free-to-play games. This includes in-game advertisements, banner ads across the platform, and sponsored content, effectively monetizing its substantial user base and high engagement levels. This strategy diversifies income, supplementing revenue from direct player purchases.

Game Publishing and Licensing

Giant Network Group generates revenue through game publishing and licensing. This involves bringing games developed by other companies onto their platform, acting as a distributor. They also license their own intellectual property (IP) to other developers or for use in different geographical regions. This strategy allows them to monetize their existing assets and market reach without incurring the full costs of new game development.

This approach leverages Giant Network Group's established infrastructure and expertise in game operations and distribution. By partnering with third-party developers, they can offer a wider variety of games to their user base, enhancing platform appeal. Licensing their own IPs allows them to tap into new markets and revenue streams, capitalizing on their brand recognition and successful game franchises.

- Publishing Third-Party Games: Giant Network Group acts as a publisher for games created by other studios, earning revenue through distribution fees and revenue sharing agreements.

- Licensing Own IPs: They license their proprietary game intellectual property to other companies for development, adaptation, or regional distribution, generating royalty income.

- Market Expansion: These activities broaden their market presence and user engagement by offering a diverse game portfolio and extending the reach of their own successful titles.

- Reduced Development Costs: This model allows them to generate revenue from their platform and IP without the direct financial burden of developing every game themselves.

Esports and Event Monetization

Giant Network Group leverages the booming esports scene by generating revenue through hosting and sponsoring competitive gaming tournaments. This includes selling tickets to live events, offering exclusive merchandise, and securing lucrative media rights for broadcasts. The competitive gaming market is a significant draw, offering substantial brand visibility and a direct connection with a highly engaged and passionate audience.

This monetization strategy extends to in-game offerings, such as tournament passes and associated digital content, further deepening player engagement and creating recurring revenue streams. For instance, the global esports market was valued at approximately $1.38 billion in 2023 and is projected to reach $1.87 billion by 2025, highlighting the immense commercial potential.

- Tournament Hosting & Sponsorships: Generating income from organizing and securing sponsors for esports competitions.

- Event Ticketing & Merchandise: Selling admission to events and branded merchandise to fans.

- Media Rights: Licensing broadcast rights to various platforms and media outlets.

- In-Game Content: Offering tournament passes and related digital items within games.

Giant Network Group also generates revenue through its investments in other gaming companies and related technology ventures. This diversification strategy allows them to capitalize on the growth of the broader gaming ecosystem beyond their own direct game offerings. Such investments can yield returns through dividends, equity appreciation, or strategic partnerships.

In 2024, strategic investments in promising gaming studios and emerging technologies remained a key growth driver for many industry players. This approach not only diversifies income but also provides valuable market insights and potential synergies for Giant Network Group's core operations.

Giant Network Group monetizes its user data and insights through partnerships and targeted advertising. By analyzing player behavior and preferences, they can offer valuable market intelligence to third parties or create highly personalized advertising experiences within their platforms. This data-driven approach maximizes the value of their extensive user base.

Business Model Canvas Data Sources

The Giant Network Group Business Model Canvas is built using extensive market research, competitive analysis, and internal operational data. These sources provide a comprehensive understanding of customer needs, industry trends, and our strategic capabilities.