Giant Network Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Network Group Bundle

Navigate the complex external forces shaping Giant Network Group's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Gain a competitive edge by leveraging these expert insights to refine your strategy and investment decisions. Download the full version now for actionable intelligence.

Political factors

The Chinese government's stringent oversight of the online gaming sector significantly impacts companies like Giant Network Group. Regulations introduced in 2024 impose strict playtime limits for minors, restricting them to a maximum of three hours per week, specifically on Fridays, Saturdays, Sundays, and public holidays.

These measures, alongside proposed spending caps for underage players, aim to curb gaming addiction and protect younger demographics. Such policies directly affect user acquisition and engagement, particularly for games with a substantial youth player base, potentially influencing revenue streams for developers and publishers operating within China.

Giant Network Group, like all game developers operating in China, must navigate the National Press and Publication Administration's (NPPA) licensing and approval processes. This is a critical step for any new game release, ensuring adherence to national laws and content regulations.

While the regulatory landscape has experienced periods of heightened scrutiny, there's been a positive trend of increased game approvals. In 2023, the NPPA approved over 1,300 domestic online games, a significant jump from previous years, and this momentum continued into early 2024, suggesting a more predictable and potentially favorable environment for companies like Giant Network Group.

Geopolitical tensions can significantly shape Giant Network Group's international growth strategies and collaborative ventures. While Chinese game developers have seen considerable global success, capturing a large share of worldwide mobile gaming revenue, ongoing trade disputes or political friction could create obstacles for market entry and operational continuity in certain regions.

Government Support and Sectoral Policies

The government's stance on the technology and gaming sectors is evolving, aiming to stimulate growth while addressing societal issues like gaming addiction. This dynamic approach is evident in recent policy shifts observed through 2024 and into 2025.

Specifically, the number of game approvals has seen an uptick, suggesting a more favorable regulatory climate for the gaming industry. This indicates a strategic move to encourage domestic innovation and development within the sector.

- Increased Game Approvals: Reports from late 2024 indicated a notable rise in the number of new game titles receiving government approval, signaling a more open policy environment.

- Focus on Responsible Gaming: Alongside growth initiatives, there's a continued emphasis on measures to mitigate gaming addiction, with new guidelines expected in 2025.

- Support for Tech Innovation: Broader government support for the tech ecosystem, including incentives for research and development, indirectly benefits companies like Giant Network Group.

Censorship and Ideological Control

Giant Network Group, like all companies operating in China's gaming sector, must navigate a stringent censorship landscape. This means game content must strictly adhere to Chinese cultural and ideological norms, a crucial factor for market access. For instance, in 2023, the National Press and Publication Administration (NPPA) continued to review and approve new game licenses, with a focus on content alignment. Prohibited themes often include sensitive political topics, explicit violence, gambling, and anything that could be seen as undermining social stability or national unity.

This regulatory environment necessitates significant investment in localization and content management. Giant Network Group likely dedicates resources to ensure their game narratives and visuals meet these requirements, potentially altering storylines or removing specific elements to gain approval. Failure to comply can result in delayed launches or outright bans, impacting revenue streams and market share. The company's ability to adapt its offerings to these evolving censorship standards is a key determinant of its success in the vast Chinese market.

- Content Compliance: Games must align with Chinese cultural and ideological standards, avoiding sensitive political themes.

- Regulatory Oversight: The NPPA's ongoing review process for game licenses impacts market entry and content.

- Localization Investment: Significant resources are required for content adaptation to meet censorship requirements.

- Market Access Risk: Non-compliance can lead to launch delays or outright bans, affecting revenue.

The Chinese government's regulatory approach to the gaming industry, particularly concerning minors, continues to evolve. In 2024, playtime restrictions for underage gamers were tightened, limiting them to three hours weekly on specific days. This focus on responsible gaming, alongside potential spending caps, directly influences user engagement and acquisition strategies for companies like Giant Network Group.

The National Press and Publication Administration (NPPA) remains central to game approvals, with a notable increase in domestic game approvals observed through 2023 and into early 2024, indicating a more predictable licensing environment. This trend suggests a government effort to foster domestic innovation within the tech and gaming sectors, while simultaneously addressing societal concerns.

| Factor | 2023/2024 Impact | Outlook for 2025 |

| Minor Playtime Restrictions | Strict limits (3 hrs/week) implemented in 2024. | Continued enforcement and potential refinement of guidelines. |

| Game Approvals | Over 1,300 domestic games approved in 2023; upward trend in early 2024. | Expectation of continued steady approval rates, supporting market entry. |

| Content Censorship | Ongoing NPPA review requires adherence to cultural/ideological norms. | Sustained need for content localization and compliance to avoid market access issues. |

What is included in the product

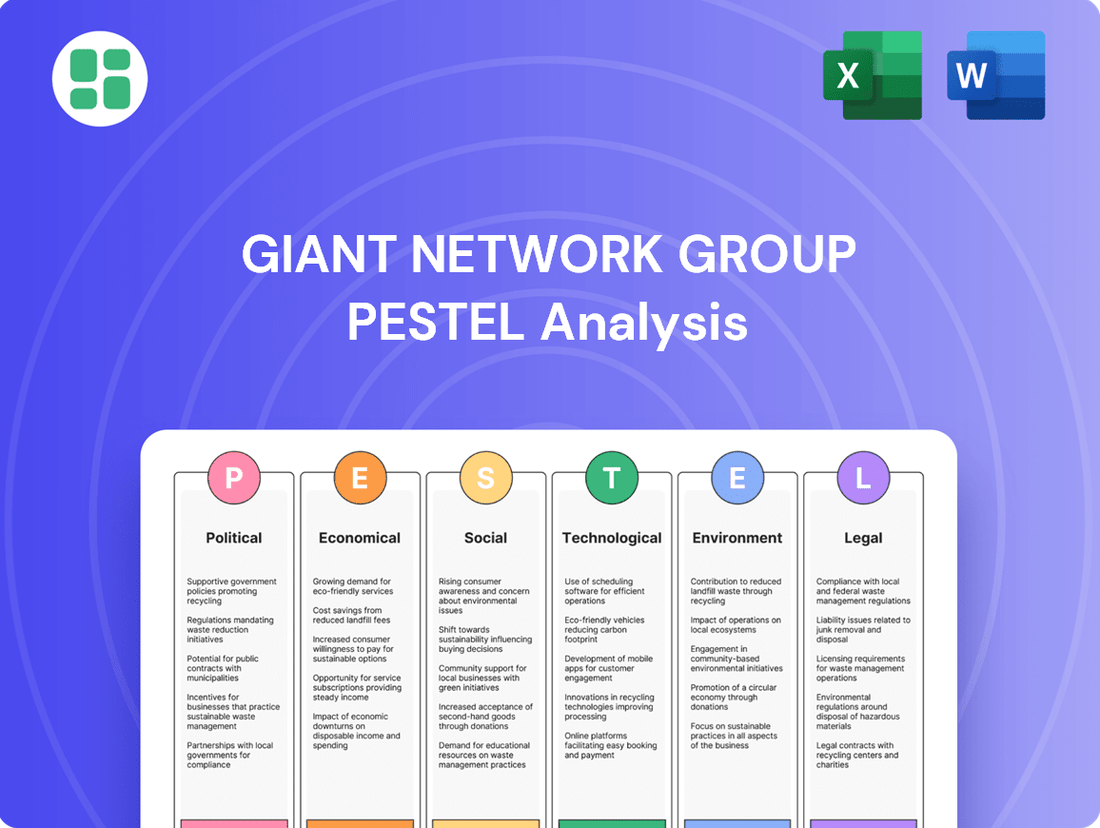

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Giant Network Group, offering a comprehensive understanding of its external operating landscape.

The Giant Network Group PESTLE Analysis offers a concise, easily shareable summary format, ideal for quick alignment across teams and departments, thereby relieving the pain point of information silos.

Economic factors

Rising disposable income among Chinese consumers is a significant tailwind for the gaming industry, including companies like Giant Network Group. As incomes grow, consumers have more discretionary funds available for entertainment, directly benefiting the gaming sector through increased spending on hardware, software, and in-game transactions.

In 2024, China's per capita disposable income is projected to continue its upward trajectory, fueling demand for digital entertainment. This trend is particularly evident in the online gaming market, where a larger consumer base can afford to invest more in premium gaming experiences and virtual goods, thereby expanding revenue streams for game developers and publishers.

The Chinese gaming market is experiencing significant expansion, with projections showing it will grow from an estimated USD 66.13 billion in 2024 to USD 95.51 billion by 2029. This upward trend, with a compound annual growth rate (CAGR) of 7.63%, indicates a strong and expanding market size. Such robust economic growth within the sector creates a favorable environment for companies like Giant Network Group.

The Chinese gaming market, a key battleground for Giant Network Group, is intensely competitive. Dominant forces like Tencent and NetEase command significant market share, forcing all players to constantly innovate and execute robust marketing campaigns to stand out. For instance, Tencent's gaming revenue alone reached approximately $28 billion in 2023, highlighting the scale of investment required to compete effectively.

Monetization Models and Revenue Generation

While free-to-play (F2P) games continue to dominate the Chinese market, subscription services are experiencing the most rapid expansion. This shift is driven by a desire for more predictable revenue streams and a growing willingness among players to pay for premium content and experiences.

The escalating costs associated with acquiring new users are compelling gaming companies to diversify their monetization approaches. This includes exploring in-game purchases, advertising, and increasingly, integrated cross-play ecosystems that allow for revenue generation across multiple platforms and devices.

For instance, in 2024, the Chinese gaming market saw a significant uptick in subscription revenue, with some reports indicating year-over-year growth exceeding 20% for services offering exclusive content or ad-free experiences. This contrasts with the more mature F2P model, which, while still substantial, faces increasing competition and player fatigue.

- Subscription Growth: Chinese gaming subscriptions saw over 20% growth in 2024.

- User Acquisition Costs: Rising costs necessitate diverse monetization strategies.

- Monetization Diversification: Companies are exploring in-game purchases, ads, and cross-play.

- Ecosystem Integration: Cross-platform revenue generation is becoming crucial for sustained growth.

Global Market Expansion Opportunities

Chinese game developers, including Giant Network Group, are strategically targeting overseas markets to boost revenue and reduce reliance on their domestic sector. This global push is a significant trend, with Chinese companies capturing a substantial portion of the worldwide mobile gaming revenue, creating promising new growth avenues.

The international gaming market presents a vast opportunity. For instance, in 2023, the global games market was valued at over $184 billion, with mobile gaming accounting for the largest share. Giants like Tencent and NetEase have already established strong international presences, demonstrating the viability of this strategy.

Giant Network Group can leverage this trend by:

- Expanding its portfolio of internationally appealing titles: Focusing on genres and themes that resonate with global audiences.

- Establishing local partnerships: Collaborating with regional publishers and distributors to navigate cultural nuances and market specificities.

- Investing in localized marketing campaigns: Tailoring promotional efforts to specific countries and player demographics.

- Acquiring or investing in overseas studios: Gaining access to established international talent and market share.

China's economic growth continues to be a primary driver for its gaming industry, directly impacting companies like Giant Network Group. With disposable incomes on the rise, consumers are allocating more funds to entertainment, which translates into increased spending on games and related services.

The projected growth of the Chinese gaming market from an estimated USD 66.13 billion in 2024 to USD 95.51 billion by 2029, at a CAGR of 7.63%, underscores a robust economic environment favorable for industry players. This expansion is fueled by a growing consumer base willing to invest in premium gaming experiences, thereby widening revenue opportunities.

While free-to-play models remain dominant, subscription services are showing the fastest growth, with some reporting over 20% year-over-year increases in 2024. This shift indicates a market evolution towards more predictable revenue streams and a player base increasingly valuing exclusive content and ad-free experiences.

| Economic Factor | Description | Impact on Giant Network Group |

|---|---|---|

| Disposable Income Growth | Rising incomes in China increase consumer spending on non-essential goods and services. | Directly boosts demand for gaming products and in-game purchases. |

| Market Size & Growth | Chinese gaming market projected to reach USD 95.51 billion by 2029 (7.63% CAGR). | Provides a large and expanding customer base for game monetization. |

| Monetization Trends | Shift towards subscription services (over 20% growth in 2024) alongside in-game purchases. | Encourages diversification of revenue streams beyond traditional F2P. |

Preview Before You Purchase

Giant Network Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of the Giant Network Group provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

The Chinese gaming landscape is profoundly influenced by shifting demographics. Mobile gaming remains the undisputed leader, capturing the vast majority of players, while esports continues its impressive upward trajectory, drawing in a dedicated and growing audience.

Interestingly, the average age of gamers in China is around 35, and a significant portion of the user base is female. This evolving profile directly impacts game development and marketing strategies, pushing for more diverse genres and appealing content that resonates with a broader spectrum of players beyond traditional demographics.

Societal concerns about gaming addiction, especially impacting younger players, are shaping how governments regulate the industry. For instance, China's 2021 regulations limiting online gaming for minors to just three hours a week demonstrate this trend, directly affecting how companies like Giant Network Group must adapt their offerings and implement stricter age verification and playtime controls.

Gaming is profoundly woven into China's entertainment fabric, boasting a colossal gamer base of 668 million individuals as of 2023. This widespread adoption fuels a strong demand for interactive digital experiences.

The rise of esports further solidifies gaming's cultural acceptance. Its increasing mainstream appeal is evidenced by its inclusion in significant sporting spectacles, such as the Asian Games, highlighting a growing societal validation of competitive gaming.

Influence of Social Media and Influencer Marketing

Social media platforms and influencer marketing are pivotal in shaping game adoption and user engagement in China. The pervasive nature of platforms like WeChat and Douyin means that trends and new game releases can spread rapidly through these channels.

The success of mini-games integrated into social applications, such as those on WeChat, underscores the significance of social interaction and ease of access. These embedded games often leverage existing social networks for viral growth. For instance, WeChat's mini-game ecosystem saw significant user activity throughout 2024, with many games achieving millions of daily active users by leveraging social sharing features.

Influencer marketing is a powerful tool, with Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs) driving considerable traffic and conversion rates for new game titles. A notable trend in 2024 was the increased investment by game developers in livestreaming promotions and collaborations with popular gaming influencers, often resulting in immediate spikes in downloads and in-game purchases. For example, a successful campaign in late 2024 for a new mobile RPG saw a 30% increase in daily active users directly attributed to a single influencer's sponsored stream.

- Social Integration: Mini-games on WeChat and similar platforms benefit from built-in social sharing and friend-based challenges, fostering organic growth.

- Influencer Impact: KOLs and KOCs on platforms like Douyin and Bilibili significantly influence purchasing decisions and game adoption.

- Livestreaming Dominance: Game promotions through live streaming by popular influencers are a key driver of user acquisition and engagement in 2024-2025.

Urbanization and Internet Infrastructure

Urbanization in China continues to fuel demand for digital entertainment, with a significant portion of the population now residing in cities. This trend is directly supported by the rapid expansion of internet infrastructure. By the end of 2024, China's 5G user base was projected to exceed 1.3 billion, providing the high-speed, low-latency connectivity essential for immersive online gaming experiences, particularly for massively multiplayer online games.

The increasing penetration of 5G technology directly enhances the accessibility and growth of online gaming services. This robust digital backbone allows for the seamless development and operation of complex, large-scale online games, catering to a growing urban demographic with disposable income and a preference for digital leisure activities.

- Urban Population Growth: China's urbanization rate reached approximately 66.16% by the end of 2023, indicating a substantial and growing urban consumer base.

- 5G Expansion: As of early 2025, China boasts over 3.37 million 5G base stations, covering a vast majority of its urban areas and ensuring widespread high-speed internet access.

- Online Gaming Market: The online gaming market in China is a multi-billion dollar industry, with continued growth driven by increased internet accessibility and mobile penetration.

Societal attitudes towards gaming are evolving, with esports gaining mainstream acceptance and even being featured in events like the Asian Games. This growing validation influences how games are perceived and consumed.

Social media and influencers are critical for game promotion in China, with platforms like WeChat and Douyin driving rapid adoption. Mini-games integrated into these social apps, leveraging social sharing, saw millions of daily active users in 2024.

Concerns about gaming addiction have led to strict regulations, such as the 2021 limits on minor gaming time, forcing companies to adapt with age verification and playtime controls.

| Factor | Description | 2024-2025 Data/Trend |

|---|---|---|

| Esports Acceptance | Growing societal acceptance of competitive gaming. | Inclusion in major sporting events like the Asian Games. |

| Social Media Influence | Key platforms for game discovery and promotion. | WeChat mini-games achieved millions of daily active users by leveraging social sharing in 2024. |

| Regulatory Impact | Government measures to address gaming addiction. | 2021 regulations limiting minors' gaming to 3 hours/week remain influential. |

Technological factors

The widespread use of smartphones in China, reaching over 1.07 billion mobile connections by the end of 2023, underpins the growth of mobile gaming. This vast user base is increasingly demanding higher quality experiences, directly benefiting companies like Giant Network Group.

The ongoing rollout of 5G technology across China is a significant catalyst. By early 2024, 5G base stations exceeded 3.3 million, providing the faster speeds and lower latency essential for immersive online games, especially MMORPGs, which rely heavily on seamless connectivity for their complex gameplay and large player interactions.

Artificial intelligence is a significant technological driver in China's gaming sector, with over 80% of domestic game developers integrating AI into their workflows. This widespread adoption aims to streamline development and elevate player engagement.

AI's application spans crucial areas like automated content generation, sophisticated chatbot design for in-game interactions, and the creation of more adaptive and immersive gameplay mechanics, directly impacting user experience and retention.

The growth of cloud gaming services presents a significant technological factor for Giant Network Group. This trend allows players to enjoy high-fidelity games on less powerful devices, removing the barrier of expensive hardware. By 2024, the global cloud gaming market was projected to reach over $12 billion, with China being a major contributor, indicating substantial user adoption and infrastructure development.

Emergence of VR/AR Technologies

While still developing, Virtual Reality (VR) and Augmented Reality (AR) are becoming key areas for innovation in China's gaming industry, a sector Giant Network Group operates within. This trend was evident at ChinaJoy 2025, where advancements in 'spatial gaming' powered by AI glasses were a significant talking point, signaling potential future growth avenues.

The market for VR/AR in gaming is projected to expand, with estimates suggesting the global VR gaming market alone could reach tens of billions of dollars by the mid-2020s. For Giant Network Group, this presents an opportunity to explore new immersive experiences and potentially capture a growing segment of the gaming audience.

- VR/AR Market Growth: Projections indicate significant expansion in the VR gaming sector throughout the 2020s.

- ChinaJoy 2025 Showcase: Demonstrations of AI-powered spatial gaming highlight technological advancements and future potential.

- Immersive Experiences: VR/AR integration offers opportunities for Giant Network Group to develop novel and engaging gaming content.

Cybersecurity and Data Protection Technologies

The escalating volume of personal data handled online necessitates robust cybersecurity and data protection technologies. Giant Network Group, like all major players, must prioritize continuous investment in advanced security protocols. This is crucial not only for compliance with evolving data privacy regulations, such as the GDPR and similar frameworks being strengthened globally through 2024 and into 2025, but also to safeguard user trust and brand reputation.

The financial implications are significant. For instance, the average cost of a data breach in 2024 is projected to exceed $5 million globally, a figure that underscores the need for proactive security investments. Companies that fail to adequately protect data risk substantial financial penalties and reputational damage, impacting their market position and customer loyalty.

- Increased Investment in AI-driven threat detection: Expect companies to allocate more resources to AI and machine learning for identifying and mitigating cyber threats in real-time, a trend already accelerating in 2024.

- Emphasis on Zero Trust Architecture: Adopting a Zero Trust security model, which assumes no implicit trust and verifies every access request, is becoming a standard for enhanced data protection.

- Compliance with evolving privacy laws: Staying ahead of and adhering to new data privacy regulations, which are becoming more stringent worldwide, is a critical technological and operational challenge.

- Data Encryption and Anonymization: Implementing advanced encryption techniques and data anonymization methods will be paramount to protect sensitive information processed by Giant Network Group.

The rapid advancement of AI is transforming game development and player experiences, with over 80% of Chinese game developers integrating AI in 2024 to enhance features like content generation and player interaction. Cloud gaming is also expanding, projected to exceed $12 billion globally by 2024, offering accessible, high-quality gaming on various devices. VR/AR technologies are emerging as significant future growth areas, with 'spatial gaming' gaining traction, indicating a shift towards more immersive interactive entertainment.

| Technology | 2023/2024 Data/Projection | Impact on Giant Network Group |

|---|---|---|

| AI Integration in Games | >80% of Chinese developers using AI (2024) | Streamlined development, enhanced player engagement, personalized experiences |

| Cloud Gaming Market | Projected >$12 billion globally (2024) | Expanded reach, reduced hardware barriers for players, new revenue streams |

| 5G Network Expansion | >3.3 million 5G base stations in China (early 2024) | Improved connectivity for real-time multiplayer, enhanced mobile gaming performance |

| VR/AR Gaming | Projected significant growth, with specific market size estimates in tens of billions by mid-2020s | Opportunity for innovative, immersive game development and new market segments |

Legal factors

China's evolving data privacy landscape, particularly with the Personal Information Protection Law (PIPL) and Data Security Law (DSL), significantly impacts how companies like Giant Network Group handle user data. These regulations, reinforced by the Network Data Security Management Regulations effective January 1, 2025, mandate strict protocols for data collection, processing, and cross-border transfers. Failure to comply can result in substantial fines, potentially reaching up to 5% of annual turnover or 50 million RMB, alongside other severe penalties.

Intellectual property rights enforcement is crucial for game developers like Giant Network Group, ensuring their creative works are protected from unauthorized copying and distribution. A strong legal framework deters piracy, which can significantly impact revenue and market share. For instance, the global video game market was valued at approximately $200 billion in 2023 and is projected to grow, making IP protection even more vital.

While specific recent enforcement actions against Giant Network Group were not publicly detailed, the general trend in the gaming industry highlights the importance of vigilant IP management. Companies actively pursue legal avenues to protect their game assets, character designs, and proprietary software. This proactive approach is fundamental for maintaining a competitive edge and fostering continued innovation within the sector.

China's intensified focus on anti-monopoly regulations, particularly since 2021, directly impacts large online platform operators like Giant Network Group. These measures aim to curb excessive market concentration and ensure fair competition, preventing dominant players from stifling innovation and disadvantaging smaller businesses. For instance, significant fines have been levied against major tech firms for monopolistic practices, underscoring the government's commitment to a more balanced digital economy.

Consumer Protection Regulations for In-Game Purchases

Consumer protection regulations for in-game purchases remain a significant consideration within China's dynamic gaming industry. While specific, stringent rules on elements like daily login rewards and loot boxes have seen some adjustments, the government's commitment to safeguarding consumers, especially minors, is unwavering. This ongoing focus necessitates that companies like Giant Network Group carefully navigate evolving legal frameworks to ensure compliance and maintain consumer trust.

The regulatory environment emphasizes transparency and fairness in monetization strategies. For instance, the National Press and Publication Administration (NPPA) has previously signaled intentions to curb excessive spending and protect younger players. While specific directives can shift, the underlying principle of consumer welfare in digital goods and services, particularly within gaming, continues to be a priority for Chinese authorities, impacting how revenue models are designed and implemented.

- Ongoing Scrutiny: Chinese regulators consistently monitor in-game purchase practices to prevent potential exploitation, especially of minors.

- Focus on Minors: Policies often aim to limit spending by underage players and ensure clear communication about purchase risks.

- Evolving Landscape: While some proposed regulations have been withdrawn, the general trend is towards greater consumer protection in digital entertainment.

Game Content Approval and Censorship Laws

In China, the National Press and Publication Administration (NPPA) mandates a strict game content approval process. This involves thorough content review to ensure compliance with national laws and to safeguard cultural sensitivities, directly influencing the permissible themes and narratives in games released within the country.

This rigorous oversight means game developers, including entities like Giant Network Group, must meticulously tailor their game designs to align with these regulations. Failure to secure NPPA approval can prevent a game's release, impacting revenue and market access. For instance, in 2023, the NPPA continued to issue licenses for new games, but the approval process remains a critical gatekeeper, with specific attention paid to content deemed inappropriate or potentially harmful.

- NPPA Approval: All games require NPPA clearance, involving content review against national laws and cultural norms.

- Impact on Design: This legal requirement shapes permissible themes, narratives, and overall game design for the Chinese market.

- Market Access: Non-compliance can lead to a complete inability to release games, directly affecting revenue streams.

- Ongoing Scrutiny: The NPPA's licensing practices in 2023 and into 2024 highlight continued regulatory attention on game content.

Giant Network Group must navigate China's stringent data privacy laws, such as the PIPL and DSL, which dictate how user data is handled, collected, and transferred across borders. Non-compliance, especially with regulations effective from January 1, 2025, can lead to penalties up to 5% of annual turnover or 50 million RMB, impacting operations and financial stability.

Protecting intellectual property is paramount for Giant Network Group, as robust enforcement deters piracy and safeguards revenue in the global gaming market, valued at approximately $200 billion in 2023. The company's competitive edge relies on actively defending its game assets and proprietary software through legal means.

China's anti-monopoly regulations, intensified since 2021, target large online platforms like Giant Network Group, aiming to foster fair competition and prevent market dominance. This regulatory push has resulted in significant fines for major tech firms, signaling a commitment to a more balanced digital economy.

Consumer protection, particularly concerning in-game purchases and minors, remains a key focus for Chinese authorities. While specific rules have seen adjustments, the underlying principle of consumer welfare necessitates that Giant Network Group ensures transparency and fairness in its monetization strategies to maintain trust.

Environmental factors

Giant Network Group, as a major online game developer, operates extensive data centers that are significant energy consumers. This reliance on computing power directly translates to a substantial electricity demand, a key environmental consideration for the company.

The Chinese tech sector, including gaming giants like Giant Network Group, is under increasing pressure to adopt greener practices. By 2023, China's data center industry aimed to improve energy efficiency, with a target of reducing the PUE (Power Usage Effectiveness) ratio. This push signifies a growing industry trend towards sustainability and renewable energy integration.

Giant Network Group, like many in the gaming sector, faces growing pressure to integrate Corporate Social Responsibility (CSR) and environmental sustainability into its operations. This includes exploring ways to embed eco-conscious messaging within games or implementing greener operational strategies. For instance, by 2024, the global gaming industry's carbon footprint was estimated to be significant, prompting a push for more sustainable data centers and energy-efficient hardware.

While Giant Network Group focuses on software, the gaming industry's hardware component generates significant electronic waste. This e-waste stems from the constant upgrades and eventual disposal of consoles, PCs, and peripherals. For instance, the global e-waste generated in 2023 was estimated at 62 million tonnes, a figure expected to rise.

Although Giant Network Group doesn't directly manufacture hardware, its success can indirectly encourage more hardware production and consumption. This creates a ripple effect, contributing to the environmental burden of e-waste. The trend towards more powerful gaming hardware, often requiring frequent replacement, exacerbates this issue.

Climate Change Impact on Infrastructure

Climate change presents significant environmental challenges for Giant Network Group's infrastructure. Extreme weather events, such as intensified storms and heatwaves, directly threaten the reliability of the internet and power grids that underpin online gaming services. For instance, a 2024 report highlighted that the increasing frequency of severe weather incidents led to an estimated $100 billion in infrastructure damage globally in the preceding year, impacting critical network uptime.

This necessitates a proactive approach to building resilience. Giant Network Group must invest in robust disaster recovery plans and infrastructure hardening to mitigate potential disruptions. The company's ability to maintain uninterrupted service during adverse conditions will be a key differentiator.

- Increased Risk of Service Disruptions: Extreme weather events can damage data centers, fiber optic cables, and power supply systems, leading to outages for online gaming platforms.

- Higher Operational Costs: Investments in climate-resilient infrastructure and disaster recovery measures will increase capital expenditure and operational expenses.

- Reputational Damage: Prolonged service interruptions due to environmental factors can severely damage customer trust and brand reputation, impacting user retention and acquisition.

Supply Chain Sustainability

For a software-focused entity like Giant Network Group, the direct environmental footprint of its supply chain is naturally less pronounced than that of hardware manufacturers. The company's core operations rely on digital infrastructure and intellectual property rather than physical goods.

However, a comprehensive sustainability assessment must consider indirect environmental impacts. This includes scrutinizing the energy consumption and environmental stewardship of their cloud service providers, which are critical for hosting and delivering software solutions. For instance, major cloud providers like Amazon Web Services (AWS) and Microsoft Azure are increasingly investing in renewable energy sources to power their data centers, with AWS aiming for 100% renewable energy by 2025 and Microsoft targeting carbon negative operations by 2030.

Furthermore, Giant Network Group should evaluate the environmental practices of any hardware partners involved in developing or supporting their software ecosystem. This could encompass the sourcing of components, manufacturing processes, and end-of-life management for any physical devices or infrastructure utilized.

- Cloud Provider Energy Mix: Examining the percentage of renewable energy used by key cloud infrastructure providers in 2024 and projected for 2025 is crucial.

- Hardware Partner Certifications: Assessing if hardware suppliers hold certifications like EPEAT (Electronic Product Environmental Assessment Tool) or ISO 14001 for environmental management.

- Data Center Efficiency: Investigating Power Usage Effectiveness (PUE) ratios of data centers used by Giant Network Group, with industry averages for efficient facilities often below 1.2.

Giant Network Group's operations are intrinsically linked to energy consumption, particularly through its data centers, which are significant electricity users. The company's reliance on computing power directly translates to a substantial electricity demand, a key environmental consideration. By 2023, the Chinese data center industry was actively working to improve energy efficiency, aiming to reduce the Power Usage Effectiveness (PUE) ratio, reflecting a broader industry trend towards sustainability and renewable energy integration.

The gaming industry, including Giant Network Group, faces increasing scrutiny regarding its environmental footprint. By 2024, the global gaming industry's carbon emissions were a growing concern, prompting a push for more sustainable data centers and energy-efficient hardware. This environmental pressure necessitates that companies like Giant Network Group embed eco-conscious messaging within their games and adopt greener operational strategies.

Climate change poses direct threats to Giant Network Group's infrastructure, with extreme weather events potentially disrupting internet and power grids. A 2024 report indicated that severe weather incidents caused approximately $100 billion in global infrastructure damage in the prior year, underscoring the risk to network uptime. Consequently, investing in robust disaster recovery and infrastructure hardening is essential for maintaining uninterrupted service.

| Environmental Factor | Impact on Giant Network Group | Industry Trend/Data (2023-2025) |

|---|---|---|

| Energy Consumption | High electricity demand for data centers | China's data center PUE reduction efforts; Global gaming industry carbon footprint concerns |

| E-Waste | Indirect contribution through hardware consumption | 62 million tonnes of global e-waste generated in 2023; Trend towards more powerful, frequently replaced hardware |

| Climate Change & Extreme Weather | Risk of service disruptions and infrastructure damage | Estimated $100 billion in global infrastructure damage from severe weather (2023); Increasing frequency of incidents |

| Supply Chain Sustainability | Reliance on cloud providers' energy mix and hardware partners' practices | Major cloud providers investing in renewables (AWS 100% renewable by 2025); Growing demand for EPEAT/ISO 14001 certified hardware |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Giant Network Group is built on comprehensive data from leading financial institutions like the IMF and World Bank, alongside reports from reputable market research firms and government publications. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the telecommunications sector.