Giant Network Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Network Group Bundle

Giant Network Group operates in a dynamic landscape shaped by intense competition, evolving buyer power, and the constant threat of substitutes. Understanding these forces is crucial for any strategic decision.

The complete report reveals the real forces shaping Giant Network Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Giant Network Group's reliance on specialized game engines like Unity and Unreal Engine, where a few dominant providers exist, directly translates to substantial supplier bargaining power. These core technologies are critical for game development, making it difficult and costly to switch, which strengthens the suppliers' hand in negotiations.

The cloud computing sector also presents a similar dynamic. Companies like Amazon Web Services (AWS) and Microsoft Azure hold significant market share, giving them leverage over pricing and service terms. For instance, in 2024, the global cloud computing market was valued at over $600 billion, with a few major players controlling a large portion of that revenue.

Furthermore, Giant Network Group's dependence on major app store platforms, such as Apple's App Store and Google Play, for game distribution amplifies the bargaining power of these platform owners. These platforms dictate revenue-sharing models and can influence a game's visibility, effectively controlling a crucial part of the developer's business.

The gaming sector in China, including companies like Giant Network Group, experiences fierce competition for specialized talent such as game developers, artists, and marketing experts. This high demand for skilled professionals can drive up labor expenses and empower individual employees with more leverage in salary and benefits discussions.

In 2023, the average salary for a senior game programmer in China could range from ¥30,000 to ¥50,000 per month, reflecting the intense demand. Companies must therefore allocate substantial resources to attract and retain top talent to maintain their competitive edge in this dynamic market.

Suppliers of marketing and user acquisition services, like major ad networks and social media platforms, wield significant influence due to their vast reach and precise targeting options. Giant Network Group relies heavily on these channels to draw in and keep players for its diverse portfolio of MMORPGs and mobile games.

The escalating costs associated with acquiring new users in China's intensely competitive gaming landscape further bolster the bargaining power of these marketing service providers. For instance, in 2023, the average cost per install (CPI) for mobile games in China saw a notable increase, impacting companies like Giant Network Group.

Hardware and Infrastructure Providers

Hardware and infrastructure providers, such as those supplying server hardware, networking equipment, and data center services, hold significant bargaining power over Giant Network Group. Their critical role in maintaining the online gaming platform and ensuring smooth gameplay means disruptions, like chip shortages affecting component availability, can directly impact the industry's ability to scale and operate efficiently.

The dependency on these suppliers for essential operational components grants them leverage regarding pricing and service reliability. For instance, in 2024, the global semiconductor shortage continued to affect the availability and cost of key components used in server and networking hardware, potentially increasing operational expenditures for companies like Giant Network Group.

- Component Availability: Shortages of critical components like GPUs and CPUs can lead to increased lead times and higher prices for essential hardware.

- Service Level Agreements (SLAs): Data center and cloud service providers can negotiate terms that impact uptime guarantees and support levels, influencing operational continuity.

- Technological Advancements: Providers of cutting-edge networking and server technology can command premium pricing due to the performance advantages they offer.

Intellectual Property and Licensing

The bargaining power of suppliers in the intellectual property and licensing domain significantly influences Giant Network Group's operational costs and strategic flexibility. Games that leverage popular licensed content, like anime or movie franchises, often face substantial licensing fees demanded by IP owners. These fees can directly impact a game's profitability and the developer's ability to innovate freely with the licensed material.

While Giant Network Group's core strategy emphasizes original intellectual property, the prospect of future collaborations with external IP holders introduces a supplier power dynamic. For instance, in 2024, the global market for licensed video game content saw continued growth, with major entertainment franchises commanding premium licensing rates. Companies that own highly sought-after IPs can exert considerable influence over terms and pricing, potentially increasing development expenses for game studios.

- High Licensing Fees: Owners of popular IPs can charge substantial fees, increasing game development costs.

- Restrictive Terms: Licensing agreements may impose limitations on creative control and marketing.

- Market Influence: Strong IP can attract a large player base, giving owners leverage in negotiations.

- Strategic Importance: While Giant Network Group focuses on original IP, potential cross-IP deals highlight supplier power.

Giant Network Group faces considerable supplier bargaining power due to its reliance on specialized game engines and cloud computing services where a few dominant providers exist. The cost and complexity of switching these critical technologies, coupled with the market concentration of cloud providers like AWS and Azure, grant these suppliers significant leverage in pricing and service terms.

The dependence on app store platforms like Apple's App Store and Google Play further amplifies supplier power, as these platforms dictate revenue-sharing models and influence game visibility. Additionally, the intense competition for skilled talent in China's gaming sector empowers individual employees, driving up labor costs and giving employees more negotiation leverage.

Marketing and user acquisition service providers also hold strong influence due to their extensive reach and targeting capabilities, with escalating user acquisition costs in China further strengthening their position. Even hardware and infrastructure providers, including those supplying server hardware and networking equipment, exert power, especially when component shortages, like those impacting semiconductors in 2024, affect availability and pricing.

| Supplier Category | Key Suppliers/Examples | Impact on Giant Network Group | 2024 Market Data/Trend |

|---|---|---|---|

| Game Engines | Unity, Unreal Engine | High switching costs, reliance on core technology | Dominant market share held by few providers |

| Cloud Computing | AWS, Microsoft Azure | Leverage in pricing and service terms | Global market valued over $600 billion in 2024 |

| App Stores | Apple App Store, Google Play | Control over distribution, revenue share, visibility | Essential distribution channels for mobile games |

| Talent | Skilled Game Developers, Artists | Increased labor costs, retention challenges | Average senior game programmer salary in China: ¥30,000-¥50,000/month (2023) |

| Marketing Services | Ad Networks, Social Media Platforms | Rising user acquisition costs (CPI) | Notable increase in mobile game CPI in China (2023) |

| Hardware & Infrastructure | Server Hardware, Networking Equipment | Impact of component shortages on costs and availability | Continued semiconductor shortages affecting component availability and cost (2024) |

What is included in the product

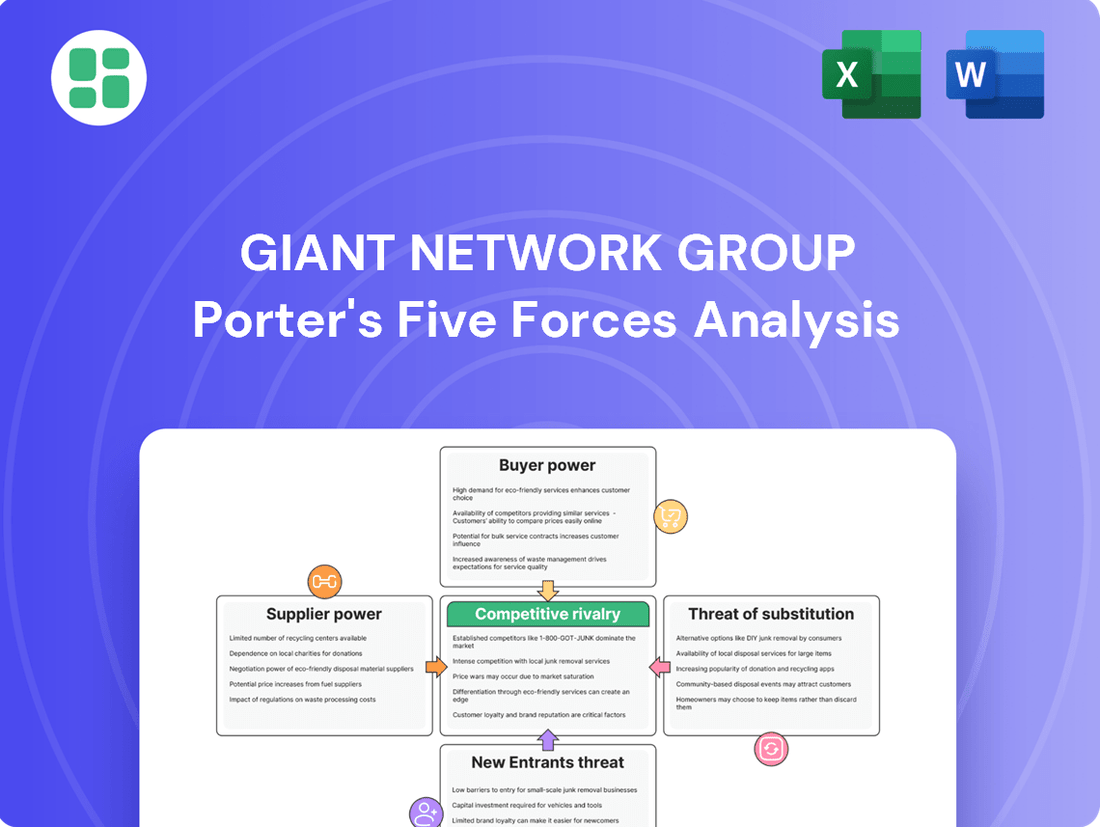

This analysis dissects the competitive landscape for Giant Network Group by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Effortlessly visualize the competitive landscape and identify strategic vulnerabilities with an intuitive, interactive Porter's Five Forces model.

Customers Bargaining Power

The sheer volume of online games available in China, a market boasting over 650 million gamers as of 2023, directly fuels the bargaining power of customers. With so many options across genres like MMORPGs, MOBAs, and battle royales, players can readily find alternatives if Giant Network Group's offerings don't meet their expectations.

This vast selection translates to low switching costs for consumers. If a player finds a game's pricing, content updates, or overall experience unsatisfactory, they can seamlessly transition to a competitor's title. This ease of movement empowers individual gamers, giving them significant leverage in the highly competitive online gaming landscape.

Giant Network Group's reliance on a free-to-play model significantly amplifies customer bargaining power. Players can sample games without upfront cost, allowing them to easily switch to competitors if the value proposition or in-game offerings are not compelling. This freedom to choose, or not spend, puts pressure on Giant Network Group to continually enhance user experience and monetization strategies to retain engagement.

The Chinese government's stringent regulations, particularly those focused on combating gaming addiction among minors, significantly curtail customer spending and engagement within the gaming sector. These policies directly limit how much underage players can spend and how long they can play, thereby reducing the potential revenue generated per user. For instance, in 2021, China implemented a rule restricting minors to just three hours of online gaming per week, a move that demonstrably impacted the industry's revenue streams.

Community Influence and Feedback

Giant Network Group's bargaining power of customers is significantly influenced by the robust online gaming communities and social media platforms prevalent in China. These platforms empower players to collectively voice their opinions, complaints, and demands, creating a powerful collective voice.

Negative feedback or organized boycotts from substantial player bases can swiftly damage a game's reputation and, consequently, its financial performance. For instance, in 2023, a major title faced significant backlash due to perceived pay-to-win mechanics, leading to a notable dip in player engagement and revenue before adjustments were made.

To counter this, Giant Network Group must proactively engage with its community, actively listening to and responding to feedback. Maintaining player loyalty hinges on demonstrating responsiveness and addressing concerns transparently. This approach is crucial for mitigating potential damage and fostering a positive long-term relationship with its player base.

- Community Feedback Channels: Players utilize platforms like Weibo, Douyu, and Bilibili to share experiences and organize feedback.

- Impact of Negative Sentiment: A significant portion of players (estimated 30-40% in some surveys) may cease playing or spending if dissatisfied with game updates or policies.

- Proactive Engagement: Giant Network Group's success depends on its ability to monitor these channels and implement player-requested changes, as seen in successful community-driven updates in 2024 for other gaming companies.

Price Sensitivity and Value Perception

Players in the free-to-play gaming market, where Giant Network Group operates, exhibit significant price sensitivity. The availability of a vast array of free alternatives means that customers will readily switch if they perceive in-game purchases to be overpriced or if monetization feels overly aggressive. For instance, in 2023, the global mobile gaming market, a key segment for Giant Network, saw continued intense competition, with player retention often tied to fair value propositions.

Giant Network Group must therefore tread carefully, balancing revenue generation with player satisfaction. Aggressive monetization tactics, such as excessively high prices for virtual goods or intrusive advertising, can alienate the player base, leading to decreased engagement and ultimately, lower long-term revenue. This delicate act requires a deep understanding of player psychology and market expectations.

- Price Sensitivity: Free-to-play games mean players have many choices and are quick to abandon games with perceived poor value.

- Value Perception: In-game purchases must offer clear benefits that align with their cost to maintain player spending.

- Monetization Strategy: Overly aggressive or unfair monetization can lead to player backlash and reduced revenue.

- Market Dynamics: The competitive landscape of 2023 highlighted the importance of player-centric monetization for sustained success.

The bargaining power of customers for Giant Network Group is substantial due to the highly competitive Chinese gaming market, which had over 650 million gamers in 2023. This vast player base has numerous alternatives, leading to low switching costs and empowering individual gamers to demand better value or readily move to other titles if dissatisfied. The prevalence of free-to-play models further amplifies this power, as players can easily sample games without initial investment, putting pressure on Giant Network Group to deliver compelling experiences and fair monetization strategies to retain engagement.

Player sensitivity to pricing and monetization is a critical factor. In the free-to-play environment, customers expect value for their in-game purchases, and aggressive tactics can lead to player churn. For instance, the global mobile gaming market in 2023 underscored that player retention is closely linked to perceived fairness in monetization. Consequently, Giant Network Group must balance revenue goals with player satisfaction to maintain a loyal user base and avoid negative sentiment that can spread rapidly through online communities.

| Factor | Impact on Giant Network Group | Example/Data Point |

|---|---|---|

| Market Size & Competition | High bargaining power | Over 650 million gamers in China (2023) |

| Switching Costs | Low bargaining power for company | Easy transition between numerous free-to-play games |

| Monetization Model | High bargaining power for customers | Free-to-play allows easy testing and switching based on value |

| Player Sentiment & Community | High bargaining power | Online platforms enable collective feedback and boycotts |

Preview the Actual Deliverable

Giant Network Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Giant Network Group, detailing the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This in-depth analysis provides actionable insights into the strategic positioning and potential challenges faced by Giant Network Group within its industry.

Rivalry Among Competitors

The Chinese online gaming market is a battleground dominated by giants. Tencent and NetEase, in particular, are titans, collectively controlling more than half of the entire market. Giant Network Group finds itself in this arena, up against these well-resourced competitors who boast extensive game libraries and loyal player communities.

This high concentration means Giant Network Group faces significant rivalry. It's a constant struggle to capture player attention and carve out market share when the top players have such a commanding presence. In 2023, Tencent's gaming revenue alone reached approximately $29.5 billion, highlighting the scale of resources available to the leading firms.

The online gaming sector, including companies like Giant Network Group, thrives on a relentless pace of innovation. Competitors are locked in a cycle of releasing new games and updating existing ones frequently to keep players engaged. This means a constant need for fresh content and the exploration of new technologies such as cloud gaming and AI integration.

In 2023, the global online gaming market was valued at approximately $220 billion, a figure expected to grow. This intense competition forces companies like Giant Network Group to invest heavily in research and development, often dedicating significant portions of their revenue to stay ahead. For instance, a substantial portion of a gaming company's budget might go towards developing new intellectual properties or enhancing existing game engines.

Giant Network Group, like many in the competitive gaming sector, faces intense rivalry fueled by aggressive marketing and user acquisition efforts. Companies pour significant resources into acquiring new players, which directly inflates customer acquisition costs and squeezes profit margins. For instance, in 2024, the average cost to acquire a paying user in mobile gaming continued to be a substantial figure, often in the double digits, making it challenging for less capitalized firms to compete effectively.

To combat this, firms like Giant Network Group increasingly rely on esports and live streaming platforms to foster player engagement and enhance brand visibility. These channels not only create a sense of community but also serve as powerful, albeit often costly, marketing tools. The constant need to innovate and outspend competitors on these fronts intensifies the rivalry, making it a defining characteristic of the industry's landscape.

Diversification and International Expansion

Giant Network Group faces intensified competitive rivalry as major Chinese gaming companies, including Tencent and NetEase, increasingly diversify their game portfolios across various genres. This strategic shift aims to capture a broader player base and reduce reliance on specific market segments. For instance, Tencent's revenue from its international gaming segment reached approximately $7.2 billion in the first half of 2024, highlighting the growing importance of global markets.

Furthermore, aggressive international expansion by these Chinese giants means Giant Network Group is not just competing domestically but also against global powerhouses like Sony, Microsoft, and Nintendo. This global reach is evident in the substantial investments made by these companies in overseas studios and marketing campaigns. In 2023, the global games market was valued at over $180 billion, with significant contributions from international players.

- Diversification Strategy: Chinese gaming firms are broadening their genre offerings, moving beyond traditional MMORPGs to include mobile, esports, and casual games.

- International Market Focus: Companies are prioritizing overseas markets to overcome domestic regulatory hurdles and tap into new revenue streams.

- Global Competitive Landscape: Giant Network Group contends with both established domestic rivals and major international gaming corporations for global market share.

- Market Saturation Mitigation: Diversification and international expansion are key tactics to combat saturation within the Chinese domestic market.

Regulatory Impact on Competition

Regulatory frameworks significantly influence the competitive intensity within the gaming industry. While strict rules can increase operational costs and slow innovation, they can also act as a shield for established players by creating high barriers to entry for newcomers. For instance, the stringent approval process for new games in China, a crucial market, directly impacts the competitive pipeline, with delays potentially hindering the launch of innovative titles and allowing incumbents to maintain market share. In 2023, the number of game licenses issued in China saw a notable increase compared to the previous year, reflecting ongoing adjustments in regulatory oversight, yet the process remains a critical gatekeeper.

Companies that proactively adapt to evolving regulations and demonstrate compliance can leverage this as a competitive advantage. This includes investing in robust internal compliance teams and developing business models that inherently align with regulatory expectations. For example, a company that prioritizes content localization and adheres to data privacy laws in multiple jurisdictions is better positioned to expand globally than one that overlooks these aspects. The ability to navigate these complexities efficiently can lead to greater market access and a more stable operating environment.

- Regulatory hurdles can favor established companies by increasing new entrant costs.

- China's game approval process directly impacts the speed of new game launches and competitive dynamics.

- Successful adaptation to regulations can create a competitive edge and market stability.

Giant Network Group faces intense rivalry from dominant players like Tencent and NetEase, who command over half the Chinese market. These giants possess vast game portfolios and dedicated player bases, making it difficult for Giant Network Group to capture attention and market share. The industry's rapid innovation cycle necessitates continuous investment in new content and technology, such as cloud gaming, to remain competitive.

Aggressive marketing and user acquisition strategies by competitors significantly increase costs for companies like Giant Network Group. The average cost to acquire a paying user in mobile gaming remained high in 2024, often in the double digits. To counter this, firms leverage esports and live streaming, which, while effective for engagement and visibility, also represent substantial marketing expenses.

The competitive landscape is further intensified by the diversification of major Chinese gaming firms into various genres and their aggressive international expansion. This means Giant Network Group competes not only domestically but also with global powerhouses. In the first half of 2024, Tencent's international gaming revenue reached approximately $7.2 billion, underscoring the global reach of its competitors.

| Competitor | Market Share (Approx.) | Key Strategies | 2023 Revenue (Approx.) |

|---|---|---|---|

| Tencent | > 30% | Diversification, International Expansion, Esports | $29.5 billion (Gaming) |

| NetEase | > 20% | Innovation, IP Development, Global Markets | $15.3 billion (Overall) |

| Giant Network Group | Smaller Share | Focus on specific genres, potentially niche markets | Data not publicly available for direct comparison |

SSubstitutes Threaten

The threat of substitutes for Giant Network Group's digital entertainment offerings is significant, primarily stemming from a wide array of alternative digital entertainment options. These include popular short-form video platforms, diverse streaming services for both video and music, and the ever-present social media landscape, all vying for consumer attention and spending.

The accessibility and often zero-cost entry point of many of these substitutes present a formidable challenge. For instance, in 2024, the average global internet user spent approximately 7 hours per day online, with a substantial portion dedicated to entertainment platforms, highlighting the intense competition for leisure time.

Beyond digital alternatives, traditional forms of entertainment like movies, television, books, and physical sports or outdoor activities also serve as substitutes for online gaming. These compete for the same finite leisure hours of potential players. For instance, global box office revenue reached approximately $26 billion in 2023, indicating continued consumer spending on traditional cinema experiences.

The burgeoning VR/AR and metaverse sectors represent a significant threat of substitution for Giant Network Group. As these immersive technologies advance, they are poised to offer compelling alternatives to existing online gaming experiences. For instance, by 2024, the global VR market size was valued at approximately $28.3 billion, with projections indicating substantial growth, potentially diverting consumer attention and spending away from traditional gaming platforms.

Casual and Mini-Games

The proliferation of hyper-casual and mini-games presents a significant threat of substitutes for companies like Giant Network Group. These games, often found within social platforms such as WeChat, offer a very accessible entry point for entertainment. They require minimal time or financial investment, directly competing with more involved gaming experiences.

This trend is particularly impactful as these simple games attract a vast, casual audience. For instance, in 2024, the mobile gaming market continued to see hyper-casual titles dominate download charts, with some games exceeding hundreds of millions of downloads. This widespread adoption means a large segment of potential players might opt for these quick diversions instead of investing in longer-form online games.

- Low Barrier to Entry: Hyper-casual and mini-games are easily accessible, often free-to-play and playable in short bursts.

- Broad Appeal: Their simplicity attracts a wide demographic, including those who might not identify as traditional gamers.

- Platform Integration: Being embedded in popular social apps increases their visibility and ease of discovery, further drawing users away from dedicated gaming platforms.

Passive Content Consumption

The rise of passive content consumption, particularly in the gaming sphere, presents a significant threat of substitutes. Consumers increasingly opt to watch gaming content, like esports or live streams on platforms such as Twitch and YouTube, rather than actively engaging in gameplay themselves. This shift can divert potential engagement away from companies like Giant Network Group, who rely on active participation in their games.

For instance, in 2024, the global esports market was projected to generate over $1.5 billion in revenue, with viewership numbers soaring. This demonstrates a substantial audience that might be satisfied by watching rather than playing, directly impacting the demand for interactive gaming experiences offered by companies like Giant Network Group. This trend means that Giant Network Group faces competition not just from other game developers, but also from entertainment platforms that offer a similar, albeit passive, gaming-related experience.

- Growing Viewership: Platforms like Twitch saw millions of daily active viewers in 2024, indicating a massive audience for passive gaming content.

- Esports Revenue: The esports industry's significant revenue growth underscores the economic viability of content consumption over active play.

- Time Allocation: Consumers may allocate their leisure time to watching gaming content, reducing the time available for playing games from companies like Giant Network Group.

The threat of substitutes for Giant Network Group is substantial, driven by the vast digital entertainment ecosystem and evolving consumer preferences. Alternatives range from short-form video and streaming services to traditional media and emerging immersive technologies. For instance, in 2024, global internet users averaged over 7 hours online daily, with a significant portion dedicated to entertainment, underscoring the intense competition for attention. The accessibility of many substitutes, often free-to-play or low-cost, further intensifies this challenge.

| Substitute Category | Examples | 2024/2023 Data Point |

|---|---|---|

| Digital Entertainment | Short-form video (TikTok), Streaming (Netflix, Spotify), Social Media | Global internet users spent ~7 hours/day online (2024) |

| Traditional Entertainment | Movies, TV, Books, Live Sports | Global Box Office Revenue: ~$26 billion (2023) |

| Emerging Technologies | VR/AR, Metaverse | Global VR Market Size: ~$28.3 billion (2024) |

| Casual Gaming | Hyper-casual, Mini-games on social platforms | Hyper-casual games dominate mobile download charts |

| Passive Entertainment | Esports, Live Streaming (Twitch, YouTube) | Global Esports Market Revenue: >$1.5 billion (2024 projection) |

Entrants Threaten

Developing and launching a new MMORPG or mobile game is incredibly capital-intensive. We're talking about significant upfront costs for game design, complex programming, robust server infrastructure, and the continuous need for fresh content to keep players engaged. For instance, a major MMORPG development can easily run into tens of millions of dollars, with marketing budgets often matching or exceeding development costs.

In the highly competitive Chinese gaming market, simply having a good game isn't enough. Aggressive marketing and user acquisition strategies are crucial to stand out and attract players. This often involves substantial spending on advertising, influencer marketing, and promotional events, creating a formidable financial hurdle that deters many potential new entrants.

The stringent regulatory environment and complex licensing procedures in China present a substantial barrier for new entrants into the online gaming market. Companies must navigate a rigorous approval process for games, which can be time-consuming and unpredictable, potentially delaying or even halting market entry.

For instance, in 2023, China continued its efforts to regulate the gaming sector, with reports indicating a slowdown in the issuance of new game licenses compared to previous periods, highlighting the difficulty for newcomers to gain traction. This regulatory uncertainty adds significant risk, making it challenging for new players to establish a foothold against established companies like Giant Network Group.

Established brand loyalty and extensive user bases represent a significant barrier for new entrants in the gaming industry. Companies like Giant Network Group, Tencent, and NetEase have cultivated strong brand recognition and dedicated player communities over many years. For instance, Tencent reported over 1.3 billion monthly active users across its gaming platforms in early 2024, highlighting the sheer scale of its existing user base. Attracting players away from these deeply entrenched ecosystems is a formidable challenge, as gamers often stick with familiar titles and the social connections they've built within those games.

Talent Scarcity and Expertise

The specialized skills needed for advanced game development, especially for intricate MMORPGs, are highly sought after. This creates a significant hurdle for new players entering the market.

Established companies like Giant Network Group often possess the resources to attract and retain top talent by offering superior compensation packages and clearer career progression paths. This makes it difficult for newcomers to secure the experienced professionals essential for creating competitive products.

- Talent Demand: The global gaming industry's demand for skilled professionals, particularly in areas like AI programming and advanced graphics, continues to surge.

- Recruitment Challenges: In 2024, the average salary for a senior game developer in major tech hubs often exceeded $150,000 annually, a figure that can be prohibitive for startups.

- Retention Advantage: Major players can leverage their financial stability to offer benefits and stock options that new entrants struggle to match, thereby securing a vital talent pool.

Distribution Channel Access and Relationships

Newcomers to the gaming industry face significant hurdles in securing prime spots on major distribution platforms like the Apple App Store or Google Play. In 2024, for instance, the sheer volume of new app submissions means that gaining visibility requires substantial marketing investment or unique appeal to stand out. Established companies often leverage long-standing partnerships and preferential terms with these platforms, creating an uneven playing field.

These established relationships translate into better placement, featured opportunities, and potentially lower commission rates for existing, successful games. For a new entrant, achieving comparable reach without these advantages can be prohibitively expensive, impacting their ability to acquire users efficiently. For example, a new mobile game might need to spend upwards of $2 per install to compete for visibility in a crowded market, a cost that can quickly drain a startup's resources.

- Distribution Channel Dominance: Major app stores and online gaming platforms act as gatekeepers, with established players enjoying preferential access and visibility.

- Relationship Advantages: Existing companies benefit from established relationships with platform providers, securing better placement and promotional opportunities.

- Cost of Entry: New entrants face higher marketing costs to achieve similar reach, often needing to spend significantly per user acquisition to compete effectively in 2024.

The threat of new entrants for Giant Network Group is relatively low due to the immense capital required for game development and aggressive marketing in the competitive Chinese market. Significant upfront investment in design, programming, and infrastructure, often in the tens of millions of dollars, acts as a substantial deterrent. Furthermore, the need for continuous content updates and high marketing spend to gain visibility creates a formidable financial barrier for any potential newcomer.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Giant Network Group leverages data from company annual reports, financial statements, and industry-specific market research reports. We also incorporate insights from regulatory filings and economic databases to provide a comprehensive view of the competitive landscape.