Fukuoka Financial Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fukuoka Financial Group Bundle

Fukuoka Financial Group's strengths lie in its regional dominance and strong customer loyalty, while its weaknesses may include slower adoption of digital transformation compared to national peers. Understanding these internal factors is crucial for navigating the competitive landscape.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Fukuoka Financial Group (FFG) commands a formidable presence across Kyushu, Japan, with a robust network spanning Fukuoka, Kumamoto, and Nagasaki prefectures. This deep regional entrenchment fosters strong, enduring relationships with local businesses, particularly the vital small and medium-sized enterprises (SMEs) that form the backbone of the regional economy.

Fukuoka Financial Group (FFG) boasts a remarkably diversified financial services portfolio, extending well beyond conventional banking. This comprehensive offering includes essential services like loans and deposits, alongside a robust suite of investment products, foreign exchange capabilities, leasing, and credit card services. This broad spectrum significantly mitigates the group's dependence on any single revenue stream, ensuring greater stability and resilience.

This strategic diversification allows FFG to effectively address the multifaceted needs of both individual customers and corporate clients. The recent integration of Fukuoka Chuo Bank into the group, completed in 2020, was a pivotal move that further broadened its operational scope and enhanced its service capabilities, solidifying its position in the market.

Fukuoka Financial Group (FFG) is leading the charge in digital banking with Minna Bank, Japan's first fully digital bank, launched in May 2021. This pioneering initiative allows FFG to tap into a younger, tech-oriented customer base nationwide, moving beyond its traditional regional footprint.

By investing in AI-driven financial advice and enhancing its mobile banking applications, FFG is actively modernizing its services. This digital focus is crucial for staying competitive, as evidenced by Minna Bank's rapid customer acquisition, reaching over 1 million accounts by March 2024, demonstrating strong market acceptance of their digital-first approach.

Focus on Customer Centricity and Innovation

Fukuoka Financial Group (FFG) places a significant emphasis on customer centricity, evidenced by its 'Client First Initiative.' This focus is designed to elevate customer service experiences, and early reports indicate a positive impact on customer satisfaction metrics, though specific 2024 or 2025 figures are still emerging. The group's ingrained culture of innovation drives the continuous development of novel financial products and services tailored to evolving client needs.

This dual commitment to putting the customer first and fostering an innovative spirit is a core strength for FFG. It allows the group to adapt swiftly to market changes and maintain a competitive edge by proactively addressing customer demands. For instance, FFG has been actively exploring digital transformation initiatives to further enhance customer engagement and service accessibility.

Key aspects of this strength include:

- Enhanced Customer Satisfaction: The 'Client First Initiative' aims to improve customer experience, with early indicators pointing towards positive shifts in satisfaction scores.

- Culture of Innovation: FFG actively cultivates an environment that encourages new ideas and advanced solutions, ensuring its offerings remain relevant and competitive.

- Service and Product Improvement: The customer-centric and innovative approach directly fuels ongoing enhancements in service delivery and the creation of new financial products.

Potential Benefits from Rising Interest Rates

Fukuoka Financial Group (FFG) is poised to benefit from the Bank of Japan's pivot towards interest rate normalization, initiated in March 2024. This policy shift, with expectations of further rate hikes, directly enhances the profitability of regional banks like FFG, whose earnings are significantly driven by net interest income. This environment provides a strong tailwind for their core lending activities.

The group's reliance on net interest income means that as interest rates climb, the spread between what they earn on loans and what they pay on deposits widens, leading to increased profitability. For instance, during the fiscal year ending March 2024, Japanese banks generally saw improved net interest margins as the market anticipated policy changes.

- Increased Net Interest Income: Higher policy rates directly boost the income generated from lending activities.

- Improved Profitability: A wider net interest margin translates to stronger overall earnings for FFG.

- Favorable Market Conditions: The move away from negative interest rates creates a more supportive operating environment for traditional banking models.

FFG's deep regional roots in Kyushu provide a significant advantage, fostering strong relationships with local businesses, especially SMEs. This established network offers a stable customer base and a deep understanding of the regional economy. Their diversified financial services, including loans, investments, and leasing, reduce reliance on any single income source, promoting resilience. The successful integration of Fukuoka Chuo Bank further broadened their reach and capabilities.

The pioneering launch of Minna Bank, Japan's first fully digital bank in May 2021, positions FFG to capture a younger, tech-savvy demographic nationwide. By March 2024, Minna Bank had already surpassed 1 million accounts, demonstrating strong market acceptance of their digital-first strategy and expanding FFG's footprint beyond its traditional regional base.

FFG's commitment to customer centricity, highlighted by its 'Client First Initiative,' aims to enhance customer satisfaction and loyalty. This focus, combined with a culture of innovation, drives the development of new products and services, ensuring FFG remains competitive and responsive to evolving customer needs. Investments in AI-driven advice and mobile banking further underscore this forward-looking approach.

The Bank of Japan's policy shift towards interest rate normalization, beginning in March 2024, is a significant tailwind for FFG. As rates rise, the group's net interest income, a key driver of profitability, is expected to increase. This environment creates more favorable conditions for traditional banking operations, boosting earnings potential.

What is included in the product

Delivers a strategic overview of Fukuoka Financial Group’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Highlights key areas for improvement and competitive advantage, offering a clear path to address challenges and leverage opportunities for Fukuoka Financial Group.

Weaknesses

While Fukuoka Financial Group (FFG) boasts a formidable presence in the Kyushu region, this very strength introduces a significant concentration risk. A substantial portion of FFG's operating income is intrinsically tied to this specific geographical area. For instance, as of the fiscal year ending March 2024, Kyushu accounted for over 80% of FFG's total loan portfolio, highlighting this deep regional dependency.

Economic downturns or localized challenges within Kyushu could therefore have a disproportionately severe impact on FFG's overall financial performance. Projections indicate continued population decline in key prefectures like Fukuoka, Kumamoto, and Nagasaki through 2025, potentially dampening regional economic activity and, consequently, FFG's growth prospects.

This heavy reliance on a single region inherently limits FFG's immediate geographical diversification, making it more vulnerable to region-specific shocks compared to financial institutions with a broader national or international footprint.

Fukuoka Financial Group (FFG) is navigating an increasingly challenging competitive environment. The rise of digital-only banks, online securities firms, and the expansion of megabanks into new service areas are intensifying pressure. Furthermore, non-financial companies are entering the financial services sector, leveraging technology to offer specialized products and services.

This heightened competition, particularly from digital players, could erode FFG's market share and put downward pressure on profit margins. As digital transformation lowers traditional barriers to entry, FFG must adapt to retain its customer base and profitability in a rapidly evolving financial landscape.

While rising interest rates can be a boon for net interest income, they also present a significant challenge for Fukuoka Financial Group (FFG) regarding credit costs. This is particularly true for regional banks like FFG, which often have a substantial exposure to small and medium-sized enterprises (SMEs).

As borrowing costs climb, less resilient businesses may face increased financial strain, potentially leading to a rise in bankruptcies. For FFG, this could translate into higher loan loss provisions, directly impacting its profitability and overall financial health.

Overhead Expenses and Digital Investment Costs

While Fukuoka Financial Group's (FFG) digital transformation efforts present a significant opportunity, the substantial investment required for these initiatives directly impacts overhead expenses. FFG has committed considerable capital to various digital projects, aiming for future efficiency and customer experience enhancements. However, these outlays contribute to increased operational costs in the near to medium term.

The ongoing need to upskill its workforce in digital literacy also represents a continuous investment and a potential operational challenge. For instance, as of their latest reported figures, significant portions of their IT budget are allocated to cloud migration and data analytics platforms, which, while strategic, add to fixed and variable costs.

- Substantial Digital Investment: FFG's commitment to digital transformation necessitates significant capital expenditure, increasing overhead.

- Short-to-Medium Term Cost Impact: While strategically beneficial long-term, these digital investments add to current operational expenses.

- Employee Digital Literacy: The cost and effort associated with improving employee digital skills represent an ongoing investment and challenge.

Impact of Demographic Decline

Fukuoka Financial Group (FFG) faces a significant weakness in the impact of demographic decline. Its core operating regions, including Fukuoka, Kumamoto, and Nagasaki prefectures, are experiencing a shrinking population, a trend that poses a long-term threat to its business model.

This population contraction directly translates to a declining customer base. For FFG, this means a potential slowdown in deposit growth, a crucial component for its lending activities. Furthermore, a smaller pool of potential borrowers and depositors could drive up funding costs as competition for these resources intensifies, ultimately squeezing profit margins and hindering organic growth opportunities within these key prefectures.

- Population Decline: As of January 1, 2024, Fukuoka Prefecture's population was approximately 4.93 million, showing a slight decrease from the previous year. Kumamoto Prefecture's population stood at around 1.73 million, also reflecting a downward trend.

- Shrinking Customer Base: This demographic shift directly impacts FFG's ability to attract new customers and retain existing ones, potentially limiting future revenue streams.

- Funding Cost Pressure: A smaller deposit base can lead to increased competition for funds, potentially driving up the cost of borrowing for FFG.

- Limited Organic Growth: The combination of a shrinking customer base and rising funding costs could constrain FFG's capacity for expanding its business organically in its primary markets.

Fukuoka Financial Group (FFG) faces a significant weakness in its heavy reliance on the Kyushu region. This concentration makes it susceptible to localized economic downturns, with over 80% of its loan portfolio tied to Kyushu as of March 2024. Projections indicate continued population decline in key prefectures through 2025, potentially impacting regional economic activity and FFG's growth.

The competitive landscape is intensifying, with digital-only banks and non-financial companies entering the market, threatening market share and profit margins. Rising interest rates, while potentially boosting net interest income, also increase credit costs, particularly for FFG's exposure to SMEs, which could lead to higher loan loss provisions.

Significant investments in digital transformation, while strategic, increase overhead costs in the short to medium term. Furthermore, the ongoing need to upskill employees in digital literacy represents a continuous investment and operational challenge.

What You See Is What You Get

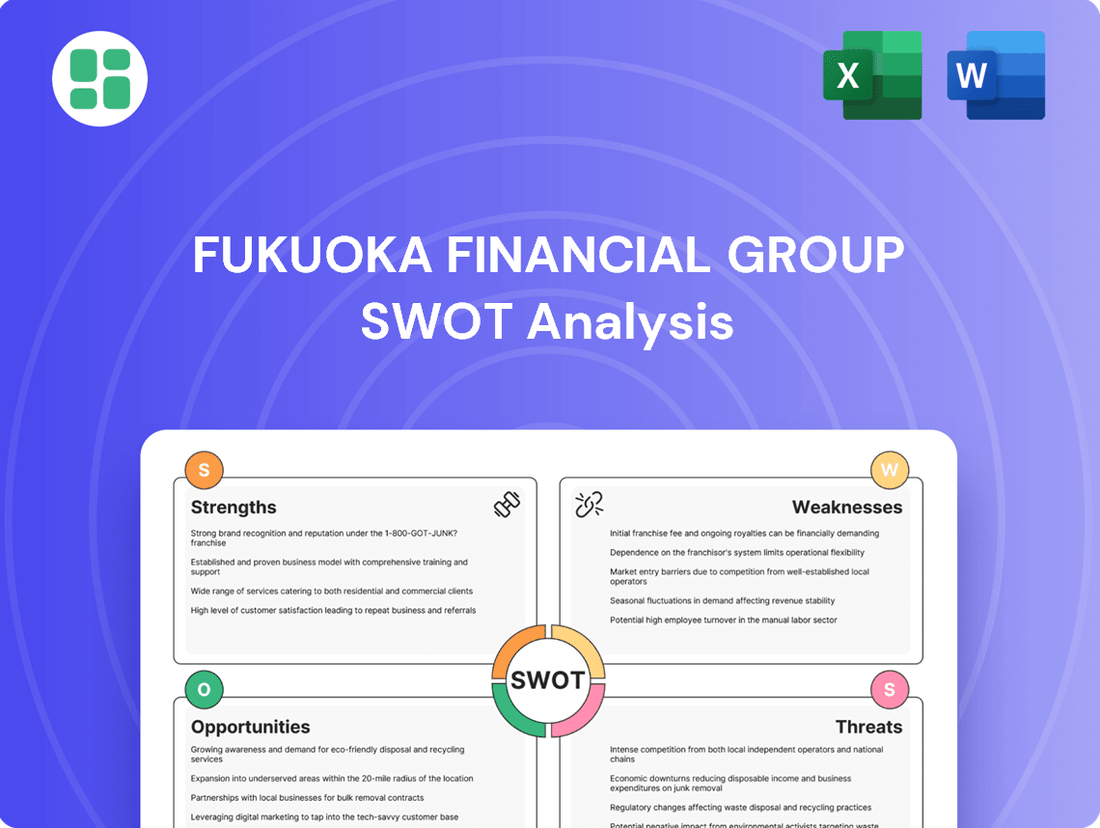

Fukuoka Financial Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a concise overview of Fukuoka Financial Group's Strengths, Weaknesses, Opportunities, and Threats, providing a solid foundation for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of the factors influencing Fukuoka Financial Group's market position and future growth potential.

Opportunities

Fukuoka Financial Group (FFG) has a prime opportunity to amplify its digital transformation, particularly through Minna Bank and strategic AI partnerships. By integrating AI agents, FFG can significantly boost operational efficiency and explore novel banking approaches. This focus on digital innovation is projected to not only deepen customer relationships but also drive down costs, opening doors for new income sources.

Fukuoka Financial Group (FFG) can significantly enhance its investment banking capabilities by offering advanced financial advisory services beyond conventional lending. This strategic move allows FFG to cater to the evolving needs of its corporate clientele, positioning itself as a comprehensive financial partner.

The group has a prime opportunity to support Japanese companies navigating complex business transitions, such as succession planning and mergers and acquisitions. By specializing in these areas, FFG can capture a larger share of the corporate finance market.

Furthermore, FFG can capitalize on the growing demand for financing in emerging sectors like Green Transformation (GX) and the startup ecosystem. For instance, in 2024, the Japanese government continued to emphasize GX initiatives, with significant public and private sector investment flowing into sustainable technologies and projects, creating a fertile ground for FFG’s expanded services.

Fukuoka Financial Group (FFG) is well-positioned to capitalize on the ongoing consolidation trend within Japan's regional banking sector. As a prominent player, FFG can pursue strategic alliances and mergers with smaller institutions facing mounting pressures from rising technology investment needs, decelerating deposit growth, and adverse demographic shifts.

Recent regulatory adjustments have lowered hurdles for bank mergers, making such combinations more feasible. For instance, the Bank of Japan's ultra-low interest rate environment, persisting through 2024, continues to squeeze profitability for smaller banks, further incentivizing them to explore consolidation opportunities with stronger entities like FFG.

Growth in Kyushu Economy, particularly Semiconductor Industry

The Kyushu region is experiencing a substantial economic uplift, largely fueled by massive investments in its burgeoning semiconductor sector. This surge is exemplified by major players like TSMC establishing operations in Kumamoto, a move that significantly bolsters the 'Silicon Island Kyushu' initiative.

Fukuoka Financial Group (FFG) is well-positioned to leverage this regional dynamism. By offering tailored financial solutions, including crucial financing and expert consulting, FFG can directly support businesses operating within and adjacent to the semiconductor supply chain. This strategic engagement not only strengthens FFG's market presence but also actively contributes to the sustained economic development of Kyushu.

- Semiconductor Investment Surge: Kyushu is attracting billions in semiconductor-related capital expenditures, with projections indicating continued growth through 2025.

- FFG's Strategic Role: The group can provide essential financial services to support the expanding ecosystem of semiconductor manufacturers and their suppliers.

- Regional Economic Impact: This growth is expected to create numerous job opportunities and stimulate ancillary industries across the Kyushu prefectures.

Addressing Evolving Customer Needs (e.g., 100-year lifespans)

Fukuoka Financial Group (FFG) has a significant opportunity to cater to the growing demand for financial solutions supporting extended lifespans. As lifespans increase, so does the need for long-term financial security and personalized advice to ensure fulfilling lives. This demographic shift presents a chance for FFG to innovate in asset management and financial planning, specifically targeting an aging yet increasingly digitally savvy population.

FFG can capitalize on this trend by developing specialized products and services. These could include:

- Enhanced retirement planning tools: Offering robust planning for individuals potentially living well into their 90s or beyond, considering healthcare costs and lifestyle maintenance.

- Flexible asset management solutions: Products that provide steady income streams and capital preservation for longer periods.

- Digital advisory platforms: Leveraging technology to offer accessible and personalized financial guidance to a tech-literate older generation.

- Consulting services for 'rich lives': Moving beyond basic financial management to offer advice on legacy planning, philanthropic endeavors, and maintaining quality of life throughout extended years.

Fukuoka Financial Group (FFG) can capitalize on the Kyushu semiconductor boom, providing financing and consulting to the expanding supply chain, a sector projected for continued growth through 2025. The group is also poised to benefit from regional banking consolidation, as regulatory changes and economic pressures encourage mergers, with FFG’s strong position making it an attractive partner. Furthermore, FFG has an opportunity to address the financial needs of an aging population by offering specialized retirement planning and asset management solutions tailored for longer lifespans.

| Opportunity Area | Key Driver | FFG's Strategic Action | Market Data/Projection |

|---|---|---|---|

| Semiconductor Ecosystem Growth | Kyushu's 'Silicon Island' initiative, significant capital investment | Provide financing and consulting to manufacturers and suppliers | Billions in CAPEX, continued growth through 2025 |

| Regional Banking Consolidation | Regulatory easing, profitability pressures on smaller banks | Pursue strategic alliances and mergers | Smaller banks incentivized by low-interest rates and tech investment needs |

| Aging Population Financial Needs | Increasing lifespans, demand for long-term financial security | Develop specialized retirement planning and asset management | Growing need for solutions for individuals living into their 90s |

Threats

The rise of digital-only banks and fintech startups presents a substantial challenge for Fukuoka Financial Group (FFG). These agile players often leverage advanced technology to offer streamlined, lower-cost services, directly competing for FFG's customer base.

Non-traditional entrants, including major tech companies, are also expanding into financial services, bringing with them vast customer networks and data analytics capabilities. This broadens the competitive landscape beyond traditional banking, potentially siphoning off lucrative segments of FFG's business.

In Japan, for instance, the digital banking sector has seen considerable growth, with new entrants attracting customers through user-friendly interfaces and competitive pricing. This trend puts pressure on established institutions like FFG to innovate rapidly to maintain market share and profitability in a rapidly evolving financial ecosystem.

While Japan's economy is projected for modest growth, the specter of an economic slowdown and a rise in small and midsize enterprise (SME) bankruptcies looms. This presents a significant threat to Fukuoka Financial Group (FFG).

Higher interest rates, a potential consequence of economic shifts, could amplify these risks. For regional banks like FFG, this translates to increased credit costs and a greater likelihood of non-performing loans, directly impacting their asset quality and overall profitability.

In 2023, the Bank of Japan maintained its ultra-loose monetary policy, but global inflation pressures and the potential for policy normalization in other major economies could influence Japan's economic trajectory. A sharp downturn could see SME default rates climb, creating headwinds for FFG's loan portfolio.

Fukuoka Financial Group, like all major financial institutions, faces the persistent threat of evolving regulatory landscapes. Changes in capital requirements, such as potential increases in Basel III or IV implementation stages, could necessitate significant adjustments to their balance sheet management and potentially impact profitability. For instance, if new liquidity coverage ratios are introduced or tightened, the group would need to hold more high-quality liquid assets, which might yield lower returns.

The increasing complexity of compliance, driven by global and domestic reforms in areas like anti-money laundering (AML) and know-your-customer (KYC) standards, presents an ongoing operational challenge. In 2024, financial institutions globally are expected to spend billions on compliance technology and personnel. Fukuoka Financial Group must continually invest in robust systems and skilled staff to navigate these requirements, ensuring adherence to rules that could otherwise lead to substantial fines or reputational damage.

Natural Disasters in the Kyushu Region

Kyushu's susceptibility to natural disasters like heavy rains and typhoons presents a significant threat to Fukuoka Financial Group (FFG). These events can directly impact FFG's physical infrastructure, including branches and ATMs, leading to operational disruptions. For instance, the severe rainfall in July 2020 caused widespread damage across Kyushu, affecting numerous businesses and communities, which would have inevitably impacted loan portfolios and deposit stability.

The economic fallout from such disasters can cripple customer businesses, increasing the risk of loan defaults and a general decline in asset quality for FFG. This also translates to potential losses in fee-based income and a reduced demand for financial services in the immediate aftermath and recovery periods. The cumulative impact of recurring natural disasters can also deter new investment and economic growth within the region, indirectly affecting the bank's long-term prospects.

- Increased Risk of Non-Performing Loans: Natural disasters can lead to business failures, directly impacting the repayment capacity of borrowers.

- Damage to Physical Assets: FFG's branches and ATMs in affected areas face direct physical damage, requiring costly repairs and temporary closures.

- Economic Slowdown: Regional economic activity can be severely hampered post-disaster, reducing overall business and consumer spending, which affects the financial sector.

- Insurance Payout Delays: Delays or shortfalls in insurance payouts for affected customers can further exacerbate financial strain and repayment issues.

Cybersecurity Risks and Data Breaches

As Fukuoka Financial Group (FFG) enhances its digital presence and online offerings, it faces escalating cybersecurity risks. A significant data breach could result in substantial financial penalties and severe damage to its reputation, eroding customer confidence.

The increasing sophistication of cyber threats poses a constant danger to FFG's sensitive financial data and operational systems. For instance, the global financial sector saw an average cost of data breaches reach $5.90 million in 2023, a figure that underscores the potential financial impact for institutions like FFG.

- Growing reliance on digital platforms increases vulnerability to cyberattacks.

- Data breaches can lead to significant financial losses and reputational damage.

- Loss of customer trust following a security incident can impact long-term stability.

- Maintaining robust cybersecurity measures is crucial for operational integrity.

The increasing prevalence of digital-only banks and agile fintech startups poses a significant threat to Fukuoka Financial Group (FFG). These competitors often leverage cutting-edge technology to offer streamlined, cost-effective services, directly challenging FFG's customer base and market share. Furthermore, major technology companies are increasingly entering the financial services arena, bringing vast customer networks and advanced data analytics, thereby broadening the competitive landscape beyond traditional banking models.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert commentary from industry analysts to ensure a robust and accurate assessment.