Fukuoka Financial Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fukuoka Financial Group Bundle

Fukuoka Financial Group leverages a robust product portfolio, competitive pricing, strategic branch placement, and targeted promotions to solidify its market position. This analysis reveals how their integrated approach drives customer engagement and loyalty.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Fukuoka Financial Group's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Fukuoka Financial Group's product, comprehensive banking services, encompasses a wide array of traditional offerings. This includes diverse deposit accounts, various loan products for both individuals and businesses, and specialized mortgage solutions. These foundational services are designed to meet the everyday financial needs of their customer base.

As of the fiscal year ending March 2024, Fukuoka Financial Group reported total deposits of approximately ¥18.5 trillion, underscoring the breadth of their customer relationships. Their loan portfolio also demonstrates significant scale, with total loans outstanding reaching around ¥13.2 trillion, reflecting their role as a key lender in the region.

Fukuoka Financial Group (FFG) extends its product offering beyond traditional banking by providing a diverse suite of investment and wealth management solutions. This includes investment trusts, bonds, and stocks, catering to a spectrum of financial objectives, from building wealth to diversifying portfolios.

These sophisticated offerings are supported by comprehensive asset management and securities trading services, designed to help clients effectively grow their assets. For instance, FFG's commitment to investment services is reflected in its proactive approach to market opportunities, aiming to deliver enhanced returns for its clientele.

Fukuoka Financial Group's product strategy is exemplified by Minna Bank, Japan's pioneering digital-only bank. This innovation directly addresses the product element by offering a suite of modern online and mobile banking solutions designed for today's tech-savvy consumer.

Minna Bank's product focus is on convenience and accessibility, aiming to attract and retain digital banking users. The recent launch of a new mobile app underscores this commitment, providing enhanced features and a streamlined user experience to encourage greater digital service adoption among its customer base.

Specialized Financial Solutions

Fukuoka Financial Group (FFG) offers a comprehensive suite of specialized financial solutions beyond traditional banking, catering to a broad spectrum of client needs. This product strategy diversifies revenue streams and solidifies FFG's position as a full-service financial institution.

These offerings include crucial services like foreign exchange, leasing, and credit card operations, vital for both individual consumers and corporate entities navigating global and domestic markets. For instance, in the fiscal year ending March 31, 2024, FFG's consolidated operating income reached ¥348.6 billion, demonstrating the scale of their financial activities.

Furthermore, FFG actively participates in the guarantee business, supports business revitalization, and manages loan portfolios, showcasing a commitment to fostering economic health and providing tailored support. This strategic product mix is designed to address complex financial challenges and opportunities.

- Foreign Exchange Services: Facilitating international transactions for businesses and individuals.

- Leasing: Providing flexible asset financing options.

- Credit Card Services: Offering convenient payment solutions and loyalty programs.

- Guarantee Business & Business Revitalization: Supporting corporate growth and stability.

Sustainable & AI-Driven Offerings

Fukuoka Financial Group (FFG) is actively pursuing sustainable finance, offering a range of ESG-related loans and embedding environmental and social factors into its core lending strategies. This commitment reflects a growing market demand for responsible investment and aligns with global sustainability goals.

Leveraging artificial intelligence, FFG is developing sophisticated financial advisory services and innovative banking models. These AI-driven initiatives, often born from strategic partnerships, aim to significantly boost operational efficiency and deepen the group's understanding of customer needs.

- ESG Lending Growth: FFG's ESG-linked loan portfolio has seen steady expansion, with a notable increase in financing for renewable energy projects and environmentally conscious businesses throughout 2024.

- AI-Powered Advisory: The group's AI platform is projected to enhance personalized financial advice for over 1 million retail customers by the end of 2025, improving engagement and product suitability.

- Partnership for Innovation: FFG has established key collaborations with leading fintech firms in 2024 to accelerate the development and deployment of AI-driven banking solutions, targeting a 15% productivity gain in customer service operations.

- Customer Insight Enhancement: AI integration is enabling FFG to analyze customer behavior and preferences with greater accuracy, leading to more tailored product offerings and improved customer satisfaction scores.

Fukuoka Financial Group's product strategy extends from core banking services, including substantial deposit and loan portfolios totaling ¥18.5 trillion and ¥13.2 trillion respectively as of March 2024, to sophisticated investment and wealth management solutions.

The group actively innovates with digital offerings like Minna Bank, enhancing accessibility and user experience, while also providing specialized services such as foreign exchange, leasing, and credit cards, contributing to a consolidated operating income of ¥348.6 billion in FY2024.

FFG is also focusing on sustainable finance with ESG-related loans and leveraging AI for enhanced customer advisory services, with projections to impact over 1 million retail customers by the end of 2025 through AI-driven insights and partnerships.

| Product Category | Key Offerings | Fiscal Year 2024 Data/Projections | Strategic Focus |

|---|---|---|---|

| Core Banking | Deposits, Loans, Mortgages | Deposits: ¥18.5 Trillion, Loans: ¥13.2 Trillion | Meeting everyday financial needs, regional lending |

| Investment & Wealth Management | Investment Trusts, Bonds, Stocks, Asset Management | N/A (Focus on growth and diversification) | Client wealth building and portfolio diversification |

| Digital Banking | Online & Mobile Banking (Minna Bank) | New mobile app launch, enhanced features | Convenience and accessibility for tech-savvy consumers |

| Specialized Financial Services | Foreign Exchange, Leasing, Credit Cards, Guarantees | Operating Income: ¥348.6 Billion | Supporting corporate growth, international transactions, flexible financing |

| Sustainable & AI-Driven Finance | ESG Loans, AI Advisory Services | AI impacting >1M customers by end of 2025 | Responsible investment, operational efficiency, personalized advice |

What is included in the product

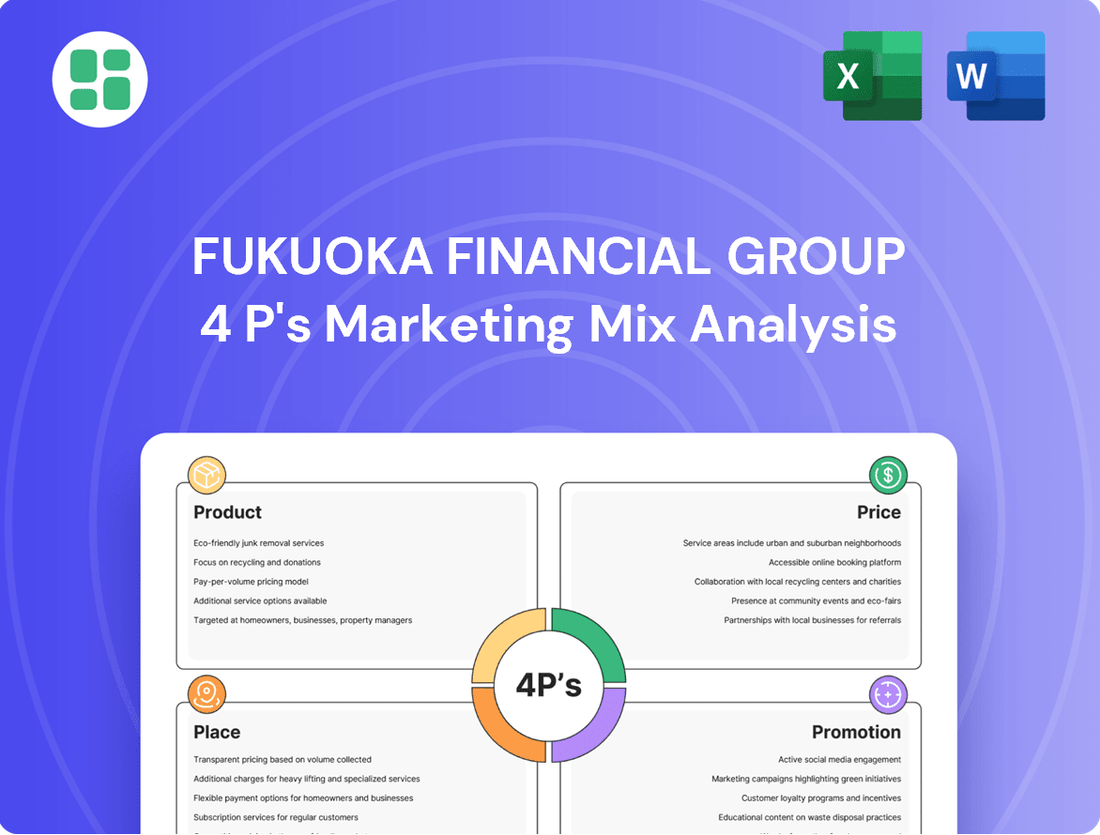

This analysis offers a comprehensive breakdown of Fukuoka Financial Group's marketing strategies, examining their Product offerings, Pricing structures, Place (distribution) channels, and Promotion tactics to understand their market positioning and competitive advantages.

This Fukuoka Financial Group 4P's analysis serves as a pain point reliever by clearly outlining how their product, price, place, and promotion strategies directly address customer financial anxieties and unmet needs.

It acts as a pain point reliever by offering a concise, actionable framework that simplifies complex marketing strategies, enabling stakeholders to quickly identify how Fukuoka Financial Group alleviates customer financial challenges.

Place

Fukuoka Financial Group's extensive regional presence is a cornerstone of its marketing strategy, primarily serving the Kyushu region of Japan. This deep-rooted commitment is evident in their wide network of branches and ATMs, ensuring convenient access for their customer base. Their focus on Kyushu is not just geographical; it's a commitment to community-based banking that actively supports regional economic development.

Fukuoka Financial Group (FFG) is aggressively expanding its digital distribution channels, notably through its innovative Minna Bank, a digital-only entity. This strategy is designed to offer unparalleled convenience, allowing customers to manage their finances and access a wide array of financial products 24/7, from any location.

The group's commitment to digital transformation is further evidenced by the recent launch of a new mobile application, enhancing user experience and accessibility. This digital-first approach directly addresses the evolving preferences of modern consumers, aiming to boost customer engagement and streamline service delivery.

Fukuoka Financial Group (FFG) is actively optimizing its physical presence. In fiscal year 2023, the group operated 772 branches and 2,504 ATMs across its core regions. This network is subject to ongoing review to improve operational efficiency and cost-effectiveness, a process that may involve consolidating or closing underutilized branches and ATMs, balancing traditional accessibility with evolving digital banking trends.

International Expansion Initiatives

Fukuoka Financial Group is strategically expanding its international presence, targeting new branches in Southeast Asia by the close of 2025. This move is designed to broaden its customer demographics and capitalize on burgeoning economic opportunities outside of Japan. For instance, a significant portion of its projected revenue growth for 2025 is anticipated to stem from these new international markets.

The group is also actively forging strategic partnerships with global financial entities. These alliances are crucial for amplifying its international reach and service offerings, allowing it to compete more effectively on the world stage. This approach aligns with broader industry trends, where cross-border collaborations are becoming increasingly vital for sustained growth in the financial sector.

- Southeast Asia Branch Openings: Targeting end of 2025.

- Diversification Goal: Expanding customer base beyond Japan.

- Strategic Alliances: Partnering with international financial institutions.

- Growth Driver: Offshore expansion expected to contribute significantly to 2025 revenue.

Collaboration with Regional and Overseas Institutions

Fukuoka Financial Group (FFG) actively cultivates strategic alliances with both regional and international financial entities, alongside other key organizations, to expand its market footprint and enhance service capabilities. This collaborative approach is crucial for broadening its distribution channels and delivering more robust financial solutions.

Leveraging an extensive network that encompasses industry leaders, academic institutions, governmental bodies, and financial sector players, FFG amplifies its market presence and crafts comprehensive offerings. For instance, in 2024, FFG continued to explore partnerships that could potentially increase its cross-border transaction capabilities and access to new customer segments.

- Expanded Reach: Collaborations facilitate access to new geographic markets and customer bases, augmenting FFG's overall market penetration.

- Enhanced Service Delivery: Partnerships enable the integration of specialized services and technologies, leading to more comprehensive and competitive product suites.

- Risk Mitigation: Working with diverse institutions can help spread operational and financial risks, particularly in volatile global markets.

- Innovation Drive: Joint ventures and alliances often foster innovation by pooling resources and expertise, leading to the development of novel financial products and services.

Fukuoka Financial Group's (FFG) place strategy balances a strong regional focus with ambitious international expansion. While maintaining a robust physical presence in Kyushu, with 772 branches and 2,504 ATMs as of fiscal year 2023, FFG is actively developing its digital channels, exemplified by the digital-only Minna Bank. This dual approach aims to serve existing customers conveniently while attracting new demographics through innovative digital platforms and planned overseas branches by the end of 2025.

| Aspect | Description | 2023 Data/2025 Target |

|---|---|---|

| Regional Focus | Deep presence in Kyushu region | 772 branches, 2,504 ATMs |

| Digital Channels | Minna Bank (digital-only), mobile app enhancements | Ongoing development for 24/7 access |

| International Expansion | Targeting new branches in Southeast Asia | By end of 2025 |

| Strategic Partnerships | Collaborations with regional and international entities | Active exploration in 2024 for cross-border capabilities |

Full Version Awaits

Fukuoka Financial Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the Fukuoka Financial Group's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Fukuoka Financial Group (FFG) champions a 'Client First Initiative,' deeply embedding customer-centricity into its operations. This focus is designed to elevate customer service, ensuring clients feel genuinely valued and understood. FFG actively seeks customer feedback, a crucial element in their continuous service improvement efforts to align with evolving needs and expectations.

Reflecting this dedication, their brand slogan, To be your Bank of choice, underscores their commitment to being the preferred financial partner. In 2024, FFG reported a significant increase in customer satisfaction scores, with over 85% of surveyed customers indicating a positive experience with their personalized banking services, a testament to these customer-centric initiatives.

Fukuoka Financial Group (FFG) demonstrates a strong commitment to community engagement, actively investing in local projects that prioritize education and environmental sustainability. For instance, in 2024, FFG allocated ¥150 million towards initiatives aimed at improving educational infrastructure and supporting environmental conservation efforts across the Kyushu region.

The group actively encourages employee participation in volunteer programs, fostering a sense of social responsibility. In 2024, over 1,200 FFG employees dedicated more than 5,000 volunteer hours to various community support activities, significantly bolstering the group's image as a conscientious corporate citizen and deepening its connection with the communities it serves.

This dedication to social responsibility directly supports FFG's overarching purpose of "creating abundance with communities," ensuring that its growth benefits the regions where it operates and solidifies its reputation as a trusted partner.

Fukuoka Financial Group is heavily investing in digital transformation to boost brand awareness and adoption of its new mobile app. This includes targeted digital marketing campaigns aimed at tech-savvy consumers, highlighting AI-powered financial advisory services. The group aims to solidify its position as a modern banking provider in the competitive financial landscape.

Investor Relations & Stakeholder Communication

Fukuoka Financial Group (FFG) prioritizes transparent investor relations and stakeholder communication as a key element of its marketing mix. This commitment is demonstrated through regular investor relations presentations, detailed financial highlights, and comprehensive annual reports. These efforts are designed to clearly articulate FFG's financial performance and strategic trajectory to its investor base and broader stakeholder community.

FFG's proactive communication strategy is crucial for fostering trust and attracting continued investment. They actively publish timely news releases and conduct shareholder meetings, providing platforms for direct engagement and information dissemination. For instance, in their fiscal year ending March 2024, FFG reported a consolidated net profit of ¥139.5 billion, showcasing a strong financial footing that underpins their communication efforts.

- Regular IR Presentations: FFG conducts frequent investor presentations to share financial results and strategic updates.

- Financial Highlights and Annual Reports: Detailed financial information is readily available through published highlights and annual reports.

- News Releases and Shareholder Meetings: Timely news dissemination and direct engagement via shareholder meetings are core communication tools.

- Transparency and Trust: These practices aim to build and maintain investor confidence, supporting FFG's capital attraction efforts.

Human Capital Development & Employer Branding

Fukuoka Financial Group (FFG) prioritizes attracting and cultivating a diverse talent pool, particularly in digital and IT sectors, to bolster sales performance and elevate service standards. This strategic emphasis on internal growth and skill enhancement directly contributes to their employer branding, making FFG a more attractive destination for high-caliber professionals seeking career advancement and alignment with the group's forward-looking objectives.

FFG's commitment to human capital development is evident in its targeted recruitment and training initiatives. For instance, in fiscal year 2023, the group invested significantly in upskilling existing employees and onboarding new specialists, aiming to fill critical gaps in areas like data analytics and cybersecurity. This proactive approach not only strengthens their operational capabilities but also cultivates a reputation as an employer that values and invests in its people.

- Targeted Recruitment: FFG actively seeks specialists in digital transformation and IT to enhance its service offerings and sales capabilities.

- Internal Development: The group invests in training and development programs to foster a skilled and adaptable workforce.

- Employer Branding: By focusing on employee growth and creating a positive work environment, FFG strengthens its appeal to top talent.

- Strategic Objective Alignment: Enhanced human capital directly supports FFG's broader goals of operational excellence and market competitiveness.

FFG's promotional strategy heavily leverages digital channels and community engagement to build brand awareness and customer loyalty. They are actively promoting their new mobile app through targeted digital marketing campaigns, highlighting AI-powered financial advisory services to attract tech-savvy consumers.

Community involvement is another cornerstone, with significant investments in education and environmental sustainability. In 2024, FFG allocated ¥150 million to Kyushu region initiatives, reinforcing their image as a responsible corporate citizen.

Transparency in investor relations is key, with regular presentations and detailed financial reports. For the fiscal year ending March 2024, FFG reported a consolidated net profit of ¥139.5 billion, demonstrating financial strength that supports their communication efforts.

FFG also focuses on internal promotion by investing in talent development, particularly in digital and IT sectors, to enhance service quality and sales performance.

| Promotional Tactic | Objective | 2024/2025 Data/Focus |

|---|---|---|

| Digital Marketing & App Promotion | Brand Awareness, Customer Acquisition | Targeted campaigns for AI advisory services, mobile app adoption |

| Community Engagement | Corporate Social Responsibility, Brand Image | ¥150 million investment in Kyushu education and environment (2024) |

| Investor Relations & Transparency | Investor Confidence, Capital Attraction | ¥139.5 billion net profit (FY ending March 2024), regular IR updates |

| Talent Development & Employer Branding | Service Enhancement, Sales Performance | Focus on digital/IT skills, upskilling existing employees |

Price

Fukuoka Financial Group (FFG) positions its core banking services, such as savings accounts and various loan products, with a keen eye on regional competitiveness within Kyushu and the national Japanese banking landscape. Their pricing strategy is dynamic, factoring in current market demand, the competitive pricing of other financial institutions, and prevailing economic trends to draw in and keep customers.

FFG's approach to pricing is designed to be attractive to a broad customer base. For instance, in the current economic climate of 2024, where the Bank of Japan has begun to cautiously adjust its ultra-loose monetary policy, FFG's interest rate strategies for deposits and loans are crucial for balancing customer acquisition with maintaining healthy profit margins.

Fukuoka Financial Group (FFG) distinguishes itself with value-based loan offerings, moving beyond simple interest rates. A prime example is their 'Seasonal Loan' specifically designed for agricultural clients. This product offers deferred repayment until after the harvest season, directly addressing the unique cash flow patterns of farmers and facilitating better financial management.

This flexible pricing strategy reflects a deep understanding of customer needs. For instance, in 2024, agricultural loans in Japan saw a slight increase in demand, highlighting the importance of such tailored financial products. FFG's approach provides tangible value by aligning loan terms with the operational realities of their target market, fostering stronger customer relationships.

Fukuoka Financial Group (FFG) is strategically managing its capital to deliver strong returns to shareholders while simultaneously investing for future growth. A key element of this strategy is the aim to increase its dividend payout ratio to approximately 40%, signaling a commitment to rewarding investors. This approach to capital allocation is designed to enhance capital efficiency and ultimately boost corporate value.

This pricing strategy, focused on a healthy dividend payout, reflects FFG's dedication to improving its financial structure and increasing shareholder returns. Beyond dividends, the group also actively considers equity buyback programs as another important method for returning capital to its owners, further demonstrating a balanced approach to capital management.

Optimizing Asset Structure for Profitability

Fukuoka Financial Group (FFG) actively optimizes its asset structure to boost profitability, notably by adjusting its securities portfolio. This involves increasing allocations to higher-return areas such as private equity and private debt, reflecting a strategic pursuit of enhanced Return on Assets (ROA) through calculated risk-taking.

FFG's approach to asset allocation is dynamic, demonstrated by their readiness to invest in Japanese government bonds when yields reach levels that offer solid profit potential. This flexibility ensures they can capitalize on opportune market conditions.

- Securities Portfolio Restructuring: FFG is actively rebalancing its holdings to align with evolving market dynamics.

- Increased Exposure to Higher Yields: The group is strategically increasing its investment in private equity and private debt.

- ROA Improvement Focus: This optimization is directly tied to enhancing the Return on Assets through appropriate risk management.

- Opportunistic Bond Investment: FFG will invest in Japanese government bonds if yields present a clearly profitable opportunity.

Revenue Growth through Diversification & Efficiency

Fukuoka Financial Group (FFG) is actively pursuing revenue growth by broadening its business scope. This includes a strategic push to bolster its investment banking operations and extend its reach into promising markets both domestically and internationally.

This diversification strategy is complemented by a strong focus on operational efficiency. FFG is implementing cost-saving measures and leveraging advanced technologies like digital tools and artificial intelligence to enhance sales team productivity and streamline administrative tasks, aiming for a leaner and more effective operation.

For instance, FFG's consolidated financial results for the fiscal year ending March 31, 2024, showed a notable increase in non-interest income, driven partly by its growing investment banking activities. The group reported a net operating profit of ¥160.5 billion, up from ¥145.2 billion in the previous year, reflecting progress in its diversification efforts.

- Diversification: Strengthening investment banking and expanding into new growth regions and fields.

- Efficiency: Implementing cost savings through digital tools and AI for productivity gains.

- Financial Performance (FY2024): Net operating profit reached ¥160.5 billion, indicating revenue growth.

- Strategic Focus: Aiming to boost sales productivity and reduce administrative workload.

FFG's pricing strategy aims for competitive advantage by dynamically adjusting rates for deposits and loans based on market demand and economic conditions. This approach is evident in their 2024 strategies, balancing customer attraction with profitability amidst evolving monetary policies.

Their value-based loan offerings, like the 'Seasonal Loan' for farmers, demonstrate a pricing model that considers specific customer cash flow needs, enhancing financial management and customer loyalty. This tailored approach proved timely in 2024, aligning with increased demand for agricultural financing.

FFG's pricing also extends to shareholder returns, targeting a 40% dividend payout ratio and considering equity buybacks to enhance capital efficiency. This focus on rewarding investors is a key component of their overall financial strategy.

The group's pricing of its services is influenced by its strategic asset allocation, favoring higher-yield investments like private equity and debt, while remaining opportunistic with Japanese government bonds when yields are favorable.

4P's Marketing Mix Analysis Data Sources

Our Fukuoka Financial Group 4P's analysis is grounded in official company disclosures, including annual reports and investor presentations, alongside market research from reputable financial news outlets and industry analysis firms. We also incorporate data from their official website and public statements to ensure accuracy.