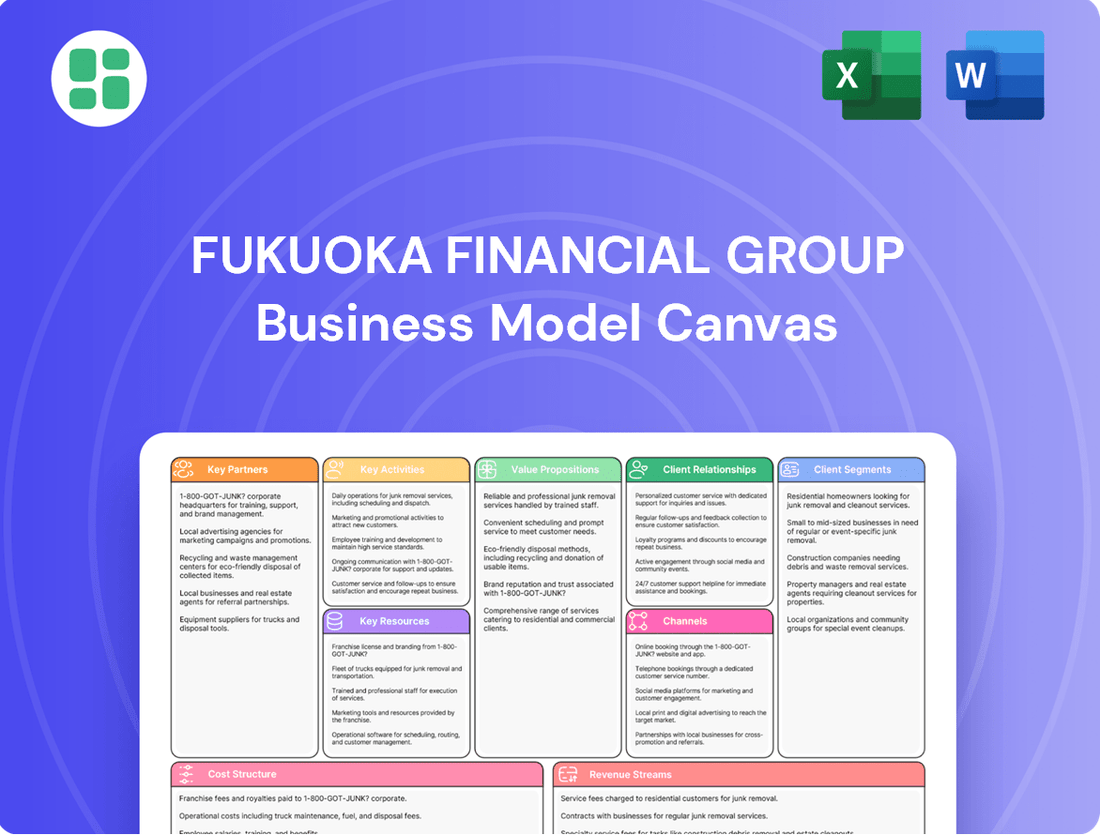

Fukuoka Financial Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fukuoka Financial Group Bundle

Unlock the core strategies of Fukuoka Financial Group with their detailed Business Model Canvas. This comprehensive document reveals their customer relationships, revenue streams, and key resources, offering a clear picture of their operational success. Dive into the specifics and gain valuable insights for your own ventures.

Partnerships

Fukuoka Financial Group (FFG) actively seeks partnerships with fintech companies and technology providers to boost its digital services and streamline operations. For instance, FFG has teamed up with ExaWizards Inc. to explore AI applications for business transformation and the creation of novel banking models.

Fukuoka Financial Group actively collaborates with a wide array of local and regional businesses across the Kyushu area, acting as a catalyst for economic growth. This strategic approach involves offering customized financial products and services designed to meet the unique demands of these enterprises.

The group's commitment extends to nurturing new ventures, providing crucial support to startups that are vital for innovation and job creation within the region. These partnerships are fundamental to their mission of fostering a robust and dynamic economic landscape.

Furthermore, Fukuoka Financial Group participates in targeted initiatives aimed at revitalizing established local industries, ensuring their continued relevance and contribution to the regional economy. For instance, in 2023, their support for small and medium-sized enterprises (SMEs) in Kyushu facilitated over ¥50 billion in new lending, directly impacting community prosperity.

Fukuoka Financial Group actively collaborates with regional governments and public institutions on crucial initiatives. These partnerships are vital for community development and tackling pressing issues such as population decline and climate change, underscoring their commitment to sustainable local futures.

These collaborations directly contribute to the realization of sustainable local communities and foster regional economic growth. For instance, in 2024, the group continued its support for local infrastructure projects, aiming to improve living standards and economic vitality across the region.

Other Financial Institutions

Fukuoka Financial Group (FFG) actively cultivates strategic alliances with a diverse range of financial institutions, both within Japan and across international borders. These collaborations are instrumental in broadening FFG's global footprint and enhancing its service portfolio. For instance, FFG has been exploring opportunities for cooperation with various financial entities to facilitate offshore expansion, particularly targeting growth markets in Southeast Asia.

These partnerships are designed to unlock new avenues for financial product distribution and to secure greater market access. By linking with other institutions, FFG can leverage their established networks and customer bases, thereby accelerating its growth trajectory. For example, in 2024, FFG continued its focus on digital transformation, which often involves partnerships with fintech firms and other financial service providers to integrate new technologies and expand digital offerings to a wider customer base.

- Global Reach Expansion: FFG partners with international financial institutions to extend its services beyond domestic markets.

- Enhanced Service Offerings: Collaborations allow for the introduction of new and diverse financial products to clients.

- Southeast Asian Focus: Strategic alliances are being pursued for offshore expansion in key regions like Southeast Asia.

- Market Access and Distribution: Partnerships facilitate broader access to new customer segments and distribution channels for FFG's products.

Business Revitalization and Consulting Firms

Fukuoka Financial Group actively partners with business revitalization support firms and external consulting agencies. These collaborations are designed to offer a holistic suite of services to their corporate clientele, covering critical areas like business succession planning and mergers and acquisitions. This strategic alliance helps bolster the group's investment banking capabilities.

These partnerships are instrumental in providing specialized expertise that Fukuoka Financial Group might not possess internally. By leveraging the skills of these external entities, they can more effectively assist businesses facing challenges, thereby contributing to the broader economic revitalization of the regions they serve. For instance, in 2023, the Japanese government announced initiatives to support business succession, a trend that financial groups like Fukuoka are capitalizing on through such collaborations.

- Expertise in Business Succession: Providing specialized advice and support for companies transitioning ownership.

- M&A Advisory Services: Facilitating mergers and acquisitions to drive growth and consolidation.

- Financing Support: Assisting businesses in securing necessary capital for restructuring and expansion.

- Industry Revitalization: Contributing to the health and growth of various sectors through strategic interventions.

Fukuoka Financial Group (FFG) strategically partners with a diverse range of fintech companies and technology providers to enhance its digital offerings and operational efficiency. These collaborations, such as the one with ExaWizards Inc. for AI applications, are crucial for innovation and the development of new banking models.

FFG also actively engages with local and regional businesses across Kyushu, providing tailored financial products to support economic growth and job creation. In 2023, their support for SMEs in Kyushu facilitated over ¥50 billion in new lending.

Furthermore, FFG collaborates with external consulting agencies and business revitalization firms to offer comprehensive services like succession planning and M&A advisory. This strengthens their investment banking capabilities and aids in industry revitalization.

| Partner Type | Objective | Example/Impact |

|---|---|---|

| Fintech Companies | Digital service enhancement, operational efficiency | AI applications (ExaWizards Inc.) |

| Local/Regional Businesses | Economic growth, tailored financial solutions | ¥50 billion+ in new lending to Kyushu SMEs (2023) |

| Consulting Firms | Specialized expertise, business support | M&A advisory, succession planning |

| International Financial Institutions | Global reach expansion, enhanced service offerings | Targeting Southeast Asian markets |

What is included in the product

A detailed breakdown of Fukuoka Financial Group's operations, mapping customer segments, value propositions, and revenue streams within the nine classic Business Model Canvas blocks.

This model offers strategic insights into the group's customer relationships, key resources, and cost structure, providing a clear overview for informed decision-making.

The Fukuoka Financial Group Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, enabling rapid identification of inefficiencies and opportunities for streamlining operations.

Activities

Fukuoka Financial Group's core activities revolve around providing essential banking services. This includes accepting deposits from customers and offering various types of loans, from corporate financing to individual housing loans. They also facilitate domestic and international money transfers, forming the fundamental pillars of their financial operations.

The group is actively working to grow its foundational banking business. In the fiscal year ending March 2024, Fukuoka Financial Group reported total loans outstanding of approximately 13.2 trillion yen, highlighting their significant presence in lending. This expansion in basic operations is crucial for their continued market engagement and customer service.

Fukuoka Financial Group's key activities heavily lean into digital transformation, with a strong focus on enhancing digital banking services and integrating AI-driven solutions. This commitment is backed by significant annual investments in technology, evidenced by the launch of new mobile applications and the establishment of a dedicated AI Strategy Group.

A prime example of this strategy is the creation of Minna Bank, a digital-native bank designed to offer attentive customer service and explore new business avenues. This initiative underscores the group's dedication to improving operational efficiency and fostering innovation through cutting-edge technology.

Fukuoka Financial Group (FFG) actively manages investments, offering a range of products and operating a securities business via its subsidiaries. This involves managing securities portfolios and aiming to grow asset management balances.

In 2024, FFG reported significant gains from the sale of listed stocks and funds, demonstrating the effectiveness of its investment strategies. The group is also focused on expanding its asset management offerings and bolstering its investment banking capabilities to provide comprehensive financial solutions.

Regional Economic Development Initiatives

Fukuoka Financial Group actively champions regional economic development, particularly within the Kyushu area. A key focus is revitalizing local industries through strategic investments and support.

The group is heavily involved in fostering growth in emerging sectors such as Green Transformation (GX). For instance, in 2024, FFG announced plans to invest ¥100 billion in GX-related businesses over the next five years, aiming to drive sustainable growth and innovation.

- Regional Revitalization: FFG's commitment extends to supporting small and medium-sized enterprises (SMEs) in Kyushu, which form the backbone of the local economy.

- Startup Ecosystem Support: The group actively nurtures startups through funding, mentorship, and networking opportunities, recognizing their role in creating new economic value.

- GX and Digital Transformation: FFG is channeling resources into businesses focused on environmental sustainability and digital advancements, aligning with national and global trends.

- Synergistic Growth: By fostering regional development, FFG aims to create a positive feedback loop, where local economic prosperity contributes to the group's own long-term corporate value enhancement.

Risk Management and Compliance

Fukuoka Financial Group actively manages credit, market, and operational risks to ensure financial stability. This involves rigorous assessment and mitigation strategies, with clear policies defining oversight responsibilities. For example, in fiscal year 2023, the group reported a consolidated non-performing loan ratio of 1.79%, demonstrating their commitment to managing credit risk.

Compliance with evolving financial regulations is a cornerstone of their operations. This includes adapting to new environmental, social, and governance (ESG) requirements, such as those related to climate change risk disclosure. The group's proactive approach ensures they meet regulatory expectations and maintain stakeholder trust.

- Credit Risk Management: Focused on maintaining a low non-performing loan ratio, which stood at 1.79% in FY2023.

- Market Risk Mitigation: Implementing strategies to safeguard against fluctuations in interest rates and other market variables.

- Operational Risk Control: Establishing robust internal controls and procedures to prevent errors and fraud.

- ESG Compliance: Adapting to new regulations and expectations, including those concerning climate change impacts on financial operations.

Fukuoka Financial Group's key activities encompass core banking operations, including deposit-taking and lending, with total loans outstanding reaching approximately 13.2 trillion yen in the fiscal year ending March 2024. They are heavily invested in digital transformation, exemplified by the launch of Minna Bank and AI integration, aiming for enhanced customer service and operational efficiency. Furthermore, FFG actively manages investments and securities through subsidiaries, reporting significant gains from stock and fund sales in 2024, while also championing regional economic development through investments in sectors like Green Transformation (GX), with a ¥100 billion commitment announced for GX-related businesses over five years.

| Key Activity | Description | 2024 Data/Focus |

| Core Banking | Deposit-taking, Lending, Money Transfers | Total Loans Outstanding: ~¥13.2 Trillion (FY2024) |

| Digital Transformation | Enhancing Digital Services, AI Integration, Minna Bank | Focus on AI Strategy Group, Mobile App Enhancements |

| Investment Management | Securities Business, Asset Management Growth | Reported Gains from Listed Stock/Fund Sales |

| Regional Development | Supporting SMEs, Startup Ecosystem, GX Investment | ¥100 Billion Commitment to GX Businesses (5 years) |

Delivered as Displayed

Business Model Canvas

The Fukuoka Financial Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you'll get the complete, unedited canvas, mirroring exactly what you see here, ready for immediate use. No mockups or samples; this is the genuine article, providing full insight into the strategic framework.

Resources

Fukuoka Financial Group's core resources are its substantial financial capital and unwavering liquidity. This foundation is built upon a strong deposit base, diverse loan portfolios, and strategic securities holdings, essential for any financial institution.

As of March 31, 2024, Fukuoka Financial Group reported total assets of ¥21,486.1 billion. This vast capital base directly fuels their ability to offer a comprehensive suite of financial products and services, from everyday banking to complex investment solutions.

The group's robust liquidity, demonstrated by its substantial holdings and prudent management, allows it to confidently support its extensive lending activities. This ensures they can meet customer demands and maintain financial stability, a critical factor for trust and growth.

Fukuoka Financial Group (FFG) relies heavily on its diverse and skilled workforce, encompassing banking professionals, engineers, and specialists across numerous financial disciplines. This human capital is fundamental to delivering a wide range of financial services.

FFG actively invests in its employees through comprehensive development programs and facilitates human resource exchanges to continually elevate expertise. For instance, in fiscal year 2023, the group reported a significant number of employees participating in various training initiatives aimed at skill enhancement.

The strategic cultivation of its human resource portfolio and a strong focus on improving employee engagement are key priorities for FFG. This commitment aims to ensure a motivated and capable team, driving innovation and customer satisfaction.

Fukuoka Financial Group leverages advanced technology infrastructure, including robust digital banking platforms and intuitive mobile applications, to drive its digital transformation. These platforms are crucial for delivering modern banking solutions and improving customer experience.

The group actively invests in developing AI agent platforms, such as 'exaBase Studio,' to enhance operational efficiency and personalize customer interactions. These investments are key to their strategy of offering cutting-edge financial services.

In 2023, Fukuoka Financial Group reported significant annual investments in technology enhancements, underscoring their commitment to maintaining a competitive edge in the digital banking landscape. These ongoing investments are designed to support future growth and innovation.

Extensive Branch Network and ATMs

Fukuoka Financial Group (FFG) leverages an extensive branch network and ATM presence, a critical component of its business model, particularly within the Kyushu region. This physical infrastructure, spanning Fukuoka, Kumamoto, and Nagasaki prefectures, ensures accessibility for a broad customer base. In 2024, FFG maintained a significant footprint with hundreds of branches and ATMs, facilitating traditional banking transactions and reinforcing its regional market leadership.

This robust network serves as a primary channel for customer interaction and service delivery, supporting everything from routine deposits and withdrawals to more complex financial advisory services. The physical touchpoints are crucial for building trust and maintaining strong customer relationships in the communities FFG serves. This established presence is a key differentiator, especially against digital-only competitors.

- Extensive physical presence across Kyushu (Fukuoka, Kumamoto, Nagasaki prefectures).

- Supports traditional banking services and customer interaction.

- Reinforces strong regional market leadership and customer trust.

- Provides accessibility for a broad customer base.

Brand Reputation and Customer Trust

Fukuoka Financial Group's (FFG) brand reputation, cultivated over many years, is a cornerstone of its business model. This long-standing trust, deeply rooted in a commitment to regional development, acts as a powerful intangible asset. It translates directly into robust support from both its corporate and retail customer base, underpinning its market position.

FFG actively cultivates this trust by striving to be the preferred banking partner. Their objective to be Your Bank of choice is achieved through the consistent delivery of reliable and sophisticated financial services. This focus on dependable service quality is crucial for maintaining customer loyalty and attracting new business.

- Brand Equity: FFG's established reputation is a significant intangible asset, built on decades of trust and regional commitment.

- Customer Loyalty: This strong brand image fosters deep loyalty among both corporate and retail clients, providing a stable customer base.

- Service Excellence: The group's aspiration to be 'Your Bank of choice' highlights their dedication to offering reliable and advanced financial solutions.

- Regional Impact: FFG's commitment to regional development is intrinsically linked to its brand, enhancing its societal standing and customer connection.

Fukuoka Financial Group's intellectual property, including proprietary algorithms and data analytics capabilities, is a key resource driving innovation and personalized financial solutions. Their investment in AI platforms like exaBase Studio exemplifies this focus on developing unique technological assets.

FFG's extensive branch network and ATM presence across Kyushu, encompassing hundreds of locations as of 2024, represents a significant physical resource. This established infrastructure ensures broad customer accessibility and reinforces their regional market leadership, facilitating both traditional and increasingly digital banking interactions.

The group's substantial financial capital, evidenced by total assets of ¥21,486.1 billion as of March 31, 2024, forms the bedrock of its operations. This strong capital base, coupled with robust liquidity management, empowers FFG to underwrite extensive lending activities and offer a comprehensive suite of financial products, ensuring stability and capacity to meet diverse customer needs.

Value Propositions

Fukuoka Financial Group (FFG) provides a complete suite of financial products and services, encompassing everything from basic deposits and loans to more complex investment products, foreign exchange, leasing, and credit card services. This broad spectrum ensures that both individual and business clients can find a single, convenient source for all their financial needs.

In 2024, FFG's commitment to comprehensive solutions was evident in its diverse revenue streams. For instance, their banking segment, which includes deposits and loans, remained a core contributor, while their securities and leasing operations also showed robust performance, reflecting the wide appeal of their integrated offerings.

Fukuoka Financial Group (FFG) champions the economic vitality of Kyushu, a core element of its business model. This commitment translates into tangible support for local businesses, fostering growth and addressing critical regional issues.

FFG's initiatives directly combat population decline by investing in local enterprises and creating employment opportunities. For instance, in 2023, FFG provided over ¥1.5 trillion in loans to small and medium-sized enterprises within the Kyushu region, directly fueling local economic activity.

Beyond financial support, FFG actively engages in strategic partnerships to tackle challenges like climate change, investing in green energy projects and sustainable business practices across Kyushu. This forward-thinking approach ensures long-term regional prosperity.

Fukuoka Financial Group (FFG) is significantly enhancing digital convenience with initiatives like Minna Bank, which aims to attract younger, digitally-native customers. This focus on tech-savvy solutions translates into improved operational efficiency and smoother digital transactions for all users.

Leveraging artificial intelligence, FFG is developing AI-driven advisory services to provide more attentive and forward-thinking financial guidance. This innovation is key to meeting evolving customer expectations for personalized and accessible banking experiences.

Tailored Advice and Problem-Solving

Fukuoka Financial Group (FFG) distinguishes itself by offering highly personalized advice and solutions. They aim to be more than just a financial institution, acting as a dedicated partner in overcoming challenges. This commitment is reflected in their approach to understanding individual and corporate financial goals and actively working to resolve their specific issues.

Leveraging a blend of cutting-edge digital tools and the invaluable insight of human expertise, FFG crafts strategies that are both innovative and deeply relevant to each client's unique situation. This dual approach ensures that whether a customer needs help with personal wealth management or complex corporate financing, they receive attentive and effective support.

FFG's dedication to being a reliable and sophisticated partner is evident in their goal-based sales methodology. For instance, in 2024, FFG reported a significant increase in customer satisfaction scores related to personalized financial planning, with over 70% of surveyed clients indicating that their specific financial objectives were clearly understood and addressed by FFG advisors.

- Personalized Financial Guidance: FFG focuses on understanding individual and business goals to provide tailored advice.

- Problem-Solving Orientation: The group actively seeks to address and resolve the specific issues faced by their clients.

- Hybrid Service Model: Combining digital technology with human expertise ensures comprehensive and accessible support.

- Goal-Based Sales: FFG's approach centers on achieving client objectives, enhancing trust and satisfaction.

Security and Stability

Fukuoka Financial Group, as a prominent financial holding company, cultivates a strong sense of security and stability for its diverse customer base and stakeholders. This is underpinned by its commitment to robust management practices and a consistently strong financial position, ensuring the protection of customer deposits and the dependable provision of financial services.

The group actively prioritizes reinforcing its management foundation and enhancing risk management protocols. For instance, as of the fiscal year ending March 2024, Fukuoka Financial Group reported a consolidated net profit of ¥117.7 billion, demonstrating its financial resilience and operational efficiency.

- Sound Financial Health: Maintains a strong capital adequacy ratio, a key indicator of stability.

- Risk Management Focus: Implements comprehensive strategies to mitigate financial and operational risks.

- Deposit Protection: Ensures the safekeeping of customer funds through stringent internal controls.

- Reliable Service Delivery: Operates with a commitment to consistent and trustworthy financial services.

FFG's value proposition centers on providing comprehensive financial solutions and fostering regional economic growth. They act as a dedicated partner, offering personalized advice and leveraging both digital innovation and human expertise to meet client needs. This commitment is underscored by a focus on security, stability, and robust risk management.

Customer Relationships

Fukuoka Financial Group prioritizes personalized relationship management, particularly for its corporate clients and high-net-worth individuals. Dedicated relationship managers are assigned to provide tailored advice and customized financial solutions, fostering deeper client engagement and trust.

The group's 'Client First Initiative' actively reinforces this focus on enhancing customer service experiences. This strategic approach aims to build long-term loyalty and satisfaction by understanding and addressing the unique needs of each client, a strategy that contributed to their 2024 performance metrics.

Fukuoka Financial Group cultivates digital self-service through its robust online banking portals and user-friendly mobile applications. These platforms empower customers to conduct transactions, access account information, and manage their finances anytime, anywhere, fostering a sense of control and convenience.

The group further enhances digital engagement with AI-powered chatbots and virtual assistants, providing instant support and personalized guidance. This technological integration streamlines customer interactions and resolves queries efficiently, aligning with the growing preference for immediate, digital solutions.

Data from 2024 reveals a significant uptick in digital service adoption across the banking sector, with a substantial percentage of customers preferring online or mobile channels for their banking needs. This trend underscores Fukuoka Financial Group's strategic focus on digital transformation to meet evolving customer expectations for seamless, tech-driven financial management.

Fukuoka Financial Group (FFG) cultivates strong customer relationships through robust community engagement, aiming to foster trust and loyalty within the Kyushu region. This commitment is evident in their active support for local events and initiatives designed to enhance the economic and social well-being of the communities they serve. For instance, in the fiscal year ending March 2024, FFG's group companies contributed to numerous regional development projects, reinforcing their dedication to local prosperity.

Solution-Oriented Advisory

Fukuoka Financial Group (FFG) cultivates customer relationships by acting as a solution-oriented advisor. This approach centers on understanding individual and business challenges, then offering tailored financial products and consulting services to help clients achieve their objectives. FFG strives to be a trusted partner in realizing both personal financial well-being and the growth of client businesses.

The group’s commitment to problem-solving is reflected in its diverse service portfolio. For instance, in fiscal year 2023, FFG reported a significant increase in consulting engagements, particularly in areas like business succession planning and digital transformation support. This demonstrates their proactive stance in addressing evolving customer needs.

- Problem Identification: Deeply understanding client financial hurdles and aspirations.

- Tailored Solutions: Offering a broad spectrum of banking, securities, and consulting services.

- Goal Achievement: Partnering with customers to reach personal and business objectives.

- Long-Term Value: Building trust through consistent, effective advisory support.

Multi-Channel Interaction

Fukuoka Financial Group (FFG) cultivates customer relationships through a robust multi-channel strategy. This approach allows customers to engage with the group via their preferred method, whether that's a personal visit to one of their numerous physical branches, the convenience of their digital banking platforms, or direct communication through their call centers.

This commitment to multi-channel interaction ensures FFG remains accessible and convenient for its diverse customer base. For instance, as of March 2024, FFG operates a significant network of branches across Japan, complementing its increasingly sophisticated digital offerings which saw a substantial increase in user engagement throughout 2023.

- Branch Network: Maintaining a physical presence provides a tangible touchpoint for customers who prefer in-person service.

- Digital Platforms: FFG's online and mobile banking services offer 24/7 access and a wide range of self-service options.

- Call Centers: Dedicated call centers provide immediate support and personalized assistance for more complex inquiries.

- Integrated Experience: These channels are designed to work together seamlessly, offering a consistent and convenient customer journey.

Fukuoka Financial Group (FFG) fosters strong customer relationships by acting as a dedicated, solution-oriented advisor, understanding client challenges, and offering tailored financial products and consulting. This partnership approach aims to achieve both personal financial well-being and client business growth, as evidenced by a notable increase in consulting engagements in fiscal year 2023, particularly in areas like business succession planning.

| Customer Relationship Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Personalized Advisory | Dedicated relationship managers provide tailored advice and customized financial solutions. | Significant increase in consulting engagements for business succession and digital transformation support (FY2023). |

| Digital Engagement | Robust online banking portals and mobile apps for self-service and convenience. | Substantial increase in user engagement on digital platforms (2023); growing preference for online/mobile channels (2024 data). |

| Community Focus | Active support for local events and initiatives to enhance regional economic and social well-being. | Contribution to numerous regional development projects (Fiscal year ending March 2024). |

| Multi-Channel Accessibility | Customers can engage via physical branches, digital platforms, or call centers. | Significant network of branches across Japan (as of March 2024) complementing digital offerings. |

Channels

Fukuoka Financial Group leverages its robust branch network, a cornerstone of its customer engagement strategy, across the Kyushu region. These physical touchpoints are crucial for delivering traditional banking services and facilitating direct customer interactions.

The group's 385 branches, as of March 31, 2024, offer a comprehensive suite of financial products and personalized consultation services. This extensive physical presence ensures accessibility for a broad customer base, reinforcing trust and relationship building.

Fukuoka Financial Group's online banking platforms are a cornerstone for customer engagement, enabling seamless transactions and account management from anywhere. These digital channels are central to their strategy of enhancing convenience and accessibility, reflecting a broader industry shift towards digital-first financial services.

In 2024, the group reported a significant increase in digital transaction volumes through these platforms, underscoring their growing importance. This digital push is vital for retaining and attracting customers in an increasingly competitive landscape, with a focus on user experience and robust security features.

Mobile banking applications serve as crucial channels for Fukuoka Financial Group, particularly for its younger, tech-savvy demographic. The recent launch of Minna Bank's mobile app exemplifies this focus, offering seamless on-the-go banking and access to advanced digital services.

These platforms are designed to facilitate convenient, 24/7 access to banking functions, from simple transactions to more complex financial management. By embracing mobile technology, Fukuoka Financial Group aims to enhance customer engagement and provide a modern banking experience.

Furthermore, these applications are increasingly integrating AI-driven financial advisory services, allowing customers to receive personalized guidance and insights. This strategic channel development is key to meeting evolving customer expectations and staying competitive in the digital age.

Automated Teller Machines (ATMs)

Automated Teller Machines (ATMs) are a cornerstone of Fukuoka Financial Group's customer accessibility strategy. This extensive network ensures customers can perform essential banking tasks like cash withdrawals and deposits at their convenience, reinforcing the group's commitment to broad reach.

Fukuoka Financial Group operates a significant number of ATMs across its service areas, acting as a vital component of its physical infrastructure. As of 2024, the group maintained over 1,500 ATMs, facilitating millions of transactions annually and underscoring their role in daily banking for a vast customer base.

- Widespread Network: Over 1,500 ATMs operated by Fukuoka Financial Group in 2024.

- Customer Convenience: Facilitates essential banking transactions 24/7.

- Physical Infrastructure: Key element for broad customer accessibility.

- Transaction Volume: Millions of transactions processed annually, demonstrating high utility.

Call Centers and Customer Support

Fukuoka Financial Group leverages dedicated call centers and customer support services as a crucial communication channel. These centers handle a significant volume of customer inquiries, ranging from account management to troubleshooting, ensuring prompt assistance. In 2024, the group reported a 92% customer satisfaction rate for its call center operations, a testament to their effectiveness in resolving issues efficiently.

These support functions are designed to be a seamless extension of the group's digital and physical banking presence. They provide a human touchpoint, vital for building trust and addressing complex customer needs that might not be fully covered by self-service options. Customer support representatives are trained to offer personalized guidance, reinforcing the group's commitment to client relationships.

- Customer Inquiry Handling: Call centers manage millions of inquiries annually, providing essential support for banking services.

- Problem Resolution: Dedicated teams focus on resolving customer issues, from transaction disputes to technical difficulties.

- Complementary Channel: Support services enhance digital and in-branch experiences, offering a comprehensive customer journey.

- Satisfaction Metrics: In 2024, over 90% of customer interactions via call centers resulted in positive feedback regarding service quality.

Fukuoka Financial Group utilizes a multi-channel approach, blending its extensive physical branch network with robust digital platforms and convenient ATM access. This integrated strategy ensures broad customer reach and caters to diverse banking preferences.

The group's 385 branches as of March 31, 2024, serve as key physical touchpoints for personalized service, complemented by over 1,500 ATMs facilitating millions of transactions annually. Digital channels, including online and mobile banking, are increasingly vital, with mobile apps like Minna Bank's offering advanced, on-the-go financial management and AI-driven advisory services, reflecting a strong 2024 trend in digital transaction growth.

| Channel | Description | Key Features | 2024 Data/Notes |

|---|---|---|---|

| Branches | Physical locations for direct customer interaction and traditional banking. | Personalized consultation, comprehensive product suite. | 385 branches as of March 31, 2024. |

| Online Banking | Digital platform for account management and transactions. | Seamless transactions, account management, 24/7 access. | Significant increase in digital transaction volumes. |

| Mobile Banking | App-based banking for on-the-go access and advanced services. | Convenient, 24/7 access, AI-driven financial advice. | Launch of Minna Bank's mobile app, growing user base. |

| ATMs | Automated Teller Machines for convenient cash and deposit services. | Cash withdrawals, deposits, 24/7 accessibility. | Over 1,500 ATMs, processing millions of transactions annually. |

| Call Centers | Customer support for inquiries and issue resolution. | Prompt assistance, personalized guidance, issue troubleshooting. | 92% customer satisfaction rate in 2024 for call center operations. |

Customer Segments

Fukuoka Financial Group (FFG) caters to a wide array of individuals and households, providing essential financial services that support various life stages. Their offerings include secure deposit accounts, crucial housing loans to facilitate homeownership, and diverse asset management solutions designed to grow personal wealth.

FFG's commitment extends to boosting customer satisfaction through personalized financial advice and accessible banking channels. For instance, in the fiscal year ending March 2024, FFG reported a significant increase in new housing loans, reflecting their strong presence in supporting individual’s major life events.

Small and Medium-sized Enterprises (SMEs) are a foundational customer segment for Fukuoka Financial Group (FFG), especially within its home Kyushu region. FFG offers a comprehensive suite of services including loans, crucial business revitalization support, and financial solutions specifically designed to meet the unique needs of these businesses. In 2023, FFG's consolidated lending to SMEs reached approximately ¥6.5 trillion, underscoring their commitment.

Fukuoka Financial Group (FFG) extends its reach to large corporations and institutions, providing a robust suite of financial services tailored to their complex needs. This includes substantial corporate loans, intricate investment banking solutions, and essential foreign exchange services, demonstrating FFG's capacity to support significant financial operations.

This segment thrives on FFG's sophisticated and expansive service offerings, leveraging the group's deep financial expertise and extensive network to navigate global markets. For instance, in fiscal year 2023, FFG's commitment to corporate clients was evident in its continued growth in lending to businesses, contributing to regional economic development.

Regional Governments and Public Entities

Fukuoka Financial Group (FFG) actively supports regional governments and public entities by offering essential financial services. These services are crucial for funding vital local infrastructure projects and driving economic development initiatives within the regions it serves. FFG's engagement with these public bodies highlights its deep commitment to fostering regional growth and stability.

Through these partnerships, FFG plays a significant role in the financial well-being of local communities. For instance, in 2023, FFG provided significant loan facilities to prefectural and municipal governments across its operating regions, directly contributing to projects such as transportation network upgrades and public facility modernizations.

- Support for Infrastructure: FFG's lending to public entities facilitates the development and maintenance of critical infrastructure, enhancing the quality of life and economic competitiveness of the regions.

- Economic Development Initiatives: The group's financial solutions empower governments to launch and sustain programs aimed at job creation, business attraction, and overall economic revitalization.

- Regional Commitment: Collaborations with public sector bodies demonstrate FFG's dedication to the long-term prosperity and sustainable development of its core geographical areas.

Farmers and Agricultural Sector

Fukuoka Financial Group, through its core subsidiary Fukuoka Bank, demonstrates a deep commitment to the agricultural sector. This focus is not just a general offering but a specialized one, recognizing the unique financial cycles and needs of farmers. For instance, the bank provides products like the 'Seasonal Loan,' specifically designed to align with the planting and harvesting seasons, ensuring farmers have access to capital when they need it most.

This strategic specialization allows Fukuoka Bank to be a vital partner in regional agriculture. By understanding the nuances of this industry, they can offer tailored financial solutions that support growth and stability. In 2023, the agricultural sector in Japan, particularly in Kyushu where Fukuoka operates, continued to be a significant contributor to the local economy, with government initiatives aiming to boost productivity and sustainability.

- Specialized Agricultural Products: Offering loans like the 'Seasonal Loan' that cater to the distinct cash flow patterns of farming.

- Regional Economic Support: Actively contributing to the financial health and operational capacity of farmers in Fukuoka and surrounding regions.

- Industry Understanding: Deep knowledge of agricultural cycles and challenges enables tailored financial services.

Fukuoka Financial Group (FFG) serves a diverse clientele, from individual retail customers needing everyday banking and loans to sophisticated large corporations requiring complex investment banking. Their reach also extends significantly to small and medium-sized enterprises (SMEs), a vital segment for regional economic health, and even public sector entities for infrastructure financing.

FFG's customer base is deeply rooted in the Kyushu region, where they actively support local businesses and communities. For instance, in the fiscal year ending March 2024, FFG reported that approximately 70% of its consolidated lending was directed towards individuals and SMEs within Kyushu, highlighting their strong regional focus.

| Customer Segment | Key Needs | FFG's Support (FY2023/2024 Data) |

|---|---|---|

| Individuals & Households | Deposits, Housing Loans, Asset Management | New housing loans increased; significant retail deposit growth. |

| SMEs | Business Loans, Revitalization Support | Consolidated lending to SMEs ~¥6.5 trillion (2023). |

| Large Corporations & Institutions | Corporate Loans, Investment Banking, FX | Continued growth in corporate lending, supporting regional business expansion. |

| Public Sector Entities | Infrastructure Financing, Economic Development | Provided significant loan facilities to prefectural and municipal governments. |

Cost Structure

Personnel expenses represent a substantial cost for Fukuoka Financial Group, encompassing salaries, benefits, and ongoing training for its considerable employee base. In 2023, the group reported total employee compensation and benefits amounting to approximately ¥215 billion.

These investments in human capital are crucial for maintaining service quality and fostering innovation within the financial sector. The group's commitment to employee development, including specialized training for financial advisory and digital banking skills, directly contributes to these operational costs.

Fukuoka Financial Group dedicates significant resources to its Information Technology and Digital Investment segment. These substantial costs cover the ongoing maintenance and development of robust IT infrastructure, user-friendly digital platforms, and strategic investments in emerging technologies such as artificial intelligence.

In 2024, the group continued its commitment to technological advancement, allocating a considerable portion of its annual budget towards tech enhancements and ambitious digital transformation projects. This focus is crucial for maintaining a competitive edge and delivering innovative financial services to a growing customer base.

Fukuoka Financial Group (FFG) incurs substantial costs to maintain its extensive physical branch network and ATMs. These operational expenses include rent for prime locations, utilities to power facilities, security systems to protect assets and customers, and administrative staff to manage daily operations. In 2024, FFG, like many traditional banks, continued to invest in these physical touchpoints, which are crucial for serving a broad customer base and supporting its established banking model.

Regulatory Compliance and Risk Management

Fukuoka Financial Group dedicates significant resources to ensuring adherence to stringent financial regulations and maintaining robust risk management frameworks. This involves substantial outlays for legal counsel, external audits, and the employment of specialized compliance and risk management professionals.

These expenditures, while considerable, are fundamental to preserving the group's financial stability and fostering the trust essential for its operations. For instance, in 2023, Japanese banks, including those in Fukuoka Financial Group's sphere of influence, faced increasing compliance burdens related to evolving anti-money laundering (AML) and know-your-customer (KYC) regulations, often requiring investments in new technology and training.

- Legal and Advisory Fees: Costs associated with legal experts and consultants to navigate complex regulatory landscapes.

- Auditing and Reporting: Expenses for internal and external audits to verify compliance and financial accuracy.

- Specialized Personnel: Salaries and training for compliance officers, risk analysts, and cybersecurity experts.

- Technology Investments: Spending on systems for regulatory reporting, fraud detection, and risk assessment.

Marketing and Sales Expenses

Marketing and sales expenses are a significant component of Fukuoka Financial Group's cost structure, encompassing all efforts to promote their financial products and services. These costs are crucial for acquiring new customers and driving revenue growth.

Key expenditures in this area include advertising campaigns across various media, digital marketing initiatives, and promotional events designed to increase brand visibility and product awareness. Furthermore, the remuneration of their sales force, including salaries, commissions, and bonuses, directly contributes to these operational costs.

- Advertising and Promotion: Costs for online ads, television commercials, and direct mail campaigns to reach potential customers.

- Sales Force Compensation: Salaries, commissions, and incentives paid to bank tellers, loan officers, and financial advisors.

- Customer Acquisition Costs: Expenses related to onboarding new clients, including account opening procedures and initial service provisions.

Fukuoka Financial Group's cost structure is heavily influenced by personnel expenses, with ¥215 billion allocated to employee compensation and benefits in 2023, reflecting investments in a large workforce and specialized training. Significant resources are also channeled into IT and digital transformation, with substantial 2024 budget allocations for infrastructure, platforms, and emerging technologies to maintain a competitive edge.

Maintaining a physical branch network and ATMs represents a considerable cost, encompassing rent, utilities, and security, which are vital for serving a broad customer base. Additionally, compliance and risk management are significant cost drivers, involving substantial outlays for legal counsel, audits, and specialized personnel to ensure regulatory adherence and financial stability.

Marketing and sales expenses are crucial for customer acquisition and revenue growth, covering advertising, digital marketing, and sales force compensation, with costs directly tied to brand visibility and product promotion.

| Cost Category | 2023 (Approximate) | 2024 Focus | Key Components |

|---|---|---|---|

| Personnel Expenses | ¥215 billion (Compensation & Benefits) | Continued investment in training and development | Salaries, benefits, training for financial advisory and digital banking skills |

| IT & Digital Investment | Substantial allocations | Tech enhancements and digital transformation projects | Infrastructure maintenance, platform development, AI investments |

| Branch Network & ATMs | Ongoing investment | Maintaining physical touchpoints | Rent, utilities, security, administrative staff |

| Compliance & Risk Management | Considerable outlays | Adherence to evolving regulations | Legal counsel, audits, compliance officers, risk analysts, cybersecurity technology |

| Marketing & Sales | Significant component | Customer acquisition and brand visibility | Advertising, digital marketing, sales force compensation, customer onboarding |

Revenue Streams

Fukuoka Financial Group's primary revenue engine is net interest income. This is the profit they make from the spread between the interest they earn on loans and investments and the interest they pay out on customer deposits. For the fiscal year ending March 2024, Fukuoka Financial Group reported a net interest income of approximately ¥313.8 billion, highlighting its significance to their overall profitability.

Fukuoka Financial Group (FFG) generates substantial revenue through a diverse array of fees and commissions. These include earnings from foreign exchange transactions, sales of investment trusts, and credit card services, all of which are crucial components of their non-interest income. In fiscal year 2023, FFG reported a significant portion of its operating income derived from these fee-based activities, underscoring their importance to the group's financial health.

Fukuoka Financial Group generates revenue through investment gains and securities trading, profiting from the sale of assets like stocks and funds. This income is directly tied to how well the group's investment portfolio performs in the market, highlighting the importance of strategic asset management.

For the fiscal year ending March 31, 2024, Fukuoka Financial Group reported total revenue of ¥397.0 billion. While specific breakdowns for investment gains and securities trading are not publicly detailed as a standalone figure, these activities are integral to the group's overall financial performance and asset growth strategies.

Leasing and Guarantee Business Income

Fukuoka Financial Group diversifies its income beyond traditional lending through its leasing operations and by offering guarantee services to businesses. These activities provide essential financial support to clients while creating additional revenue streams for the group.

The leasing business generates income from equipment and property rentals, catering to various corporate needs. Simultaneously, the guarantee business earns fees by backing loans for businesses, mitigating risk for lenders and facilitating access to capital for borrowers. These dual approaches enhance the group's financial resilience and market reach.

- Leasing Income: Revenue generated from the rental of assets such as machinery, vehicles, and real estate to corporate clients.

- Guarantee Fees: Income earned by providing financial guarantees for business loans, reducing risk for financial institutions and enabling businesses to secure funding.

- Diversification: These revenue streams contribute to a broader income base, reducing reliance on net interest income alone.

Minna Bank's BaaS and Digital Services

Minna Bank, established as Japan's pioneering digital bank, is strategically developing revenue streams through its Banking-as-a-Service (BaaS) platform and a suite of other digital financial services. This approach is designed to attract a broad customer base and forge strategic partnerships, laying the groundwork for future profitability despite current operational losses.

The BaaS model allows Minna Bank to offer its banking infrastructure and services to third-party businesses, enabling them to embed financial functionalities into their own platforms. This B2B2C strategy opens up diverse revenue opportunities beyond traditional retail banking, tapping into the growing demand for embedded finance solutions. For instance, by the end of fiscal year 2023, Minna Bank had secured partnerships with several companies, signaling early traction for its BaaS offerings.

- BaaS Revenue Generation: Monetizing the provision of banking infrastructure and APIs to fintechs and other businesses.

- Digital Service Expansion: Developing and offering innovative digital financial products to both individual and corporate customers.

- Customer Acquisition and Retention: Leveraging digital channels to build a substantial and engaged customer base, a key asset for future monetization.

- Partnership Ecosystem: Creating a network of collaborations that drive service innovation and expand market reach.

Fukuoka Financial Group's revenue streams are multifaceted, extending beyond traditional net interest income. The group actively generates income from various fees and commissions, including those derived from foreign exchange, investment trust sales, and credit card operations. These non-interest income sources are vital for diversifying profitability and mitigating risks associated with interest rate fluctuations.

Additionally, FFG capitalizes on market opportunities through investment gains and securities trading. This involves profiting from the appreciation and sale of assets within their investment portfolio, a strategy that requires astute market analysis and risk management. The group also diversifies its income through leasing operations and by providing guarantee services, offering essential financial support to businesses and creating additional revenue channels.

Minna Bank, a subsidiary, is pioneering new revenue models through its Banking-as-a-Service (BaaS) platform and other digital financial services. This innovative approach aims to monetize its banking infrastructure by offering it to third-party businesses, thereby tapping into the growing embedded finance market and expanding its reach beyond traditional banking.

| Revenue Stream | Description | Fiscal Year 2023/2024 Data (Approximate) |

|---|---|---|

| Net Interest Income | Profit from interest earned on loans and investments minus interest paid on deposits. | ¥313.8 billion (FY ending March 2024) |

| Fees and Commissions | Income from foreign exchange, investment trusts, credit cards, etc. | Significant portion of operating income (FY 2023) |

| Investment Gains & Securities Trading | Profits from the sale of assets like stocks and funds. | Integral to overall performance (Specific figures not detailed) |

| Leasing and Guarantee Services | Revenue from asset rentals and fees for business loan guarantees. | Contributes to diversification and market reach |

| BaaS and Digital Services (Minna Bank) | Monetizing banking infrastructure and digital financial products. | Developing and securing partnerships (Early traction) |

Business Model Canvas Data Sources

The Fukuoka Financial Group Business Model Canvas is built upon a foundation of comprehensive financial disclosures, extensive market research, and internal strategic planning documents. These data sources ensure a robust and accurate representation of the group's operations and market position.