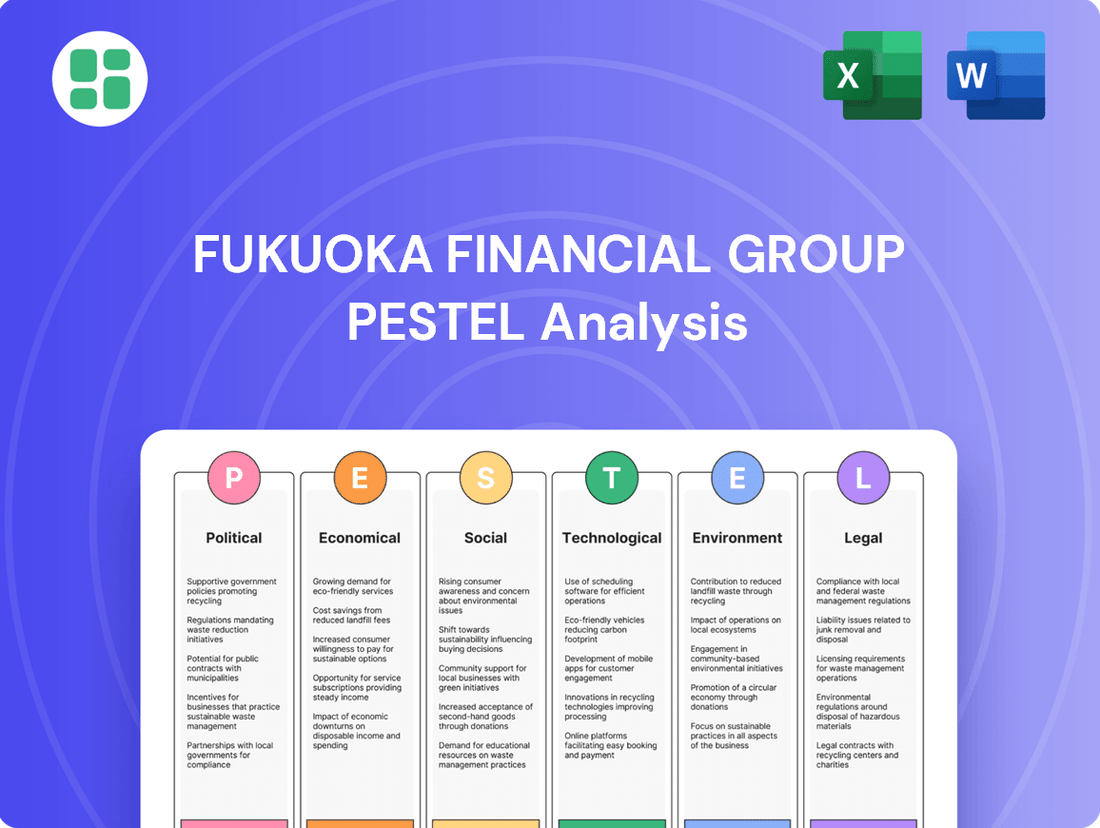

Fukuoka Financial Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fukuoka Financial Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Fukuoka Financial Group's future. Our comprehensive PESTLE analysis provides actionable intelligence to help you anticipate market shifts and identify strategic opportunities. Download the full report now to gain a competitive edge.

Political factors

The stability of the Japanese government and its financial policies are key determinants for Fukuoka Financial Group's operating landscape. A predictable political environment, exemplified by the current administration's focus on economic revitalization, supports consistent regulatory frameworks. This stability is crucial for long-term financial planning and investment decisions within the Kyushu region.

Japan's Financial Services Agency (FSA) continues to refine banking regulations, impacting Fukuoka Financial Group. Recent updates, such as stricter capital adequacy ratios aligning with Basel III, require ongoing adjustments to the group's financial structure. For instance, as of the end of fiscal year 2023, major Japanese banks, including those within Fukuoka Financial Group's peer set, generally maintained Common Equity Tier 1 (CET1) ratios well above the regulatory minimums, often exceeding 10%, demonstrating their preparedness for such requirements.

Fukuoka Financial Group's deep roots in the Kyushu region make it highly susceptible to regional government policies and development programs. For instance, the Kyushu Economic Federation's ongoing efforts to boost the semiconductor industry, a key focus for Fukuoka, directly translate into potential new lending and investment avenues for the group.

International Trade Agreements and Relations

Japan's active participation in international trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), significantly shapes its economic landscape. These agreements facilitate trade and investment, impacting sectors vital to Fukuoka's economy. For instance, RCEP, which came into effect for Japan in March 2023, aims to reduce trade barriers across a vast economic bloc, potentially boosting exports for Kyushu's manufacturing and agricultural sectors.

Changes in global trade policies and geopolitical tensions can introduce volatility. For Fukuoka Financial Group, this translates to potential impacts on its loan portfolio. Businesses reliant on exports to key markets like the United States or China may face challenges due to shifting tariff structures or supply chain disruptions. For example, ongoing trade discussions between major economies in 2024 and 2025 could introduce new uncertainties for Japanese exporters.

The financial stability of businesses within Fukuoka's service area is directly linked to these international trade dynamics. Fluctuations in global demand or increased import costs can affect corporate profitability, potentially leading to higher non-performing loans for the bank. In 2023, Japan's trade deficit widened, partly due to energy import costs, highlighting the sensitivity of its economy to global price fluctuations and trade balances.

- CPTPP and RCEP Membership: Japan's commitment to these agreements fosters greater market access for its industries.

- Geopolitical Risk Exposure: Evolving international relations and trade disputes pose risks to export-dependent businesses.

- Supply Chain Resilience: Disruptions in global supply chains, exacerbated by geopolitical events, can impact business operations and financial health.

- Trade Balance Sensitivity: Japan's economic performance is sensitive to its trade balance, influenced by global commodity prices and demand.

Geopolitical Risks and Financial Stability

Broader geopolitical tensions, such as ongoing trade disputes or regional conflicts, while not directly impacting Fukuoka Financial Group's day-to-day operations, can introduce systemic risks to the broader Japanese financial system. These risks can manifest as increased market volatility, shifts in investor sentiment, or disruptions to international financial flows. For instance, a significant escalation in global trade tensions could lead to a repricing of assets across the Japanese market, affecting the value of the group's investment portfolio.

To safeguard financial stability amidst these external pressures, Fukuoka Financial Group must continuously enhance its risk management frameworks and contingency planning. This involves stress-testing portfolios against various geopolitical scenarios and ensuring robust liquidity management. The group’s ability to navigate these complexities is crucial for maintaining investor confidence and ensuring its long-term resilience.

- Geopolitical Impact: Increased market volatility and potential disruptions to international financial flows due to broader global tensions.

- Risk Mitigation: Necessity for Fukuoka Financial Group to bolster risk management frameworks and contingency plans.

- Systemic Risk: Indirect exposure to systemic risks within the Japanese financial system stemming from geopolitical instability.

The Japanese government's ongoing commitment to fiscal stimulus and economic growth initiatives, particularly in the Kyushu region, provides a supportive backdrop for Fukuoka Financial Group. For example, the government's continued investment in infrastructure projects, such as high-speed rail expansion in Kyushu, creates opportunities for increased lending and project financing for the group.

Regulatory changes from the Financial Services Agency (FSA) are a constant factor, influencing capital requirements and operational compliance. As of early 2024, the FSA continues to emphasize robust cybersecurity measures for financial institutions, prompting ongoing investment in IT infrastructure for banks like Fukuoka Financial Group.

Regional development policies are critical, with local governments in Kyushu actively promoting specific industries. Fukuoka's focus on attracting technology and tourism businesses, supported by regional subsidies and tax incentives, directly impacts the group's lending strategies and potential for new business growth in these sectors.

The stability of the political landscape in Japan, including consistent policy direction from the ruling party, underpins the predictable operating environment for financial institutions. This stability is crucial for long-term strategic planning and investment decisions by Fukuoka Financial Group.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Fukuoka Financial Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, enabling the group to navigate challenges and capitalize on emerging opportunities within its operating landscape.

Provides a concise version of the Fukuoka Financial Group's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The Bank of Japan's (BOJ) monetary policy is a critical economic factor for Fukuoka Financial Group. In March 2024, the BOJ ended its negative interest rate policy, moving its policy rate from -0.1% to a range of 0% to 0.1%. This shift is expected to improve net interest income for banks like Fukuoka Financial Group by allowing them to charge more for loans, potentially widening their net interest margins.

This policy pivot, moving away from prolonged ultra-loose monetary conditions, could lead to gradual interest rate increases. While higher rates generally benefit lending profitability, they also present challenges. Fukuoka Financial Group might see increased costs for customer deposits as rates rise, and its existing bond holdings could experience valuation declines if market interest rates climb significantly.

The BOJ's commitment to maintaining accommodative conditions, even after exiting negative rates, means the pace of rate hikes will likely be measured. This cautious approach aims to support economic recovery without destabilizing markets. For Fukuoka Financial Group, this suggests a gradual improvement in its interest income environment rather than an immediate, dramatic surge.

The economic vitality of Kyushu, Fukuoka Financial Group's core market, directly impacts its performance. In 2024, Kyushu's GDP growth is projected to be around 1.5%, supported by strong performance in the semiconductor sector, which saw significant investment in the region. This expansion fuels demand for the group's lending and financial services.

However, potential headwinds exist. A global economic slowdown in late 2024 or early 2025 could dampen demand for Kyushu's export-oriented industries, particularly electronics and automotive components, potentially leading to increased credit risk for Fukuoka Financial Group. For example, a 1% dip in regional exports could translate to a measurable increase in non-performing loan ratios.

Inflationary pressures in Japan significantly shape consumer spending habits and the operational landscape for Fukuoka Financial Group. While the Bank of Japan aims for stable inflation, recent data indicates shifts. For instance, Japan's core inflation rate reached 2.8% in April 2024, a notable increase that impacts real wages and purchasing power.

This trend can lead to cautious consumer behavior, potentially slowing demand for credit and impacting the profitability of financial services. Conversely, if inflation remains moderate and managed effectively by the Bank of Japan's monetary policy, it could support asset values and stimulate certain economic activities, benefiting both the bank and its clients.

Business Investment and Lending Demand

Trends in business investment, particularly within the Kyushu region, are a critical driver for Fukuoka Financial Group's corporate loan and financial solution demand. The influx of significant capital, exemplified by major semiconductor manufacturers establishing operations, translates directly into substantial lending opportunities. This activity not only fuels the group's asset growth but also underscores its role in supporting regional economic expansion through targeted financing.

For instance, the massive investments in the semiconductor industry, such as those by TSMC in Kumamoto, are projected to inject trillions of yen into the regional economy, creating a robust pipeline for corporate lending. Fukuoka Financial Group's proactive engagement with these burgeoning industries directly impacts its loan portfolio performance.

- Regional Investment Boom: Kyushu is experiencing unprecedented capital expenditure, driven by high-tech manufacturing, creating a strong demand for corporate financing.

- Semiconductor Sector Impact: Major semiconductor facility expansions are a primary catalyst for increased lending demand, directly benefiting financial institutions like Fukuoka Financial Group.

- FGF's Supportive Role: The group's commitment to regional businesses ensures it captures a significant share of this investment-driven lending market.

Global Economic Trends and Financial Market Volatility

While Fukuoka Financial Group primarily serves a regional market, its operations are intrinsically linked to global economic currents. A projected slowdown in global growth for 2024, with the IMF forecasting 3.2% in 2024, could dampen demand for Japanese exports, indirectly impacting Kyushu's businesses and increasing volatility in the financial markets where the group invests.

Managing the group's securities portfolio requires a keen eye on international economic indicators. For instance, persistent inflation in major economies or shifts in global interest rate policies can significantly alter asset valuations and risk profiles. The Bank of Japan's accommodative stance, while supportive domestically, needs to be considered against the backdrop of global monetary tightening.

- Global GDP Growth: IMF projects global GDP growth to moderate to 3.2% in 2024, down from an estimated 3.3% in 2023, highlighting a general slowdown.

- Inflationary Pressures: While easing in some regions, inflation remains a concern, influencing central bank policies and market sentiment.

- Interest Rate Differentials: Divergent monetary policies between major economies create currency fluctuations and impact cross-border investment flows.

The Bank of Japan's shift away from negative interest rates in March 2024, moving rates to 0%-0.1%, is a key economic driver. This policy change is anticipated to boost net interest income for Fukuoka Financial Group by enabling higher lending rates, potentially widening net interest margins.

Kyushu's economic health, particularly its projected 1.5% GDP growth in 2024 fueled by semiconductor investments, directly supports demand for the group's services. However, a global economic slowdown could negatively impact Kyushu's export-oriented sectors, increasing credit risk.

Inflation, with Japan's core rate at 2.8% in April 2024, influences consumer spending and can lead to cautious credit demand, though moderate inflation can also stimulate economic activity beneficial to the bank.

Major investments in Kyushu's semiconductor industry, such as TSMC's Kumamoto facility, are creating substantial lending opportunities for Fukuoka Financial Group, directly contributing to asset growth.

| Economic Factor | 2024 Projection/Data | Impact on Fukuoka Financial Group |

| Bank of Japan Policy Rate | 0% - 0.1% (from March 2024) | Potential for increased net interest income; risk of higher deposit costs and bond valuation declines. |

| Kyushu GDP Growth | ~1.5% (2024) | Supports lending and financial service demand; growth driven by semiconductor sector. |

| Japan Core Inflation | 2.8% (April 2024) | May lead to cautious consumer spending and credit demand; moderate inflation can stimulate economic activity. |

| Global GDP Growth | 3.2% (IMF 2024 forecast) | Slower global growth could dampen Japanese exports, impacting regional businesses and increasing market volatility. |

Same Document Delivered

Fukuoka Financial Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fukuoka Financial Group.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive PESTLE analysis of Fukuoka Financial Group.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external forces shaping Fukuoka Financial Group's strategic landscape.

Sociological factors

Fukuoka Financial Group faces a significant challenge from Japan's aging population and declining birth rates. By 2025, Japan's elderly population (65+) is projected to exceed 30% of the total population, impacting the size of its customer base and the demand for financial services.

These demographic shifts directly affect the group's potential customer base, requiring a strategic re-evaluation of product offerings. Demand for retirement planning, long-term care insurance, and inheritance services is likely to rise, while demand for products catering to younger demographics may stagnate.

Furthermore, labor availability will be a growing concern. As the working-age population shrinks, Fukuoka Financial Group will need to focus on talent acquisition and retention strategies, potentially exploring automation and upskilling existing employees to meet operational needs.

Consumer preferences are rapidly shifting, with a notable surge in digital banking adoption and a move towards cashless transactions. This trend is particularly evident in Japan, where, according to a 2023 report by Statista, the e-commerce market alone saw a substantial increase in digital payment usage, indicating a broader societal embrace of non-cash alternatives.

Fukuoka Financial Group must actively respond to these evolving behaviors by enhancing its digital infrastructure. Investing in intuitive mobile banking applications and secure, seamless cashless payment solutions is crucial for meeting contemporary customer demands and maintaining a competitive edge in the financial services sector.

Internal migration within Japan continues to see a trend of population movement from rural areas to major metropolitan centers. This dynamic directly impacts Fukuoka Financial Group's regional customer base in Kyushu. For instance, while Fukuoka city itself might be a magnet for new residents, other prefectures within the Kyushu region could be experiencing population decline, potentially affecting the group's localized market share and service demand.

This demographic shift necessitates strategic adjustments for Fukuoka Financial Group. The group must consider how to maintain its regional presence and support in areas experiencing population outflow, perhaps by optimizing its branch network or enhancing digital service delivery models to cater to a potentially smaller, yet still vital, customer base in those areas.

Financial Literacy and Demand for Products

The financial literacy levels within Fukuoka and the broader Kyushu region directly shape consumer demand for sophisticated financial instruments and wealth management services. Fukuoka Financial Group can capitalize on this by focusing on customer education and developing clear, accessible product offerings. This is particularly relevant as individuals navigate evolving economic landscapes and aim to grow their assets.

For instance, in 2023, a significant portion of Japanese adults, particularly younger demographics, expressed a desire for improved financial knowledge. Surveys indicated that over 60% of individuals aged 20-30 felt they lacked sufficient understanding of investment products. This presents a clear opportunity for financial institutions like Fukuoka Financial Group to bridge this knowledge gap.

- Growing Demand for Investment Education: A substantial percentage of the Japanese population, especially younger adults, actively seeks to enhance their financial understanding.

- Opportunity for Tailored Products: Financial institutions can drive growth by offering products that are not only understandable but also directly address the educational needs of their customer base.

- Impact of Economic Uncertainty: As economic conditions fluctuate, the need for sound financial planning and investment advice becomes more pronounced, increasing the potential market for well-explained financial services.

Work-Life Balance and Employee Expectations

Societal trends increasingly prioritize work-life balance, influencing how employees view their careers. This shift directly impacts Fukuoka Financial Group's capacity to attract and retain skilled personnel in a competitive labor market.

As a significant employer in Fukuoka, the group needs to adapt its human resource strategies. This includes offering attractive benefits packages, flexible work options, and fostering a supportive corporate culture to secure a capable workforce.

- Employee Demand for Flexibility: Reports from 2024 indicate a strong preference among Japanese professionals for hybrid work models, with over 60% expressing a desire for such arrangements.

- Talent Retention Challenges: Companies failing to offer robust work-life balance initiatives face higher turnover rates, potentially costing significant amounts in recruitment and training.

- Fukuoka Financial Group's Response: The group is exploring enhanced remote work policies and flexible scheduling to align with evolving employee expectations.

Fukuoka Financial Group must adapt to Japan's aging demographic and declining birth rates, which by 2025 will see over 30% of the population aged 65+. This necessitates a strategic shift towards retirement, inheritance, and long-term care services, while also addressing potential labor shortages by focusing on talent acquisition and employee upskilling.

The increasing adoption of digital banking and cashless transactions, evidenced by a substantial rise in e-commerce digital payment usage in Japan in 2023, requires Fukuoka Financial Group to bolster its digital infrastructure with user-friendly mobile apps and secure payment solutions.

Societal trends prioritizing work-life balance are influencing employee expectations, prompting Fukuoka Financial Group to enhance its human resource strategies with flexible work options and attractive benefits to retain talent, especially as over 60% of Japanese professionals in 2024 expressed a preference for hybrid work models.

Financial literacy is a key factor, with over 60% of Japanese adults aged 20-30 in 2023 reporting a lack of investment knowledge, creating an opportunity for Fukuoka Financial Group to offer educational initiatives and accessible financial products.

Technological factors

The financial services sector is undergoing a significant shift due to rapid FinTech advancements, including digital banking, payment solutions, and AI. Fukuoka Financial Group's commitment to digital transformation, exemplified by its Minna Bank digital platform, is crucial for staying competitive against both established banks and agile FinTech startups. This strategic focus ensures the group can offer modern, user-friendly services to its customer base.

The evolving landscape of cyber threats presents a substantial challenge for financial institutions like Fukuoka Financial Group. As cyberattacks become more sophisticated, the need for advanced cybersecurity protocols and stringent data protection practices is critical. This is essential to shield customer information, preserve client confidence, and avert financial damages stemming from breaches.

Japanese financial regulators are indeed escalating their cybersecurity mandates for banks. For instance, in 2023, the Financial Services Agency (FSA) emphasized enhanced oversight of financial institutions' IT systems and data handling, reflecting a proactive approach to mitigating digital risks. This heightened regulatory focus underscores the importance of continuous investment in cybersecurity infrastructure and compliance for entities such as Fukuoka Financial Group.

Fukuoka Financial Group can significantly enhance its operations by integrating AI and machine learning. These technologies are revolutionizing banking by improving credit scoring accuracy and bolstering fraud detection systems. For instance, global banks reported that AI-powered fraud detection systems reduced false positives by up to 30% in 2024.

The group can leverage AI for personalized customer service, offering tailored financial advice and product recommendations. This can lead to increased customer satisfaction and loyalty. In 2024, financial institutions that adopted AI for customer interaction saw a 15% uplift in customer engagement metrics.

Furthermore, AI and ML can drive operational efficiency by automating routine tasks, such as data entry and customer onboarding. This streamlining of processes allows staff to focus on more complex, value-added activities. Early adopters in 2025 are projecting cost savings of 10-20% through AI-driven process automation.

Digital Transformation of Banking Operations

Fukuoka Financial Group is deeply involved in the digital transformation of its banking operations, extending far beyond customer interfaces. This strategic shift focuses on automating internal processes, digitizing workflows, and enhancing data analytics. For instance, in 2024, many financial institutions, including those in Japan, are investing heavily in AI-powered back-office automation to streamline tasks like compliance checks and transaction processing, aiming for significant efficiency gains.

This internal overhaul is crucial for reducing operational costs and boosting overall efficiency. By digitizing workflows, Fukuoka Financial Group can expedite service delivery, offering customers faster and more integrated banking experiences. A report from late 2024 indicated that banks successfully implementing these internal digital transformations saw an average reduction in processing times for loan applications by up to 30%.

- Automated Back-Office Processes: Implementing AI and robotic process automation (RPA) to handle routine tasks.

- Digitized Workflows: Moving from paper-based to digital systems for all operational procedures.

- Enhanced Data Analytics: Leveraging advanced analytics for better risk management and customer insights.

- Cost Reduction & Efficiency: Aiming for significant savings and faster service delivery through digitalization.

Investment in Cloud Computing and Data Analytics

Fukuoka Financial Group's investment in cloud computing and data analytics is a significant technological driver. Leveraging platforms like AWS or Azure allows for enhanced scalability and flexibility, crucial for adapting to fluctuating market demands. For instance, the global public cloud services market was projected to reach $679 billion in 2024, demonstrating the widespread adoption and importance of these technologies.

This technological investment enables deeper insights into customer behavior and market trends. By analyzing vast datasets, Fukuoka Financial Group can identify emerging opportunities and refine risk management strategies. In 2024, financial institutions are increasingly relying on AI and machine learning, powered by cloud infrastructure, to personalize customer experiences and detect fraudulent activities more effectively.

- Scalability and Cost-Effectiveness: Cloud adoption allows for dynamic resource allocation, optimizing IT expenditure.

- Enhanced Data Insights: Advanced analytics provide a competitive edge in understanding customer needs and market dynamics.

- Innovation in Financial Products: Data-driven insights facilitate the creation of new, tailored financial services.

- Improved Risk Management: Predictive analytics help in identifying and mitigating potential financial risks more proactively.

The integration of Artificial Intelligence (AI) and machine learning is fundamentally reshaping banking operations for Fukuoka Financial Group. These technologies are key to enhancing credit scoring accuracy and strengthening fraud detection capabilities, with AI-powered systems in 2024 reducing false positives by up to 30% in global banking environments.

Furthermore, AI adoption is driving personalized customer service, leading to a projected 15% uplift in customer engagement metrics for financial institutions in 2024 that leverage AI for client interactions.

Operational efficiency is also being significantly boosted through AI and ML, with early adopters in 2025 anticipating 10-20% cost savings from automating routine tasks like data entry and customer onboarding.

Fukuoka Financial Group's strategic investment in cloud computing platforms is enabling greater scalability and flexibility. The global public cloud services market was projected to reach $679 billion in 2024, highlighting the widespread reliance on these technologies for modern financial operations.

| Technology Area | Impact on Fukuoka Financial Group | Key Data/Trend (2024-2025) |

| AI & Machine Learning | Improved credit scoring, fraud detection, personalized customer service, operational automation | 30% reduction in false positives for fraud detection (global banks, 2024); 15% uplift in customer engagement (AI for interaction, 2024); 10-20% cost savings from automation (early adopters, 2025) |

| Cloud Computing & Data Analytics | Enhanced scalability, flexibility, deeper customer insights, improved risk management | Global public cloud services market projected at $679 billion (2024) |

| Digital Transformation | Streamlined internal processes, digitized workflows, faster service delivery | Up to 30% reduction in loan application processing times (successful implementers, late 2024) |

Legal factors

Fukuoka Financial Group must meticulously follow Japan's Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These laws mandate stringent internal controls, comprehensive reporting, and thorough customer due diligence to thwart illicit financial flows.

The Japanese government continually refines its compliance frameworks, as evidenced by updates to the Act on Prevention of Transfer of Criminal Proceeds in recent years, placing increased responsibility on financial institutions like Fukuoka Financial Group to enhance their preventative measures and reporting accuracy.

Fukuoka Financial Group must navigate Japan's robust data privacy landscape, primarily governed by the Act on the Protection of Personal Information (APPI). This necessitates meticulous handling, storage, and processing of sensitive customer data to ensure compliance. Failure to adhere to these stringent requirements, which were further strengthened with amendments effective in April 2022, can lead to significant penalties and erode vital customer trust.

The Banking Act of Japan and related financial services regulations are fundamental to Fukuoka Financial Group's operations, dictating everything from capital requirements to lending and risk management. These laws directly influence how the group conducts its core business, ensuring stability within the financial system.

Recent or anticipated amendments, such as those that might broaden permissible ancillary services or refine regulations for bank holding companies, could significantly alter Fukuoka Financial Group's business scope and operational mandates. For instance, if new regulations in 2024-2025 allow for greater integration of fintech services, the group would need to adapt its strategies and potentially invest in new technologies to remain competitive.

Consumer Protection Laws

Consumer protection laws are a cornerstone for Fukuoka Financial Group, shaping how it interacts with its customer base. These regulations, such as the Financial Services Agency's (FSA) guidelines in Japan, mandate clear disclosure of fees, interest rates, and product terms, fostering transparency. For instance, the enhanced disclosure requirements implemented in recent years aim to prevent mis-selling and ensure customers fully understand their financial commitments.

Adherence to these consumer protection statutes is not merely a compliance exercise; it's fundamental to maintaining trust and mitigating significant legal and reputational risks. Failure to comply could lead to substantial fines, as seen in other financial institutions globally, and erode customer loyalty, impacting long-term profitability. Fukuoka Financial Group's commitment to these principles directly supports its strategy for sustainable growth and customer retention.

Key aspects of consumer protection laws relevant to Fukuoka Financial Group include:

- Fair Lending Practices: Ensuring equitable treatment and preventing discriminatory lending.

- Transparency in Product Offerings: Clear and understandable communication about financial products and services.

- Customer Redress Mechanisms: Providing accessible channels for complaints and dispute resolution.

- Data Privacy and Security: Protecting sensitive customer financial information.

Corporate Governance and Disclosure Requirements

As a publicly traded financial holding company, Fukuoka Financial Group (FFG) must adhere to stringent corporate governance standards and disclosure mandates set by authorities such as the Tokyo Stock Exchange and the Financial Services Agency (FSA). These regulations are crucial for maintaining transparency and accountability to stakeholders.

FFG's commitment to these rules, which increasingly encompass sustainability reporting, directly impacts investor confidence and its ability to attract capital. For instance, the Tokyo Stock Exchange's Corporate Governance Code, updated in June 2024, emphasizes enhanced disclosure on board independence and executive compensation, areas critical for FFG's operational oversight.

- Compliance with Tokyo Stock Exchange (TSE) Corporate Governance Code: FFG must meet the TSE's evolving guidelines, which in 2024 placed greater emphasis on diversity and inclusion in leadership roles and robust risk management frameworks.

- Financial Services Agency (FSA) Regulations: The FSA's oversight includes capital adequacy ratios and consumer protection rules, directly influencing FFG's product offerings and operational procedures.

- Sustainability Disclosure Requirements: FFG is increasingly expected to provide detailed information on Environmental, Social, and Governance (ESG) performance, aligning with global trends and investor demand for sustainable finance.

- Shareholder Rights and Transparency: Adherence to disclosure requirements ensures that shareholders receive timely and accurate information, fostering trust and enabling informed decision-making regarding their investments in FFG.

Fukuoka Financial Group operates within a strict legal framework in Japan, necessitating adherence to anti-money laundering (AML) and counter-terrorism financing (CTF) laws, which were updated in 2023 to strengthen reporting and due diligence requirements. The Act on the Protection of Personal Information (APPI), with significant amendments effective April 2022, mandates robust data privacy measures, impacting how customer data is managed. Furthermore, the Banking Act and consumer protection regulations, including enhanced disclosure rules implemented by the Financial Services Agency (FSA) in recent years, shape the group's lending practices and product transparency.

Environmental factors

Fukuoka Financial Group faces significant climate change risks impacting its loan portfolios. Physical risks, such as increased frequency of extreme weather events in Kyushu, could impair the ability of borrowers in agriculture or real estate to repay loans. For instance, the Kyushu region has experienced a rise in heavy rainfall events, as seen in the July 2020 flood disaster, which directly affected businesses and households.

Transition risks are also a concern, particularly for loans to businesses in high-emission sectors like manufacturing or energy. As Japan moves towards its 2050 carbon neutrality goal, companies in these industries may face increased operational costs due to carbon pricing or a need for substantial investment in greener technologies, potentially affecting their creditworthiness and the value of collateral.

There's a significant and growing global push towards integrating Environmental, Social, and Governance (ESG) principles into investment and lending. This trend is also strongly evident within Japan, influencing how financial institutions operate.

Fukuoka Financial Group is feeling this pressure and is expected to weave ESG considerations into its core financing strategies. This includes developing and offering sustainable financial products that appeal to a widening base of responsible investors and clients. Demonstrating a clear commitment to environmental stewardship is becoming a key differentiator.

For instance, the total assets under management for ESG-focused funds globally reached an estimated $37.7 trillion in 2024, a substantial increase from previous years, highlighting the market's appetite for sustainable investments. Japanese investors are increasingly aligning their portfolios with these values, making ESG integration crucial for financial groups like Fukuoka.

Japanese regulators are actively pushing for sustainable finance, with the Financial Services Agency (FSA) encouraging banks to integrate environmental, social, and governance (ESG) factors into their lending decisions. This regulatory push aims to steer capital towards environmentally sound projects and businesses committed to decarbonization.

Fukuoka Financial Group, like its peers, may find itself subject to evolving guidelines that incentivize or mandate support for green projects, such as renewable energy development and businesses undergoing low-carbon transitions. For instance, the Bank of Japan's climate stress tests, initiated in 2022, signal a growing focus on climate-related financial risks and opportunities for the banking sector.

Natural Disaster Risk in Kyushu

Kyushu, including Fukuoka, is highly susceptible to natural disasters like earthquakes and typhoons, posing significant environmental risks to Fukuoka Financial Group. The region's geological activity means the potential for seismic events is a constant concern, impacting physical infrastructure and economic stability.

The group must consider the financial implications of these events on its loan portfolio, as borrowers in affected areas may struggle with repayment. For instance, in 2023, Japan experienced over 1,500 earthquakes with a seismic intensity of 1 or greater, highlighting the ongoing seismic risk.

Typhoons also present a considerable threat, with potential for widespread damage to property and disruption of economic activities. The economic impact of major typhoons can be substantial, affecting industries and consumer spending, which directly influences loan performance and the group's operational resilience.

- Earthquake Risk: Kyushu is part of the Pacific Ring of Fire, increasing the frequency and intensity of seismic activity.

- Typhoon Impact: Seasonal typhoons can cause significant damage to infrastructure and disrupt business operations across the region.

- Flood Potential: Heavy rainfall associated with typhoons and seasonal patterns can lead to localized flooding, affecting businesses and residential areas.

- Economic Vulnerability: Natural disasters can lead to increased non-performing loans and impact the overall economic health of Kyushu, affecting the financial group's performance.

Reputational Risks from Environmental Practices

Fukuoka Financial Group's reputation is closely tied to its environmental stewardship and the sustainability of the companies it supports. Negative perceptions stemming from financing environmentally questionable ventures or a perceived lack of dedication to green initiatives can significantly harm its public image.

This reputational damage can directly impact customer trust and investor confidence. For instance, a growing number of consumers and institutional investors are actively divesting from or avoiding financial institutions with poor environmental track records. In 2023, for example, reports indicated a significant increase in investor engagement with banks regarding their climate risk disclosures and lending practices, highlighting the growing importance of environmental performance.

Fukuoka Financial Group faces the challenge of balancing its financial objectives with increasing societal expectations for environmental responsibility. Failure to adequately address these concerns could lead to:

- Decreased customer acquisition and retention.

- Reduced attractiveness to socially responsible investors.

- Potential boycotts or negative media campaigns.

Fukuoka Financial Group is exposed to significant environmental risks, including those stemming from natural disasters prevalent in Kyushu, such as earthquakes and typhoons. These events can directly impact the group's loan portfolios by affecting borrowers' repayment capabilities and the value of collateral.

The global shift towards sustainability and ESG principles is a major environmental factor, influencing investor and customer expectations. Fukuoka Financial Group must integrate these considerations into its strategies and product offerings to maintain competitiveness and attract responsible capital, with global ESG assets projected to grow substantially.

Regulatory bodies like Japan's FSA are actively promoting sustainable finance, encouraging banks to incorporate ESG factors into lending decisions. This regulatory environment, coupled with initiatives like the Bank of Japan's climate stress tests, pushes financial institutions towards supporting green projects and managing climate-related financial risks.

The group's reputation is increasingly linked to its environmental performance and commitment to sustainability. Failure to meet evolving societal expectations regarding environmental responsibility could lead to decreased customer trust, reduced investor appeal, and potential reputational damage, impacting its overall financial health.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fukuoka Financial Group is constructed from a robust blend of official government publications, reports from international financial institutions, and comprehensive industry-specific market research. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental landscape impacting the group.