Fukuoka Financial Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fukuoka Financial Group Bundle

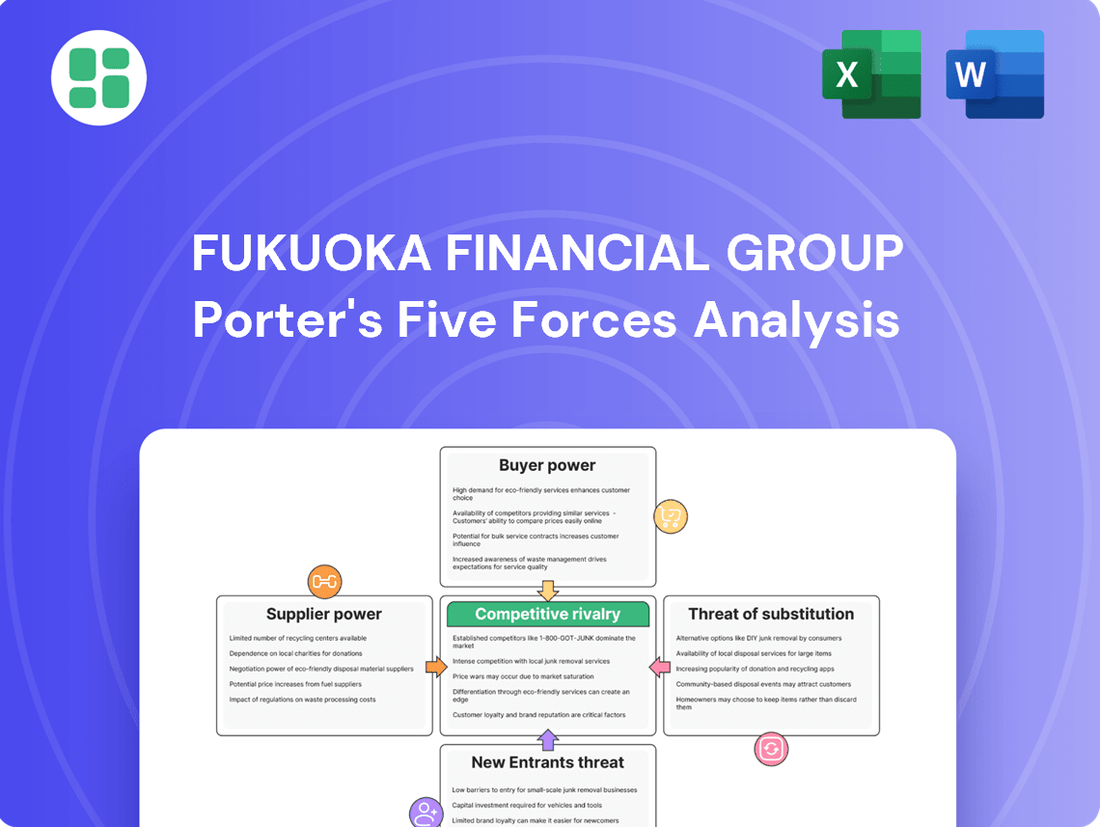

Fukuoka Financial Group navigates a competitive landscape shaped by moderate buyer power and the constant threat of new entrants. Understanding these forces is crucial for grasping their strategic positioning. The full analysis reveals the real forces shaping Fukuoka Financial Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of individual depositors with Fukuoka Financial Group (FFG) is typically low. This is because their deposits are largely interchangeable, and the perceived effort and risk involved in switching banks can be a deterrent. However, when viewed collectively, especially in a rising interest rate environment, depositors gain significant leverage as they can seek better yields elsewhere.

FFG's financial strength is built upon a substantial and stable deposit base, primarily sourced from the Kyushu region. As of the fiscal year ending March 31, 2024, FFG reported total deposits of approximately ¥15.1 trillion, underscoring the importance of this funding source.

In the current economic climate, with interest rates on an upward trend, depositors are increasingly motivated to compare offerings. This heightened awareness of alternative returns can amplify their collective bargaining power, potentially pressuring FFG to adjust its deposit rates to retain its funding base.

Fukuoka Financial Group's reliance on technology suppliers, especially for digital transformation initiatives like those seen with Minna Bank, significantly amplifies supplier bargaining power. As financial institutions increasingly depend on specialized fintech solutions for core banking, AI, and cybersecurity, providers of these critical digital tools can command higher pricing and more favorable terms due to the bank's need for cutting-edge, competitive technology.

The bargaining power of suppliers of human capital for Fukuoka Financial Group is influenced by the availability of skilled financial professionals, IT experts, and digital talent. In 2024, the demand for these specialized roles, particularly in areas like digital transformation and artificial intelligence, remains high across the financial sector.

Recruitment firms and individual professionals possessing in-demand skills in these niche areas can command higher compensation and more favorable working conditions, thereby increasing their bargaining power. This is particularly true as financial institutions increasingly rely on technological advancements to remain competitive.

Regulatory Bodies and Central Bank

Regulatory bodies like the Bank of Japan (BOJ) and the Financial Services Agency (FSA) exert considerable influence over Fukuoka Financial Group. These entities set crucial parameters such as capital adequacy ratios and compliance standards, directly shaping the financial landscape. For instance, the BOJ's monetary policy decisions, including the shift away from negative interest rates in early 2024, directly affect banks' funding costs and net interest margins.

- Bank of Japan's Policy Shift: The BOJ ended its negative interest rate policy in March 2024, marking a significant change that impacts borrowing costs for financial institutions.

- Capital Requirements: Regulatory mandates on capital reserves influence how much capital Fukuoka Financial Group must hold, affecting its lending capacity and profitability.

- Compliance Costs: Adhering to evolving financial regulations incurs operational costs and requires ongoing investment in systems and personnel.

- Interest Rate Sensitivity: Changes in benchmark interest rates, driven by central bank policy, directly influence Fukuoka Financial Group's interest income and expenses.

Payment Network Providers

Payment network providers like Visa and Mastercard hold significant sway over Fukuoka Financial Group. These networks are the backbone of the bank's credit card and payment processing operations, and their global reach means financial institutions have few alternatives. This reliance translates into substantial bargaining power for the networks, allowing them to dictate transaction fees and set operational standards that Fukuoka Financial Group must adhere to.

In 2024, the digital payments market continued its rapid expansion, with global transaction volumes reaching trillions of dollars. For instance, Visa reported processing over $14.1 trillion in total payment volume in its fiscal year 2023, highlighting the sheer scale of their operations and their indispensable role. This dominance allows them to negotiate favorable terms, impacting the profitability of financial institutions like Fukuoka Financial Group by influencing the interchange fees and other charges associated with card transactions.

- Global Reach: Payment networks offer access to a vast international customer base, a critical service for any financial institution with global aspirations.

- Technological Infrastructure: They provide the secure and reliable technology necessary for processing billions of transactions daily, a complex and costly undertaking for individual banks.

- Brand Recognition: The established trust and recognition associated with brands like Visa and Mastercard are invaluable assets that banks leverage.

- Interchange Fees: These fees, set by the networks, represent a significant cost for merchants and a revenue stream for banks, but the networks ultimately control their structure.

Fukuoka Financial Group's (FFG) bargaining power with its suppliers, particularly technology providers and human capital, is considerable but nuanced. While reliance on specialized fintech for digital transformation, as seen with Minna Bank, grants tech suppliers leverage, FFG's scale and strategic partnerships can mitigate this. The demand for skilled financial and IT professionals in 2024 also empowers potential employees, but FFG's established reputation as an employer can attract talent.

The bargaining power of suppliers to Fukuoka Financial Group is significantly influenced by the critical nature of their offerings and the availability of alternatives. For technology providers essential to digital banking and cybersecurity, their specialized expertise and the high cost of switching can give them considerable leverage. Similarly, suppliers of essential financial infrastructure, like payment networks, benefit from their indispensable role and global reach, allowing them to dictate terms and fees.

In 2024, the financial sector's ongoing digital transformation means that providers of advanced IT solutions, AI, and cybersecurity are in high demand. This elevates their bargaining power, as institutions like FFG need cutting-edge technology to remain competitive. For instance, the increasing complexity of regulatory compliance also necessitates specialized software and consulting services, further strengthening the position of these suppliers.

| Supplier Type | Key Factors Influencing Bargaining Power | FFG's Countervailing Power | 2024 Context |

|---|---|---|---|

| Technology Providers (Fintech, AI, Cybersecurity) | Specialized expertise, high switching costs, critical for digital transformation | Scale of operations, potential for long-term partnerships, in-house development capabilities | High demand for digital solutions, increasing reliance on specialized vendors |

| Human Capital (Skilled IT/Finance Professionals) | Scarcity of specialized skills, high demand in the sector | Brand reputation, employee benefits, training and development programs | Continued competition for top talent in digital and AI roles |

| Payment Networks (Visa, Mastercard) | Dominant market share, essential infrastructure, global reach | Large transaction volumes, potential for negotiation on fees, development of proprietary payment solutions | Continued growth in digital payments, but also increasing scrutiny on network fees |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks for Fukuoka Financial Group within Japan's banking sector.

Instantly identify and address competitive threats with a clear breakdown of buyer power and threat of substitutes, enabling proactive strategy adjustments.

Customers Bargaining Power

Retail customers in Fukuoka Financial Group's core Kyushu region possess moderate bargaining power. This power is amplified by increased access to financial information and a widening selection of digital banking services, making it easier for individuals to compare rates and terms. For instance, in 2024, digital-only banks continued to gain traction, offering competitive rates that put pressure on traditional institutions.

Small and Medium-sized Enterprises (SMEs) represent a significant customer base for Fukuoka Financial Group, wielding moderate bargaining power. Their reliance on established local banking relationships for customized financial solutions and credit access is a key factor, though this can be offset by the increasing availability of alternative financing options.

As interest rates fluctuate, SMEs may explore options beyond their primary regional bank, including megabanks or non-bank lenders, thereby increasing their leverage in negotiations for loans and services. For instance, in 2023, the Bank of Japan's policy adjustments influenced lending rates, potentially empowering SMEs to seek more competitive terms.

Large corporate customers wield significant bargaining power within the financial services sector. Their substantial transaction volumes mean that even a small shift in pricing or service terms can have a considerable impact on a financial institution's profitability. For instance, in 2024, large corporations often have access to a diverse range of funding options, including direct access to capital markets and international banks, which intensifies competition among domestic financial groups like Fukuoka Financial Group.

This ability to easily switch providers or secure financing elsewhere means Fukuoka Financial Group must continually offer attractive interest rates and tailored financial solutions to retain these key accounts. The threat of disintermediation, where large clients bypass traditional banking channels for direct market funding, is a constant concern, compelling the group to innovate and provide value-added services beyond basic lending.

Digital-Savvy Customers

Digital-savvy customers wield significant bargaining power, particularly those drawn to the convenience and competitive pricing offered by digital-first banking solutions. Fukuoka Financial Group's Minna Bank exemplifies this trend, attracting users who value seamless digital experiences over traditional branch interactions. These customers are less loyal to established banking relationships and readily switch providers if they find better user interfaces, lower fees, or more innovative digital features.

The increasing adoption of digital banking highlights this shift. For instance, by the end of March 2024, Minna Bank reported a substantial customer base, with over 1.3 million accounts opened, demonstrating the strong appeal of its digital model. This digital focus allows customers to easily compare offerings and switch, intensifying competition and pressuring traditional banks to adapt.

- Digital Preference: Customers increasingly favor digital channels for banking, seeking ease of use and accessibility.

- Price Sensitivity: Competitive pricing and transparent fee structures are key drivers for customer loyalty in the digital banking space.

- Switching Behavior: A lower switching cost for digital services empowers customers to move to providers offering superior user experience and features.

- Minna Bank's Growth: Fukuoka Financial Group's Minna Bank saw its deposit balance reach approximately ¥2.1 trillion by the end of March 2024, underscoring the market's receptiveness to digital banking innovation.

Customers with Access to Diverse Investment Options

Customers now have a wider array of investment choices beyond traditional savings accounts, significantly boosting their bargaining power. Government initiatives encouraging a shift from saving to investing, coupled with new tax-advantaged options like NISA, provide consumers with more avenues for wealth management. This empowers them to move funds from low-yield bank deposits to potentially higher-return investment products, directly impacting a bank's deposit base and its ability to attract and retain capital.

- Increased Investment Alternatives: The proliferation of investment products, including those benefiting from tax exemptions, gives customers more options than ever before.

- Shift from Savings to Investment: Government policies actively promote this transition, channeling funds away from simple deposits.

- Impact on Deposit Base: Customers can now easily redirect their money to investments, exerting pressure on banks to offer more competitive rates or services to maintain their deposit funding.

The bargaining power of customers for Fukuoka Financial Group is multifaceted, influenced by digital adoption, investment alternatives, and the size of the client. Retail customers, particularly those embracing digital banking, exhibit moderate power due to increased transparency and ease of switching. SMEs also hold moderate leverage, balancing their need for local relationships against the growing availability of alternative financing.

| Customer Segment | Bargaining Power Level | Key Factors Influencing Power | Relevant 2024 Data/Trend |

|---|---|---|---|

| Retail Customers (Digital-Savvy) | Moderate to High | Digital channel preference, price sensitivity, ease of switching | Minna Bank's customer base exceeded 1.3 million accounts by March 2024. |

| Small and Medium-sized Enterprises (SMEs) | Moderate | Reliance on local relationships vs. alternative financing access | BOJ policy adjustments in 2023 influenced lending rates, potentially empowering SMEs. |

| Large Corporate Customers | High | Transaction volume, access to capital markets, disintermediation threat | Large corporations in 2024 have diverse funding options beyond traditional banks. |

Full Version Awaits

Fukuoka Financial Group Porter's Five Forces Analysis

This preview showcases the complete Fukuoka Financial Group Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the financial services sector. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact file, providing a comprehensive understanding of industry attractiveness and potential threats.

Rivalry Among Competitors

Fukuoka Financial Group (FFG) faces fierce rivalry in its core Kyushu region. Competitors include other regional banks, credit unions, and shinkin banks, all vying for the same customer base. This intense competition is a hallmark of Japan's mature banking sector.

The Japanese banking landscape, especially at the regional level, is highly competitive. This is exacerbated by a declining population, meaning banks are fighting for a shrinking pool of potential customers. For instance, as of March 2024, the total number of bank branches in Japan continued its downward trend, highlighting consolidation pressures and increased competition for remaining customers.

Japan's megabanks, such as Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, and Mizuho Financial Group, represent a formidable competitive force. These institutions possess extensive national networks and are making substantial investments in digital transformation, aiming to capture market share even in Fukuoka Financial Group's traditional regional strongholds.

While Fukuoka Financial Group excels in its regional focus, the megabanks' broad service offerings and significant capital allow them to compete aggressively, particularly through advanced digital channels. For instance, in 2023, the combined digital transaction volume across Japan's major banks saw a notable increase, reflecting their commitment to online and mobile banking solutions that appeal to a wider customer base.

The financial landscape is rapidly evolving with the rise of digital-only banks and innovative fintech firms. These new players, like Fukuoka Financial Group's own Minna Bank, are shaking up the industry by offering streamlined, cost-effective, and digitally-focused services. Minna Bank, for instance, launched in 2021 and has quickly attracted a significant customer base by emphasizing a user-friendly app and minimal fees.

This digital shift intensifies competition as these new entrants appeal to a growing segment of tech-savvy consumers. They are pushing traditional banks, including established players like Fukuoka Financial Group, to accelerate their own digital transformation efforts to remain competitive and retain customers. The pressure is on to deliver similar levels of convenience and innovation.

Demographic Challenges and Market Saturation

Japan's demographic shifts present a significant hurdle for Fukuoka Financial Group. The nation's declining and aging population, especially pronounced in regional areas like Kyushu, directly constrains opportunities for organic customer growth. This reality intensifies the rivalry among financial institutions vying for a shrinking pool of potential clients.

The competitive landscape is further exacerbated by an already saturated banking market. With many banks operating in Japan, particularly in Fukuoka's home region, the pressure to attract and retain customers is immense. This 'overbanked' condition forces banks like Fukuoka Financial Group into more aggressive competition for market share and existing client relationships.

- Population Decline: Japan's population is projected to continue declining, with a significant portion of the population over 65.

- Regional Impact: Kyushu, Fukuoka Financial Group's primary operating region, faces particularly acute demographic challenges.

- Market Saturation: The Japanese banking sector is characterized by a high density of financial institutions relative to its population.

- Intensified Competition: These factors collectively drive fiercer competition for customers and deposits.

Product and Service Differentiation

Basic banking products are often seen as commodities, which naturally leads to a lot of competition based on price. This means banks are constantly trying to offer the lowest fees or best interest rates to attract customers.

Fukuoka Financial Group is working to stand out by focusing on its regional strengths and embracing digital advancements, notably with its digital-only bank, Minna Bank. However, staying ahead in such a crowded market demands ongoing investment in technology and developing financial products that are specifically designed for customer needs.

- Commoditization of Basic Banking: Many core banking services, like checking accounts and basic loans, are virtually identical across different institutions, intensifying price wars.

- Fukuoka Financial Group's Differentiation Strategy: The group leverages its deep understanding of the Kyushu region and invests in digital platforms like Minna Bank to offer unique value.

- Minna Bank's Digital Focus: Launched in 2021, Minna Bank aims to capture a younger, digitally-savvy demographic with its app-centric approach and streamlined services.

- Continuous Investment Needs: To maintain a competitive edge, consistent capital allocation towards technological upgrades and innovative product development is crucial, especially as competitors also enhance their digital offerings.

Fukuoka Financial Group (FFG) navigates an intensely competitive banking sector, particularly within its Kyushu stronghold. The rivalry stems from other regional banks, credit unions, and the formidable presence of national megabanks like MUFG, SMFG, and Mizuho, which are actively expanding their digital footprints. This competitive pressure is heightened by Japan's demographic challenges, including a declining and aging population, which shrinks the customer base and intensifies the fight for market share.

The commoditization of basic banking services further fuels price-based competition, forcing FFG to innovate. The group's strategic response includes leveraging its regional expertise and investing in digital transformation, exemplified by its digital-only bank, Minna Bank, launched in 2021. This move aims to capture a younger, tech-savvy demographic, but it also places FFG in direct competition with other fintech disruptors and digital offerings from larger institutions.

| Competitor Type | Key Characteristics | Competitive Impact on FFG |

|---|---|---|

| Regional Banks, Credit Unions, Shinkin Banks | Local focus, established customer relationships | Direct competition for deposits and loans in Kyushu |

| Megabanks (MUFG, SMFG, Mizuho) | National networks, significant capital, advanced digital capabilities | Threaten market share through scale and digital innovation |

| Digital-Only Banks (e.g., Minna Bank) | App-centric, low fees, agile operations | Attract tech-savvy customers, pressure traditional banks on digital experience |

SSubstitutes Threaten

The rise of digital payment platforms like PayPay and LINE Pay in Japan poses a considerable threat of substitutes for Fukuoka Financial Group. By mid-2024, PayPay reported over 60 million registered users, demonstrating a strong shift away from traditional banking channels for everyday purchases.

These fintech solutions provide a seamless user experience and often integrate loyalty points, making them an attractive alternative for consumers seeking convenience. This growing preference for non-bank payment methods directly erodes the transaction volume that banks like Fukuoka Financial Group would typically handle.

The threat of substitutes for Fukuoka Financial Group is significant, particularly in savings and wealth management. Direct investment in stocks, bonds, and investment trusts presents a compelling alternative to traditional bank deposits. Government initiatives, such as Japan's new NISA program, actively encourage this shift from savings to investment, potentially diverting substantial funds away from bank-held assets.

Peer-to-peer (P2P) lending and crowdfunding platforms represent a growing threat of substitutes for traditional bank financing, particularly for small and medium-sized enterprises (SMEs) and individual borrowers. These alternative channels offer quicker access to capital and can bypass the stringent requirements often associated with bank loans. For instance, the global P2P lending market was valued at over $100 billion in 2023 and is projected to continue its upward trajectory, indicating a significant shift in financing preferences.

Insurance and Wealth Management Products

The threat of substitutes for Fukuoka Financial Group's offerings, particularly in insurance and wealth management, is significant. Various insurance products, such as annuities and life insurance with investment components, can act as direct substitutes for traditional bank savings and investment accounts. These alternatives often provide different risk-return profiles and can offer distinct tax advantages, drawing customer assets away from conventional banking products.

Furthermore, the competitive landscape includes a growing number of non-bank financial institutions that specialize in wealth management. These firms, including independent financial advisors and specialized investment houses, actively compete for customer assets. For example, in 2024, the global wealth management market continued its expansion, with assets under management (AUM) reaching new highs, indicating a substantial pool of capital that could be diverted from traditional banks like Fukuoka Financial Group.

- Insurance Products as Substitutes: Life insurance policies with cash value accumulation and annuities offer investment growth potential and tax deferral, directly competing with bank deposits and mutual funds.

- Wealth Management Competition: Independent financial advisors and robo-advisors provide personalized investment strategies, attracting clients seeking alternatives to bank-managed portfolios.

- Market Trends: The increasing popularity of alternative investments and fee-based advisory services further intensifies the threat from substitutes, as customers seek diversification and specialized financial guidance.

- Customer Preferences: Shifting customer preferences towards holistic financial planning and integrated solutions, often provided by non-bank entities, challenge traditional banking models.

Cryptocurrencies and Digital Assets

Cryptocurrencies and digital assets present a nascent but growing threat of substitution for traditional financial services. While still in their developmental stages, assets like Bitcoin and Ethereum offer alternative methods for transactions and value storage, potentially bypassing conventional banking infrastructure.

By mid-2024, the total market capitalization of cryptocurrencies fluctuated significantly, demonstrating both investor interest and volatility. For instance, in May 2024, the global crypto market cap was reported to be around $2.4 trillion, indicating a substantial potential alternative financial ecosystem.

- Payment Alternatives: Cryptocurrencies can serve as a medium of exchange, offering a decentralized alternative to fiat currency for certain transactions.

- Store of Value: Digital assets are increasingly viewed as a potential store of value, similar to gold or other commodities, especially during periods of economic uncertainty.

- Evolving Regulatory Landscape: As regulatory frameworks for digital assets mature globally, their legitimacy and usability as substitutes for traditional financial products are likely to increase.

Digital payment platforms and fintech solutions are increasingly substituting traditional banking services for Fukuoka Financial Group. By mid-2024, platforms like PayPay, with over 60 million users, offer a convenient alternative for everyday transactions, directly impacting bank transaction volumes.

Investment opportunities outside traditional banking, such as direct stock and bond investments, are also growing substitutes. Japan's new NISA program, encouraging investment over savings, further diverts funds from bank deposits.

Alternative financing channels like P2P lending and crowdfunding are becoming viable substitutes for bank loans, especially for SMEs. The global P2P lending market’s growth, exceeding $100 billion in 2023, highlights this trend.

| Substitute Category | Key Offerings | Impact on Fukuoka Financial Group | Market Trend/Data (mid-2024) |

|---|---|---|---|

| Digital Payments | PayPay, LINE Pay | Erodes transaction volume, shifts customer engagement | PayPay: 60M+ users |

| Direct Investments | Stocks, Bonds, Investment Trusts | Diverts savings and wealth management assets | Japan NISA program expansion |

| Alternative Financing | P2P Lending, Crowdfunding | Reduces demand for traditional bank loans | Global P2P market >$100B (2023) |

| Wealth Management | Independent Advisors, Robo-advisors | Competes for customer assets and advisory services | Global Wealth Management AUM at record highs |

Entrants Threaten

The threat of new entrants for Fukuoka Financial Group is significantly dampened by the exceptionally high regulatory barriers and substantial capital requirements inherent in Japan's financial sector. The Financial Services Agency (FSA) imposes rigorous oversight, demanding considerable capital reserves and adherence to strict licensing protocols, making it exceedingly difficult for new institutions to establish a foothold.

Established brand loyalty and trust represent a significant barrier for new entrants looking to challenge traditional financial institutions like those within the Fukuoka Financial Group. Customers often stick with banks they know and trust, especially for managing their finances. For instance, as of the end of fiscal year 2023, Fukuoka Financial Group reported a robust customer base, underscoring the deep-rooted relationships they've cultivated over time.

The cost of building essential banking infrastructure, such as advanced IT systems and customer service networks, presents a significant barrier for new entrants. For instance, in 2024, major digital banks often report initial setup costs in the hundreds of millions of dollars to establish secure and scalable platforms.

Establishing a widespread distribution network, even for digital-first banks that still require robust online and mobile platforms, demands considerable capital. This includes investment in cybersecurity, regulatory compliance technology, and user experience development, all of which are substantial upfront expenses that deter many potential competitors.

Niche Entry by Fintech Companies

Fintech companies are increasingly targeting specific banking functions, bypassing the stringent requirements for full banking licenses. This niche entry strategy allows them to focus on areas like digital payments or specialized lending platforms. For instance, in 2023, the global fintech market was valued at over $1.1 trillion, demonstrating significant growth and investment in these specialized areas.

These nimble players can rapidly scale their operations within these niches, often by leveraging partnerships with incumbent institutions. By disaggregating traditional banking services, fintechs can offer more streamlined and cost-effective solutions in their chosen segments. This competitive pressure forces established banks to adapt and innovate to retain market share.

- Niche Focus: Fintechs excel by concentrating on specific services like payments, lending, or wealth management, avoiding the need for full banking charters.

- Reduced Barriers: Entry into these niches often requires less capital and regulatory hurdles compared to establishing a traditional bank.

- Scalability & Partnerships: Successful fintechs can scale quickly and often partner with existing banks, amplifying their reach and impact.

- Service Disaggregation: This strategy breaks down traditional, bundled banking services into specialized, often more appealing, offerings.

Demographic and Regional Challenges

New entrants into Fukuoka Financial Group's (FFG) market, especially those targeting a wide customer base, grapple with significant demographic hurdles. Japan's overall demographic trend, characterized by a shrinking and aging population, directly impacts the potential customer pool for any financial institution, including new challengers. This is particularly pronounced in many Japanese regions where FFG operates.

While digital banking models offer the potential to overcome traditional geographical limitations, establishing a robust and loyal customer base remains a formidable challenge for new entrants. They must compete for the attention and trust of consumers who are already well-served by established regional banks like FFG.

- Demographic Headwinds: Japan's population is projected to decline from approximately 123 million in 2023 to around 105 million by 2050, presenting a shrinking market for all financial services.

- Aging Consumer Base: The proportion of individuals aged 65 and over is expected to rise to over 35% by 2050, influencing product demand and service delivery preferences.

- Digital Adoption Gap: While digital channels are growing, a significant segment of the population, particularly older demographics, may still prefer traditional banking methods, posing a barrier for purely digital newcomers.

The threat of new entrants for Fukuoka Financial Group is low due to substantial regulatory hurdles and high capital requirements in Japan's banking sector. Fintechs are entering niche markets, but full-service banking entry remains challenging, especially given established trust and infrastructure costs.

Japan's demographic trends, with a shrinking and aging population, also limit the potential customer base for new financial institutions, making it harder to gain significant traction against established players like Fukuoka Financial Group.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Requirements | Stringent licensing, capital reserves, and oversight by the FSA. | Very High - significantly limits new bank formation. |

| Capital Investment | Substantial costs for IT infrastructure, cybersecurity, and distribution networks. | High - requires hundreds of millions of dollars for modern platforms. |

| Brand Loyalty & Trust | Customers prefer established, trusted institutions. | High - deep customer relationships are hard to replicate. |

| Demographics | Shrinking and aging population reduces the addressable market. | Moderate to High - limits growth potential for all players. |

Porter's Five Forces Analysis Data Sources

Our Fukuoka Financial Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the group's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific research from financial news outlets and market analysis firms.