Fresnillo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresnillo Bundle

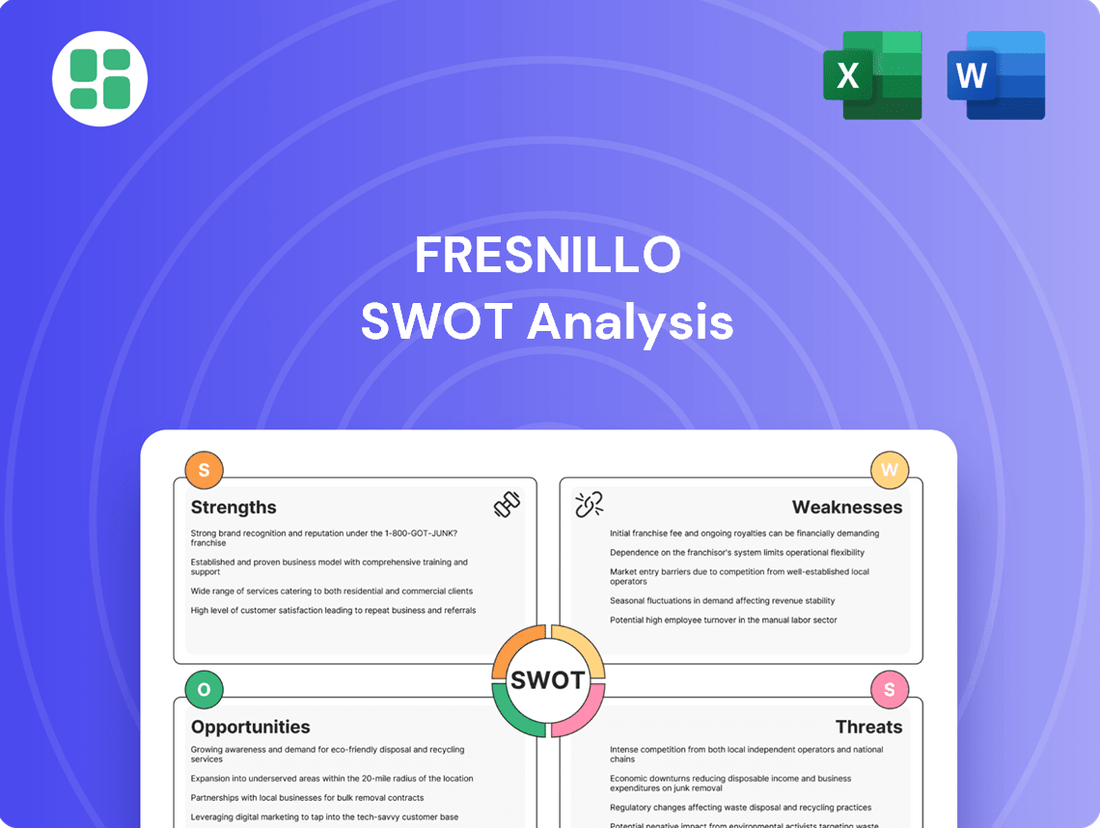

Fresnillo's market leadership in silver and gold production presents significant strengths, but understanding the full scope of its operational efficiencies, potential regulatory hurdles, and evolving market dynamics is crucial. Our comprehensive SWOT analysis dives deep into these factors, offering a clear roadmap for strategic advantage.

Want the full story behind Fresnillo's competitive edge, potential risks, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Fresnillo plc stands as the world's largest primary silver producer and Mexico's leading gold producer. This commanding market share translates into a substantial competitive edge and inherent stability within the volatile precious metals industry.

In 2023, Fresnillo reported silver production of 49.7 million ounces and gold production of 620,200 ounces, underscoring its immense scale. This established leadership ensures a consistent and robust revenue stream, solidifying its position among the top global mining entities.

Fresnillo Plc showcased impressive financial performance in the first half of 2025, building on a strong 2024. The company reported a significant uplift in revenues, gross profit, and EBITDA, underscoring its operational efficiency and favorable market conditions for precious metals.

This robust financial health is further evidenced by substantial free cash flow generation, a direct result of effective cost management strategies and the prevailing high precious metals prices. For instance, the company's EBITDA margin remained strong throughout 2024 and into early 2025, a testament to their disciplined approach to operations.

A solid balance sheet, boasting ample liquidity, provides Fresnillo with the flexibility to pursue strategic growth initiatives and maintain consistent returns to shareholders. This financial resilience positions the company favorably for future investments and navigating market volatility.

Fresnillo PLC has consistently demonstrated strong operational efficiency and a disciplined approach to cost management. This has been a key driver of their profitability, allowing them to navigate market fluctuations effectively. For instance, in the first half of 2024, the company reported a significant reduction in cash costs per payable ounce of silver, benefiting from their operational improvements and a favorable exchange rate environment.

The depreciation of the Mexican peso against the US dollar in 2024 played a crucial role in further reducing Fresnillo's production costs. This currency advantage directly translates into improved profit margins, as a larger portion of their revenue, denominated in USD, now covers a smaller peso-denominated cost base. This strategic advantage bolsters their financial resilience.

Extensive Portfolio of Assets and Exploration Pipeline

Fresnillo PLC boasts an impressive collection of operating mines primarily located in Mexico, complemented by a robust pipeline of exploration projects spanning Mexico, Peru, and Chile. This strategic asset base is crucial for long-term operational stability and growth.

Key exploration projects like Guanajuato, Orisyvo, and Rodeo are particularly noteworthy. These ventures are in advanced stages and show considerable promise for converting existing resources into mineable reserves, thereby extending the company's operational lifespan and ensuring future production capacity.

- Diversified Asset Base: Operates multiple producing mines in Mexico, reducing reliance on any single location.

- Exploration Potential: Holds a strong pipeline of advanced exploration projects in Mexico, Peru, and Chile.

- Future Growth Drivers: Projects like Guanajuato, Orisyvo, and Rodeo are positioned to enhance future resource conversion and production.

- Mine Life Extension: The exploration efforts are vital for extending the operational life of Fresnillo's mining assets.

Strategic Flexibility and Adaptability

Fresnillo has shown impressive strategic flexibility. A prime example is their buyback of the Silverstream agreement in 2024. While this resulted in an initial non-cash loss of $37 million, it effectively removed future production volatility and allowed for a more accurate recalibration of their production guidance.

This adaptability is crucial. It empowers Fresnillo to adjust its production mix and capital allocation strategies swiftly, enabling them to capitalize on shifting market dynamics and optimize their operational performance.

- Strategic Agility: Demonstrated by the Silverstream agreement buyback in 2024.

- Risk Mitigation: Elimination of future production volatility post-buyback.

- Operational Optimization: Ability to recalibrate guidance and leverage market opportunities.

Fresnillo's primary strength lies in its unparalleled position as the world's largest primary silver producer and Mexico's leading gold producer, ensuring significant market influence and revenue stability.

The company's 2023 production figures of 49.7 million ounces of silver and 620,200 ounces of gold highlight its immense operational scale and consistent output.

Strong financial performance in early 2025, marked by increased revenues and EBITDA, demonstrates effective cost management and favorable precious metal prices.

A robust balance sheet with ample liquidity provides financial flexibility for growth and shareholder returns, underpinning its resilience.

| Metric | 2023 (Actual) | H1 2025 (Projected/Actual) |

| Silver Production (Moz) | 49.7 | ~25-27 (Est.) |

| Gold Production (Koz) | 620.2 | ~300-320 (Est.) |

| EBITDA Margin | Strong & Stable | Continued Strength |

What is included in the product

Analyzes Fresnillo’s competitive position through key internal and external factors, detailing its strengths in precious metals production and opportunities for expansion against threats like market volatility and operational challenges.

Offers a clear, actionable SWOT analysis for Fresnillo, identifying key strengths and weaknesses to mitigate operational risks and capitalize on market opportunities.

Weaknesses

Fresnillo's silver production faced a notable downturn. This decline was largely due to the planned end of mining at San Julián DOB and reduced ore grades encountered at key operations such as Ciénega and Juanicipio. The Silverstream buyback also contributed to this downward trend in output.

Fresnillo has grappled with operational hurdles, notably in its development projects. For instance, issues with ball mills and conveyor belt installations at key sites like Saucito and Juanicipio have caused significant delays.

These disruptions directly impact production volumes and force a reevaluation of project timelines. Such setbacks can potentially affect the company's ability to meet its future output targets, creating a ripple effect on financial performance and investor confidence.

Fresnillo's primary operations are heavily concentrated in Mexico, which inherently exposes the company to significant country-specific risks. These include potential political instability, evolving regulatory landscapes, and social factors that could impact its mining activities.

Despite a more business-friendly stance from the current Mexican administration, ongoing regulatory uncertainties persist. Concerns remain about potential future changes to mining laws, which could affect Fresnillo's operational costs and profitability.

For instance, in 2023, Fresnillo reported that its Mexican operations accounted for 100% of its silver production and 99% of its gold production, highlighting this extreme geographical concentration.

Vulnerability to Commodity Price Volatility

Fresnillo's profitability is intrinsically linked to the fluctuating prices of silver and gold, creating inherent vulnerability. While recent market trends have been supportive, the company's financial performance remains susceptible to significant downturns in precious metal values. For instance, a sharp decline in gold prices during late 2023, even if temporary, directly impacted revenue streams and could compress margins in the short term.

This dependence on commodity prices presents a persistent challenge for financial forecasting and operational planning. Unexpected price drops can erode profitability, impacting the company's ability to meet revenue targets and potentially affecting its overall financial stability. The volatility inherent in precious metals markets means that even with strong operational execution, external price shocks can significantly alter financial outcomes.

- Dependence on Silver and Gold Prices: Fresnillo's revenue is heavily reliant on the global market prices of silver and gold.

- Impact of Price Fluctuations: Significant volatility in these commodity prices can directly affect the company's revenue, profitability, and operational margins.

- Financial Stability Risk: Continuous fluctuations pose a risk to Fresnillo's financial stability and its ability to consistently meet financial projections.

- Market Sensitivity: Even with efficient operations, external market price movements are a primary driver of financial performance.

Safety and Social Challenges

The mining sector inherently presents significant safety risks, and Fresnillo has unfortunately experienced fatalities in recent months, underscoring persistent safety concerns. These incidents, such as the fatal accident at the San Julián mine in early 2024, highlight the critical need for continuous improvement in safety protocols and training. The company's commitment to safety is paramount, especially given the inherent dangers of underground mining operations.

Maintaining strong community relations and fulfilling environmental and social responsibilities are ongoing challenges that can affect Fresnillo's operations. Negative community sentiment or failure to meet social license obligations can lead to disruptions, as seen in past instances where local opposition has impacted project timelines or access. For example, in 2023, community engagement efforts were intensified at various sites to ensure alignment with local expectations regarding environmental impact and economic benefits.

- Safety Incidents: Fresnillo reported fatalities in early 2024, indicating ongoing safety challenges within its mining operations.

- Community Relations: The company faces continuous pressure to maintain positive relationships with local communities and address their concerns effectively.

- Social License to Operate: Failure to meet environmental and social obligations can jeopardize the company's ability to operate smoothly and gain community acceptance.

Fresnillo's operational efficiency is hampered by delays in crucial development projects, such as issues with ball mill installations at Saucito and Juanicipio. These setbacks directly impact production volumes and can jeopardize the company's ability to meet future output targets, potentially affecting financial performance.

The company's heavy reliance on Mexico for all its silver and nearly all its gold production exposes it to significant country-specific risks, including political instability and evolving regulatory frameworks. Despite a more business-friendly government, ongoing uncertainties about future mining law changes remain a concern.

Fresnillo's profitability is highly sensitive to silver and gold price fluctuations. While prices have been supportive recently, any sharp downturns, like the temporary dip in gold prices in late 2023, directly impact revenue and can compress margins.

Recent safety incidents, including fatalities in early 2024 at San Julián, highlight persistent safety challenges. Additionally, maintaining positive community relations and fulfilling social and environmental obligations are ongoing challenges that can lead to operational disruptions.

| Metric | 2023 (Actual) | 2024 (Guidance) | Notes |

|---|---|---|---|

| Silver Production (million oz) | 57.7 | 57-61 | Impacted by planned cessation at San Julian DOB and lower grades. |

| Gold Production (thousand oz) | 617.1 | 600-640 | Lower grades at Ciénega and Juanicipio affected output. |

| Capital Expenditure (USD million) | 541 | 575-625 | Includes ongoing development and exploration. |

Full Version Awaits

Fresnillo SWOT Analysis

The preview you see is the actual Fresnillo SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of the company's strategic position. Unlock the full, in-depth analysis by completing your purchase.

Opportunities

The current macroeconomic climate, characterized by ongoing geopolitical instability and robust central bank gold acquisitions, is significantly bolstering gold prices. This, coupled with growing industrial applications in sectors like AI and solar energy, creates a powerful tailwind for gold demand. For Fresnillo, this translates into a prime opportunity to benefit from a prolonged bull market, potentially boosting revenue and profitability throughout 2024 and into 2025.

Silver's role as a safe-haven asset is increasingly being overshadowed by robust industrial demand, especially from the burgeoning solar energy sector. This surge in consumption is creating a structural supply deficit, a trend expected to continue through 2025 and beyond.

Fresnillo, with its cost-efficient silver production, is exceptionally well-positioned to capitalize on this imbalance. As demand outstrips supply, silver prices are anticipated to climb, directly benefiting Fresnillo's profitability and market position.

The incoming Mexican administration's 'Plan Mexico' and a generally more open stance towards private sector engagement across various industries present a significant opportunity for mining investments. This evolving policy landscape could translate into streamlined permitting processes and a reduction in regulatory complexities, fostering a more predictable and supportive operational environment for Fresnillo's existing projects and future growth initiatives.

Advancement of Exploration and Development Projects

Fresnillo's strong pipeline of exploration projects, including Orisyvo and Rodeo, presents significant opportunities for future expansion. Advancing these into production could unlock substantial new silver and gold resources, extending the company's operational runway and diversifying its revenue streams.

By successfully developing projects like Tajitos and Guanajuato, Fresnillo can bolster its long-term production capacity. This strategic advancement is crucial for maintaining market leadership and delivering sustained value to shareholders.

- Orisyvo: This advanced exploration project is a key component of Fresnillo's growth strategy, with ongoing drilling and feasibility studies.

- Rodeo: Another significant exploration asset, Rodeo holds the potential to contribute meaningfully to Fresnillo's gold production profile.

- Tajitos and Guanajuato: These projects represent further opportunities to expand the company's resource base and extend mine life.

- Resource Expansion: Successful development of these projects is expected to add millions of ounces of silver and hundreds of thousands of ounces of gold to Fresnillo's reserves.

Further Cost Optimization and Efficiency Gains

Fresnillo can capitalize on further cost optimization by maintaining its focus on operational efficiencies. The continued depreciation of the Mexican peso, for instance, presents a favorable exchange rate environment that inherently reduces costs when measured in US dollars, a key currency for the company. This ongoing trend offers a tangible opportunity to lower the overall cost base.

Implementing advanced metallurgical and underground mining optimization projects represents another significant avenue for efficiency gains. These initiatives are designed to extract more value from ore bodies and streamline extraction processes. For example, in 2024, Fresnillo has been investing in technologies to improve recovery rates, which directly translates to a lower cost per ounce of silver and gold produced. These optimizations not only enhance the production platform but also bolster the company's cost competitiveness in the global market.

- Favorable Exchange Rates: Continued peso depreciation in 2024-2025 offers inherent cost advantages for a significant portion of Fresnillo's operational expenses.

- Metallurgical Improvements: Investments in enhanced processing techniques aim to boost recovery rates, thereby reducing the cost per unit of precious metal output.

- Underground Mining Efficiency: Optimization projects in underground operations are targeting increased productivity and reduced operational expenditure per tonne mined.

- Margin Enhancement: Successfully implementing these cost-saving measures directly improves profit margins and strengthens Fresnillo's competitive positioning.

The rising gold prices, driven by geopolitical instability and central bank buying, present a significant tailwind for Fresnillo. This trend, expected to persist through 2024 and into 2025, offers a prime opportunity for increased revenue and profitability.

Strong industrial demand for silver, particularly from the solar sector, is creating a structural supply deficit. Fresnillo, with its cost-efficient production, is well-positioned to benefit from anticipated price increases as demand outstrips supply, a scenario projected to continue through 2025.

A more favorable policy environment in Mexico, with an administration potentially more open to mining investment, could streamline permitting and reduce regulatory hurdles. This evolving landscape offers a chance for smoother operations and easier expansion of Fresnillo's projects.

Fresnillo's robust exploration pipeline, including Orisyvo and Rodeo, offers substantial opportunities for future growth and resource expansion. Successfully developing these projects could significantly boost the company's silver and gold reserves, extending its operational life and diversifying revenue streams.

Threats

Ongoing reforms to Mexico's Federal Mining Law, including potential changes to concession terms and stricter environmental obligations, create significant regulatory uncertainty for Fresnillo. While the company has indicated no immediate material impact, the future clarity and implementation of these laws could indeed affect its operations, exploration, and expansion plans. For instance, proposed changes to water rights and social impact assessments could add complexity and cost to new projects.

Heightened geopolitical tensions, exemplified by ongoing conflicts and trade disputes in 2024, create significant market volatility. This instability can directly impact precious metals prices, as investors often seek safe-haven assets during uncertain times, but also can disrupt supply chains and increase operational costs for mining companies like Fresnillo.

The increasing possibility of a global recession, with forecasts for muted growth in major economies through 2025, poses a substantial threat. A recession typically dampens industrial demand for metals and reduces consumer spending on jewelry, potentially leading to lower sales volumes and pricing power for Fresnillo's key products.

Such macroeconomic and geopolitical instability can significantly impact investor sentiment towards emerging market assets, including mining companies. Fresnillo, with its substantial operations in Mexico, could face increased scrutiny and potentially higher capital costs if global risk aversion rises, affecting its ability to fund future projects and maintain profitability.

Fresnillo's mature mines are grappling with declining ore grades and reduced processed ore volumes, directly impacting production efficiency and driving up unit costs. This trend poses a significant challenge to maintaining profitability and operational output.

The depletion of key assets, exemplified by the closure of the San Julián DOB, underscores the critical need for ongoing exploration and development of new mineral resources. Without successful discoveries, Fresnillo faces the risk of falling short of its production targets in the coming years.

Rising Operational Costs and Inflationary Pressures

While Fresnillo has demonstrated cost discipline and benefited from favorable currency movements, the mining sector inherently faces threats from rising operational costs. Inflationary pressures, particularly concerning energy prices, labor, and essential supplies, can significantly impact profitability. For instance, the global inflation rate remained elevated through much of 2023 and into early 2024, directly affecting input costs for mining operations.

These escalating expenses can erode profit margins, making it challenging for Fresnillo to maintain its competitive cost position against peers.

- Rising Energy Prices: Global energy markets experienced volatility in 2023-2024, with Brent crude oil prices fluctuating significantly, impacting fuel and electricity costs for mining equipment and operations.

- Labor Cost Increases: Many mining regions have seen wage pressures due to labor shortages and increased demand for skilled workers, contributing to higher operational expenditures.

- Supply Chain Disruptions: Lingering global supply chain issues can lead to increased costs for spare parts, equipment, and consumables, further pressuring operational budgets.

Intense Competition and Market Dynamics

The precious metals sector is inherently competitive, featuring a multitude of global participants vying for market share. Fresnillo faces constant pressure from these players, where shifts in global supply from other major producers, fluctuations in industrial demand for metals like silver and gold, or technological advancements by rivals can directly affect Fresnillo's market position and its ability to influence pricing. For instance, during 2024, the global silver market experienced price volatility influenced by factors such as industrial applications and investment demand, directly impacting revenue streams for primary silver producers like Fresnillo.

Furthermore, the unpredictable nature of demand for Fresnillo's by-products, such as lead and zinc, introduces an additional layer of market risk. These base metals, often extracted alongside precious metals, are subject to their own distinct supply and demand dynamics, which can diverge significantly from those of silver and gold. In the first half of 2024, zinc prices saw considerable fluctuation due to global economic sentiment and supply chain disruptions, posing a challenge for companies with significant zinc output.

- Global Competition: The precious metals market is populated by numerous large-scale producers, including companies like Barrick Gold and Newmont, creating a highly competitive landscape.

- Supply Shocks: Disruptions in production from other major silver or gold producing nations, such as Peru or Canada, can alter global supply balances and impact Fresnillo's pricing power.

- Industrial Demand Volatility: Key industrial uses for silver, like in electronics and solar panels, are sensitive to economic cycles. For example, a slowdown in the automotive sector in 2024 impacted demand for silver used in catalytic converters.

- By-product Market Risk: Fluctuations in lead and zinc prices, driven by factors like construction activity and battery manufacturing, can affect the overall profitability of mines that produce these metals as by-products.

Fresnillo faces considerable threats from evolving mining regulations in Mexico, with potential changes to concession terms and stricter environmental mandates creating operational uncertainty. Geopolitical instability and the increasing likelihood of a global recession in 2024-2025 also loom large, potentially impacting precious metal prices and demand. Furthermore, the company's mature mines are experiencing declining ore grades and rising operational costs due to inflation, particularly in energy and labor, which could erode profit margins.

SWOT Analysis Data Sources

This Fresnillo SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide a robust understanding of the company's operational performance, market positioning, and the broader economic landscape impacting the precious metals sector.