Fresnillo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresnillo Bundle

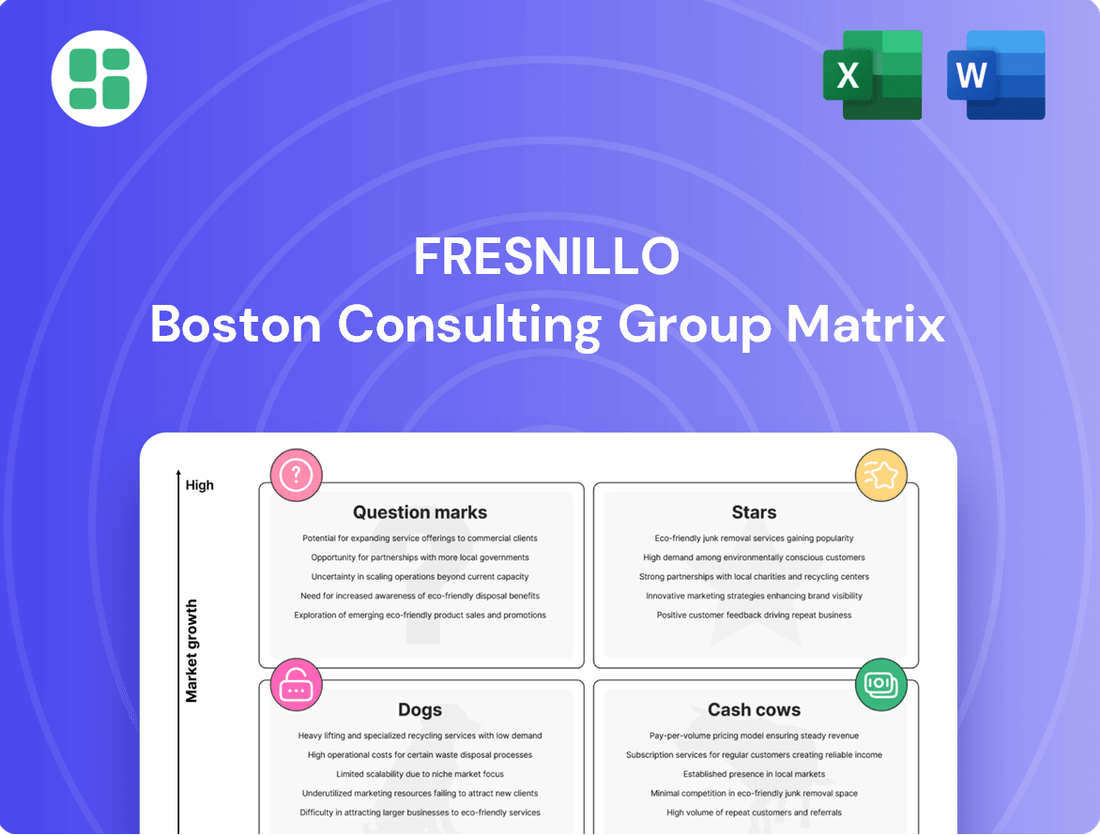

Uncover the strategic positioning of Fresnillo's diverse product portfolio with this insightful BCG Matrix preview. See where your investments are shining and where they might be faltering.

Ready to transform this snapshot into actionable intelligence? Purchase the full BCG Matrix for a comprehensive breakdown, revealing the Stars, Cash Cows, Dogs, and Question Marks within Fresnillo, and equip yourself with the data-driven insights needed to optimize your strategy and drive future growth.

Stars

The Juanicipio mine, a significant collaboration with MAG Silver, began commercial production in mid-2023. It's anticipated to substantially boost Fresnillo's silver and gold production volumes.

With silver and gold prices reaching record levels and a favorable market forecast extending into 2025, Juanicipio operates within a robust growth sector. Its ongoing ramp-up and eventual full operational capacity will cement its substantial market share within Fresnillo's overall asset mix.

This strategic positioning, driven by strong market demand and increasing production, firmly places Juanicipio as a key Star asset in Fresnillo's Business Growth Share Matrix. For instance, Fresnillo reported that in the first quarter of 2024, its attributable silver production increased by 15% year-on-year to 16.3 million ounces, with Juanicipio contributing significantly to this growth.

Herradura, a cornerstone of Fresnillo's operations, continues to be a significant gold producer, even with slight revisions to its 2025 gold output projections. Its substantial contribution underpins Fresnillo's position in the global gold market.

The mine demonstrated robust performance in the fourth quarter of 2024. Furthermore, ongoing initiatives, such as potential underground expansion, are poised to solidify Herradura's market standing amidst favorable gold price trends and consistent demand.

Saucito Mine is a key silver producer for Fresnillo, showing a remarkable comeback. Despite some periods of lower production volume, its higher ore grades have been a significant advantage. This strong performance, coupled with robust silver demand and projected market deficits, firmly places Saucito in the Star category of the BCG Matrix.

Fresnillo's strategic investment in deepening the Jarillas shaft at Saucito is a testament to the mine's future potential. This ongoing development is designed to boost long-term productivity and operational efficiency, further solidifying Saucito's position as a high-growth, high-market-share asset.

Orisyvo Project

The Orisyvo project, situated in Chihuahua, represents a significant gold exploration endeavor for Fresnillo. Currently in the feasibility stage, it is one of the company's four advanced exploration initiatives.

Fresnillo has earmarked substantial investment for Orisyvo's development, anticipating a positive long-term trajectory for gold prices. This strategic focus positions Orisyvo to potentially evolve into a key production asset for the company.

Should Orisyvo successfully transition into production, it would allow Fresnillo to capitalize on the expanding gold market, securing a greater share in a sector characterized by robust growth. The project aligns with Fresnillo's strategy to bolster its gold production portfolio.

- Project Status: Orisyvo is in the feasibility stage, indicating significant progress toward potential production.

- Strategic Importance: It is one of Fresnillo's four advanced exploration projects, highlighting its role in future growth.

- Market Outlook: The project benefits from a positive long-term outlook for gold prices, a key driver for its economic viability.

- Investment Focus: Substantial investment is planned, underscoring Fresnillo's commitment to its development and potential as a major production asset.

Guanajuato Project

The Guanajuato project, situated in a prime silver and gold vein district, presents considerable promise. Early assessments, including a preliminary conceptual study, have identified significant silver-rich veins and indicated favorable economic potential.

Fresnillo is actively advancing this high-growth asset by intensifying drilling operations and progressing through permitting processes. This strategic push underscores the company's dedication to unlocking the project's value.

- Project Location: World-class epithermal silver and gold vein district.

- Key Findings: Identification of significant silver-rich veins.

- Economic Outlook: Preliminary conceptual study indicates good economic prospects.

- Fresnillo's Action: Ramping up drilling and permitting activities.

The Juanicipio mine, now in commercial production, is a significant contributor to Fresnillo's silver and gold output, driving growth in a sector with strong market forecasts extending into 2025. Its increasing production volumes, as evidenced by a 15% year-on-year rise in attributable silver production in Q1 2024, firmly establish it as a Star asset.

Saucito Mine is a high-performing silver producer, benefiting from higher ore grades and strategic investments like the deepening of the Jarillas shaft. Its strong performance amidst robust silver demand and projected market deficits solidifies its position as a Star in Fresnillo's portfolio.

Herradura, a key gold producer, continues to be a strong performer, with ongoing initiatives like potential underground expansion set to maintain its market standing. Despite slight revisions to 2025 projections, its consistent contribution underpins Fresnillo's robust position in the gold market.

The Orisyvo project, in feasibility stage, represents a significant future gold asset for Fresnillo, with substantial investment planned to capitalize on positive long-term gold price trends. Guanajuato, in a prime silver and gold district, is also being advanced with increased drilling and permitting, indicating strong potential.

| Asset | Commodity | BCG Category | Key Metric/Status | Market Context |

| Juanicipio | Silver/Gold | Star | Commercial production started mid-2023; 15% YoY silver production growth (Q1 2024) | Record precious metal prices, favorable market forecast to 2025 |

| Saucito | Silver | Star | Higher ore grades, strategic shaft deepening underway | Robust silver demand, projected market deficits |

| Herradura | Gold | Star | Consistent gold producer, potential underground expansion | Favorable gold price trends, consistent demand |

| Orisyvo | Gold | Question Mark (potential Star) | Feasibility stage, significant investment planned | Positive long-term gold price outlook |

| Guanajuato | Silver/Gold | Question Mark (potential Star) | Advancing with increased drilling and permitting | World-class vein district, favorable economic prospects |

What is included in the product

The Fresnillo BCG Matrix offers a strategic overview of its mining assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

The Fresnillo BCG Matrix offers a clear, visual representation of their mining assets, simplifying strategic decision-making.

Cash Cows

The Fresnillo mine, the company's namesake, stands as a cornerstone asset and historically the world's largest primary silver producer. Despite facing operational adjustments, ongoing investments, such as the deepening of the San Carlos shaft, aim to boost its long-term efficiency and sustained output. This mature but valuable silver asset consistently generates substantial cash flow for Fresnillo plc.

San Julián Veins is a significant contributor to Fresnillo's silver output, demonstrating robust performance with recent increases in ore grades and extraction volumes. This operation is a cornerstone of the company's silver business, consistently delivering substantial production figures.

While the San Julián DOB operation has ceased, the San Julián Veins segment continues to thrive as a stable and established producer, ensuring ongoing silver supply. This resilience highlights the operational strength and strategic importance of the Veins.

The San Julián Veins consistently generate reliable cash flow for Fresnillo, underscoring its role as a cash cow within the company's portfolio. Its steady performance provides a crucial financial foundation for the business.

The Ciénega mine stands as a mature, established gold-silver operation within Fresnillo's diverse portfolio, consistently contributing to the company's revenue. Despite experiencing some variability in ore grade and volume, its enduring operational history and dependable production solidify its role as a reliable cash generator.

In 2023, Fresnillo reported that Ciénega produced 156,273 ounces of gold and 3,607,072 ounces of silver. This steady output underpins the company's overall financial resilience, providing a stable revenue stream that helps support other ventures.

Noche Buena Mine (Gold)

The Noche Buena mine has been a reliable gold source for Fresnillo, with gold extracted from leaching pads boosting its production. Even though mining operations ceased in May 2023, the continued recovery from these pads and its past performance highlight its strong cash-generating ability, solidifying its role as a cash cow.

This mine has a history of generating significant profits throughout its operational lifespan. For instance, in 2022, Noche Buena contributed approximately 13.1 million ounces of silver equivalent, showcasing its substantial production capacity.

- Consistent Gold Producer: Noche Buena has reliably supplied gold to Fresnillo.

- Post-Mining Cash Flow: Ongoing recovery from leaching pads continues to generate revenue.

- Historical Profitability: The mine has a proven track record of delivering substantial returns.

By-product Zinc Production

By-product zinc production at Fresnillo functions as a classic cash cow within its diversified portfolio. The company benefits from this revenue stream without needing substantial new capital outlays, as zinc is recovered during the processing of its primary silver and gold ores.

Increases in zinc output have been notable, driven by factors such as improved ore grades and expanded processing capacities at key Fresnillo operations. For instance, the Saucito and Juanicipio mines have been instrumental in boosting these volumes.

- Fresnillo's zinc production saw a significant increase in 2023, reaching 67.8 thousand tonnes, up from 58.5 thousand tonnes in 2022.

- This growth is attributed to higher ore grades and increased processing volumes at mines like Saucito and Juanicipio.

- Zinc, while secondary to precious metals, consistently contributes to Fresnillo's revenue and cash flow generation.

The San Julián Veins operation exemplifies a cash cow for Fresnillo, consistently generating substantial revenue with minimal need for new investment. Its established production and operational efficiency ensure a steady financial contribution.

Similarly, the Ciénega mine, despite some production variability, acts as a reliable cash generator due to its mature status and consistent output of gold and silver. Fresnillo reported 156,273 ounces of gold and 3,607,072 ounces of silver from Ciénega in 2023.

The Noche Buena mine, even after ceasing active mining in May 2023, continues to be a cash cow through ongoing precious metal recovery from its leaching pads. Historically, it has delivered significant profits, contributing approximately 13.1 million ounces of silver equivalent in 2022.

By-product zinc production further solidifies Fresnillo's cash cow status, particularly with notable increases in output. In 2023, zinc production reached 67.8 thousand tonnes, up from 58.5 thousand tonnes in 2022, driven by higher ore grades and processing volumes at mines like Saucito and Juanicipio.

| Asset | Primary Metal | 2023 Production (Key Metric) | Cash Flow Contribution | BCG Matrix Status |

| San Julián Veins | Silver | Strong, consistent output | Substantial and reliable | Cash Cow |

| Ciénega | Gold, Silver | 156,273 oz Gold, 3,607,072 oz Silver | Dependable revenue stream | Cash Cow |

| Noche Buena | Gold | Post-mining recovery from pads | Proven historical profitability | Cash Cow |

| By-product Zinc | Zinc | 67.8 thousand tonnes (up from 58.5 kt in 2022) | Consistent revenue enhancement | Cash Cow |

Preview = Final Product

Fresnillo BCG Matrix

The Fresnillo BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just the fully formatted, analysis-ready BCG Matrix ready for immediate strategic application. You can trust that the insights and structure presented here are identical to the final, downloadable file, empowering your decision-making processes without delay. This preview guarantees you're seeing the exact professional-grade document that will be yours to use for business planning and competitive analysis.

Dogs

The San Julián Disseminated Ore Body (DOB) segment of Fresnillo Plc has been classified as a Dog within the Boston Consulting Group (BCG) matrix. This classification stems from the cessation of mining activities at San Julián DOB in November 2024, signaling a definitive downturn in its operational performance and market position.

This move indicates that the San Julián DOB likely faced challenges such as declining profitability, escalating operational expenses that outpaced revenue generation, or the depletion of its economically extractable mineral reserves. Assets in this state typically represent a drain on resources rather than a source of significant cash flow.

As of the cessation, the San Julián DOB no longer contributes meaningfully to Fresnillo's overall production or financial results. The company now faces the ongoing costs associated with managing the closure of this operation, a characteristic hallmark of a Dog in the BCG framework, requiring capital for rehabilitation and environmental stewardship rather than expansion or growth.

Operations at Fresnillo's Soledad-Dipolos mine are currently suspended, meaning it's not contributing to the company's production or revenue streams. This inactivity positions it as a potential drain on resources, incurring costs without generating income.

While future operational changes are possible, Soledad-Dipolos, in its current state, does not hold a significant market share or exhibit growth potential. This lack of active contribution places it in a challenging position within Fresnillo's strategic portfolio.

Fresnillo PLC has several exploration projects that haven't delivered substantial results. These are the 'Dogs' in their BCG Matrix, representing areas where initial exploration investments haven't led to significant resource discoveries or economic viability. For instance, the company's exploration expenditure in 2023 was $79.9 million, and while a portion of this is allocated to promising new ventures, some older, less fruitful prospects continue to consume capital without demonstrating clear potential for future returns or market share growth.

Older, High-Cost Veins at Mature Mines

Within Fresnillo plc's established operations, such as the Fresnillo and Saucito mines, certain older or deeper veins are exhibiting characteristics of 'Dogs' in a BCG matrix analysis. These sections often face declining ore grades and escalating extraction costs, diminishing their profitability relative to more recently developed, higher-grade areas. For instance, while the overall mines might be cash cows, these specific, less efficient segments could be draining resources without commensurate returns.

The economic viability of continuing extraction from these specific veins is questionable if the returns do not justify the operational expenditure. This situation is common in mature mining assets where the easiest-to-access and richest ore has already been exploited. In 2023, Fresnillo plc reported a total production of 51.7 million ounces of silver, but the cost of sales per ounce increased to $13.4 per ounce, up from $12.0 in 2022, reflecting some of these cost pressures in older sections.

- Declining Ore Grades: Older veins often contain lower concentrations of valuable minerals, requiring more rock to be processed for the same output.

- Higher Extraction Costs: Deeper mines or those with more complex geological structures lead to increased energy, labor, and equipment expenses per tonne.

- Sub-optimal Unit Performance: Despite being part of profitable larger operations, these specific vein sections may not meet internal profitability benchmarks.

- Potential for Divestment or Closure: If costs continue to outweigh revenues, these 'Dog' segments might eventually be considered for closure or sale to focus capital on more promising ventures.

By-product Lead Production with Declining Prices

Lead, while a by-product for Fresnillo, experienced a price decline of 2.7% in 2024. This downturn, coupled with potential increases in extraction complexity, positions lead as a potential 'Dog' in the BCG matrix if revenues don't keep pace.

The minimal contribution of lead to Fresnillo's overall profit margin raises questions about the justification of continued investment.

- By-product Status: Lead extraction is secondary to Fresnillo's primary metal production.

- Price Volatility: Lead prices saw a 2.7% decrease in 2024, impacting its revenue potential.

- Profitability Concerns: Low contribution to overall profit margins suggests it may not be a high-growth, high-share asset.

- Strategic Re-evaluation: Declining prices and potential extraction challenges could necessitate a review of lead's role in the portfolio.

Fresnillo's San Julián Disseminated Ore Body (DOB) is a prime example of a Dog in the BCG matrix, with operations ceasing in November 2024. This indicates significant challenges like dwindling profitability or depleted reserves, making it a resource drain rather than a cash generator.

The company's Soledad-Dipolos mine, currently suspended, also fits the Dog profile by incurring costs without generating revenue or showing growth potential. Additionally, several exploration projects, despite $79.9 million in 2023 expenditure, have not yielded substantial results, consuming capital without clear future returns.

Older, deeper veins within established mines like Fresnillo and Saucito also exhibit Dog characteristics due to declining ore grades and rising extraction costs, impacting profitability. For instance, the cost of sales per ounce of silver increased to $13.4 in 2023 from $12.0 in 2022, reflecting these pressures.

Lead, a by-product for Fresnillo, with a 2.7% price drop in 2024, also faces potential Dog classification if extraction costs escalate and its minimal profit contribution is insufficient.

| Asset/Segment | BCG Classification | Key Rationale | Relevant Data Point |

| San Julián DOB | Dog | Cessation of mining activities in Nov 2024 | Operations ceased Nov 2024 |

| Soledad-Dipolos | Dog (potential) | Suspended operations, no revenue generation | Currently inactive |

| Underperforming Exploration Projects | Dog | Lack of significant resource discoveries | 2023 Exploration Expenditure: $79.9 million |

| Older/Deeper Veins (within Fresnillo/Saucito) | Dog (specific segments) | Declining ore grades, higher extraction costs | 2023 Cost of Sales per oz Silver: $13.4 (up from $12.0 in 2022) |

| Lead (by-product) | Dog (potential) | Price decline, low profit contribution | 2024 Lead Price Change: -2.7% |

Question Marks

The Rodeo Project, an early-stage open-pit gold venture in Durango, Mexico, is Fresnillo's question mark in its BCG matrix. Its exploration commenced following positive engagement with local landowners, signaling a potentially promising future.

Currently in the preliminary economic assessment stage, Rodeo exhibits high growth potential, contingent on resource confirmation and development. However, as it's not yet in production, its market share remains negligible, reflecting its nascent status and the substantial investment needed to bring it online.

The Tajitos Project, a significant open-pit gold operation within Fresnillo's portfolio, is positioned as a rising star in the BCG matrix. Its recent comprehensive evaluation in 2024, including updated resource estimates and a preliminary economic assessment, highlights its substantial growth potential in a prime gold-producing area.

While Tajitos demonstrates strong future prospects, its current market share is relatively low, necessitating considerable capital investment for ongoing exploration and detailed studies. This investment is crucial to unlocking its full potential and solidifying its position as a future growth driver for Fresnillo.

Fresnillo's international exploration ventures in Peru, specifically the Racaycocha project targeting copper, gold, and molybdenum, and in Chile with the Yastai project focused on copper and gold, represent significant bets on future growth. These initiatives are designed to diversify Fresnillo's geographic footprint beyond Mexico, tapping into potentially rich new mining territories.

Currently, these projects are in their nascent drilling and evaluation phases, meaning they are high-risk, high-reward endeavors. While they offer substantial market potential in new regions, they currently hold no market share and necessitate considerable, speculative investment, placing them firmly in the question mark category of the BCG matrix.

New Technologies for Ore Processing/Recovery

Fresnillo is actively exploring and investing in cutting-edge technologies for ore processing and recovery, aiming to boost efficiency and output. These advancements are considered high-risk, high-reward opportunities, aligning with the characteristics of a question mark in the BCG Matrix due to their significant growth potential but also their current developmental stage and uncertain immediate returns.

These new technologies, while promising substantial improvements, are in the early phases of implementation, requiring significant capital investment without guaranteed immediate profitability. This strategic focus on innovation is crucial for Fresnillo's long-term competitive advantage in the precious metals sector.

- Investment in Metallurgical Optimization: Fresnillo's commitment to improving processing techniques signifies a forward-thinking approach to resource utilization.

- High Growth Potential: Successful implementation of new technologies could lead to substantial increases in recovery rates and operational efficiency, driving significant growth.

- Current Stage of Development: These ventures are in the developmental phase, meaning they are capital intensive and their immediate financial returns are not yet assured.

- Uncertainty of Immediate Returns: The risk associated with these technologies lies in the possibility of unforeseen challenges during development or market adoption, impacting short-term profitability.

Deepening Projects at Mature Mines for New Ore Bodies

Deepening projects at mature mines, like the ongoing work at Fresnillo's Saucito mine with its Jarillas shaft, represent a strategic move to unlock previously inaccessible ore bodies. These are not simply extensions but rather significant, high-cost undertakings. They are essentially speculative bets on future production, requiring substantial capital outlay with uncertain timelines for positive returns. Currently, their contribution to new production is minimal, reflecting their early-stage, development-focused nature.

These ventures are characteristic of Question Marks in the BCG matrix due to their high investment needs and uncertain outcomes. For instance, such deep shaft expansions often involve complex geological challenges and advanced engineering, pushing upfront costs significantly higher. Fresnillo's 2023 annual report highlighted continued investment in underground development, a portion of which is allocated to these deeper exploration efforts, demonstrating the company's commitment to these long-term growth prospects.

- High Capital Expenditure: Deepening shafts requires substantial investment in infrastructure, machinery, and personnel.

- Long-Term Horizon: Realizing returns from these projects can take many years, often a decade or more.

- Geological Uncertainty: The success of accessing new, economically viable ore bodies is not guaranteed.

- Low Current Market Share: Until new reserves are proven and brought into production, their contribution to overall output is negligible.

Fresnillo's international exploration, specifically the Racaycocha project in Peru and Yastai in Chile, are prime examples of Question Marks. These ventures are in early drilling and evaluation stages, targeting copper and gold. They represent high-risk, high-reward opportunities with significant market potential but currently no market share, demanding substantial speculative investment.

The Rodeo Project, an open-pit gold venture in Durango, Mexico, is also categorized as a Question Mark. Currently in the preliminary economic assessment phase, it shows high growth potential contingent on resource confirmation. However, its lack of production means a negligible market share, requiring considerable investment for development.

Investments in new ore processing and recovery technologies also fall under the Question Mark category. These are high-risk, high-reward initiatives with significant growth potential but are in early implementation phases, requiring substantial capital without guaranteed immediate profitability.

Deepening projects at mature mines, such as the Jarillas shaft at the Saucito mine, are speculative bets on future production. They require significant capital outlay with uncertain returns and minimal current contribution to new production, characteristic of Question Marks due to high investment needs and uncertain outcomes.

| Project/Initiative | Location | Target Metals | BCG Category | Current Status | Investment Need |

|---|---|---|---|---|---|

| Racaycocha | Peru | Copper, Gold, Molybdenum | Question Mark | Early drilling/evaluation | High, speculative |

| Yastai | Chile | Copper, Gold | Question Mark | Early drilling/evaluation | High, speculative |

| Rodeo | Durango, Mexico | Gold | Question Mark | Preliminary Economic Assessment | Substantial |

| New Processing Technologies | Various | N/A | Question Mark | Early implementation | Substantial |

| Jarillas Shaft (Saucito) | Zacatecas, Mexico | N/A | Question Mark | Deepening/development | High, long-term |

BCG Matrix Data Sources

Our Fresnillo BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.