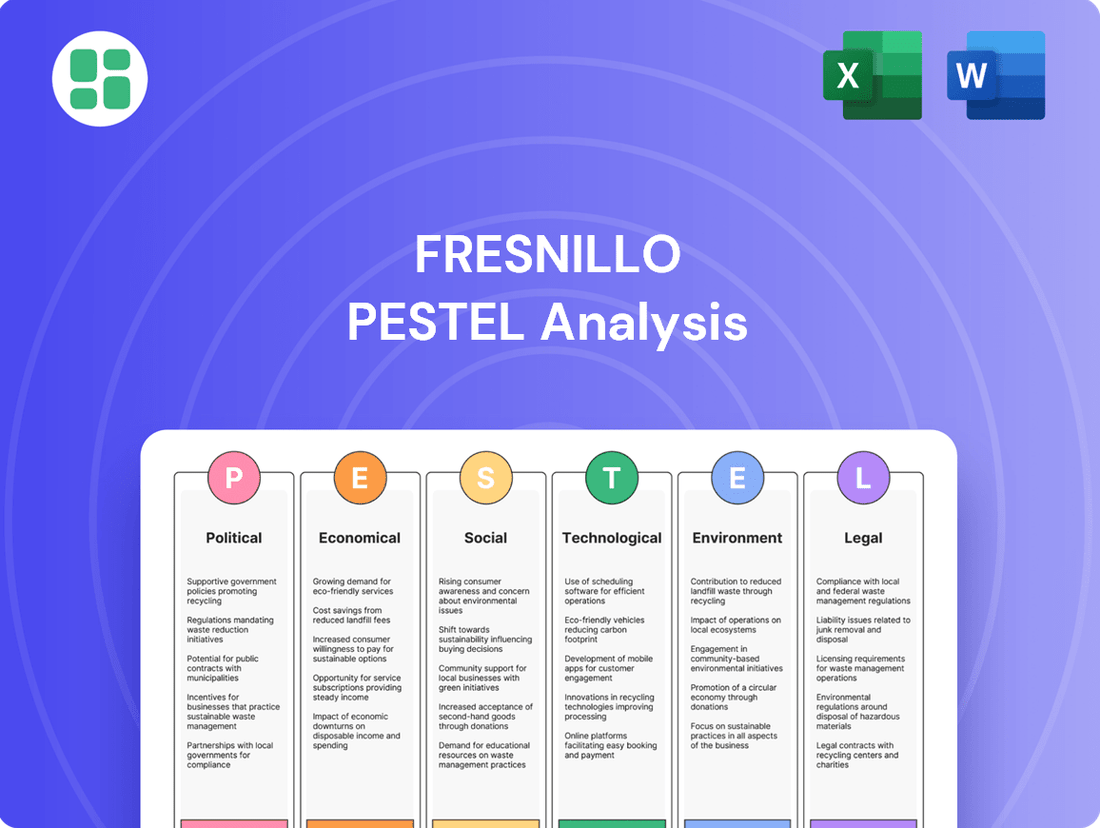

Fresnillo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresnillo Bundle

Navigate the complex external forces shaping Fresnillo's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are impacting this mining giant. Gain a strategic advantage by downloading the full report and unlock actionable intelligence for your own market strategy.

Political factors

The Mexican government's approach to the mining sector remains a critical political factor for Fresnillo. Recent discussions and proposals, such as potential modifications to mining laws and the consideration of an open-pit mining ban, introduce significant uncertainty. For instance, the proposed reforms in 2023 aimed to increase state control over strategic mineral resources, which could impact Fresnillo's exploration and development plans.

Past administrations have also contributed to this volatility. For example, the freezing of new mining concessions by the previous government created a challenging environment for companies seeking to expand their operations. Furthermore, shifts in royalty structures can directly affect profitability, as seen with past increases that added to operational costs.

While a change in political leadership can sometimes signal an opportunity for more stable dialogue, the history of policy shifts necessitates a cautious approach. Fresnillo's ability to adapt to these evolving political landscapes, including potential changes in environmental regulations and fiscal policies, will be key to its long-term operational stability and investment decisions in Mexico.

The suspension of new mining concessions in Mexico since 2018, coupled with ongoing delays in permit approvals, significantly impacts Fresnillo's operational expansion. These administrative hurdles directly affect the company's ability to advance exploration programs and greenfield projects, a crucial aspect for future growth. For instance, securing timely permits is vital for projects like Fresnillo's San Julián mine, where efficient operations depend on regulatory predictability.

Maintaining a strong social license to operate is critical for mining firms in Mexico, with community expectations and environmental oversight intensifying. Fresnillo prioritizes robust engagement with local communities, channeling investments into education, healthcare, and water infrastructure to cultivate favorable relationships.

In 2023, Fresnillo reported investing over $40 million in community development programs across its operations in Mexico, focusing on areas like education and infrastructure, demonstrating a tangible commitment to social responsibility.

Effectively addressing community concerns and ensuring equitable distribution of socio-economic benefits are vital to prevent operational disruptions and secure long-term sustainability, as evidenced by the company's proactive approach to stakeholder dialogue.

Security Situation in Mining Regions

Security challenges in key Mexican mining areas, particularly those affected by illegal extraction and organized crime, present a considerable risk to operations. Fresnillo must maintain strong security protocols to safeguard its workforce, assets, and logistical networks. For instance, in 2023, reports indicated an increase in security incidents in certain Zacatecas communities where Fresnillo operates, underscoring the persistent nature of these threats.

The effectiveness of government initiatives aimed at curbing illicit mining activities directly influences the safety and stability of the operating landscape for legitimate enterprises. A 2024 government report highlighted ongoing efforts to increase patrols and surveillance in critical mining zones, though the impact on reducing organized crime's influence remains a key metric to monitor. These government actions are crucial for fostering a more secure environment for companies like Fresnillo.

- Security Risks: Organized crime and illegal mining in regions like Zacatecas directly threaten personnel safety and asset integrity.

- Operational Impact: These security issues can disrupt supply chains and increase operational costs due to necessary security investments.

- Government Role: Government effectiveness in combating illegal mining is vital for creating a stable and secure operating environment for legitimate mining companies.

International Trade and Geopolitical Tensions

Global geopolitical tensions and evolving international trade policies significantly impact commodity prices and investment into Mexico's mining sector. Fresnillo, despite its Mexican focus, sees its precious metals demand shaped by these worldwide economic and political shifts. Staying attuned to these trends is crucial for maintaining its market standing and export potential.

The company's performance is indirectly linked to global trade agreements and geopolitical stability, which can affect the cost of imported inputs and the ease of exporting its products. For instance, disruptions in global supply chains, often exacerbated by geopolitical events, could increase operational expenses for Fresnillo. In 2024, ongoing trade disputes and regional conflicts continue to create uncertainty in global commodity markets, potentially affecting the price of silver and gold, Fresnillo's key outputs.

- Global Trade Policy Shifts: Changes in tariffs or trade barriers between major economies can alter demand patterns for precious metals.

- Geopolitical Instability: Conflicts or political unrest in key regions can disrupt supply chains and influence investor sentiment towards emerging market assets.

- Commodity Price Volatility: International trade dynamics directly influence the pricing of silver and gold, impacting Fresnillo's revenue streams.

Government policy shifts in Mexico, including potential mining law reforms and royalty adjustments, create uncertainty for Fresnillo. The administration's stance on state control over resources and the speed of permit approvals directly influence operational expansion and project development. For example, delays in concession renewals in 2023 impacted exploration timelines.

Security concerns, particularly in regions like Zacatecas, remain a significant political challenge. The effectiveness of government efforts to combat illegal mining and organized crime is crucial for safeguarding operations and personnel. Reports in early 2024 indicated continued government initiatives to bolster security in mining zones.

Global geopolitical events and trade policies indirectly affect Fresnillo by influencing commodity prices and investment flows. Trade disputes and regional conflicts in 2024 continue to create volatility in precious metal markets, impacting the demand and pricing of silver and gold.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Fresnillo, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise PESTLE analysis for Fresnillo, highlighting key external factors impacting operations, serves as a pain point reliever by providing clarity on market dynamics and potential risks, enabling proactive strategic adjustments.

Economic factors

Fresnillo's financial performance is intrinsically linked to the fluctuating prices of key commodities like silver, gold, lead, and zinc. In 2024, the precious metals market, particularly gold and silver, experienced notable price increases, driven by global geopolitical uncertainties and robust buying from central banks. For instance, silver prices have shown a strong upward trajectory, often exceeding $28 per ounce in early to mid-2024.

While precious metals benefit from safe-haven demand, the industrial applications of silver and platinum could face headwinds. A slowdown in global economic activity might dampen demand for these metals in sectors like automotive and electronics. Therefore, Fresnillo must closely monitor economic indicators to anticipate potential shifts in industrial metal demand.

High inflation in major economies, such as the UK and Mexico, directly impacts Fresnillo's operational expenses. For instance, the UK's Consumer Price Index (CPI) saw significant increases throughout 2023 and into early 2024, averaging around 4.5%, which raises costs for labor, energy, and raw materials essential for mining operations.

Central banks, including the Bank of England and Banxico, have responded with interest rate hikes to curb inflation. While higher interest rates can make financing more expensive for Fresnillo, potentially impacting capital expenditures, gold's traditional role as an inflation hedge could offer some price support.

However, the persistent inflationary environment means Fresnillo must carefully manage rising input costs. If these cost increases outpace the price appreciation of gold and silver, the company's profit margins could be squeezed, affecting its financial performance in 2024 and 2025.

Currency exchange rate fluctuations, particularly between the Mexican Peso (MXN) and the US Dollar (USD), are a critical economic factor for Fresnillo. Since a significant portion of its operating expenses are incurred in MXN, while its primary revenue stream is in USD, the MXN's value directly influences its cost base.

A weaker Mexican Peso relative to the US Dollar generally benefits Fresnillo by reducing its production costs when translated into USD. For instance, in early 2024, the MXN experienced a depreciation trend against the USD, which would have provided a favorable tailwind for Fresnillo's cost structure. This dynamic highlights the importance of effective foreign exchange risk management strategies.

Labor Costs and Availability

Labor costs and availability are significant considerations for Fresnillo, particularly given Mexico's economic landscape. As of early 2024, Mexico has seen a historically low unemployment rate, hovering around 2.5%, which tightens the labor market. Furthermore, ongoing discussions and implementation of minimum wage increases, with the national minimum wage seeing a significant jump in recent years, directly impact operating expenses for companies like Fresnillo.

These dynamics necessitate adaptive human resource strategies. Fresnillo must focus on attracting and retaining skilled personnel in a competitive environment. This includes offering competitive compensation packages and fostering positive working conditions to ensure operational continuity and access to the necessary workforce.

- Low Unemployment: Mexico's unemployment rate remained low in early 2024, around 2.5%, indicating a tight labor market.

- Wage Increases: Minimum wage hikes in Mexico are a direct factor influencing Fresnillo's labor costs.

- Talent Attraction: The company must implement strategies to secure and keep skilled workers amidst competition.

- Operational Stability: Competitive wages and good working conditions are crucial for maintaining stable operations.

Foreign Direct Investment Trends in Mexico

Foreign direct investment (FDI) is a critical barometer for the health of Mexico's mining sector, directly influencing capital availability for new ventures and expansion. Investor confidence, heavily swayed by policy predictability, plays a paramount role in this dynamic.

Despite generally favorable commodity prices, FDI in Mexico's mining industry experienced a notable downturn in 2024. This decline underscores the persistent impact of policy uncertainty on investment decisions. For instance, reports indicated a significant drop in FDI inflows compared to previous years, though specific figures for the mining sector alone can fluctuate.

A stable and transparent regulatory framework is essential to reverse this trend and foster a more attractive environment for both domestic and international investors. Without this, attracting and retaining the necessary capital for growth will remain a considerable challenge for the industry.

- FDI Impact: Directly correlates with capital availability for mining projects.

- 2024 Trend: Significant decline in mining FDI due to policy uncertainty.

- Key Driver: Investor confidence hinges on a predictable regulatory environment.

- Future Need: Stability is crucial for sustained investment and sector growth.

Fresnillo's profitability remains closely tied to commodity prices, with silver and gold showing strength in early to mid-2024 due to geopolitical concerns and central bank purchases, pushing silver above $28 per ounce. However, a potential global economic slowdown could temper demand for industrial metals like silver and platinum used in automotive and electronics, necessitating close monitoring of economic indicators.

Rising inflation in key markets like the UK and Mexico directly increases Fresnillo's operational costs, with UK CPI averaging around 4.5% in early 2024, impacting expenses for labor and energy. While central bank interest rate hikes to combat inflation may increase financing costs, gold's hedge against inflation could provide price support, though margin pressure remains a concern if cost increases outpace metal price gains.

Currency fluctuations, particularly the MXN against the USD, significantly affect Fresnillo. A weaker MXN in early 2024 provided a cost advantage by reducing MXN-denominated expenses when translated to USD. Mexico's low unemployment rate (around 2.5% in early 2024) and minimum wage increases necessitate competitive compensation strategies to attract and retain skilled labor, ensuring operational stability.

Foreign direct investment in Mexico's mining sector saw a notable dip in 2024, largely attributed to policy uncertainty, despite generally favorable commodity prices. A stable and transparent regulatory environment is crucial to attract the capital needed for industry growth and expansion, as investor confidence is directly linked to policy predictability.

| Economic Factor | Trend (Early-Mid 2024) | Impact on Fresnillo | Key Data Point/Example |

| Commodity Prices | Silver prices strong, Gold firm | Positive revenue potential, but industrial demand risk | Silver > $28/oz |

| Inflation | Elevated in UK, Mexico | Increased operational costs (labor, energy) | UK CPI ~4.5% |

| Interest Rates | Rising | Higher financing costs, potential capital expenditure impact | Central bank policy |

| Currency Exchange Rates | MXN depreciating vs. USD | Reduced USD-denominated operating costs | Favorable MXN/USD trend |

| Labor Market | Tight, rising minimum wage | Increased labor costs, need for competitive strategy | Mexico unemployment ~2.5% |

| Foreign Direct Investment (FDI) | Declining in mining | Reduced capital availability, policy uncertainty impact | FDI downturn |

What You See Is What You Get

Fresnillo PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Fresnillo PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Fresnillo's operations and strategic decisions.

Sociological factors

Fresnillo's social license to operate hinges on deep, ongoing engagement with local communities. In 2024, the company continued to invest in community development programs, allocating significant resources to education and infrastructure projects. For instance, their commitment to local employment saw over 80% of their workforce in Mexico sourced from surrounding communities.

Addressing community needs through targeted socio-economic initiatives and maintaining open, transparent communication are cornerstones of Fresnillo's strategy. This proactive stance is essential for fostering trust and preventing operational disruptions, as demonstrated by successful community partnerships in their operations in Zacatecas and Durango.

Fresnillo places a high value on its workforce, emphasizing employee health, safety, and fostering an inclusive culture as detailed in its sustainability reports. This commitment is crucial for maintaining stable operations and boosting productivity.

Maintaining strong relationships with labor unions and investing in employee training and development are key strategies for Fresnillo. For instance, in 2023, the company reported significant investment in training programs aimed at enhancing skills and ensuring operational continuity.

The company actively promotes employee well-being through various initiatives, including programs that encourage healthy lifestyles and support emotional health. These efforts contribute to a more positive and productive work environment, reducing absenteeism and improving overall morale.

Public perception of mining in Mexico is a significant factor, with growing emphasis on environmental and social impacts. Concerns about water usage and land reclamation are prominent, influencing community acceptance of new projects. For instance, by late 2024, reports indicated a rise in local opposition to mining ventures across several Mexican states due to these very issues.

Fresnillo needs to proactively address these perceptions by highlighting its sustainability initiatives. Demonstrating a commitment to responsible resource management, such as reducing water intensity by 15% in its Zacatecas operations by mid-2025, is crucial to building trust. This involves clear communication about environmental protection measures and social contributions.

Transparency in operations and tangible benefits for local communities are key to improving the mining industry's reputation. Fresnillo's investment in community development projects, which reached over $10 million USD in 2024 across its operational areas, directly contributes to a more positive public image and fosters stronger stakeholder relationships.

Indigenous and Local Community Rights

New mining legislation in Mexico is increasingly focused on safeguarding the rights of indigenous and Afro-Mexican communities. This includes mandatory consultation processes that Fresnillo must adhere to before any mining concessions are granted, ensuring their interests are considered. This legal framework underscores the importance of respecting ancestral land rights and local governance structures.

Fresnillo's operational strategy must actively incorporate these community rights, making thorough consultation a cornerstone of its development plans. Failure to comply could lead to significant legal challenges and operational delays, impacting project timelines and overall profitability. For instance, in 2024, several mining projects across Latin America faced significant delays due to inadequate community engagement, resulting in estimated losses of millions of dollars.

Respecting these rights is not just about legal compliance; it's about building sustainable and equitable relationships with the communities where Fresnillo operates. This approach fosters social license to operate, which is vital for long-term business success and mitigating reputational risks. By proactively engaging and addressing concerns, Fresnillo can build trust and ensure smoother project execution.

- Legal Mandates: Mexican laws now prioritize consultation with indigenous and Afro-Mexican communities before concession approvals.

- Operational Impact: Non-compliance with consultation requirements can lead to project delays and financial penalties.

- Social License: Building trust through respectful engagement is crucial for long-term operational viability.

- Risk Mitigation: Proactive community relations can prevent costly disputes and reputational damage.

Contribution to Local Socio-Economic Development

Fresnillo plc significantly bolsters the socio-economic fabric of its operational areas. In 2023, the company directly employed approximately 8,400 individuals, with a substantial portion of these roles filled by local residents, thereby fostering economic stability and skill development within these communities. Beyond employment, Fresnillo's commitment extends to local procurement, with over 60% of its suppliers in Mexico being local entities, injecting vital capital into regional economies.

The company's investment in community projects is a cornerstone of its development strategy. These initiatives, which in 2023 saw Fresnillo allocate over $15 million to social programs, are strategically aligned with UN Sustainable Development Goals. Key areas of focus include enhancing educational infrastructure, improving healthcare access, and ensuring water quality, all of which are critical for uplifting local living standards and building enduring community relationships.

- Employment: Fresnillo directly employed around 8,400 people in 2023, prioritizing local hires.

- Local Procurement: Over 60% of Fresnillo's suppliers in Mexico are local businesses, supporting regional economic growth.

- Community Investment: In 2023, the company invested over $15 million in social programs focused on education, healthcare, and water quality.

- SDG Alignment: Community initiatives are designed to support UN Sustainable Development Goals, enhancing local livelihoods.

Societal attitudes towards mining, particularly concerning environmental and social impacts, directly influence Fresnillo's operational landscape. Growing public concern over water usage and land reclamation has intensified scrutiny, leading to increased community opposition in some regions by late 2024. Fresnillo's proactive approach involves highlighting sustainability efforts and demonstrating responsible resource management, such as aiming for a 15% reduction in water intensity in Zacatecas operations by mid-2025, to foster trust and acceptance.

Fresnillo's commitment to community well-being is evident in its substantial investments. In 2023, the company invested over $15 million in social programs focused on education, healthcare, and water quality, aligning with UN Sustainable Development Goals. This extensive community engagement, coupled with prioritizing local employment (over 80% of its Mexican workforce sourced locally) and procurement (over 60% of suppliers are local), significantly strengthens its social license to operate.

New Mexican legislation, effective through 2024 and into 2025, mandates enhanced consultation with indigenous and Afro-Mexican communities for mining concessions. Fresnillo's adherence to these legal requirements, which includes respecting ancestral land rights, is critical to avoid project delays and financial penalties, as seen in other Latin American projects facing similar challenges in 2024.

| Sociological Factor | Fresnillo's Approach/Data (2023-2025) | Impact |

|---|---|---|

| Community Relations & Social License | Over 80% local workforce; Over $15M invested in social programs (2023); Aiming for 15% water intensity reduction in Zacatecas by mid-2025. | Enhances social license to operate; Mitigates operational disruptions. |

| Public Perception of Mining | Addressing concerns on water usage and land reclamation; Highlighting sustainability initiatives. | Influences community acceptance and regulatory support. |

| Indigenous & Local Rights | Adhering to new Mexican legislation mandating community consultations (2024-2025). | Ensures legal compliance; Prevents project delays and financial penalties. |

| Employee Well-being & Development | Significant investment in training programs (2023); Promoting healthy lifestyles and emotional health initiatives. | Boosts productivity and reduces absenteeism; Fosters a positive work environment. |

Technological factors

Automation and robotics are revolutionizing mining, boosting efficiency and safety. Fresnillo can integrate autonomous haul trucks and drilling rigs, reducing human exposure to hazardous conditions and optimizing ore extraction. For instance, by 2024, the mining industry saw a significant increase in the deployment of autonomous mining systems, with companies reporting up to a 20% increase in productivity in pilot projects.

Advanced data analytics and AI are revolutionizing how Fresnillo operates. By analyzing immense geological survey and sensor data, AI and ML pinpoint richer ore deposits and refine production, boosting efficiency. For instance, in 2023, Fresnillo's focus on technological advancement contributed to a significant increase in its silver production, reaching 50.7 million ounces.

These technologies also enhance predictive maintenance, a critical factor in mining. Fresnillo can leverage AI to anticipate equipment failures, thereby minimizing costly downtime and optimizing operational schedules. This proactive approach directly impacts cost reduction and overall output consistency.

Technological advancements are key to making mining more environmentally friendly. This includes better ways to manage water, use energy more efficiently, and harness renewable power sources. Fresnillo, for instance, is actively investing in these areas to lessen its impact.

Specifically, Fresnillo is implementing advanced water recycling systems to significantly reduce its reliance on freshwater. The company also focuses on energy efficiency across its operations and is exploring the use of renewable electricity. These efforts are crucial for meeting sustainability goals and adapting to evolving environmental regulations.

Cybersecurity and Digital Infrastructure

As mining operations increasingly rely on digital systems, Fresnillo faces growing cybersecurity threats. The company must invest in advanced security protocols to safeguard its operational technology and ensure the integrity of its vast data reserves. This focus on secure digital transformation is crucial for uninterrupted operations and protecting sensitive corporate and operational information.

The increasing digitalization of mining processes, including autonomous vehicles and remote monitoring, amplifies the need for robust cybersecurity. Fresnillo's commitment to innovation means a proportional increase in its digital attack surface. For instance, the global cybersecurity market for industrial control systems, which includes mining operations, was projected to reach $22.1 billion in 2024, highlighting the significant investment required.

- Increased Vulnerability: Digitalization of mining operations creates new entry points for cyber threats targeting operational technology (OT) and IT systems.

- Data Integrity and Privacy: Protecting sensitive geological data, production figures, and employee information is paramount to prevent breaches and maintain trust.

- Operational Continuity: Cybersecurity failures can lead to significant downtime, impacting production targets and revenue, as seen in other industrial sectors where cyber incidents have cost millions.

- Investment in Defenses: Fresnillo needs to allocate substantial resources to cybersecurity solutions, including threat detection, incident response, and employee training, to mitigate these risks effectively.

Innovation in Processing and Metallurgy

Fresnillo's operational success hinges on continuous innovation in mineral processing and metallurgy to boost recovery rates for gold, silver, and other valuable by-products. For instance, in 2023, the company reported an average silver recovery rate of 94.1% and a gold recovery rate of 95.2%, demonstrating the impact of their established processes.

The company's strategic emphasis on optimizing mine plans and advancing brownfield projects, such as the San Julián Phase III expansion, directly supports efforts to enhance processing efficiencies and reduce the overall cost base. This focus on incremental improvements is key to maintaining competitiveness.

Further research and development in advanced metallurgical techniques, including flotation and leaching processes, hold the potential to unlock additional value from Fresnillo's existing ore bodies. Investing in R&D is crucial for staying ahead in an industry where resource efficiency directly translates to profitability.

- Innovation in Processing: Fresnillo aims to increase recovery rates, crucial for maximizing the yield of precious metals from its mines.

- Operational Optimization: Advancing brownfield projects and refining mine plans are central to improving processing efficiencies and reducing costs.

- R&D Potential: Continued investment in metallurgical research can unlock further value from existing ore reserves.

- 2023 Performance: The company achieved a 94.1% silver recovery and a 95.2% gold recovery in 2023, highlighting the effectiveness of current technologies.

Technological advancements are fundamentally reshaping mining operations, with automation and AI driving significant efficiency gains and safety improvements. Fresnillo's adoption of these technologies, such as autonomous haul trucks and advanced data analytics for ore deposit identification, directly contributes to optimized production and reduced operational risks. The company's 2023 silver production reached 50.7 million ounces, partly due to these technological integrations.

Legal factors

Recent amendments to Mexico's Mining Law have significantly altered concession terms, shortening their duration from 50 to 30 years, with a single 25-year extension possible. This shift, effective from 2024, also introduces a public bidding process for new concessions, moving away from the previous first-come, first-served approach. Fresnillo, a major silver producer in Mexico, must now strategically navigate these changes to secure and maintain its operational rights, impacting its long-term project viability and exploration strategies.

Mexico has tightened its environmental regulations, focusing on water use, waste disposal, and impact studies, which directly affect Fresnillo's operations. The company must now adhere to stricter rules for mine rehabilitation and eventual closure, a significant undertaking for any mining firm.

Compliance with these evolving legal frameworks is critical; for instance, failure to meet new standards for tailings management could result in penalties. In 2024, the Mexican government continued to emphasize sustainable mining practices, increasing oversight and the potential for sanctions on companies not demonstrating adequate environmental stewardship.

Recent amendments to Mexico's National Waters Law impose more stringent requirements on mining companies regarding water concessions. These changes emphasize the industrial use of water and mandate specific water recycling percentages, directly impacting operations like those of Fresnillo.

In response, Fresnillo is prioritizing water stewardship. For instance, the company is integrating treated wastewater into its operational processes. This proactive approach is crucial for maintaining compliance with the evolving legal framework and ensuring responsible water management, especially in regions facing significant water scarcity.

Labor Laws and Social Impact Requirements

Mexican labor laws, including those enacted in 2019, mandate stricter adherence to fair labor practices, impacting operational costs and human resource management for companies like Fresnillo. New requirements for social impact studies and indigenous consultations before granting mining concessions introduce significant procedural hurdles, potentially delaying project timelines and increasing compliance expenses.

Navigating these evolving legal and social landscapes is crucial for Fresnillo's sustained operations. For instance, the reforms to Mexico's outsourcing laws in 2021 aimed to curb labor abuses and require companies to ensure proper benefits and contract conditions for all workers, directly affecting Fresnillo's workforce management and associated costs.

- Stricter Labor Compliance: Adherence to updated Mexican labor laws, including those from 2019 and 2021, necessitates careful management of employee contracts, benefits, and working conditions.

- Social Impact Assessments: The mandatory social impact studies and indigenous consultations prior to concession grants can extend project development timelines and increase upfront investment.

- Community Engagement: Proactive and transparent engagement with local communities is vital to secure and maintain the social license to operate, mitigating risks of legal challenges and operational disruptions.

- Regulatory Navigation: Fresnillo must allocate resources to understand and comply with a complex web of labor and social regulations to avoid penalties and maintain operational continuity.

Taxation and Royalty Changes

Proposed changes to Mexico's tax framework, particularly the potential for increased extraordinary mining taxes outlined in the 2025 budget, could directly affect Fresnillo's financial performance. Such adjustments might necessitate a re-evaluation of capital expenditure plans and could influence the company's overall profitability. For instance, if these taxes were to significantly increase, it could lead to a reduction in net income, impacting dividend payouts or reinvestment opportunities.

Fresnillo's strategic response will involve close monitoring of these evolving fiscal policies and active engagement with Mexican authorities. Advocating for a stable and predictable tax environment is crucial for long-term investment planning and operational certainty. Understanding the implications of double taxation treaties is also paramount, especially for attracting and retaining foreign investment in the mining sector.

- Potential Impact of 2025 Budgetary Tax Proposals: Increased extraordinary mining taxes in Mexico could reduce Fresnillo's after-tax profits.

- Strategic Imperative: Continuous monitoring of fiscal policy changes and proactive engagement with government bodies are essential for a favorable operating environment.

- Foreign Investment Considerations: Clarity on double taxation treaties is vital for securing and maintaining international capital inflows.

Mexico's mining legislation, particularly amendments effective from 2024, has shortened concession durations to 30 years with a single 25-year extension, and introduced public bidding for new concessions. This necessitates strategic adaptation by Fresnillo to secure long-term operational rights and impacts project planning. Stricter environmental regulations, focusing on water use and waste management, along with updated labor laws from 2019 and 2021, also demand significant compliance efforts and may increase operational costs.

Potential tax increases, as indicated by proposals for the 2025 Mexican budget, could affect Fresnillo's profitability and investment strategies. The company must actively monitor fiscal policy changes and engage with authorities to advocate for a stable tax environment. Furthermore, navigating complex social impact assessments and indigenous consultation requirements adds procedural layers to concession acquisition, potentially delaying projects.

| Legal Factor | Impact on Fresnillo | Action/Consideration |

|---|---|---|

| Mining Law Amendments (2024) | Shorter concession terms (30+25 years), public bidding for new concessions. | Strategic planning for concession acquisition and renewal, project viability assessment. |

| Environmental Regulations | Stricter rules on water use, waste disposal, mine rehabilitation. | Enhanced compliance measures, investment in sustainable practices, water recycling. |

| Labor Laws (2019, 2021) | Increased adherence to fair labor practices, outsourcing regulations. | Review and adjustment of HR policies, workforce management, and associated costs. |

| Tax Policy (Potential 2025 changes) | Possible increase in extraordinary mining taxes. | Financial modeling, monitoring fiscal policy, advocacy for stable tax environment. |

| Social Impact & Consultation | Mandatory studies and consultations for concessions. | Resource allocation for studies, proactive community engagement, timeline management. |

Environmental factors

Mining, especially in Mexico's dry areas where Fresnillo operates, is heavily impacted by water scarcity. This environmental factor poses a significant operational challenge.

Fresnillo is actively addressing this through a robust water stewardship program. The company prioritizes water efficiency, maximizing reuse within its processes, and diligently works to prevent pollution.

A key initiative involves the use of treated municipal wastewater in their mining operations. For example, in 2023, Fresnillo reported progress in its water management, aiming to reduce reliance on freshwater sources by integrating recycled water, a crucial step in mitigating environmental impact and ensuring long-term operational sustainability.

The mining industry, including Fresnillo, faces mounting pressure regarding the management of waste, particularly tailings. Environmental and safety concerns mean that how mining waste is handled is under a microscope. This scrutiny is driving stricter regulations worldwide, requiring companies to focus on waste prevention and robust management systems.

Fresnillo must navigate a complex web of environmental regulations that govern waste prevention, management, and accountability. Adhering to these stringent rules is not just a matter of compliance but a fundamental aspect of responsible mining operations. The company's commitment to these standards directly impacts its social license to operate and its long-term sustainability.

Ensuring the safety and long-term stability of tailings facilities is a paramount environmental responsibility for Fresnillo. Failures in tailings dams can have catastrophic environmental and social consequences. Therefore, significant investment in monitoring, maintenance, and innovative containment technologies is crucial to mitigate these risks and protect surrounding ecosystems.

Fresnillo's operations, like those of many mining companies, are energy-intensive, directly impacting its carbon footprint. The global push for decarbonization is intensifying pressure on the mining sector to adopt cleaner energy alternatives.

While government policies have presented some hurdles to Fresnillo's target of sourcing 75% of its electricity from renewable sources, the company is actively pursuing emission reduction strategies. Initiatives such as implementing ventilation on demand systems and utilizing dual fuel engines are key components of their efforts to lower their environmental impact.

Biodiversity Protection and Land Reclamation

Mining activities inherently pose risks to biodiversity and surrounding land ecosystems. Fresnillo recognizes this and is dedicated to minimizing its environmental impact through proactive land remediation and biodiversity stewardship programs. For instance, in 2023, the company reported progress in its reforestation efforts, planting over 50,000 trees across its operational sites as part of its ongoing commitment to ecological restoration.

These initiatives are fundamental to Fresnillo's strategy for responsible mine closure and underscore its commitment to environmental accountability across all stages of its operations. The company's biodiversity action plans, often developed in consultation with local environmental agencies, aim to protect and enhance native flora and fauna. Fresnillo's 2024 sustainability report highlights a 5% reduction in land disturbance per tonne of ore processed compared to the previous year, reflecting the effectiveness of these mitigation strategies.

- Land Remediation: Fresnillo actively rehabilitates disturbed land, aiming to return it to a state that supports local ecosystems.

- Biodiversity Stewardship: The company implements programs to protect and enhance the diversity of plant and animal life in and around its mining concessions.

- Reforestation Efforts: Significant investment is made in planting native tree species to aid in land recovery and carbon sequestration.

- Environmental Accountability: Fresnillo integrates environmental considerations throughout the mining lifecycle, from exploration to closure, ensuring compliance and best practices.

Climate Change Impacts and Adaptation

Climate change presents significant physical risks to mining operations, including disruptions from extreme weather events. Fresnillo is proactively addressing these challenges by investing in regional climate modeling to better understand and prepare for potential impacts on its sites.

The company's adaptation strategies are part of a broader commitment to environmental stewardship. Fresnillo aims to mitigate its own environmental footprint and contribute positively to a sustainable future.

- Physical Risks: Increased frequency and intensity of extreme weather events like floods and droughts can directly impact mining infrastructure and operations, potentially leading to downtime and increased costs. For instance, in 2023, several mining regions globally experienced weather-related disruptions impacting production schedules.

- Adaptation Investments: Fresnillo's regional climate modeling projects are crucial for identifying vulnerabilities and developing site-specific adaptation plans. This forward-looking approach helps in safeguarding assets and ensuring operational continuity amidst a changing climate.

- Sustainability Commitment: Fresnillo's dedication to environmental protection extends beyond risk management. The company is actively pursuing initiatives to reduce greenhouse gas emissions and improve resource efficiency, aligning with global sustainability goals and demonstrating corporate responsibility.

Water scarcity remains a critical environmental factor for Fresnillo, particularly in Mexico's arid regions, driving its focus on water stewardship and reuse. The company's commitment to reducing reliance on freshwater sources is evident in its ongoing integration of treated municipal wastewater, a strategy highlighted in its 2023 progress reports.

Managing mining waste, especially tailings, is under intense global scrutiny, necessitating robust prevention and management systems for Fresnillo to comply with increasingly stringent environmental regulations and maintain its social license to operate.

Fresnillo's energy-intensive operations contribute to its carbon footprint, prompting intensified efforts to adopt cleaner energy alternatives and reduce emissions, with initiatives like ventilation on demand and dual fuel engines forming key parts of their strategy.

The company is actively engaged in land remediation and biodiversity stewardship, including reforestation efforts, to mitigate the inherent risks to ecosystems posed by mining activities. Fresnillo reported a 5% reduction in land disturbance per tonne of ore processed in 2023, showcasing the effectiveness of these mitigation strategies.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fresnillo is built on a robust foundation of data from official Mexican government agencies, international financial institutions like the World Bank, and reputable industry-specific market research reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the mining sector.