Fresnillo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresnillo Bundle

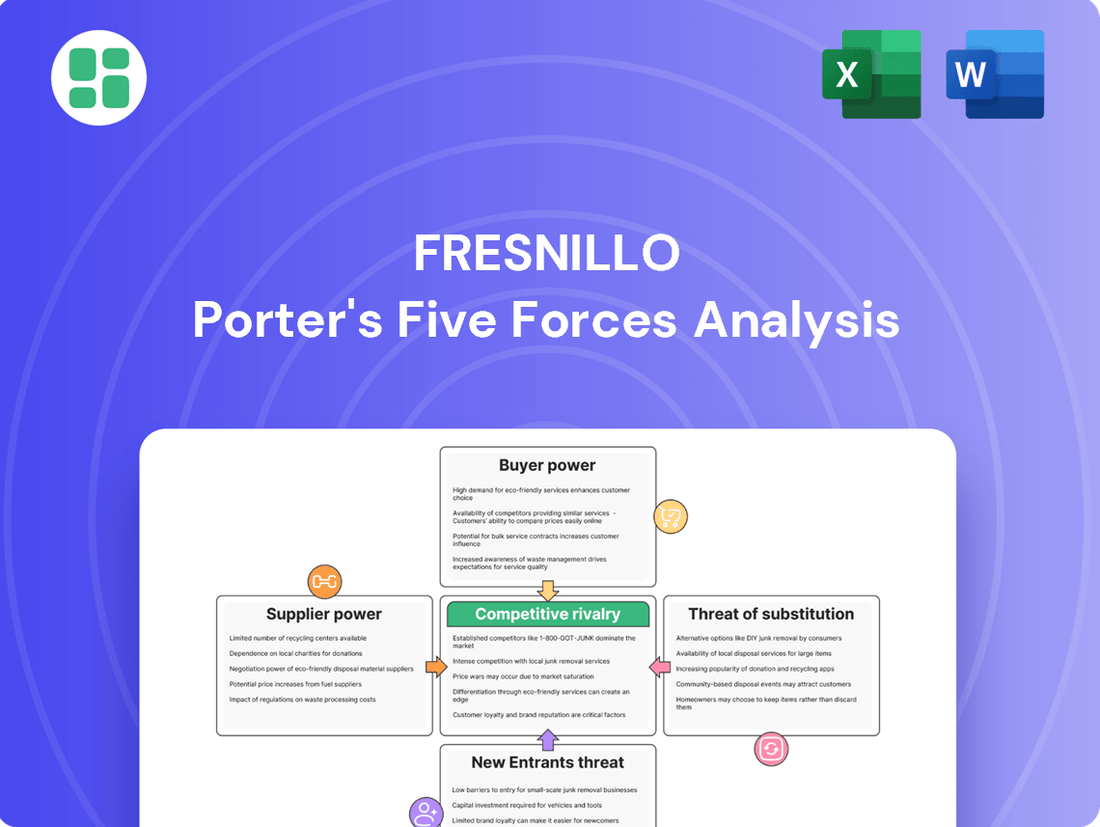

Fresnillo, a leading silver producer, faces a dynamic competitive landscape shaped by powerful market forces. Understanding the intensity of buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing competitors is crucial for strategic success. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Fresnillo’s competitive dynamics, market pressures, and strategic advantages in detail. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Fresnillo is significantly shaped by the specialized nature of mining equipment and technology providers. The global mining equipment market, projected to exceed USD 147 billion in 2024, is characterized by a few dominant companies offering highly specialized machinery, automation, and electrification solutions.

This industry concentration grants these key suppliers considerable leverage, especially when Fresnillo requires critical components or faces high switching costs and extended lead times for new equipment. Such dependencies can impact Fresnillo's operational efficiency and capital expenditure planning.

The bargaining power of suppliers for Fresnillo is significantly influenced by the availability and cost of crucial consumables and energy. Suppliers of essential inputs like processing chemicals, explosives, and energy sources such as electricity and fuel hold considerable sway. For instance, a sharp increase in global diesel prices, a key fuel for mining operations, directly escalates Fresnillo's operating costs.

Fluctuations in these commodity prices, or disruptions in the supply chain for specialized chemicals needed in ore extraction, can have a direct and substantial impact on Fresnillo's expenditures. In 2023, the average price of Brent crude oil, a benchmark for global energy prices, hovered around $82 per barrel, illustrating the potential volatility suppliers can leverage.

To mitigate this supplier influence, Fresnillo focuses on securing favorable long-term supply contracts for critical materials and investing in energy-efficient technologies. This proactive approach helps stabilize input costs and reduces vulnerability to market price swings, a strategy vital for maintaining profitability in the mining sector.

The global mining sector, including Fresnillo's operations, grapples with a persistent scarcity of skilled professionals like engineers and geologists. This deficit empowers the available workforce, driving up wage expectations and consequently increasing operational expenditures for mining companies.

In 2023, various reports indicated a significant gap between the demand for specialized mining talent and its supply, with some regions experiencing shortages of up to 20% for certain critical roles. This trend is expected to continue, placing upward pressure on labor costs for companies like Fresnillo.

Fresnillo's reliance on its Mexican operations means it is particularly sensitive to local labor market conditions and evolving social expectations regarding employment and compensation within the mining industry.

Financing and Capital Market Access

While Fresnillo itself boasts a strong financial position, the broader mining sector faces supplier power from capital markets. Lenders and investors, essentially suppliers of financing, wield influence by dictating terms based on project risk, commodity price fluctuations, and increasingly, environmental, social, and governance (ESG) factors. This dynamic directly impacts the cost and accessibility of funds for crucial expansions and new mine developments across the industry.

The ability to secure financing for substantial projects is a key area where suppliers can exert power. For instance, in 2023, global mining investment saw significant inflows, yet the terms were heavily scrutinized, particularly for projects with higher perceived risks or those not aligning with stringent ESG mandates. This means that even financially sound companies like Fresnillo must navigate these capital supplier expectations.

- Capital Availability: Access to debt and equity financing can be constrained for projects deemed too risky or not meeting ESG benchmarks.

- Cost of Capital: Lenders and investors can command higher interest rates or demand greater equity stakes for projects with uncertain futures or volatile commodity price exposure.

- Project Terms: Financing agreements often include covenants and conditions that can limit operational flexibility or require adherence to specific development timelines, influenced by capital suppliers.

Regulatory and Environmental Compliance Service Providers

The bargaining power of regulatory and environmental compliance service providers for Fresnillo is substantial due to escalating global ESG scrutiny. These specialized firms, offering environmental consulting, permitting, and compliance services, are critical for Fresnillo to maintain its social license to operate and comply with ever-changing regulations.

Their expertise is not a discretionary expense but a fundamental requirement for continuous operation. For instance, in 2024, the mining sector faced increased pressure to demonstrate robust environmental management plans, with significant fines levied for non-compliance in various jurisdictions. The availability and quality of these specialized services directly impact Fresnillo's ability to secure and maintain mining permits, a non-negotiable aspect of its business.

- Criticality of Services: Environmental and regulatory compliance services are essential for Fresnillo's operational continuity and social license, making these providers indispensable.

- Increasing Regulatory Burden: Global trends show a consistent rise in environmental regulations, particularly concerning water usage, emissions, and waste management in mining, directly impacting Fresnillo's operational costs and compliance needs.

- Limited Substitutes: The highly specialized nature of these services means there are few readily available substitutes, granting providers significant leverage in pricing and contract terms.

- ESG Investment Influence: Investor demand for strong ESG performance means Fresnillo must engage with top-tier compliance providers to attract and retain capital, further enhancing supplier power.

The bargaining power of suppliers for Fresnillo is influenced by the specialized nature of mining equipment and consumables, alongside the critical need for skilled labor and capital. Dominant equipment manufacturers and providers of essential chemicals and energy can leverage industry concentration and price volatility, impacting Fresnillo's operational costs and capital expenditure. The scarcity of skilled mining professionals also drives up labor costs, while capital markets, influenced by ESG factors, dictate financing terms.

| Supplier Type | Key Influence Factors | Impact on Fresnillo | 2024/2023 Data Point |

| Equipment & Technology | Industry concentration, high switching costs | Affects CapEx, operational efficiency | Global mining equipment market projected > USD 147 billion in 2024 |

| Consumables & Energy | Commodity price volatility, supply chain disruptions | Impacts operating costs (e.g., fuel, chemicals) | Brent crude oil averaged ~$82/barrel in 2023 |

| Skilled Labor | Talent scarcity, wage expectations | Increases operational expenditures | Reported talent shortages up to 20% for critical roles in 2023 |

| Capital Markets | Project risk, ESG mandates, lender/investor terms | Influences cost and accessibility of financing | Mining investment terms scrutinized for ESG alignment in 2023 |

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like Fresnillo, while also evaluating supplier and buyer power within the precious metals mining sector.

Quickly identify and address the specific competitive pressures impacting Fresnillo's profitability with a focused analysis of each Porter's Five Forces.

Customers Bargaining Power

Fresnillo's primary products, silver and gold, are sold into a massive global market characterized by a highly fragmented customer base. This broad spectrum of buyers includes industrial users in sectors like electronics and automotive, jewelry makers, individual and institutional investors, and even central banks.

This widespread distribution means that no single buyer commands substantial individual bargaining power to influence Fresnillo's pricing or sales volumes. For instance, in 2023, Fresnillo reported total revenues of $2.3 billion, with sales spread across numerous industrial, investment, and manufacturing clients, underscoring the lack of customer concentration.

As a producer of highly standardized commodities like silver and gold, Fresnillo operates as a price-taker. This means market prices are dictated by global supply and demand, not by individual customer negotiations. For instance, in 2024, the average spot price for silver fluctuated significantly, impacting Fresnillo's revenue irrespective of any single buyer's demands.

Customers in the precious metals market are typically well-informed, with real-time price transparency available through global exchanges. This accessibility means they can readily compare prices from various suppliers. Consequently, their ability to exert direct price bargaining power is limited, as they can easily shift to any supplier offering prevailing market rates.

The bargaining power of customers for precious metals like silver and gold is generally moderate to low, largely due to the critical nature of these materials in specific end-use applications. Silver's exceptional electrical conductivity makes it indispensable in electronics, and its reflectivity is vital for solar panels. Similarly, gold's unique properties are crucial in dentistry and specialized industrial components. These essential roles mean that for many buyers, securing a reliable supply of high-quality precious metals outweighs aggressive price negotiation.

Demand Drivers: Investment vs. Industrial Use

Customer demand for precious metals like silver and gold, key products for Fresnillo, is shaped by both investment and industrial applications. Investment demand often surges during times of economic uncertainty or geopolitical instability, as these metals are seen as safe havens. For instance, gold prices frequently react to global tensions.

Industrial demand, however, presents a more consistent growth story, particularly for silver. In 2024, silver's role in green technologies, such as solar panels and electric vehicles, has driven record consumption levels. This increasing industrial uptake provides a crucial counterbalance to the volatility sometimes seen in investment-driven markets.

- Investment Demand: Acts as a hedge against inflation and economic uncertainty, often increasing during geopolitical events.

- Industrial Demand: Driven by technological advancements, especially in renewable energy and electronics, showing strong growth.

- 2024 Trends: Silver's use in green technologies is reaching record highs, bolstering its industrial demand profile.

- Diversified Demand: Fresnillo benefits from this dual demand base, which helps to stabilize revenue streams against market fluctuations.

Substitution Potential for By-Products

Fresnillo's by-products, lead and zinc, are industrial metals. Customers in this broader market often have more leverage because there are many alternative materials and suppliers available. This means they can more easily switch if prices or terms aren't favorable.

For instance, the global lead market in 2024 saw prices fluctuate, influenced by supply from various mining operations and demand from industries like battery manufacturing. Similarly, zinc prices in 2024 were affected by global production levels and demand from sectors such as construction and automotive. These factors contribute to the bargaining power of customers for these specific commodities.

- By-product Revenue Contribution: While lead and zinc contribute to Fresnillo's overall revenue, their impact on the company's core precious metals business is limited.

- Market Dynamics: The industrial metals market for lead and zinc is characterized by a greater number of suppliers and substitute materials compared to the precious metals market.

- Customer Leverage: This wider availability of alternatives enhances the bargaining power of customers for Fresnillo's lead and zinc by-products.

- Strategic Focus: Fresnillo's primary focus remains on its precious metals operations, which are generally less exposed to significant customer bargaining power related to by-product substitution.

Fresnillo's customers for its primary products, silver and gold, are highly diversified across industrial, investment, and manufacturing sectors, limiting the power of any single buyer. The company's 2023 revenue of $2.3 billion was spread across a vast customer base, preventing significant individual price influence. As a commodity producer, Fresnillo is largely a price-taker, with global supply and demand dictating market rates, as seen with silver's price volatility in 2024.

While customers have price transparency, their bargaining power is constrained by the essential nature of precious metals in applications like electronics and renewable energy, where reliable supply often trumps aggressive negotiation. Silver's critical role in 2024's booming green technologies, such as solar panels, further solidifies demand and moderates customer leverage. This dual demand from investment and industrial sectors provides a stabilizing effect for Fresnillo.

| Customer Segment | Bargaining Power Influence | Key Drivers | Fresnillo's Position |

|---|---|---|---|

| Industrial Users (Electronics, Automotive, Solar) | Moderate | Essential material properties, supply chain reliability | Price-taker, but essentiality limits extreme price pressure |

| Jewelry Manufacturers | Moderate | Price sensitivity, design flexibility | Price-taker, subject to fashion trends and economic conditions |

| Investors (Individual & Institutional) | Low to Moderate | Market sentiment, economic outlook, diversification needs | Price-taker, influenced by global macroeconomics |

| Central Banks | Low | Strategic reserves, geopolitical stability | Price-taker, long-term holding strategies |

Full Version Awaits

Fresnillo Porter's Five Forces Analysis

This preview displays the complete Fresnillo Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the precious metals mining industry. You're viewing the exact document that will be instantly available for download after your purchase, ensuring you receive a professionally formatted and ready-to-use analysis without any surprises.

Rivalry Among Competitors

The precious metals mining sector is crowded with numerous global competitors, ranging from massive multinational corporations to smaller, localized operations. Fresnillo, while a dominant force as the world's leading primary silver producer and Mexico's largest gold producer, contends with formidable rivals such as Newmont Corporation and Barrick Gold. These industry giants possess significant production scale and financial resources, intensifying the competitive pressure on all participants.

Silver and gold are essentially undifferentiated commodities, meaning their quality and characteristics are largely the same no matter who produces them. This lack of differentiation naturally leads to a market where price becomes the primary deciding factor for buyers. Consequently, competition among producers like Fresnillo is heavily focused on offering the lowest price while ensuring a reliable supply.

For Fresnillo, this means its competitive edge isn't about making its silver or gold "special" but rather about being the most efficient producer. Achieving economies of scale and maintaining consistent, high-volume output are crucial. For instance, in 2023, Fresnillo reported total silver production of 62.5 million ounces, underscoring the importance of scale in this price-sensitive market.

The mining sector, including precious metals like those Fresnillo PLC operates in, is inherently capital-intensive. Companies face massive upfront investments for exploration, mine construction, and essential infrastructure, often running into hundreds of millions or even billions of dollars. For instance, developing a new silver mine can easily require over $500 million in capital expenditure.

These substantial fixed costs, combined with specialized equipment and the long-term nature of mining projects, erect significant exit barriers. It’s not easy for a company to simply shut down operations and walk away; the sunk costs are too high. This often forces competitors to maintain production even when market prices are low, simply to cover operational expenses and avoid further losses, which can exacerbate oversupply and fuel intense competition.

Limited New Major Discoveries and Reserve Depletion

The mining industry faces a significant hurdle with a noticeable decline in major new gold discoveries. Despite gold prices reaching highs, global exploration expenditure has been on a downward trend. Companies are increasingly prioritizing the optimization of their existing mining assets over the pursuit of entirely new, high-grade reserves. This scarcity of new discoveries, coupled with the natural depletion of existing reserves, heightens the competitive pressure among established players.

This environment intensifies the rivalry as companies scramble to maximize output from their current operations and acquire proven deposits. Fresnillo, with its substantial and established reserve base, holds a distinct competitive advantage in this landscape. For instance, as of the end of 2023, Fresnillo reported proven and probable mineral reserves of 43.7 million ounces of gold, a critical asset when new discoveries are scarce.

- Declining Exploration Spending: Global gold exploration expenditure has seen a downward trend, impacting the pipeline of future discoveries.

- Scarcity of New Major Discoveries: Few significant new gold deposits have been identified in recent years, exacerbating reserve depletion concerns.

- Focus on Existing Assets: Mining companies are concentrating on maximizing production from current operations rather than investing heavily in new exploration.

- Intensified Competition for Reserves: The limited supply of new discoveries and depletion of existing ones intensifies competition for proven and probable reserves.

Geographical Concentration and Regulatory Environment

Fresnillo's significant operational focus in Mexico, the globe's leading silver producer and a major gold source, naturally intensifies rivalry. This geographical concentration means competing directly with other substantial mining entities within the country, leveraging established regional knowledge and infrastructure.

The regulatory landscape in Mexico, particularly concerning mining, plays a crucial role in shaping competitive dynamics. Shifts in taxation, royalty structures, or environmental regulations can either bolster or hinder specific producers, influencing their cost structures and overall competitiveness.

- Mexico's Dominance: In 2023, Mexico accounted for approximately 23% of global silver mine production, underscoring the concentrated nature of Fresnillo's operating environment.

- Regulatory Impact: Changes in Mexican mining laws, such as the 2023 tax reform proposals that included potential adjustments to royalty rates, directly affect the profitability and competitive positioning of all operators in the country.

- Peer Competition: Fresnillo faces competition from other large-scale silver and gold producers operating within Mexico, including companies like Industrias Peñoles (its parent company) and various international mining firms with significant Mexican footprints.

Competitive rivalry in the precious metals mining sector is fierce due to the commodity nature of silver and gold, driving competition based on cost efficiency and scale. Fresnillo, as the leading primary silver producer, faces intense pressure from global giants like Newmont Corporation and Barrick Gold, who also possess substantial production capacity and financial clout. The lack of product differentiation means price is paramount, forcing companies to focus on operational excellence to maintain profitability.

The capital-intensive nature of mining, with high fixed costs and significant exit barriers, compels companies to maintain production even during price downturns, potentially increasing supply and intensifying competition. This is compounded by a scarcity of new major discoveries, leading to increased competition for existing reserves. Fresnillo's substantial reserve base, reporting 43.7 million ounces of gold reserves at the end of 2023, provides a competitive advantage in this environment.

Mexico's position as a leading silver producer, accounting for approximately 23% of global mine production in 2023, concentrates competition geographically. Regulatory changes, such as potential tax adjustments in Mexico, directly impact the competitive landscape by altering cost structures for all operators, including Fresnillo and its peers like Industrias Peñoles.

| Competitor | 2023 Silver Production (Moz) | 2023 Gold Production (Moz) | Market Cap (Approx. USD Bn, July 2025) |

|---|---|---|---|

| Fresnillo PLC | 62.5 | 611,300 oz | ~6.0 |

| Newmont Corporation | 46.9 | 4,900,000 oz | ~35.0 |

| Barrick Gold | 40.5 | 6,500,000 oz | ~25.0 |

SSubstitutes Threaten

While silver's unique conductivity and reflectivity make it essential in sectors like electronics and solar energy, ongoing research explores substitutes. Copper and aluminum are being considered for certain electrical components, and novel materials could replace silver in reflective coatings.

However, these alternatives often come with performance trade-offs or increased costs, particularly in high-demand applications. For example, while copper is a good conductor, it's not as efficient as silver in certain sensitive electronic circuits, limiting its immediate widespread adoption as a direct replacement in all scenarios.

Gold and silver are often seen as havens for wealth, but investors have many other places to put their money. Think about government bonds, real estate, stocks, and even newer options like cryptocurrencies. These alternatives can draw money away from precious metals.

For instance, in early 2024, the U.S. 10-year Treasury yield hovered around 4%, offering a competitive return compared to the then-current price of gold. This yield competes directly with the investment appeal of precious metals, especially when economic uncertainty is low.

Investor preferences can change quickly. If interest rates rise or the economic outlook improves, capital might flow out of gold and silver and into assets offering higher yields or growth potential. This dynamic directly affects the demand for the products Fresnillo produces.

The growing efficiency and volume of precious metals recycling, especially from electronic waste and old jewelry, provide a substantial alternative supply. This secondary supply directly competes with newly mined metals, impacting market prices and limiting the potential for increased demand for Fresnillo's primary production.

This trend effectively functions as a substitute for primary mining operations. For instance, silver recycling saw a notable 6% increase in 2024, reaching a twelve-year peak. This surge in recycled silver offers a readily available alternative for industries that might otherwise rely on newly extracted silver.

Technological Advancements in Material Science

Ongoing advancements in material science present a potential threat of substitutes for precious metals like silver and gold. Novel materials could emerge that mimic or even outperform precious metals in specific applications, impacting demand. For instance, research into advanced ceramics and composite materials continues to explore properties that could offer alternatives in electronics or industrial uses, areas where precious metals currently hold sway due to conductivity and inertness. While a complete replacement is improbable due to the intrinsic value and unique characteristics of gold and silver, incremental innovations could gradually diminish their demand in certain niche markets over time. Fresnillo needs to stay vigilant regarding these technological shifts, as even minor inroads by substitute materials can affect market share and pricing power.

The threat of substitutes is amplified by the continuous innovation in material science. Consider the automotive industry, where lightweight alloys and advanced polymers are increasingly replacing traditional metal components. While not a direct substitute for the investment appeal of gold or silver, such shifts in industrial demand can influence overall market dynamics. For example, the demand for silver in the solar panel industry, a significant market for the metal, could be indirectly affected if new photovoltaic technologies emerge that require different materials. Fresnillo’s strategy must account for these evolving material landscapes.

Key areas where material science could pose a threat include:

- Electronics: Development of new conductive materials that could reduce reliance on silver in printed circuit boards or connectors.

- Catalysis: Innovations in non-precious metal catalysts that might replace platinum group metals, indirectly impacting the precious metals market's overall perception and demand drivers.

- Jewelry and Investment: While the intrinsic value and cultural significance of gold and silver are hard to replicate, advancements in lab-grown gemstones or alternative high-value materials could offer substitutes for ornamental or store-of-value purposes.

Substitution for By-Product Metals (Lead and Zinc)

Fresnillo's by-product metals, lead and zinc, encounter a more significant threat from substitutes than its primary silver and gold offerings. In applications like construction and manufacturing, materials such as plastics, various alloys, or entirely different metals can be employed as replacements for lead and zinc. This substitution is often driven by factors including cost-effectiveness, desired performance characteristics, and evolving environmental regulations.

The demand for lead and zinc is therefore more susceptible to shifts based on the accessibility and competitive pricing of these alternative materials. For instance, in 2024, the global zinc market experienced price volatility influenced by supply chain issues and demand from the automotive and construction sectors, where alternative materials are increasingly considered.

- Lead Substitutes: In battery applications, lithium-ion technology continues to gain traction, potentially reducing reliance on lead-acid batteries.

- Zinc Substitutes: For galvanizing steel, alternative coatings or more corrosion-resistant steel alloys are sometimes explored, especially in specific environmental conditions.

- Market Influence: Fluctuations in the price of plastics or aluminum can directly impact the cost-competitiveness of lead and zinc in certain industrial uses.

The threat of substitutes for Fresnillo's core products, silver and gold, is multifaceted, encompassing both investment alternatives and material science innovations. While precious metals retain unique appeal, other assets like government bonds and cryptocurrencies offer competitive returns, particularly when interest rates are favorable, as seen with U.S. 10-year Treasury yields around 4% in early 2024. Simultaneously, advancements in material science are exploring new materials for electronics and industrial applications, potentially reducing reliance on silver, though direct replacements with comparable performance remain challenging.

Furthermore, the increasing efficiency and volume of precious metals recycling act as a direct substitute for newly mined production, with silver recycling seeing a notable 6% increase in 2024, reaching a twelve-year peak. This secondary supply competes with primary extraction, impacting market prices and Fresnillo's output demand. For Fresnillo's by-products, lead and zinc, the threat from substitutes like plastics, alternative alloys, and emerging technologies such as lithium-ion batteries is more pronounced, driven by cost and regulatory factors.

| Substitute Category | Primary Product | Example Substitute | 2024 Impact/Trend | Fresnillo Relevance |

|---|---|---|---|---|

| Investment Alternatives | Gold, Silver | U.S. 10-Year Treasury Bonds | Yields ~4% in early 2024, competing with precious metal investment appeal. | Investor capital diversion from precious metals. |

| Material Science | Silver | Advanced Ceramics, Composite Materials | Ongoing research exploring properties for electronics and industrial uses. | Potential erosion of demand in niche markets due to performance or cost advantages. |

| Recycling | Silver | Recycled Silver from E-waste, Jewelry | Silver recycling increased 6% in 2024, reaching a 12-year peak. | Direct competition with primary production, impacting market prices. |

| Industrial Materials | Lead | Lithium-ion Batteries | Gaining traction, potentially reducing reliance on lead-acid batteries. | Reduced demand for lead in battery applications. |

| Industrial Materials | Zinc | Alternative Steel Coatings, Advanced Alloys | Explored for galvanizing steel, influenced by cost and environmental regulations. | Potential substitution in construction and manufacturing sectors. |

Entrants Threaten

The mining industry, particularly for precious metals like those Fresnillo PLC operates in, demands colossal upfront capital. Think billions of dollars for exploration, developing new mines, building essential infrastructure, and setting up processing facilities. This sheer scale of investment acts as a significant deterrent for potential new competitors looking to enter the market.

For instance, developing a new large-scale mine can easily cost over $1 billion, and often much more. Fresnillo's existing, operational mines, with their established infrastructure and proven reserves, represent a substantial asset base that newcomers would find incredibly difficult and expensive to match, effectively raising the barrier to entry.

The mining industry, particularly for precious metals like silver and gold which Fresnillo Plc focuses on, is characterized by a complex and often lengthy regulatory and permitting landscape. New entrants must navigate a labyrinth of approvals, including rigorous environmental impact assessments, securing land use rights, and obtaining various operational licenses. For instance, in Mexico, where Fresnillo has significant operations, obtaining mining concessions can be a multi-year process involving federal and state agencies.

Compliance with evolving environmental, social, and governance (ESG) standards further escalates the complexity and cost for prospective entrants. These evolving requirements, such as stricter emissions controls and community engagement protocols, demand substantial upfront investment and ongoing operational adjustments. In 2024, the global mining sector continued to see increased scrutiny on ESG performance, with many jurisdictions implementing new regulations or enhancing existing ones, effectively raising the barrier to entry.

The scarcity of proven and accessible precious metals reserves presents a significant barrier to new entrants. Identifying and securing economically viable deposits demands substantial geological expertise and exploration capital, with no certainty of a positive outcome.

Established companies, such as Fresnillo, already hold considerable reserves, making it harder for newcomers to find high-quality, unexploited deposits. These remaining deposits are often in remote or politically unstable areas, increasing the risk and cost for potential new competitors.

Economies of Scale and Operational Experience

Existing large-scale producers like Fresnillo leverage significant economies of scale in production, processing, and procurement, leading to lower per-unit costs. For instance, in 2023, Fresnillo reported total production costs of $1,125 per silver ounce, a figure that would be challenging for a new entrant to replicate immediately.

These established players also possess decades of accumulated operational experience, specialized technical know-how, and robust, pre-existing supply chains. This deep well of expertise translates into greater efficiency and fewer costly mistakes, which are inherent risks for newcomers.

New entrants would face substantial hurdles in matching these cost efficiencies and operational expertise without considerable time and investment. This puts them at a significant competitive disadvantage from the outset, as they must build infrastructure and knowledge from the ground up.

- Economies of Scale: Fresnillo's large-scale operations in 2023 allowed for efficient resource utilization, contributing to competitive production costs.

- Operational Experience: Decades of mining and processing expertise enable Fresnillo to optimize yield and minimize downtime.

- Supply Chain Mastery: Established relationships with suppliers and logistics providers reduce input costs and ensure timely delivery.

- Barriers to Entry: The capital required to establish comparable operational scale and experience presents a formidable barrier for potential new entrants in the silver mining sector.

Brand Recognition and Market Access

New entrants face significant hurdles in establishing brand recognition and securing market access within the precious metals sector. While precious metals are commodities, established players like Fresnillo Plc have cultivated deep-rooted relationships with refiners, traders, and key industrial consumers. These existing ties are crucial for ensuring efficient and reliable off-take of products, a factor that new entrants would need considerable time and effort to replicate. For instance, Fresnillo's 2024 performance, characterized by consistent production and strong financial results, underscores its established market position and the trust it commands from buyers.

Building credibility and demonstrating consistent quality are paramount for market penetration. New companies must not only produce but also prove their reliability in a market where supply chain integrity and product specifications are non-negotiable. Fresnillo's long-standing reputation as a leading and dependable producer of silver and gold inherently acts as a formidable barrier, making it difficult for newcomers to gain traction and secure favorable terms with buyers and intermediaries. This established trust is a significant competitive advantage that new entrants must overcome.

- Established Relationships: Fresnillo benefits from long-standing connections with refiners, traders, and industrial buyers, ensuring smooth market access.

- Credibility and Reliability: New entrants must build trust and demonstrate consistent quality, which takes time and significant effort in the precious metals market.

- Brand Recognition: Fresnillo's strong reputation as a leading producer creates a significant barrier to entry for new companies seeking market share.

- Market Access Hurdles: Overcoming the established networks and buyer confidence enjoyed by incumbents is a major challenge for new market participants.

The threat of new entrants in the precious metals mining sector, where Fresnillo operates, is generally low due to substantial barriers. The immense capital required for exploration, mine development, and infrastructure, often exceeding $1 billion for a single large-scale mine, is a primary deterrent. Furthermore, navigating complex and lengthy regulatory processes, including environmental permits and land rights, adds years and significant cost to market entry. For example, in Mexico, obtaining mining concessions is a multi-year endeavor. In 2024, increased ESG scrutiny globally further elevated these entry costs and complexities.

| Barrier Category | Description | Impact on New Entrants | Example Data/Context |

| Capital Requirements | High upfront investment for exploration, development, and infrastructure. | Significant financial hurdle, limiting the pool of potential entrants. | Developing a new large-scale mine can cost over $1 billion. |

| Regulatory & Permitting | Complex, lengthy processes for approvals, environmental assessments, and land rights. | Time-consuming and costly, requiring deep knowledge of local laws. | Multi-year process for mining concessions in Mexico. |

| ESG Compliance | Meeting evolving environmental, social, and governance standards. | Increases operational costs and demands significant upfront investment. | Stricter emissions controls and community engagement protocols. |

| Resource Availability | Scarcity of proven, accessible, and economically viable precious metal deposits. | Difficult to secure high-quality reserves, often located in remote or risky areas. | Established players like Fresnillo hold significant proven reserves. |

| Economies of Scale & Experience | Established producers benefit from lower per-unit costs and operational expertise. | New entrants face higher initial costs and operational inefficiencies. | Fresnillo's 2023 production cost was $1,125 per silver ounce. |

| Market Access & Relationships | Established networks with refiners, traders, and buyers. | New entrants struggle to secure reliable off-take and favorable terms. | Fresnillo's 2024 performance reflects established market trust. |

Porter's Five Forces Analysis Data Sources

Our Fresnillo Porter's Five Forces analysis is built upon a robust foundation of data, drawing from annual reports, investor presentations, and regulatory filings from Fresnillo plc and its key competitors. We also incorporate industry-specific market research reports and commodity price data from reputable sources to gauge competitive intensity and market dynamics.