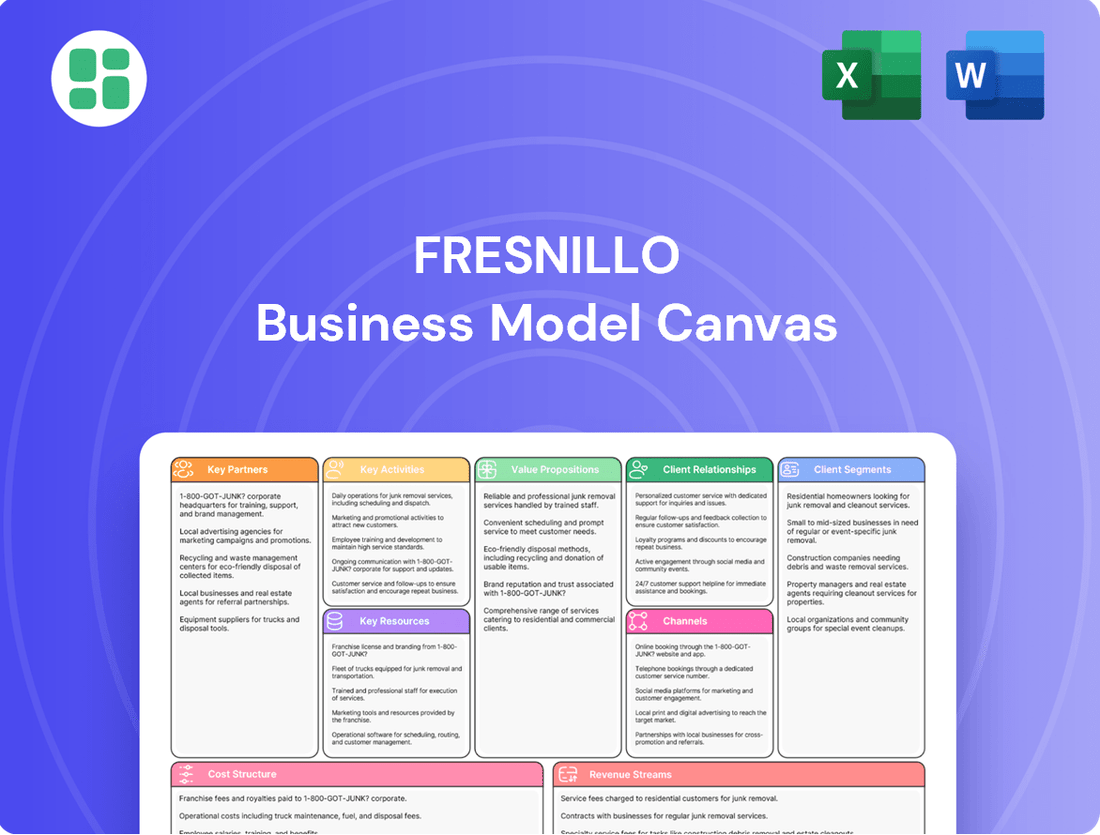

Fresnillo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresnillo Bundle

Unlock the strategic blueprint behind Fresnillo's success with our comprehensive Business Model Canvas. Discover how they create value, reach customers, and manage resources in the competitive mining industry. This in-depth analysis is perfect for anyone looking to understand and replicate effective business strategies.

Partnerships

Fresnillo plc maintains crucial relationships with strategic suppliers and contractors who provide essential mining equipment, advanced technology, and specialized operational services. These partnerships are vital for securing state-of-the-art machinery and expert knowledge, underpinning efficient extraction and processing activities.

In 2024, Fresnillo continued to leverage these alliances to ensure access to critical components and services, such as specialized drilling equipment and advanced processing technologies. For instance, their ongoing investment in automation and digital solutions relies heavily on the expertise and supply chains of key technology providers, directly impacting operational efficiency and cost management.

Fresnillo's operations are intrinsically linked to collaboration with Mexican government entities and regulatory agencies. This partnership is essential for securing and upholding mining concessions, obtaining necessary permits, and ensuring strict adherence to environmental protection standards and labor legislation. For instance, in 2024, the company continued its engagement with agencies like the Ministry of Economy and SEMARNAT to manage its extensive portfolio of exploration and exploitation rights across Mexico.

Fresnillo plc's strategic alliances with financial institutions are paramount for funding its extensive operations. These partnerships with banks and other lenders are critical for securing the substantial capital required for exploration ventures, the development of new mining sites, and ongoing capital expenditures necessary to maintain and expand its production capacity.

In 2024, Fresnillo plc reported significant capital expenditure, underscoring the reliance on robust financial backing. For instance, the company's investment in projects like the San Julián mine expansion demonstrates the need for consistent access to credit lines and project financing, often facilitated by these key financial partners.

Local Communities and Indigenous Groups

Engaging with local communities and Indigenous groups is paramount for securing a social license to operate and fostering community support, particularly for mining operations like Fresnillo. These relationships are crucial for effectively managing social impacts and ensuring that development benefits are shared. In 2024, Fresnillo plc continued to emphasize these partnerships, recognizing their integral role in long-term sustainability and operational continuity.

Partnerships with these groups typically manifest through formal agreements. These agreements often outline commitments regarding local employment opportunities, investment in community development projects such as education and infrastructure, and collaborative approaches to environmental stewardship. Fresnillo's commitment to these principles is reflected in its ongoing dialogue and program development with stakeholders in its operating regions.

- Community Investment: Fresnillo plc's social responsibility programs in 2024 focused on tangible benefits for local communities, including infrastructure improvements and educational support, aiming to build trust and shared prosperity.

- Employment and Local Sourcing: A key aspect of these partnerships involves prioritizing local hiring and sourcing goods and services from local suppliers, thereby injecting economic benefits directly into the communities where Fresnillo operates.

- Environmental Stewardship: Collaborative efforts with Indigenous groups and local communities are vital for responsible environmental management, ensuring that mining activities are conducted with respect for natural resources and cultural heritage.

Exploration and Joint Venture Partners

Fresnillo PLC actively seeks strategic alliances with other mining entities to mitigate the substantial financial and operational risks inherent in exploration and development. These partnerships allow for the sharing of capital expenditure and the pooling of specialized geological and engineering knowledge, thereby enhancing the probability of successful discovery and efficient resource extraction.

In 2024, Fresnillo continued to assess opportunities for joint ventures and exploration agreements, particularly in prospective regions where its own expertise might be complemented by partners. Such collaborations are crucial for accelerating the pace of new project evaluation and for expanding the company's overall resource base, ensuring long-term growth and sustainability.

- Risk Sharing: Joint ventures distribute the significant upfront costs and exploration risks associated with identifying and developing new mineral deposits among multiple parties.

- Expertise Leverage: Collaborations allow Fresnillo to tap into the specific technical skills, geological insights, or operational experience of partner companies, optimizing project execution.

- Accelerated Development: By pooling resources and expertise, these partnerships can significantly shorten the timeline from discovery to production for new mining projects.

- Resource Expansion: Joint ventures facilitate access to larger or more complex exploration targets that might be beyond the scope or risk appetite of a single company.

Fresnillo plc relies on a network of specialized suppliers for mining equipment, technology, and services. These partnerships are critical for accessing advanced machinery and expertise, ensuring efficient extraction and processing. In 2024, the company continued to invest in automation and digital solutions, heavily dependent on technology providers for these advancements.

Collaboration with Mexican government bodies is essential for maintaining mining concessions, permits, and regulatory compliance, including environmental and labor laws. Fresnillo's engagement in 2024 with entities like the Ministry of Economy and SEMARNAT highlights the importance of these relationships for its operational rights.

Financial institutions are key partners for Fresnillo, providing the substantial capital needed for exploration, mine development, and ongoing capital expenditures. The company's significant capital investments in 2024, such as the San Julián expansion, underscore this reliance on financial backing.

Building strong relationships with local communities and Indigenous groups is vital for Fresnillo's social license to operate and long-term sustainability. In 2024, the company continued its focus on these partnerships, which often involve commitments to local employment, community development, and environmental stewardship.

Strategic alliances with other mining companies help Fresnillo mitigate financial and operational risks in exploration and development. These joint ventures allow for the sharing of capital expenditure and technical knowledge, as seen in 2024 with ongoing assessments of exploration agreements to expand its resource base.

What is included in the product

A detailed breakdown of Fresnillo's operations, outlining its key customer segments, value propositions, and revenue streams within the mining industry.

The Fresnillo Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their operations, allowing for swift identification and resolution of inefficiencies.

It simplifies complex mining processes into a digestible, one-page snapshot, easing the burden of understanding and managing multifaceted challenges.

Activities

Fresnillo's core activity revolves around discovering and meticulously defining new mineral deposits. This crucial process involves sophisticated geological surveys, extensive drilling campaigns, and advanced resource modeling to accurately assess the quantity and quality of valuable minerals.

This ongoing exploration is vital for Fresnillo's future, as it directly contributes to replenishing the company's mineral reserves and ensuring the long-term viability of its mining operations. For instance, in 2023, Fresnillo reported total attributable gold reserves of 10.4 million ounces and silver reserves of 660.6 million ounces, underscoring the importance of these definition activities.

Mine development and construction are core activities, involving the creation of new mining sites or the expansion of existing ones. This includes essential tasks like sinking shafts, excavating tunnels, and building the necessary infrastructure to support ore extraction operations.

This phase requires substantial capital outlay and specialized engineering know-how to ready the sites for production. For instance, Fresnillo plc's significant investments in projects like the San Julián Chispas expansion in 2024 underscore the capital-intensive nature of this key activity.

Fresnillo's fundamental activities revolve around the secure and effective extraction of precious and base metals, including silver, gold, lead, and zinc. This process is carried out through both underground and open-pit mining methods, demanding meticulous planning and sophisticated operational execution.

In 2023, Fresnillo plc reported a total attributable silver production of 52.5 million ounces, alongside 563.1 thousand ounces of gold. The company's operational focus remains on optimizing these extraction processes to ensure safety and efficiency across its diverse mining sites.

Mineral Processing and Beneficiation

Mineral processing and beneficiation are central to Fresnillo's operations, transforming raw ore into valuable commodities. This intricate process involves crushing and grinding the ore to liberate the metals, followed by flotation to concentrate the silver and gold. In 2024, Fresnillo plc reported significant progress in its processing capabilities, with a focus on optimizing recovery rates across its various mines, contributing to their overall production targets.

The company's sophisticated metallurgical plants are designed to handle diverse ore types, ensuring efficient separation of not only silver and gold but also valuable by-products like lead and zinc. These concentrates and doré bars are then further refined. For instance, Fresnillo's operations in Mexico are equipped with advanced smelting and refining technologies, crucial for meeting international quality standards for their precious metals.

- Processing Capacity: Fresnillo's processing plants are designed to handle millions of tonnes of ore annually, a testament to their scale.

- Recovery Rates: Continuous investment in metallurgical technology aims to maximize the recovery of silver and gold, often exceeding 90% for key metals.

- By-product Value: The efficient beneficiation of lead and zinc concentrates adds significant revenue streams, diversifying their product mix.

- Operational Efficiency: In 2024, the company focused on energy efficiency and water management within its processing operations, aligning with sustainability goals.

Environmental Management and Sustainability Initiatives

Fresnillo PLC actively implements comprehensive environmental management systems, focusing on minimizing its operational impact. This includes significant investment in reclamation efforts, where mined areas are restored to a natural state, aiming to achieve biodiversity targets. In 2024, the company continued its commitment to water conservation, with initiatives designed to reduce freshwater consumption across its operations.

Energy efficiency programs are also a cornerstone of Fresnillo's sustainability strategy. The company is exploring and implementing technologies to lower its carbon footprint. For instance, in 2024, Fresnillo reported progress in its energy efficiency projects, contributing to a more sustainable operational model and ensuring compliance with stringent environmental regulations.

- Environmental Management Systems: Fresnillo maintains ISO 14001 certified environmental management systems across its sites.

- Reclamation Efforts: In 2024, the company continued its progressive rehabilitation of mined land, with specific targets for vegetation cover and ecosystem recovery.

- Water Conservation: Fresnillo's water management strategy focuses on increasing water recycling and reducing reliance on freshwater sources, achieving a significant reduction in water intensity per tonne of ore processed in 2024.

- Energy Efficiency: The company is investing in energy-efficient technologies and exploring renewable energy sources to reduce its greenhouse gas emissions.

Fresnillo's key activities encompass the entire mining lifecycle, from initial discovery to the final sale of refined metals. This includes the critical stages of exploration, mine development, ore extraction, and the subsequent processing and beneficiation of minerals. The company also places a strong emphasis on environmental stewardship and operational efficiency throughout these processes.

The company's focus on exploration and resource definition ensures a pipeline of future mining opportunities. Mine development and construction are capital-intensive but essential for expanding production capacity. Efficient extraction and processing are paramount for maximizing metal recovery and profitability.

Environmental management and sustainability are integrated into all operations, reflecting a commitment to responsible mining practices. Fresnillo's operational performance in 2023 and ongoing projects in 2024 highlight their dedication to these core activities.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Exploration & Resource Definition | Discovering and defining new mineral deposits. | Attributable silver reserves of 660.6 million ounces (2023). |

| Mine Development & Construction | Creating or expanding mining sites. | Significant investment in San Julián Chispas expansion (2024). |

| Ore Extraction | Safely and effectively extracting precious and base metals. | 52.5 million ounces of silver produced (2023). |

| Mineral Processing & Beneficiation | Transforming raw ore into valuable commodities. | Focus on optimizing recovery rates across mines (2024). |

| Environmental Management | Minimizing operational impact and restoring mined areas. | Continued commitment to water conservation initiatives (2024). |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you're previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this fully editable and ready-to-use Business Model Canvas, allowing you to immediately apply its insights to Fresnillo's strategic planning.

Resources

Fresnillo's most crucial asset is its vast, high-grade silver and gold reserves, predominantly situated in Mexico. These geological endowments form the bedrock of its production capabilities and enduring value.

As of December 31, 2023, Fresnillo plc reported proven and probable mineral reserves of 709.4 million ounces of silver and 10.1 million ounces of gold. This substantial resource base underpins its operational longevity and future growth potential.

Fresnillo's key resources include its extensive mining and processing infrastructure, a critical component of its business model. This encompasses a wide array of physical assets vital for extracting and refining precious metals.

These assets comprise a vast network of mines, sophisticated processing plants, and essential tailings facilities. Furthermore, the company relies on associated infrastructure such as reliable power supply, water management systems, and robust transportation networks to support its operations.

In 2024, Fresnillo continued to invest in and maintain this infrastructure, recognizing its direct impact on operational efficiency and production capacity. The company's ability to effectively manage and upgrade these facilities is fundamental to its success in the competitive mining sector.

Fresnillo's success hinges on its highly skilled workforce, encompassing geologists, engineers, miners, and metallurgists. This human capital is crucial for maintaining efficient and safe operations across all its mining and processing activities.

Experienced management provides the strategic direction and operational oversight necessary for innovation and excellence. In 2023, Fresnillo reported that its workforce comprised approximately 7,600 employees, reflecting a significant investment in skilled labor.

Financial Capital and Access to Funding

Fresnillo PLC requires significant financial capital to fuel its extensive operations, from the initial stages of exploration and mine development to ongoing operational costs and necessary technological advancements. In 2024, the company's robust financial position and established access to capital markets are crucial for its continued growth and long-term sustainability, enabling it to undertake large-scale projects and navigate market volatility.

The company's financial strategy hinges on maintaining strong financial health to secure funding for its ambitious growth plans. This includes investments in new technologies and potential acquisitions to enhance its competitive edge in the precious metals sector.

- Capital Requirements: Exploration, mine development, and operational expenditures necessitate substantial financial backing.

- Access to Capital Markets: Maintaining a strong credit rating and positive investor relations is vital for raising funds.

- Financial Health: Profitability, cash flow generation, and a sound balance sheet are key indicators for securing future financing.

- Investment in Technology: Funding for innovation and upgrades ensures operational efficiency and competitiveness.

Proprietary Technology and Operational Know-how

Fresnillo's proprietary technology and operational know-how are cornerstones of its success. They employ advanced mining and processing techniques, particularly honed for deep underground operations. This expertise directly translates to improved efficiency and safety in their mines.

This accumulated knowledge allows Fresnillo to achieve higher recovery rates for precious metals. For instance, in 2023, Fresnillo reported a silver production of 52.6 million ounces and gold production of 622.9 thousand ounces, demonstrating the effectiveness of their operational capabilities.

- Advanced Mining and Processing: Fresnillo utilizes cutting-edge technology in its mining and processing operations, optimizing resource extraction.

- Deep Underground Expertise: The company possesses specialized knowledge and experience in navigating and operating in deep underground mining environments.

- Efficiency and Safety Gains: This proprietary know-how directly contributes to enhanced operational efficiency and a strong safety record.

- Enhanced Recovery Rates: Fresnillo's technological and operational advancements result in superior recovery rates for silver and gold.

Fresnillo's key resources are its substantial silver and gold reserves, extensive mining and processing infrastructure, a skilled workforce, significant financial capital, and proprietary operational know-how. These elements collectively enable the company to efficiently extract and process precious metals, ensuring its competitive position in the global market.

The company's vast geological endowments, particularly in Mexico, provide a stable foundation for production. This is complemented by significant investments in maintaining and upgrading its physical assets, including mines and processing plants. Furthermore, Fresnillo's human capital, comprising experienced geologists, engineers, and management, is vital for operational excellence and strategic decision-making.

Access to substantial financial capital is critical for exploration, development, and technological advancements, ensuring Fresnillo can pursue growth opportunities. Its proprietary technology and deep underground mining expertise contribute to higher recovery rates and operational efficiency, as demonstrated by its production figures.

| Resource Category | Key Components | 2023 Data/Significance |

|---|---|---|

| Mineral Reserves | Silver and Gold Deposits | 709.4 million oz Silver, 10.1 million oz Gold (proven & probable as of Dec 31, 2023) |

| Infrastructure | Mines, Processing Plants, Tailings Facilities | Extensive network supporting operations; ongoing investment in 2024 |

| Human Capital | Skilled Workforce & Management | Approx. 7,600 employees in 2023; essential for operations and strategy |

| Financial Capital | Funding for Operations & Growth | Robust financial position and access to capital markets in 2024 |

| Proprietary Know-How | Mining & Processing Technology | Advanced techniques leading to higher recovery rates; 52.6Moz Silver, 622.9Koz Gold produced in 2023 |

Value Propositions

Fresnillo plc is a significant global player, renowned for its substantial output of high-purity silver and gold. This consistent, high-quality production directly addresses the rigorous demands of industrial applications, discerning investment buyers, and the intricate craftsmanship of the jewelry sector. The company's global leadership as the largest primary silver producer solidifies this value proposition, assuring customers of a dependable and premium source of precious metals.

Fresnillo's business model leverages strategic by-product metals, notably lead and zinc, alongside its primary precious metals. This diversification not only broadens its product portfolio but also enhances its contribution to essential industrial supply chains.

In 2024, Fresnillo's lead production reached 59.4 thousand tonnes, while zinc output stood at 71.2 thousand tonnes. These figures underscore the significant volume of these by-products, adding substantial incremental value beyond gold and silver.

Fresnillo PLC demonstrates a strong commitment to responsible and sustainable mining, a key value proposition for its stakeholders. This dedication appeals to a growing segment of customers and investors who increasingly prioritize environmental stewardship and ethical sourcing in their investment and purchasing decisions.

The company actively adheres to rigorous international standards for environmental management and social responsibility. For instance, in 2024, Fresnillo continued its focus on reducing greenhouse gas emissions, aiming to achieve a 55% reduction by 2030 from a 2019 baseline, showcasing tangible progress in its sustainability goals.

Furthermore, Fresnillo emphasizes robust community engagement programs. These initiatives are designed to foster positive relationships and contribute to the socio-economic development of the regions where it operates, reinforcing its social license to operate and enhancing its reputation as a responsible corporate citizen.

Reliable and Consistent Supply Chain

Fresnillo, as a leading global producer, ensures a reliable and consistent supply of precious metals. This large-scale output provides crucial stability and predictability for various stakeholders, including refiners, industrial consumers, and financial institutions that depend on uninterrupted deliveries. For instance, in 2023, Fresnillo reported total silver production of 55.9 million ounces and gold production of 597.5 thousand ounces, underscoring its capacity to meet significant demand.

This consistent flow directly translates to reduced supply chain risk for buyers. Knowing they can depend on Fresnillo's output allows partners to plan their operations and inventory management with greater confidence, avoiding the disruptions that can plague markets with more volatile supply.

- Consistent Large-Scale Output: Fresnillo's operational scale guarantees substantial volumes of silver and gold.

- Predictability for Buyers: Refiners and industrial users benefit from predictable delivery schedules.

- Reduced Supply Chain Risk: Partners experience greater certainty and fewer disruptions in their metal sourcing.

- Financial Market Stability: Financial institutions rely on this steadiness for hedging and investment strategies.

Investment Opportunity in Precious Metals

For investors, Fresnillo PLC offers a direct avenue to participate in the silver and gold markets. This appeal is bolstered by the company's robust asset portfolio and a history of consistent operational performance, presenting a compelling case for commodity-linked investments.

Fresnillo's value proposition for investors centers on its status as a publicly traded entity providing exposure to precious metals. The company's strong asset base, coupled with its proven operational capabilities and prospects for future growth, makes it an attractive option for those looking to diversify into commodities.

- Exposure to Precious Metals: Direct investment opportunity in silver and gold prices.

- Strong Asset Base: Backed by significant mineral reserves and resources.

- Proven Operational Track Record: Demonstrated ability to efficiently extract and process metals.

- Growth Potential: Opportunities for expansion and development of new projects.

Fresnillo's value proposition is built on being the world's largest primary silver producer and a significant gold producer, offering high-purity precious metals. This ensures a reliable and premium supply for industrial, investment, and jewelry sectors. Additionally, the company strategically utilizes by-product metals like lead and zinc, contributing to essential industrial supply chains and broadening its product offering.

In 2024, Fresnillo's operational scale was evident with lead production at 59.4 thousand tonnes and zinc at 71.2 thousand tonnes, complementing its precious metal output. The company's commitment to sustainability is a key differentiator, appealing to environmentally conscious consumers and investors, with a target to reduce greenhouse gas emissions by 55% by 2030 from a 2019 baseline.

This consistent, large-scale output provides crucial supply chain stability for buyers, reducing risk and enabling better operational planning. For investors, Fresnillo offers direct exposure to precious metals through its strong asset base and proven operational track record, presenting a compelling commodity-linked investment opportunity.

| Metric | 2023 Value | 2024 Target/Estimate |

|---|---|---|

| Silver Production (million ounces) | 55.9 | 55.0 - 57.0 |

| Gold Production (thousand ounces) | 597.5 | 600 - 620 |

| Lead Production (thousand tonnes) | N/A (reported 59.4 in 2024) | 58.0 - 62.0 |

| Zinc Production (thousand tonnes) | N/A (reported 71.2 in 2024) | 68.0 - 72.0 |

Customer Relationships

Fresnillo PLC cultivates direct sales channels with key players like major refiners, industrial consumers, and commodity traders. This direct engagement, often formalized through long-term supply contracts, is crucial for securing consistent demand and predictable revenue. For instance, in 2023, Fresnillo reported that its sales volumes were primarily driven by these direct relationships, underscoring their importance for financial stability.

Fresnillo plc prioritizes transparent and proactive communication with its investor base. In 2024, the company continued its commitment to regular financial reporting, including quarterly updates and detailed annual reports, ensuring stakeholders have timely access to performance data.

Investor calls and presentations are key tools for engagement. These sessions allow management to discuss operational highlights, financial results, and strategic outlooks, fostering trust and facilitating capital attraction. For instance, Fresnillo's 2023 full-year results presentation in February 2024 provided insights into production volumes and cost management.

The company actively seeks to build strong relationships with both individual and institutional investors. This includes responding to inquiries, providing clear guidance, and ensuring accessibility to key decision-makers, which is vital for maintaining investor confidence and supporting long-term capital growth.

Fresnillo PLC's commitment to exceptional technical support and rigorous product quality assurance is a cornerstone of its customer relationships. By providing tailored assistance and ensuring consistent adherence to precise metal purity and form specifications, Fresnillo cultivates trust and loyalty with its industrial clientele.

In 2024, Fresnillo continued its focus on delivering high-quality silver and gold. For instance, their Zacatecas operations consistently aim for high purity levels, often exceeding 99.9% for silver, a critical factor for industrial applications like electronics and medical devices. This dedication to quality, coupled with responsive technical support to meet specific customer needs, reinforces their position as a reliable supplier.

Commodity Market Engagement

Fresnillo PLC actively engages with global commodity exchanges and trading platforms. This interaction is crucial for selling its precious metals and discovering fair market prices. While these aren't personal relationships, being a constant presence is vital for market access.

In 2024, Fresnillo's sales were significantly influenced by these market interactions. For instance, the price discovery on exchanges directly impacts the revenue generated from its silver and gold output. The company's ability to efficiently trade on these platforms underpins its financial performance.

- Market Access: Participation on exchanges like the London Metal Exchange (LME) and the COMEX division of the CME Group ensures Fresnillo can sell its output.

- Price Discovery: Real-time trading on these platforms provides benchmarks for silver and gold prices, impacting Fresnillo's revenue.

- Liquidity: Active engagement contributes to market liquidity, facilitating smoother transactions for Fresnillo's production.

- 2024 Performance: Fresnillo reported strong production figures in early 2024, with its silver production reaching 65.3 million ounces in the first half of the year, directly benefiting from established market pricing mechanisms.

ESG Communication and Stakeholder Dialogue

Fresnillo Plc actively engages with investors prioritizing Environmental, Social, and Governance (ESG) criteria. This dialogue is crucial for building trust and showcasing the company's commitment to sustainable mining practices, which is increasingly important for attracting capital. In 2024, Fresnillo continued its efforts to transparently communicate its ESG performance, responding to growing stakeholder interest in these non-financial aspects of business.

The company understands that robust stakeholder dialogue extends beyond financial reporting. By proactively addressing concerns raised by non-governmental organizations (NGOs) and other community representatives, Fresnillo aims to foster positive relationships and manage potential risks associated with its operations. This approach helps to solidify its reputation as a responsible corporate citizen.

- ESG Investor Engagement: Fresnillo actively participates in ESG-focused forums and provides detailed sustainability reports to meet the demands of investors who integrate ESG factors into their decision-making.

- Stakeholder Dialogue: The company maintains open channels of communication with NGOs and local communities to address environmental and social impacts, ensuring their concerns are heard and considered.

- Reputation Building: Consistent and transparent communication on ESG matters strengthens Fresnillo's brand image and addresses the growing non-financial expectations of a diverse stakeholder base.

Fresnillo PLC focuses on building strong, direct relationships with major refiners, industrial consumers, and commodity traders. These partnerships, often solidified through long-term supply agreements, are fundamental for ensuring consistent demand and predictable revenue streams. In 2023, these direct sales channels were a primary driver of Fresnillo's sales volumes, highlighting their critical role in the company's financial stability.

The company also prioritizes transparent communication with its investor base, providing regular financial updates and detailed reports to ensure stakeholders have timely access to performance data. Investor calls and presentations are key to discussing operational highlights and strategic outlooks, fostering trust and attracting capital. For instance, Fresnillo's 2023 full-year results presentation in February 2024 offered insights into production and cost management.

Fresnillo actively engages with global commodity exchanges like the London Metal Exchange and COMEX, which is vital for selling its precious metals and determining fair market prices. This consistent market presence ensures access and price discovery, directly impacting revenue. In the first half of 2024, Fresnillo's silver production reached 65.3 million ounces, benefiting from these established market pricing mechanisms.

Channels

Fresnillo primarily utilizes direct sales channels, shipping its precious metal concentrates and doré directly to refiners and industrial users across the globe. This approach facilitates direct negotiation, enabling the company to establish tailored supply agreements that meet specific customer needs and market conditions.

In 2024, Fresnillo's direct sales strategy was a cornerstone of its revenue generation. For instance, the company reported that its total sales volume for silver concentrates and doré in the first quarter of 2024 was approximately 16.7 million ounces and 176,500 ounces, respectively, all of which were sold under these direct arrangements.

Fresnillo PLC may leverage global commodity markets and exchanges to sell specific metals or any surplus production. These platforms are crucial for achieving competitive pricing and ensuring efficient sales channels.

In 2024, the London Metal Exchange (LME) and the COMEX division of CME Group remain key venues for trading precious and base metals. For instance, silver prices on COMEX saw significant volatility, trading in a range that reflected global industrial demand and investment flows, providing Fresnillo with benchmarks for its sales.

Utilizing these exchanges offers Fresnillo enhanced market access and liquidity, allowing for the sale of metals at prevailing global prices. This strategy is particularly important for managing price discovery on products where direct off-take agreements might not cover all volumes or for optimizing sales of less common metal by-products.

Fresnillo plc relies on a comprehensive logistics and shipping network to move its precious metals. This includes partnerships with specialized freight companies ensuring the secure and timely transport of concentrates and doré bars from its Mexican mines to global customers. In 2024, Fresnillo's efficient supply chain is paramount for meeting international demand and maintaining its competitive edge.

Investor Relations Platforms (Websites, Reports)

Fresnillo plc leverages its corporate website, annual reports, and financial disclosures as crucial channels to engage and inform its investor base. These platforms are designed to offer transparency regarding the company's operational and financial performance, ensuring stakeholders have readily available data for their decision-making processes.

These investor relations platforms provide a comprehensive view of Fresnillo's activities, including detailed operational updates and financial results. For instance, the company's 2023 annual report highlighted a significant increase in silver production, reaching 54.7 million ounces, and gold production of 613,000 ounces, demonstrating its robust output capabilities.

- Corporate Website: Serves as a central hub for all investor-related information, including news, presentations, and financial filings.

- Annual Reports: Offer in-depth analysis of the company's performance, strategy, and outlook, providing a holistic view for investors.

- Financial Disclosures: Timely releases of quarterly and annual financial statements ensure investors have up-to-date information on the company's financial health.

- Investor Presentations: Provide concise summaries and strategic insights, often delivered by senior management, to clarify performance and future plans.

Industry Conferences and Trade Shows

Fresnillo PLC actively participates in key industry conferences and trade shows, such as the Prospectors & Developers Association of Canada (PDAC) convention and LME Week. These events are crucial for networking with potential customers, suppliers, and financial institutions, and for showcasing the company's operational advancements and exploration successes. In 2023, PDAC saw over 1,300 exhibitors and drew more than 30,000 attendees, highlighting the scale of these networking opportunities.

These gatherings provide a platform to present Fresnillo's latest exploration results and production updates, reinforcing its position as a leading silver and gold producer. For instance, at the 2024 BMO Global Metals & Mining Conference, Fresnillo's management discussed their strategic outlook and project pipeline, engaging directly with investors and analysts. Such interactions are vital for maintaining investor confidence and securing capital for future growth initiatives.

- Networking Opportunities: Connect with potential customers, partners, and investors at major mining events.

- Market Intelligence: Gain insights into emerging trends, technological advancements, and competitive landscapes.

- Brand Visibility: Showcase operations, exploration successes, and corporate strategy to a global audience.

- Investor Relations: Engage with the financial community to communicate value and future prospects.

Fresnillo's channels are primarily direct sales to refiners and industrial users, ensuring tailored agreements. They also leverage global commodity markets like COMEX for price discovery and liquidity, especially for surplus or by-product metals. Crucially, Fresnillo utilizes its corporate website and financial disclosures for investor relations, alongside active participation in industry conferences such as PDAC and LME Week to foster relationships and market intelligence.

| Channel Type | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales | Selling concentrates and doré directly to refiners/industrial users. | Q1 2024 sales: 16.7M oz silver concentrates, 176.5K oz doré. |

| Commodity Markets | Utilizing exchanges like COMEX for price benchmarks and liquidity. | COMEX silver prices in 2024 reflected industrial demand and investment flows. |

| Investor Relations | Corporate website, annual reports, financial disclosures. | 2023 Annual Report showed 54.7M oz silver, 613K oz gold production. |

| Industry Events | Conferences like PDAC, LME Week for networking and market intelligence. | PDAC 2023 had over 30,000 attendees; BMO Metals & Mining Conference 2024 included Fresnillo management. |

Customer Segments

Precious metal refiners represent a core customer segment for Fresnillo. These entities are crucial as they transform Fresnillo's doré and concentrates into highly purified silver and gold. This processing enables the metals to be utilized in a wide array of industrial, jewelry, and investment applications.

These refiners are typically large-scale operations, engaging in high-volume, long-term purchase agreements with Fresnillo. For instance, in 2023, Fresnillo’s total silver production reached 63.7 million ounces, and gold production was 598.5 thousand ounces, underscoring the significant throughput these refiners manage.

Industrial consumers, particularly those in electronics, solar energy, photography, and medical device manufacturing, represent a crucial customer segment for precious metals. These sectors rely on the unique properties of silver and gold, demanding consistent quality and unwavering supply reliability to maintain their production cycles. For instance, the global solar panel market, a significant consumer of silver, was projected to reach over $300 billion by 2024, highlighting the scale of demand for this industrial application.

Commodity traders and financial institutions are key players, actively engaging in the physical trading of silver and gold. They serve as vital links, connecting producers like Fresnillo with consumers, while also participating for investment and speculative gains. Their involvement is fundamental to maintaining market liquidity and facilitating accurate price discovery.

In 2024, the global precious metals market continued to see robust activity. For instance, the average daily trading volume for gold futures on the COMEX exchange remained substantial, reflecting consistent institutional participation. Similarly, silver ETFs saw significant inflows throughout the year, demonstrating sustained interest from financial institutions looking to gain exposure to the metal.

Investors (Institutional and Retail)

Investors, both institutional and retail, form a vital customer segment for Fresnillo. While they don't purchase the company's physical silver or gold directly, their capital is essential. They provide funding through the purchase of Fresnillo's shares on stock exchanges, anticipating financial returns based on the company's operational success and the fluctuating prices of precious metals.

In 2024, Fresnillo's market capitalization fluctuated, reflecting investor sentiment and market conditions. For instance, as of mid-2024, the company's stock performance was closely watched by a diverse range of investors, from large pension funds to individual traders, all seeking growth and income from their investment in this leading precious metals producer.

- Capital Provision: Investors supply crucial equity capital, enabling Fresnillo to fund operations, exploration, and expansion projects.

- Return Expectations: They seek capital appreciation and potential dividends, driven by factors like commodity prices, production volumes, and cost management.

- Market Influence: Investor confidence and trading activity directly impact Fresnillo's share price and overall market valuation.

- Information Demand: This segment requires transparent and timely financial reporting, operational updates, and strategic outlooks to make informed decisions.

Base Metal Consumers (for Lead and Zinc)

Fresnillo serves industrial consumers who rely on lead for essential applications like automotive batteries and construction materials. These sectors represent a significant demand driver for the company's lead by-product.

Zinc, another key by-product, is vital for galvanizing steel to prevent corrosion and for manufacturing various alloys used in diverse industries. This broad utility underpins Fresnillo's zinc market presence.

- Lead Applications: Batteries (automotive, industrial), construction (pipes, roofing).

- Zinc Applications: Galvanizing (steel protection), alloys (brass, die-casting), chemicals.

- Market Contribution: By-products like lead and zinc contribute to Fresnillo's overall revenue diversification, operating independently from its primary precious metals business.

Precious metal refiners are essential partners, processing Fresnillo's doré and concentrates into high-purity silver and gold for various industrial, jewelry, and investment uses. These are typically large-scale operations with long-term agreements, handling substantial volumes of metals. In 2023, Fresnillo produced 63.7 million ounces of silver and 598.5 thousand ounces of gold, demonstrating the scale of these refining partnerships.

Industrial consumers, especially in electronics, solar energy, and medical devices, are critical customers for silver and gold due to their unique properties. These sectors require consistent quality and reliable supply. The global solar panel market, a major silver consumer, was projected to exceed $300 billion by 2024, indicating significant industrial demand.

Commodity traders and financial institutions play a crucial role in the physical trading of precious metals, linking producers to consumers and contributing to market liquidity and price discovery. Their active participation in 2024, seen through substantial trading volumes and ETF inflows, underscores their importance.

Investors, both institutional and retail, are vital for providing equity capital through share purchases, enabling Fresnillo's operations and growth. Their investment decisions are influenced by commodity prices, production levels, and overall market conditions. Fresnillo's market capitalization in mid-2024 reflected this investor engagement.

Fresnillo also serves industrial consumers who utilize lead, a by-product, in automotive batteries and construction. Zinc, another key by-product, is essential for galvanizing steel and creating alloys. These by-products contribute to revenue diversification.

| Customer Segment | Key Needs | 2023/2024 Data Points |

|---|---|---|

| Precious Metal Refiners | High-purity metals, large volumes, long-term contracts | 63.7 million oz silver, 598.5 thousand oz gold produced (2023) |

| Industrial Consumers | Consistent quality, reliable supply of silver & gold | Solar market projected >$300 billion by 2024 |

| Commodity Traders & Financial Institutions | Market liquidity, price discovery, physical trading | Substantial trading volumes, significant ETF inflows (2024) |

| Investors (Institutional & Retail) | Capital appreciation, dividends, company performance | Fluctuating market capitalization, active share trading (mid-2024) |

| Industrial Consumers (Lead & Zinc) | By-products for batteries, construction, galvanizing | Lead for automotive batteries; Zinc for steel protection |

Cost Structure

Mining operations and production costs are the most significant expense drivers for Fresnillo. These costs cover the entire process from extracting ore to smelting, including essential elements like energy, reagents, and maintenance, all directly influenced by production output.

In 2024, Fresnillo reported that its total operating costs were approximately $1,150 million. The cost of sales, a major component of this, was around $970 million, reflecting the substantial investment in these core mining activities.

Fresnillo PLC's cost structure heavily relies on exploration and development expenditure. In 2023, the company reported significant investment in these areas, with capital expenditure on exploration and evaluation totaling $136.6 million. This substantial outlay is directly linked to their strategy of identifying new mineral reserves and expanding existing mining operations, ensuring future production capacity.

This investment in exploration and development is vital for Fresnillo's long-term sustainability and growth. It directly supports the replacement of depleted reserves, a critical factor in the mining industry. For instance, successful exploration in areas like the San Julián Chispas project in 2023 contributed to an increase in their silver reserve base.

Labor and personnel costs are a significant component of Fresnillo's expenses, encompassing wages, salaries, and benefits for its large workforce across mining, processing, and administrative functions. In 2024, the company's total employee costs, including social security and other personnel-related expenses, are projected to be a substantial portion of its operating budget, reflecting the capital-intensive nature of its operations and the need for skilled labor. A crucial element within these costs is investment in safety training, ensuring compliance with rigorous industry standards and protecting its employees.

Environmental Compliance and Remediation Costs

Fresnillo plc incurs substantial expenses to meet stringent environmental regulations, a crucial aspect of its operational license. These costs encompass managing mine tailings, treating wastewater, and rehabilitating land disturbed by mining activities. For instance, in 2023, the company reported significant investments in environmental protection and social responsibility initiatives, reflecting the growing importance of sustainable practices.

These environmental compliance and remediation costs are vital for maintaining Fresnillo's social license to operate and ensuring long-term business viability. The company actively invests in technologies and processes to minimize its environmental footprint.

- Environmental Compliance: Adherence to regulations regarding emissions, waste disposal, and water usage.

- Remediation and Rehabilitation: Costs associated with restoring mined land and managing tailings facilities.

- Sustainable Practices: Investments in water conservation, energy efficiency, and biodiversity protection.

- Operational License: Ensuring continued operations by meeting all environmental standards and community expectations.

Capital Expenditures (CAPEX)

Fresnillo's capital expenditures are substantial, reflecting the capital-intensive nature of mining. These investments are essential for acquiring and maintaining the heavy machinery, processing plants, and infrastructure needed for efficient extraction and production. For instance, in 2023, Fresnillo reported capital expenditures of $721 million, a significant portion of which was allocated to the development of new projects and the modernization of existing operations to ensure long-term competitiveness and capacity expansion.

These expenditures are not just about keeping the lights on; they are strategic investments in the future. Upgrading technology, for example, can lead to improved recovery rates and reduced operating costs. Fresnillo’s commitment to investing in new equipment and plant upgrades, such as those at its flagship Fresnillo and San Julián mines, directly impacts its ability to meet production targets and capitalize on market opportunities. These outlays are critical for sustaining and growing production volumes.

- Acquisition of new mining equipment: Essential for efficient resource extraction and maintaining operational capacity.

- Plant upgrades and modernization: Crucial for improving processing efficiency, recovery rates, and environmental compliance.

- Infrastructure development: Includes investments in roads, power, and water systems to support mine operations and expansion.

- Technology improvements: Investing in automation, data analytics, and advanced exploration techniques to enhance productivity and discovery.

Fresnillo's cost structure is dominated by operational expenses, including mining, processing, and smelting, which in 2024 accounted for approximately $1,150 million in total operating costs, with the cost of sales around $970 million. Significant investments in exploration and development, totaling $136.6 million in 2023, are crucial for future reserve replacement and growth. Labor and personnel costs, encompassing wages, benefits, and safety training, represent another substantial expenditure, reflecting the need for a skilled workforce in capital-intensive mining operations.

| Cost Category | 2023 (Millions USD) | 2024 (Projected/Actual Millions USD) |

| Total Operating Costs | N/A | ~1,150 |

| Cost of Sales | N/A | ~970 |

| Exploration & Development Expenditure | 136.6 | N/A |

| Capital Expenditures | 721 | N/A |

Revenue Streams

As the world's largest primary silver producer, Fresnillo's core revenue comes from selling silver. This includes both refined silver, known as doré, and silver still within a concentrate form. These sales are the bedrock of their financial performance, directly influenced by how much silver they extract and the prevailing market price for the metal.

In 2024, silver prices have shown volatility, trading around $28-$30 per ounce for much of the year, a significant increase from previous years. Fresnillo's production volumes are crucial; for example, in the first quarter of 2024, they reported silver production of 14.9 million ounces, underscoring the direct link between physical output and revenue generation.

As Mexico's largest gold producer, Fresnillo generates significant revenue from gold sales. This revenue stream, which includes sales of gold in concentrate and doré, stands as the company's second-largest contributor.

The performance of gold sales is directly tied to two key factors: the prevailing international gold prices and Fresnillo's own gold production volumes. For instance, in 2023, Fresnillo reported total gold production of 626,200 ounces, contributing substantially to its overall financial results.

Fresnillo PLC generates revenue from selling lead, which is extracted as a by-product during the processing of its silver and gold ores. This stream offers a valuable supplementary income source. The company's 2024 financial performance, for instance, saw lead sales contributing to its overall profitability, though the exact figures are subject to market fluctuations.

Zinc By-Product Sales

Revenue generated from the sale of zinc, another significant by-product, adds to Fresnillo's diversified income streams. Zinc sales performance is directly influenced by global zinc prices and the volume of zinc recovered from the mined ore. For instance, in 2024, Fresnillo reported that its zinc production contributed meaningfully to its overall financial results, with sales volumes and prices playing a key role in this revenue segment.

- Zinc as a By-Product: Zinc is recovered during the processing of silver and gold ores, providing an additional revenue source.

- Market Dependency: Income from zinc sales is sensitive to fluctuations in global zinc market prices.

- 2024 Performance Indicator: Fresnillo's 2024 operational reports highlighted the importance of zinc by-product sales in bolstering total revenue.

Potential Future Project Royalties/Dividends

While not a core revenue generator presently, Fresnillo’s future could see income from royalties and dividends. This would stem from any joint ventures or investments made in new mining projects or other companies as they begin to generate profits. This stream is viewed as a long-term avenue for growth and diversification.

- Future Royalties/Dividends: Potential income from equity stakes in productive mining ventures.

- Long-Term Growth: Represents a strategic play for future revenue diversification.

- Investment Focus: Dependent on successful future project developments and partnerships.

Fresnillo's revenue streams are primarily driven by the sale of precious and base metals. Silver and gold are the dominant contributors, with by-products like lead and zinc adding significant supplementary income. The company also has potential for future revenue from royalties and dividends derived from strategic investments.

| Metal | Primary Revenue Driver | 2023 Production (oz) | 2024 Price Range (approx.) |

|---|---|---|---|

| Silver | Largest primary producer globally; sales of doré and concentrate. | 14.9 million (Q1 2024) | $28-$30/oz |

| Gold | Mexico's largest producer; sales of doré and concentrate. | 626,200 (2023) | $2,300-$2,400/oz |

| Lead | By-product of silver and gold processing. | N/A | Market dependent |

| Zinc | By-product of silver and gold processing. | N/A | Market dependent |

Business Model Canvas Data Sources

The Fresnillo Business Model Canvas is built using extensive market research, operational data from mining activities, and financial disclosures. These sources ensure each canvas block accurately reflects the company's strategic approach and market position.