Frasers Property SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frasers Property Bundle

Frasers Property's robust brand recognition and diversified portfolio present significant strengths, but understanding their potential vulnerabilities and competitive landscape is crucial for informed decisions. Our comprehensive SWOT analysis delves into these aspects, offering a clear view of their market position.

Want the full story behind Frasers Property's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Frasers Property Limited's strength lies in its remarkably diversified property portfolio. This includes a wide array of assets across residential, retail, commercial, industrial, and hospitality sectors, offering a robust hedge against sector-specific downturns.

This extensive geographical spread, encompassing key regions like Southeast Asia, Australia, Europe, and China, further solidifies its resilience. For instance, as of the first half of fiscal year 2024, Frasers Property reported a strong performance across its various segments, with its industrial and logistics segment in Australia showing particularly robust leasing demand.

Frasers Property showcased a remarkably robust financial performance in FY2024. The company achieved a net profit of S$567 million, a substantial 76.2% jump from the previous year, on revenues of S$3.2 billion. This impressive growth was driven by strong occupancy across its commercial portfolio and efficient operational strategies.

Frasers Property demonstrates a significant commitment to sustainability, a key strength that resonates with today's environmentally conscious investors and stakeholders. This dedication is underscored by their achievement of Regional Sector Leader status in the 2024 Global Real Estate Sustainability Benchmark (GRESB) for the fourth year running. This consistent recognition highlights their ongoing efforts in integrating sustainable practices across their operations.

The company actively pursues green financing, having secured green loans to fund their sustainable initiatives. Furthermore, Frasers Property prioritizes the design and development of environmentally friendly properties, incorporating features that reduce their ecological footprint. These actions not only align with global sustainability goals but also position them favorably in a market increasingly valuing ESG (Environmental, Social, and Governance) performance.

Integrated Real Estate Solutions

Frasers Property's strength lies in its integrated real estate solutions, managing the entire property lifecycle from development to long-term ownership and management. This comprehensive approach provides significant control over asset quality and operational efficiency, fostering sustainable value creation across its diverse portfolio. For instance, in FY2023, the company reported a Return on Equity of 7.9%, demonstrating the effectiveness of its integrated model in generating returns.

This end-to-end capability allows Frasers Property to optimize asset performance and capture value at multiple stages. The company's strategic focus on integrated solutions supports its ability to adapt to market dynamics and deliver consistent results. In the first half of FY2024, Frasers Property reported a net profit after tax of S$308 million, up 29% year-on-year, underscoring the strength of its diversified and integrated business model.

Key aspects of their integrated solutions include:

- Development Expertise: Proven track record in creating high-quality residential, commercial, and industrial properties.

- Asset Management Prowess: Skilled in managing properties to maximize their long-term value and operational efficiency.

- Investment & Capital Allocation: Strategic deployment of capital across the value chain to drive growth and returns.

- Customer-Centric Approach: Focus on understanding and meeting the needs of stakeholders throughout the property lifecycle.

Strategic Land Banks and Development Pipeline

Frasers Property boasts strategically positioned land banks, especially in the booming industrial and logistics segments. This foresight provides a robust development pipeline, ensuring a consistent flow of future projects and predictable earnings. For instance, as of their fiscal year 2023, the company reported a significant development pipeline valued at approximately S$15.9 billion, demonstrating their capacity for sustained growth.

This strong pipeline translates into enhanced earnings visibility, a crucial factor for investors seeking stability and long-term returns. The company’s strategic land acquisitions are geared towards high-demand sectors, which supports their overall growth strategy and market positioning.

- Strategic Land Banks: Holdings in prime locations, particularly for industrial and logistics development.

- Development Pipeline: A substantial S$15.9 billion pipeline as of FY2023, indicating future revenue streams.

- Sector Focus: Emphasis on high-demand industrial and logistics sectors for optimal returns.

- Earnings Visibility: The pipeline provides a clear outlook for future financial performance.

Frasers Property's financial health is a significant strength, evidenced by its impressive FY2024 performance. The company reported a net profit of S$567 million, a remarkable 76.2% increase year-on-year, on revenues of S$3.2 billion. This robust growth highlights effective operational strategies and strong occupancy rates, particularly in its commercial segment.

The company's commitment to sustainability is a key differentiator, earning it Regional Sector Leader status in the 2024 Global Real Estate Sustainability Benchmark (GRESB) for the fourth consecutive year. This consistent recognition underscores Frasers Property's dedication to integrating ESG principles, further bolstered by its active pursuit of green financing and development of eco-friendly properties.

Frasers Property's integrated real estate solutions, covering the entire property lifecycle, provide substantial control over asset quality and operational efficiency. This end-to-end capability, demonstrated by a 7.9% Return on Equity in FY2023 and a 29% year-on-year increase in net profit after tax to S$308 million in H1 FY2024, ensures sustainable value creation and adaptability to market changes.

The strategically positioned land banks, especially in the high-demand industrial and logistics sectors, represent a crucial strength. With a development pipeline valued at approximately S$15.9 billion as of FY2023, Frasers Property has secured a strong foundation for future earnings visibility and sustained growth, particularly in markets experiencing robust leasing demand, such as Australia.

| Metric | FY2024 (or latest available) | FY2023 | Significance |

|---|---|---|---|

| Net Profit | S$567 million | S$322 million | Significant 76.2% YoY increase |

| Revenue | S$3.2 billion | (Not explicitly stated for FY2024, but implied growth) | Indicates strong operational performance |

| GRESB Ranking | Regional Sector Leader (2024) | Regional Sector Leader (2023) | Consistent leadership in sustainability |

| Development Pipeline Value | (Not explicitly stated for FY2024) | S$15.9 billion | Strong future revenue visibility |

What is included in the product

Explores the strategic advantages and threats impacting Frasers Property’s success, detailing its internal capabilities and external market dynamics.

Provides a clear, actionable framework to identify and address Fraser Property's strategic challenges and opportunities.

Weaknesses

Frasers Property's financial structure shows elevated debt levels, with a net debt-to-EBITDA ratio reported at 2.8x for FY2024. This figure is notably higher than the typical range for its industry peers.

Further highlighting this concern, the company's net debt to total equity ratio climbed to 88.5% by March 2025. Such a substantial reliance on debt financing can amplify risks, particularly when the broader economic landscape becomes unpredictable.

Frasers Property's substantial debt, even with hedging, leaves it vulnerable to interest rate shifts. An increase in borrowing costs directly impacts its bottom line and could put pressure on cash flow, as evidenced by the rise in interest expenses during the first half of fiscal year 2025.

Frasers Property's significant exposure to the commercial real estate market presents a notable weakness due to its inherent cyclicality. Economic downturns can directly impact rental income and property valuations, as seen with declining retail rents in certain key markets during 2023. This sensitivity means that periods of economic contraction can lead to fair value losses on the company's commercial property portfolio, affecting overall financial performance.

Operational Challenges in Industrial Logistics Development

Frasers Property faces significant operational hurdles in scaling its industrial logistics segment. The substantial capital required for development and expansion can strain financial resources, especially given the current economic climate. For instance, the company's 2024 financial statements indicated that capital expenditures for new logistics facilities are projected to increase by 15% year-over-year, reflecting these investment demands.

Furthermore, the company is susceptible to external factors impacting construction and supply chains. Rising material costs, as noted in the 2024 annual report, coupled with persistent global supply chain disruptions, directly affect project timelines and profitability. These issues could lead to margin compression on new logistics developments, impacting the overall return on investment.

- High Upfront Investment: Developing industrial logistics infrastructure demands considerable capital outlays.

- Rising Construction Costs: The 2024 annual report cited a 10% increase in key construction material costs.

- Supply Chain Delays: Ongoing global logistics bottlenecks can extend project completion times and increase expenses.

- Potential Margin Pressure: The combination of higher costs and delays could negatively impact profitability on new developments.

Exposure to Fair Value Losses

Frasers Property has faced significant unrealized losses on certain commercial properties, notably in the UK and Australia, which can affect its overall financial performance. For instance, in the first half of fiscal year 2024, the company reported a net loss of S$103 million, partly influenced by valuation adjustments on investment properties. While these fair value adjustments can be offset by gains in other segments, they introduce volatility into the company's reported earnings, making financial outcomes less predictable.

The impact of these fair value losses is particularly evident when looking at specific market conditions. For example, a challenging real estate market in the UK during late 2023 and early 2024 led to downward revaluations for some of Frasers Property's assets. This exposure means that fluctuations in property markets can directly translate into swings in the company's balance sheet and income statement, creating an element of risk for investors.

- Exposure to Market Downturns: Frasers Property's portfolio is susceptible to declines in commercial property values, as seen in the UK and Australia.

- Earnings Volatility: Unrealized losses from property revaluations can create unpredictable swings in reported profits.

- Impact on Financial Ratios: Significant fair value losses can temporarily depress key financial metrics, affecting investor sentiment.

- Geographic Concentration Risk: A concentration of assets in markets experiencing downturns amplifies the impact of fair value losses.

Frasers Property's financial leverage remains a significant concern, with its net debt to EBITDA ratio standing at 2.8x in FY2024, exceeding industry averages. This high debt burden exposes the company to increased financial risk, particularly in a rising interest rate environment.

The company's substantial reliance on debt financing, evidenced by a net debt to total equity ratio of 88.5% as of March 2025, amplifies its vulnerability to economic downturns and interest rate fluctuations.

Furthermore, Frasers Property's significant exposure to the cyclical commercial real estate market, particularly in sectors like retail where rents faced pressure in 2023, introduces earnings volatility and potential fair value losses on its asset portfolio.

| Financial Metric | FY2024 Value | March 2025 Value | Industry Benchmark (Approx.) |

|---|---|---|---|

| Net Debt to EBITDA | 2.8x | N/A | 1.5x - 2.0x |

| Net Debt to Total Equity | N/A | 88.5% | < 50% |

What You See Is What You Get

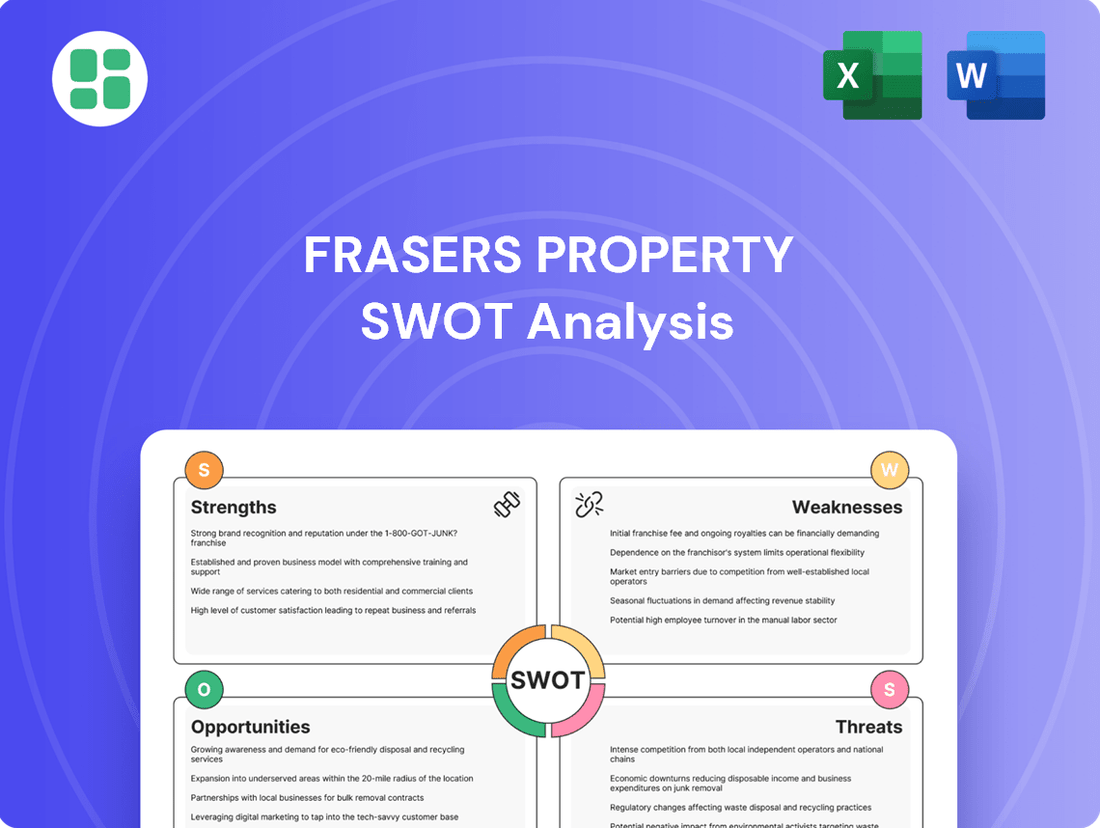

Frasers Property SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the Strengths, Weaknesses, Opportunities, and Threats facing Fraser's Property, providing actionable insights for strategic planning.

Opportunities

The industrial and logistics sector presents a substantial growth avenue, fueled by the booming e-commerce market and the strategic shift of manufacturing away from single-country reliance, often termed the China +1 strategy. This trend is creating robust demand for modern warehousing and distribution facilities.

Frasers Property is strategically positioning itself to benefit from this, with significant investments in industrial and logistics assets throughout Southeast Asia. The company is experiencing strong leasing demand for its properties in this segment, indicating a healthy market and successful execution of its expansion strategy.

Frasers Property is actively expanding its footprint in dynamic, high-growth regions like Thailand, Vietnam, Singapore, and Jakarta. These markets are characterized by favorable demographics, ongoing urbanization trends, and a growing middle class, all of which are strong indicators of sustained demand for property and urban infrastructure.

For instance, Vietnam's GDP growth was projected to be around 6.5% for 2024, underscoring its economic vitality and attractiveness for real estate investment. Similarly, Thailand's tourism sector, a key economic driver, saw a significant rebound in 2023, boosting consumer confidence and demand for residential and commercial spaces.

Frasers Property's commitment to capital efficiency, demonstrated by divesting non-core assets and reinvesting in higher-yield projects, offers a significant opportunity. This strategy, a cornerstone of their approach, allows them to bolster their financial standing and boost overall returns.

For instance, in FY2023, Frasers Property achieved approximately S$1.5 billion in divestments, a clear indicator of their active asset optimization. This capital recycling directly fuels their pipeline of attractive development opportunities, enhancing financial resilience and strategic agility.

Growth in Hospitality Segment

Frasers Hospitality is strategically expanding its presence, aiming to add 20 new properties within the next four years. This growth is fueled by increasing demand across diverse hospitality sectors and is bolstered by key strategic partnerships.

This expansion directly addresses the growing global demand for accommodation and hospitality services. Frasers Hospitality's proactive approach, including leveraging partnerships, is designed to capture market share and enhance its international brand recognition.

- Target: Addition of 20 new properties over the next four years.

- Strategy: Expansion through organic growth and strategic partnerships.

- Market Driver: Capitalizing on rising demand across various hospitality segments.

- Outcome: Strengthening international footprint and market position.

Leveraging Technology for Property Management

The real estate sector is rapidly embracing technology, presenting a significant opportunity for Frasers Property to enhance its property management capabilities. By integrating proptech solutions, the company can streamline operations, from tenant onboarding to maintenance requests, leading to greater efficiency and cost savings. For instance, the global proptech market was valued at approximately USD 27.4 billion in 2023 and is projected to reach USD 100.7 billion by 2030, growing at a CAGR of 20.4% during this period, according to some industry reports. This indicates a strong market appetite for technological advancements in property management.

Investing in smart building technologies can also create new revenue streams and improve tenant satisfaction. Features like integrated building management systems, energy-efficient solutions, and personalized amenity access can differentiate Frasers Property's offerings. In 2024, many real estate firms are focusing on digital transformation to improve customer experience, with a significant portion of capital expenditure being allocated to AI and IoT solutions for properties.

Frasers Property can leverage these trends to gain a competitive edge. The adoption of advanced analytics for predicting maintenance needs or optimizing space utilization can translate into tangible financial benefits. Furthermore, digital platforms for tenant engagement and communication can foster stronger relationships and increase retention rates.

- Enhanced Operational Efficiency: Implementing AI-powered predictive maintenance can reduce downtime and repair costs.

- Improved Customer Experience: Digital platforms for rent payment, service requests, and community engagement can boost tenant satisfaction.

- Smart Building Integration: IoT sensors for energy management and security can lead to cost savings and a safer environment.

- Data-Driven Decision Making: Utilizing data analytics for occupancy rates and space utilization can optimize property performance.

Frasers Property is well-positioned to capitalize on the burgeoning demand in the industrial and logistics sector, driven by e-commerce growth and supply chain diversification strategies. The company's expansion in high-growth Asian markets like Vietnam and Thailand, supported by strong GDP and tourism recovery respectively, presents significant opportunities for increased property demand.

The company's strategic capital recycling, evidenced by approximately S$1.5 billion in divestments in FY2023, fuels investment in higher-yield projects, enhancing financial resilience. Frasers Hospitality's plan to add 20 new properties over the next four years targets the rising global demand for accommodation, bolstered by strategic partnerships.

Furthermore, the integration of proptech, a market projected to reach USD 100.7 billion by 2030, offers opportunities for operational efficiency and improved tenant experiences through smart building technologies and data analytics.

Threats

Frasers Property is vulnerable to a global economic slowdown, with a projected 2.6% growth for the global economy in 2024 according to the IMF, potentially dampening demand for its properties and impacting rental yields.

Rising geopolitical tensions, such as ongoing conflicts and trade disputes, create significant uncertainty, which could lead to increased operating costs and reduced investor confidence in the real estate sector, affecting Frasers Property's development pipelines and asset values.

The imposition of new or increased trade barriers could disrupt supply chains for construction materials and impact cross-border investment flows, potentially hindering Frasers Property's international projects and profitability.

A persistent 'higher-for-longer' interest rate environment, with central banks maintaining elevated borrowing costs into 2025, presents a significant threat to Frasers Property. This directly increases the cost of capital for new projects and refinancing existing debt, impacting profitability. For instance, if benchmark rates remain at or above 4.5% through 2025, Frasers Property's financing expenses could see a substantial uptick compared to the low-rate environment of previous years.

Furthermore, sustained high inflation, projected to remain above 3% in many key markets through 2025, erodes purchasing power and can dampen overall property demand. This could lead to slower sales cycles and potentially pressure property valuations downwards, resulting in revaluation losses on Frasers Property's extensive asset portfolio. The combination of increased borrowing costs and potentially softer demand creates a challenging operating landscape.

Frasers Property navigates fiercely competitive real estate landscapes, contending with established developers and Real Estate Investment Trusts (REITs) across its operational regions. This rivalry intensifies pressure on land acquisition costs, potentially leading to more conservative bidding strategies and impacting profit margins on new projects.

The company's ability to secure prime development sites and maintain attractive rental yields is directly challenged by this intense competition. For instance, in the Singapore industrial sector, where Frasers Property has a significant presence, competition from players like Ascendas REIT and Mapletree Industrial Trust can drive down effective rents and increase capital expenditure for property enhancements to remain competitive.

Adverse Regulatory and Policy Changes

Frasers Property's diversified international footprint means it navigates a complex web of varying regulatory landscapes. Inconsistent or sudden policy shifts in countries where it operates, such as new property taxes or zoning laws, can significantly impact its financial performance and strategic planning. For instance, a change in foreign ownership rules in a key market could directly affect investment inflows and project viability.

These regulatory shifts can lead to increased operating expenses, higher compliance costs, and potential disruptions to ongoing development projects and business models. For example, a tightening of environmental regulations might necessitate costly retrofitting or redesigns for existing properties, impacting profitability. The company's ability to adapt quickly to these evolving rules is crucial for mitigating financial risks and maintaining its competitive edge across its global portfolio.

- Exposure to diverse regulatory environments: Frasers Property operates in multiple jurisdictions, each with its own unique and potentially changing legal and policy frameworks.

- Impact on costs and operations: Adverse regulatory changes can directly increase operating costs, investment requirements, and disrupt established business processes.

- Example of potential impact: Stricter capital controls or changes in foreign investment regulations in a significant market could hinder expansion plans or affect asset valuations.

- Need for agility: The company must maintain flexibility and robust compliance strategies to effectively manage risks arising from policy volatility across its international ventures.

Supply Chain Disruptions and Cost Escalations

Ongoing risks related to supply chain delays and rising construction material prices continue to pose a significant threat to Frasers Property. For instance, the global supply chain faced considerable strain throughout 2023 and into early 2024, leading to extended lead times for essential building components. This can negatively impact development project timelines and budgets.

These operational challenges can pressure profit margins and affect the timely delivery of new properties. The volatility in commodity prices, such as steel and timber, remained a concern, with some reports indicating double-digit percentage increases in material costs in certain regions during 2023. This directly impacts the cost-effectiveness of new developments.

- Supply Chain Volatility: Continued global shipping disruptions and geopolitical factors can lead to delays in material procurement, pushing back project completion dates.

- Rising Material Costs: Fluctuations in the prices of key construction inputs like concrete, steel, and energy can significantly increase project budgets, impacting profitability.

- Labor Shortages: Skilled labor shortages in the construction sector can further exacerbate delays and drive up labor costs, adding to the financial pressure.

Frasers Property faces significant headwinds from potential interest rate hikes, with central banks signaling a commitment to maintaining higher borrowing costs through 2025. This directly increases the cost of capital for new developments and debt refinancing, potentially squeezing profit margins. For example, if the US Federal Funds Rate remains at its current elevated levels into 2025, Frasers Property's financing expenses could rise substantially compared to the previous low-rate environment.

Persistent inflation, projected to stay above 3% in many key markets through 2025, erodes consumer purchasing power, potentially dampening demand for properties and impacting rental yields. This could lead to slower sales cycles and downward pressure on asset valuations, affecting Frasers Property's portfolio performance.

The company operates in a highly competitive real estate market, facing pressure from established developers and REITs. This intense rivalry can drive up land acquisition costs and necessitate greater investment in property enhancements to maintain attractive rental yields, impacting profitability. For instance, in Singapore's industrial sector, competition from entities like Mapletree Industrial Trust can lead to reduced effective rents.

Navigating diverse and potentially volatile regulatory landscapes across its international operations presents a significant threat. Sudden policy shifts, such as new property taxes or changes in foreign investment rules, can increase operating costs, disrupt projects, and impact asset valuations. For example, stricter capital controls in a key market could hinder expansion plans.

Continued supply chain disruptions and rising construction material costs remain a concern, impacting project timelines and budgets. Reports from 2023 indicated double-digit percentage increases in material costs for components like steel and timber in certain regions, directly affecting the cost-effectiveness of new developments.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Frasers Property's official financial statements, comprehensive market research reports, and expert analyses of the real estate sector. These diverse sources ensure a well-rounded and accurate assessment of the company's strategic position.