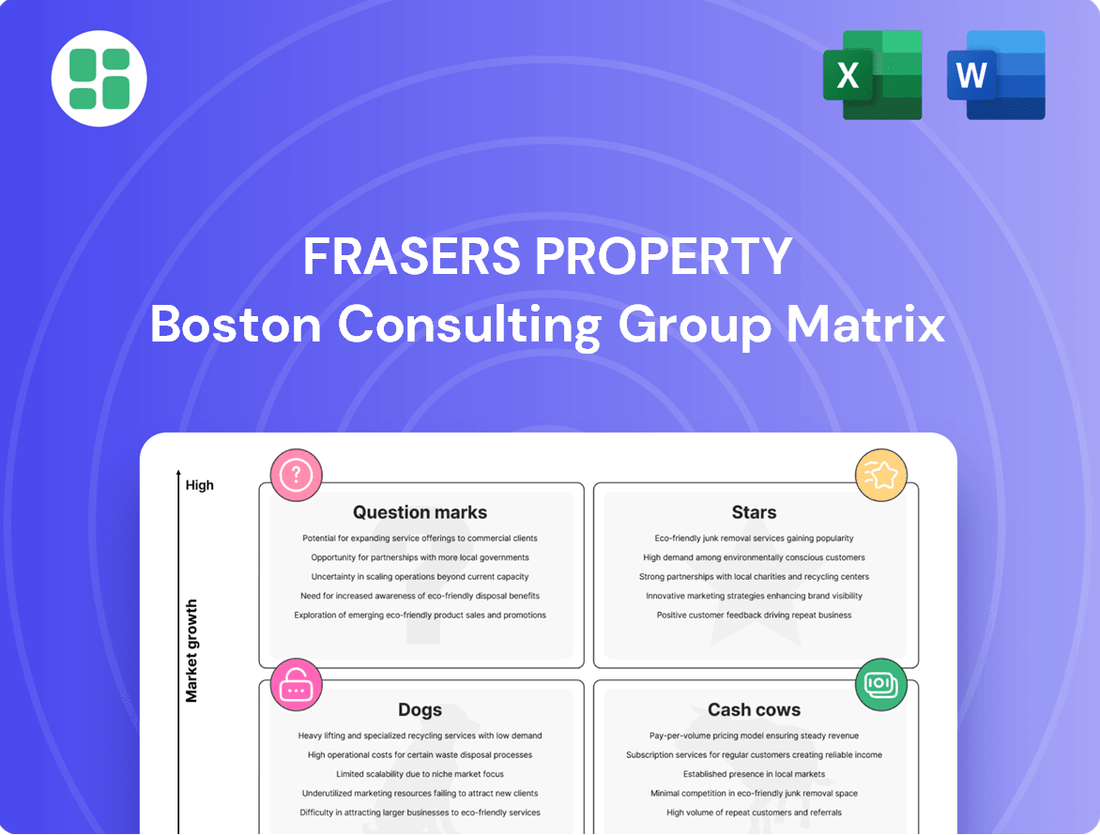

Frasers Property Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frasers Property Bundle

Explore the strategic positioning of Fraser's Property portfolio through its BCG Matrix! Understand which ventures are market leaders (Stars), which are generating consistent revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs).

This glimpse into Fraser's Property's BCG Matrix is just the beginning. Unlock the full report to receive detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investment and product strategies. Don't miss out on the complete picture!

Stars

Frasers Property's industrial and logistics portfolio across Australia and Europe stands out with impressive performance, marked by consistently high occupancy rates and strong leasing activity. This segment is a significant contributor to the Group's overall financial health, generating substantial profit before interest and taxes (PBIT).

The sustained demand within the industrial and logistics sector is a key driver of its robust performance. Frasers Property's strategic land holdings and ongoing development projects in these regions reinforce its position as a market leader, paving the way for continued expansion and value creation.

Frasers Property's master-planned residential communities in Australia, like Midtown and The Grove, are a clear strength. These projects are built with liveability and sustainability at their core, attracting significant buyer interest. In the first half of 2024, Frasers Property Australia reported a 16% increase in pre-sold residential revenue, with these large-scale developments being a major driver.

Prime residential developments in Singapore, such as The Orie and The Robertson Opus, are performing exceptionally well, demonstrating rapid sales upon launch. This success highlights Frasers Property's ability to capture significant market share in a thriving urban landscape.

The resilience of the Singapore residential market, bolstered by consistent demand and limited land availability, allows Frasers Property to recognize substantial unearned revenue from these pre-sold units. This strategic advantage positions these developments as strong contenders within the BCG matrix.

Strategic Industrial & Logistics Development Pipeline

Frasers Property's industrial and logistics segment boasts a robust development pipeline, demonstrating a clear strategy to capitalize on sector growth. This pipeline spans key geographies including Australia, Europe, Thailand, and Vietnam, reflecting a commitment to expanding its footprint in high-demand markets.

The company has earmarked over 380,000 square meters for development in fiscal year 2025-2026, a significant investment aimed at meeting anticipated strong tenant demand. This proactive approach is designed to secure future revenue streams and maintain market leadership.

- Extensive Pipeline: New industrial and logistics developments are underway in Australia, Europe, Thailand, and Vietnam.

- FY25/26 Development: Over 380,000 sqm of new space is planned for development in the upcoming fiscal years.

- Demand Focus: Projects are strategically positioned to meet robust tenant demand in key markets.

- Sustained Growth: This pipeline is crucial for ensuring continued market leadership and cash generation as new assets become operational.

One Bangkok Integrated Development in Thailand

One Bangkok, a monumental mixed-use development in Thailand, is set to become a global hub, integrating retail, office, hospitality, and residential spaces. Its phased opening, beginning in late 2024, emphasizes people-centric design, sustainability, and smart city principles, targeting substantial market penetration in a vibrant urban environment.

This ambitious project is poised to be a significant growth engine, leveraging its comprehensive offerings to capture a considerable share of the market. Its integrated approach aims to set new benchmarks for urban living and commercial activity in Thailand.

- Development Focus: People-centric, green sustainability, and smart city living.

- Opening Timeline: Phased opening commencing late 2024.

- Market Position: Aiming for significant market share in a growing urban landscape.

- Strategic Importance: Identified as a key growth driver for its parent entity.

Frasers Property's industrial and logistics segment, with its extensive development pipeline and focus on high-demand markets, is a clear Star in the BCG matrix. The company's commitment to developing over 380,000 square meters in FY25/26 underscores its aggressive growth strategy in this sector.

The strong performance of its Australian and European industrial and logistics portfolios, characterized by high occupancy and leasing activity, further solidifies its Star status. These segments are not only generating substantial profits but are also well-positioned for continued expansion.

The company's prime residential developments in Singapore, such as The Orie and The Robertson Opus, are also performing exceptionally well, demonstrating rapid sales and contributing significantly to unearned revenue. This success in a resilient market highlights their Star potential.

One Bangkok, a major mixed-use development with a phased opening starting late 2024, is positioned as a key growth driver. Its focus on people-centric design and sustainability aims to capture substantial market share, indicating its Star trajectory.

| Segment | BCG Category | Key Performance Indicators | Strategic Rationale | Recent Data (H1 2024) |

| Industrial & Logistics (Aus/Europe) | Star | High occupancy, strong leasing, robust PBIT | Capitalizing on sustained demand, strategic land holdings | Consistent strong performance |

| Residential (Singapore) | Star | Rapid sales, significant unearned revenue | Resilient market, limited land availability | Strong sales momentum |

| One Bangkok (Mixed-Use) | Star | Phased opening late 2024, people-centric design | Key growth engine, urban hub development | Project commencement |

| Residential (Australia - Master-planned) | Star | High buyer interest, liveability focus | Major driver of growth | 16% increase in pre-sold residential revenue |

What is included in the product

This BCG Matrix analysis provides a strategic overview of Frasers Property's business units, categorizing them by market share and growth potential.

It offers insights into which segments require investment, maintenance, or divestment for optimal portfolio performance.

Frasers Property's BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategy dissection.

Cash Cows

Frasers Centrepoint Trust's portfolio of Singapore suburban retail malls are classic cash cows. These properties consistently boast occupancy rates hovering around 99%, showcasing their enduring appeal and stability.

These mature assets are reliable income generators, providing substantial and consistent rental income that fuels Frasers Property's overall financial health. For instance, in the first half of fiscal year 2024, Frasers Centrepoint Trust reported a distributable income of S$130.3 million, underscoring the stable cash flow from these suburban retail assets.

Continuous investment in asset enhancement initiatives keeps these malls competitive and relevant in Singapore's mature retail landscape. This strategic approach ensures they continue to perform strongly and generate predictable returns in a market characterized by steady, albeit low, growth.

Frasers Property's established commercial office buildings in Singapore's prime districts are strong cash cows. These properties consistently boast high occupancy rates, generating reliable rental income for the company.

For instance, in 2023, Frasers Property reported robust performance from its Singapore office portfolio, benefiting from long-term leases with reputable tenants. This stability means they don't need significant new investment for marketing or development, allowing them to churn out consistent cash.

Frasers Property's mature industrial and logistics assets in Australia and Europe are its quintessential cash cows. These are not new developments, but rather completed and stable properties that boast high occupancy rates and long lease agreements, with weighted average lease expiries (WALE) typically extending well beyond five years. This stability ensures a predictable and substantial stream of rental income.

These established assets generate consistent, robust rental income with very little need for ongoing capital expenditure. For instance, in 2024, Frasers Property's industrial and logistics portfolio in Australia and Europe continued to demonstrate strong performance, with occupancy rates consistently above 95% and average lease terms exceeding 7 years. This reliability makes them the foundational cash generators for the company.

The dependable income from these mature properties is crucial. It provides the financial backbone that supports and enables other growth initiatives, such as investments in newer, potentially higher-growth but riskier business segments. Their consistent cash flow allows Frasers Property to maintain financial flexibility and pursue strategic expansion without jeopardizing its core operations.

Frasers Hospitality's Established Serviced Residences and Hotels

Frasers Hospitality's portfolio of established serviced residences and hotels in prime, mature Asia-Pacific cities, including Singapore, Australia, Japan, and Malaysia, consistently demonstrates robust demand and high occupancy rates. These mature assets leverage strong brand recognition and proven operational efficiency, translating into dependable revenue generation with minimal need for extensive marketing spend.

The enduring appeal of these locations, coupled with Frasers Hospitality's operational expertise, ensures these properties remain valuable cash cows for the group. For instance, in 2024, Frasers Hospitality reported strong performance across its established markets, with occupancy rates often exceeding 85% in key cities.

- Singapore: Properties like Fraser Residence Singapore consistently achieve high occupancy, contributing significantly to revenue.

- Australia: Serviced residences in Sydney and Melbourne benefit from sustained corporate and leisure travel demand.

- Japan: Frasers Hospitality's presence in Tokyo and Osaka capitalizes on the country's robust tourism sector.

- Malaysia: Established hotels and residences in Kuala Lumpur provide a stable income stream.

Completed and Substantially Sold Residential Projects in China

Frasers Property's completed residential projects in China, now substantially sold, are acting as cash cows. These developments, having moved past their peak marketing and sales phases, continue to yield cash flow as outstanding unit settlements occur. This ongoing revenue generation requires minimal additional investment, effectively converting past capital expenditure into realized profits. For instance, as of the first half of fiscal year 2024, Frasers Property reported a robust performance in its China residential segment, with a significant portion of its completed inventory settled.

The strategic advantage of these mature projects lies in their reduced operational demands. With the bulk of units already sold, the focus shifts to efficient settlement processes rather than new sales initiatives. This allows Frasers Property to benefit from the residual revenue streams without the substantial marketing and development outlays typically associated with active projects. This operational efficiency directly translates into higher margins and a stable cash contribution to the company's overall financial health.

- Continued Revenue Generation: Substantially sold projects in China provide a steady stream of income from ongoing unit settlements.

- Minimized Costs: These mature assets require minimal new marketing or development expenditure, boosting profitability.

- Capital Realization: Completed projects represent the successful conversion of past investments into tangible cash returns.

- Contribution to Profitability: The cash generated from these projects supports overall financial performance with low incremental investment.

Frasers Property's Singapore suburban retail malls are prime examples of cash cows, consistently maintaining near-perfect occupancy rates of around 99%. These mature assets are dependable income generators, providing stable rental income that supports the company's financial stability. In the first half of fiscal year 2024, Frasers Centrepoint Trust reported S$130.3 million in distributable income, highlighting the consistent cash flow from these properties.

The company's established commercial office buildings in Singapore's prime districts also function as strong cash cows, benefiting from high occupancy and long-term leases with reputable tenants. This stability means minimal new investment is required, allowing these assets to generate consistent cash flow. Frasers Property's 2023 performance report indicated robust returns from this portfolio, underscoring their reliability.

Mature industrial and logistics assets in Australia and Europe, characterized by high occupancy (above 95% in 2024) and long lease terms (averaging over 7 years), are quintessential cash cows. These completed, stable properties require very little ongoing capital expenditure, ensuring a predictable and substantial stream of rental income that forms the company's financial foundation.

Frasers Hospitality's serviced residences and hotels in established Asia-Pacific cities, with occupancy often exceeding 85% in key cities during 2024, are valuable cash cows. Their strong brand recognition and proven operational efficiency in markets like Singapore, Australia, Japan, and Malaysia ensure dependable revenue generation with minimal marketing spend.

Completed residential projects in China, now largely sold, are also acting as cash cows, yielding cash flow from outstanding unit settlements with minimal additional investment. Frasers Property's performance in the first half of fiscal year 2024 showed robust settlement activity in its China residential segment, converting past investments into realized profits.

| Asset Class | Location | Key Characteristic | FY24 Performance Indicator | Role |

|---|---|---|---|---|

| Suburban Retail Malls | Singapore | ~99% Occupancy | S$130.3M Distributable Income (H1 FY24) | Cash Cow |

| Prime Commercial Offices | Singapore | High Occupancy, Long Leases | Robust Rental Income (2023) | Cash Cow |

| Industrial & Logistics | Australia, Europe | >95% Occupancy, >7 Yrs WALE | Strong Performance (2024) | Cash Cow |

| Serviced Residences & Hotels | Asia-Pacific | >85% Occupancy (Key Cities FY24) | Dependable Revenue | Cash Cow |

| Completed Residential | China | Substantially Sold, Ongoing Settlements | Robust Settlement Activity (H1 FY24) | Cash Cow |

What You’re Viewing Is Included

Frasers Property BCG Matrix

The Frasers Property BCG Matrix preview you are viewing is the definitive document you will receive upon purchase, offering a comprehensive strategic overview. This exact file, free from watermarks or sample content, is professionally formatted and ready for immediate application in your business planning. You can confidently expect the same detailed analysis and actionable insights that will be delivered directly to you, enabling you to make informed strategic decisions without delay.

Dogs

Certain UK commercial properties and business parks within Frasers Property's portfolio are experiencing significant headwinds, registering substantial unrealised losses and fair value declines. These assets are situated in a low-growth market segment, delivering consistently low returns.

As of the latest reporting, these underperforming assets represent a notable drag on Frasers Property's overall financial performance, prompting active strategic review. The company is exploring various avenues, including potential divestment, to mitigate their negative impact.

Frasers Property's divestment of non-core retail assets, such as the Coorparoo Square Retail Centre in Australia, aligns with a strategy to shed low-growth, low-market-share holdings. These strategic disposals are designed to free up capital from assets that may require substantial investment for minimal return. For instance, in 2024, Frasers Property continued its portfolio optimization, focusing on core segments.

Commercial office properties in challenging CBD markets, such as Melbourne, are currently experiencing headwinds. These locations often exhibit a low market share within a highly competitive or oversupplied environment, making them prime candidates for the 'Dog' category in a BCG matrix analysis. For instance, Frasers Commercial Trust's divestment of 357 Collins Street in Melbourne in 2023, reportedly for A$140 million, exemplifies a strategic move away from such underperforming assets.

Older, Less Competitive Industrial Assets Under Divestment

Older, less competitive industrial assets are typically categorized as Dogs in the BCG Matrix. Frasers Property's capital recycling strategy involves divesting such properties to enhance capital efficiency. For instance, the divestment of an industrial property in Tarneit, Australia, and another in Saarwellingen, Germany, exemplify this. These assets, often older or less strategically positioned, may no longer meet the company's performance benchmarks due to low growth potential or market share.

These divestments are part of a broader capital recycling initiative. In 2024, Frasers Property continued to actively manage its portfolio, seeking opportunities to divest non-core or underperforming assets. This strategy allows the company to reallocate capital towards more promising growth areas. The sale of these older industrial assets frees up resources that can be reinvested in higher-yielding opportunities, thus improving the overall return on capital.

- Divested Assets: Properties in Tarneit, Australia, and Saarwellingen, Germany, identified as older or less competitive industrial assets.

- Strategic Rationale: These sales are part of Frasers Property's capital recycling efforts to improve capital efficiency.

- Performance Benchmarks: Assets divested often represent those with low growth potential or market share that no longer meet company performance standards.

- Capital Reallocation: Proceeds from these divestments are intended for reinvestment into more strategically important or higher-growth segments of the business.

Residential Developments in Thailand Facing Macroeconomic Headwinds

Frasers Property's residential developments in Thailand are currently navigating significant macroeconomic headwinds. The environment is characterized by elevated interest rates, which dampen buyer affordability, and rising material costs, squeezing developer margins. Furthermore, more stringent loan assessments by financial institutions are making it harder for potential buyers to secure financing.

While some sales continue, overall revenue has seen a decline. This dip is largely attributed to delays in the completion of higher-margin projects and the general sluggishness of the property market. The situation points to a low-growth market where Frasers Property's residential segment in Thailand may hold a relatively smaller market share.

- Challenging Market Conditions: Thailand's residential sector faces pressure from high interest rates, increased construction costs, and tighter lending standards.

- Revenue Impact: A revenue dip signals project completion delays and a market that is not experiencing robust growth.

- Strategic Imperative: The combination of a difficult operating environment and potentially lower market share necessitates careful strategic management and resource allocation for Frasers Property's Thai residential business.

Frasers Property's "Dogs" are assets with low market share in low-growth markets, often characterized by unrealized losses and declining fair values. These include certain UK commercial properties and business parks, as well as challenging CBD office spaces like those in Melbourne. Older, less competitive industrial assets also fall into this category, exemplified by divestments in Tarneit, Australia, and Saarwellingen, Germany, as part of capital recycling efforts.

The company is actively managing these underperformers, with strategic reviews exploring divestment to mitigate their negative financial impact. For instance, the sale of 357 Collins Street in Melbourne in 2023 for A$140 million highlights this strategy. These moves aim to free up capital from low-return assets for reallocation to more promising growth areas, improving overall capital efficiency.

The Thai residential market, facing headwinds from high interest rates and rising costs, also presents potential "Dog" characteristics for Frasers Property. Revenue declines in this segment, linked to project delays and market sluggishness, underscore the need for careful strategic management and resource allocation.

Frasers Property’s ongoing portfolio optimization in 2024 continues to focus on shedding such low-growth, low-market-share holdings. This strategic pruning is crucial for enhancing capital efficiency and re-investing in segments with higher growth potential.

Question Marks

Frasers Hospitality's expansion into emerging markets like China and Vietnam exemplifies a strategic move into potential high-growth areas. With several new hotels and serviced residences set to open within the next two years, the company is positioning itself for future gains. For instance, Frasers Hospitality announced the opening of the Fraser Residence Chongqing in China in early 2024, a key market for their expansion.

These new ventures, while promising, are likely to be classified as question marks within the BCG matrix. They operate in markets with substantial growth prospects, but their current market share is minimal. Significant capital investment will be necessary to build brand awareness, attract customers, and compete effectively against established players, a common characteristic of question mark assets.

Frasers Hospitality's acquisition and development of the first Yotel property in Japan, slated for an early 2025 launch, signifies a strategic move into a new market segment. This venture, while targeting Japan's robust tourism sector, begins with a nascent market share, positioning it as a question mark within Frasers Property's BCG matrix.

The Japanese tourism market is a significant draw, with inbound tourism to Japan reaching approximately 31.88 million visitors in 2023, a substantial increase from previous years. However, Yotel's initial presence will be small, necessitating considerable investment to build brand recognition and establish a competitive foothold.

Frasers Property's acquisition of new Government Land Sales (GLS) residential sites, like the Bukit Timah Turf City Masterplan site, positions them in a high-demand, supply-constrained Singaporean market. These newly acquired plots represent potential Stars in the BCG matrix due to their strong growth prospects in a desirable location.

However, as these sites are in the early stages of development and pre-launch, their current market share is zero. This means they are effectively Question Marks, requiring significant upfront investment in planning, construction, and marketing before they can generate any substantial returns or establish a market presence.

New Industrial and Logistics Development Sites in Nascent Growth Corridors

New industrial and logistics development sites in nascent growth corridors, like Frasers Property's recent land acquisitions in regional Victoria, Australia, represent potential Stars in the BCG matrix. These locations are characterized by high demand for modern warehousing and distribution facilities, driven by e-commerce expansion and supply chain optimization. For instance, a 2024 report indicated a 15% year-over-year increase in industrial space demand in secondary Australian markets.

While these sites offer significant future growth prospects, their current market share is relatively low. This is typical for "Stars" that are in the early stages of development and market penetration. Frasers Property's strategy here involves substantial capital investment to construct state-of-the-art facilities, aiming to capture a larger share of the emerging market. The company's 2024 capital expenditure plan includes a dedicated allocation for greenfield developments in these strategic corridors.

- High Growth Potential: Nascent corridors benefit from increasing demand for modern logistics infrastructure, fueled by factors like e-commerce growth and reshoring initiatives.

- Low Current Market Share: These new sites, often greenfield developments, are in early stages of market penetration, meaning their current contribution to overall market share is minimal.

- Significant Capital Expenditure: Realizing the potential of these sites requires substantial investment in land acquisition, construction, and infrastructure development to meet modern logistics standards.

- Strategic Importance: Despite initial low market share, these locations are crucial for future expansion and capturing emerging market trends, positioning them as potential future market leaders.

Specific Green and Sustainable Development Projects

Frasers Property's commitment to green and sustainable development is exemplified by projects like The Tube industrial park in Germany. This initiative features advanced photovoltaic systems and aims for high-tier green certifications, positioning it within the rapidly expanding sustainable real estate sector.

These pioneering projects, while crucial for long-term ESG alignment and capturing future market demand, currently represent a small market share. The initial investment required is significant, as Frasers Property works to prove the economic viability and attract tenants to these innovative, eco-conscious developments.

- The Tube Industrial Park, Germany: Incorporates advanced photovoltaic systems, targeting high green certifications.

- Market Niche: Positions Frasers Property in the high-growth, sustainable real estate sector.

- Investment Requirement: Substantial upfront capital is needed to establish viability and attract tenants.

- ESG Alignment: Projects support the company's environmental, social, and governance goals and align with future market trends.

Question Marks in Frasers Property's portfolio represent investments in high-growth potential areas but with currently low market share. These ventures require substantial capital to build brand recognition and compete effectively. For example, new industrial sites in regional Victoria, Australia, are experiencing a 15% year-over-year increase in demand, yet Frasers Property's share is minimal, necessitating significant investment for development.

The Yotel property in Japan, set to launch in early 2025, also falls into this category. Despite Japan's robust tourism sector, with 31.88 million visitors in 2023, Yotel's initial market share will be small, demanding considerable investment to establish a competitive presence.

Similarly, newly acquired GLS residential sites in Singapore, like the Bukit Timah Turf City Masterplan site, are question marks at the pre-launch stage. They offer strong growth prospects but have zero current market share, requiring significant upfront investment before generating returns.

Emerging market expansions, such as Frasers Hospitality's new hotels in China and Vietnam, also start as question marks. While these markets show promise, the company's current share is minimal, and substantial capital is needed to build brand awareness and compete against established players.

| Business Unit/Project | Market Growth | Current Market Share | Capital Investment Needs | BCG Classification |

|---|---|---|---|---|

| Frasers Hospitality (China/Vietnam) | High | Low | Significant | Question Mark |

| Yotel (Japan) | High | Low | Significant | Question Mark |

| GLS Residential Sites (Singapore) | High | Zero (pre-launch) | Significant | Question Mark |

| Industrial Sites (Regional Victoria, Australia) | High (15% YoY demand increase) | Low | Significant | Question Mark |

BCG Matrix Data Sources

Our Frasers Property BCG Matrix leverages comprehensive data from financial disclosures, market research reports, and internal performance metrics to provide strategic insights.