Frasers Property Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frasers Property Bundle

Unlock the strategic blueprint of Frasers Property's diverse real estate ventures. This comprehensive Business Model Canvas details how they connect with key customer segments, forge vital partnerships, and deliver unique value propositions across their portfolio. Discover the core activities and revenue streams that fuel their growth.

Dive deeper into Frasers Property’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Frasers Property frequently forms strategic joint ventures with fellow developers and investment firms to tackle significant projects, thereby distributing risk and capitalizing on combined skills. For instance, in 2024, Frasers Property announced a joint venture with a leading Australian investor for a substantial industrial and logistics development, aiming to tap into the growing demand in that sector.

These collaborations are crucial for broadening Frasers Property's project portfolio and extending its presence across different markets. The company's involvement in joint ventures for residential projects, such as the 'The Orie' development in Singapore, highlights its strategy of partnering to access prime locations and share development expertise.

Frasers Property actively cultivates relationships with a diverse array of financial institutions and investors. These partnerships are fundamental for securing project financing, managing its extensive debt portfolio, and attracting capital for its various investment vehicles, including its Real Estate Investment Trusts (REITs).

In 2024, Frasers Property continued to leverage these relationships, demonstrating its ability to access capital markets effectively. For instance, its ongoing access to credit facilities from major banking syndicates underscores the trust placed in its financial management and strategic direction by these key partners.

Frasers Property actively collaborates with government bodies and regulatory authorities to secure land for development and obtain crucial permits. In 2024, the company continued to navigate complex regulatory landscapes across its diverse markets, ensuring compliance with urban planning and environmental standards. This engagement is fundamental to their strategy, enabling smoother project execution and adherence to local and international best practices.

Construction and Engineering Firms

Frasers Property collaborates with numerous construction and engineering firms to bring its extensive property portfolio to life. These external partners are crucial for the actual building and execution of projects, spanning residential, commercial, industrial, and hospitality sectors. For instance, in 2024, Frasers Property continued to leverage a network of specialized contractors to manage the complexities of large-scale developments, ensuring adherence to stringent quality and safety standards.

The success of Frasers Property's developments hinges on the expertise and reliability of these construction and engineering partners. Their capabilities directly impact project timelines and the final quality of the assets delivered to the market. Maintaining robust relationships with these firms is a cornerstone of efficient project management and risk mitigation.

Key aspects of these partnerships include:

- Specialized Expertise: Access to firms with specific skills in areas like high-rise construction, sustainable building practices, or complex infrastructure development.

- Capacity and Scalability: Engaging partners who can handle the volume and demands of Frasers Property's diverse project pipeline.

- Quality Assurance: Ensuring that construction partners meet and exceed established quality benchmarks and regulatory requirements.

- Timely Delivery: Working with firms committed to project schedules, critical for market responsiveness and financial performance.

Technology and Sustainability Solution Providers

Frasers Property collaborates with technology and sustainability solution providers to embed smart building features, renewable energy infrastructure, and sophisticated climate risk assessment tools within its portfolio. These partnerships are crucial for realizing their vision of sustainable and inspiring environments and advancing their net-zero carbon objectives.

These strategic alliances fuel innovation, enhancing operational efficiency across their developments. For instance, in 2024, Frasers Property continued to expand its use of smart technologies, aiming to reduce energy consumption by a further 15% in its newly developed properties by 2025. Collaborations with firms like Schneider Electric are instrumental in implementing these energy-efficient solutions.

- Smart Building Integration: Partnerships with tech firms enable the deployment of IoT sensors and building management systems to optimize energy usage and occupant comfort.

- Renewable Energy Adoption: Collaborations with sustainability experts facilitate the integration of solar panels and other renewable energy sources, contributing to a cleaner energy mix.

- Climate Risk Management: Working with climate analytics providers helps Frasers Property to better understand and mitigate physical and transitional risks associated with climate change in their asset management strategies.

- Innovation and Efficiency: These partnerships drive the adoption of cutting-edge solutions, leading to improved operational performance and cost savings.

Frasers Property's key partnerships are vital for project execution and market access, including joint ventures with investors like those in Australian industrial developments in 2024, and collaborations on residential projects such as 'The Orie' in Singapore. These alliances share development risks and leverage combined expertise.

The company also relies heavily on financial institutions and investors for capital, exemplified by its continued access to credit facilities from major banking syndicates in 2024, underpinning its financial stability and growth strategies.

Furthermore, partnerships with construction firms ensure quality and timely delivery of diverse projects, while collaborations with technology and sustainability providers, such as Schneider Electric, drive innovation and net-zero carbon objectives, aiming for a 15% energy consumption reduction in new properties by 2025.

| Partner Type | Example Collaboration (2024) | Strategic Benefit |

|---|---|---|

| Investment Firms / Developers | Australian Industrial JV | Risk sharing, market access, combined expertise |

| Financial Institutions | Banking Syndicates | Capital access, debt management, investor confidence |

| Construction Firms | Specialized Contractors | Project execution, quality assurance, timely delivery |

| Technology/Sustainability Providers | Schneider Electric | Smart building features, energy efficiency, net-zero goals |

What is included in the product

A comprehensive, pre-written business model tailored to Frasers Property's strategy of diversified real estate development and investment, covering customer segments from homebuyers to corporate tenants and their evolving needs.

Reflects the real-world operations of Frasers Property by detailing their value propositions across residential, commercial, and industrial segments, supported by robust channels and key partnerships.

Frasers Property's Business Model Canvas offers a clear, structured approach to understanding their operations, acting as a pain point reliever by simplifying complex strategies into a single, digestible page for efficient decision-making.

Activities

Frasers Property's primary focus is on the complete lifecycle of property development, from initial land acquisition and meticulous planning to innovative design and diligent construction oversight. This encompasses a broad spectrum of property types, including homes, shopping centers, offices, industrial spaces, and hotels.

The company actively manages a robust and ongoing development pipeline, ensuring a steady stream of new projects. Notably, Frasers Property has substantial ongoing developments in key markets such as Australia and various European countries, reflecting its global reach and commitment to growth.

Frasers Property actively manages its extensive property portfolio, encompassing residential, commercial, and industrial assets. This hands-on approach ensures peak operational efficiency and tenant satisfaction, directly contributing to asset value. For instance, in FY2023, the company reported a strong performance across its managed properties, with occupancy rates remaining robust in key markets, demonstrating the effectiveness of their operational strategies.

Key activities include proactive leasing, comprehensive maintenance, and strategic facilities management. The company also undertakes property upgrades to maintain competitiveness and enhance long-term returns. This focus on operational excellence is fundamental to generating stable recurring revenue streams, a core component of Frasers Property's business model, as evidenced by their consistent rental income growth.

Frasers Property actively manages a diverse portfolio, including sponsoring and overseeing Real Estate Investment Trusts (REITs) and other investment funds. This strategic approach focuses on optimizing assets through acquisitions, divestments, and efficient capital recycling, aiming to enhance investor returns. For instance, in the fiscal year 2023, Frasers Property reported a substantial increase in its funds under management, reflecting its growing expertise in managing international real estate assets.

Land Bank Management and Acquisition

Frasers Property's land bank management is crucial for its sustained growth. This involves strategically acquiring and managing land parcels to secure future development opportunities across its diverse markets.

Key activities include identifying prime locations, conducting thorough due diligence, and executing acquisitions to maintain a healthy pipeline of projects. For instance, in FY2023, Frasers Property continued to focus on strategic land acquisitions, contributing to its development pipeline and future revenue streams.

- Strategic Land Replenishment: Continuously identifying and acquiring suitable land parcels in target markets to ensure a steady flow of development projects.

- Geographic Diversification: Focusing on acquiring land in various countries and regions to mitigate risk and capitalize on diverse market growth.

- Pipeline Management: Effectively managing the existing land bank to optimize development timelines and resource allocation for upcoming projects.

- Market Analysis: Conducting in-depth analysis of market trends and demand to inform land acquisition strategies and ensure alignment with development plans.

Sustainability Integration and ESG Reporting

Frasers Property actively integrates Environmental, Social, and Governance (ESG) principles throughout its entire value chain, from initial project design to ongoing property management. This commitment is evidenced by their pursuit of green building certifications and concrete actions to reduce carbon emissions.

A significant aspect of their strategy involves transparently reporting on their sustainability progress. Frasers Property has set an ambitious target to achieve net-zero carbon emissions by 2050 and is also committed to disclosing information related to nature-based issues, reflecting a comprehensive approach to sustainability.

- Green Building Certifications: Frasers Property aims for high standards in its developments, pursuing recognized green building certifications to ensure environmental performance.

- Carbon Emission Reduction: The company is actively implementing strategies to lower its carbon footprint across its operations and portfolio.

- Net-Zero Carbon Target: Frasers Property has committed to achieving net-zero carbon emissions by the year 2050.

- Nature-Related Disclosures: The organization plans to provide transparency on issues concerning nature and biodiversity within its business activities.

Frasers Property's key activities revolve around developing and managing a diverse real estate portfolio. This includes acquiring land, designing and constructing properties, and then actively managing these assets through leasing, maintenance, and upgrades. They also focus on growing their funds under management by sponsoring and overseeing REITs and investment funds, demonstrating a commitment to capital efficiency and investor returns.

| Key Activity | Description | FY2023 Data/Impact |

|---|---|---|

| Property Development | End-to-end management from land acquisition to construction oversight across various property types. | Continued focus on strategic land acquisitions to bolster development pipeline. |

| Property Management | Active management of residential, commercial, and industrial assets to ensure efficiency and tenant satisfaction. | Robust occupancy rates in key markets, contributing to stable recurring revenue. |

| Fund Management | Sponsoring and overseeing REITs and investment funds, optimizing assets through acquisitions and divestments. | Substantial increase in funds under management, indicating growing expertise in international real estate asset management. |

| Sustainability Integration | Embedding ESG principles throughout the value chain, including green building certifications and carbon reduction. | Committed to net-zero carbon emissions by 2050, with ongoing efforts in nature-related disclosures. |

Preview Before You Purchase

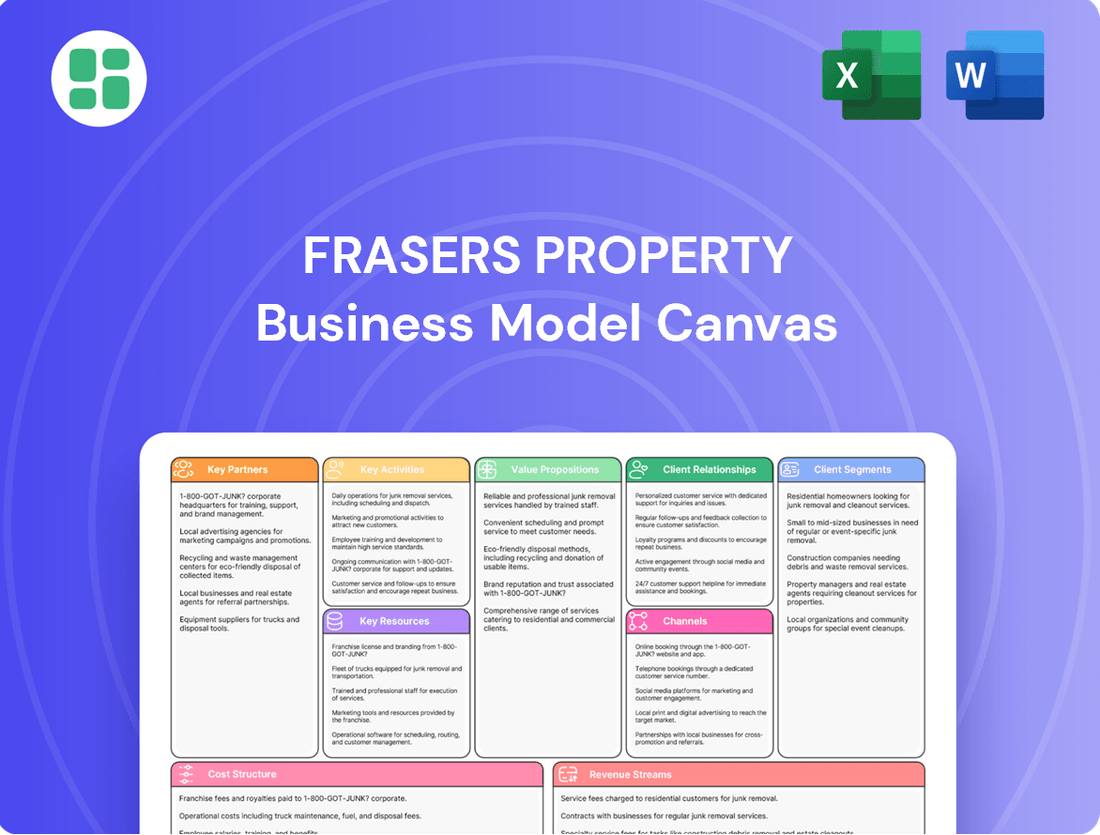

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a mockup or a sample; it's a direct representation of the final deliverable, allowing you to see the exact structure and content you will gain access to. Once your order is complete, you will download this identical file, ready for immediate use and customization.

Resources

Frasers Property's diversified property portfolio is a cornerstone of its business model, encompassing residential, retail, commercial, industrial, and hospitality sectors across numerous global markets. This wide array of asset classes offers significant resilience and creates multiple avenues for revenue generation, mitigating risks associated with any single sector.

As of the first half of fiscal year 2024, Frasers Property's portfolio is substantial, featuring 175 completed industrial properties spread across five countries. This strategic focus on industrial assets, alongside its other holdings, underscores the company's commitment to a balanced and robust real estate presence.

Frasers Property leverages its strategically located land banks as a core resource, ensuring access to prime development sites across its global markets. This is crucial for maintaining a consistent pipeline of projects and seizing future growth opportunities.

As of early 2024, Frasers Property's robust land holdings provided a significant competitive advantage, underpinning its development capabilities. The company's ongoing strategy involves actively replenishing these land banks to sustain long-term growth and market presence.

Frasers Property leverages significant financial capital, encompassing equity, debt, and capital raised through its sponsored Real Estate Investment Trusts (REITs), to fuel its ambitious large-scale development projects and strategic acquisitions. For instance, as of the first half of fiscal year 2024, the company reported a robust financial position, enabling continued investment in its diverse portfolio.

The company's financial health is paramount, directly influencing its capacity to manage existing debt effectively and attract crucial capital partners. This financial stewardship is essential for both sustaining ongoing operations and driving future expansion initiatives, ensuring a stable foundation for growth.

Human Capital and Multinational Expertise

Frasers Property leverages a highly skilled workforce possessing extensive multinational expertise in real estate development, investment, and management. This human capital is a critical intellectual resource, underpinning their ability to navigate diverse global markets and property sectors.

Specialized teams across various geographies and property types are central to Frasers Property's operational strength. These groups are adept at delivering integrated solutions, demonstrating proficiency in development, asset management, and investment management.

For instance, as of their fiscal year 2023, Frasers Property reported a global workforce of approximately 13,000 employees. This diverse talent pool is instrumental in executing their strategy across their portfolio, which spans residential, commercial, retail, and industrial properties.

- Multinational Expertise: A global team with deep understanding of international real estate markets and regulations.

- Integrated Capabilities: Professionals skilled in the full real estate lifecycle, from acquisition and development to asset and investment management.

- Sector Specialization: Dedicated teams focusing on specific property types like residential, commercial, and industrial, ensuring specialized knowledge.

- Talent Pool Size: Approximately 13,000 employees globally (FY2023), representing a significant concentration of industry talent.

Brand Reputation and Sustainability Leadership

Frasers Property's strong brand reputation, built on a commitment to quality and sustainability, is a significant intangible asset. This reputation fosters trust among customers, investors, and partners, differentiating the company in a competitive market.

The company's leadership in sustainability, recognized through various global benchmarks, attracts environmentally conscious consumers and investors. For example, Frasers Property achieved a CDP A- score for climate change in 2023, highlighting its dedication to environmental stewardship.

This focus on Environmental, Social, and Governance (ESG) principles is consistently communicated through their reporting. In 2023, Frasers Property reported that 84% of its portfolio by value was covered by its sustainability targets, demonstrating a tangible commitment to its ESG leadership.

- Brand Reputation: Frasers Property is recognized globally for its quality and commitment to sustainable development, enhancing customer and investor confidence.

- Sustainability Leadership: The company's strong performance in global sustainability benchmarks, such as its CDP A- score in 2023, validates its leadership in ESG practices.

- Stakeholder Trust: This established reputation and sustainability focus build significant trust with a broad range of stakeholders, from customers to investors.

- ESG Reporting: Frasers Property's consistent and transparent ESG reporting, with 84% of its portfolio covered by sustainability targets in 2023, reinforces its commitment to responsible business.

Frasers Property's intellectual property, including its proprietary development methodologies and market research, is a key resource. This intellectual capital drives innovation and efficiency across its diverse operations.

The company's extensive network of strategic partnerships and joint ventures is a vital resource, enabling access to new markets, capital, and expertise. These collaborations are fundamental to executing large-scale projects and expanding its global footprint.

As of early 2024, Frasers Property actively managed a diverse portfolio of 226 properties, with a significant portion being investment properties. This robust portfolio is a testament to its strategic resource allocation and partnership capabilities.

| Key Resource | Description | Relevance to Business Model |

| Intellectual Property | Proprietary development methodologies, market research, and brand equity. | Drives innovation, efficiency, and market differentiation. |

| Strategic Partnerships & JVs | Collaborations with local and international entities. | Facilitates market entry, capital access, and risk sharing for large projects. |

| Global Property Portfolio | 226 properties as of early 2024, spanning various sectors and geographies. | Generates diversified revenue streams and provides a platform for growth. |

Value Propositions

Frasers Property designs properties with sustainability at their core, aiming for top-tier environmental performance and a strong focus on community well-being. This commitment is evident in their portfolio of green-certified buildings, which actively pursue initiatives to lower carbon emissions and boost local biodiversity.

The company’s vision extends to creating places that are not only resilient and economically vibrant but also aesthetically pleasing and inspiring for occupants. For example, in 2023, Frasers Property reported that 77% of its completed projects were green-certified, demonstrating tangible progress towards its sustainability goals.

Frasers Property provides a complete suite of real estate services, encompassing everything from initial development to ongoing management. This end-to-end capability ensures a smooth and efficient experience for all stakeholders involved in the property lifecycle.

By managing the entire property value chain, Frasers Property delivers a seamless journey for clients and tenants alike. Their integrated model streamlines operations and enhances value across all stages of property ownership and occupancy.

Leveraging deep expertise across diverse markets and property types, Frasers Property consistently delivers enhanced value. For instance, in FY2023, their integrated solutions contributed to a robust performance, with their property development and management segments working in synergy to achieve key strategic objectives.

Frasers Property is dedicated to building enduring value for its stakeholders, encompassing investors and property owners. This is achieved through careful investment choices, responsible development practices, and diligent management of its assets.

The company's strategy is built on three core pillars: creating new value, sustaining existing value, and unlocking further value from its portfolio. This holistic approach aims for consistent capital growth over the long term.

For instance, Frasers Property's commitment to long-term value is evident in its strategic acquisitions and developments. In the fiscal year 2023, the company reported a substantial increase in its property development pipeline, indicating a forward-looking approach to capital growth.

Diverse Portfolio and Global Reach

Frasers Property offers customers a comprehensive selection of property types, including residential, retail, commercial, industrial, and hospitality. This broad spectrum caters to diverse needs, from living and working to shopping and leisure, across multiple international markets.

The company's global footprint is a significant advantage, with operations spanning Southeast Asia, Australia, Europe, the UK, and China. This extensive reach allows customers to find opportunities and solutions in key economic hubs worldwide.

- Diverse Property Offerings: Residential, retail, commercial, industrial, and hospitality assets.

- Global Presence: Operations in Southeast Asia, Australia, Europe, UK, and China.

- Customer Needs: Catering to a wide range of living, working, shopping, and leisure preferences.

Customer-Centric Design and Experience

Frasers Property is deeply invested in creating customer-centric designs that prioritize well-being and deliver memorable experiences. This commitment is evident in their ongoing efforts to boost customer satisfaction, with a focus on developing properties that actively enhance both productivity and overall quality of life for residents and users.

The company's strategic approach involves designing spaces that foster connection and a sense of belonging among people. This focus on community building is a core element of their value proposition, aiming to create environments where individuals and families can thrive.

- Customer Satisfaction Focus: Frasers Property aims to elevate customer satisfaction, a key metric for their success.

- Enhanced Living and Working: Properties are designed to improve daily life, boosting productivity and quality of life.

- Community and Belonging: Projects are intentionally crafted to encourage social interaction and a strong sense of community.

Frasers Property offers a diverse portfolio of real estate, spanning residential, retail, commercial, industrial, and hospitality sectors. This breadth ensures they can meet a wide array of customer needs across various international markets, from essential living spaces to vibrant commercial hubs.

Their commitment to sustainability is a key differentiator, with a strong emphasis on green-certified buildings and initiatives to reduce environmental impact. For example, in FY2023, 77% of their completed projects achieved green certification, underscoring their dedication to responsible development.

The company's integrated approach to property management, from development to ongoing operations, provides a seamless experience for stakeholders. This end-to-end capability allows them to build enduring value and foster strong customer relationships through enhanced living and working environments.

| Value Proposition | Description | Supporting Data (FY2023) |

|---|---|---|

| Diverse Property Offerings | Comprehensive range of residential, retail, commercial, industrial, and hospitality assets catering to varied customer needs. | Operations across multiple property types in key global markets. |

| Sustainability Leadership | Focus on green-certified buildings and environmental performance, enhancing community well-being and reducing carbon footprint. | 77% of completed projects were green-certified. |

| Integrated Value Chain | End-to-end services from development to management, ensuring seamless operations and enhanced value across the property lifecycle. | Synergy between development and management segments driving strategic objectives. |

| Customer-Centric Design | Creating spaces that prioritize well-being, foster community, and enhance productivity and quality of life. | Ongoing efforts to boost customer satisfaction and create memorable experiences. |

Customer Relationships

Frasers Property cultivates enduring customer relationships via specialized property and asset management teams. These teams are instrumental in the day-to-day oversight, upkeep, and strategic improvement of their extensive property portfolio, ensuring tenant contentment and sustained asset value. This hands-on approach helps build trust and loyalty, crucial for long-term success.

This dedicated management fosters long-standing partnerships, often spanning numerous facilities and international markets. For instance, in the fiscal year 2023, Frasers Property reported a significant increase in its recurring income streams, a testament to the stability and satisfaction derived from these well-managed assets and the relationships they support.

Frasers Property actively cultivates customer relationships through its 'Care & Rewards' program, a key initiative designed to boost engagement across its residential and commercial segments. This program offers tangible benefits, fostering a sense of value and encouraging repeat engagement from its clientele.

The 'Care & Rewards' program is central to Frasers Property's strategy for building enduring customer loyalty and creating a palpable sense of community among its residents and business tenants. By providing exclusive advantages, the company reinforces its dedication to delivering an exceptional customer experience.

Frasers Property actively seeks customer input through various direct channels. In 2024, they continued to leverage customer satisfaction surveys and hosted numerous community events across their developments, fostering direct interaction. These initiatives are crucial for gathering real-time feedback on their properties and services.

This direct engagement allows Frasers Property to understand evolving customer needs and preferences. By actively listening and responding, the company can refine its service offerings and tailor solutions to enhance the overall customer experience, thereby building stronger loyalty.

Strategic Tenant Partnerships

Frasers Property actively builds strategic partnerships with its key tenants across its commercial, industrial, and retail portfolios. This approach goes beyond standard landlord-tenant agreements, focusing on understanding each tenant's unique business requirements and growth aspirations.

To foster these relationships, Frasers Property offers adaptable leasing arrangements and actively supports tenant expansion within its diverse property developments. This collaborative strategy is a cornerstone of their customer relationship management.

- Tenant-Centric Approach: Understanding and catering to the specific business needs of major tenants.

- Flexible Leasing: Providing adaptable lease terms to accommodate tenant growth and evolving market conditions.

- Partnership Support: Assisting tenants in their expansion and operational success within Frasers Property’s ecosystem.

- Performance Metrics: High occupancy rates and a strong weighted average lease expiry (WALE) demonstrate the success of these strategic tenant partnerships. For instance, Frasers Property reported a global occupancy rate of 94.4% as of September 30, 2023, highlighting the stability derived from these relationships.

Digital Communication and Support

Frasers Property actively leverages digital platforms to foster strong customer relationships. This includes online portals and mobile applications designed for residents, tenants, and investors, offering a streamlined channel for communication, updates, and support. For instance, their resident app allows for easy booking of facilities and submission of maintenance requests, enhancing convenience and engagement.

These digital touchpoints are crucial for maintaining transparency and accessibility across their diverse stakeholder groups. By providing timely information on property management, community events, and investment updates, Frasers Property ensures stakeholders feel informed and connected. This digital-first approach supports efficient problem resolution and proactive engagement.

- Digital Communication: Online portals and mobile apps for residents, tenants, and investors.

- Accessibility: Providing convenient access to information and support services.

- Engagement: Facilitating community interaction and property management feedback.

- Transparency: Ensuring stakeholders receive timely and accurate updates.

Frasers Property nurtures customer relationships through dedicated management teams and loyalty programs like 'Care & Rewards.' They actively solicit feedback via surveys and events, as seen in their 2024 initiatives, to refine services and enhance customer experience. Strategic partnerships with key tenants, supported by flexible leasing and expansion assistance, further solidify these bonds, evidenced by strong occupancy rates.

| Relationship Strategy | Key Initiatives | Impact/Data Point |

|---|---|---|

| Dedicated Property Management | Day-to-day oversight, upkeep, strategic improvement | Fosters tenant contentment and sustained asset value; contributed to recurring income streams in FY2023. |

| Loyalty Programs | 'Care & Rewards' program | Boosts engagement across residential and commercial segments, fostering value and repeat business. |

| Customer Feedback Channels | Satisfaction surveys, community events (2024) | Gathers real-time feedback to refine services and tailor solutions. |

| Strategic Tenant Partnerships | Adaptable leasing, tenant expansion support | High occupancy rates (94.4% globally as of Sept 30, 2023) and strong weighted average lease expiry (WALE). |

| Digital Engagement | Online portals, mobile apps | Streamlines communication, offers support, and enhances convenience for residents and tenants. |

Channels

Frasers Property leverages its own sales force for residential property transactions. This direct approach ensures that potential buyers receive tailored service and benefit from the team's in-depth understanding of the properties. It's a crucial method for finalizing property sales.

Dedicated leasing teams manage Frasers Property's commercial, industrial, and retail portfolios. These teams are instrumental in securing tenants for these diverse asset classes. Their direct engagement allows for effective negotiation and relationship building with prospective occupants, crucial for occupancy rates.

Frasers Property collaborates with a wide array of external real estate agencies and broker networks. This strategic partnership is crucial for expanding their market presence and accessing a larger customer base for both property sales and leasing activities.

These extensive networks offer Frasers Property invaluable access to a broader pool of potential buyers and tenants. Furthermore, they provide specialized market intelligence, helping the company understand niche demands and pricing strategies, which is vital in today's competitive landscape.

By leveraging these partnerships, Frasers Property effectively accelerates property sales cycles and improves occupancy rates across their diverse portfolio. For instance, in 2024, many developers reported faster sales velocity in projects marketed through established agency channels compared to those relying solely on in-house teams.

Frasers Property leverages its official website, active social media presence, and prominent property listing portals to present its diverse portfolio. These digital channels are crucial for customer engagement and lead generation, offering widespread visibility and easy access to information for potential buyers and investors.

In 2024, Frasers Property continued to invest in targeted digital marketing campaigns. These efforts are designed to precisely reach specific customer segments, ensuring marketing spend is efficient and impactful, driving engagement and ultimately, sales conversions.

Property Showrooms and Experience Centres

Frasers Property utilizes dedicated showrooms and experience centers as key physical channels for its residential and new commercial developments. These spaces are designed to allow potential customers to truly visualize and experience the properties firsthand, offering immersive tours and detailed information to aid in their purchasing decisions.

These physical touchpoints are critical for Frasers Property to effectively showcase the quality, design, and lifestyle associated with its new projects. For instance, in 2024, Frasers Property Singapore continued to invest in sophisticated customer experience centers, such as the one for its Hillock Green development, which aimed to provide a tangible feel for the unit layouts and amenities.

- Physical Interaction: Enables potential buyers to touch, feel, and see the quality of materials and finishes, fostering greater confidence.

- Immersive Experience: Showrooms often incorporate virtual reality or augmented reality elements to provide a comprehensive understanding of the space and its potential.

- Sales Conversion: These centers act as crucial conversion points, directly influencing purchasing decisions by bridging the gap between digital marketing and physical reality.

- Brand Reinforcement: They serve as tangible representations of the Frasers Property brand promise, highlighting attention to detail and customer-centricity.

Investor Relations and Public Relations

Frasers Property actively engages institutional investors and the financial community through its dedicated investor relations (IR) and public relations (PR) functions. These channels are crucial for communicating financial performance, strategic direction, and significant corporate developments. For instance, in their fiscal year 2024 reporting, Frasers Property highlighted continued operational resilience and strategic growth initiatives, underscoring their commitment to transparency.

The company leverages a suite of tools to ensure broad dissemination of information. This includes detailed annual reports, timely press releases announcing key milestones, and investor briefings that offer direct engagement with analysts and fund managers. These efforts are designed to build trust and attract the necessary capital for their ongoing projects and expansion plans.

- Financial Transparency: Dissemination of quarterly and annual financial results, including key performance indicators and segment-specific data, to the investment community.

- Strategic Communication: Sharing updates on business strategy, capital allocation, sustainability initiatives, and major project developments through press releases and investor presentations.

- Investor Engagement: Hosting investor briefings, conference calls, and one-on-one meetings to facilitate dialogue and address inquiries from analysts and shareholders.

- Market Perception: Cultivating a positive corporate image and building confidence among stakeholders by consistently providing accurate and timely information.

Frasers Property utilizes a multi-channel approach for customer engagement, blending direct sales forces with extensive broker networks and robust digital platforms. This strategy ensures broad market reach and caters to diverse customer preferences, from personalized in-person interactions to convenient online browsing. The company's commitment to showcasing its properties through immersive physical spaces like showrooms further enhances customer experience and aids purchasing decisions.

In 2024, Frasers Property's digital channels, including its website and social media, played a significant role in lead generation and customer engagement, supported by targeted marketing campaigns. Their investor relations and public relations functions are vital for transparent communication with the financial community, fostering trust and attracting investment. This integrated approach supports both property sales and the company's overall financial strategy.

| Channel Type | Key Activities | 2024 Focus/Data | Impact |

|---|---|---|---|

| Direct Sales Force | Residential property transactions, tailored customer service | Continued emphasis on in-house expertise for property sales. | Ensures personalized buyer experience and deep product knowledge. |

| Leasing Teams | Tenant acquisition for commercial, industrial, retail portfolios | Focus on effective negotiation and relationship building for occupancy. | Crucial for maintaining high occupancy rates across diverse assets. |

| External Agencies & Brokers | Expanding market presence, accessing broader customer base | Leveraging partnerships for accelerated sales and leasing. | Access to wider market intelligence and customer pools. |

| Digital Platforms (Website, Social Media, Portals) | Customer engagement, lead generation, property showcasing | Investment in targeted digital marketing campaigns for efficient reach. | Widespread visibility and easy access to property information. |

| Physical Showrooms & Experience Centers | Immersive property visualization, firsthand experience | Investment in sophisticated centers for tangible feel of units and amenities. | Aids purchasing decisions by bridging digital and physical realities. |

| Investor Relations (IR) & Public Relations (PR) | Communicating financial performance, strategic direction | Continued operational resilience and strategic growth initiatives highlighted in FY2024. | Builds trust and attracts capital through transparency. |

Customer Segments

Individual homebuyers and residential tenants represent a core customer segment for Frasers Property. This group encompasses a broad spectrum of people, from young professionals looking for their first apartment to families seeking spacious homes in master-planned communities. They are actively searching for residences that offer not just shelter, but a quality living experience, characterized by thoughtful design, desirable community amenities, and increasingly, a commitment to sustainability.

Frasers Property caters to these diverse needs by offering a wide array of residential options. For instance, in 2024, Frasers Property continued to focus on developing integrated communities that provide residents with access to parks, recreational facilities, and retail spaces, enhancing their lifestyle and sense of belonging. Their portfolio includes everything from urban apartments to landed properties, ensuring there's a fit for different life stages and preferences.

Retail businesses, from independent shops to major brands, are key customers seeking prime locations in Frasers Property's malls and commercial hubs. These tenants prioritize high foot traffic and appealing, well-maintained environments to drive sales.

In 2024, Frasers Property continued to attract a diverse tenant mix, including anchor tenants like [mention a specific anchor tenant if data is available, otherwise generalize]. Their portfolio offers strategic advantages, with many properties situated in densely populated urban areas, ensuring consistent customer flow.

Frasers Property's commitment to developing award-winning retail spaces is a significant draw. For instance, their [mention a specific award-winning mall or project if data is available] demonstrates their capability in creating environments that foster tenant success and customer engagement.

Industrial and logistics clients are businesses that need space for storing goods, managing supply chains, and operating distribution networks. Think of companies that run large warehouses, fulfillment centers, or business parks where various industries operate.

These clients place a high value on where their facilities are located, often prioritizing proximity to major transportation routes and key markets. They also demand modern, efficient infrastructure that supports smooth operations and allows for future growth, or scalability.

Frasers Property Industrial actively targets this segment, focusing on attracting tenants who require top-tier facilities. Their strategy involves maintaining a strong pipeline of development projects to meet this demand. For instance, in 2024, Frasers Property reported a robust development pipeline, with a significant portion allocated to industrial and logistics assets across key global markets, reflecting strong tenant interest and commitment.

Hospitality Guests and Corporate Clients

Frasers Hospitality's customer base is diverse, encompassing both individual travelers and businesses. This segment includes tourists seeking leisure stays and corporate clients requiring accommodations for business trips or extended assignments. They value comfort, accessibility, and dependable service, often booking for short or longer durations.

The company's global reach is a significant draw, operating in more than 70 cities worldwide. This extensive network allows Frasers Hospitality to cater to a broad spectrum of needs. For instance, in 2024, the serviced apartment sector continued to see strong demand from both leisure and business travelers, with occupancy rates often exceeding 70% in key urban centers, reflecting the segment's resilience and appeal.

- Leisure Travelers: Tourists and vacationers looking for comfortable and well-located accommodations.

- Business Travelers: Professionals on assignments, attending conferences, or conducting business, often requiring longer stays and amenities like workspace.

- Corporate Clients: Companies booking blocks of rooms or serviced apartments for their employees, often negotiating corporate rates.

Institutional Investors and REIT Unitholders

Institutional investors, including pension funds and large asset managers, are key stakeholders for Frasers Property. These sophisticated investors are attracted to Frasers Property's sponsored REITs, such as Frasers Centrepoint Trust (FCT) and Frasers Logistics & Industrial Trust (FLT), seeking consistent income streams and long-term capital growth. In 2024, FCT reported a distributable income of S$208.5 million for the fiscal year ended September 30, 2023, demonstrating the stability these vehicles can offer.

REIT unitholders, encompassing both institutional and retail investors, rely on Frasers Property's management expertise to deliver stable yields and portfolio appreciation. The company's commitment to a diversified property portfolio across various sectors and geographies provides a hedge against market volatility. As of early 2024, Frasers Property's global portfolio spanned over 180 properties, valued at approximately S$25.3 billion, underscoring the scale and breadth of opportunities for unitholders.

These investor segments prioritize transparency, strong governance, and a proven track record of operational excellence. Frasers Property's strategic focus on sustainable development and its ability to generate recurring rental income are critical factors in attracting and retaining these capital providers. The company's proactive asset management strategies aim to enhance property values and optimize returns for all unitholders.

Key characteristics of this customer segment include:

- Seeking stable, income-generating assets

- Prioritizing capital preservation and appreciation

- Valuing diversified property portfolios and strong management

- Responding to transparent financial reporting and corporate governance

Frasers Property's customer segments are diverse, reflecting its broad real estate operations. These include individual homebuyers and tenants seeking quality living, retail businesses requiring prime locations, and industrial clients needing efficient logistics spaces. The company also serves a significant base of institutional and retail investors through its REITs, who are drawn to stable income and capital growth.

Cost Structure

Property development and construction costs represent a substantial investment for Frasers Property. These expenses include everything from securing land and initial design work to sourcing materials, paying skilled labor, and managing contractor fees for both new projects and renovations. This category is a major driver of capital expenditure, particularly given the company's ongoing development activities.

In the fiscal year 2023, Frasers Property reported significant capital expenditure, with a substantial portion allocated to development and construction across its diverse portfolio. For instance, their investment in new developments and enhancements to existing properties is a critical component of maintaining their competitive edge and expanding their market presence.

These costs are spread across various property sectors, including residential, commercial, and industrial, and are incurred in numerous international markets where Frasers Property operates. The scale of these expenditures directly reflects the company's commitment to its development pipeline and its strategy of delivering high-quality properties.

Frasers Property incurs ongoing costs for managing its extensive property portfolio. These include essential expenses like property maintenance, utility payments, security services, cleaning, property taxes, and salaries for administrative staff. These operational costs are critical for preserving asset quality and ensuring high tenant satisfaction across their diverse holdings.

For instance, in their Fiscal Year 2023, Frasers Property Limited reported significant operational expenditures. While specific breakdowns vary by segment, the company's consolidated financial statements reflect substantial outlays in property operating expenses, which are directly tied to maintaining their real estate assets and ensuring smooth operations. These costs are a fundamental part of their business model, directly impacting profitability.

Frasers Property's cost structure heavily features financing and interest expenses, reflecting the capital-intensive nature of real estate. These costs are directly tied to borrowing money for acquiring land and funding development projects, encompassing interest payments on various loans and financial instruments.

For instance, in the first half of fiscal year 2024, Frasers Property reported finance costs of S$305 million. This figure highlights the significant expense associated with servicing its debt, a crucial element in managing profitability within the property sector.

The company's reliance on debt means that fluctuations in interest rates, particularly the benchmark rates, can materially affect its bottom line. A rising interest rate environment, as seen in recent periods, directly translates to higher borrowing costs, thus impacting the overall cost of capital and, consequently, profit margins on its developments and investments.

Sales, Marketing, and Administrative Overheads

Frasers Property's cost structure includes significant expenditures on sales, marketing, and administrative overheads. These are essential for building brand recognition and managing a global enterprise.

These costs cover a range of activities, from broad marketing campaigns and advertising to direct sales commissions. Additionally, general corporate functions like executive salaries, office leases, and professional services are factored in. For instance, in the fiscal year ending September 30, 2023, Frasers Property reported selling, general, and administrative expenses of S$1.2 billion.

- Marketing and Advertising: Expenditures on campaigns to promote properties and brand awareness.

- Sales Commissions: Payments to sales teams for successful property transactions.

- Administrative Salaries: Compensation for non-operational staff, including management and support functions.

- Corporate Overheads: Costs such as office rent, utilities, and professional fees for legal and accounting services.

Sustainability and Compliance Investments

Frasers Property's cost structure includes significant investments in sustainability and compliance. These are essential for achieving their net-zero carbon goals and ensuring responsible operations.

- Renewable Energy Infrastructure: This involves capital outlays for solar panels and other clean energy solutions across their property portfolio.

- Green Building Certifications: Costs are incurred for obtaining and maintaining certifications like LEED or Green Mark, which validate sustainable building practices.

- Climate Risk Assessment: Investment in platforms and expertise to assess and mitigate climate-related risks within their developments and operations.

- Regulatory Compliance: Ongoing expenses to adhere to increasingly stringent environmental regulations and reporting requirements, particularly in key markets like Singapore and Australia.

For instance, in FY2023, Frasers Property reported a 24% increase in sustainability-related capital expenditure compared to the previous year, reflecting a strategic commitment to integrating ESG principles deeply into their business model.

Frasers Property's cost structure is heavily influenced by property development and construction expenses, which are fundamental to its business. These costs encompass land acquisition, design, materials, and labor for new projects and renovations. In fiscal year 2023, the company made significant capital expenditures on development activities across its global portfolio, underscoring the importance of these outlays for maintaining competitiveness and expanding its market reach.

Revenue Streams

Frasers Property generates substantial revenue from selling residential properties like apartments, condominiums, and houses to individual buyers. This is a core income driver, particularly when new projects launch successfully and land sales perform well in important locations.

In the fiscal year 2023, Frasers Property reported strong performance in its residential segment. For instance, their residential segment contributed significantly to the group's overall revenue, with notable sales achieved in markets like Australia and Singapore, reflecting the demand for their housing developments.

Frasers Property generates recurring revenue by leasing out a variety of properties. This includes commercial offices, retail spaces within its shopping malls, and industrial and logistics facilities. The company also earns income from hospitality assets, such as serviced apartments and hotels, by charging for stays.

This diversified approach to rental income provides a stable and predictable cash flow across its extensive portfolio. For instance, in the fiscal year ending September 30, 2023, Frasers Property reported strong leasing performance, with a significant portion of its revenue stemming from these rental agreements, underscoring the reliability of this key revenue stream.

Frasers Property generates income through property and asset management fees. These fees are earned by managing its own extensive portfolio and also by providing these services to third-party clients and its sponsored Real Estate Investment Trusts (REITs). This highlights the service-oriented nature of their business, leveraging their deep expertise in handling a wide array of assets.

For the fiscal year 2023, Frasers Property reported that its management fees, including those from its REITs, were a significant contributor to its overall revenue, underscoring the value derived from its operational capabilities and asset stewardship.

Divestments and Capital Recycling

Frasers Property generates revenue through divestments and capital recycling, strategically selling non-core or mature assets to fund new growth initiatives. This process unlocks capital, allowing for reinvestment in development projects and portfolio optimization. For example, in fiscal year 2023, Frasers Property completed divestments totaling approximately S$2.5 billion, demonstrating a proactive approach to managing its asset base.

These capital recycling efforts are crucial for maintaining a dynamic portfolio and pursuing strategic opportunities. The company actively manages its property holdings, identifying and disposing of assets that no longer align with its long-term vision. This could involve the sale of specific retail centers or other underperforming properties.

- Strategic Asset Sales: Revenue is realized from the sale of properties that have reached maturity or are deemed non-core to the group's strategic objectives.

- Capital Unlocking: Divestments free up capital that can be redeployed into higher-yielding development projects or acquisitions.

- Portfolio Optimization: This revenue stream contributes to a more efficient and focused property portfolio, enhancing overall returns.

- Reinvestment Strategy: Proceeds from divestments are a key source of funding for new development pipelines and strategic growth areas.

Investment Returns from REITs and Joint Ventures

Frasers Property generates revenue through investment returns from its stakes in various Real Estate Investment Trusts (REITs) and joint venture projects. These returns manifest as distributions, dividends, and a share of profits, underscoring the company's dual role as a developer and a strategic investor.

This approach diversifies Frasers Property's income streams, reducing reliance solely on direct property operations. For instance, in fiscal year 2023, Frasers Property's income from its investment portfolio, which includes REITs and joint ventures, contributed significantly to its overall financial performance, reflecting a steady stream of passive income alongside its active development activities.

- Income from REITs and Joint Ventures: Distributions, dividends, and profit shares from strategic investments.

- Dual Role: Reflects Frasers Property's capacity as both a property developer and an active investor.

- Diversification: Broadens revenue base beyond direct property sales and leasing.

- FY2023 Contribution: Investment returns played a key role in the company's financial results for the year.

Frasers Property's revenue streams are diverse, encompassing property sales, rental income from commercial and hospitality assets, management fees, strategic divestments, and returns from investments in REITs and joint ventures.

In FY2023, the company demonstrated robust performance across these segments, with residential sales remaining a key driver and rental income providing stability. Strategic asset sales, such as divestments totaling approximately S$2.5 billion in FY2023, further bolstered its financial position by unlocking capital for reinvestment.

The company's income from REITs and joint ventures also contributed significantly, highlighting its dual role as a developer and investor. This multifaceted approach ensures a resilient financial structure and supports ongoing growth initiatives.

| Revenue Stream | Description | FY2023 Relevance |

| Property Sales | Revenue from selling residential units. | Core income driver, strong performance in key markets. |

| Rental Income | Recurring revenue from leasing commercial, retail, industrial, and hospitality properties. | Provided stable and predictable cash flow. |

| Management Fees | Fees earned from managing own assets and third-party properties/REITs. | Significant contributor, showcasing operational expertise. |

| Divestments/Capital Recycling | Proceeds from selling mature or non-core assets. | FY2023 divestments reached ~S$2.5 billion, funding new growth. |

| Investment Returns | Distributions, dividends, and profit shares from REITs and joint ventures. | Diversified income, played a key role in overall financial performance. |

Business Model Canvas Data Sources

Frasers Property's Business Model Canvas is informed by a robust blend of internal financial data, extensive market research across property sectors, and strategic insights gleaned from industry analysis. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's operations and market position.