Frasers Property PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frasers Property Bundle

Unlock the critical external factors shaping Frasers Property's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. This ready-to-use analysis is your key to informed decision-making and strategic advantage. Download the full version now to gain actionable insights.

Political factors

Government policies, such as urban planning directives, zoning laws, and building codes, are crucial in shaping real estate development. For Frasers Property, these regulations directly affect project viability, construction expenses, and the market's appetite for various property classes. For instance, in 2024, Singapore's Urban Redevelopment Authority continued to emphasize sustainable development, influencing Frasers Property's focus on green building certifications for its projects.

Adapting to a patchwork of evolving regulations across its global operations is a constant challenge for Frasers Property. Changes in environmental standards or foreign investment rules in markets like Australia or Thailand can necessitate significant adjustments to business strategies and project timelines, impacting overall profitability and market entry.

Frasers Property's operations span diverse political landscapes, making political stability a critical factor. For instance, in 2024, countries like Singapore, where Frasers Property is headquartered, continue to exhibit strong political stability, fostering a secure environment for investments. Conversely, regions experiencing heightened geopolitical tensions, such as certain parts of Southeast Asia or Europe, can introduce volatility, impacting project timelines and investor sentiment.

Shifts in government leadership or policy direction can significantly alter the operating environment. For example, new regulations on foreign investment or property development, which could emerge in 2024 or 2025, might affect Frasers Property's expansion plans or profitability in specific markets. The company's strategy must be agile enough to adapt to these evolving political dynamics across its global portfolio.

Changes in corporate tax rates, property taxes, and stamp duties significantly influence Frasers Property's bottom line and strategic investment choices. For instance, if a country where Frasers operates increases its corporate tax rate from, say, 17% to 20%, this directly impacts profitability.

Favorable tax incentives, such as those for green buildings or affordable housing projects, can unlock new avenues for growth and enhance returns. Conversely, a hike in property taxes or stamp duties can reduce the attractiveness of real estate investments and potentially dampen demand for Frasers' developments.

Frasers Property's strategy of maintaining a substantial portion of fixed-rate debt, as seen in its robust financial structure, provides a degree of insulation against the volatility of interest rate changes, which are often linked to fiscal policy shifts.

Government Incentives for Sustainable Development

Governments worldwide are increasingly incentivizing sustainable development, offering grants and preferential treatment for green buildings. For instance, in 2024, Singapore's Building and Construction Authority (BCA) continued its Green Mark scheme, providing financial incentives for developers achieving higher sustainability standards. Frasers Property, with its established ESG focus, can capitalize on these initiatives to bolster project attractiveness and potentially lower development costs.

These government policies directly support Frasers Property's strategic objectives. The company's commitment to integrating renewable energy solutions and obtaining green certifications, such as LEED or Green Mark, allows it to benefit from these financial advantages. This alignment creates a competitive edge, making its developments more appealing to environmentally conscious investors and tenants.

- Government support for green building initiatives is growing.

- Frasers Property can leverage incentives to reduce development costs.

- ESG commitments align with government sustainability goals.

- Incentives enhance project appeal and competitive advantage.

International Relations and Trade Agreements

Frasers Property, as a global real estate developer, is significantly impacted by the evolving landscape of international relations and trade agreements. Changes in geopolitical alliances and trade policies directly influence cross-border investments and capital accessibility, crucial for its multinational projects. For instance, the stability of supply chains for construction materials, a key operational component, is often tied to these agreements, with disruptions potentially increasing costs and timelines.

Preferential trade terms, such as those within ASEAN or bilateral agreements, can streamline operations and reduce tariffs, facilitating Frasers Property's expansion into new markets. Conversely, the rise of protectionist sentiment globally, exemplified by recent trade disputes between major economic blocs, can introduce complexities and barriers to entry, impacting the ease of international business conduct and M&A activities.

- Global Trade Dynamics: The World Trade Organization (WTO) reported a 0.1% decrease in global trade volume in 2023, highlighting the sensitivity of international business to geopolitical shifts.

- Regional Trade Blocs: Frasers Property benefits from agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which aims to reduce trade barriers among member nations.

- Foreign Direct Investment (FDI): In 2024, UNCTAD projected a modest rebound in global FDI, but noted that geopolitical tensions remain a significant risk factor affecting investment flows into developing economies.

- Supply Chain Resilience: The COVID-19 pandemic underscored the vulnerability of global supply chains, prompting companies like Frasers Property to diversify sourcing strategies, often influenced by trade agreements and regional manufacturing hubs.

Government stability and policy consistency are paramount for Frasers Property's long-term investments. In 2024, countries like Singapore, where Frasers is headquartered, offer a stable political climate, supporting strategic growth. However, geopolitical shifts in regions like Southeast Asia can introduce volatility, impacting project execution and investor confidence.

Taxation policies, including corporate and property taxes, directly influence Frasers Property's profitability and investment decisions. For example, changes in stamp duties or capital gains tax in key markets can alter the attractiveness of real estate ventures. The company's financial strategy, including its debt structure, aims to mitigate risks associated with fluctuating interest rates, which are often tied to fiscal policies.

Government incentives for sustainable development, such as those for green buildings, present significant opportunities for Frasers Property. In 2024, Singapore's BCA Green Mark scheme, for instance, offers financial advantages for developers achieving higher sustainability standards, aligning with Frasers' ESG commitments and enhancing project appeal.

What is included in the product

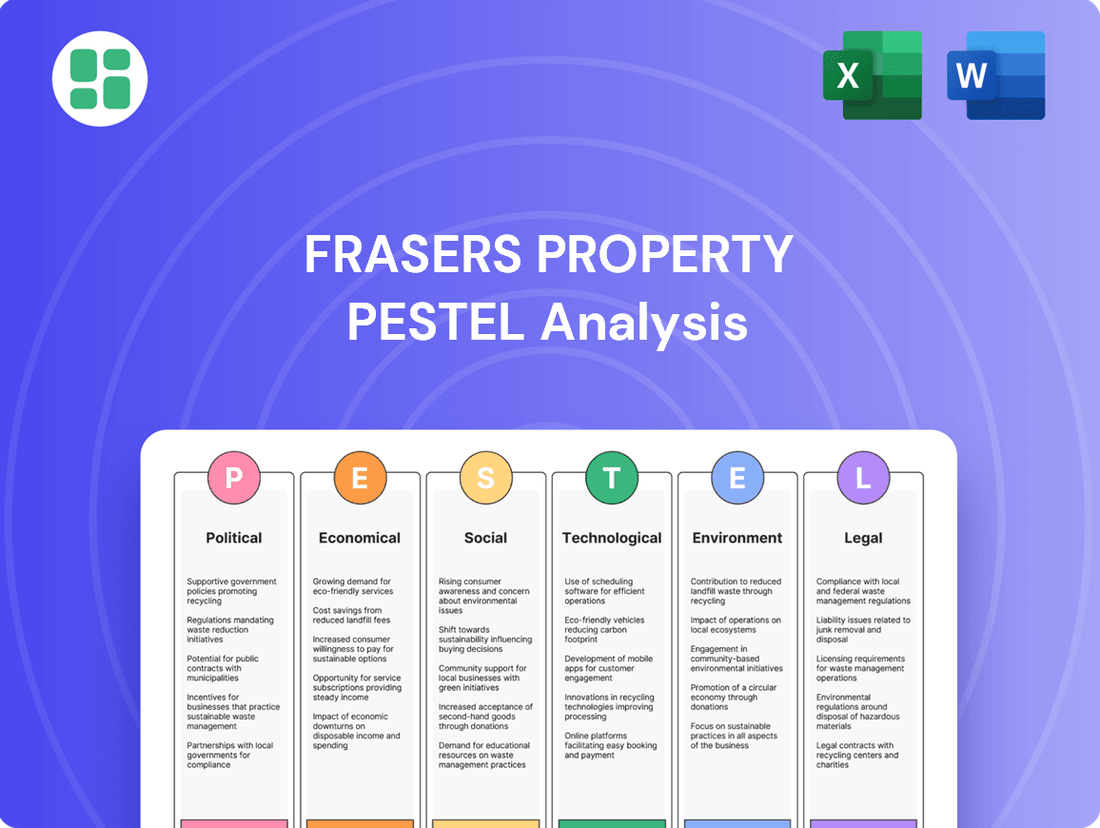

This PESTLE analysis of Frasers Property systematically examines the influence of Political, Economic, Social, Technological, Environmental, and Legal forces on its operations and strategic direction.

It provides a comprehensive understanding of the external landscape, highlighting key trends and potential impacts to inform Frasers Property's strategic decision-making and risk management.

A concise Fraser Property PESTLE analysis provides actionable insights, acting as a pain point reliever by highlighting external factors that can be proactively managed to improve market positioning and mitigate risks.

Economic factors

Interest rate fluctuations significantly influence Frasers Property's operations by directly affecting borrowing costs for its development projects and the affordability of mortgages for its customers. As of their 1QFY2025 update, the company highlighted concerns about a higher-for-longer interest rate environment, which can escalate debt expenses and potentially impact the feasibility of new developments.

To counter these pressures, Frasers Property has strategically focused on maintaining a substantial portion of its debt on fixed rates. This approach aims to insulate the company from the adverse effects of rising interest rates, providing greater certainty over financing costs and supporting project financial viability amidst market volatility.

Inflationary pressures are a significant concern for Frasers Property, directly impacting construction costs. Rising prices for labor, raw materials like steel and concrete, and energy can substantially increase development budgets. For instance, in early 2024, global commodity prices, including those crucial for construction, remained elevated, reflecting ongoing supply chain challenges and geopolitical uncertainties.

These escalating costs directly affect Frasers Property's ability to maintain healthy development margins. The company operates within a volatile business environment where managing these unpredictable expenses is paramount to project profitability and financial performance. Successfully navigating these inflationary headwinds requires robust cost management strategies and careful financial planning.

Global economic growth is a significant driver for Frasers Property's diverse portfolio. In 2024, the IMF projected global GDP growth at 3.2%, a steady pace that supports demand across residential, commercial, and industrial sectors. This overall economic health directly translates into increased consumer spending and business investment, positively impacting property markets where Frasers operates.

Frasers Property's key markets are experiencing varied growth trajectories. For instance, Australia's GDP growth was around 1.5% in 2023, expected to remain subdued but stable in 2024, supporting its residential and industrial segments. Singapore's economy, a major hub for Frasers, saw a projected GDP growth of 1.5% to 2.5% for 2024, underpinning demand for its commercial and residential offerings.

China's economic performance, while facing some headwinds, remains crucial. Its GDP growth, estimated around 4.6% for 2024 by the IMF, directly influences demand for industrial and logistics properties, a growing area for Frasers. Thailand's economic outlook for 2024, with projected growth around 3%, also supports Frasers' presence in its hospitality and residential sectors.

Consumer Spending and Confidence

Consumer spending and confidence are pivotal for Frasers Property, directly influencing its retail and residential segments. When consumers feel secure about their financial future, they are more likely to invest in property and spend at retail outlets. For instance, in early 2024, consumer confidence in many developed economies showed a gradual improvement, supported by easing inflation and a stable job market. This trend bodes well for Frasers Property’s malls and residential projects.

Conversely, a dip in consumer confidence can significantly dampen demand. Economic uncertainties, such as rising interest rates or job market volatility, can lead consumers to postpone major purchases like homes or reduce discretionary spending in malls. This directly impacts Frasers Property’s sales pipelines and rental income streams, highlighting the sensitivity of its business model to consumer sentiment.

- Consumer Confidence Index (CCI) for the US reached 104.7 in May 2024, indicating a positive but cautious outlook.

- Retail sales in the UK saw a modest increase of 1.0% in April 2024 compared to the previous year, suggesting continued consumer engagement.

- The Asia-Pacific region, a key market for Frasers Property, experienced varied consumer confidence levels, with some economies showing robust recovery post-pandemic.

- Higher disposable incomes, often linked to strong employment figures, directly correlate with increased residential property demand and retail spending.

Foreign Exchange Rate Volatility

Frasers Property's global operations mean it's directly exposed to foreign exchange rate volatility. Changes in currency values can significantly affect how its overseas assets, revenues, and liabilities are reported in its financial statements. For instance, a stronger Singapore Dollar (SGD) against currencies where Frasers Property holds assets could reduce the reported value of those assets when translated back into SGD.

The company actively manages this risk through a natural hedging strategy for its international assets. This approach aims to offset potential losses from currency fluctuations by matching foreign currency-denominated assets with corresponding liabilities in the same currency. This strategy is crucial for maintaining stable financial performance despite global economic shifts.

For example, as of the first half of 2024, Frasers Property reported significant international exposure. While specific figures for currency impact are often embedded within segment results, the overall trend in global markets suggests that currency fluctuations, particularly between major currencies like the USD, EUR, and AUD against the SGD, could have presented a notable factor in their reported earnings. The company's ability to mitigate this through natural hedges is a key operational strength.

- Geographic Diversification: Frasers Property operates in over 20 countries, increasing its exposure to diverse currency risks.

- Impact on Earnings: For the fiscal year ending September 2023, fluctuations in foreign currencies could have impacted the translation of overseas profits into the reporting currency, Singapore Dollars.

- Hedging Effectiveness: The success of their natural hedging strategy is critical to minimizing reported earnings volatility stemming from foreign exchange movements.

- 2024 Outlook: Analysts monitoring Frasers Property in 2024 have noted that continued strength in the US Dollar against several Asian currencies could present both opportunities and challenges for the company's international asset valuations.

Interest rate hikes directly impact Frasers Property's borrowing costs and customer mortgage affordability. The company's strategy to fix a substantial portion of its debt aims to mitigate these effects, ensuring project viability amid rising rates. For instance, in 1QFY2025, they noted concerns about a higher-for-longer rate environment, which could increase debt expenses.

Inflationary pressures, particularly on construction materials and labor, directly affect development budgets and profit margins. Elevated commodity prices in early 2024, driven by supply chain issues and geopolitical events, exemplify this challenge. Managing these unpredictable costs is crucial for maintaining profitability.

Global economic growth supports demand across Frasers Property's diverse sectors. The IMF's 2024 global GDP growth projection of 3.2% indicates a stable environment for property markets. Key markets like Singapore (projected 1.5%-2.5% GDP growth for 2024) and China (estimated 4.6% GDP growth for 2024) show varied but generally supportive economic trajectories.

Consumer spending and confidence are vital, especially for retail and residential segments. Improved consumer confidence in early 2024, seen in the US CCI reaching 104.7 in May 2024, positively impacts demand. Conversely, economic uncertainties can dampen confidence, affecting sales and rental income.

Preview the Actual Deliverable

Frasers Property PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Frasers Property PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Frasers Property's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering a robust framework for understanding the opportunities and threats facing Frasers Property.

Sociological factors

Demographic shifts significantly shape property demand. For instance, in many developed nations, an aging population increases the need for accessible and specialized housing, while declining birth rates in some regions might temper demand for family-oriented properties. Frasers Property must adapt its portfolio to cater to these evolving needs, ensuring a mix that serves diverse age groups and household structures.

Urbanization continues to be a powerful driver, with global urban populations projected to reach 68% by 2050 according to the UN. This trend fuels demand for residential, retail, and office spaces in key metropolitan areas where Frasers Property has a presence. The company's strategy of developing integrated communities that foster well-being directly addresses the desire for convenient and connected urban living.

Shifting lifestyle preferences are a major driver in property development, with a growing demand for mixed-use environments that blend living, working, and leisure. This includes a surge in interest for co-working spaces and master-planned communities designed for social interaction and resilience. For instance, in 2024, the global flexible workspace market was projected to reach $200 billion, highlighting this trend.

The widespread adoption of hybrid work models significantly influences both commercial and residential real estate. Companies are re-evaluating office footprints, while individuals are seeking homes that better accommodate remote work, often prioritizing space and amenities that support this flexibility. This has led to increased demand for larger residences and properties with dedicated home office areas.

Frasers Property is actively responding to these evolving lifestyle and work-life trends by focusing on creating integrated communities. Their strategy involves developing properties that foster social connectedness and enhance community resilience, aligning with the desire for more holistic living experiences. This approach aims to meet the needs of a populace increasingly valuing well-being and community integration.

Societal expectations are shifting, pushing real estate firms like Frasers Property to actively enhance community well-being, not just construct buildings. This involves developing green areas, fostering social connections, and backing local projects, reflecting a growing demand for businesses to be responsible corporate citizens.

Frasers Property's commitment to creating 'places for good' directly addresses this trend. Their community investment initiatives, such as supporting local charities and developing accessible public spaces, aim to boost the mental and physical health of those who live and work in their developments, demonstrating a tangible social impact.

In 2024, Frasers Property continued its focus on sustainability and community, with initiatives like their 'Green Shoots' program, which supports environmental and social projects. While specific financial figures for community investment are often integrated into broader ESG reporting, the strategic emphasis signals a growing allocation of resources towards social impact, aligning with investor and consumer preferences for purpose-driven companies.

Health, Safety, and Well-being Standards

Growing awareness of health and well-being is significantly shaping the real estate market, pushing demand for properties that prioritize occupant comfort and health. This trend is particularly evident in the increasing preference for spaces with excellent indoor air quality, ample natural light, and convenient access to wellness facilities. For instance, a 2024 survey indicated that over 70% of commercial real estate tenants consider health and well-being features a key factor in their leasing decisions.

Frasers Property is actively responding to these evolving demands by integrating features that promote a healthier built environment. Their strategy includes incorporating biophilic design principles, which connect occupants with nature, and pursuing certifications like the WELL Building Standard. This commitment is reflected in projects designed to enhance occupant experience and potentially command premium rental rates, aligning with market shifts towards sustainability and occupant welfare.

- Increased Tenant Demand: Over 70% of commercial tenants in 2024 cited health and well-being features as crucial in property selection.

- Biophilic Design Integration: Frasers Property actively incorporates elements like indoor greenery and natural materials to improve occupant connection with nature.

- WELL Building Standard Pursuit: The company targets certifications like WELL to validate and enhance the health credentials of its properties.

- Market Alignment: These initiatives position Frasers Property to capitalize on the growing market preference for sustainable and health-conscious real estate.

Talent Attraction and Retention

Frasers Property's success hinges on its ability to attract and keep top talent, a challenge amplified in the competitive global real estate market. This means offering more than just a paycheck; it involves cultivating an environment where employees feel valued and can grow. In 2024, companies are increasingly judged by their commitment to diversity, equity, and inclusion, directly impacting their employer brand and talent acquisition efforts.

The company actively works on this by building flexible and inclusive workplaces. Providing avenues for professional development, such as sustainability training as noted in their initiatives, is key to keeping employees engaged and skilled. This focus on employee growth not only benefits the individual but also strengthens Frasers Property's overall capabilities and adaptability in a rapidly evolving industry.

Societal expectations around employee well-being and work-life balance are also significant drivers. Frasers Property's efforts to create supportive work environments align with these broader societal trends. For instance, reports from 2024 indicate a growing demand from employees for companies that demonstrate genuine commitment to social responsibility and employee welfare, which Frasers Property aims to address.

- Competitive Compensation: Offering salaries and benefits that are attractive compared to industry peers is fundamental for talent attraction.

- Inclusive Work Environment: Fostering a culture of belonging and respect, where diverse perspectives are welcomed, is crucial for retention.

- Professional Development: Providing opportunities for upskilling, training (like sustainability programs), and career advancement keeps employees motivated.

- Work-Life Balance: Implementing flexible work arrangements and supporting employee well-being are increasingly important factors for attracting and retaining talent in 2024.

Societal values are increasingly emphasizing community well-being and corporate social responsibility, influencing real estate development. Frasers Property’s focus on creating ‘places for good’ and investing in community initiatives, such as their ‘Green Shoots’ program, directly addresses this by enhancing social impact and aligning with consumer and investor preferences for purpose-driven businesses.

There's a growing demand for properties that actively promote health and well-being, with over 70% of commercial tenants in 2024 prioritizing such features. Frasers Property is responding by integrating biophilic design and pursuing WELL Building Standard certifications, positioning them to meet this market shift towards healthier, more sustainable real estate.

The talent market in 2024 highlights the importance of an inclusive and supportive work environment, with employees seeking companies committed to social responsibility and work-life balance. Frasers Property’s efforts in professional development and flexible work arrangements are crucial for attracting and retaining skilled employees in this competitive landscape.

Technological factors

Frasers Property is actively integrating smart building technologies across its portfolio. This includes deploying IoT sensors for real-time environmental monitoring and AI-driven systems for optimized energy usage. For instance, in their 2024 sustainability reports, Frasers Property highlighted a 15% reduction in energy consumption in buildings equipped with advanced smart systems.

These advancements contribute to enhanced operational efficiency and a better occupant experience. Predictive maintenance, powered by AI, helps minimize downtime and reduce maintenance costs, a key factor in asset management. Frasers Property’s commitment to innovation in this area aims to create more sustainable and user-friendly spaces, aligning with growing market demand for intelligent infrastructure.

The real estate sector is undergoing a significant digital overhaul, often termed PropTech. This transformation touches everything from how properties are viewed and sold, with virtual tours and online platforms becoming commonplace, to how market trends are understood through sophisticated data analytics. Embracing these technological advancements is key for efficiency and better customer connections.

Frasers Property is actively integrating these innovations. For instance, their commitment to data-driven strategies extends to critical areas like decarbonization efforts and evaluating climate-related risks, showcasing a forward-thinking approach to sustainability within their operations.

Advances in sustainable construction, like green concrete and modular building, are reshaping property development. These innovations allow for the creation of more eco-friendly buildings. Frasers Property is actively integrating these sustainable materials, with a stated goal of reducing the embodied carbon in its developments.

Data Analytics and Climate Risk Platforms

Frasers Property leverages advanced data analytics and climate risk platforms to proactively manage environmental challenges. These tools enable the company to pinpoint and evaluate climate-related risks and opportunities impacting its diverse global real estate holdings. This sophisticated approach underpins more informed investment strategies and robust adaptation planning, ultimately bolstering the company's operational resilience.

By integrating data analytics, Frasers Property can better understand the potential impacts of climate change on its assets. For instance, the increasing frequency of extreme weather events, such as the record-breaking heatwaves experienced in parts of Asia in early 2024, necessitates detailed risk assessments for properties in vulnerable regions. The company's investment in these technologies allows for a more granular understanding of these threats, influencing development and operational decisions.

- Climate Risk Assessment: Platforms provide detailed analysis of physical risks (e.g., flooding, heat stress) and transition risks (e.g., regulatory changes, market shifts) relevant to Frasers Property's portfolio.

- Data-Driven Investment: Insights from analytics inform capital allocation, prioritizing projects in lower-risk areas or those incorporating climate-resilient designs.

- Adaptation Planning: The data helps in developing site-specific adaptation strategies, such as enhancing building insulation or implementing water-saving measures, to mitigate future climate impacts.

- Portfolio Resilience: This proactive management of climate-related factors enhances the long-term value and stability of Frasers Property's assets in a changing climate.

Cybersecurity and Data Privacy

As Frasers Property continues its digital transformation, the imperative for strong cybersecurity and data privacy escalates. Protecting sensitive customer information and proprietary operational data is paramount for maintaining trust and ensuring compliance with evolving global regulations.

The increasing reliance on digital platforms for property management, sales, and customer engagement means that breaches can have severe financial and reputational consequences. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risks involved.

Frasers Property must therefore invest in advanced cybersecurity infrastructure and protocols to safeguard against threats. This includes:

- Implementing multi-factor authentication across all digital touchpoints.

- Conducting regular vulnerability assessments and penetration testing.

- Ensuring compliance with data privacy laws such as GDPR and CCPA.

- Providing ongoing cybersecurity training for all employees.

Failure to adequately address these technological factors could undermine customer confidence and expose the company to substantial legal penalties and operational disruptions.

Technological advancements are a cornerstone of Frasers Property's operational strategy, driving efficiency and sustainability. The company is actively deploying smart building technologies, including IoT sensors and AI for energy optimization, which in 2024 led to a reported 15% reduction in energy consumption in equipped buildings. This focus on PropTech, encompassing virtual tours and data analytics, enhances customer engagement and market understanding.

Legal factors

Frasers Property operates within a complex web of property and land ownership laws, which differ greatly by country. These regulations dictate how land can be used, acquired, and owned, requiring the company to conduct thorough due diligence in each market. For instance, recent legal amendments in Vietnam, such as those impacting foreign ownership and development rights, directly influence real estate business operations and residential housing projects.

Frasers Property must adhere to a complex web of national and local building codes, safety standards, and environmental regulations for all its development projects. These rules govern everything from architectural design and material selection to construction methods and final occupancy standards. For instance, in 2024, Singapore’s Building and Construction Authority (BCA) continues to emphasize stricter energy efficiency requirements, pushing developers like Frasers Property to incorporate more sustainable building materials and practices.

The company actively ensures its developments meet various green building certification schemes, such as Singapore's Green Mark or Australia's Green Star. This commitment is not just about compliance; it's a strategic imperative. By integrating eco-friendly designs and construction, Frasers Property aims to reduce operational costs for building owners and occupants, enhance property value, and align with growing investor and tenant demand for sustainable real estate solutions, a trend strongly evidenced by the increasing number of green-certified buildings in their portfolio by the end of 2024.

Environmental laws are a significant factor for real estate companies like Frasers Property. These regulations cover everything from emissions and waste disposal to how water is used and how biodiversity is protected. Companies must ensure they are meeting these legal obligations.

Frasers Property actively works to meet and even surpass these environmental legal standards. Their ESG goals and Climate and Nature Transition Plan highlight this dedication. For instance, in FY2023, Frasers Property reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their FY2019 baseline, demonstrating tangible progress in their compliance and beyond.

Leasehold and Tenancy Laws

Frasers Property's operations are significantly shaped by leasehold and tenancy laws, which dictate the terms of their retail, commercial, and hospitality leases. These regulations define tenant rights and landlord obligations, impacting everything from rent reviews to property upkeep. For instance, the UK's ongoing leasehold reform discussions, particularly concerning the potential for leaseholders to extend their leases or buy their freehold at more favorable terms, could alter the financial landscape for properties Frasers Property manages or owns. Such reforms aim to create a more balanced market, potentially affecting future rental income streams and property valuations.

Changes in these laws can have a direct financial consequence. For example, if new legislation mandates shorter lease terms or caps rent increases, Frasers Property's revenue predictability and profitability from its leased assets could be affected. The company must remain agile, adapting its leasing strategies and financial models to comply with evolving tenant protection laws and landlord responsibilities across its diverse geographical markets.

Consider the impact of evolving tenancy laws on commercial leases. In 2023, several jurisdictions saw increased tenant advocacy for greater flexibility, potentially leading to shorter lease commitments and more tenant-friendly break clauses. This trend, if it continues into 2024 and 2025, would require Frasers Property to adjust its leasing strategies to maintain occupancy and rental yields, perhaps by offering more diverse lease structures or enhanced property services to retain tenants.

The legal framework surrounding leasehold and tenancy directly influences Frasers Property's financial performance and strategic planning. Key considerations include:

- Regulatory Compliance: Ensuring all lease agreements adhere to local and national tenancy laws, which vary significantly by country and region.

- Leasehold Reform Impact: Monitoring and adapting to legislative changes, such as those affecting lease extensions or ground rent, which could alter the value of Frasers Property's leasehold portfolio.

- Tenant Rights and Obligations: Managing tenant relationships and property management services in line with established tenant rights, impacting operational costs and tenant satisfaction.

- Contractual Agreements: The enforceability and interpretation of lease contracts, including rent review mechanisms and dispute resolution processes, are critical for revenue stability.

Corporate Governance and Reporting Standards

Frasers Property, operating as a publicly traded multinational, navigates a complex web of corporate governance mandates and financial reporting standards. Compliance with regulations like those set by the Singapore Exchange (SGX) is paramount, alongside meeting disclosure obligations in every jurisdiction where it operates. This ensures adherence to legal frameworks and fosters trust among stakeholders.

Transparency is a cornerstone of Frasers Property's operations, particularly evident in its annual reports and environmental, social, and governance (ESG) disclosures. For instance, in its FY2023 report, Frasers Property highlighted its commitment to sustainability, detailing progress against its targets. This commitment is crucial for maintaining investor confidence and satisfying regulatory scrutiny.

- SGX Listing Requirements: Frasers Property adheres to the listing rules of the Singapore Exchange, which mandate specific corporate governance practices and financial reporting timelines.

- ESG Reporting: The company actively discloses its ESG performance, aligning with global frameworks to demonstrate accountability and commitment to sustainable business practices.

- Market-Specific Compliance: Frasers Property must also comply with local corporate laws and reporting standards in countries like Australia, Thailand, and the UK, adding layers of regulatory complexity.

- Investor Relations: Robust corporate governance and transparent reporting are vital for attracting and retaining investors, as evidenced by Frasers Property's ongoing engagement with the financial community.

Legal frameworks significantly shape Frasers Property's operations, from land acquisition laws to building codes and tenant regulations. The company must navigate diverse national and local legal landscapes, ensuring compliance with property ownership, development, and leasing statutes across its global portfolio. For instance, ongoing leasehold reforms in markets like the UK could impact rental income streams and property valuations, requiring strategic adaptation.

Adherence to building codes and environmental laws is critical, with Singapore's BCA continuing to emphasize stricter energy efficiency in 2024. Frasers Property's commitment to green building certifications, like Singapore's Green Mark, demonstrates proactive compliance and a strategic focus on sustainability, evidenced by a 15% reduction in Scope 1 and 2 GHG emissions intensity reported for FY2023 against an FY2019 baseline.

Corporate governance and transparent financial reporting, particularly adhering to SGX listing requirements and ESG disclosures, are paramount for maintaining stakeholder trust. Frasers Property's FY2023 report highlights its ESG commitments, underscoring the importance of regulatory compliance and market-specific laws in countries like Australia and Thailand.

Environmental factors

Frasers Property actively manages the growing threat of climate change, recognizing that more frequent and intense extreme weather events, rising sea levels, and dwindling resources directly impact its properties. The company utilizes tools like its Climate Value at Risk platform to systematically identify and evaluate these physical risks throughout its global portfolio, ensuring resilience.

The real estate industry is a major player in global carbon emissions, with buildings accounting for a substantial portion of energy consumption and greenhouse gas output. Recognizing this, Frasers Property has set an ambitious goal to reach net-zero carbon emissions across all scopes (1, 2, and 3) by the year 2050.

To achieve this, the company is implementing interim targets and prioritizing the adoption of renewable energy sources, alongside significant investments in energy efficiency measures throughout its portfolio. For instance, Frasers Property reported a 15% reduction in Scope 1 and 2 emissions intensity in its FY2023 sustainability report compared to its 2019 baseline, demonstrating tangible progress towards its net-zero commitment.

Growing concerns over resource depletion, particularly water scarcity and the availability of raw materials, are pushing the property sector towards circular economy models. Frasers Property is actively addressing this by prioritizing responsible resource management, aiming to significantly reduce waste across its operations and boost energy efficiency in its developments.

For instance, Frasers Property's commitment to sustainability is evident in its 2023 Sustainability Report, which highlighted a 15% reduction in waste intensity compared to their 2019 baseline. This focus on circularity not only mitigates environmental impact but also presents opportunities for cost savings and innovation in property development and management.

Biodiversity and Ecosystem Protection

Protecting biodiversity and natural ecosystems is becoming a key consideration for sustainable development, impacting how businesses operate. Real estate developments, like those Frasers Property undertakes, can significantly affect local plant and animal life, necessitating meticulous planning and strategies to lessen negative impacts. For instance, the UN Convention on Biological Diversity's Strategic Plan for Biodiversity 2011-2020 aimed to halt biodiversity loss, a goal that continues to influence development practices globally.

Frasers Property is actively working on a framework to better evaluate and prioritize the risks and opportunities associated with biodiversity. This proactive approach acknowledges the growing importance of environmental stewardship in the real estate sector. As of early 2024, many leading companies are enhancing their ESG reporting to include more detailed metrics on biodiversity impact, reflecting increasing investor and regulatory pressure.

The company's efforts align with broader industry trends where developers are increasingly expected to demonstrate positive contributions to ecological health rather than just minimizing harm. This includes initiatives like:

- Implementing green building certifications that consider biodiversity impacts.

- Restoring or enhancing natural habitats within or adjacent to development sites.

- Engaging with local conservation groups to inform project design and management.

Green Building Certifications and Standards

The global push for sustainability is significantly boosting the demand for green building certifications like LEED, Green Mark, and BREEAM. Frasers Property has actively embraced this trend, aiming to green-certify a substantial portion of its owned and managed properties. For instance, as of 2024, Frasers Property reported that over 80% of its portfolio by value had achieved or was pursuing green building certifications, underscoring their commitment to environmental stewardship and meeting evolving market expectations.

This focus on green building standards is not just about environmental responsibility; it's increasingly a driver of market value and investor confidence. Regulatory bodies worldwide are also tightening requirements for sustainable construction, making certifications a de facto necessity for new developments. Frasers Property's proactive approach, including its target to have 100% of new developments certified by 2025, positions them favorably in a market where green credentials translate directly to competitive advantage and long-term resilience.

Key aspects of Frasers Property's green building strategy include:

- Commitment to Certification: A significant majority of owned and managed assets are certified or in the process of certification.

- New Development Standards: All new developments are targeted for green building certification.

- Market Alignment: Responding to increasing regulatory emphasis and investor demand for sustainable assets.

- Environmental Leadership: Demonstrating proactive engagement with global sustainability initiatives.

Environmental regulations are increasingly shaping the real estate sector, pushing companies like Frasers Property to adopt sustainable practices. This includes managing carbon emissions, a critical factor given the industry's significant contribution to global greenhouse gases.

Frasers Property's commitment to net-zero carbon emissions by 2050 is a key environmental strategy. They reported a 15% reduction in Scope 1 and 2 emissions intensity in FY2023 compared to their 2019 baseline, demonstrating measurable progress. This aligns with global efforts to combat climate change and reduce the building sector's environmental footprint.

The company is also focusing on resource efficiency, aiming to reduce waste intensity by 15% compared to their 2019 baseline, as noted in their 2023 Sustainability Report. This reflects a broader industry shift towards circular economy principles to address resource depletion.

Biodiversity and green building certifications are also gaining prominence. Frasers Property aims for 100% of new developments to be green building certified by 2025, and as of 2024, over 80% of its portfolio by value was certified or pursuing certification, highlighting a strong emphasis on environmental stewardship.

| Environmental Metric | Target/Status | Year |

|---|---|---|

| Net-Zero Carbon Emissions | Target by 2050 | Ongoing |

| Scope 1 & 2 Emissions Intensity Reduction | 15% reduction | FY2023 (vs. 2019 baseline) |

| Waste Intensity Reduction | 15% reduction | FY2023 (vs. 2019 baseline) |

| New Developments Green Building Certification | 100% target | 2025 |

| Portfolio Green Building Certification | >80% by value certified or pursuing | 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Frasers Property draws from a comprehensive dataset including government economic reports, real estate market trend analyses, and industry-specific regulatory updates. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing their operations.