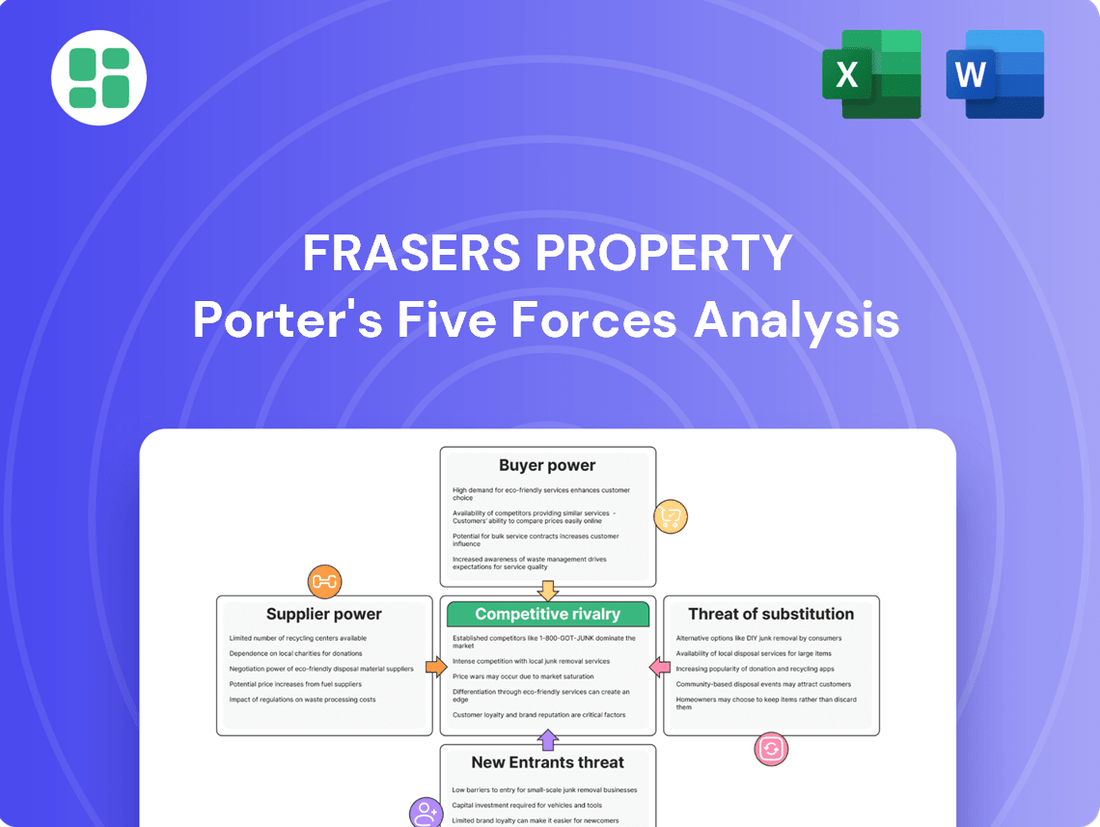

Frasers Property Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frasers Property Bundle

Frasers Property navigates a complex real estate landscape, facing pressures from intense rivalry and the ever-present threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for their strategic positioning.

The complete report reveals the real forces shaping Frasers Property’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of land and raw material suppliers for Frasers Property is a significant consideration. The availability and cost of prime land parcels are critical, as land is a finite resource. Scarcity, particularly in highly sought-after urban areas, can significantly amplify supplier power. For example, in 2024, prime land acquisition costs in major Asian cities where Frasers Property operates saw an average increase of 5-8% due to high demand and limited supply.

Fluctuations in the prices of key construction materials such as steel, cement, and timber directly impact project costs and profit margins for Frasers Property. In the first half of 2024, global steel prices experienced volatility, with some regions seeing price increases of up to 10% due to supply chain disruptions and increased demand from infrastructure projects. Frasers Property's ability to secure these materials efficiently and cultivate strong supplier relationships is paramount to mitigating this supplier leverage.

The bargaining power of construction contractors and skilled labor can significantly impact Frasers Property. In 2024, many regions faced persistent labor shortages in the construction sector, pushing up wages and project costs. For instance, a report indicated that construction labor costs in some key markets saw an increase of 5-7% year-over-year. This situation necessitates Frasers Property to actively manage its relationships with contractors, ensuring competitive bidding and exploring alternative construction methods to mitigate rising expenses.

Frasers Property's reliance on financial institutions for funding is significant, impacting its bargaining power. The cost and availability of capital from banks and other lenders directly influence the company's ability to acquire land, undertake development projects, and manage its investment portfolio.

In 2024, global interest rates remained a key determinant of financing costs for real estate developers like Frasers Property. For instance, the US Federal Reserve's monetary policy decisions, including potential rate hikes or holds, directly affect borrowing expenses. This financial supplier power is further shaped by credit market conditions and overall economic health, which can either ease or tighten the availability of loans for large-scale projects.

Technology and Service Providers

The increasing integration of smart building technologies, sustainable solutions, and advanced property management systems into real estate significantly elevates the bargaining power of specialized technology and service providers. These entities often possess unique, proprietary systems that are difficult for companies like Frasers Property to replicate, granting them considerable leverage. Frasers Property's strategic focus on sustainability and innovation, as evidenced by its ongoing investments in green building certifications and digital transformation initiatives, directly translates into a reliance on these specialized suppliers for maintaining its competitive edge in the market.

The bargaining power of technology and service providers is amplified by several factors:

- Proprietary Technology: Providers of unique smart building platforms or advanced energy management systems can command higher prices due to the difficulty in finding direct substitutes.

- Switching Costs: The cost and complexity associated with integrating new systems or migrating data can deter companies from switching providers, thus strengthening the incumbent's position.

- Industry Standards: As certain technologies become industry standards, providers of these solutions may face increased competition, potentially moderating their bargaining power unless they offer truly differentiated value.

Utilities and Infrastructure Providers

Utilities and infrastructure providers, such as electricity, water, and waste management companies, often operate as monopolies or oligopolies. This inherently grants them significant bargaining power over Frasers Property. For instance, in many regions, there's only one provider for electricity, meaning Frasers Property has limited options if they wish to switch providers, directly impacting operational costs for their developments.

Frasers Property must meticulously consider the cost and, crucially, the reliability of these essential services. This is particularly vital for their large-scale, integrated developments where consistent utility supply is paramount for tenant satisfaction and operational efficiency. Disruptions can lead to significant financial losses and reputational damage.

- Monopolistic/Oligopolistic Nature: Utility providers often face limited competition, allowing them to dictate terms.

- Operational Dependence: Frasers Property's developments rely heavily on uninterrupted utility services.

- Cost Management: Long-term agreements and exploring sustainable energy solutions can mitigate rising utility costs.

- Reliability Factor: Consistent service is critical for property operations and tenant retention.

The bargaining power of suppliers for Frasers Property is multifaceted, encompassing land, materials, labor, finance, technology, and utilities. In 2024, rising material costs, labor shortages, and fluctuating interest rates presented significant challenges, impacting project profitability and development timelines.

For instance, the average cost of key construction materials like steel and cement saw an increase of 5-10% in various Asian markets during the first half of 2024, driven by supply chain issues and robust demand. Similarly, construction labor costs in some regions rose by 5-7% year-over-year due to persistent shortages. These factors underscore the leverage suppliers hold.

| Supplier Category | 2024 Impact Factors | Estimated Cost Increase (H1 2024) | Frasers Property Mitigation Strategy |

|---|---|---|---|

| Land & Raw Materials | Scarcity in urban areas, global demand | Land acquisition: 5-8% increase in prime Asian cities | Strategic land banking, long-term supplier contracts |

| Construction Materials | Supply chain disruptions, infrastructure demand | Steel, cement: Up to 10% increase in some regions | Diversified sourcing, bulk purchasing agreements |

| Skilled Labor | Persistent shortages, wage inflation | Labor costs: 5-7% increase in key markets | Alternative construction methods, strong contractor relationships |

| Financial Institutions | Interest rate policies, credit market conditions | Impacted by global monetary policy decisions | Hedging strategies, diverse financing sources |

| Technology Providers | Proprietary systems, high switching costs | Variable, dependent on technology adoption | Strategic partnerships, focus on integrated solutions |

| Utilities & Infrastructure | Monopolistic/oligopolistic nature, operational dependence | Variable, subject to regulatory pricing | Long-term service agreements, sustainable energy investments |

What is included in the product

This analysis unpacks the competitive forces impacting Frasers Property, assessing the threat of new entrants, the bargaining power of buyers and suppliers, and the intensity of rivalry within its markets.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, enabling Fraser's Property to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Residential buyers, particularly in bustling markets, wield considerable influence. This is largely because they have a wide array of choices, and their decisions are heavily swayed by price. For instance, in 2024, the average home price in many major cities saw fluctuations, directly impacting buyer affordability and their willingness to negotiate.

Interest rates and overall housing affordability are critical drivers for these buyers. When borrowing costs rise, as they have in recent periods, buyers become more price-sensitive, increasing their bargaining power. This forces developers like Frasers Property to consider these economic conditions in their pricing strategies.

Frasers Property actively manages this by presenting a diverse range of housing options, from apartments to landed properties, catering to various budgets. Their strategy of developing master-planned communities also adds value, offering amenities and a lifestyle that can mitigate some of the direct price pressure from buyers.

Retail tenants, especially major chains and anchor tenants, hold significant sway over lease agreements, rental prices, and incentives. This power stems from their ability to drive foot traffic and the availability of numerous alternative retail locations. For instance, in 2024, the average retail vacancy rate in prime shopping centers remained a key indicator of tenant leverage.

The growing influence of e-commerce further amplifies tenant bargaining power by presenting them with more choices and diminishing their dependence on brick-and-mortar stores. Frasers Property counters this by focusing on developing appealing, mixed-use developments that create a strong draw for consumers, thereby enhancing the value proposition for its retail tenants.

Commercial and industrial tenants, especially larger corporate clients, often wield significant bargaining power. Their substantial space needs and long-term lease commitments mean they can negotiate favorable terms, particularly when modern, strategically located alternatives are readily available. Frasers Property's focus on high-quality, flexible assets is a direct response to this, aiming to retain these key tenants.

In 2024, the demand for premium office space remained robust, yet the rise of hybrid work models continued to empower tenants to seek more flexible lease agreements. This dynamic means Frasers Property must continually adapt its offerings to maintain tenant loyalty and occupancy rates, especially for its commercial office portfolio.

Hospitality Guests

Hospitality guests wield significant bargaining power, a reality Frasers Hospitality must navigate. The sheer volume of choices available, coupled with the ease of comparing prices and amenities online, empowers consumers. In 2024, the hospitality industry saw continued emphasis on guest reviews, with platforms like TripAdvisor and Booking.com heavily influencing booking decisions. For instance, a study by Phocuswright in early 2024 indicated that over 80% of travelers consider online reviews before booking a hotel.

Price sensitivity remains a core concern for many travelers. However, there's a growing segment seeking unique, personalized experiences, which can shift the focus from pure price to value. Frasers Hospitality's strategy to counter this involves differentiating itself through superior service quality, a diverse portfolio of properties catering to various needs, and prime locations that offer convenience and appeal. This approach aims to build loyalty and reduce the reliance on price as the primary decision factor.

- High Guest Choice: The market offers numerous hotels, serviced apartments, and alternative accommodations, increasing guest options.

- Online Transparency: Websites and apps allow for easy price and feature comparisons, putting pressure on providers to remain competitive.

- Influence of Reviews: Online reviews significantly impact purchasing decisions, making guest satisfaction paramount.

- Demand for Personalization: Guests increasingly expect tailored experiences, moving beyond standardized offerings.

Institutional Investors and Fund Managers

Institutional investors and fund managers wield considerable bargaining power when Frasers Property divests assets or seeks capital partnerships. Their substantial capital reserves, deep market understanding, and access to diverse global investment options allow them to negotiate favorable terms. For instance, as of early 2024, global institutional investor allocations to real estate remained robust, with many seeking yield-generating assets, giving them leverage in deals with developers like Frasers Property.

Frasers Property's strategic approach involves cultivating long-term capital partnerships. This is crucial for optimizing its capital structure and boosting returns. The ability of these institutional players to deploy significant capital means they can influence deal structures, pricing, and ongoing asset management arrangements, directly impacting Frasers Property's profitability and strategic flexibility.

- Significant Capital Deployment: Institutional investors can deploy billions, giving them considerable sway in negotiations.

- Market Expertise: Their in-depth knowledge of real estate markets allows them to identify undervalued assets and negotiate from a position of strength.

- Global Investment Options: Access to a wide array of global opportunities means they are not reliant on any single transaction, enhancing their bargaining power.

- Strategic Partnership Focus: Frasers Property's reliance on these partnerships for growth means accommodating their demands is often a necessity.

The bargaining power of customers for Frasers Property is significant across its various segments. Residential buyers can exert considerable influence due to the availability of numerous housing options and their sensitivity to price fluctuations. In 2024, the average home price in many urban centers experienced volatility, directly impacting buyer affordability and their negotiation leverage.

Retail and commercial tenants, particularly anchor tenants and large corporations, also hold substantial power. Their ability to drive foot traffic and the availability of alternative locations empower them to negotiate favorable lease terms and rental rates. For instance, the retail vacancy rate in prime shopping centers in 2024 served as a key indicator of tenant leverage.

Hospitality guests have amplified bargaining power due to the vast array of choices and the transparency offered by online booking platforms. In 2024, online reviews heavily influenced guest decisions, with over 80% of travelers considering them before booking, as indicated by early 2024 industry reports. Frasers Hospitality counters this by focusing on differentiated service and prime locations.

| Customer Segment | Key Drivers of Bargaining Power | Impact on Frasers Property | 2024 Data/Trend Example |

|---|---|---|---|

| Residential Buyers | High choice, price sensitivity, interest rate sensitivity | Pressure on pricing, need for diverse product offerings | Fluctuating average home prices in major cities |

| Retail Tenants | Ability to drive foot traffic, availability of alternatives, e-commerce growth | Negotiation on rental rates, lease terms, and incentives | Key retail vacancy rates in prime locations |

| Commercial Tenants | Large space needs, long-term leases, availability of modern alternatives | Negotiation on lease flexibility and terms for premium spaces | Demand for flexible lease agreements due to hybrid work |

| Hospitality Guests | High choice, online price transparency, influence of reviews | Focus on guest satisfaction, service quality, and competitive pricing | Over 80% of travelers consider reviews before booking |

Full Version Awaits

Frasers Property Porter's Five Forces Analysis

This preview showcases the complete Fraser Property Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. You're looking at the actual, ready-to-use document, providing comprehensive insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Rivalry Among Competitors

Frasers Property operates in a highly competitive arena, facing robust rivalry from a multitude of global and regional real estate developers and investors. This competition spans across its varied property segments, including residential, commercial, industrial, and hospitality. For instance, in 2024, the global real estate market saw significant activity, with major players like Brookfield Asset Management and Blackstone continuing to expand their portfolios, directly challenging Frasers Property's market share in key regions.

Competition for prime land and development sites is intense, significantly impacting Frasers Property. Developers vie fiercely for these limited opportunities, which in turn inflates land acquisition costs and compresses potential profit margins for all involved.

Frasers Property's established network and robust financial standing are crucial assets in this environment, enabling them to secure strategic land banks and maintain a competitive edge in acquiring desirable development parcels.

Competitors in the real estate sector actively vie for market share by emphasizing distinct attributes. These include superior design aesthetics, robust sustainability credentials, prime locations, comprehensive service offerings, and a strong brand image. For instance, many developers are highlighting green building certifications like LEED or Green Mark to attract environmentally conscious buyers and tenants.

Frasers Property distinguishes itself through its dedication to crafting spaces that are not only sustainable but also inspiring, coupled with its provision of integrated real estate solutions. This approach aims to offer a holistic experience to customers, encompassing development, investment, and management services. The company's focus on quality and community building forms a core part of its value proposition.

The market is also influenced by a 'flight to quality' phenomenon, particularly in sectors like premium office spaces and high-end residential properties. This trend intensifies competition as developers and investors increasingly seek out and prioritize assets that offer superior specifications, amenities, and long-term value. In 2024, this has led to higher occupancy rates and rental growth in prime locations compared to secondary markets.

Market Saturation and Economic Cycles

In mature real estate markets, Frasers Property faces heightened competitive rivalry. This is especially true in oversupplied segments where developers compete fiercely for a shrinking pool of customers. For instance, in 2024, many developed Asian markets saw increased vacancy rates in office and retail spaces, prompting aggressive leasing strategies and rental concessions.

Economic cycles significantly amplify this rivalry. During economic downturns or periods of high interest rates, such as those experienced in parts of 2023 and continuing into 2024, developers may resort to price wars or offer substantial incentives to secure sales or leases. This pressure can impact profit margins across the industry.

- Market Saturation: In sectors like prime office space in Singapore, vacancy rates in early 2024 hovered around 8-10%, indicating a competitive tenant market.

- Economic Impact: Rising interest rates throughout 2023 and into 2024 increased financing costs for developers and reduced buyer affordability, intensifying competition for fewer transactions.

- Diversification Strategy: Frasers Property's presence in diverse geographies, including Australia and Europe, alongside its varied asset classes (residential, commercial, industrial), helps buffer the impact of localized market saturation or economic slowdowns.

Capital and Financing Access

Access to capital and favorable financing terms are crucial competitive differentiators in the real estate sector. Companies with robust balance sheets and strong ties to lenders can more readily fund new developments and navigate economic downturns. Frasers Property's focus on capital efficiency, exemplified by its asset recycling initiatives and increasing use of sustainable financing, directly addresses this competitive pressure.

For instance, Frasers Property reported a gearing ratio of 36.9% as of March 31, 2024, indicating a healthy leverage position. This financial strength allows them to secure competitive financing for their extensive project pipeline. Their commitment to sustainable financing, with a growing proportion of their debt linked to ESG (Environmental, Social, and Governance) criteria, also appeals to a wider range of investors and lenders.

- Capital Efficiency: Frasers Property's strategy of asset recycling, which involves divesting mature assets to reinvest in growth opportunities, enhances capital efficiency and supports continuous development.

- Financing Access: Maintaining a strong balance sheet and favorable credit ratings grants Frasers Property access to a wider pool of capital and more attractive financing rates compared to less financially sound competitors.

- Sustainable Financing: The company's increasing integration of sustainable financing, such as green bonds, not only aligns with global ESG trends but also broadens its appeal to environmentally conscious investors and lenders, potentially lowering the cost of capital.

- Project Pipeline Funding: Robust access to capital ensures Frasers Property can adequately fund its development projects, allowing it to seize market opportunities and outpace competitors who may face capital constraints.

Competitive rivalry within the real estate sector is a defining characteristic for Frasers Property, with numerous global and regional players constantly vying for market share across residential, commercial, industrial, and hospitality segments. This intense competition is particularly evident in the pursuit of prime land, driving up acquisition costs and compressing profit margins for all developers. For instance, in 2024, major developers continued aggressive portfolio expansion, directly challenging Frasers Property's established market positions in key geographies.

The fight for customers is fierce, with competitors differentiating themselves through superior design, sustainability features, prime locations, comprehensive services, and strong brand building. Many are highlighting green certifications to attract environmentally conscious buyers. This dynamic is further amplified by economic cycles; periods of high interest rates, as seen through 2023 and into 2024, increase financing costs and reduce buyer affordability, leading to more aggressive pricing and incentives among developers.

Frasers Property's strategic advantages lie in its established networks, financial strength, and diversification across geographies and asset classes. This allows them to secure land banks and navigate market fluctuations. Their commitment to capital efficiency, including asset recycling and sustainable financing, as evidenced by a gearing ratio of 36.9% as of March 31, 2024, provides a competitive edge in accessing capital and funding its extensive project pipeline.

| Key Competitive Factors | Frasers Property's Approach | Industry Trend (2024) |

| Land Acquisition | Leverages established networks and financial strength to secure prime parcels. | Intense competition for limited sites, driving up costs. |

| Differentiation | Focus on sustainability, integrated solutions, and quality. | Emphasis on green building certifications and unique value propositions. |

| Capital Access | Maintains strong balance sheet, utilizes asset recycling and sustainable financing. | Higher interest rates increase financing costs; ESG-linked financing gains traction. |

| Market Saturation Impact | Diversified portfolio across geographies and asset classes mitigates localized saturation. | Increased vacancy rates in mature markets lead to aggressive leasing strategies. |

SSubstitutes Threaten

The increasing adoption of remote work and the growth of co-working spaces pose a substantial threat of substitutes for traditional commercial office spaces. Companies are increasingly exploring hybrid work models, which can lead to a reduced need for large, dedicated office leases. This shift allows businesses to potentially lower overhead costs and offer greater flexibility to their employees.

For instance, by mid-2024, a significant percentage of companies were still operating with hybrid work policies, impacting the demand for traditional office footprints. Co-working spaces, offering flexible terms and shared amenities, further provide an alternative for businesses that previously would have sought conventional office leases. This trend is particularly impactful on older office buildings that may lack the modern amenities and flexibility demanded by today's workforce.

The persistent expansion of e-commerce presents a significant substitute threat to conventional retail properties. As consumers increasingly opt for online shopping, the demand for physical retail spaces diminishes, impacting Frasers Property's retail portfolio. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, a substantial increase from $5.7 trillion in 2023, underscoring this shift.

While Frasers Property strategically develops its retail assets as experiential destinations to counter this trend, the fundamental change in consumer purchasing habits remains a persistent challenge. This evolving landscape, however, simultaneously fuels demand for industrial and logistics properties, an area where Frasers Property also actively engages in development, leveraging the growth in online fulfillment and supply chain infrastructure.

In the residential market, the threat of substitutes is significant. Alternative housing models like co-living spaces and extended-stay hotels offer flexible living arrangements that can appeal to a broader demographic, potentially drawing demand away from traditional Frasers Property offerings. For instance, the rise of co-living has seen significant investment, with the global co-living market projected to reach $16.5 billion by 2025, indicating a growing consumer preference for these models.

Furthermore, the persistent affordability challenges in many housing markets, exacerbated by elevated interest rates in 2024, make renting a more attractive option for many compared to homeownership. This shift in consumer behavior directly impacts the demand for new residential unit sales, a core business for Frasers Property. Reports from early 2024 indicated that rental yields in key urban centers remained competitive, further bolstering the appeal of renting.

To counter this, Frasers Property needs to continuously innovate its residential portfolio, exploring hybrid models or developing properties that cater to evolving lifestyle preferences and the pressing need for affordability. This strategic adaptation is crucial to maintaining market share against these encroaching substitute housing solutions.

Peer-to-Peer Lodging and Vacation Rentals

The rise of peer-to-peer lodging and vacation rentals presents a significant threat to Frasers Property's hospitality segment. Platforms like Airbnb offer travelers alternative accommodations that can be more cost-effective or provide unique, localized experiences compared to traditional hotels and serviced apartments. This trend directly impacts demand for Frasers Hospitality's offerings.

In 2024, the short-term rental market continued its robust growth. For instance, Airbnb reported over 1.5 million listings in Europe alone by early 2024, indicating a substantial supply of alternative lodging options. This broad availability means travelers have more choices, potentially diverting customers from Frasers Hospitality.

- Market Penetration: Peer-to-peer platforms have gained considerable market share in the travel accommodation sector, offering a viable alternative to traditional hospitality providers.

- Price Sensitivity: Many travelers, particularly budget-conscious ones or those seeking longer stays, find vacation rentals to be more economically attractive than hotel rooms.

- Differentiation Strategy: Frasers Hospitality counters this threat by emphasizing its commitment to professional management, consistent service quality, and the provision of integrated amenities, aiming to attract guests who prioritize reliability and a higher standard of service.

- Target Audience Appeal: While peer-to-peer rentals appeal to a broad segment, Frasers Hospitality focuses on attracting guests who value brand assurance, predictable service levels, and the conveniences of a professionally managed property.

Modular Construction and Prefabricated Buildings

While modular construction and prefabricated buildings aren't direct substitutes for an entire property portfolio, they pose a growing threat. These methods offer faster and potentially more cost-effective solutions for specific development types, such as industrial facilities or affordable housing projects. For instance, the global modular construction market was valued at approximately USD 126.2 billion in 2023 and is projected to reach USD 233.8 billion by 2030, indicating significant growth and adoption.

This trend represents a long-term disruptive force, as it challenges traditional, site-built construction methodologies. By simplifying complexity and potentially lowering barriers to entry, these off-site construction techniques could impact the perceived value of large-scale, custom-designed developments. Companies like Katerra, though facing challenges, demonstrated the potential for significant scale in this sector, highlighting the competitive pressure these alternatives can exert.

- Faster Project Timelines: Prefabricated units can significantly reduce construction time compared to traditional methods.

- Cost Efficiencies: Factory-controlled environments often lead to less waste and more predictable costs.

- Market Disruption: The increasing adoption of modular building could alter industry norms and competitive landscapes.

- Scalability Potential: Advancements in technology are making modular solutions increasingly viable for larger and more complex projects.

The threat of substitutes for Frasers Property is multifaceted, impacting its commercial, retail, residential, and hospitality segments. In commercial real estate, hybrid work models and co-working spaces are key substitutes for traditional office leases, a trend amplified in 2024 as many companies maintained flexible work policies. Similarly, e-commerce directly substitutes for physical retail, with global sales projected to hit $7.4 trillion by 2025. The residential sector sees co-living and the increasing preference for renting, driven by affordability concerns in 2024, as significant substitutes for traditional homeownership. Finally, the hospitality division faces competition from peer-to-peer lodging platforms like Airbnb, which offer alternative accommodations and continued robust growth in 2024, with over 1.5 million listings in Europe alone by early 2024.

Entrants Threaten

Entering the real estate development and management sector, particularly on a global scale like Frasers Property, demands substantial financial investment. This includes significant outlays for acquiring land, funding construction projects, and establishing robust operational infrastructure, creating a formidable barrier for prospective newcomers.

The sheer scale of capital needed to compete effectively deters many potential entrants from even attempting to enter the market. For instance, major development projects can easily run into hundreds of millions or even billions of dollars, a sum that only well-capitalized firms can readily access.

Frasers Property's established financial strength, evidenced by its extensive asset portfolio and established relationships with various financing institutions, further solidifies its competitive standing. This financial muscle allows them to undertake large-scale projects and weather market fluctuations more effectively than smaller, less capitalized competitors.

The real estate sector is a minefield of regulations, from intricate zoning laws to stringent environmental standards and building codes, all of which differ dramatically by location. Successfully navigating these complex requirements and obtaining the necessary permits is a significant undertaking, demanding considerable time and financial investment, thereby creating a substantial barrier for any newcomers looking to enter the market.

For Frasers Property, their deep-seated expertise in regulatory compliance and intimate knowledge of local market nuances provides a distinct competitive edge, allowing them to manage these complexities more efficiently than emerging competitors.

Securing prime land in strategic locations is a major hurdle for new real estate developers. These sought-after sites are often scarce and already held by established entities or long-term owners, making acquisition difficult and expensive for newcomers.

In 2024, the competitive landscape for prime land continued to be intense. For instance, major urban centers saw land prices rise, with some reports indicating double-digit percentage increases in certain prime commercial districts, further complicating entry for new players.

Frasers Property, with its established presence, benefits from a substantial land bank and strong existing relationships with landowners and government bodies, giving it a significant advantage in securing desirable development sites over potential new entrants.

Brand Reputation and Trust

In the competitive real estate arena, especially for residential and commercial projects, a strong brand reputation and established trust are paramount. Newcomers often struggle to gain traction against established players like Frasers Property, who have cultivated deep customer loyalty and confidence over years of successful development. This makes it challenging for new entrants to immediately capture market share.

Frasers Property's extensive history and a diverse portfolio of successful projects, ranging from urban regeneration to integrated developments, significantly bolster its brand equity. For instance, in 2024, the company continued to emphasize its commitment to quality and customer satisfaction across its global operations, reinforcing its image as a reliable developer.

The threat of new entrants is somewhat mitigated by the high cost and complexity associated with building a comparable brand reputation and trust in the real estate sector. Potential new players must invest heavily in marketing and demonstrate a consistent delivery of high-quality projects to even approach the credibility enjoyed by incumbents.

- Brand Credibility: New entrants lack the established trust and proven track record that Frasers Property has built over its operational history.

- Customer Loyalty: Existing customers and tenants are often more inclined to engage with brands they know and trust, making it difficult for new companies to attract them.

- Development History: Frasers Property's long-standing presence and diverse portfolio, showcasing successful residential and commercial developments, contribute to its strong brand equity.

- Market Perception: The perception of reliability and quality associated with a well-known brand like Frasers Property acts as a significant barrier to entry for less-established competitors.

Expertise in Integrated Real Estate Solutions

Frasers Property's strength in offering integrated real estate solutions, spanning development through property management across residential, retail, commercial, industrial, and hospitality sectors, presents a formidable barrier to new entrants. This requires a broad spectrum of specialized knowledge and skilled personnel that newcomers may struggle to replicate quickly. For instance, in 2024, Frasers Property continued to manage a diverse portfolio, highlighting the depth of expertise needed.

The sheer complexity of managing a multinational real estate portfolio, as Frasers Property does, further deters potential competitors. Newcomers often start with a narrower focus, making it challenging to match the operational efficiency and market understanding of established players. This integrated capability, built over years, acts as a significant deterrent.

- Diverse Expertise: Frasers Property's integrated model demands expertise in numerous real estate segments, a difficult feat for new, specialized firms.

- Talent Acquisition: Attracting and retaining the necessary talent across development, sales, leasing, and management is a substantial hurdle for emerging companies.

- Portfolio Complexity: The challenge of managing a geographically dispersed and multi-asset class portfolio creates significant operational barriers for new entrants.

The threat of new entrants for Frasers Property is generally moderate due to high capital requirements and regulatory hurdles. However, the real estate sector's attractiveness means that well-funded entities can still pose a challenge.

Newcomers face significant barriers in securing prime land and establishing brand credibility, areas where Frasers Property has a strong advantage. For example, in 2024, prime land acquisition remained competitive, with significant investment needed for development projects.

Frasers Property's integrated business model, spanning various real estate segments, demands broad expertise and talent that is difficult for new entrants to quickly replicate, further limiting their competitive impact.

| Barrier | Impact on New Entrants | Frasers Property's Advantage |

|---|---|---|

| Capital Requirements | High; significant investment needed for land acquisition and development. | Established financial strength and access to diverse funding sources. |

| Regulatory Complexity | Challenging; requires navigating zoning, environmental, and building codes. | Deep expertise in compliance and local market nuances. |

| Land Scarcity | Difficult; prime locations are scarce and often held by incumbents. | Substantial land bank and strong relationships with landowners. |

| Brand Reputation & Trust | Low initially; takes time and consistent delivery to build. | Long history of successful projects and customer loyalty. |

| Integrated Capabilities | Challenging; requires diverse expertise across multiple real estate sectors. | Broad spectrum of specialized knowledge and skilled personnel. |

Porter's Five Forces Analysis Data Sources

Our Frasers Property Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Frasers Property's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports and data from reputable financial information providers to ensure a thorough understanding of the competitive landscape.