Fox SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fox Bundle

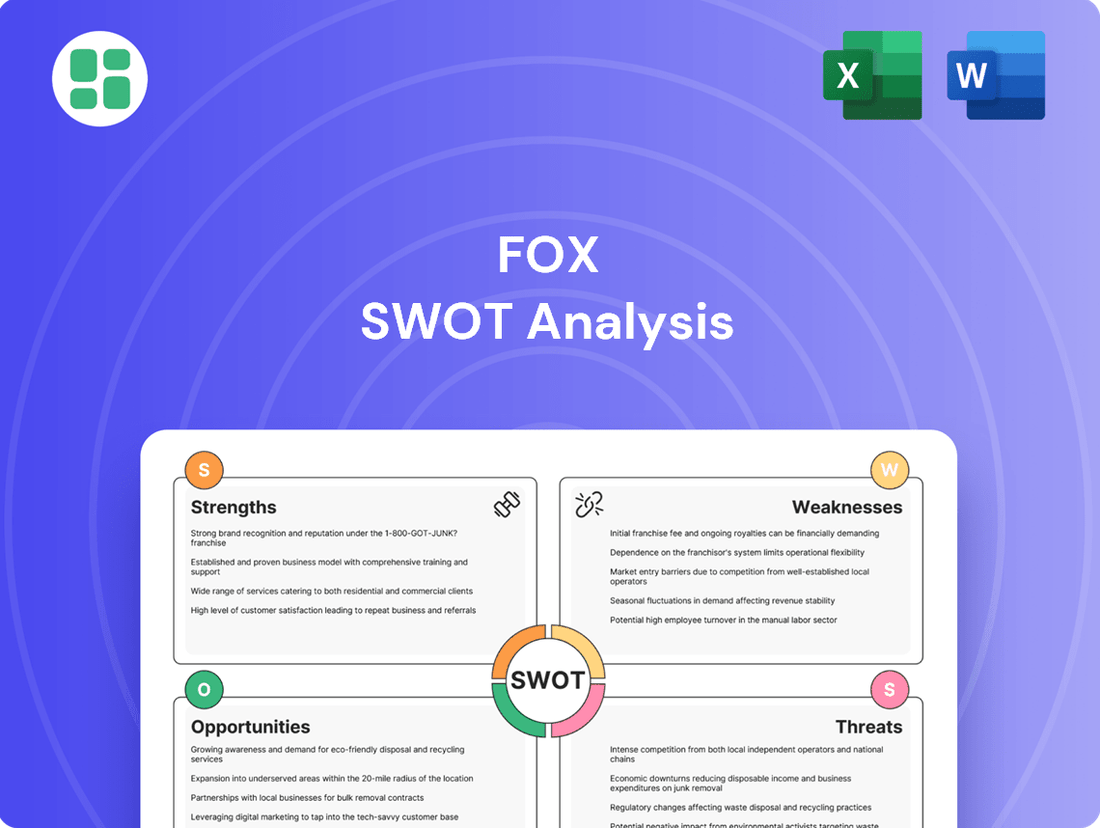

Our Fox SWOT analysis reveals key strengths like brand recognition and a strong content library, alongside potential weaknesses such as reliance on traditional media. Understand the competitive landscape and emerging threats to capitalize on future opportunities.

Want the full story behind Fox's market position, including detailed insights into its opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Fox Corporation's dominance in news and sports is a significant strength, anchored by its highly recognizable and trusted brands. Fox News Media consistently leads the national cable news landscape, maintaining its top-rated position for over twenty years, a testament to its enduring audience connection and brand loyalty.

This strong brand equity extends to Fox Sports, which commands substantial viewership and engagement, particularly during major sporting events. For instance, the 2023 NFL season saw Fox broadcasts drawing millions of viewers, reinforcing its position as a premier destination for live sports content.

Fox's emphasis on live and appointment-based programming, like breaking news and major sports, has been a significant strength, proving remarkably resilient. This strategy directly counters the general decline in traditional TV viewership.

Content that demands real-time viewing, such as the NFL on Fox, fosters consistent engagement and builds a loyal audience. This makes Fox less vulnerable to the widespread cord-cutting phenomenon affecting other networks.

For instance, the 2023 NFL season opener on Fox drew an average of 24.8 million viewers, demonstrating the power of live sports to command a significant and dedicated audience, a key differentiator in today's fragmented media landscape.

Tubi, Fox's free, ad-supported streaming service, has solidified its position as a major player in the AVOD market. Its significant growth provides Fox with a vital digital revenue stream and access to an expanding audience, enabling diversification beyond traditional television models and catering to changing viewer preferences.

Robust Financial Health and Capital Allocation

Fox Corporation demonstrates a strong financial foundation, characterized by a healthy balance sheet and a strategic focus on capital deployment. The company consistently delivers solid revenue growth and impressive EBITDA margins, reinforcing its financial stability.

Fox's substantial cash reserves provide significant flexibility for both strategic investments and shareholder returns. For the fiscal year ending June 30, 2023, Fox reported total cash and cash equivalents of $3.3 billion, a testament to its effective financial management.

- Strong Revenue and Profitability: Fox has shown consistent revenue growth, with reported total revenues of $13.05 billion for the fiscal year 2023.

- Healthy EBITDA: The company maintained a robust EBITDA, indicating strong operational profitability.

- Ample Liquidity: Holding $3.3 billion in cash and cash equivalents as of June 30, 2023, provides significant financial maneuverability.

- Disciplined Capital Allocation: Fox actively returns capital to shareholders through dividends and share repurchases, alongside strategic investments.

Significant Digital and Multiplatform Growth

Fox has seen substantial expansion in its digital and multiplatform presence. Fox News Digital, for instance, reported a significant increase in unique visitors, reaching approximately 150 million in early 2024, showcasing its growing online audience. This digital surge complements its traditional broadcast strength.

The company's multiplatform minutes and views have also climbed, reflecting a successful strategy to engage audiences across various digital channels. This indicates a strong adaptation to evolving media consumption habits, broadening Fox's overall reach and influence in the digital landscape.

- Digital Audience Growth: Fox News Digital consistently ranks among the top news sites, with unique visitors often exceeding 150 million monthly in 2024.

- Multiplatform Engagement: Increased multiplatform minutes indicate viewers are spending more time with Fox content across websites, apps, and social media.

- Video Views: Significant growth in video views on digital platforms highlights the success of Fox's online video strategy.

- Brand Reach Expansion: The digital expansion allows Fox to connect with a wider demographic beyond its traditional television viewership.

Fox's robust financial health is a cornerstone strength, underscored by consistent revenue generation and strong profitability metrics. The company reported total revenues of $13.05 billion for the fiscal year ending June 30, 2023, demonstrating its ability to maintain significant commercial success.

This financial stability is further evidenced by a healthy EBITDA, reflecting efficient operations and strong cash flow generation. With $3.3 billion in cash and cash equivalents as of June 30, 2023, Fox possesses substantial liquidity, enabling strategic flexibility for investments and shareholder returns.

| Financial Metric | Value (as of FYE June 30, 2023) | Significance |

|---|---|---|

| Total Revenues | $13.05 billion | Indicates strong market presence and sales performance. |

| Cash and Cash Equivalents | $3.3 billion | Provides financial flexibility and operational resilience. |

| EBITDA | Strongly positive | Demonstrates robust operational profitability. |

What is included in the product

Offers a full breakdown of Fox’s strategic business environment, examining its internal capabilities and external market challenges.

Offers a clear, structured framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Fox Corporation's substantial reliance on advertising revenue presents a significant weakness. In fiscal year 2023, advertising revenue accounted for a considerable portion of the company's overall income, making it highly susceptible to economic downturns and shifts in the media landscape. For instance, a slowdown in consumer spending or a decrease in corporate marketing budgets directly impacts Fox's top line, as seen in periods of economic uncertainty. This dependency means that any softening in the advertising market, whether due to macroeconomic factors or changing consumer behavior towards digital platforms, can disproportionately affect Fox's financial health and profitability.

Fox faces a significant challenge from the ongoing trend of cord-cutting, as consumers increasingly abandon traditional cable and satellite television subscriptions. This accelerating shift directly erodes the affiliate fees and advertising revenue Fox generates from its linear TV networks.

The decline in linear TV viewership is a persistent headwind for Fox's established broadcast model. For instance, by the end of 2023, the U.S. pay-TV market had fewer than 70 million subscribers, a stark contrast to its peak, impacting the reach and revenue potential of Fox's traditional channels.

Fox, like many legacy media giants, grapples with the intricate task of merging its established infrastructure with cutting-edge digital platforms. This integration is crucial for staying competitive, yet the inherent complexities of updating older systems can slow down innovation and create operational friction. For instance, the media industry saw significant shifts in advertising spend towards digital in 2024, with digital ad spending projected to reach $375 billion in the US alone, highlighting the urgency for companies like Fox to adapt their legacy systems to capture this growing market.

Limited Long-Term Stock Valuation Narrative

Some financial analysts have raised concerns about the absence of a clearly articulated and compelling long-term narrative for Fox Corporation's stock valuation. This perceived lack of a robust future-oriented story could potentially dampen investor enthusiasm and confidence in the company's ability to achieve sustained growth beyond immediate market cycles.

This weakness might hinder Fox's ability to attract and retain investors who are seeking a predictable and strong growth trajectory. For instance, while Fox reported a net income of $1.2 billion for the fiscal year ended June 30, 2023, the market may be looking for clearer indicators of how this translates into long-term value creation beyond its current content and sports rights.

- Lack of a Defined Long-Term Growth Strategy: Investors may struggle to identify a clear, overarching strategy that promises consistent, long-term value appreciation for Fox Corporation.

- Dependence on Event Cycles: The company's valuation narrative might be too closely tied to the success of specific events or content releases, rather than a more resilient, foundational growth plan.

- Investor Confidence Impact: Without a strong long-term narrative, investor confidence could waver, potentially leading to a lower valuation multiple compared to peers with more compelling forward-looking stories.

- Challenges in Sustaining Momentum: The absence of a clear long-term vision might make it difficult for Fox to maintain investor interest and support during periods of market volatility or industry disruption.

Potential for Audience Disruption from Programming Changes

While programming changes aim to refresh content and attract new viewers, they risk alienating existing audiences by disrupting established viewing patterns. For instance, a shift in a popular show's format or the introduction of a new host might cause confusion or a decline in viewership, as seen when networks experiment with schedule overhauls. In 2024, media companies are increasingly focused on data-driven content decisions to mitigate this risk, but the inherent unpredictability of audience response to change remains a significant challenge.

These disruptions can manifest as temporary dips in ratings or even a permanent loss of subscribers if the changes are perceived negatively. For example, a poorly executed transition for a flagship program could lead to a noticeable drop in ad revenue or subscription renewals. Fox, like other broadcasters, must carefully manage these transitions, potentially leveraging market research and audience feedback to minimize negative impacts.

- Viewer Attrition Risk: Programming shifts, especially those involving new talent or format changes, can lead to a loss of loyal viewers who prefer the familiar.

- Data-Driven Mitigation: In 2024, networks are increasingly using analytics to predict audience response to changes, aiming to soften potential negative impacts.

- Revenue Impact: Disruptions can directly affect advertising revenue and subscription numbers if viewership declines significantly.

- Brand Perception: Poorly managed programming changes can negatively impact the overall brand perception of the network.

Fox Corporation's significant reliance on advertising revenue, which formed a substantial part of its income in fiscal year 2023, makes it vulnerable to economic slowdowns and shifts in media spending. For instance, a downturn in consumer spending or reduced corporate marketing budgets directly impacts Fox's financial performance.

The company faces a persistent challenge from cord-cutting, leading to a decline in linear TV viewership. By the end of 2023, the U.S. pay-TV market had fewer than 70 million subscribers, impacting affiliate fees and advertising revenue for Fox's traditional networks.

Integrating legacy systems with newer digital platforms presents operational complexities, potentially slowing innovation. In 2024, digital ad spending was projected to reach $375 billion in the US, underscoring the need for Fox to adapt its infrastructure to capture this growing market.

Furthermore, some analysts note a lack of a clearly defined long-term growth strategy, which could affect investor confidence. For fiscal year 2023, Fox reported $1.2 billion in net income, but investors seek clearer indicators of sustained long-term value creation.

Full Version Awaits

Fox SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Fox has a significant opportunity to capitalize on the burgeoning streaming market by further expanding Tubi's reach and enhancing its digital advertising infrastructure. Tubi, already a leader in the ad-supported video on demand (AVOD) sector, is well-positioned to capture a larger share of this growing market. In the first quarter of fiscal year 2024, Fox reported that Tubi's revenue increased by 25%, demonstrating strong momentum.

This expansion directly addresses the shift in consumer behavior towards streaming content, offering a crucial avenue to offset potential declines in traditional linear television viewership. By strengthening its digital advertising capabilities, Fox can monetize this growing audience more effectively. For instance, Fox's digital advertising revenue saw a 12% increase in the same fiscal quarter, underscoring the effectiveness of its digital strategy.

Upcoming major event cycles, including the 2024 US Presidential Election and the 2026 FIFA World Cup, offer significant opportunities for Fox Corporation. These events typically drive substantial increases in advertising revenue as brands vie for consumer attention. Fox's established presence in political news and sports broadcasting positions it to capture a large share of this heightened advertising spend.

Fox Corporation's robust financial health, evidenced by its reported $4.5 billion in cash and cash equivalents as of the first quarter of fiscal year 2024, positions it advantageously for strategic acquisitions. This strong liquidity allows Fox to actively pursue companies that could bolster its content library or expand its distribution networks, potentially acquiring smaller studios or technology firms to enhance its media capabilities.

Forming strategic partnerships is another avenue. For instance, collaborations with emerging streaming technology providers or content creators could grant Fox access to new audiences and innovative distribution models, thereby diversifying its revenue streams beyond traditional advertising and affiliate fees.

Investment in Emerging Sports Ventures

Investing in nascent sports leagues presents a significant avenue for Fox to broaden its content offerings and capture burgeoning fan engagement. The United Football League (UFL), in which Fox holds a notable stake, exemplifies this strategy, providing a platform to cultivate new audiences and diversify revenue streams. This move is particularly timely given the projected growth in sports media rights and fan spending.

This strategic investment allows Fox to:

- Diversify Content Portfolio: Accessing new sports leagues expands Fox's programming beyond traditional major sports, attracting a wider demographic.

- Tap into Growing Fan Bases: Emerging leagues often represent underserved or rapidly expanding fan segments, offering opportunities for deep engagement.

- Create New Revenue Streams: Beyond broadcast rights, these ventures can generate income through sponsorships, merchandise, and digital content.

- Strengthen Sports Programming: Integrating these leagues enhances Fox's overall sports broadcasting appeal, potentially increasing viewership and advertising revenue.

Leveraging AI and Data Analytics for Content and Personalization

Fox can leverage AI and data analytics to revolutionize its content strategy. By analyzing user behavior and preferences, AI can help tailor content recommendations, leading to higher engagement. For instance, platforms are seeing significant uplift; a 2024 report indicated that personalized content can boost engagement by up to 20%.

Implementing these technologies can also streamline internal operations. AI-powered tools can automate tasks like content tagging, moderation, and even initial draft generation, freeing up human resources for more strategic work. This efficiency gain is crucial in a fast-paced media environment. In 2025, many media companies are investing heavily in AI for content optimization, with some reporting a 15% reduction in content production time.

The strategic advantage lies in data-driven decision-making. Advanced analytics provide deep insights into audience demographics, content performance, and market trends. This allows Fox to allocate resources more effectively and identify new growth opportunities. For example, understanding audience consumption patterns can inform editorial calendars and advertising strategies, potentially increasing ad revenue by 10-15%.

- Enhanced Audience Engagement: AI-driven personalization can increase user interaction with content.

- Improved Operational Efficiency: Automation of content workflows reduces production time and costs.

- Smarter Strategic Decisions: Data analytics provide actionable insights for market adaptation and growth.

- Revenue Optimization: Tailored content and advertising strategies can lead to increased monetization.

Fox has a significant opportunity to capitalize on the burgeoning streaming market by further expanding Tubi's reach and enhancing its digital advertising infrastructure. Tubi, already a leader in the ad-supported video on demand (AVOD) sector, is well-positioned to capture a larger share of this growing market. In the first quarter of fiscal year 2024, Fox reported that Tubi's revenue increased by 25%, demonstrating strong momentum.

This expansion directly addresses the shift in consumer behavior towards streaming content, offering a crucial avenue to offset potential declines in traditional linear television viewership. By strengthening its digital advertising capabilities, Fox can monetize this growing audience more effectively. For instance, Fox's digital advertising revenue saw a 12% increase in the same fiscal quarter, underscoring the effectiveness of its digital strategy.

Upcoming major event cycles, including the 2024 US Presidential Election and the 2026 FIFA World Cup, offer significant opportunities for Fox Corporation. These events typically drive substantial increases in advertising revenue as brands vie for consumer attention. Fox's established presence in political news and sports broadcasting positions it to capture a large share of this heightened advertising spend.

Fox Corporation's robust financial health, evidenced by its reported $4.5 billion in cash and cash equivalents as of the first quarter of fiscal year 2024, positions it advantageously for strategic acquisitions. This strong liquidity allows Fox to actively pursue companies that could bolster its content library or expand its distribution networks, potentially acquiring smaller studios or technology firms to enhance its media capabilities.

Forming strategic partnerships is another avenue. For instance, collaborations with emerging streaming technology providers or content creators could grant Fox access to new audiences and innovative distribution models, thereby diversifying its revenue streams beyond traditional advertising and affiliate fees.

Investing in nascent sports leagues presents a significant avenue for Fox to broaden its content offerings and capture burgeoning fan engagement. The United Football League (UFL), in which Fox holds a notable stake, exemplifies this strategy, providing a platform to cultivate new audiences and diversify revenue streams. This move is particularly timely given the projected growth in sports media rights and fan spending.

This strategic investment allows Fox to:

- Diversify Content Portfolio: Accessing new sports leagues expands Fox's programming beyond traditional major sports, attracting a wider demographic.

- Tap into Growing Fan Bases: Emerging leagues often represent underserved or rapidly expanding fan segments, offering opportunities for deep engagement.

- Create New Revenue Streams: Beyond broadcast rights, these ventures can generate income through sponsorships, merchandise, and digital content.

- Strengthen Sports Programming: Integrating these leagues enhances Fox's overall sports broadcasting appeal, potentially increasing viewership and advertising revenue.

Fox can leverage AI and data analytics to revolutionize its content strategy. By analyzing user behavior and preferences, AI can help tailor content recommendations, leading to higher engagement. For instance, platforms are seeing significant uplift; a 2024 report indicated that personalized content can boost engagement by up to 20%.

Implementing these technologies can also streamline internal operations. AI-powered tools can automate tasks like content tagging, moderation, and even initial draft generation, freeing up human resources for more strategic work. This efficiency gain is crucial in a fast-paced media environment. In 2025, many media companies are investing heavily in AI for content optimization, with some reporting a 15% reduction in content production time.

The strategic advantage lies in data-driven decision-making. Advanced analytics provide deep insights into audience demographics, content performance, and market trends. This allows Fox to allocate resources more effectively and identify new growth opportunities. For example, understanding audience consumption patterns can inform editorial calendars and advertising strategies, potentially increasing ad revenue by 10-15%.

- Enhanced Audience Engagement: AI-driven personalization can increase user interaction with content.

- Improved Operational Efficiency: Automation of content workflows reduces production time and costs.

- Smarter Strategic Decisions: Data analytics provide actionable insights for market adaptation and growth.

- Revenue Optimization: Tailored content and advertising strategies can lead to increased monetization.

The expansion of Tubi's AVOD model presents a prime opportunity, with the platform's revenue growing 25% in Q1 FY24. Leveraging major upcoming events like the 2024 US Presidential Election and 2026 FIFA World Cup can significantly boost advertising revenue. Furthermore, Fox's substantial cash reserves of $4.5 billion as of Q1 FY24 enable strategic acquisitions to bolster content and distribution, while AI integration promises to enhance audience engagement and operational efficiency, potentially boosting ad revenue by 10-15%.

Threats

The advertising market is showing signs of softening, which directly impacts media companies like Fox. This means advertisers might be spending less overall, making it harder for Fox to secure the ad revenue it relies on.

Adding to this challenge is the increasing fragmentation of the media landscape. With so many platforms and content creators vying for attention, it's tougher for any single entity to capture a significant share of advertising dollars. For Fox, this means more competition for the same pool of ad money.

For instance, digital advertising spending is projected to grow, but the growth rate for traditional media advertising, where Fox has a strong presence, is expected to be more modest. In 2024, global ad spend growth was estimated around 5%, but the digital share continues to dominate, putting pressure on linear TV advertising revenue streams.

Fox's valuable sports rights portfolio faces intense pressure from well-funded streaming services like Amazon and Apple, which are aggressively bidding for live sports. This competition is driving up the costs of securing these crucial broadcast rights. For instance, Amazon's deal for the NFL's Thursday Night Football, reportedly worth $1 billion annually, highlights the escalating financial stakes involved in acquiring premium sports content.

The ongoing shift away from traditional cable and satellite TV, often called cord-cutting, is a significant challenge for Fox. This trend directly impacts the revenue Fox earns from cable providers, known as affiliate fees. As more households opt for streaming services, Fox's traditional television business model faces increasing pressure.

Data from 2024 indicates this acceleration is persistent. For instance, projections suggest that by the end of 2025, the number of U.S. households subscribing to traditional pay-TV could fall below 50 million, a substantial decline from previous years. This erosion of the subscriber base directly translates to lower affiliate fee revenues for companies like Fox.

Evolving Regulatory Landscape and Privacy Concerns

The media sector, including companies like Fox, faces a growing web of regulations, especially around data privacy. Laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) demand strict adherence. For instance, in 2023, fines for GDPR violations exceeded €1.5 billion globally, highlighting the financial risks of non-compliance.

Navigating these evolving rules requires substantial investment in compliance infrastructure and ongoing vigilance. Failure to adapt can lead to significant legal battles and hefty penalties, impacting Fox's operational costs and reputation.

- Increased compliance costs: Significant financial outlay needed for data protection measures and legal counsel.

- Potential for substantial fines: Regulatory breaches can result in multi-million dollar penalties.

- Impact on data monetization: Stricter privacy rules may limit how Fox can collect and utilize user data for advertising.

- Reputational damage: Privacy violations can erode consumer trust and brand image.

Growing Cybersecurity Risks

Fox Corporation's extensive digital presence, including its live news and sports streaming services, makes it a significant target for increasingly sophisticated cyberattacks. The company handles vast amounts of sensitive user data, requiring continuous investment in advanced cybersecurity protocols to safeguard against breaches and maintain operational integrity. In 2023, the media industry reported a 22% increase in ransomware attacks, highlighting the escalating threat landscape.

The evolving nature of hacking techniques demands that Fox Corporation consistently update its defenses to protect its systems and proprietary content. Failure to do so could result in significant financial losses, reputational damage, and disruption to its broadcasting operations. For instance, a successful attack could compromise subscriber information or disrupt live event broadcasts, impacting revenue streams.

- Increased Sophistication of Threats: Cybercriminals are employing more advanced methods, including AI-driven attacks, to breach corporate defenses.

- Data Breach Impact: A successful breach could expose millions of customer records, leading to substantial regulatory fines and loss of consumer trust.

- Operational Disruption: Attacks targeting broadcasting infrastructure could halt live programming, directly impacting viewership and advertising revenue.

- Intellectual Property Theft: Sensitive content, including unreleased programming or sports rights data, could be targeted for theft.

The increasing competition for advertising dollars, fueled by a fragmented media landscape and the rise of digital platforms, poses a significant threat to Fox's traditional revenue streams. Furthermore, the escalating costs associated with securing premium sports rights, driven by aggressive bids from tech giants, place considerable financial strain on the company.

The persistent trend of cord-cutting continues to erode Fox's affiliate fee revenue, while stringent data privacy regulations necessitate costly compliance measures and carry the risk of substantial fines. Additionally, the growing sophistication of cyberattacks presents a constant threat to Fox's digital assets and operational integrity.

SWOT Analysis Data Sources

This Fox SWOT analysis is built upon a robust foundation of data, including Fox Corporation's official financial filings, comprehensive market research reports, and expert analyses of the media and entertainment landscape.